Blog Content Overview

- 1 Executive Summary

- 2 Strategic Cost Management – the founder’s playbook

- 3 Benchmarking Fundamentals – Reduce costs without harming outcomes

- 4 KPI and Benchmark Map – What to measure first

- 5 Operating Model Levers – Where savings typically hide

- 6 Stage-Aligned Cost Architecture – Keep option value while scaling

- 7 Six-Step Quarterly Cadence from slides to savings

- 8 Evidence-led vignettes – Anonymous, Lesson-first

- 9 Founder Diagnostic Scorecard

- 10 Founder Takeaway – Strategic Coherence Over Simplistic Optimization

Executive Summary

Most founders approach cost management reactively. They wait until board pressure forces across-the-board cuts that damage growth, or they spend aggressively during expansion only to realise their cost base has become fundamentally misaligned with their business model and stage.

Cost optimization is not about spending less. It is about spending better. It means allocating resources to capabilities that genuinely drive competitive differentiation, while tightening or eliminating expenditure that does not contribute to strategic outcomes.

The stakes are high. Failure is not rare. Globally, close to 90% of startups eventually shut down, with more than one in five failing within the first year. Post-mortem analyses consistently indicate that financial issues, including weak cost discipline and cash flow mismanagement, contribute to roughly 15–20% of these failures. Cost structure, therefore, is not a hygiene decision. It is a strategic one.

This guide provides a strategic framework for cost management, benchmarking, and performance evaluation based on patterns observed across growth-stage companies.

Spend asymmetrically: protect, optimize, eliminate

- Protect spend tied to differentiation and revenue defensibility; validate impact with outcome metrics before altering.

- Optimize table-stakes activities with quality, reliability, and risk guardrails.

- Eliminate non-essential costs via vendor rationalization, tool overlap removal, and zero-value activities.

Treat benchmarking as diagnosis, not prescription

- Use benchmarks to surface performance gaps, then run root-cause analysis before setting targets.

- Compare only with peers that match your stage, business model, go-to-market, and geography.

- Track a short list of value-driving metrics to avoid metric overload.

People and vendor costs move fastest

- People costs have risen due to premiums for niche skills, retention incentives, and higher re-/up-skilling spend; prioritize internal upskilling and a disciplined hiring mix.

- Consolidate suppliers, negotiate bundles, and shift repetitive work to managed services or automation where quality can be maintained.

- Rebalance footprint toward efficient locations with strong utilization; keep real estate flexible.

- Reduce travel with virtual collaboration and pooled demand; reserve in-person for high-impact interactions.

Fast facts to anchor the narrative

| Metric | Trend | Practical implication |

| Workforce cost per FTE in India centers | increased from about 12.5L to about 20.3L between 2019 and 2022 | plan for higher steady-state people costs and protect productivity investments that offset them |

| People cost growth and niche-skill premiums | grew about 9.9 percent year over year in FY2017–2018; niche skills commanded about 1.8x salary increases with higher re-/up-skilling investment | prioritize internal upskilling and clear hire triggers for scarce roles |

| Tier-2 location shift | moving from Tier-1 to Tier-2 delivered about 30 to 50 percent infrastructure cost savings with better seat utilization and lower rent growth | evaluate location strategy before reducing service levels |

Strategic Cost Management – the founder’s playbook

Principles that prevent bad cuts

- Anchor spend to strategy. Fund capabilities that create defensibility, speed, reliability, or measurable customer value.

- Avoid uniform cuts. Broad reductions erode quality and slow growth when input and talent costs are volatile.

- Prioritize unit economics over line-item reductions. Tie every change to CAC payback, gross margin, NRR, cycle time, or SLA impact.

- Convert fixed to variable where signal is weak. Use flexible capacity until the business case is proven.

- Review quarterly. Re-benchmark, reclassify, and reset targets as market and wage dynamics shift.

