Blog Content Overview

- 1 Introduction: Set Up a WOS in India

- 2 Why India Is a Top Global Investment Destination

- 3 What Is a Wholly Owned Subsidiary (WOS) in India?

- 4 Who Can Set Up a Wholly Owned Subsidiary in India?

- 5 Structures for Setting Up a Wholly Owned Subsidiary in India

- 6 Pre-Incorporation Requirements for WOS in India

- 7 Documents Required for Incorporation of a Wholly Owned Subsidiary in India

- 8 Step-by-Step Process: Incorporation of a Wholly Owned Subsidiary in India

- 9 Post-Incorporation Compliance for WOS in India

- 10 RBI & FEMA Compliance for Wholly Owned Subsidiary in India

- 11 Taxation of Wholly Owned Subsidiary in India

- 12 Ongoing Compliance & Governance Requirements

- 13 Benefits of a Wholly Owned Subsidiary in India

- 14 Timeline for Setting Up a Wholly Owned Subsidiary in India

- 15 Challenges in Starting a Wholly Owned Subsidiary(WOS) in India

AI Summary

Setting up a wholly owned subsidiary (WOS) in India is an advantageous market-entry strategy for foreign companies, providing operational control and compliance under India’s Companies Act, 2013. With India becoming a prime destination for Foreign Direct Investment (FDI), key incentives include high GDP growth, a large consumer base, and various government initiatives. A WOS offers numerous benefits over branch offices, such as full operational control, limited liability, and easier regulatory compliance. Eligible entities can incorporate a WOS in sectors permitting 100% FDI, either through automatic or government approval routes. The incorporation process, conducted via the SPICe+ framework, can generally be completed within 3-5 weeks, provided documentation is in order. Hence, a WOS presents foreign businesses with strategic advantages for long-term expansion in the Indian market.

Introduction: Set Up a WOS in India

Setting up a wholly owned subsidiary in India has emerged as the most preferred market-entry strategy for foreign companies seeking long-term presence, operational control, and regulatory flexibility. A wholly owned subsidiary (WOS) is an Indian company in which 100% of the share capital is held by a foreign parent entity, incorporated under the Companies Act, 2013. This structure enables global businesses to fully participate in India’s economic growth while operating as a separate legal entity with limited liability.

Why India Is a Top Global Investment Destination

India continues to strengthen its position as one of the world’s most attractive destinations for foreign direct investment (FDI), driven by policy reforms, digital governance, and a large consumer market.

Key Economic & Market Indicators

- India’s GDP growth projection (in 2026): 7%, among the fastest-growing major economies globally

- 71% of multinational corporations (MNCs) consider India a priority market for global expansion

- Strong government push through initiatives such as Make in India, Digital India, and sector-specific FDI liberalisation

- Access to a large talent pool, cost-efficient operations, and improving ease of doing business rankings

These factors make incorporation of a wholly owned subsidiary in India a strategic move for companies targeting Asia-Pacific and emerging markets.

Why Foreign Companies Prefer a Wholly Owned Subsidiary Over Branch or Liaison Offices

Foreign businesses consistently choose setting up a WOS in India over branch or liaison offices due to the following structural advantages:

- Full operational control

Unlike branch or liaison offices (which are restricted in activities), a WOS can conduct commercial, revenue-generating operations without RBI pre-approvals in most sectors. - Separate legal entity & limited liability

The parent company’s liability is limited to its capital investment, protecting global assets. - Easier regulatory and tax compliance

A WOS is treated as a domestic company for taxation and business operations, unlike branch offices which face higher tax rates and restrictions. - FDI flexibility and repatriation benefits

Profits and dividends are freely repatriable (subject to applicable taxes) under the direct FDI route. - Access to incentives and local contracts

Many government tenders, incentives, and state-level benefits are accessible only to Indian-incorporated entities.

What Is a Wholly Owned Subsidiary (WOS) in India?

A wholly owned subsidiary in India (WOS) is an Indian-incorporated company in which 100% of the share capital is owned by a foreign or Indian parent company. It operates as a separate legal entity with limited liability and is the most preferred structure for foreign companies setting up a wholly owned subsidiary in India for long-term operations.

