Blog Content Overview

- 1 Details: India–EU FTA 2026

- 1.1 Scope and scale of Free Trade Agreement

- 1.2 Key takeaways

- 1.3 What market access actually means (Post Approval)

- 1.4 Who wins first

- 1.5 Sensitive areas and the real risks

- 1.6 How this is strategic

- 1.7 Quick view: what opens when (effective after ratification)

- 1.8 Sector-level signals to watch

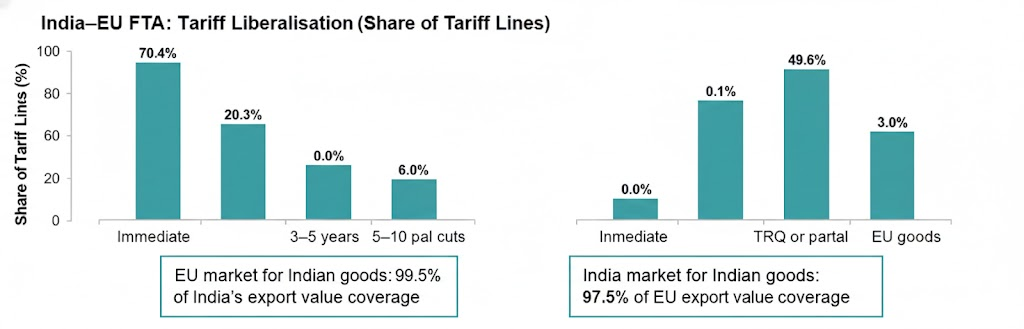

- 1.9 India–EU FTA: What opens when (share of tariff lines)

- 2 The Story behind India-EU Trade: How We Got Here

- 3 Backdrop: India–EU Trade Snapshot (Pre-FTA)

- 4 What Was Traded: Top Buckets (Pre-FTA)

- 5 What Becomes Duty-Free Now on the EU Side

- 6 India’s Offer to the EU

- 7 Industry-wise Tariff Outcomes (Snapshot)

- 8 Services, Mobility and Digital

- 9 Agriculture and Processed Food: Access with Safeguards

- 10 India Access to the EU vs India’s Offer to the EU

- 11 Key Growth Drivers and Supply-Chain Rewiring

- 12 Winners vs. Losers

- 13 India–EU Perspectives: What Each Side Wants

- 14 Rules, Standards and the Non-Tariff Terrain

- 15 Significance for India–EU Relations and Geopolitics

- 16 Implementation Roadmap: What to Track Next

- 17 Appendix: Key Data Points from the India–EU Free Trade Agreement 2026

AI Summary

The India-EU Free Trade Agreement (FTA), set to be finalized in 2026, aims to create a vast marketplace for nearly two billion people, contributing approximately $24 trillion to global GDP. With negotiations now concluded, the focus shifts to legal reviews and parliamentary approvals. The agreement will primarily benefit India's labor-intensive sectors, eliminating tariffs on 70.4% of EU tariff lines for Indian exports. India will also offer reduced tariffs on 92.1% of EU goods. Key sectors like textiles, automotive, and pharmaceuticals will see significant changes, encouraging competitiveness and investment. However, challenges in sensitive areas such as agriculture and automotive must be managed carefully. This FTA is a strategic move towards diversifying supply chains and enhancing trade relations between India and the EU.

Details: India–EU FTA 2026

Scope and scale of Free Trade Agreement

The India-EU Free Trade Agreement 2026 links two large economic blocs into a near two-billion-people marketplace. The combined output is estimated at about 24 trillion dollars, roughly one quarter of global GDP. For exporters and investors, the agreement is a rules-based platform to integrate with a deep, high-income market while preserving policy space for sensitive sectors.

Status: Negotiations have concluded on the India–EU Free Trade Agreement (FTA). The text now moves to legal scrubbing and approvals EU institutions and Member States on one side, and the Indian Parliament on the other. The provisions below reflect the negotiated package and will take effect only after ratification and entry into force.

Key takeaways

- Market size: ~2 billion consumers; ~USD 24 trillion GDP (as referenced in official factsheets).

- Design: Tariff cuts plus disciplines on services, mobility, and standards.

- Balance: Market opening with calibrated protection for sensitive sectors.

- Timing: All market-access effects begin post-approval and on agreed implementation schedules.

What market access actually means (Post Approval)

EU access for Indian goods (negotiated package)

The EU to open 97 percent of its tariff lines, covering 99.5 percent of India’s exports by value. This creates immediate price certainty for labour-intensive sectors and a clear schedule for the remainder.

- Day one (entry into force): ~70.4% of lines at zero duty (~90.7% of current exports). Immediate-zero lines include textiles, apparel, leather, toys, gems & jewellery, and many marine items.

- Transition window: ~20.3% of lines to zero over 3–5 years.

- Calibrated items: ~6.1% with partial cuts/TRQs (e.g., cars, steel).

India’s offer to EU goods

India to reduce tariffs across 92.1 percent of its tariff lines, covering 97.5 percent of EU export value. The offer blends immediate liberalisation with phased schedules for sensitive categories.

- Day one (entry into force): ~49.6% of lines to zero.

- Phasing: ~39.5% of lines to zero over 5/7/10 years; small, sensitive farm items under limited TRQs.