Treelife Three-Bucket model

Differentiating – protect or increase

Invest where performance directly drives acquisition, retention, or operating leverage. Examples

- Product and data: low-latency core data pipelines, secure data platforms, reliability engineering, ML training workloads

- Customer experience: onboarding automation that improves time-to-value, advanced support tooling tied to CSAT and NRR

- Revenue systems: ICP enrichment, pricing experimentation infrastructure, RevOps analytics that shorten payback

Table-stakes – optimize with guardrails

Meet baseline expectations at the lowest sustainable cost. Examples

- GTM: paid and field mix tuned to CAC payback, SDR tooling consolidation, partner program spend optimized to ROI

- IT and security: device lifecycle management, baseline compliance automation, identity and access controls

- Finance and operations: billing accuracy, close automation, procurement controls that maintain throughput

Non-essential – eliminate decisively

Remove spend that does not move core KPIs or risk thresholds. Examples

- G&A: overlapping productivity apps, low-use licenses, vanity subscriptions

- Facilities and travel: excess seat capacity, unmanaged travel, premium space without utilization

- Projects: initiatives with no KPI linkage, unclear owner, or stale business case

Cost Classification Cheat Sheet

| Function | Typical Spend | Bucket | Decision Rule | Review Cadence |

| Product or Data | Core data infrastructure, reliability engineering | Differentiating | do not risk SLAs or developer velocity | Monthly |

| GTM | Paid and field mix, SDR tooling | Table-stakes | stay within CAC payback guardrail by channel | Monthly |

| Customer Success | Onboarding automation, support platform | Differentiating | protect if NRR or CSAT improves on trend | Monthly |

| Engineering | CI or CD, test automation | Table-stakes | maintain deploy frequency and lead time targets | Monthly |

| Analytics or RevOps | Attribution, pricing experiment tools | Differentiating | keep if it shortens sales cycle or lifts win rate | Quarterly |

| IT | Device lifecycle, collaboration suite | Table-stakes | meet reliability and security baselines at lowest TCO | Quarterly |

| Finance | Close automation, AP or AR tools | Table-stakes | reduce days to close and DSO without manual effort growth | Quarterly |

| Facilities | Excess seats, premium leases | Non-essential | cut unless utilization clears threshold | Now |

| G&A | Overlapping productivity apps | Non-essential | consolidate or deprecate duplicates | Now |

| Travel | Non-critical trips | Non-essential | default to virtual unless revenue critical | Now |

Benchmarking Fundamentals – Reduce costs without harming outcomes

Three types that matter and when to use them

Use the right lens for the decision at hand. Start internal, then compare externally only with truly comparable peers by stage, model, go to market, and geography.

| Benchmark type | Best used for | Typical metrics | Output you need |

| Performance | Target setting and variance detection | conversion rates, CAC payback, gross margin, NRR, OPEX as percent of revenue | a small set of gaps with size and direction |

| Process | Complexity and capability comparison | lead time, deploy frequency, ticket backlog, first contact resolution, time to close | bottlenecks and waste to remove without harming outcomes |

| Strategic | Capital allocation and operating model choices | cost to serve by segment, channel mix efficiency, location footprint economics | invest, hold, or exit decisions linked to strategy |

Six mistakes to avoid with practical fixes

Keep the scope tight, the data recent, and the peer set truly comparable. Convert insights into owned targets.

| Pitfall | What it looks like | Fix to apply |

| Ambiguous scope | vague goals and shifting questions | write one problem statement, success criteria, and data definitions before analysis |

| Outdated data | pre shift numbers driving today’s targets | timebox recency and refresh quarterly for fast moving cost items |

| Apples to oranges peers | different models and geographies | enforce comparability gates on stage, model, go to market, and location |

| Too many metrics | dashboards without decisions | shortlist value drivers that link to margin, growth, and risk |

| Variance with no context | copying the top quartile number | run root cause and isolate mix, quality, and scale effects before targeting |

| Bias and soloing | one function setting targets alone | require cross functional reviews and assign a single owner per target |

