Blog Content Overview

- 1 Introduction

- 2 What is a Private Limited Company?

- 3 What Are Compliances for a Private Limited Company?

- 4 List of Compliances for Private Limited Company in India

- 4.1 1. INC-20A – Declaration for Commencement of Business

- 4.2 2. Appointment of Auditor – Form ADT-1

- 4.3 3. First Board Meeting

- 4.4 4. Subsequent Board Meetings (4 per Year)

- 4.5 5. Annual General Meeting (AGM)

- 4.6 6. AOC-4 – Filing of Financial Statements

- 4.7 7. MGT-7 / MGT-7A – Annual Return

- 4.8 8. DIR-12 – Appointment / Resignation of Directors

- 4.9 9. DIR-3 KYC – Director Verification

- 4.10 10. DPT-3 – Return of Deposits / Loans

- 4.11 11. MGT-14 – Filing of Board Resolutions

- 4.12 12. Directors’ Report

- 4.13 13. Maintenance of Statutory Registers

- 4.14 14. Circulation of Financial Statements (21 Days Before AGM)

- 4.15 15. Filing of Income Tax Return (Form ITR-6)

- 4.16 16. GST Returns (GSTR-3B / GSTR-1)

- 4.17 17. TDS Returns (Form 24Q, 26Q)

- 4.18 18. PF & ESI Returns

- 4.19 19. Professional Tax Return (State Specific)

- 4.20 20. CSR Report (If Applicable)

- 5 Tabular View of Private Limited Company Compliances

- 6 What Founders Usually Get Wrong

- 7 If You’ve Raised Capital

- 8 Event-Based and Other Statutory Compliances for Private Limited Companies

- 9 Non-Registrar (Other Statutory) Compliances

- 10 Annual Compliance Checklist for a Private Limited Company

- 11 Documents required for Online Private Limited Company Compliance

- 12 Streamline Company Compliance (MCA V3 Portal)

Introduction

Why Compliance Matters for Private Limited Companies & Funded Startups in India

Compliance is the backbone of sound corporate governance in India. For a Private Limited Company (Pvt. Ltd.), adhering to statutory regulations under the Companies Act, 2013 ensures transparency, accountability, and trust among stakeholders. It’s not just about meeting deadlines it’s about protecting directors from penalties, safeguarding company credibility, and maintaining good standing with the Registrar of Companies (ROC). Failing to comply with ROC requirements can lead to hefty fines, director disqualification, and even company strike-off under Section 248 of the Act. According to the Ministry of Corporate Affairs (MCA), companies that neglect annual filings can face daily penalties of up to ₹100 per form per day of delay, underscoring the significance of timely compliance.

When it comes to funded startups, compliance becomes even more critical. Startups that have secured funding from venture capitalists, angel investors, or institutional investors are under heightened scrutiny. Investors conduct thorough due diligence before and after investing, and any lapse in statutory filings, board governance, or financial reporting can impact valuation, future funding rounds, and investor confidence. For funded startups, maintaining accurate cap tables, issuing share certificates on time, filing PAS-3 for allotments, and complying with FEMA regulations in case of foreign investment are essential components of corporate discipline. Non-compliance not only attracts regulatory penalties but can also trigger investor rights such as indemnities, anti-dilution protections, or even exit clauses. Therefore, for funded startups, compliance is not merely a legal formality it is a strategic necessity that supports sustainable growth and long-term credibility.

Legal Foundation: Companies Act, 2013

The Companies Act, 2013, governs all private limited companies incorporated in India.

It sets forth legal obligations related to:

- Formation & Registration – Minimum two shareholders and directors.

- Statutory Filings – Annual returns, financial statements, and board resolutions.

- Corporate Governance – Transparent management, board accountability, and reporting.

- Penalties & Enforcement – Sections 92, 129, 137, and 441 prescribe penalties for defaults in filing or disclosure.

This act ensures that private limited companies operate within India’s legal and financial framework, aligning business integrity with national compliance standards.

Current Landscape: MCA Statistics (2025)

As per MCA’s Annual Report (2025):

- As of March 2025, India has over 1.85 million active companies, out of a total of 2.85 million registered entities, according to data released by the Ministry of Corporate Affairs (MCA). Nearly 65% of all registered entities fall under the Private Limited Company category reflecting the continued dominance of this structure among Indian businesses.

- Nearly 70% of registered entities fall under the “Private Limited” category.

- A significant number of these are startups and SMEs in sectors like fintech, manufacturing, and professional services.

- With the MCA V3 portal transitioning to fully web-based e-filing (including 38 forms for annual filings and audits), compliance efficiency and accuracy are expected to rise further through automation, pre-validation, and real-time error checks. With the MCA V3 portal simplifying filings, compliance rates have improved by 22% year-on-year (YOY) between FY 2023–2024.

What is a Private Limited Company?

Definition under the Companies Act, 2013 (Section 2(68))

A Private Limited Company (Pvt. Ltd.) is defined under Section 2(68) of the Companies Act, 2013 as a company that:

“by its Articles of Association, restricts the right to transfer its shares and limits the number of its members to two hundred.”

This form of entity is the most preferred business structure in India, combining operational flexibility with limited liability protection. It is regulated by the Ministry of Corporate Affairs (MCA) and governed by the Companies Act, 2013 and the Companies (Incorporation) Rules, 2014.

What Are Compliances for a Private Limited Company?

Meaning of Compliance

In simple terms, compliance means adhering to the statutory rules, regulations, and deadlines set by government authorities. For a Private Limited Company (Pvt. Ltd.), this includes following the legal framework established under the Companies Act, 2013, and meeting periodic filing obligations with the Registrar of Companies (ROC) and other regulatory bodies such as the Income Tax Department, GST, and Labour Authorities.

A compliant company is considered credible, transparent, and trustworthy by investors, regulators, and financial institutions making compliance a cornerstone of good corporate governance.