- Autos: Finished cars to glide from ~110% toward ~10% over time; parts to zero within 5–10 years.

Who wins first

Early gains are expected in India’s labour-intensive goods with immediate duty elimination and strong EU demand. Roughly USD 33 billion of current shipments in apparel, leather & footwear, marine, toys, sports goods, and gems would face zero duty improving price competitiveness and predictability.

On services, the EU schedules liberalisation across 144 subsectors and a structured mobility regime (business visitors, ICTs, contractual suppliers, independent professionals). Predictable entry/stay and social-security coordination can support Indian IT, engineering, and professional services upon entry into force.

Sensitive areas and the real risks

- Automotive & premium segments: Tariff glide paths could intensify competition in India’s mid-to-premium vehicle market; parts liberalisation deepens supply-chain integration.

- Agriculture & fisheries: Opening must be sequenced with safeguards/standards support to mitigate pressures on small dairy producers and small-scale fishers.

- EU regulatory compliance: CBAM, the EU Deforestation Regulation, and CSDDD may offset tariff gains without workable flexibilities and technical support. MFN-style assurances and cooperation are noted, but near-term compliance costs remain material for metals and agri value chains.

How this is strategic

The FTA is positioned to enable supply-chain diversification in pharmaceuticals, automotive, and clean energy; streamline pharma compliance for EU healthcare supply chains; lower component costs for autos; and expand joint opportunities in solar, wind, grids, and green hydrogen supporting export-led growth and scale manufacturing once operative.

Quick view: what opens when (effective after ratification)

| Side | Immediate zero duty | Zero in 3–5 years | Zero in 5–10 years | TRQ or partial cuts | Coverage by value |

| EU market for Indian goods | 70.4% of tariff lines | 20.3% | n.a. | 6.1% | 99.5% of India’s exports |

| India market for EU goods | 49.6% of tariff lines | part of 39.5% phased | part of 39.5% phased | limited farm and autos | 97.5% of EU exports |

Sector-level signals to watch

- Textiles & apparel: Zero-duty access to a ~USD 263.5B EU import market; India’s 15–20% manufacturing cost edge in key hubs could accelerate sourcing shifts.

- Leather & footwear: Removal of tariffs up to 17% opens a ~USD 100B EU market.

- Marine products: Tariffs up to 26% eliminated on several lines; some products under TRQ.

- Pharma & med-tech: Lower tariff frictions and regulatory cooperation to deepen integration into EU healthcare supply chains.

- Automotive: Parts to zero strengthens links with EU OEM networks; calibrated car tariffs reshape the premium segment over time.

- Services: 144 subsectors with mobility commitments and time-bound social-security arrangements across EU Members once in force.

The Story behind India-EU Trade: How We Got Here

From first talks to a concluded deal

The India–EU Free Trade Agreement has been nearly two decades in the making. Talks began in 2007, paused in 2013 after 15 rounds, and restarted in 2022 with a wider scope covering goods, services, digital trade and sustainable development. Negotiations concluded on 27 January 2026 alongside the 16th India–EU Summit, reflecting convergence on market access, professional mobility and standards cooperation. Unlike tariff-only pacts, this agreement embeds SPS and TBT problem-solving and structured pathways to manage EU sustainability rules, while allowing phased liberalisation where India requires transition time.

Negotiation timeline at a glance

| Milestone | What changed | Why it was important |

| 2007 | Formal launch of FTA negotiations | Set ambition for a comprehensive agreement on goods and services |

| 2013 | Talks suspended after 15 rounds | Divergences on autos, wines and spirits, visas for professionals, regulatory frictions |

| 2022 | Talks revived with upgraded scope | Added services mobility framework, sustainability, and standards cooperation |

| 27 January 2026 | Negotiations concluded at the 16th India–EU Summit | Locked market access schedules and regulatory workstreams; moved to legal steps |

Why Now: Resilience, Diversification, and Friend-Shoring

A trade landscape shaped by geopolitical rivalry, trade remedies, and supply shocks is pushing firms toward multi-node supply chains and policymakers toward de-risking. The negotiated India–EU FTA 2026 aligns with this shift by setting up a de-risked corridor between a ~€22.5 trillion integrated market and a large, fast-growing manufacturing and services base.

- For Europe: early-mover position in Asia and a second export engine as China exposure is managed.

- For India: stronger investment case in autos, electronics, clean tech, and pharmaceuticals, complementing PLI-type incentives.

What Would Change on the Ground

- Pharmaceuticals – Streamlined regulatory compliance and stronger IP disciplines to move Indian firms deeper into EU healthcare sourcing.

- Automotive – Components to zero duty on agreed schedules, tightening India–EU production links. Calibrated access for finished vehicles to protect sensitive segments.

- Clean Energy – Cooperation that aligns the EU Green Deal with India’s 2030 target of 500 GW renewables, opening joint opportunities in solar, wind, grids, and green hydrogen.

- Apparel and Footwear – Zero-duty access and predictable rules can pivot sourcing to Indian hubs (e.g., Tiruppur, Surat) where manufacturing costs are reported 15–20% lower supporting friend-shored capacity.