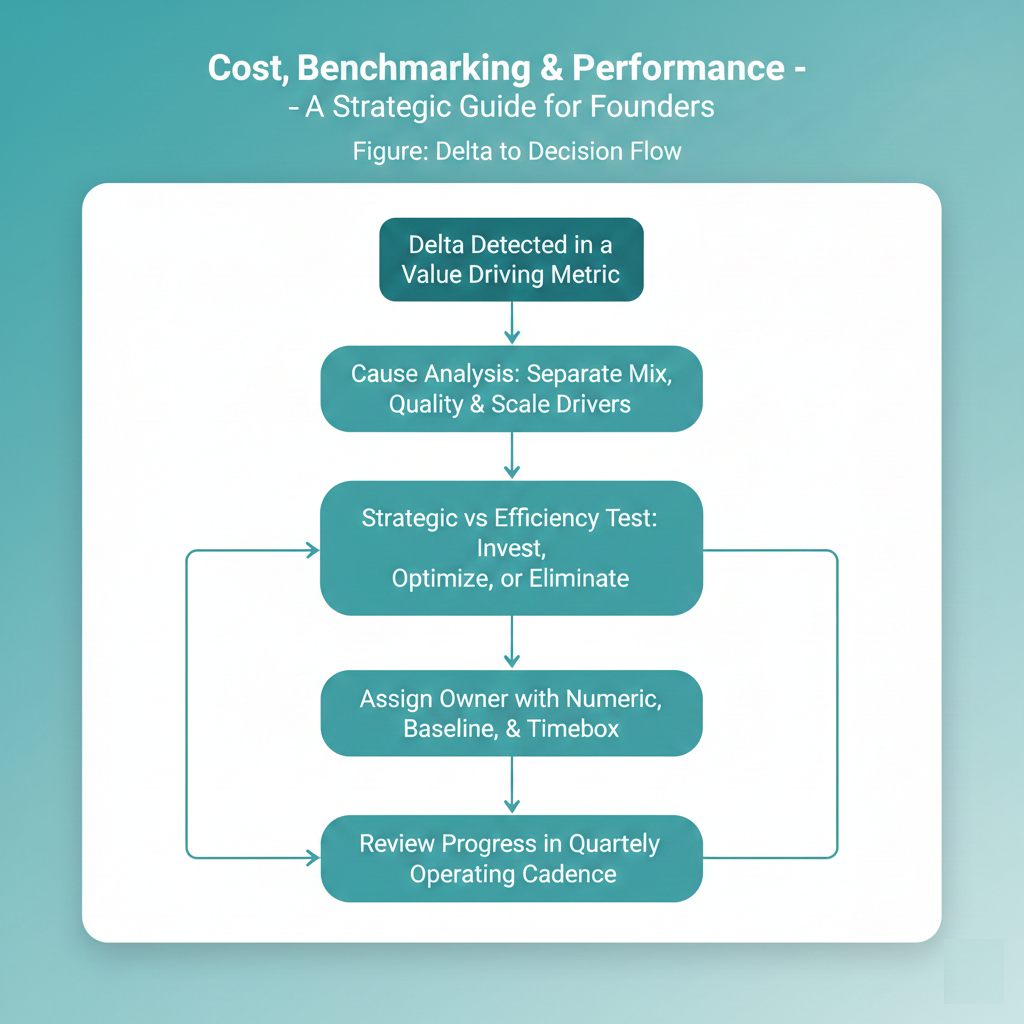

One page checklist

- Define the decision: what will change if a gap is confirmed

- Write the data dictionary: metric names, formula, source, time window

- Select peers with gates for stage, model, go to market, geography

- Compute deltas on a short list of value drivers

- Run cause analysis: mix effects, quality thresholds, scale and timing

- Classify each gap as strategic or efficiency

- Convert into targets with an owner, baseline, and deadline

- Schedule a quarterly refresh and track lift and drift

KPI and Benchmark Map – What to measure first

Internal KPIs to baseline before looking out

- CAC payback by channel

- Definition: months for gross margin from a new customer to recover fully loaded acquisition cost.

- Use: prioritize channels, throttle spend when payback extends.

- Sales productivity

- Definition: new ARR per seller per period, normalized by ramp and quota coverage.

- Use: diagnose pipeline health, pricing, enablement.