Categories of Compliance for Private Limited Company (Pvt. Ltd.)

| Categories of Compliance | Description | Key ROC Forms / Examples |

| Annual Compliance | Yearly ROC filings & statutory disclosures to maintain active status. | AOC-4, MGT-7/MGT-7A, DIR-3 KYC |

| Event-Based Compliance | Triggered by specific corporate events like director change or share allotment. | PAS-3, DIR-12, INC-22 |

| Financial Compliance | Covers statutory audit, tax filing & GST returns under Indian tax laws. | ITR-6, GSTR-1, GSTR-3B, TDS Returns |

| Regulatory Compliance | Industry or activity-specific registrations and periodic filings. | FSSAI, MSME, PF/ESIC, Environmental Permits |

| Secretarial Compliance | Maintenance of statutory registers, minutes & resolutions. | Board/AGM Minutes, MGT-14, Statutory Registers |

Key Aspects of Compliance for Private Limited Companies

| Aspect | What It Covers | Examples / Key Filings |

| Legal Compliance | Fulfilling mandatory filings and procedures under the Companies Act, 2013. | AOC-4, MGT-7, DIR-3 KYC, board meetings, AGM minutes. |

| Financial Compliance | Ensuring accuracy in financial reporting, audits, and tax filings. | Statutory Audit, ITR-6, GST Returns, TDS filings. |

| Regulatory Compliance | Following sector-specific laws and operational regulations. | FSSAI, SEBI (for startups), MSME, PF/ESIC, Environmental NOC. |

| Governance | Maintaining transparency through record-keeping and timely ROC filings. | Registers, MGT-14, financial statements circulation. |

Importance(Benefits) of Compliance for Private Limited Companies

Compliance isn’t just a legal necessity it’s what keeps a private limited company credible, investment-ready, and operationally sound. Here’s why it matters:

- Legal Protection: Timely compliance shields directors and companies from heavy fines, legal notices, and disqualification under the Companies Act, 2013.

Missing ROC filings can lead to daily penalties (₹100 per form) or even company strike-off under Section 248. - Investor Confidence: Transparent financials and ROC filings build trust among investors, VCs, and banks.

Companies with a clean compliance record close funding rounds faster and command better valuations. - Operational Efficiency: Regular filings ensure accurate records, structured reporting, and smoother decision-making.

A compliant company avoids last-minute scrambling during audits or due diligence. - Financial Health: Consistent compliance improves creditworthiness, allowing easier access to loans and credit lines.

Banks and investors view compliance as a sign of disciplined financial management. - Reputation Management: A company marked as “Active” on the MCA portal signals reliability.

Public visibility of compliance builds brand trust and enhances long-term business credibility.

Types of Compliances under the Companies Act, 2013

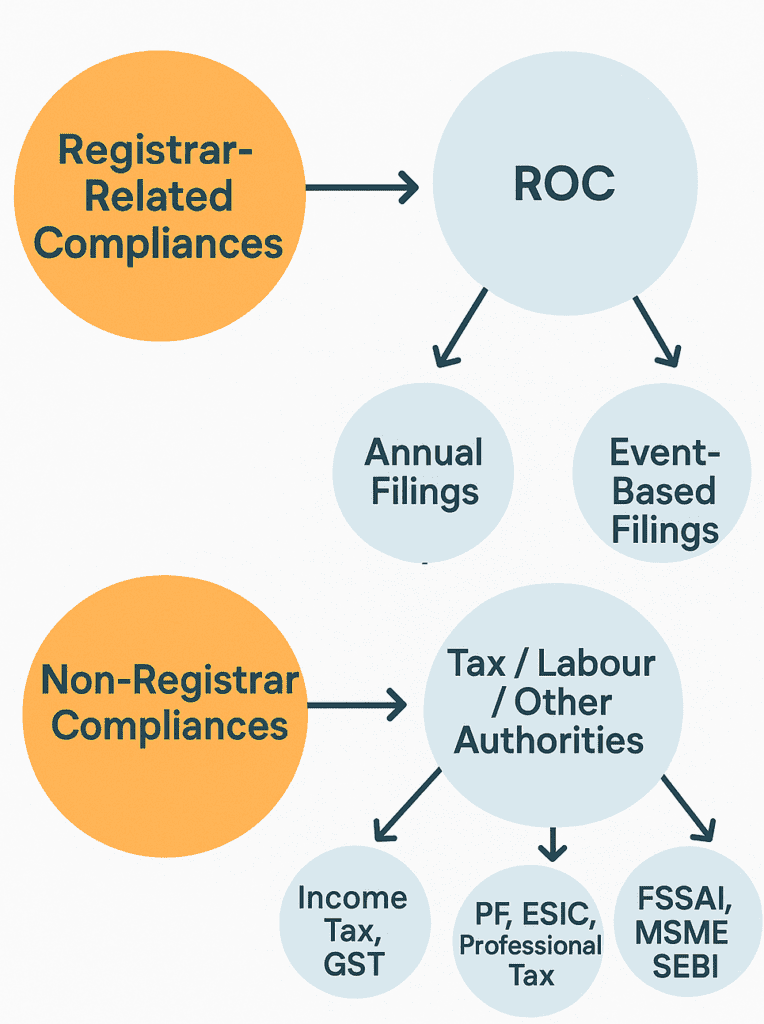

Compliances for a Private Limited Company (Pvt. Ltd.) in India fall into two broad categories Registrar-Related (ROC) Compliances and Non-Registrar Compliances. Understanding the difference helps ensure all legal, tax, and labour obligations are met accurately and on time.

Registrar-Related (ROC) Compliances

These are filings made directly with the Registrar of Companies (ROC) under the Companies Act, 2013 and are monitored by the Ministry of Corporate Affairs (MCA).

- Annual Compliances:

- Yearly disclosures like financial statements and annual returns.