Signals Policy Teams Track

- Re-routing of EU retail and med-tech sourcing pipelines toward India.

- Early investments in component lines co-located with Indian OEMs.

- Expansion of services delivery centers using mobility categories and social-security coordination windows.

What Happens Next: Legal Scrubbing to Ratification

- Legal scrubbing & language finalisation of the negotiated text.

- Translation into all EU languages.

- EU approval pathway: European Parliament and all 27 Member States.

- Indian approval pathway: Parliamentary processes.

These steps provide legal certainty across the EU single market. Provisions take effect only after all approvals and the agreement’s entry into force.

Backdrop: India–EU Trade Snapshot (Pre-FTA)

Where the relationship stood before the India–EU Free Trade Agreement 2026

Before tariff schedules take effect, the corridor is already large and diversified. In FY24–25, goods trade reached about 136.54 billion USD (India exports to EU 75.85 billion USD, India imports from EU 60.69 billion USD). In 2024, services trade added 83.10 billion USD, reflecting strong ties in IT, engineering, finance and professional services. The European Union consistently ranks among India’s top trading partners, which is why the India EU trade deal targets rules, standards and mobility in addition to tariffs.

Table 1: India–EU trade baseline

| Indicator | Value |

| Goods trade (FY24–25) | 136.54 billion USD |

| India → EU exports (FY24–25) | 75.85 billion USD |

| India ← EU imports (FY24–25) | 60.69 billion USD |

| Services trade (2024) | 83.10 billion USD |

What sits inside the numbers

Pre-FTA relationship profile

The EU is among India’s largest partners in goods and services, with deep corporate footprints in capital goods, clean tech, automotive and healthcare. Trade is broad-based rather than commodity heavy, so the India–EU Free Trade Agreement is structured to address non-tariff frictions and service-mobility bottlenecks alongside tariff cuts.

Composition highlights for analysis and outreach

- India’s manufactured exports to the EU include textiles, apparel, leather and footwear, gems and jewellery, engineering goods and select marine products that meet a high-income, standards-driven market.

- India’s imports from the EU skew toward technology- and capital-intensive goods such as machinery, automotive, medical devices and chemicals, supporting domestic upgrading and investment cycles.

Services corridor signal

The 83.10 billion USD services figure covers IT and business services, engineering R&D, education and professional mobility that already connect Indian talent with EU demand. The India EU FTA 2026 builds on this base with clearer access rules and social-security coordination.

What Was Traded: Top Buckets (Pre-FTA)

India to EU: the manufactured core with agri-processed depth

Before the India–EU Free Trade Agreement 2026, India’s exports to the EU were already led by manufactured goods, with meaningful depth in agri-processed products and pharmaceuticals that meet EU quality and SPS thresholds. The India-EU FTA is expected to amplify these established lanes where tariff preferences and standards/SPS cooperation bite fastest, so zero-duty access would accelerate existing flows rather than create demand from scratch, enabling quicker conversion into production, jobs, and shipment growth.

India → EU: key buckets and indicative products

- Manufactured goods and energy: textiles and apparel, leather and footwear, gems and jewellery, engineering items, refined petroleum, marine products, pharma formulations

- Agri-processed and speciality foods: tea, coffee, spices, table grapes, gherkins and cucumbers, dried onion, fresh fruits and vegetables, processed foods

Table: illustrative India → EU product mix

| Bucket | Typical examples |

| Textiles and apparel | Knitwear, woven garments, home textiles, accessories |

| Leather and footwear | Fashion footwear, leather goods, gloves |

| Gems and jewellery | Cut and polished diamonds, studded jewellery |

| Marine | Shrimp, frozen fish, processed seafood |

| Pharma | Generic formulations and APIs supplying EU healthcare systems |

| Agri-processed | Tea, coffee, spices, grapes, gherkins, dried onion, processed foods |

India’s pre-FTA imports from the EU were concentrated in technology- and capital-intensive lines aircraft/aerospace, nuclear-reactor components, precision and general machinery, automotive vehicles and parts, chemicals, and medical devices; with negotiations concluded and approvals pending, the India–EU FTA is expected once in force to lower landed costs for investment goods as tariffs phase down, deepen integration with European technology supply chains, and support India’s industrial upgrading and Make in India priorities through cheaper, more predictable access to machinery, med-tech, and specialised chemicals, while calibrated timelines on sensitive finished autos preserve space for domestic manufacturers even as parts liberalisation encourages localisation.

EU → India: key buckets and indicative products

- High-tech and capital goods: nuclear and aircraft parts, turbines, machine tools, process equipment, industrial automation

- Autos and components: premium vehicles, transmissions, electronics, braking systems

- Chemicals and med-tech: intermediates, specialty chemicals, medical instruments and devices that previously faced tariffs up to 6.7 percent

Table: illustrative EU → India product mix

| Bucket | Typical examples |

| Aircraft and nuclear components | Airframe parts, avionics sub-assemblies, reactor hardware |

| Precision machinery | CNC machine tools, compressors, material-handling equipment |

| Automotive | Luxury cars, hybrid and EV models, drivetrains, safety electronics |

| Chemicals | Industrial and specialty chemicals used by MSMEs and large plants |

| Medical devices | Lenses, spectacles, diagnostic and measuring instruments |

What Becomes Duty-Free Now on the EU Side

Immediate impact for Indian exporters

The India–EU Free Trade Agreement 2026 represents the largest negotiated single-step tariff gain India has lined up in a developed market; upon entry into force, the EU would drop duties on a large share of India’s export basket, with the deepest relief in categories where Indian firms already compete at scale. A very high share of labour-intensive lines that previously faced 4–26% tariffs would fall to zero, reinforcing manufacturing clusters and coastal export hubs while converting existing competitiveness into price advantages and predictable market access.