Legal Definition Under Indian Laws

Meaning Under the Companies Act, 2013

- The Companies Act, 2013 does not explicitly define a “wholly owned subsidiary.”

- However, Section 2(87) defines a subsidiary company as one in which the holding company:

- Controls the composition of the Board of Directors, or

- Exercises or controls more than one-half of the total share capital (directly or indirectly).

- A WOS is a subset of a subsidiary, where the holding company owns 100% shareholding.

No Explicit Statutory Definition of “Wholly Owned Subsidiary”

- Indian corporate law recognizes WOS through interpretation and practice, not a standalone definition.

- Regulatory compliance, governance, and reporting are identical to any Indian company under the Companies Act, 2013.

Interpretation Under FEMA & RBI Regulations

- Under FEMA and RBI regulations, a foreign company may:

- Incorporate a wholly owned subsidiary in India

- Set up a joint venture, associate, or

- Establish a branch, liaison, or project office

- A WOS is treated as FDI (Foreign Direct Investment) and is permitted only in sectors allowing 100% FDI, either via:

- Automatic route, or

- Government approval route, depending on the sector.

This regulatory clarity makes incorporation of a wholly owned subsidiary in India the most compliant and scalable entry option.

Wholly Owned Subsidiary vs Subsidiary Company

In India, the difference between a subsidiary company and a wholly owned subsidiary is mainly based on the extent of shareholding and control exercised by the parent company. A subsidiary company is one in which the parent company holds more than 50% of the equity share capital or controls the composition of the board of directors. This structure allows the parent to influence key business decisions while still permitting minority shareholders, which is common in joint ventures, strategic alliances, or foreign direct investment (FDI) models operating under Indian corporate regulations.

A wholly owned subsidiary, on the other hand, is a special type of subsidiary where 100% of the share capital is held by the parent company. This provides complete ownership, operational control, and strategic flexibility, making it a preferred structure for foreign companies entering the Indian market. While both forms are treated as separate legal entities under Indian law, a wholly owned subsidiary offers stronger control, simplified decision-making, and easier alignment with the parent company’s long-term business objectives.

| Criteria | Wholly Owned Subsidiary | Subsidiary Company |

| Shareholding | 100% | 51%–99% |

| Control | Full control by parent | Majority control |

| Minority shareholders | No | Yes |

| Strategic autonomy | High | Medium |

| Decision-making speed | Faster | Moderated |

| Risk exposure | Lower (no minority disputes) | Higher |

Who Can Set Up a Wholly Owned Subsidiary in India?

Setting up a wholly owned subsidiary in India is legally permitted for a wide range of foreign and non-resident entities, subject to sectoral FDI rules under FEMA and RBI regulations.

Eligible Entities for Incorporation of a Wholly Owned Subsidiary in India

The following entities are eligible to set up a WOS in India:

- Foreign companies

Any company incorporated outside India under foreign law - International organizations

Multilateral institutions and global bodies engaging in permitted activities - Foreign governments or government agencies

Including departments, authorities, or state-owned enterprises - NRIs and PIOs

- Can act as shareholders (no residency restriction)

- Can be directors, provided at least one director is an Indian resident

Sector Eligibility: 100% FDI Requirement

- A wholly owned subsidiary in India can be incorporated only in sectors where 100% FDI is permitted

- Sectoral caps and conditions are prescribed under India’s Consolidated FDI Policy

FDI Routes for Setting Up a WOS in India

| FDI Route | RBI / Government Approval | Applicability |

| Automatic Route | Not required | IT, software, manufacturing, consultancy, R&D, trading |

| Approval Route | Required | Defence, telecom, media, financial services (sector-specific) |

Most foreign companies prefer incorporation of a wholly owned subsidiary in India under the automatic route, as it allows faster setup and minimal regulatory friction.