- Forms: AOC-4, MGT-7/MGT-7A, DIR-3 KYC, ADT-1.

- Event-Based Compliances:

- Triggered by specific corporate events such as share allotment, director change, or change in registered office.

- Forms: PAS-3, DIR-12, INC-22, SH-7.

Purpose: To maintain transparency, ensure compliance with the Companies Act, 2013, and keep the company’s MCA status “Active.”

Non-Registrar Compliances

These are operational and regulatory compliances governed by other laws beyond the Companies Act. They ensure the company meets tax, labour, and industry-specific obligations.

- Tax Filings: Income Tax Return (ITR-6), TDS/TCS, Advance Tax.

- Indirect Tax: Monthly or quarterly GST Returns (GSTR-1, GSTR-3B).

- Labour Laws: Provident Fund (PF), Employees’ State Insurance (ESIC).

- Professional Tax (PT): State-wise monthly or annual returns.

- Sector-Specific Filings: FSSAI, MSME, SEBI, or Environmental permissions depending on business type.

Purpose: To ensure lawful operation under Income Tax Act, GST Act, Labour Codes, and other industry laws.

List of Compliances for Private Limited Company in India

A Private Limited Company (Pvt. Ltd.) must adhere to multiple annual, ROC, event-based, and tax compliances under the Companies Act, 2013, Income Tax Act, 1961, GST Act, 2017, and other allied laws. Below is a comprehensive and much detailed compliance list with each activity containing category, forms & penalty.

1. INC-20A – Declaration for Commencement of Business

Category: ROC / Event-Based

Description: This is a mandatory declaration filed by companies incorporated after November 2018, confirming that the company has received its paid-up capital. It must be filed within 180 days of incorporation using Form INC-20A with the Registrar of Companies (ROC).

Penalty: ₹50,000 for the company and ₹1,000 per day for each officer in default until filed; ROC may strike off the company if not filed within the prescribed time.

2. Appointment of Auditor – Form ADT-1

Category: Annual / ROC

Description: Every company must appoint its first statutory auditor within 30 days of incorporation, and subsequent auditors at the first Annual General Meeting (AGM). The appointment is filed with ROC in Form ADT-1 within 15 days of the AGM.

Penalty: Non-compliance may attract penalties under Section 139 and disqualification from submitting financial statements.

3. First Board Meeting

Category: Event-Based / Governance

Description: The first board meeting must be held within 30 days of incorporation, as required under Section 173 of the Companies Act. The agenda typically includes appointment of the first auditor, adoption of the common seal, and authorization of share certificates.

Penalty: ₹25,000 per director for failure to hold the meeting on time.

4. Subsequent Board Meetings (4 per Year)

Category: Annual / Governance

Description: A minimum of four board meetings must be conducted every financial year, with a maximum gap of 120 days between any two meetings. Proper minutes must be recorded and maintained in statutory registers.

Penalty: ₹25,000 per defaulting director under Section 173(4).

5. Annual General Meeting (AGM)

Category: Annual / Governance

Description: Every company must hold its first AGM within 9 months from the close of its first financial year, and subsequently within 6 months after the end of every financial year. Business includes adoption of financial statements, appointment of auditors, and declaration of dividends.

Penalty: ₹1,00,000 and ₹5,000 per day of continuing default under Section 99.

6. AOC-4 – Filing of Financial Statements

Category: ROC / Annual

Description: Companies must file their audited financial statements (Balance Sheet, P&L, and Directors’ Report) in Form AOC-4 within 30 days of the AGM.

Penalty: ₹100 per day of delay; directors may face additional prosecution under Section 137.

7. MGT-7 / MGT-7A – Annual Return

Category: ROC / Annual

Description: Companies must file their annual return containing shareholding pattern, directors, and key managerial data in Form MGT-7 (regular companies) or MGT-7A (small companies / OPCs) within 60 days of the AGM.

Penalty: ₹100 per day of delay under Section 92(5).

8. DIR-12 – Appointment / Resignation of Directors

Category: Event-Based / ROC

Description: Whenever a director is appointed or resigns, the company must file Form DIR-12 within 30 days of the event. It records changes in the company’s directorship.

Penalty: ₹500 per day of delay and potential fines up to ₹50,000.

9. DIR-3 KYC – Director Verification

Category: Annual / ROC

Description: Every director with a DIN must submit KYC verification annually using Form DIR-3 KYC or via DIR-3 KYC Web (if no changes) by September 30 each year.

Penalty: ₹5,000 for non-filing; DIN becomes “Deactivated” until compliance.

10. DPT-3 – Return of Deposits / Loans

Category: Annual / ROC

Description: Companies must disclose all outstanding loans, advances, and deposits (secured or unsecured) through Form DPT-3 by June 30 each year.

Penalty: ₹5,000 to ₹25,000; continuing default attracts ₹500 per day.

11. MGT-14 – Filing of Board Resolutions

Category: Event-Based / ROC

Description: Certain board resolutions, such as borrowing limits, share issue, or alteration of MOA/AOA, must be filed with ROC in Form MGT-14 within 30 days of passing the resolution.

Penalty: ₹1 lakh for company and ₹50,000 for every officer in default.

12. Directors’ Report

Category: Annual / Governance

Description: Prepared under Section 134 of the Companies Act, the Directors’ Report summarizes company performance, CSR, and risk disclosures. It must be circulated before the AGM and filed with AOC-4.

Penalty: ₹3 lakh for the company and ₹50,000 for each defaulting officer.

13. Maintenance of Statutory Registers

Category: Annual / Secretarial

Description: Every company must maintain updated statutory registers such as Register of Members, Directors, Charges, and Contracts under Sections 88 and 189.

Penalty: ₹50,000 and ₹1,000 per day for continuing default.

14. Circulation of Financial Statements (21 Days Before AGM)

Category: Annual / Governance

Description: Financial statements, auditor’s report, and director’s report must be circulated to all shareholders at least 21 days prior to the AGM under Section 136.