How the EU market would open (post-ratification)

Immediate zero duty (from entry into force)

- Coverage: ~70.4% of tariff lines; ~90.7% of India’s export value

- Core winners: textiles & apparel, leather & footwear, sports goods, toys, gems & jewellery, several marine items

- Scale: ~USD 33 billion of current labour-intensive exports shift to zero duty on day one

Zero duty in 3–5 years

- Coverage: ~20.3% of tariff lines; ~2.9% of export value

- Examples: processed foods and selected marine products that graduate to duty-free on short phase-outs

Preferential access / TRQs

- Coverage: ~6.1% of tariff lines; ~6.0% of export value

- Examples: partial tariff cuts or tariff-rate quotas in sensitive areas such as cars, steel, and specific shrimp/prawn lines

Table 2: EU market access for Indian goods

| Access bucket | Tariff lines | Share of India’s export value | Examples |

| Immediate zero | 70.4% | 90.7% | Textiles, leather, toys, gems, marine |

| Zero in 3–5 years | 20.3% | 2.9% | Processed foods, marine |

| Preferential or TRQ | 6.1% | 6.0% | Cars, steel, certain seafood |

India-EU Trade Deal Tariff Comparison

| Product | Current Tariffs | Expected Tariffs After India-EU Deal |

| Pearls, Precious Stones & Metals | 22.5% | 0% (for 20% of products; others reduced) |

| Aircraft & Spacecraft | 11% | 0% |

| Optical, Medical & Surgical Equipment | 27.5% | 0% (for 80% of products) |

| Machinery & Electrical Equipment | 44% | 0% |

| Iron & Steel | 22% | 0% |

| Motor Vehicles | 110% | 10% (quota of 25k) |

| Pharmaceuticals | 11% | 0% |

| Spirits | 150% | 40% |

| Wine | 150% | 20% (Premium) / 30% (Medium) |

| Beer | 110% | 50% |

| Chemicals | 22% | 0% |

| Plastics | 16.5% | 0% |

| Sheep Meat | 33% | 0% |

| Kiwis & Pears | 33% | 10% (in quota) |

| Processed Food | 50% | 0% |

| Fruit Juices & Non-Alcoholic Beer | 55% | 0% |

| Sausages & Other Meat Preparations | 110% | 50% |

| Olive Oil, Margarine & Other Vegetable Oils | 45% | 0% |

Quick summary for commercial teams

Apparel and home textiles

- Zero duty at entry into force across all lines

- Addresses tariffs up to 12 percent and opens a 263.5 billion USD EU market

Leather and footwear

- Tariffs up to 17 percent eliminated from day one

- Operates in a market near 100 billion USD with India’s current exports around 2.4 billion USD as a base

Gems and jewellery

- Preferential access across the full trade value improves pricing for cut and polished diamonds and studded jewellery

Marine products

- Duty relief up to 26 percent with full-value preferential access

- Unlocks a 53.6 billion USD EU marine import market for shrimp, frozen fish and value-added seafood

Chemicals and medical instruments

- Eliminates duties up to 12.8 percent in chemicals and up to 6.7 percent in medical devices across very high coverage

- Supports competitiveness and regulatory-ready expansion into EU healthcare and industrial supply chains

India’s Offer to the EU

The scale of India’s market opening

India’s offer grants broad access while ring-fencing a small sensitive list: about 92.1% of tariff lines, covering roughly 97.5% of EU export value, are included; 49.6% drop to zero at entry into force, another 39.5% phase out over 5, 7, or 10 years, around 3% receive partial cuts, and a narrow fruit set apples, pears, peaches, kiwifruit enters via TRQs. The design lowers input costs, supports capex, and deepens India–EU supply-chain ties while preserving safeguards through timelines, partial cuts, and quotas; effects commence only after ratification.

How the tariff timeline works

- Immediate elimination: 49.6% of lines across industrial inputs, capital goods and consumer items.

- Phased to zero: 39.5% over 5, 7 or 10 years to smooth adjustment for domestic value chains.

- Partial reductions: 3% where full elimination is not suitable.

- TRQs are confined to a handful of fruits to protect farm incomes while enabling predictable EU access.

Autos: calibrated liberalisation with a long runway

Under the negotiated package, finished EU cars would glide from ~110% duty toward ~10% over time, while auto parts move to zero within 5–10 years; this sequencing steers EU OEMs toward CKD assembly, component sourcing, and engineering in India, even as calibrated car timelines preserve space for domestic manufacturers in mass-market price bands.

