Quick Summary

Equity dilution occurs when a company issues new shares, reducing existing shareholders’ ownership percentages. In India, this often happens during fundraising rounds, mergers, or employee stock option plans. While dilution can provide essential capital for growth, it may lead to decreased control and value for original investors. To manage equity dilution effectively, Indian startups should consider strategies such as negotiating favorable investment terms, exploring alternative funding options, and carefully planning the timing and amount of equity issued. Understanding the implications of equity dilution is crucial for founders aiming to maintain control and maximize their company’s value.

Blog Content Overview

- 1 What Is Equity Dilution?

- 2 When Does Equity Dilution Happen?

- 3 Working of Equity Dilution

- 4 Example of Equity Dilution

- 5 Effects of Equity Dilution

- 6 How to minimize equity dilution?

- 7 Pros of Equity Dilution:

- 8 Cons of Equity Dilution:

- 9 Conclusion

- 10 Frequently Asked Questions (FAQs) on Equity Dilution in India

Equity dilution is a critical concept in the realm of finance, particularly in the context of corporate structures and investments. In the dynamic landscape of India’s burgeoning economy where businesses constantly seek avenues for growth and expansion, understanding the intricacies of equity dilution becomes paramount for entrepreneurs, investors, and stakeholders alike.

This article delves into the multifaceted aspects of equity dilution providing a comprehensive overview of its definition, mechanics, underlying causes, and real-life examples. By unraveling the complexities surrounding this phenomenon, the article will give valuable insights into its implications for companies, shareholders, and the broader market dynamics.

What Is Equity Dilution?

Equity dilution refers to the reduction in ownership percentage and/or value of existing shares in a company as a result of any circumstance resulting in either a drop in the valuation of the shares itself or upon new securities being issued, causing a decrease in the overall stake. Equity dilution is a mathematical consequence of commonly undertaken corporate decisions such as raising funding, incentivizing employees through stock options, or acquisition/liquidation of any businesses. While equity dilution is a common phenomenon in corporate finance, its implications can be far-reaching and have significant effects on the company’s stakeholders.

In the context of India, where innovation, entrepreneurship and investment in the startup ecosystem are thriving, equity dilution plays a pivotal role in shaping the trajectory of businesses across industries. Founders often resort to equity dilution as a means to access much-needed capital for growth and expansion. By selling a portion of their ownership stake to investors, founders can infuse funds into the business, fueling innovation, scaling operations, and penetrating new markets.

However, equity dilution is not without its challenges. For existing shareholders, the prospect of their ownership stake being diluted can be concerning, as it can dilute not only the impact of their voting rights and stake on future earnings, but also the value of the shares themselves, potentially triggering disagreements between shareholders and founders regarding the company’s worth.

When Does Equity Dilution Happen?

Equity dilution or share dilution is a is caused by any of the following actions:

- Conversion by holders of optionable securities: Holders of optionable securities (i.e., securities they have a right to purchase and hold title in their name once successfully purchased) may convert their holdings into common shares by exercising their stock options, which will increase the company’s ownership stake. This includes employees, board members, and other individuals.

- Mergers and acquisitions: In case of a merger of corporate entities or amalgamation/acquisition thereof, the resultant entity may buy out the existing shareholders or have a lower valuation, leading to a lower price per share and an economic dilution of the equity stake.

- Issue of new stock: A company may issue new securities as part of a funding round. Where any equity shares or equity securities are issued, the existing shareholders’ would see a dilution to their shareholding on a fully diluted basis (i.e., all convertible securities are converted into equity shares for the purpose of calculation).

Working of Equity Dilution

Given the nuanced commercial terms involved, a company may opt to pursue any of the following in the ordinary course of business, and as a result experience equity dilution:

- Issuing New Shares for Capital: This is the most common cause of dilution. Companies raise capital by issuing new securities to investors. The more shares issued, the smaller the percentage of ownership held by existing shareholders ultimately becomes. Economic dilution happens here when the shares are issued at a lower price than the one paid by the existing shareholders.

