Blog Content Overview

- 1 Introduction

- 2 What Are Damages in Contract Law?

- 3 What Are Liquidated Damages?

- 4 What Are Unliquidated Damages?

- 5 Key Differences Between Liquidated and Unliquidated Damages

- 6 What are the Conditions to Claim Damages (Liquidated and Unliquidated)?

- 7 How Are Liquidated Damages Calculated?

- 8 How Are Unliquidated Damages Calculated?

- 9 What Are the Legal Principles Governing Damages?

- 10 Common Scenarios Where Damages Are Claimed

- 11 Global & Indian Perspectives on Damages

AI Summary

In contract law, damages are monetary compensation for breach, with liquidated damages pre-agreed in contracts and unliquidated damages assessed by courts. The Indian Contract Act, 1872, Sections 73 and 74, govern these, ensuring compensation for actual losses, not remote ones, and enforcing reasonable pre-agreed sums. Liquidated damages offer certainty and risk allocation, common in construction with penalties for delays. Unliquidated damages, conversely, provide flexibility for unforeseen losses, requiring proof of loss. Key differences lie in predetermination, proof requirements, and flexibility. Claiming either requires a valid contract, breach, causation, and reasonableness. Legal principles governing damages include causation, remoteness, mitigation, and proof, vital for fair compensation. Indian courts emphasize reasonableness, unlike stricter international enforcement.

Introduction

In contract law, damages refer to the monetary compensation awarded to an aggrieved party when the other side breaches a contract. They ensure that the injured party is placed, as far as money can do, in the same position as if the contract had been performed.

Understanding the distinction between liquidated damages (pre-agreed sums written into contracts) and unliquidated damages (court-assessed compensation for actual loss) is critical. For businesses, it reduces financial risk and litigation costs. For lawyers, it frames negotiation and dispute strategy. For contracting parties, it determines whether compensation will be swift and certain or require proof of loss in court.

Did you know?

According to the FICCI Arbitration Study (2023), over 60% of construction disputes in India arise from damages claims linked to project delays or performance failures. This highlights why drafting and interpreting damages clauses correctly can directly impact dispute outcomes and financial exposure.

What Are Damages in Contract Law?

In simple terms, damages in contract law are the financial compensation awarded to a party who suffers a loss because the other party failed to honor their contractual obligations. They serve as a legal remedy that balances fairness: the injured party is restored to the position they would have been in had the contract been performed, while the defaulting party bears the financial consequence of their breach.

Definition under the Indian Contract Act, 1872

The Indian Contract Act codifies the rules on damages:

- Section 73: When a contract is broken, the party who suffers is entitled to compensation for losses that naturally arise from the breach or which the parties knew were likely at the time of entering into the contract. Losses that are remote or indirect are not recoverable.

- Section 74: If a contract specifies a sum payable on breach (liquidated damages), the aggrieved party can claim reasonable compensation not exceeding the pre-agreed amount. Courts will not enforce punitive or excessive sums.

Why Sections 73 & 74 Matter

- They form the statutory backbone for distinguishing unliquidated damages (court-determined) and liquidated damages (pre-agreed).

- They provide clarity to businesses and individuals on what kind of losses are legally compensable.

- They ensure damages are compensatory, not punitive, aligning Indian law with global contract law principles.

Quick Reference Table

| Provision | Covers | Key Rule |

| Section 73 | Unliquidated damages | Compensation for actual loss caused by breach; excludes remote/indirect loss |

| Section 74 | Liquidated damages | Enforces pre-agreed sum if reasonable; courts reduce excessive/penal sums |

What Are Liquidated Damages?

Definition

Liquidated damages are a pre-determined sum written into a contract, payable if one party breaches its obligations. Instead of leaving compensation to be decided later by a court, the parties agree upfront on the financial consequences of a breach.

This makes liquidated damages a powerful tool in contract drafting and dispute prevention.

Purpose of Liquidated Damages

The inclusion of a liquidated damages clause serves multiple objectives:

- Certainty – Both parties know in advance what the breach will cost.

- Risk Allocation – Financial risks are fairly distributed, especially in high-value projects.

- Efficiency – Avoids lengthy litigation over quantum of damages.

- Deterrence – Encourages timely and proper performance of contractual duties.