Penalty: ₹25,000 per defaulting officer.

15. Filing of Income Tax Return (Form ITR-6)

Category: Annual / Tax

Description: All companies (other than those claiming exemption under Section 11) must file Form ITR-6 by October 31 every year, irrespective of profit or loss.

Penalty: ₹5,000 under Section 234F; ₹10,000 if income exceeds ₹5 lakh and filed after the due date.

16. GST Returns (GSTR-3B / GSTR-1)

Category: Tax / Indirect

Description: Companies registered under GST must file GSTR-1 (outward supplies) and GSTR-3B (summary return) monthly or quarterly, depending on turnover.

Penalty: ₹50 per day of delay (₹20 for nil returns) and interest at 18% per annum.

17. TDS Returns (Form 24Q, 26Q)

Category: Tax / Statutory

Description: Companies deducting tax at source must file quarterly TDS returns using Forms 24Q (salaries) and 26Q (other payments).

Penalty: ₹200 per day of delay under Section 234E, capped at TDS amount.

18. PF & ESI Returns

Category: Labour / Regulatory

Description: Companies employing eligible workers must contribute to and file returns under the Employees’ Provident Fund (EPF) and Employees’ State Insurance (ESI) Acts. Returns are due monthly.

Penalty: Late deposit attracts interest at 12% and damages up to 25% of default amount.

19. Professional Tax Return (State Specific)

Category: State / Labour

Description: Applicable in select states (e.g., Maharashtra, Karnataka, West Bengal). Employers must deduct and pay professional tax monthly or annually.

Penalty: ₹5 per day of delay or up to 10% of tax amount depending on state law.

20. CSR Report (If Applicable)

Category: Annual / Regulatory

Description: Companies meeting CSR thresholds under Section 135 (Net worth ₹500 crore+, Turnover ₹1,000 crore+, or Net Profit ₹5 crore+) must submit an Annual CSR Report along with the Board Report.

Penalty: Twice the unspent CSR amount or imprisonment for officers in severe defaults.

Managing this yourself takes 15+ hours/month. See how funded startups outsource compliance. Let’s Talk

Tabular View of Private Limited Company Compliances

Incorporation Compliances

| Compliance | Description | Forms | Deadline and Penalty |

| Declaration of Commencement of Business | Since November 2018, companies in India with a share capital need to file a declaration with the Registrar of Companies (ROC) for the receipt of subscription money in the Bank account of the Company upon incorporation before starting operations or borrowing. Essentially, it acts as a go-ahead signal for the company to officially begin functioning. | INC-20A | Within 180 days of incorporation. Penalty of Rs. 50,000 for the company & Rs. 1000 per day for the directors for each day of default not exceeding Rs. 100,000/- |

| Auditor Appointment | Getting your finances in order is crucial right from the start for companies in India. Appointing a statutory auditor ensures proper oversight of your company’s financial health. | ADT-1 Filing | Within 30 days of incorporation. Penalty of Rs. 25,000/- but which may extend to Rs. 500,000/- for the Company and Rs. 10,000/- but which may extend to Rs. 100,000/- for the Director or officer of the Company who is in default. |

| Holding First Board Meeting | Newly formed PLCs in India have a crucial meeting on their agenda within the first month. This initial board meeting focuses on setting up the company’s financial foundation. Key items on the discussion table include opening a company bank account to deposit the share capital collected from shareholders, PLC’s incorporation certificate, seal, directors’ disclosures, etc. Additionally, the board will address issuing share certificates, | – | Within 30 days of incorporation. Rs. 25,000/- on the officer of the Company whose duty was to give notice for holding such meeting |

| Company Merchandise | All business letters, envelopes, invoices, etc. should have: Full name of PLC, Corporate Identification Number [CIN], Registered office address, Contact details – Telephone number &; Email id | – | As soon as the PLC is incorporated |

| Labour & Other Laws | Obtaining registration under labour laws if applicable and other laws etc. | – | – |

Director KYC & Disclosures

| Compliance | Description | Forms | Deadline and Penalty |

| KYC Filing for Directors | Keeping Director information up-to-date is essential in India. When filing the KYC form (DIR-3 KYC), both email and mobile phone one-time passwords (OTPs) are required for verification. If a Director’s email or phone number changes, they need to re-file the DIR-3 KYC form to update their information. For other changes in Director details, such as address, a different form (DIR-6) needs to be submitted. | DIR-3 KYC / Web KYC | Before 30th September of every year (Annual) Deactivation of Director Identification Number (DIN) |

| Disclosure of Directors’ Interest | Indian company directors must disclose their financial interests annually. This includes: – Directorships in other companies, bodies corporate, Partnership firms, association of individuals, | MBP-1 | Every First Board Meeting of the Financial Year (Annual) and whenever there is any change in the disclosures already made then at the first Board meeting held after such change The Director shall be liable to a penalty of Rs. 100,000/- |

| Disclosure of Non-Disqualification by Directors | Indian company directors must file a “Director Non-Disqualification Disclosure” | DIR-8 | At the time of appointment or reappointment Rs. 50,000/- on the Company and every officer of the Company who is in default and in case of continuing failure, a further penalty of Rs. 500/- per day during which such failure continues, subject to a maximum of Rs. 300,000/- in case of Company and Rs. 100,000/- in case of an officer who is in default |