Table 3: What opens in India for EU goods

| Coverage element | Share of tariff lines | Share of EU export value | Illustrative impact |

| Immediate zero duty | 49.6% | Included within 97.5% | Faster commissioning for projects using EU machinery, instruments |

| Phased to zero (5/7/10 yrs) | 39.5% | Included within 97.5% | Predictable glide path for local supply chains to adapt |

| Partial reductions | 3.0% | Small share | Price relief without full elimination |

| TRQs on select fruits | Narrow set | Minimal | Seasonal access with farm safeguards |

| Overall offer | 92.1% | 97.5% | Broad market access package to a developed partner |

Industry-wise Tariff Outcomes (Snapshot)

Sectoral tariff changes and outlook

| Sector | Outcome | India impact | EU or market impact |

| Textiles and apparel | Zero duty entry into EU; India retains calibrated access for EU goods domestically | Scale and jobs in clusters; stronger price competitiveness into a 263.5 billion USD EU market | EU brands diversify sourcing to India; deeper vendor development |

| Leather and footwear | EU duties up to 17 percent eliminated for Indian exports; India opens inputs and select lines | Export surge potential; MSME upgrading and design-led shift | Cost-effective sourcing and resilient supply for EU retailers |

| Gems and jewellery | Preferential access across full trade value on EU side; India keeps import stance balanced | Margin and volume uplift for cut and polished and studded lines | Wider product variety and steady supply for EU retail |

| Marine | EU duty elimination up to 26 percent on several lines; India manages TRQs in sensitive items | Gains for shrimp and processed seafood with value addition | Stable supplies to EU’s 53.6 billion USD marine market |

| Autos | India phases EU car duty from about 110 percent to about 10 percent; parts to zero in 5 to 10 years | Competitive pressure in premium segments; localisation push for components | Market expansion for EU OEMs; deeper India EU auto value chains |

| Chemicals, machinery, medical devices | India lowers barriers, including med device tariffs previously up to 6.7 percent | Cheaper capital goods and med tech; faster tech diffusion | Stronger high tech export growth into India |

| Pharma | Low tariffs and regulatory cooperation frameworks from both sides | Tighter integration into EU healthcare supply chains | Affordable, reliable sourcing and collaborative R&D |

Services, Mobility and Digital

Why services are the quiet big story

- Scope: The EU schedules market access in 144 services subsectors (IT/ITES, professional services, education, financial services, tourism, construction). India schedules commitments across 102 subsectors, establishing a predictable, non-discriminatory regime once in force.

- Mobility framework: Covers business visitors, intra-corporate transferees, contractual service suppliers, and independent professionals, with a time-bound goal to conclude Social Security Agreements with all EU states within five years.

- Operational impact (post-approval): Easier talent deployment, reduced double social-security costs, and stronger scaling of digitally delivered services into a high-value EU market.

At a glance: services and mobility commitments

| Pillar | EU commitments | India commitments | Practical effect |

| Market access breadth | 144 subsectors | 102 subsectors | Wider certainty for cross border supply and establishment in priority services |

| Mobility categories | Business visitors, ICTs, CSS, Independent Professionals | Mirror lanes for EU providers | Faster deployments, fewer visa hurdles, clearer stays |

| Targeted access windows | 37 subsectors for CSS; 17 for Independent Professionals | Opens EU priority services in professional, business, telecom, maritime, financial, environmental | Contract delivery visibility for IT, R&D, higher education |

| Social Security Agreements | Enable with all EU states in 5 years or less | Reciprocal coordination | Lower total cost of deployment; no double contributions |

What changes in day to day operations

- Smoother short term work and study pathways for engineers, IT consultants, researchers and students, with clearer post study work options.

- Predictable entry and stay for project teams across software, R&D, design and higher education, improving ramp up times for client delivery.

- Easier movement for spouses and dependents in intra corporate transfers, improving the attractiveness of EU postings for Indian professionals.

- Digital trade emphasis plus regulatory cooperation reduces friction for online service delivery and knowledge based exports.

Agriculture and Processed Food: Access with Safeguards

What opens in Europe for Indian agri and food

Tea, coffee, spices, table grapes, gherkins/cucumbers, dried onion, fresh fruits and vegetables, and a wide range of processed foods receive preferential access under the negotiated package taking effect after approvals. For producers, this can lift pricing power in a high-income, standards-driven market that rewards quality, traceability, and consistent supply. Parallel SPS and TBT cooperation is designed to speed conformity assessment and make clearances more predictable, reducing time-to-market and compliance friction.

Indicative agri processed opportunity set

| Product group | Access outcome | Execution lever |

| Tea, coffee, spices | Preferential access | Align residues and labelling; leverage GI and premium branding |

| Table grapes, fresh fruit and vegetables | Preferential access | Pre clearances, cold chain, farm to packhouse compliance |

| Gherkins, cucumbers, dried onion | Preferential access | Contract farming, processing standards, EU retail ready packs |

| Processed foods | Preferential access | Reformulate to EU ingredient lists and nutrition panels |

Safeguards that ring fence sensitive sectors

- Protected farm lines: Dairy, cereals, poultry, and soymeal remain shielded to balance farm incomes with export growth; fisheries sensitivities are recognised.

- Faster, credible compliance: Product-specific rules and origin self-certification aim to speed clearances without compromising integrity.

- Food-security lever: India retains the option to use export taxes as a food-security instrument, even as some EU stakeholders prefer their removal.