Practical Examples

Liquidated damages are common in construction, supply, and service contracts:

- Construction delays: A contractor agrees to pay ₹50,000 per day for each day of delay in completing a project.

- Supply contracts: A vendor pays a fixed penalty for late delivery of critical components.

- Software/IT projects: Fixed compensation for missing go-live deadlines.

According to the FICCI Arbitration Study (2023), delays and performance defaults account for over 60% of disputes in Indian construction projects, making liquidated damages clauses central to resolving claims quickly.

Statutory Position in India

Under Section 74 of the Indian Contract Act, 1872:

- Courts will enforce liquidated damages only if they represent a genuine pre-estimate of loss.

- If the stipulated amount is penal or excessive, courts may reduce it and award reasonable compensation instead.

- Key precedent: ONGC v. Saw Pipes Ltd. (2003) – the Supreme Court upheld liquidated damages where they were a fair and genuine estimate of probable loss.

Liquidated damages provide predictability and enforceability, but in India, they are never punitive. Courts act as gatekeepers to ensure parties only recover what is fair, not what is oppressive.

What Are Unliquidated Damages?

Definition

Unliquidated damages are damages not pre-decided in the contract. Instead, they are assessed by a court or arbitral tribunal after a breach occurs, based on the actual loss suffered. Unlike liquidated damages (where the amount is predetermined), unliquidated damages require the claimant to prove the extent of loss with evidence such as invoices, expert reports, or financial statements.

Purpose of Unliquidated Damages

The core purpose of unliquidated damages is flexibility:

- Covers unforeseen losses that were not, or could not be, predetermined when drafting the contract.

- Ensures fairness by compensating only the actual harm suffered.

- Protects claimants in complex situations where damages are uncertain or vary widely (e.g., reputational harm, loss of future profits).

This mechanism allows courts to tailor compensation to the specific facts of each dispute rather than relying on fixed formulas.

Practical Examples

Unliquidated damages commonly arise in disputes where losses are uncertain or variable:

- Professional negligence: A consultant gives faulty advice, causing financial loss to a business.

- Supply chain disruptions: A supplier’s failure to deliver raw materials forces a manufacturer to buy substitutes at a higher cost.

- Employment disputes: Wrongful termination leading to claims for lost salary and benefits.

- Service defaults: A software company’s system outage causes measurable business downtime and lost revenue.

In arbitration cases tracked by SCC Online (2019 study), nearly 40% of commercial disputes in India involve unliquidated damages, especially in supply chain and service contracts.

Case Law Spotlight

Union of India v. Raman Iron Foundry (1974):

The Supreme Court held that a claim for unliquidated damages does not become a debt until the court has determined the amount. This means that merely alleging breach is not enough—damages must be proven and quantified before they are recoverable.

Unliquidated damages ensure fair, evidence-based compensation where losses cannot be estimated in advance. They require proof, causation, and legal scrutiny, making them vital in disputes involving negligence, supply failures, or wrongful termination.

Key Differences Between Liquidated and Unliquidated Damages

Understanding the difference between liquidated damages and unliquidated damages is critical for anyone drafting, negotiating, or enforcing contracts. While both provide monetary relief for breach of contract, they operate very differently under the Indian Contract Act, 1872.

| Aspect | Liquidated Damages | Unliquidated Damages |

| Predetermined? | Yes – Fixed in the contract as a pre-agreed sum payable on breach | No – Assessed by court after breach, based on actual loss |

| Statutory Basis | Section 74 of the Contract Act | Section 73 of the Contract Act |

| Proof Required | Breach is assumed to cause loss, but party must show that some loss occurred | Actual loss must be proven through evidence (invoices, expert reports, financial records) |

| Purpose | Ensures certainty, efficiency, and faster enforcement | Provides fair compensation for unforeseen or hard-to-quantify losses |

| Flexibility | Low – Bound to contractual figure (subject to reasonableness test by courts) | High – Courts can tailor compensation to the facts of each dispute |

| Risk Allocation | Predominantly risk-shifting tool; loss is quantified upfront | Risk remains open; loss determined only after breach |

Why This Difference Matters

- For Businesses: A well-drafted liquidated damages clause minimizes disputes over calculation and gives financial predictability.

