Page Contents

India’s financial and technological ecosystem has been expanding exponentially, and the newest feather in its cap is the Gujarat International Finance Tec-City, popularly known as GIFT City.

This initiative, nestled in the heart of Gujarat can be a hotspot for Indian FinTech companies catering to a global clientele. Here’s a deep dive into why this initiative offers an unparalleled advantage.

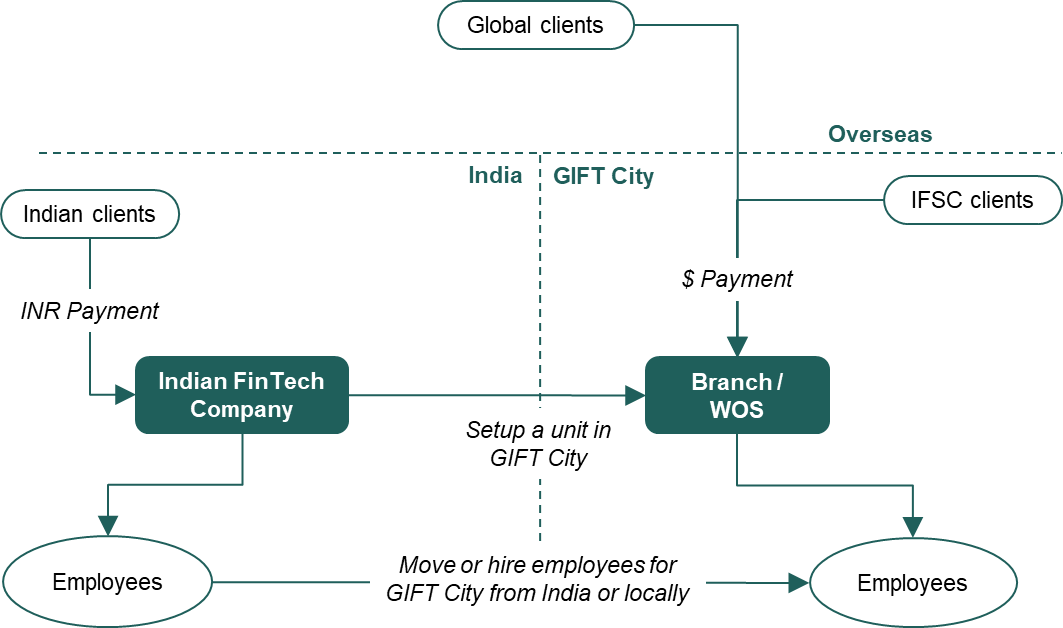

Broad Mechanics:

- Indian FinTech companies can opt to establish a unit within GIFT City. This could either be in the form of a branch or a wholly-owned subsidiary. The primary purpose? To service its roster of global clients as well as other enterprises located within the IFSC.

- Existing employees of such companies can be relocated to GIFT City. Alternatively, companies can also scout and hire local talent from the vicinity of GIFT City.

- One of the major operational benefits is the ability for the unit in GIFT City to receive payments in foreign exchange directly from its global clientele and IFSC clients.

Key Benefits:

- 100% income-tax exemption for 10 consecutive years out of 15 years

- Reduced MAT / AMT @ 9% on book profits – not applicable for companies opting for new regime

- No GST on services:

(i) Received by unit in IFSC

(ii) Provided to IFSC / SEZ units

(iii) Provided to global clients

- State subsidies such as lease rental, provident fund contribution, electricity charges

Want to know more about GIFT City?