Risk dashboard from stakeholder analyses

- Dairy: competition from efficient European producers could pressure small cooperatives if opening is not carefully sequenced.

- Fisheries: livelihoods of small scale fishers and sustainability are key concerns to monitor during implementation.

- Export taxes: calls to lift them could limit India’s ability to manage availability and prices during supply shocks.

India Access to the EU vs India’s Offer to the EU

Reciprocity in a snapshot

The India–EU Free Trade Agreement 2026 is reciprocal in architecture: India secures near-complete duty-free access to the EU for its export basket, while offering a calibrated opening at home that front-loads inputs and investment-heavy lines and shields a narrow set of sensitive products; with negotiations concluded and approvals pending, the design is intended once in force to translate quickly into orders for Indian manufacturers and services firms and to lower domestic production costs via predictable access to European technology, components, and capital goods.

Table 4: Reciprocity dashboard

| Dimension | EU → India (what India gets) | India → EU (what EU gets) |

| Goods market access | 97% of tariff lines, covering 99.5% of India’s export value; large immediate zero duty tranche across labour intensive and industrial lines | 92.1% of tariff lines, covering 97.5% of EU export value; 49.6% immediate elimination, 39.5% phased over 5, 7 or 10 years; limited TRQs for select farm items |

| Services access | 144 subsectors with strong mobility lanes for business visitors, intra corporate transferees, contractual service suppliers and independent professionals | 102 subsectors bound by India, aligned with domestic regulatory space and talent needs |

| Sensitive areas | TRQs or caps for cars, steel and certain seafood products | Autos on a glide path for finished vehicles; selective TRQs for apples, pears, peaches and kiwifruit |

| Regulatory | SPS and TBT cooperation plus MFN style CBAM flexibility with technical assistance and transition pathways | Structured dialogue on standards and Quality Control Orders to reduce non tariff frictions |

Key Growth Drivers and Supply-Chain Rewiring

The package is built for diversification. Near-zero tariffs (once in force), regulatory cooperation, and talent mobility enable end-to-end sector networks from design to after-sales. Firms assessing India–EU FTA 2026 opportunities should prioritise the spokes below.

Pharma: From vendor to essential supplier

- Streamlined compliance and predictable IP are set to cut time-to-market for generics and complex formulations.

- Expected post-approval outcomes: faster onboarding to EU procurement, better utilisation of FDA-compliant plants for Europe-bound runs, and scaling of CDMO services.

Automotive: Parts to zero, platforms go regional

- With parts phasing to zero and finished vehicles on a glide path, Indian component ecosystems can plug into EU platforms with shorter lead times and lower BOMs.

- EU OEMs in India gain incentives to localise critical modules; Indian tier-1/2 suppliers move up into higher-value sub-assemblies.

Clean energy: Financing a green buildout

- Joint opportunities in solar, wind, grid equipment, and green hydrogen align EU decarbonisation goals with India’s 2030 500-GW target.

- Lower capital-goods costs and technology partnerships can accelerate commissioning for IPPs and state utilities once provisions take effect.

Textiles & fashion: Speed-to-shelf with cost advantage

- EU brands de-risking single-country exposure gain a sourcing base in hubs like Tiruppur and Surat, where 15–20% cost advantages and stronger design/compliance capabilities are reported.

- Zero-duty access plus deeper vendor development can compress sampling-to-bulk cycles and improve OTIF performance after entry into force.

Quick matrix: where value is created

| Sector | Tariff end state | EU → India benefit | India → EU benefit | Likely KPI uplifts |

| Pharma | Low tariffs plus regulatory cooperation | Stable access to affordable formulations and CDMO | Expanded EU procurement and co-development | Faster approvals, higher OTIF |

| Automotive | Parts to zero; cars phased | Lower BoM for local assembly; tech transfer | Wider model variety; deeper supply chains | Higher localisation, shorter lead times |

| Clean energy | Capital goods cheaper | Faster commissioning of RE projects | Larger addressable market for EU OEMs | Lower LCOE, better capacity factors |

| Textiles/fashion | Zero duty into EU | Higher EU order wins for India | De-risked, competitive sourcing for EU retailers | Better margin realisation, higher fill rates |

Winners vs. Losers

What shifts with the India–EU FTA 2026

- Incentives reset across labour-intensive goods, premium consumer segments, and capital-intensive industries.

- Indian exporters gain where tariffs + scale already intersect; exposure rises where EU brands have entrenched advantages.

- For the EU, the deal opens a structurally growing market for autos, capital goods, medical devices, and chemicals, with investment-led access to raw materials and local supply chains once in force.

Likely winners in India

- Textiles & apparel; leather & footwear; gems & jewellery; select marine: zero or preferential EU duty → sharper landed prices and faster order wins post-approval.

- IT/ITeS & professional services: EU binds 144 subsectors and sets mobility lanes (business visitors, ICTs, CSS, independent professionals) → smoother deployment and scale.

- Engineering goods & electronics: medium-term tailwinds as EU buyers diversify; tariff relief + compliance alignment support move-up the value chain.

Pressure points in India

- Premium autos: tougher competition as fully built EU cars glide to lower tariffs; mid-to-premium domestic segments must answer with localisation and partnerships.