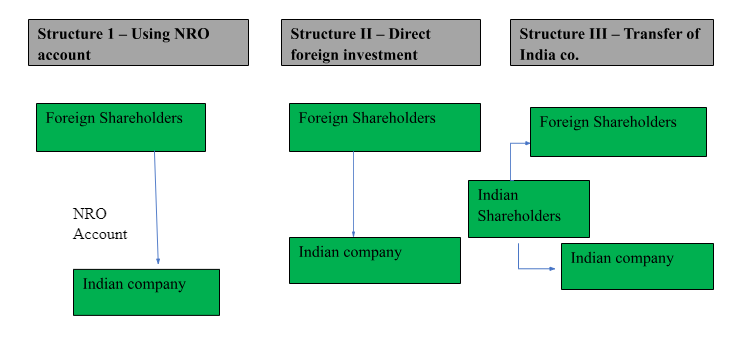

Structures for Setting Up a Wholly Owned Subsidiary in India

Foreign companies setting up a wholly owned subsidiary in India can choose from three legally recognised structures under the Companies Act, 2013 and FEMA regulations. The optimal structure depends on capital source, repatriation flexibility, RBI compliance, and timeline.

Structure I – Using NRO Account

This structure is commonly used by NRIs and foreign shareholders with existing Indian income.

Key Features

- Initial capital is funded from an NRO (Non-Resident Ordinary) account

- Income includes rent, dividends, pension, or other India-sourced earnings

- RBI filings: Not applicable at the time of incorporation

Repatriation Rules

- Repatriation from NRO account is restricted to USD 1 million per financial year

- Funds are maintained in Indian Rupees

Best suited for: Small or India-income-funded investments where immediate free repatriation is not critical.

Structure II – Direct Foreign Investment (FDI)

This is the most preferred structure for foreign companies incorporating a wholly owned subsidiary in India.

Key Features

- Capital remitted from overseas bank account into Indian company’s bank account

- Treated as Foreign Direct Investment (FDI) under FEMA

- Form FC-GPR is mandatory and must be filed within 30 days of share allotment

Repatriation

- Freely repatriable, subject to applicable taxes

- No annual cap on profit or dividend repatriation

Best suited for: Foreign companies seeking full control, scalability, and unrestricted capital movement

Structure III – Transfer of Existing Indian Company

This structure involves acquiring 100% ownership in an already incorporated Indian company.

Key Features

- Indian company initially incorporated with Indian shareholders

- Shares subsequently transferred to the foreign parent company

- Valuation report is mandatory for share transfer

RBI Filings

- Form FC-TRS for share transfer

- Form FC-GPR for any additional foreign investment

Best suited for: Businesses seeking faster market entry using an existing Indian entity.

Comparative Table: Structures for Setting Up a WOS in India

| Parameter | NRO Route | Direct FDI | Transfer Route |

| RBI filing | Not required | FC-GPR | FC-TRS + FC-GPR |

| Valuation report | Not required | Not required | Required |

| Repatriation | Restricted (USD 1M/year) | Freely repatriable | Freely repatriable |

| Approx. timeline | ~3 weeks | ~3 weeks | ~5 weeks |

Pre-Incorporation Requirements for WOS in India

Before incorporating a wholly owned subsidiary in India, foreign companies must meet minimum statutory requirements under the Companies Act, 2013. These conditions are straightforward and designed to facilitate faster market entry.

Directors

To set up a wholly owned subsidiary in India, the following director requirements apply:

- Minimum 2 directors are mandatory

- At least 1 director must be an Indian resident

- Resident = stayed in India for ≥182 days in the previous calendar year

- Foreign nationals, NRIs, and PIOs are permitted to act as directors

- Directors must obtain DIN and Class-3 DSC

Shareholding requirements for registering a wholly owned subsidiary in India are minimal:

- Minimum 2 shareholders required at incorporation

- No residency restriction for shareholders

- Nominee shareholder permitted

- Used to satisfy the two-member requirement

- Nominee holds shares on behalf of the parent company

This structure enables 100% ownership by the foreign parent despite the two-shareholder rule.

Capital Requirements

- No minimum paid-up capital mandated

- As per the Companies (Amendment) Act, 2015

- The Articles of Association (AOA) may prescribe the initial share capital

- Capital can be infused later via:

- Direct FDI

- Rights issue

- Additional share allotment

Documents Required for Incorporation of a Wholly Owned Subsidiary in India

For setting up a wholly owned subsidiary in India, accurate documentation is critical. All foreign documents must be notarized and apostilled (or consularised, where applicable) before submission to the Ministry of Corporate Affairs (MCA).