- Gross margin mix-adjusted

- Definition: gross margin after isolating product, segment, and contract term effects.

- Use: reveals true delivery efficiency and pricing power.

- Support cost per customer vs CSAT and retention

- Definition: all-in support expense divided by active customers, tracked with service quality outcomes.

- Use: reduce cost to serve without compromising experience.

- Engineering lead time and deploy frequency

- Definition: median commit-to-production time and successful releases per period.

- Use: tie platform investments to delivery velocity and incident reduction.

Minimum Viable KPI Set

| Area | KPI | Exact definition | Guardrail or target | Why it matters |

| Growth | CAC payback | months to recover CAC from gross margin | ≤ X months by channel and segment | capital efficiency and runway control |

| Revenue quality | NRR | percent including expansion and contraction | ≥ Y percent by cohort | compounding and pricing power |

| Delivery | Support dollar per account | total support costs ÷ active accounts | trend down quarter over quarter while CSAT ≥ Z | scale quality and cost to serve |

| Engineering | Lead time | median time from commit to production | trend down quarter over quarter | product velocity and risk |

| Profit engine | Gross margin mix-adjusted | GM after product and segment normalization | stable or improving with volume | operating leverage |

| Sales | Productivity per seller | net new ARR per fully ramped seller | rising with consistent win rate | go-to-market effectiveness |

Notes for accurate measurement

- Lock a data dictionary with metric formulas, sources, and time windows.

- Separate cohort effects and mix shifts before drawing conclusions.

- Refresh quarterly where people and vendor costs move fastest.

External comparison rules that keep benchmarks useful

- Match on company stage, business model, go-to-market motion, and operating geography.

- Normalize methodology for CAC, gross margin, and cost allocations before computing deltas.

- Compare a short list of value drivers instead of full dashboards.

- Translate gaps into actions: invest where differentiation wins, optimize table-stakes, eliminate non-essential.

Operating Model Levers – Where savings typically hide

People and talent

- Niche skills drove the sharpest wage inflation, amplified by joining and retention bonuses and higher re or upskilling spend.

- Mitigate through internal academies and clearer hiring triggers that gate external hires to proven revenue or reliability signals.

- Use automation to shift repetitive work, freeing capacity without lowering service levels.

Quick wins

- Hiring mix rules: prioritize internal mobility and apprenticeships before external niche hires.

- Bonus guardrails: link joining and retention incentives to milestone-based vesting and productivity thresholds.

- Skills taxonomy and academy: standardize roles, map skill gaps, and run quarterly sprints to fill them.

- Make versus buy: insource repeatable work, buy short-lived niche expertise on outcome terms.

Vendors and tooling

- Consolidate contracts to 1–2 strategic suppliers per category; negotiate bundles with tiered usage and shared success outcomes.

- Deprecate overlaps in analytics, collaboration, and DevOps; reclaim idle licenses monthly.

- Use outcome-based models for niche capabilities and time-bound initiatives.

Facilities

- Enforce seat-utilization thresholds and space standards by role type; switch underused areas to flex arrangements.

- Use a blend of flexible and long-term leases to match demand cycles.

- Where talent depth allows, shift from Tier 1 to Tier 2 locations and pair with utilization discipline to capture 30 to 50 percent infrastructure savings.

Technology and IT

- Prefer device and software as a service to reduce capex and improve refresh agility.

- Upgrade selectively where it enables strategic services, reliability, or security baselines.

- Rationalize monitoring, CI or CD, and collaboration stacks to one primary per need.

Travel

- Keep post-pandemic gains: default to virtual collaboration for internal and low-value meetings.

- Reopen travel with supplier consolidation, advance-purchase rules, and pooled demand for negotiated discounts.

- Prioritize in-person for revenue-critical, customer-facing, or leadership alignment events.