- Employee Stock Options (ESOPs): When companies grant employees stock options as part of their compensation package, they are essentially creating a pool of shares that will only be issued in the future to employees. The right to purchase these securities (at a discounted price) is first granted to an employee, creating an option. Upon fulfillment of the conditions of the ESOP policy, employees exercise their options and purchase these shares in their name. The creation or increase of an ESOP pool will lead to a mathematical dilution in the overall percentage distribution, affecting a shareholder’s individual stake in the company.

- Convertible Debt: Some debt instruments, such as convertible notes or compulsorily convertible debentures, can be converted into equity shares at a later date and on certain predetermined conversion terms. This conversion leads to an increase in the total number of equity shares, leading to dilution of the individual percentage stakes. Depending on the terms of the convertible debt securities, there could also be an economic dilution of the value of the equity shares held by existing shareholders.

- Stock Splits: While a stock split doesn’t technically change the total value of a company’s equity, it does increase the number of outstanding shares. For example, a 2-for-1 stock split doubles the number of shares outstanding, which dilutes ownership percentages without affecting the overall company value.

- Acquisitions Using Shares: When a company acquires another company using its own shares as currency, it issues new shares to the acquired company’s shareholders. This increases the total number of outstanding shares and dilutes existing shareholders’ ownership. This is commonly seen with schemes of arrangement between two sister companies under common ownership and control.

- Reacquired Stock Issuances: If a company repurchases or buys back its own shares (reacquired stock) and then issues them later, it can dilute the existing shareholders’ ownership. This impact can be both stake-wise and economic, especially if the shares are essentially reissued at a lower price than the original price.

- Subsidiary Formation: When a company forms a subsidiary and issues shares in that subsidiary, it technically dilutes its own ownership stake. However, this is usually done for strategic reasons and doesn’t necessarily impact the value of the parent company.

Example of Equity Dilution

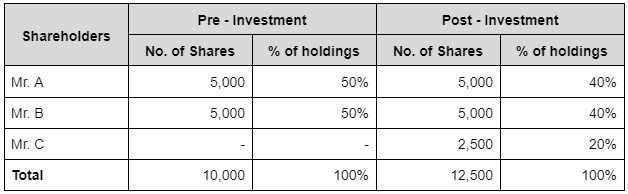

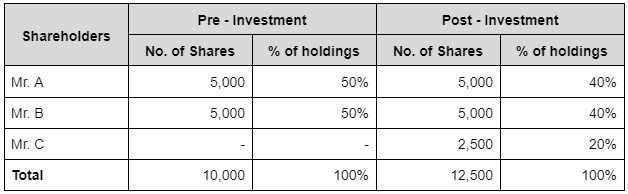

Infographic Illustration

Fundamentally, each company is made of 100% shares (remember the one whole of something is always 100%). Let’s understand this with an example to get clarity.

- 2 Founders viz. A and B are holding 5,000 shares each with 50% of ownership in the Company.

- An investor, C comes with an investment of 1Mn dollars considering the valuation of 3Mn dollars

Now have a look at the figures in below table to understand this quickly:

Here, the number of shares has been increased basis the ratio to post investment i.e. 25% (1Mn/4Mn). The investor can keep any ratio post investment basis the agreement.

We can understand that post investment round, the holding % of founders are getting diluted and their controlling interest has been reduced from the original scenario.

There are various types of dilution, including dilution of shares in a private company. It’s also important to know the equity dilution meaning and examples of equity dilution in startups.

There is no exact solution to how much equity to dilute; it depends on the stage of the business you are at. Too much dilution can be of concern to a future incoming investor and too little dilution concerns investors as they should have skin in the game. The ultimate goal is to grow the business. So even if the dilution numbers are skewed from the expected dilution you have in mind, the growth of the business is primary, and investment helps you get closer to that goal.

Pre-money valuation is the value of the company prior to receiving the investment amount. It is derived through various internationally accepted valuation methods like the discounted cash flow method. Investors offer equity based on pre-money valuation; however, the percentage sought is based on post-money valuation.

Understanding dilution and cap tables are pertinent metrics for fundraising and talking to investors. Founders often neglect it due to a lack of clarity of these concepts. A grasp on concepts like dilution and the cap table enables the founder to have better control of the startup equity.