- Wines & spirits; specialty cheeses; gourmet foods: stronger EU price competitiveness challenges Indian premium and artisanal brands.

- Talent dynamics: mobility gains without parallel upskilling/retention could accelerate brain-drain risks alongside clear opportunities.

Vulnerable segments to watch

- Dairy & small fisheries: scale asymmetries vs. EU players; outcomes hinge on safeguards and sequencing.

- Autos, chemicals, precision machinery: intensified industrial competition as duties fall and EU firms expand locally.

Likely winners in the EU

- Autos & components; capital goods; medical devices; chemicals: deeper access to a high-growth market with clearer tariff paths and standards alignment.

- Investment-led diversification: improved access to Indian resources and manufacturing bases reduces single-source risk.

Table: Winners vs losers snapshot

| Side | Likely winners | Exposure and risks |

| India | Textiles and apparel, leather and footwear, gems and jewellery, select marine, IT, ITeS and professional services | Premium autos, wines and spirits, gourmet foods, potential brain drain |

| EU | Autos and components, capital goods, medical devices, chemicals, upstream resource access via investment | Political economy sensitivities around Indian standards and QCOs; need to localise to hit price points |

India–EU Perspectives: What Each Side Wants

India’s priorities in the India European Union Trade Agreement

- Preferential access for labour intensive goods with rapid zero duty entry in the EU to lift jobs and MSME competitiveness

- Services and mobility as force multipliers, including time bound Social Security Agreements to lower deployment costs

- Regulatory cooperation on SPS and TBT to reduce non tariff barriers and speed conformity assessment

- Flexibility on carbon related measures and room to preserve domestic policy space in sensitive sectors

EU priorities in the India EU FTA 2026

- Market opening in autos, alcohol and capital goods, with standards alignment and transparent, predictable rules

- Progress on public procurement and an investment led pathway to secure raw materials and industrial inputs

- A strategic partnership that embeds India into European value chains and strengthens the EU role in global trade governance

Rules, Standards and the Non-Tariff Terrain

Why rules can outweigh tariffs

Even after duties fall under the India–EU Free Trade Agreement 2026, regulatory costs can shape real market access. Three EU pillars matter most: Carbon Border Adjustment Mechanism (CBAM), EU Deforestation Regulation (EUDR) and Corporate Sustainability Due Diligence Directive (CSDDD). India has an MFN-style CBAM assurance so any flexibilities offered to others extend to India, plus joint work on carbon pricing recognition, verification standards and finance support for exporters in steel and aluminium. Uncertainty is lower, but firms still need workable carve outs and transition timelines.

A second friction point is alignment between India’s Quality Control Orders (QCOs) and EU non tariff regimes. The pathway is operational SPS/TBT cooperation and a Rapid Response Forum to resolve issues early.

Finally, tariff asymmetry matters: EU average tariffs ~3–4 percent vs India ~10–12 percent. Headline EU goods gains are smaller, shifting the real prize toward services, mobility and investment.

Where deals succeed or fail

| Issue | What creates risk | What the FTA provides | What firms should do next |

| CBAM | Extra carbon cost on metal exports | MFN-type assurance; joint work on carbon pricing and verification | Build product-level emissions data; use finance windows to decarbonise |

| EUDR | Traceability burdens in coffee, rubber, wood | Transition dialogue under sustainability and SPS tracks | Deploy plot geotagging and supplier-trace tools; aggregate smallholders |

| CSDDD | Supply chain audits and data-sharing obligations | Regulatory cooperation forum | Set confidentiality clauses; standardise due diligence templates |

| QCOs vs EU NTBs | Dual audits and certification delays | SPS/TBT cooperation and Rapid Response Forum | Pre-certify to EU norms; escalate bottlenecks early via the forum |

Significance for India–EU Relations and Geopolitics

A strategic anchor in a fracturing world

The pact goes beyond tariffs. It creates a rules based bridge between India’s scale in manufacturing and services and the EU’s high income single market, strengthening investment, technology flows and standard setting. Well negotiated terms can lift trade and FDI, embed Indian firms in European value chains and reinforce the EU’s role in global trade governance.

Global positioning and knock on effects

By reducing single country dependence and building resilient supply chains, the corridor aligns Europe’s de risking with India’s export led growth. It can spur parallel initiatives, including possible US–India frameworks, as partners react to the EU–India axis. For businesses, this means earlier access to finance, standards partnerships and customers across autos, clean energy, defence and digital services.

Implementation Roadmap: What to Track Next

Milestones from text to trade

The agreement advances through formal steps before entry into force. Plan as if timelines are short and align pricing, staffing and compliance to published schedules.