Foreign Parent Company Documents

Mandatory documents from the foreign holding entity for incorporation of a wholly owned subsidiary in India:

- Board Resolution (apostilled)

- Approving incorporation of the Indian WOS

- Authorising a representative/signatory

- Memorandum & Articles of Association (MOA & AOA) of the parent company (apostilled)

- Certificate of Incorporation / Registration of the foreign company

- Trademark Registration Certificate (apostilled, if Indian entity uses parent’s brand name)

- No Objection Certificate (NOC) for use of parent company’s name in India

Required for all proposed directors and shareholders when registering a wholly owned subsidiary in India:

- Passport (mandatory for foreign nationals)

- Address proof (not older than 2 months)

- Utility bill / bank statement / government-issued ID

- Class-3 DSC application details

- Indian mobile number and valid email ID (mandatory for DSC and MCA filings)

Indian Registered Office Documents

Proof of registered office address in India is mandatory at incorporation or within statutory timelines:

- Lease deed / rent agreement or ownership documents

- Utility bill (electricity / water / gas)

- Must be ≤ 2 months old

- NOC from property owner (if premises are rented)

Step-by-Step Process: Incorporation of a Wholly Owned Subsidiary in India

Foreign companies setting up a wholly owned subsidiary in India must follow a streamlined, MCA-driven process under the Companies Act, 2013. The entire incorporation of a wholly owned subsidiary in India is executed digitally through the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) framework.

Step 1: Obtain Digital Signature Certificate (DSC)

- Class-3 Digital Signature Certificate (DSC) is mandatory

- Required for all proposed directors and authorised signatories

- Documents typically include:

- Passport (mandatory for foreign nationals)

- Address proof (not older than 2 months)

- Email ID and Indian mobile number (mandatory for OTP-based verification)

- Photograph

DSC enables secure and authenticated filing of incorporation and compliance forms on the MCA portal.

Step 2: Name Reservation via SPICe+ Part A

- Application submitted through SPICe+ Part A on the MCA portal

- Two proposed names can be submitted per application

- Name may be:

- Same as foreign parent company, or

- A variation with “India” / “Private Limited” suffix

Validity of Approved Name

- Initial validity: 20 days

- Extendable up to 60 days with additional fees

Supporting documents (apostilled) may include:

- Parent company resolution

- NOC for name usage

- Trademark certificate (if applicable)

Step 3: Filing SPICe+ Part B & C (Integrated Incorporation)

This is the core incorporation stage for setting up a wholly owned subsidiary in India. SPICe+ Part B & C is a single consolidated application covering corporate, tax, and statutory registrations.

Inclusions Under SPICe+ Part B & C

Corporate Registrations

- Company incorporation under Companies Act, 2013

- DIN allotment for first-time directors

- Issuance of Certificate of Incorporation

Tax Registrations

- Permanent Account Number (PAN)

- Tax Deduction & Collection Account Number (TAN)

Operational Registrations

- GST registration (optional, based on business model)

- Bank account opening through MCA-integrated banks

- EPFO registration (mandatory once employee threshold is met)

- ESIC registration (mandatory once salary threshold applies)

Key Attachments

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Subscriber declarations

- Proof of registered office

- Apostilled foreign documents

Estimated timeline: 7–10 working days

This integrated filing significantly reduces setup time and compliance burden.

Step 4: Certificate of Incorporation & CIN Allotment

Once the Registrar of Companies (RoC) verifies the application:

- Certificate of Incorporation (COI) is issued

- Corporate Identification Number (CIN) is allotted

- PAN and TAN are generated simultaneously

Legal Effect

- The company becomes a separate legal entity from the date mentioned on the COI

- Eligible to:

- Open operational bank accounts

- Receive foreign investment

- Enter into contracts

- Hire employees

Post-Incorporation Compliance for WOS in India

After incorporation of a wholly owned subsidiary in India, strict post-registration compliances apply under the Companies Act, 2013, FEMA, and RBI regulations. Timely compliance is critical to avoid penalties, restriction on business commencement, and regulatory scrutiny.