Levers by cost theme

| Theme | Lever | Evidence or insight | Effort | Typical impact |

| People | Upskill versus hire niche | wage pressure in scarce skills and higher L and D spend | M | Med |

| Vendors | Consolidate 3 to 1 | tighter onshore management and outcome-based models reduce waste | M | Med to High |

| Facilities | Tier 2 plus utilization | infrastructure savings in the 30 to 50 percent range with seat discipline | M | High |

| Travel | Policy plus virtual plus pooling | cost per FTE stabilization from virtual defaults and supplier consolidation | L | Med |

| Tech | Device or software as a service | lower capex and faster refresh improve total cost of ownership | L | Med |

Stage-Aligned Cost Architecture – Keep option value while scaling

Validation (under 2M ARR)

- Cost posture: mostly variable to preserve flexibility. Favor pay-as-you-go cloud, contractors, short-term tooling.

- Where to invest: rapid iteration capacity, observability for reliability, foundational data capture for future insight.

- What to rent: niche expertise, non-core operations, point tools with monthly terms where the signal is weak.

- Decision triggers: lock costs only when a channel, segment, or feature shows repeatable conversion, stable unit economics, and predictable support load.

- KPIs to watch: CAC payback by channel, time-to-value, defect rates, incident minutes, deploy frequency.

Early Growth (2M to 10M ARR)

- Cost posture: selectively fix costs in proven areas while keeping flexibility elsewhere.

- Where to invest: data pipelines for consistent metrics, customer success tooling that improves onboarding and retention, core security and identity.

- How to optimize: clean up tool overlap in GTM and engineering, introduce vendor tiers and volume discounts, track license utilization monthly.

- Decision triggers: protect spend that shortens payback or lifts retention; shift variable to fixed only where demand and quality are stable.

- KPIs to watch: sales productivity, gross margin after mix adjustment, support cost per customer with CSAT, lead time to production.

Growth (10M to 50M ARR)

- Cost posture: standardize processes and consolidate vendors to unlock scale effects.

- Where to invest: automation for repetitive workflows, platform reliability, data quality, and shared services.

- How to optimize: move to category leaders in tooling, reduce suppliers per category, formalize procurement and refresh cycles.

- Decision triggers: if outcomes hold as volume rises, convert more spend to fixed to reduce unit costs; if outcomes drift, pause commitments and fix process bottlenecks first.

- KPIs to watch: OPEX as a percent of revenue by function, NRR cohorts, defect escape rate, first-contact resolution, days to close.

Scale (50M ARR and above)

- Cost posture: pursue operating leverage with sublinear SG&A growth.

- Where to invest: automation at scale, centralized platforms, standardized data models, resilience and security baselines.

- How to optimize: shared services for back-office, location strategy with utilization discipline, structured vendor ecosystems with outcome-linked agreements.

- Decision triggers: when incremental revenue can be served without proportional headcount or tool growth, redeploy savings to differentiation.

- KPIs to watch: SG&A growth versus revenue growth, cost to serve by segment, platform uptime, change failure rate.

Fixed versus variable mix by stage

| Stage | Primary cost posture | Typical fixed focus | Typical variable focus | Decision checkpoints |

| Validation | variable dominant | none beyond compliance and baseline reliability | contractors, on-demand tools, pay-as-you-go cloud | repeatability of conversion and support load |

| Early Growth | mixed with selective fixes | data pipelines, core CS tooling, baseline security | channel tests, pilots, niche expertise | stable payback and retention trends |

| Growth | increasing fixed in proven paths | shared services, platform reliability, standardized tooling | overflow capacity, spikes in demand | quality holds as volume scales |

| Scale | fixed platform plus selective variable | automation, centralized platforms, common services | specialized projects, seasonal demand | SG&A growth below revenue growth |

Six-Step Quarterly Cadence from slides to savings

What this cadence delivers

A repeatable, twelve-week loop that converts benchmarks and cost data into owned targets, measurable savings, and protection for differentiating capabilities. It prioritizes fast-moving cost items such as people and vendors while preserving service levels.

The six steps

- Clarify differentiating capabilities

- Identify the 3 to 5 activities that directly drive retention, conversion, reliability, or margin.

- Pre approve spend that sustains SLAs and unit economics in these areas.

- Classify every major cost into buckets

- Assign each top cost line to differentiating, table stakes, or non essential.