Financial Statements & Filings

| Compliance | Description | Forms | Deadline and Penalty |

| Financial Statements & Audit Report | Indian companies are required to file their financial health report with the government within 30 days of holding their annual general meeting (AGM) . This report includes the balance sheet, profit and loss statement, cash flow statement, a director’s report, and an auditor’s report. However, only companies with a paid-up capital of Rs. 5 crore or more or turnover of Rs. 100 crore or more need to file this information electronically in a specific format called XBRL (eXtensible Business Reporting Language). | AOC-4 / AOC-4 XBRL | Within 30 days of AGM Penalty of Rs. 10,000/- and in case of continuing failure, with a further penalty of Rs. 100/- per day during which such failure continues, subject to a maximum of Rs. 200,000/- on Company and a penalty of Rs. 10,000/- and in case of continuing failure, with a further penalty of Rs. 100/- per day during which such failure continues, subject to a maximum of Rs. 50,000/- on directors and officers of the Company |

| Annual Return | In India, companies file an annual return summarizing their activities for the financial year (April 1st to March 31st). This report details the registered office, principal business activities, particulars of holding, subsidiary and associate Companies, shares, debentures and other securities, shareholding pattern, its members, and debenture-holders, promoters, Directors, Key Managerial Personnel (KMP), meetings of members or a class thereof, Board, Remuneration details of the Directors and KMP, penalty or punishment imposed on the Company, its directors or officers and details of compounding of offenses, matters relating to certification of compliances | MGT-7 | Within 60 days of AGM. Penalty of Rs. 10,000/- on the Company and every officer who is in default and in case of continuing failure, a further penalty of Rs. 100/- per day for each day during which such failure continues subject to a maximum of Rs. 200,000/- on in case of Company and Rs. 50,000/- in case of an officer in default |

Meetings & Resolutions

| Compliance | Description | Forms | Deadline and Penalty |

| Board Meetings | Board meetings in India are CEO summits. Directors discuss strategy, vote on key decisions, and oversee company management. Regular meetings ensure transparency and guide the company’s direction. | – | Minimum 4 meetings per year with max 120 days gap between meetings Rs. 25,000/- on the officer of the Company whose duty was to give notice for holding such meeting |

| Notice of AGM | In India, convening an annual general meeting (AGM) requires a proper notice sent to all entitled participants. This notice follows strict guidelines set out in Section 101 of the Companies Act, 2013, and further elaborated in Secretarial Standard-II. This ensures everyone receives timely information about the meeting, allowing them to prepare and participate effectively. | – | 21 clear days before AGM A penalty of upto Rs. 100,000/- and in case of continuing default, with a further fine upto Rs. 5,000/- for every day during which such default continues on the Company and every officer who is in default |

| Circulation of Financial Statements & Reports | -. | – | 21 clear days before AGM |

| AGM (Annual General Meeting) | Annual General Meetings (AGMs) are yearly gatherings mandated by the Indian Companies Act, 2013. Here, shareholders convene to discuss and approve company matters. AGMs serve a dual purpose: Transparency & Accountability: Financial statements are presented, allowing shareholders to assess the company’s health. They can then vote on proposals like electing directors, appointing auditors, and approving dividend payments.Shareholder Engagement: This forum provides a platform for shareholders to ask questions, voice concerns, and offer feedback on the company’s performance and direction. This interaction fosters better communication and strengthens corporate governance. | – | Within 9 months from the first financial year-end Within 6 months from the financial year-end A penalty of upto Rs. 100,000/- and in case of continuing default, with a further fine upto Rs. 5,000/- for every day during which such default continues on the Company and every officer who is in default |

| Appointment/Resignation/Change in Designation of Director | Director changes in India require specific procedures to ensure transparency and smooth company operation. Any appointment, resignation, or designation change of a director must be filed with the Registrar of Companies (ROC) within 30 days. Additionally, for resignations, a specific notice period must be provided. | DIR-12 | Within 30 days of appointment Penalty of Rs. 50,000/- and in case of continuing offense, a further penalty which may extend to Rs. 500/- for each day during which such default continues on every Director. Rs. 50,000/- and in case of continuing offense, a further penalty which may extend to Rs. 500/- for each day during which such default continues subject to a maximum of Rs. 300,000/- on Company. |

| Filing Special Resolutions (Board Report & Annual Accounts) | Special resolutions in India hold significant weight when it comes to company decisions. These require a higher approval threshold compared to regular resolutions, typically needing over 75% of voting members in agreement. . These documents detail the company’s performance, finances, and future direction, providing crucial information for shareholders to make informed decisions on matters like mergers, substantial asset sales, or changes to the company’s capital structure. | MGT-14 | Within 30 days of AGM A Penalty of Rs. 10,000/- and in case of continuing failure with a further penalty of Rs. 100/- for each day during which such failure continues subject to a maximum of Rs. 2,00,000/- on the Company. Penalty of Rs. 10,000/- for each day during which such failure continues subject to a maximum of Rs. 50,000/- on every officer who is in default |

Tax Compliances

| Compliance | Description | Forms | Deadline and Penalty |

| Advance Tax Calculation and Payment | To avoid a year-end tax crunch, private limited companies in India pre-pay a portion of their estimated annual tax liability through advance tax installments. Calculating your advance tax involves estimating your taxable income for the financial year (April 1st to March 31st) and applying the relevant tax rate. | – | Quarterly Missing these deadlines attracts a penalty of 1% monthly interest on the unpaid amount |

| Income Tax Returns | Private limited companies in India are required to file income tax returns every year, ensuring transparency and timely tax contributions. Filing income tax returns accurately reflects the company’s income and allows for proper tax assessment and payment. | – | The deadline for filing these returns typically falls on September 30th of the assessment year (following the financial year ending March 31st) Minimum penalty of Rs. 10,000 to a maximum of Rs. 1,00,000 |

| Tax Audit(Only if Turnover exceeds Rs. 10 Crore) | This annual audit by a qualified professional ensures the company’s financial records and tax calculations are accurate. By undergoing a tax audit, companies not only fulfill their legal obligation but also gain valuable insights into their financial health and potential tax optimization strategies. | – | Deadline 30th September Monetary penalties and may also involve delaying processing of the company’s tax return |