Mandatory Compliance Timeline

| Compliance | Statutory Time Limit |

| First Board Meeting | Within 30 days of incorporation |

| Appointment of First Auditor | Within 30 days of incorporation |

| INC-20A (Commencement of Business) | Within 180 days of incorporation |

| Issue of Share Certificates | Within 60 days of incorporation |

Key Execution Notes

- Business operations cannot commence until INC-20A is filed

- Subscription money must be deposited before filing INC-20A

- Auditor holds office until the first Annual General Meeting (AGM)

Statutory & Operational Requirements

To remain compliant after setting up a wholly owned subsidiary in India, the following ongoing obligations apply:

- Name board display

Company name, registered office address, CIN, contact details, and GST number (if applicable) must be displayed at every place of business. - Statutory registers

Mandatory registers include:- Register of members

- Register of directors & KMP

- Register of charges

- Share transfer records

- Electronic maintenance of registers is legally permitted.

- Business licences & registrations

Depending on operations:- GST registration

- Importer Exporter Code (IEC)

- Shops & Establishment Act licence

- Professional Tax (PT)

RBI & FEMA Compliance for Wholly Owned Subsidiary in India

Foreign capital infusion into a WOS is governed by FEMA and RBI reporting norms. Non-compliance can attract monetary penalties and compounding proceedings.

What Qualifies as Foreign Direct Investment (FDI)

- Any capital contribution from a non-resident into the Indian company’s share capital

- Includes equity shares, compulsorily convertible instruments, and additional infusions

Mandatory RBI Compliance Workflow

- Foreign Inward Remittance Certificate (FIRC)

Issued by the Indian bank receiving foreign funds - KYC from Remitter Bank

Confirms identity of foreign investor - Allotment of shares

Must be completed after receipt of funds - Form FC-GPR filing

- Mandatory within 30 days of share allotment

- Filed through the authorised dealer (AD) bank

- Applicable when:

- Shares are transferred from resident to non-resident, or vice versa

- Valuation report required

- Filing responsibility lies with:

- Buyer or seller (as per transaction type)

Compliance Risk Insight

For foreign companies, delays in FC-GPR or FC-TRS filings are among the most penalised FEMA violations. Proper sequencing of remittance → allotment → reporting is essential after registering a wholly owned subsidiary in India.

Taxation of Wholly Owned Subsidiary in India

A wholly owned subsidiary in India is taxed as a domestic company, making it significantly more tax-efficient than branch or liaison offices. Understanding corporate tax, MAT, and incentives is critical when setting up a wholly owned subsidiary in India.

Corporate Income Tax

- Standard corporate tax rate:

22% + surcharge & cess = 25.17%

(Applicable if the company opts for Section 115BAA) - Foreign company tax (specific incomes):

40% on royalty, technical services, and certain other incomes

This lower domestic rate is a key reason foreign entities prefer incorporation of a wholly owned subsidiary in India over branch offices.

Other Applicable Taxes

- Minimum Alternate Tax (MAT):

15% on book profits

Applicable if the company does not opt for concessional tax regimes - Surcharge on income tax:

- INR 1–10 crore: 2%

- Above INR 10 crore: 5%

- Health & Education Cess:

4% on income tax plus surcharge

Tax Incentives for Wholly Owned Subsidiaries

Foreign companies incorporating a wholly owned subsidiary in India may benefit from:

- Presumptive taxation exemptions

Available to specific sectors such as shipping, air transport, oil exploration, and turnkey construction - Amortisation of startup & expansion costs

Eligible expenses can be amortised over five years - Dividend tax relief

Dividends received from foreign subsidiaries where shareholding is 26% or more are taxed at a reduced 15% rate, improving group-level tax efficiency

Ongoing Compliance & Governance Requirements

After registering a wholly owned subsidiary in India, continuous governance compliance is mandatory to remain legally active.