- Set a decision rule per line: protect, optimize with guardrails, or eliminate.

- Link KPIs to activities and shortlist value drivers

- Map each cost line to one KPI.

- Keep 6 to 8 value drivers such as CAC payback by channel, mix adjusted gross margin, NRR, lead time, deploy frequency, support cost per account with CSAT.

- Run external benchmarking with comparability gates

- Match peers on stage, model, go to market, and geography.

- Normalize methodology for CAC and margin before computing deltas.

- Convert deltas into owned targets

- For each gap, choose invest, optimize, or eliminate.

- Set baseline, numeric target, timebox, and a single accountable owner.

- Re run quarterly and watch drift and second order effects

- Refresh fast moving assumptions in people and vendor costs.

- Validate that savings do not degrade reliability, CSAT, or growth velocity.

Checklist with owner, inputs, outputs

| Step | Primary owner | Key inputs | Required outputs | Review SLA |

| Differentiate | CEO or COO | product and customer outcome metrics, reliability reports | list of differentiating capabilities with KPI linkage | week 1 |

| Bucket costs | Finance | top 20 cost lines, contracts, utilization | bucketed list with protect or optimize or eliminate tags | week 2 |

| KPI map | RevOps | data dictionary, dashboard extracts | shortlist of 6 to 8 value drivers with owners | week 3 |

| External compare | Finance | peer list, normalized formulas | delta table with context notes | week 5 |

| Target setting | Exec sponsor | delta table, risk thresholds | owned targets with baseline and timebox | week 6 |

| Execute and monitor | Ops PMO | target tracker, QA, CSAT | progress updates, drift flags, corrective actions | weeks 7 to 12 |

Quarterly timeline guide

| Week | Focus | Outcome |

| 1 to 2 | differentiation and bucket pass | protected list and immediate eliminations queued |

| 3 | KPI linkage and value driver shortlist | single page KPI map |

| 4 to 5 | external benchmarking | delta to peer set with context |

| 6 | target setting and approvals | owned targets with dates |

| 7 to 10 | execution sprints | vendor exits, overlap removal, automation pilots |

| 11 to 12 | results readout and drift check | savings verified, quality guardrails intact |

RACI table

| Step | Exec | Finance | Ops | Product | RevOps |

| Bucket review | A | R | C | C | C |

| KPI refresh | C | R | C | C | A |

| Benchmark deltas | A | R | C | C | C |

| Investment triggers | A | R | C | R | C |

Evidence-led vignettes – Anonymous, Lesson-first

Context

- Demand was volatile and people costs were rising, with niche skills attracting premium pay and bonuses.

- The objective was to protect service quality without locking into higher fixed costs.

Action

- Retained outsourced customer support during volatility to keep variable capacity.

- Set guardrails for experience and reliability using NRR, CSAT, and incident minutes.

- After volume and quality stabilized, transitioned core tiers in-house at an efficient location while enforcing seat-utilization discipline.

Outcomes

- Service quality held through spikes while avoiding premature headcount commitments.

- On stabilization, the in-house shift paired with Tier-2 footprint delivered infrastructure savings in the 30 to 50 percent range and reduced cost to serve.

- COGS improved as work moved to standardized processes and automation.

Lesson

- Pay the flexibility premium when signal is weak; convert to fixed only after repeatability is proven and location/utilization advantages can be captured.

KPI tracker

| KPI | Baseline | Guardrail | Outcome trend |

| NRR | set by cohort | no decline through transition | maintained or improved |

| CSAT | rolling 90-day | at or above threshold | maintained |

| Cost to serve | current run rate | reduce post-stabilization | down after in-house move |

| Incident minutes | current average | no regression | stable or better |

Vendor model shift for niche digital skills

Context

- Scarce skills carried salary premiums and incentives, increasing unit costs and time to ramp.

- The objective was to accelerate capability build while safeguarding ROI.

Action

- Replaced time-and-materials staffing with outcome-based engagements tied to milestones and acceptance criteria.