| GST filing (if applicable) | Private limited companies in India need to register for Goods and Services Tax (GST) if their annual turnover surpasses Rs. 40 lakh (for goods) or Rs. 20 lakh (for services) in a specific state (certain special category states have a Rs. 10 lakh threshold). Once registered, GST filing becomes mandatory. | – | Monthly Filing (for Turnover exceeding Rs. 1.5 crore) Quarterly Filing (for Turnover between Rs. 40 lakh and Rs. 1.5 crore) Penalties apply |

| TDS/TCS (if any) | Private limited companies in India act as tax collection agents for the government through Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) on specific payments they make. This applies when the company makes payments like salaries, rent, or professional fees.Filing TDS/TCS returns becomes mandatory if the company deducts tax during the financial year. These filings detail the deducted tax information, including the payee’s details, the amount deducted, and the nature of the payment. | – | The deadline for filing TDS/TCS returns depends on the quarter in which the tax was deducted: 1st Quarter (April-June): 15th of July2nd Quarter (July-September): 15th of October3rd Quarter (October-December): 15th of January4th Quarter (January-March): 15th of May |

Other Compliances

| Compliance | Description | Forms | Deadline and Penalty |

| Delay in Payment to MSME Vendor | Avoiding delayed payments to MSME vendors is a crucial compliance concern for private limited companies in India. The MSMED Act mandates payment within 45 days of accepting goods or services (or 15 days if no written agreement exists). Failing to comply can result in hefty penalties, including compounded monthly interest on the outstanding amount. This not only impacts your company’s financial standing but also disrupts your supply chain and potentially damages your reputation with smaller vendors. | MSME-1 | Half-yearly (April-Sep: Oct 1st; Oct-Mar: April 30th) Penalty of Rs. 25,000/- and in case of continuing failure, with a further penalty of Rs. 1,000/- for each day during which such default continues subject to a maximum of Rs. 300,000/- on the Company and every officer in default. No filing fee |

| Return of Deposits | For private limited companies in India that accept public deposits, complying with “Return of Deposits” regulations is crucial. An annual form, DPT-3, needs to be filed with the Registrar of Companies (ROC) by June 30th, detailing all deposit activity for the previous financial year. This includes amounts received, interest paid, and outstanding deposits, along with non-deposit transactions like loans. Filing the DPT-3 ensures transparency and responsible financial management for handling public funds. | DPT-3 | Every year on or before 30th June Penalty of Rs. 5,000/- and in case of continuing failure, a further fine of Rs. 100/- for every day after the first day during which the default continues on the Company and every officer of the Company who is in default. |

| Active Company Tagging (Companies registered before Dec 31, 2017) | Private limited companies registered in India before December 31, 2017, need to be aware of a specific compliance requirement called “Active Company Tagging” (ACT). Introduced in 2019, this is a one-time process to verify the company’s registration details and registered office address. The deadline to file the e-form (INC-22A) for ACT was April 25, 2019. However, companies that missed the deadline can still file it. | INC-22A | On or before 25th April 2019 (one-time filing) Penalty of Rs. 10,000 |

| Significant Beneficial Owner (SBO) Declaration (if applicable) | Significant Beneficial Owners (SBOs) – individuals with major control or influence. SBOs are obliged to file a declaration with the Company on acquiring any significant beneficial ownership and on receipt of such declaration the Company shall file a return with the Registrar of Companies This transparency strengthens corporate governance and deters malpractice, but failing to comply can result in penalties for both the SBO and the company. | BEN-1 & BEN-2 | BEN-1: To be filed with the Company within 30 days of acquiring any significant beneficial ownership or any change therein BEN-2: To be filed with the Registrar of Companies (ROC) Within 30 days from the date of receipt of declaration by SBO in form BEN-1 A penalty of Rs. 50,000/- and in case of continuing failure, then with a further penalty of Rs. 1,000/- for each day during which such failure continues, subject to a maximum of Rs. 200,000/- on the person failing to make a declaration. A Penalty of Rs. 100,000/- and in case of continuing failure, then with a further penalty of Rs. 500/- for each day during which such failure continues, subject to a maximum of Rs. 500,000/- on the Company and a penalty of Rs. 200/- for each day, in case of continuing failure subject to a maximum of Rs. 100,000/- on the officer who is in default. |

| Appointment of Company Secretary (if applicable) | Mandatory Appointment: Companies with a paid-up capital of Rs. 10 crore or more (listed or public).Every Private Limited Companies having paid up share capital of Rs. 10 crore or more must appoint a whole-time company secretary. Board Meeting: Convene a board meeting and pass a resolution appointing a qualified company secretary.File the requisites form electronically with the Registrar of Companies (ROC) within 30 days of the appointment. Compliance Benefits: A company secretary plays a crucial role in ensuring good corporate governance, legal compliance, and smooth functioning. They handle tasks like managing board meetings, maintaining statutory records, and filing various legal documents. | DIR-12 | Within 30 days of appointment of Company Secretary. Failure in appointment of a Company Secretary shall make the Company liable to a penalty of Rs. 500,000/- and every director and KMP who is in default shall be liable to a penalty of Rs. 50,000/- and in case of a continuing default, with a further penalty of Rs. 1,000/- for each day during which such default continues but not exceeding Rs. 500,000/- |

| Maintaining Employee related Compliances like ESI, PF | – | – | Annual |

What Founders Usually Get Wrong

Many early-stage founders and their teams inadvertently neglect critical compliance requirements that later create friction during fundraising, investor due diligence, or regulatory audits. Understanding these common pitfalls helps you avoid costly mistakes and maintain a legally sound operation.

Missing Board Meetings

One of the most frequently overlooked compliance obligations is holding regular board meetings. Founders often operate in “execution mode” and postpone formal board governance, viewing it as administrative overhead. However, the Companies Act mandates a minimum of four board meetings per year with a maximum gap of 120 days between meetings. Missing this requirement not only attracts a penalty of ₹25,000 per defaulting director, but it also signals weak governance to investors and creates legal vulnerabilities. Proper board meetings establish a documented decision-making process, protect directors from personal liability, and demonstrate institutional maturity—all critical when raising capital.