Annual & Periodic Compliance Checklist

- Minimum 4 board meetings per year

Maximum gap between meetings: 120 days - Annual General Meeting (AGM)

Mandatory once every financial year - Statutory audit

Conducted by a practising Chartered Accountant - Books of accounts (Section 128)

Must present a true and fair view of financial position - Annual ROC filings

Includes financial statements and annual return - SEBI & FEMA reporting

Applicable if listed securities, foreign investment, or cross-border transactions are involved

Benefits of a Wholly Owned Subsidiary in India

Foreign companies setting up a wholly owned subsidiary in India gain strategic, legal, and financial advantages that are not available through branch or liaison office structures. This is why incorporation of a wholly owned subsidiary in India remains the most scalable and risk-efficient entry model.

Strategic & Operational Advantages

- Full managerial control

The parent company owns 100% shareholding, enabling complete control over operations, policies, and governance. - Faster decision-making

No minority shareholders → quicker approvals, streamlined execution, and agile business expansion. - Brand continuity & global goodwill

A WOS can operate under the parent company’s name, leveraging existing brand value and international reputation. - Local market credibility

Indian customers, regulators, and partners show higher trust in Indian-incorporated entities compared to foreign branches.

Legal & Risk Advantages

- Separate legal entity

A WOS is distinct from the parent company under the Companies Act, 2013. - Limited liability protection

Parent company’s exposure is limited to its capital investment. - Asset ring-fencing

Indian operational risks, litigation, and liabilities remain confined to the subsidiary.

Financial & Tax Advantages

- Profit repatriation (structure-dependent)

Profits and dividends are freely repatriable under the direct FDI route, subject to applicable taxes. - Consolidated tax planning

Losses and profits can be aligned with global tax strategies for efficiency. - R&D deductions & amortisation benefits

Eligible startup, expansion, and R&D expenses can be amortised over five years under Indian tax laws. - MAT exemptions for certain sectors

Companies under presumptive taxation (shipping, air transport, oil exploration, turnkey projects) are exempt from Minimum Alternate Tax (MAT), which otherwise applies at 15% of book profits.

Timeline for Setting Up a Wholly Owned Subsidiary in India

Foreign companies planning setting up a wholly owned subsidiary in India typically complete the process within 3–5 weeks, provided documentation and apostilles are prepared in advance.

Estimated Timeline Breakdown

| Activity | Estimated Time |

| Document preparation & apostille | 7–10 days |

| Name approval (SPICe+ Part A) | 2–5 days |

| Incorporation (SPICe+ Part B & C) | 7–10 days |

| RBI filings (FDI-related) | Parallel |

| Total time to set up a WOS in India | 3–5 weeks |

Delays typically arise due to incomplete documentation or apostille requirements for foreign documents.

Challenges in Starting a Wholly Owned Subsidiary(WOS) in India

Despite a streamlined process, incorporating a wholly owned subsidiary in India presents practical challenges for foreign entities.

Key Risks & Mitigation Measures

- Regulatory complexity

Mitigation: Engage India-focused legal and compliance experts early. - Apostille delays

Mitigation: Initiate apostille of parent company documents before name reservation. - RBI & FEMA compliance risks

Mitigation: Follow strict sequencing—remittance → allotment → FC-GPR/FC-TRS filing. - State-wise labour law variations

Mitigation: Assess local Shops Act, PT, and labour requirements at the registered office location. - Infrastructure & cost challenges

Mitigation: Use serviced offices or EOR partners during the initial phase.

Setting up a wholly owned subsidiary in India is a legally robust, tax-efficient, and operationally flexible option for foreign companies seeking long-term presence, revenue generation, and full control under Indian law. With simplified incorporation, competitive corporate tax rates (effective 25.17%), and clear FEMA/RBI pathways, a WOS is preferable to a branch office for scalable operations and to an EOR for businesses moving beyond pilot hiring into IP ownership, contracting, and market expansion. Strategically, a WOS suits companies entering a growth or scale phase, while EOR fits early testing and branches suit limited, non-revenue activities making the WOS the optimal choice for sustained India-focused growth.

FAQs on How to Setup Wholly Own Subsidiary in India

-

Who can set up a WOS in India?