- For Lawyers: Choice of LD vs. ULD impacts litigation strategy, burden of proof, and settlement negotiations.

- For Courts: The distinction ensures that damages remain compensatory, not punitive, upholding fairness in commercial law.

Real-World Insight

According to FICCI Arbitration Study (2023), more than 60% of construction disputes in India involve damages claims for delays and performance defaults. Many of these disputes turn on whether a clause qualifies as liquidated damages or requires the court to award unliquidated damages.

Key Takeaway:

- Liquidated damages = Pre-decided certainty, governed by Section 74.

- Unliquidated damages = Court-decided fairness, governed by Section 73.

What are the Conditions to Claim Damages (Liquidated and Unliquidated)?

Not every contractual breach automatically entitles the aggrieved party to compensation. Courts and arbitral tribunals apply well-established legal tests to decide whether liquidated damages or unliquidated damages can be awarded. Meeting these conditions is critical to ensure enforceability.

1. Existence of a Valid Contract

- A legally enforceable agreement must exist with concluded terms.

- If terms are vague, incomplete, or not properly executed, claims for damages usually fail.

- Case reference: Vedanta Ltd. v. Emirates Trading Agency – the Supreme Court held that without a validly concluded contract, damages cannot be claimed.

2. Breach of Obligation

- The claimant must show that the other party failed to perform a contractual duty.

- Breach may be:

- Non-performance (e.g., failure to deliver goods).

- Defective performance (e.g., substandard construction work).

- Delay in performance (e.g., late completion of a project).

3. Proof of Causation

- There must be a direct link between the breach and the loss suffered.

- Courts use “common sense” and “dominant cause” tests to exclude remote or unrelated losses.

- Example: If a contractor delays a project, the employer can recover additional costs for substitute performance but not speculative losses like reputational harm.

4. Proof of Actual Loss (For Unliquidated Damages)

- Unliquidated damages require credible evidence of the loss:

- Financial records, invoices, or contracts for substitute performance.

- Expert testimony in cases of professional negligence.

- Audited accounts in claims involving loss of profit.

- Union of India v. Raman Iron Foundry: the Supreme Court held that unliquidated damages do not constitute a debt until the court determines liability and quantifies the loss.

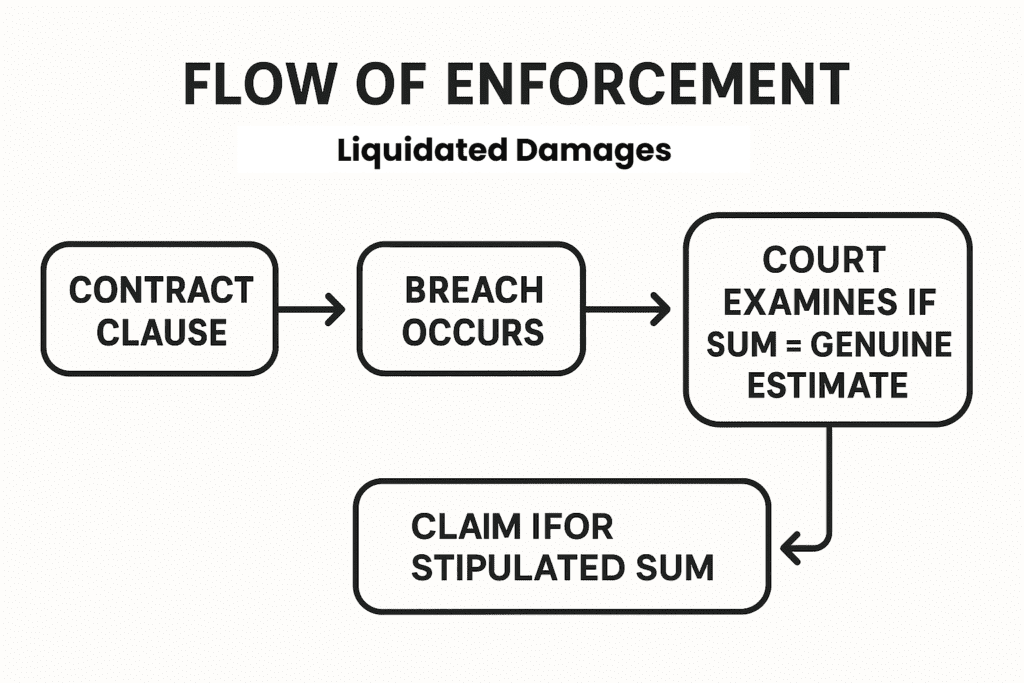

5. Reasonableness (For Liquidated Damages)

- Under Section 74 of the Contract Act, even when a contract specifies a sum as liquidated damages, courts examine if it is a genuine pre-estimate of loss.

