Latest Legal Posts

April 18, 2024 | Legal

RBI (Outsourcing of Information Technology Services) Master Directions, 2023

Read More

Other Resources

What’s in a Name? The ₹80 Crore Lesson from Bira 91’s Costly Mistake

The Rise of Bira 91 Bira 91 emerged as a disruptor in India’s beer market, challenging the dominance of traditional brands with its bold flavors, innovative branding, and youthful appeal. The brand quickly became synonymous with India’s growing craft…

Read More

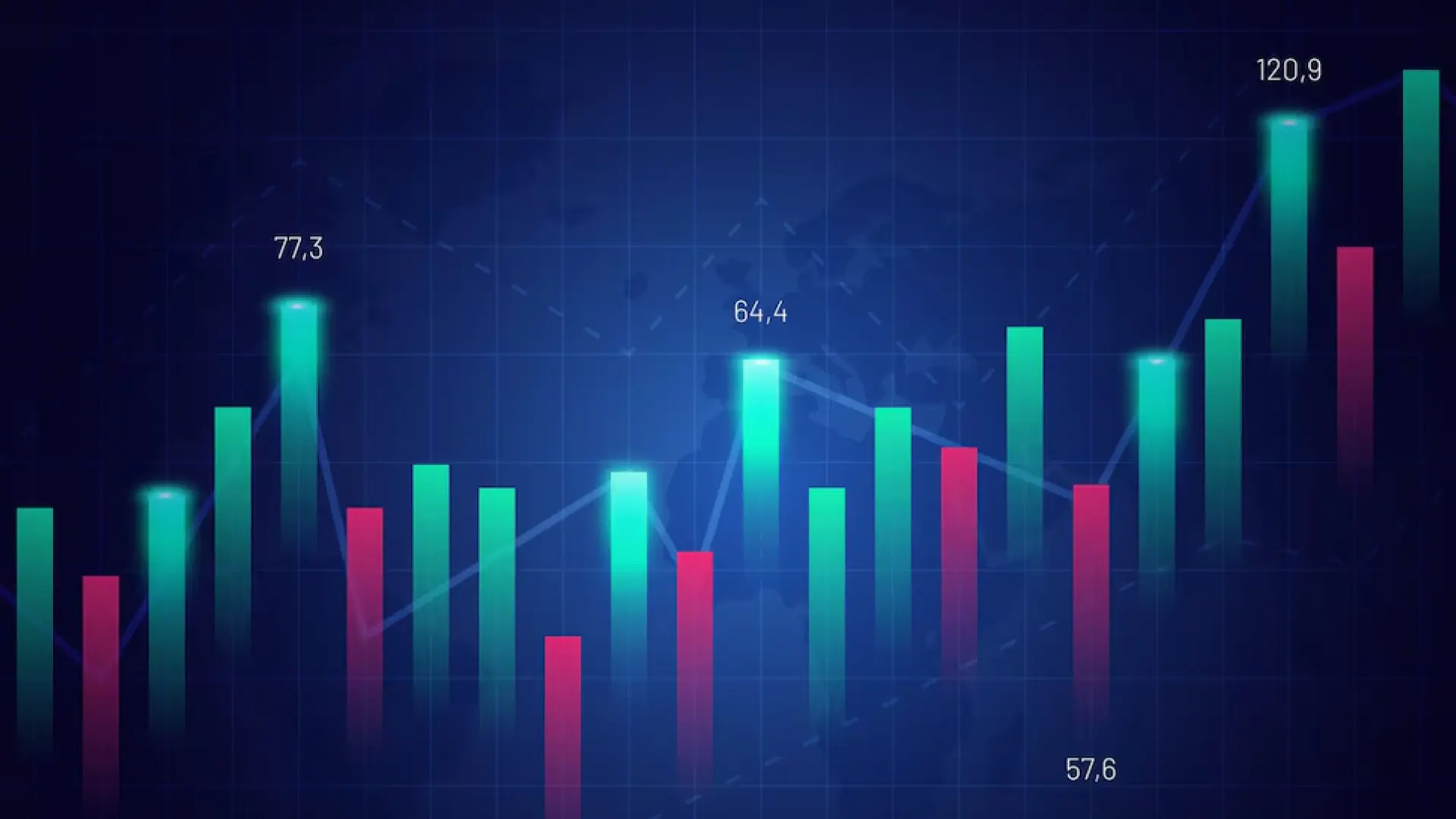

NIFTY 50: The Asset Class Killer – A 28-Year Journey of Growth

DOWNLOAD FULL PDF As we are witnessing NIFTY 50’s 52-week high, it's a moment to reflect on the extraordinary journey this index has taken since its inception in 1996. Launched with an index value of 1000, NIFTY 50 has steadily…

Read More

Compliances for Startups in India: Annual Legal & Financial Checklist

Introduction – Why Annual Compliances Matter for Startups What Are Annual Compliances for Startups? Annual Compliances for Startups refer to the mandatory legal and financial filings that every registered business in India must complete each financial year. These include submissions…

Read More