Any foreign company, international organization, foreign government agency, or eligible NRI/PIO can set up a wholly owned subsidiary in India, subject to sectoral FDI rules permitting 100% foreign ownership.

-

Is RBI approval required for setting up WOS?

Not usually. If the sector falls under 100% FDI via the Automatic Route, no prior RBI or government approval is needed. Approval is required only for sectors under the Government Approval Route.

-

Can WOS profits be repatriated?

Yes. Profits and dividends are freely repatriable after payment of applicable taxes. Repatriation may be restricted only under specific structures (e.g., NRO-funded investments).

-

Is valuation mandatory for starting wholly owned subsidiary in India?

Only in specific cases. Valuation is mandatory for share transfers between resident and non-resident shareholders (FC-TRS). It is not required for initial incorporation under direct FDI.

-

Can foreign nationals be directors in Wholly Owned Subsidiary?

Yes. Foreign nationals can be directors, provided at least one director is an Indian resident as per the Companies Act, 2013.

-

What is the minimum capital required to setup wholly owned subsidiary?

No minimum paid-up capital is prescribed (Companies Amendment Act, 2015). Capital levels can be defined in the Articles of Association.

-

What is the difference between a WOS and a branch office?

A WOS is an Indian-incorporated company with limited liability, allowed to conduct full commercial operations and taxed as a domestic company. A branch office is an extension of the foreign company with restricted activities, higher tax exposure, and unlimited liability.

-

What are the different structures for setting up a WOS in India?

There are three recognised structures for setting up a wholly owned subsidiary in India: (1) funding through an NRO account (with restricted repatriation), (2) direct foreign investment (FDI) through overseas remittance (most preferred, freely repatriable), and (3) acquisition/transfer of an existing Indian company (requires valuation and additional RBI filings). The choice depends on capital source, timelines, and repatriation needs.

-

What are the key steps involved in incorporating a WOS in India?

The process includes obtaining Class-3 DSCs for directors, reserving the company name via SPICe+ Part A, filing SPICe+ Parts B & C for incorporation and integrated registrations (DIN, PAN, TAN, GST, bank account, EPFO/ESIC where applicable), receiving the Certificate of Incorporation and CIN, and completing post-incorporation compliances such as board meetings, auditor appointment, and INC-20A filing.

-

What are the minimum requirements for directors and shareholders of a WOS?

A WOS requires a minimum of two directors, with at least one Indian resident director, and two shareholders. There is no residency restriction for shareholders, and a nominee shareholder may be appointed to meet statutory requirements while retaining 100% parent ownership.

-

What are the repatriation requirements for profits earned by a WOS?

Profits and dividends of a WOS are freely repatriable after payment of applicable taxes when funded through direct FDI. Repatriation is restricted (USD 1 million per year) if capital is routed through an NRO account. The applicable structure determines the repatriation flexibility.

-

What are the RBI filings required for a WOS in India?

RBI filings depend on the transaction type. For foreign investment, Form FC-GPR must be filed within 30 days of share allotment. For share transfers between resident and non-resident shareholders, Form FC-TRS is required. Supporting documents include FIRC, remitter bank KYC, and valuation (where applicable).

-

Are valuation reports or document apostilles required for setting up a WOS?

Apostille or consularisation is mandatory for foreign documents submitted to Indian authorities (e.g., parent company resolutions, MOA/AOA). Valuation reports are not required for initial incorporation under direct FDI, but are mandatory for share transfers between residents and non-residents under FEMA regulations.

-

What is the key difference between a subsidiary company and a wholly owned subsidiary in India?

The primary difference lies in ownership and control. A subsidiary company in India is one where the parent company holds more than 50% but less than 100% of the share capital, allowing the presence of minority shareholders. In contrast, a wholly owned subsidiary is fully owned by the parent company with 100% shareholding, giving it complete control over management, operations, and strategic decisions.

-

Which structure is better for foreign companies entering the Indian market?

A wholly owned subsidiary is generally preferred by foreign companies as it offers full ownership, faster decision-making, and greater strategic autonomy. However, a subsidiary company may be more suitable for businesses seeking local partnerships, shared risk, or regulatory advantages under specific FDI policies in India.

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More