- If the amount is excessive or penal, it will be reduced to “reasonable compensation.”

- Key precedent: ONGC v. Saw Pipes Ltd. – liquidated damages clauses are enforceable if they represent a fair estimate of probable loss.

Checklist for Claimants

- Is there a valid and enforceable contract?

- Has a clear breach of obligation occurred?

- Can you demonstrate causation between breach and loss?

- Do you have documentary proof of actual loss (for unliquidated claims)?

- Is the claim amount fair and proportionate (for liquidated claims)?

Key Takeaway:

To succeed in claiming damages, parties must establish contract validity, breach, causation, quantifiable loss, and reasonableness. Without meeting these conditions, even strong claims risk rejection in court or arbitration.

How Are Liquidated Damages Calculated?

When a contract includes a liquidated damages clause, the calculation follows a structured approach. The goal is not punishment, but reasonable compensation for breach.

Step-by-Step Process

- Refer to the Clause in the Contract

- Identify the pre-agreed damages clause specifying compensation (e.g., per day of delay).

- Establish Breach

- Prove that the contractual obligation (e.g., delivery, performance, completion date) was breached.

- Demonstrate Loss (Though Not Exact)

- While exact quantification isn’t necessary, evidence that some loss occurred is required.

- Example: Additional costs, lost revenues, substitute performance expenses.

- Court Tests Reasonableness

- Under Section 74 of the Contract Act, courts enforce only reasonable compensation.

- Excessive or penal sums are reduced.

- Judicial Precedent

- ONGC v. Saw Pipes Ltd. (2003) – The Supreme Court upheld liquidated damages where they represented a genuine pre-estimate of loss, even if actual loss was difficult to quantify.

Example Calculation

- Clause: Contractor pays ₹50,000 per day of project delay.

- Breach: 10-day delay in completion.

- Claim: ₹50,000 × 10 = ₹5,00,000.

- Court Review: Award upheld if reasonable and reflective of probable loss.

Insight: In construction arbitration, daily LD clauses between 0.05%–0.1% of project value per day are common globally, ensuring proportionality.