- Limited internal hiring to roles that compound value; funded internal upskilling where capability durability was high.

- Applied monthly license and tool overlap reviews to keep the stack lean.

Outcomes

- Faster delivery on critical milestones without paying long-term niche premiums.

- Clear ROI visibility from milestone-linked payments and acceptance.

- Internal teams absorbed repeatable work; vendors focused on short-lived spikes and specialized problems.

Lesson

- Use outcome models to buy short-lived, high-skill capacity; reserve permanent hiring and platform spend for durable, differentiating capabilities.

Decision worksheet

| Decision input | Threshold | Action |

| Skill scarcity and wage premium | elevated | buy outcomes, time-box engagement |

| Capability durability | high | build internally and upskill |

| Tool utilization | sub-80 percent | consolidate or deprecate |

| Payback on capability | within target months | proceed with permanent investment |

Founder Diagnostic Scorecard

Use this scorecard to assess your cost management maturity. For each statement, rate your organization: Strong (2 points), Developing (1 point), or Weak (0 points).

| Assessment Criteria | Score (0-2) |

| We can clearly articulate the 3-5 capabilities that differentiate our business from competitors. | |

| Every major cost category is classified as differentiating, table stakes, or non-essential. | |

| Our resource allocation clearly reflects strategic priorities rather than historical patterns. | |

| Our fixed/variable cost mix is appropriate for our current stage and revenue level. | |

| We maintain comprehensive internal benchmarks tracking key performance metrics over time. | |

| When using external benchmarks, we ensure true comparability in stage, model, and market. | |

| We investigate variance drivers rather than accepting benchmark differences at face value. | |

| We have clear, objective triggers determining when to make permanent hires or commitments. | |

| We maintain a complete vendor inventory with costs, renewal dates, and utilization metrics. | |

| Our compensation philosophy is clearly defined and applied consistently across teams. | |

| Before attributing issues to headcount, we systematically test for process problems. | |

| We focus on outcome metrics (CAC payback, NRR, sales productivity) rather than cost percentages. | |

| We systematically assess risks from cost decisions including technical debt and key person dependency. | |

| We review cost structure quarterly to ensure alignment with evolving strategy and priorities. | |

| We can identify which costs create competitive advantage versus which are merely necessary. | |

| TOTAL SCORE |

Scoring interpretation:

- 24-30 points: Strong cost management discipline with strategic coherence

- 16-23 points: Developing capabilities with specific improvement opportunities

- 8-15 points: Reactive cost management requiring systematic strengthening

- 0-7 points: Immediate attention needed to avoid strategic misalignment

Founder Takeaway – Strategic Coherence Over Simplistic Optimization

The Core Principle

Cost optimization is not about spending less – it is about spending better. Allocate resources to capabilities that genuinely drive competitive differentiation while tightening or eliminating expenditure that does not contribute to strategic outcomes.

The Three-Bucket Framework

- Differentiating costs: Build or protect competitive advantage → Protect or increase

- Table stakes costs: Necessary but don’t differentiate → Optimize to sensible levels

- Non-essential costs: Don’t support outcomes → Eliminate

Stage-Aligned Cost Balance

- Early stage (<$2M): Maximize variability and optionality

- Early growth ($2M-$10M): Selectively fix costs in proven areas

- Growth stage ($10M-$50M): Accept higher fixed costs for proven model

- Scale stage ($50M+): Focus on operating leverage and margin expansion

Benchmarking as Diagnosis

- Start with internal benchmarks – more reliable than external comparisons

- Use external benchmarks cautiously, ensuring true comparability

- Investigate variance drivers, not just percentages

- Determine if variance reflects strategic choice or inefficiency

- Link benchmarking to capabilities, not just costs

Six-Step Action Framework

- 1. Establish strategic clarity on differentiating capabilities

- 2. Classify all major costs into three buckets

- 3. Allocate resources asymmetrically based on strategic contribution

- 4. Set clear, objective triggers for permanent investments

- 5. Use benchmarking to guide investigation, not dictate decisions

- 6. Review cost structure quarterly as strategy evolves

Key Insights

- Winning companies often spend more than peers – but asymmetrically on what matters