Timeline checkpoints

- Legal scrubbing and language finalisation, then translation and ratification by all 27 EU Member States and the European Parliament

- Publication of product level phase outs and TRQs that convert headline shares into SKU duty paths

- Release of services protocols detailing mobility categories, subsector coverage and a five year roadmap to conclude Social Security Agreements across member states

Operational workstreams to stand up now

- CBAM cooperation plus SPS and TBT recognition pilots so conformity assessments are accepted faster with less duplication

- Supply chain moves by EU firms into India in autos, med tech, clean energy and apparel as tariffs fall and vendor development accelerates

Action list for commercial teams

- Map your top ten HS codes to phase out tables to lock pricing ladders and tenders

- Stand up cross functional squads for CBAM, EUDR and CSDDD with carbon accounting, traceability and supplier due diligence playbooks

- Pre qualify with EU notified bodies where SPS and TBT recognition is planned to shorten time to market

- Build mobility calendars for ICT, CSS and Independent Professionals to sequence deployments with services openings

Appendix: Key Data Points from the India–EU Free Trade Agreement 2026

A. Big number to remember

Nearly 33 billion USD of India’s labour-intensive exports enter the EU at zero duty on day one.

What this includes

- Textiles and apparel, leather and footwear, marine products, gems and jewellery, toys, sports goods, select engineering products

- Previously faced 4% to 26% EU tariffs; sectors employ millions, especially MSMEs and women

B. Automobiles: how tariffs change

| Product | Before the FTA | After the FTA |

| Fully built EU cars | ~110% import duty | Reduced toward ~10% gradually |

| Auto components | 10–15% (varies) | 0% duty over 5–10 years |

C. Sustainability and compliance: how EU rules are handled

| Issue | What the agreement ensures |

| Carbon Border Adjustment Mechanism | MFN-type, non-discriminatory treatment |

| EU standards (SPS and TBT) | Technical cooperation and equivalence pathways |

| Climate transition | Dedicated cooperation channels for gradual adjustment |

| Regulatory friction | Transparency, data sharing and recognition of conformity assessment |

References:

- https://www.pib.gov.in/PressReleasePage.aspx?PRID=2219065

- https://www.commerce.gov.in/wp-content/uploads/2026/01/Factsheet-on-India-EU-trade-deal-27.1.2026.pdf

- https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/india/eu-india-agreements/memo-eu-india-free-trade-agreement-chapter-chapter-summary_en

- https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/india/eu-india-agreements/factsheet-eu-india-free-trade-agreement-main-benefits_en

- https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/india/eu-india-agreements/factsheets-and-guides_en

- https://www.mea.gov.in/bilateral-documents.htm?dtl/40614/India__EU_Joint_Statement_on_the_State_Visit_of_President_of_the_European_Council_and_President_of_the_European_Commission_to_India_and_the_16th_India_EU_Summit

- https://www.reuters.com/business/autos-transportation/india-eu-slash-tariffs-autos-spirits-textile-landmark-deal-2026-01-27/

- https://www.reuters.com/world/india/details-eu-india-trade-deal-tariffs-quotas-market-access-2026-01-27/

- https://www.theguardian.com/business/2026/jan/27/eu-and-india-sign-free-trade-agreement

- https://timesofindia.indiatimes.com/business/india-business/india-eu-fta-finalised-top-15-frequently-asked-questions-faqs-on-trade-deal-answered/articleshow/127609699.cms

FAQs on India–EU FTA 2026

-

What is the India–EU FTA 2026?

A comprehensive pact concluded on 27 January 2026 covering goods, services, mobility, sustainability and investment cooperation.

-

How much of India’s exports get zero duty in the EU?

Preferential access on 97% of EU tariff lines covering 99.5% of India’s export value, with 70.4% of lines zero duty immediately.

-

What are India’s tariff commitments to the EU?

Covers 92.1% of lines and 97.5% of EU export value: 49.6% immediate zero, 39.5% phased over 5/7/10 years, limited TRQs on select fruits.

-

Which Indian sectors benefit first?

Textiles, leather and footwear, gems and jewellery, marine products; plus IT, ITeS and professional services via 144 EU services subsectors.

-

What’s the biggest execution risk?

EU regulatory measures like CBAM, EUDR and CSDDD can offset tariff gains without parity flexibilities, transition windows and fast troubleshooting.

-

How are autos treated under the deal?

Finished EU cars glide from around 110% to near 10% over time; auto parts head to zero within 5–10 years.

-

What does the services and mobility chapter change?

Clear lanes for business visitors, intra-corporate transferees, contractual service suppliers and independent professionals, plus a path to Social Security Agreements within five years.

-

How big was India–EU trade before the FTA?

Goods trade about 136.5 billion USD in FY24–25 and services around 83.1 billion USD in 2024.

-

Which EU sectors gain in India?

Autos and components, capital goods, medical devices, chemicals, helped by phased tariff cuts and standards cooperation.

-

What should firms track next?

Ratification milestones, item-wise phase-out schedules and TRQs, services protocols for mobility, and CBAM/SPS/TBT cooperation pilots.

We Are Problem Solvers. And Take Accountability.

Related Posts

Net 30/60/90 Payment Terms : The Playbook for Indian B2B Finance Leaders

For Indian founders, CFOs, and Finance heads at Growth-stage B2B businesses. Sectors: SaaS | Services | Manufacturing | Wholesale Distribution...

Learn More

![Financial Modeling for Startups & Founders – Complete Guide [2026]](https://treelife.in/wp-content/uploads/2024/02/Financial-Modeling-for-Startups-Founders-Complete-Guide.webp)

Financial Modeling for Startups & Founders – Complete Guide [2026]

Financial modeling for startups in 2026 is no longer optional. It is the core operating system that connects vision to...

Learn More