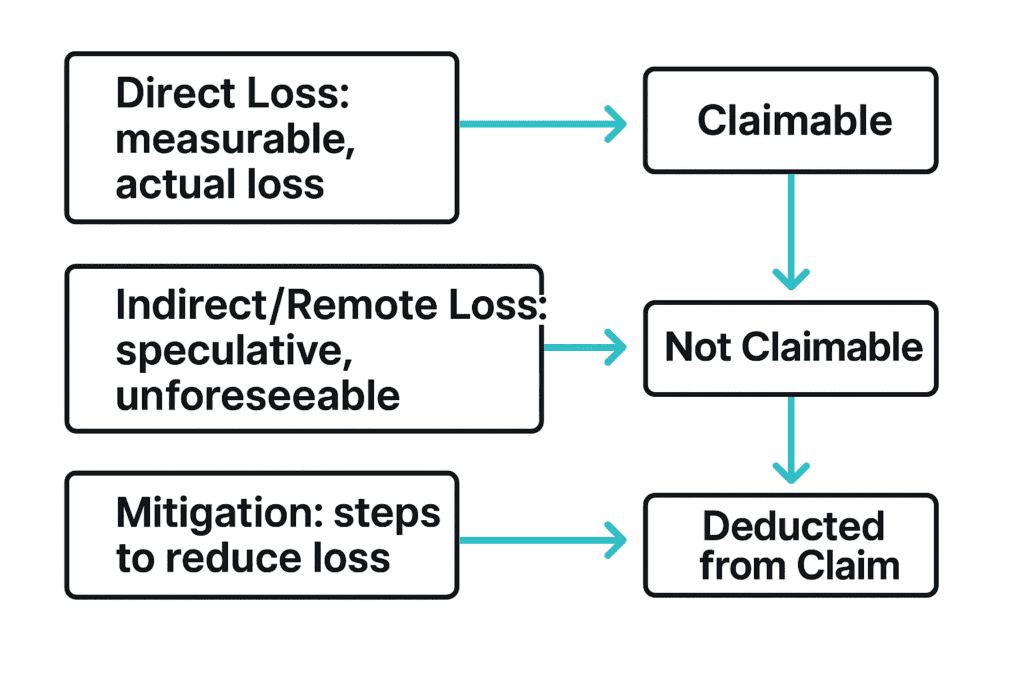

How Are Unliquidated Damages Calculated?

Unlike liquidated damages, unliquidated damages are determined after breach, based on actual evidence of loss. Courts apply structured principles to avoid overcompensation.

Unliquidated Damages = Total Direct Loss – Mitigation + Expectation / Reliance Interest – Remote or Indirect Losses

Key Factors Considered

- Substitute Performance Costs

- If goods/services are not delivered, the injured party’s higher purchase costs are recoverable.

- Lost Profits

- Profits lost due to breach (e.g., buyer refuses contracted goods, seller loses resale margin).

- Costs to Remedy Defective Work

- Expenses to fix or replace faulty performance (e.g., repair defective construction).

- Interest on Delayed Payment

- Compensation for money withheld beyond due date.

Example Application

- The manufacturer fails to supply raw material.

- Buyer sources substitute at ₹12,00,000 (contract price = ₹10,00,000).

- Direct Loss = ₹2,00,000.

- Buyer also claims ₹50,000 for extra transport and ₹30,000 interest.

- Court awards ₹2,80,000, excluding remote claims like reputational harm.

What Are the Legal Principles Governing Damages?

When courts decide whether to award liquidated damages or unliquidated damages, they rely on long-standing legal principles. These principles ensure that compensation is fair, proportionate, and rooted in evidence rather than speculation.

1. Principle of Causation

- The breach must be the real and effective cause of the loss.

- Courts exclude consequences that are too remote or unrelated.

- Example: If a supplier fails to deliver steel, damages may cover higher replacement costs but not speculative losses like “missed future projects.”

2. Principle of Remoteness

- Established in Hadley v. Baxendale (1854): only losses that naturally arise from the breach or were reasonably foreseeable at contract formation are recoverable.

- Reinforced in Victoria Laundry v. Newman Industries (1949): ordinary lost profits were recoverable, but extraordinary profits from special contracts were too remote.

- This principle prevents parties from claiming for unexpected, unforeseeable consequences.

3. Principle of Mitigation

- Claimants must take reasonable steps to reduce their losses.

- British Westinghouse v. Underground Electric Railways (1912): the claimant replaced defective turbines with more efficient ones, reducing losses; the court deducted the benefits gained.

- Failure to mitigate (e.g., not sourcing substitute goods) may reduce compensation.

4. Principle of Proof

- Damages must be backed by credible evidence:

- Contracts, invoices, and purchase orders.

- Expert testimony in technical disputes.

- Financial statements in profit-loss claims.

- Courts reject speculative or exaggerated claims without proof.

