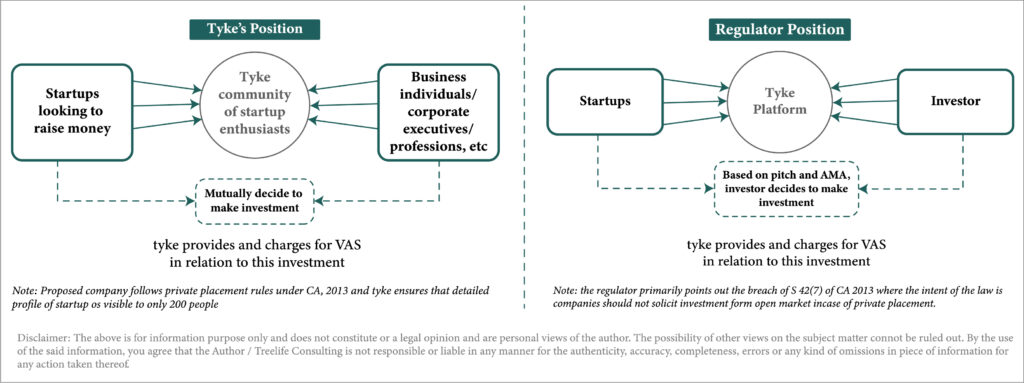

Regulators position – primary breach of S 42 (Issue of Shares on Private Placement basis) of CA, 2013

Extract of S 42(7) of the CA, 2013: “(7) No company issuing securities under this section shall release any public advertisements or utilize any media, marketing or distribution channels or agents to inform the public at large about such an issue.”

“S 42 of the Act clearly provides that the private placement shall be made to a select group of persons who have been identified by the Board. The number of such persons cannot exceed 200 (prescribed in the rules). The Explanation I. to S 42(3) makes it very clear that the process of “private placement” covers:

• the offer or

• invitation to subscribe or

• issue of

securities to a select group of persons by a company (other than by way of public offer) through private placement offer-cum-application, which satisfies the conditions specified in the section.

”In summary – the concept of the term ‘private placement’ stands for the fact that the company is identifying a certain set of parties to whom it wants to offer its securities rather than making any kind of public offer which generally happens in the case of listed companies. Private is construed as 200 people.

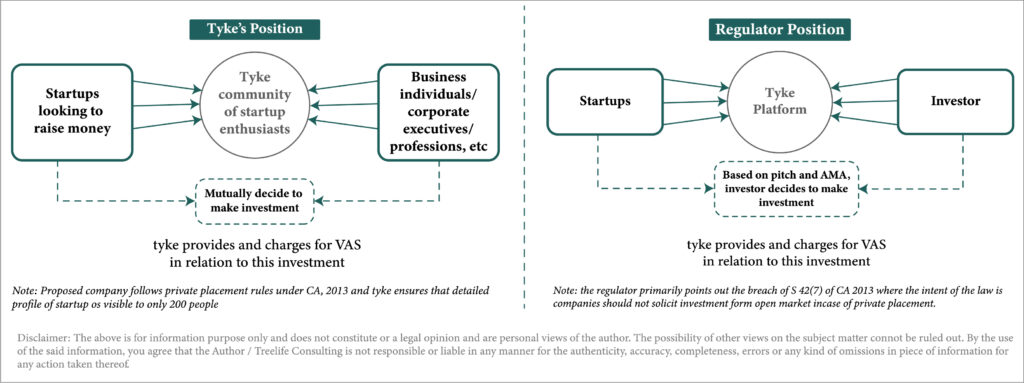

TYKE + Company’s position

“Tyke provides value added services in the form of facilitation of connecting like-minded people. Community with start-ups. Tyke also provides the verification of KYC, identification of KYC of people who have shown interest to invest in the company.”

“The Companies have only availed the value added services (VAS) which is provided by the Tyke platform.”

In summary – Tyke calls itself like a ‘community of like minded people and startups’ where the startup is leveraging on the community to raise investments and TYKE acts as a facilitator for the investment once the proposed investor and startup agree.

Our thoughts!

In the era of Shark Tank, every individual aspires to be a ‘shark’ and wants to participate in the startup ecosystem and ride the wave. TYKE serves as a great platform to provide access to both startups and retail investors for raising money and to invest money in startups respectively. In the USA, for example, this is considered as a high risk asset class and hence there are restrictions on the annual investment amount for regular investors other than ‘accredited investor’. Keeping this in mind, in the current scenario, despite all the explanations given by Tyke and the Company, the regulator primarily points out to the intent of the law where private placement (fundraise) cannot be published in open markets to solicit any investments through communities, etc

We Are Problem Solvers. And Take Accountability.

Related Posts

ESOP Taxation in India – A Complete Guide (2025)

Employee Stock Option Plans (ESOPs) have become an essential tool for businesses, especially startups and growth-stage companies, to attract, retain,...

Learn More

ESOPs in India: Process, Tax Implications, Exercise Price, Benefits

In the contemporary competitive job market, companies are constantly seeking innovative ways to attract and retain top talent. Employee Stock...

Learn More

Tax Exemption for Startups in India (2025)

In India, tax exemptions for startups are crucial for encouraging innovation and promoting the growth of new businesses. These exemptions...

Learn More