ESOP-Related ROC Filings

Employee Stock Option Plans (ESOPs) are integral to startup compensation strategies, yet many founders fail to file the requisite ROC forms when issuing ESOPs or stock options. Forms like PAS-3 (for share allotment) and MGT-14 (for board resolutions authorizing ESOP issuance) must be filed within 30 days of the corporate action. Non-compliance can result in daily penalties and, more importantly, creates ambiguity around employee ownership—a major red flag during investor due diligence. Additionally, inconsistent ESOP documentation weakens your cap table credibility and can delay funding rounds.

Cap Table Inconsistencies

Your cap table is the single source of truth for ownership. Many early-stage companies maintain cap tables in spreadsheets that diverge from their actual ROC records due to untracked ESOP grants, forgotten share transfers, or misaligned board resolutions. These inconsistencies create legal and financial risk: they confuse investor valuations, complicate future fundraising, and expose the company to shareholder disputes. The discipline of maintaining a cap table that mirrors your ROC filings (shareholding pattern in MGT-7, share issuances in PAS-3) is non-negotiable for any founder seeking institutional capital.

Investor Reporting Gaps

Once you raise capital, investors expect transparent and timely reporting. Yet many founders fail to establish consistent governance around cap table updates, quarterly financial disclosures, and board-level decision documentation. Missing or delayed investor updates erode trust and create compliance friction when follow-on investors or acquirers conduct due diligence. Establishing a rhythm of annual AGMs, timely financial statement filings (AOC-4 within 30 days of AGM), and transparent board minutes ensures your company remains investor-ready at all times.

If You’ve Raised Capital

Raising capital fundamentally elevates your compliance obligations. Investors bring not only capital but also governance expectations and legal accountability. Understanding how compliance intersects with investor protection ensures smoother operations and reduces friction during future fundraising or exit events.

Compliance as Investor Governance

When you accept investor capital, compliance transforms from a regulatory checkbox to a governance mechanism that protects investor interests. Annual filings like AOC-4 (financial statements) and MGT-7 (annual return) provide investors with transparent records of company performance, shareholding, and board activity. Regular board meetings document decision-making and strategic discussions, assuring investors that the company is well-managed. Timely filing of director and auditor appointments (DIR-12, ADT-1) signals organizational stability. Non-compliance in these areas doesn’t just expose the company to penalties—it breaches the implicit governance covenant investors expect, eroding their confidence and creating grounds for investor disputes or follow-on investment delays.

Risk of Non-Compliance During Due Diligence

Investor due diligence is your compliance audit. When investors (or acquirers in an M&A scenario) review your company, they scrutinize every ROC filing, shareholding record, and governance document. Missing or delayed filings, inconsistent cap table records, absent board minutes, or unresolved director KYC submissions (DIR-3 KYC) become deal-breakers. These gaps create legal uncertainty, increase acquisition risk, and often necessitate expensive remedial filings or board resolutions to “cure” historical non-compliance. In worst cases, undisclosed compliance violations discovered during due diligence can lead to deal termination, valuation haircuts, or post-closing indemnification claims. Maintaining pristine compliance throughout your company’s lifecycle ensures you enter due diligence with clean records, faster investor approval, and better valuation outcomes.

Event-Based and Other Statutory Compliances for Private Limited Companies

Event-Based Compliances for Private Limited Company

Event-based compliances are triggered whenever specific business or structural changes occur within the company. These filings ensure that every internal modification is legally recorded with the Registrar of Companies (ROC) as per the Companies Act, 2013.

Key Events Requiring Compliance:

- Change in Authorized or Paid-up Capital: File Form SH-7 for authorized capital and PAS-3 for share allotment.

- Allotment or Transfer of Shares: File Form PAS-3 within 30 days of allotment.

- Change in Directors or Auditors: File Form DIR-12 for director appointment/resignation and ADT-1 for auditor change.

- Loan to Director or Other Entities: Ensure board approval and file MGT-14 under Section 179.

- Change in Registered Office: File Form INC-22 within 30 days of the move.

- Change in Bank Account or Signatories: File a board resolution in MGT-14 and update bank authorities.

Key ROC Forms: MGT-14, SH-7, DIR-12, INC-22, PAS-3

Penalty: ₹100 per day of delay per form, plus possible disqualification for repeated defaults.

Non-Registrar (Other Statutory) Compliances

These compliances fall outside the ROC’s purview but are essential for a company’s tax, labour, and regulatory obligations. They ensure ongoing legal and fiscal conformity across departments.

Major Non-Registrar Compliances:

- GST Filings: Monthly/Quarterly/Annual returns (GSTR-1, GSTR-3B).

- TDS/TCS Returns: Quarterly filings (Form 24Q, 26Q).

- Income Tax Return (ITR-6): Annual filing by October 31 each year.

- PF and ESIC Returns: Monthly/half-yearly returns under labour laws.

- Professional Tax: State-wise monthly or annual filings.

- Other Acts: Factory Act, Environmental Regulations, and Shops & Establishment Act compliance depending on business activity.

Penalty: Varies by law e.g., late GST attracts ₹50 per day, TDS delays ₹200 per day (Sec. 234E, IT Act), and PF delays incur up to 25% damages of dues.