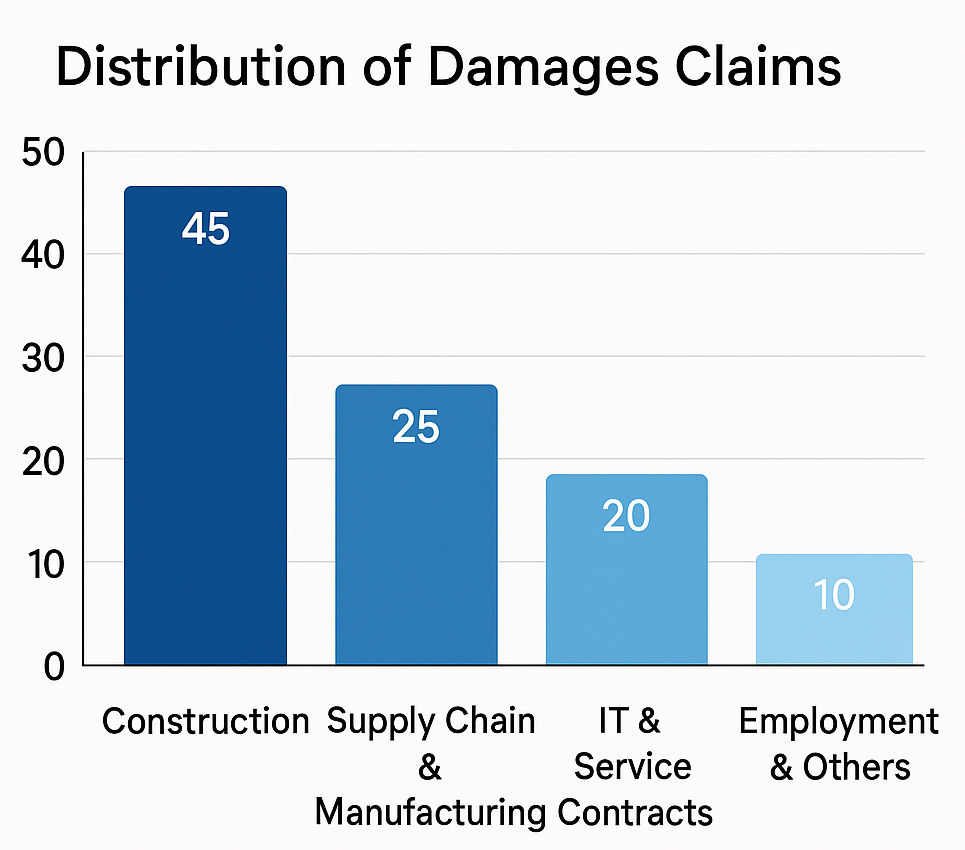

Common Scenarios Where Damages Are Claimed

Damages disputes are especially common in commercial, construction, and service contracts. Based on arbitration studies and reported cases, the following sectors dominate claims:

- Construction delays – disputes over project deadlines with or without liquidated damages clauses.

- Supply chain failures – higher replacement costs when suppliers default.

- Professional negligence – losses caused by consultants, auditors, or advisors giving faulty advice.

- Employment disputes – wrongful termination, delayed wages, or breach of employment contracts.

Damages in contract law are governed by principles of causation, remoteness, mitigation, and proof, ensuring that awards remain compensatory, not punitive. In practice, disputes often arise in construction and supply contracts, where the line between liquidated and unliquidated damages becomes crucial for financial outcomes.

Global & Indian Perspectives on Damages

Understanding how liquidated damages and unliquidated damages operate across jurisdictions is crucial for companies engaged in both domestic and cross-border transactions. While Indian law emphasizes reasonableness, many international systems enforce clauses more strictly.

Indian Perspective

- Governed by the Indian Contract Act, 1872.

- Section 73: Provides for unliquidated damages, limited to losses that naturally arise or were in the contemplation of the parties.

- Section 74: Governs liquidated damages, but courts only enforce amounts that are reasonable compensation—never punitive.

- ONGC v. Saw Pipes Ltd. (2003) reinforced that pre-estimated damages are valid but subject to judicial review for fairness.

- Arbitration studies show that over 60% of construction disputes in India revolve around damages claims linked to delays or performance failures (FICCI, 2023).

International Perspective (English Law as Benchmark)

- English law enforces liquidated damages clauses as agreed, unless they amount to a penalty.

- Cavendish Square Holding BV v. Talal El Makdessi (2015, UKSC) clarified that a clause is enforceable if it protects a legitimate commercial interest and is not extravagant or unconscionable.

- This creates more certainty and predictability for contracting parties, with courts rarely interfering in agreed sums.

Cross-Border Contract Implications

For businesses operating across India and international markets:

- Adapt LD Clauses – Ensure clauses are drafted to meet the stricter reasonableness test in India, while still enforceable abroad.

- Choice of Law Provisions – Clearly specify governing law and jurisdiction in contracts to avoid disputes on enforceability.

- Risk Allocation Strategy – Use liquidated damages where losses are quantifiable (construction, supply contracts) and rely on unliquidated damages where risks are uncertain (services, consultancy).