Effects of Equity Dilution

During share dilution, the amount of extra shares issued and retained may impact a portfolio’s value. Dilution affects a company’s EPS (earnings per share) in addition to the price of its shares. For instance, a company’s earnings per share or EPS could be INR 50 prior to the issuance of new shares, but after dilution, it might be INR 18. However, if the dilution dramatically boosts earnings, the EPS might not be impacted. Revenue may rise as a result of dilution, offsetting any increase in shares, and earnings per share may remain constant.

Public companies may calculate diluted EPS to assess the effects of share dilution on stock prices in the event of stock option exercises. As a result of dilution, the book value of the shares and earnings per share of the company decline.

Equity dilution, a fundamental consequence of issuing new shares, is a double-edged sword for companies. While it unlocks doors to growth capital, it also impacts existing shareholders’ ownership and potential control. Understanding the effects of dilution is crucial for companies navigating fundraising rounds and strategic decisions.

Example: If a company having 100 shares issued, paid up and subscribed, each representing 1% ownership, issues 20 new shares, the total number of issued, paid up and subscribed shares becomes 120. Consequently, the existing shareholders’ ownership stake is diluted post-issue, as each share now represents only 0.83% (100/120) of the company. This translates to a decrease in:

- Ownership Percentage: Existing shareholders own a smaller portion of the company.

- Voting Power: Their voting rights are proportionally reduced, potentially impacting their influence on company decisions.

- Earnings Per Share: If company profits remain constant, EPS might decrease as profits are spread over a larger number of shares. This can affect short-term stock price performance.

How to minimize equity dilution?

Companies can employ various strategies to minimize dilution and maximize the benefits of issuing new shares:

- Strategic Valuation: A higher valuation during fundraising allows the company to raise the target capital while offering fewer shares. However, maintaining a realistic valuation is crucial to attract investors without inflated expectations.

- Debt Financing: Exploring debt options like loans or convertible notes can provide capital without immediate dilution. However, debt carries interest payments and other obligations.

- Structured Equity Instruments: Utilizing options like preferred shares can offer different rights and value compared to common shares, potentially mitigating the dilution impact on common shareholders.

- Phased Funding with Milestones: Structuring investments in tranches tied to achieving milestones allows the valuation to climb incrementally, reducing dilution in later rounds.

- Focus on Organic Growth: Prioritizing revenue and profit growth naturally leads to higher valuations. This requires less equity dilution to raise capital in the future.

Pros of Equity Dilution:

Equity dilution, while often viewed with apprehension by existing shareholders, can also bring several advantages to a company. By issuing new shares and thereby diluting existing ownership, companies can access capital and unlock opportunities for growth and expansion:

- Access to Capital: Equity dilution allows companies to raise funds by selling shares to investors. This infusion of capital can be instrumental in financing expansion projects, funding research and development initiatives, or addressing financial challenges.

- Diversification of Shareholder Base: Bringing in new investors through equity dilution can diversify the company’s shareholder base. This diversification can enhance liquidity in the stock, broaden the investor pool, and potentially attract institutional investors or strategic partners.

- Alignment of Interests: Equity dilution can align the interests of shareholders and management, particularly in startups or early-stage companies. By offering equity stakes to employees, management can incentivize them to work towards the company’s long-term success, fostering a culture of ownership and commitment.

- Reduced Financial Risk: Diluting ownership through equity issuance can reduce the financial risk for existing shareholders. By sharing the burden of ownership with new investors, shareholders may benefit from a more diversified risk profile, particularly in cases where the company’s prospects are uncertain.

Cons of Equity Dilution:

While equity dilution offers certain advantages, it also presents challenges and drawbacks that companies and shareholders must carefully consider. From the perspective of existing shareholders, dilution can erode ownership stakes and diminish control over the company. Let’s delve into some of the key drawbacks of equity dilution:

- Loss of Ownership and Control: One of the primary concerns associated with equity dilution is the loss of ownership and control for existing shareholders. As new shares are issued and ownership is spread among more investors, the influence of individual shareholders over corporate decisions may diminish.