Penalties for Non-Compliance (Quantitative Overview)

| Non-Compliance | Penalty | Governing Provision |

| INC-20A Delay | ₹50,000 (Company) + ₹1,000/day (Director) | Section 10A, Companies Act |

| DIR-3 KYC Non-Filing | ₹5,000 per Director | Rule 12A, Companies Rules |

| AOC-4 / MGT-7 Delay | ₹100 per day each | Section 403, Companies Act |

| Continuous Default | Company Strike-off | Section 248, Companies Act |

Annual Compliance Checklist for a Private Limited Company

Below is a summarized Checklist for Annual Compliances of a Private Limited Company (PLC)

- Filing MSME Form 1 (Due by 30th April for the half year October to March and Due by 31st October for the half year April to September)

- Filing Return of Deposits (DPT-3) (Due by 30th June of every year)

- Holding Annual General Meeting (AGM) (Typically within 6 months of financial year-end)

- Filing Annual Financial Statements (AOC-4) (Due within 30 days of AGM)

- Filing Annual Return (MGT-7) (Due within 60 days of AGM)

- Holding Board Meetings during a Financial Year (At Least 4 meetings in a calendar year with a gap of not more than 120 days between 2 meetings)

- Filing Income Tax Return (ITR) (Due by September 30th as specified by Income Tax Department)

- Filing Tax Audit Report (if applicable) (Due within specified time frame after tax audit is conducted)

- Payment of Advance Tax (Quarterly throughout the financial year)

- Filing GST Returns (if applicable) (Frequency depends on turnover – monthly, quarterly, or annually)

- Filing TDS/TCS Returns (if applicable) (Quarterly with the Income Tax Department)

- Renewal of Licenses and Permits

- Employee-related compliances (ESI & PF) (For companies with employees)

Documents required for Online Private Limited Company Compliance

Here are some essential documents required for online Private Limited Company (PLC) compliance in India:

- Director’s Identity and Address Proof: Passport or PAN Card copy for Indian Nationals and apostille/notarized Passport copy for Foreign Nationals (all self-attested)

- Director’s DIN (Director Identification Number)

- PAN Card of the Company

- Subscription Details and Share Allotment Proof

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Digital Signature Certificate (DSC) of Directors

- Proof of Registered Office Address (Rent Agreement, No Objection Certificate from Landlord)

- Form MGT-7 (Annual Return) (within 60 days of holding the AGM)

- Form AOC-4 (Financial Statements) (within 30 days of holding the AGM) – includes Balance Sheet, Profit & Loss Account, and Director’s Report

- Changes in shareholding or capital structure

- Appointment or removal of directors or auditors

- Loans or advances given to other companies or directors

- Opening or closing of bank accounts or changes in signatories

- Income Tax Return Documents (as per specific requirements)

- TDS/TCS Return filing documents (if applicable)

Streamline Company Compliance (MCA V3 Portal)

Managing company compliance doesn’t have to be complex. With the right digital tools and expert support, private limited companies can simplify their filing processes and stay audit-ready year-round.

Use MCA V3 for Real-Time Compliance Tracking

The MCA V3 portal, launched by the Ministry of Corporate Affairs, offers real-time tracking of ROC compliances, form submissions, and document status.

- Log in with your Director Identification Number (DIN) or company credentials.

- Use the “My Application” dashboard to view filed forms like AOC-4, MGT-7, or DIR-3 KYC.

- Set alerts for upcoming due dates to avoid penalties under the Companies Act, 2013.

Adopt Digital Compliance Dashboards

Tools such as LEDGERS, Zoho Books, and QuickBooks help automate financial and compliance tasks:

- Generate GST, TDS, and ROC reports automatically.

- Sync accounting data with compliance trackers for error-free filings.

- Maintain secure cloud-based documentation for audit readiness.

We take care of all your compliances Let’s Talk

FAQs: Private Limited Company (Pvt. Ltd.) Compliance in India

-

What are the annual filing requirements for a private limited company?

Every year, PLCs need to file two main forms with the Registrar of Companies (ROC):

- Form MGT-7 (Annual Return): This details shareholder and director information within 60 days of the annual general meeting (AGM).

- Form AOC-4 (Financial Statements): This includes the company’s balance sheet, profit and loss account, and director’s report, filed within 30 days of the AGM.

-

How often do I need to hold board meetings for my Pvt. Ltd.?

Private Limited Companies must hold their first board meeting within 30 days of incorporation. Subsequently, at least four board meetings are required each year, with a gap of no more than three months between each meeting.

-

What happens if I miss a deadline for filing a compliance document?

Missing deadlines for filings typically results in financial penalties imposed by the ROC. The penalty amount can vary depending on the specific form and the delay period.

-

Do I need to appoint a company secretary for my Pvt Ltd?

Appointment of a company secretary is mandatory for Pvt Ltds with a paid-up capital of Rs. 10 crore or more (listed or public) and those exceeding Rs. 5 crore (unlisted private companies).

-

What are some event-based compliances I need to be aware of?

Besides annual filings, various other compliances are triggered by specific events within the company. These include changes in share capital, director appointments or resignations, loans granted, and bank account activities.

-

What are the consequences of non-compliance for a Private Limited Company?

Failing to comply with regulations can lead to penalties, legal action, delayed approvals, reputational damage, difficulty raising capital, and even director disqualification in severe cases.

-

How can I ensure my Company maintains good compliance?

Consulting with a professional like a company secretary or chartered accountant can help you stay updated on compliance requirements and deadlines. Additionally, online portals and government websites often provide valuable resources and information.

-

What are the benefits of maintaining good compliance for my Private Limited Company?

Compliance fosters smooth operations, enhances credibility, reduces penalty risks, improves corporate governance, and strengthens your company’s legal position. It also allows for better decision-making and can give you a competitive edge.

-

Can I file my Pvt Ltd compliance documents online?

Yes, the Ministry of Corporate Affairs (MCA) offers an online portal for filing various company forms and documents. This simplifies the process and reduces the need for physical submissions.

-

Where can I find more information about Pvt Ltd compliance requirements?

The Ministry of Corporate Affairs (MCA) website (https://www.mca.gov.in/content/mca/global/en/home.html) is a valuable resource for information on PLC compliance requirements, forms, and deadlines. Additionally, professional bodies and legal resources can provide further guidance.

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More