Key Takeaway:

- India: Courts cap damages at reasonable compensation.

- International (English law): Courts enforce LD unless penal.

- Businesses with cross-border contracts must customize their damages clauses to ensure they are valid and enforceable in all relevant jurisdictions.

In summary, liquidated damages and unliquidated damages are the two cornerstone remedies under contract law that balance certainty with fairness. While liquidated damages provide pre-agreed compensation that ensures predictability and risk allocation, unliquidated damages allow courts to tailor awards based on actual loss, supported by proof and governed by principles of causation, remoteness, mitigation, and reasonableness. Under the Indian Contract Act, 1872, damages are capped at reasonable compensation, whereas international regimes like English law often enforce liquidated damages unless they are penal, making cross-border contract drafting critical. For businesses, lawyers, and contracting parties, understanding these distinctions not only helps minimize disputes but also ensures enforceable, fair, and commercially viable agreements—especially in high-dispute areas like construction, supply chain, and service contracts, where over 60% of arbitration cases in India involve damages claims.

FAQs on Understanding Liquidated & Unliquidated Damages

-

What is the difference between liquidated and unliquidated damages?

Liquidated damages are a specific, predetermined amount agreed upon in a contract to be paid in the event of a breach. Unliquidated damages, on the other hand, are an amount of monetary compensation that is not pre-agreed upon and must be determined by a court based on the actual loss suffered from the breach.

-

What is the purpose of a liquidated damages clause?

A liquidated damages clause provides certainty for both parties, as the financial consequence of a breach is known in advance. It also helps avoid lengthy and costly litigation by removing the need for the injured party to prove their actual loss in court.

-

Are liquidated damages enforceable in India?

Yes, under Section 74 of the Indian Contract Act, 1872, a party can claim reasonable compensation up to the pre-agreed amount mentioned in the contract. However, courts will not enforce clauses that are deemed excessive or punitive.

-

How are unliquidated damages calculated?

The legal provisions in the Indian Contract Act do not specify a formula for calculating unliquidated damages. Courts typically determine the amount based on the facts of each case, the claims made, and the efforts taken by the non-defaulting party to mitigate the loss.

-

What is the principle of mitigation in damages claims?

The principle of mitigation requires an injured party to take reasonable steps to minimize the loss caused by the breach of contract. They cannot simply allow losses to accumulate and then claim the full amount from the defaulting party.

-

What is meant by a 'genuine pre-estimate' of loss?

A “genuine pre-estimate” of loss refers to a stipulated damages amount in a contract that is a reasonable and fair forecast of the actual loss that would likely be caused by a breach. If the amount is not a genuine pre-estimate but rather a penalty, a court may reduce it.

-

Can a party claim both liquidated and unliquidated damages for the same breach?

Generally, no. The purpose of a liquidated damages clause is to provide a sole remedy for a specific breach. In many cases, courts have held that a party cannot claim unliquidated damages if they have already agreed to a liquidated damages clause.

-

What are the legal principles governing damages in India?

The legal principles are primarily governed by the Indian Contract Act, 1872, specifically Section 73 and Section 74. Section 73 deals with unliquidated damages, while Section 74 pertains to liquidated damages. These sections ensure that compensation is awarded for losses that naturally arise from a breach, and that damages are compensatory, not punitive.

-

What are the common scenarios for damages claims in contracts?

Damages claims are common in commercial contracts where one party fails to fulfill their obligations. According to a FICCI study from 2023, over 60% of construction disputes in India arise from damages claims related to project delays or performance failures.

We Are Problem Solvers. And Take Accountability.

Related Posts

India-US Trade Deal: Details, Strategic Insights & Economic Impact

The India-US trade deal is a strategic tariff reset and economic understanding aimed at expanding bilateral trade and geopolitical alignment....

Learn More

Compliance Calendar February 2026 – GST TDS PF ESI Deadlines

Sync with Google Calendar Sync with Apple Calendar Plan your February filings in one place. Figures and forms are mapped...

Learn More

Union Budget 2026 – Synopsis for Founders, Investors & Startups

DOWNLOAD PDF India’s Union Budget 2026 signals a strategic evolution in economic policy one that emphasizes macroeconomic stability, sectoral capability...

Learn More