- Premature scaling and chronic underinvestment both destroy value

- Process problems often masquerade as people problems

- Vendor consolidation typically reduces costs 20-30% without harming operations

- Technical debt costs 3-5X more to fix than to prevent

- Outcome metrics matter more than static cost percentages

References:

- https://ijrpr.com/uploads/V6ISSUE11/IJRPR55400.pdf

- https://yanpeichen.com/professional/BenchmarkingPitfallsIEEE.pdf

- https://www.geckoboard.com/best-practice/kpi-examples/cac-payback-period

- https://stripe.com/resources/more/net-revenue-retention

- https://media.zinnov.com/wp-content/uploads/2023/03/nasscom-zinnov-gcc-report-q4-2022-v2.pdf

- https://www.blueprism.com/resources/case-studies/op-financial-emea-longstanding-innovation

- https://www.vendr.com/blog/vendor-consolidation

Founder FAQs on Cost, Benchmarking & Performance

-

How do I optimise costs in my business?

To optimise costs effectively, focus on spending better, not just spending less. Classify every expense into three categories:

- Differentiating costs (which build competitive advantage): protect or increase these.

- Table stakes costs (needed to function): optimize them to minimum viable levels.

- Non-essential costs (no direct business impact): eliminate or phase them out immediately.

Cost optimisation works best when tied to strategic clarity invest more in what sets you apart, and aggressively cut what doesn’t drive outcomes

-

How do I compare my costs with industry benchmarks?

Use benchmarking as a diagnostic tool, not a rulebook. Start with internal benchmarks like CAC, NRR, sales productivity, and gross margin trends to understand your own performance. Then, cautiously apply external benchmarks, making sure you’re comparing similar:

- Stage (e.g., Series A vs. public companies),

- Business model (SaaS vs. marketplaces),

- Go-to-market strategy (PLG vs. enterprise),

- Geographic context.

Focus on variance analysis if you differ from peers, determine whether that reflects a strategic choice or an inefficiency

-

Is my expense structure correct for my revenue?

Your cost structure should evolve with revenue:

- Early stage (<$2M ARR): Keep costs variable and avoid long-term commitments.

- Early growth ($2M–$10M ARR): Fix costs in proven areas, stay flexible elsewhere.

- Growth stage ($10M–$50M ARR): Build infrastructure, but avoid scaling ahead of reality.

- Scale stage ($50M+ ARR): Focus on operating leverage and automation.

Overbuilt structures constrain flexibility; underinvestment leads to bottlenecks. A healthy business knows what will break next, and plans accordingly

-

Am I overpaying vendors or staff?

Rather than asking if you’re overpaying, ask: “Are we getting value equal to the cost?” Common cost leaks include:

- Tool sprawl and legacy contracts,

- Fragmented vendor negotiations,

- Auto-renewals without review.

Maintain a vendor inventory, review tools 90 days pre-renewal, and consolidate where possible. On staffing, use a clear, consistent compensation philosophy, and distinguish process problems from actual people problems before attributing poor performance to overstaffing

-

What is the ideal cost structure for my industry?

There is no one-size-fits-all cost structure. Instead, focus on unit economics and outcomes:

- In SaaS, expect high margins, with 20–30% in R&D and variable GTM spend (15–50% depending on model).

- In services, focus on utilization, not percentages.

- In marketplaces, trust and safety investments may reduce margins but increase defensibility.

Use industry patterns as context, not targets. Strategic overinvestment in key areas can be justified if it leads to superior outcomes like faster CAC payback or higher NRR

-

What risks am I taking unknowingly through cost decisions?

Key hidden risks include:

- Cutting too deep: May create key person dependency, technical debt, or degrade customer experience.

- Over-concentration: Relying on one vendor or geographic model can lead to fragility.

- Underinvestment in long-term value: Skimping on R&D, brand, or data infrastructure erodes competitive advantage over time.

Most damaging are second-order effects—slow burn issues like declining brand strength or mounting technical debt that appear only after serious damage is done

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More