- Dilution of Earnings Per Share: Equity dilution can lead to a reduction in earnings per share for existing shareholders. This dilution occurs when the company’s profits are spread across a larger number of shares, potentially decreasing the value of each share and impacting shareholder returns.

- Potential for Share Price Decline: The issuance of new shares through equity dilution can signal to the market that the company is in need of capital or that its growth prospects are uncertain. This perception may lead to a decline in the company’s share price, adversely affecting shareholder wealth.

- Strain on Shareholder Relations: Equity dilution can strain relations between existing shareholders and management, particularly if the dilution is perceived as unfair or detrimental to shareholder interests. Managing investor expectations and communicating the rationale behind equity issuances is crucial to maintaining trust and credibility.

Conclusion

Equity dilution poses a significant impact on the ownership stakes of founders and investors alike. Whether you are already implementing a corporate equity plan or considering setting one up, equity dilution is a critical aspect to consider. Understanding the fundamentals of equity dilution and how it functions, particularly in the context of stock option dilution, is essential for informed decision-making.

Share dilution, occurring whenever a corporation issues new shares to investors, can significantly affect the value of your financial portfolio. During this process, the corporation must adjust its earnings-per-share and share price ratios accordingly. While share dilution is often viewed unfavorably, it can also signify potential acquisitions that may enhance stock performance in the future. To mitigate any potential surprises, it is prudent to remain vigilant for indicators of stock dilution. By staying informed and proactive, stakeholders can navigate the complexities of equity dilution with confidence and clarity.

Frequently Asked Questions (FAQs) on Equity Dilution in India

1. What is equity dilution?

Equity dilution refers to the reduction in ownership percentage of existing shareholders in a company due to the issuance of new shares. This dilution can occur during fundraising rounds, employee stock option plans (ESOPs), mergers, acquisitions, or other corporate actions.

2. How does equity dilution work in Indian companies?

Equity dilution typically occurs when a company issues additional shares, either through primary offerings to raise capital or secondary offerings for employee incentives or acquisitions. This issuance increases the total number of shares outstanding, reducing the ownership percentage of existing shareholders.

3. What are the primary causes of equity dilution in India?

Equity dilution in India can be caused by various factors, including fundraising activities such as initial public offerings (IPOs), follow-on offerings, private placements, or debt conversions. Additionally, the implementation of ESOPs, mergers, acquisitions, and convertible securities can also contribute to equity dilution.

4. Can you provide examples of equity dilution in Indian companies?

Examples of equity dilution in India include IPOs of startups or established firms where new shares are issued to the public, leading to dilution for existing shareholders. Similarly, when companies offer ESOPs to employees or acquire other businesses through stock issuance, equity dilution occurs.

5. What are the implications of equity dilution for shareholders in India?

Equity dilution can impact shareholders in India by reducing their ownership percentage and voting rights in the company. It may also lead to dilution of earnings per share (EPS) and share price, potentially affecting shareholder value and returns on investment.

6. How can companies minimize equity dilution in India?

Companies in India can minimize equity dilution by carefully managing their capital structure, negotiating favorable terms during fundraising rounds, implementing efficient ESOP schemes, and exploring alternative financing options such as debt financing or strategic partnerships.

7. Are there any regulatory considerations related to equity dilution in India?

Yes, companies in India must comply with regulatory requirements set forth by the Securities and Exchange Board of India (SEBI) and other relevant authorities when issuing new shares or implementing equity-related transactions. Compliance with disclosure norms and corporate governance standards is essential to ensure transparency and accountability.

We Are Problem Solvers. And Take Accountability.

Related Posts

Compliance Calendar – July 2025 (Checklist & Deadlines)

Sync with Google CalendarSync with Apple Calendar As we enter the second half of 2025, staying compliant with various financial,...

Learn More

Conversion of Partnership Firm to LLP – Complete Process

Converting a Partnership Firm to a Limited Liability Partnership (LLP) is a strategic decision that offers several advantages for businesses...

Learn More

Memorandum of Association – MoA Clauses, Format & Types

The Memorandum of Association (MOA) is one of the most essential documents in the company incorporation process, forming the foundation...

Learn More