Blog Content Overview

AI Summary

Damages and indemnity are legal concepts addressing financial losses, but differ significantly. Damages, under Sections 73 and 74 of the Indian Contract Act, compensate for breach of contract, covering actual and liquidated damages. Indemnity, as per Section 124, protects against losses from the indemnifier's or a third party's actions, shifting risk via indemnity agreements. Key differences include: damages arising from breaches, while indemnity covers broader loss sources; damages being secondary obligations awarded post-wrongdoing, while indemnity is a primary obligation regardless of fault. Indemnity potentially covers all losses within the agreement's scope, unlike damages limited to actual losses. While damages claims involve a duty to mitigate losses, indemnity may not. Indemnity offers broader protection, but poorly negotiated clauses pose risks.

Introduction

Let’s face it, contracts are broken, and sometimes, unexpected situations cause financial losses. But what recourse do you have? When it comes to recouping your losses, legal concepts like damages and indemnity come into play. While they both aim to compensate for financial hardship, they differ significantly. This blog post will be your guide to understanding damages vs indemnity. In this Article Difference between Indemnity and Damages, We’ll explore into the situations where each applies, the scope of what you can recover, and the key differences that can make all the difference in your claim. So, whether you’re a business owner, an entrepreneur , or simply someone who wants to be prepared, buckle up and get ready to understand the legalese of damages and indemnity!

Damage, Damages & Compensation

The terms ‘damage’ and ‘compensation’ are often used interchangeably for ‘damages’, it is essential to understand that the two terms hold significant differences to the concept of ‘damages’.

‘Damages’ are related to the compensation that is granted or sought for, whereas ‘damage’ pertains to the pecuniary and non-pecuniary harm or loss for which such compensation is requested or granted.

‘Damage’ can encompass both aspects, such as harm to one’s reputation, physical or mental suffering, while ‘damages’ strictly refer to monetary relief.

Compensation is a comprehensive term that covers payments to address losses or harm resulting from acts or omissions, such as property acquisition by another party, legal violations, wrongful termination. In contrast, damages specifically arise from actionable legal wrongs.

What are Damages?

In Common Cause v Union of India, the apex court observed that damages refer to a form of compensation awarded in case of breach, loss or injury.

Damages are covered under Sections 73 and 74 of the Indian Contract Act, 1872 (Act). While section 73 of the Act encompasses the actual damage incurred upon breach of contract, Section 74 provides for liquidated damages i.e., genuine estimate of the loss incurred by the aggrieved party.

What is Indemnity?

According to section 124 of the Indian Contract Act, a claim for indemnity arises due to the conduct of the indemnifier or by the conduct of any other person. This is a major advantage of claiming indemnities over damages. Indemnity clauses shift the entire risk of future loss to indemnifier.

Indemnity is a form of protection from any third-party losses and is established by way of an indemnity agreement between the claimant and indemnifier. Indemnity clauses are often subject to extensive debate during the commercial contract negotiations since poorly negotiated indemnity clauses can cause serious repercussions to the parties.

Understanding the Differences between Damages and Indemnity

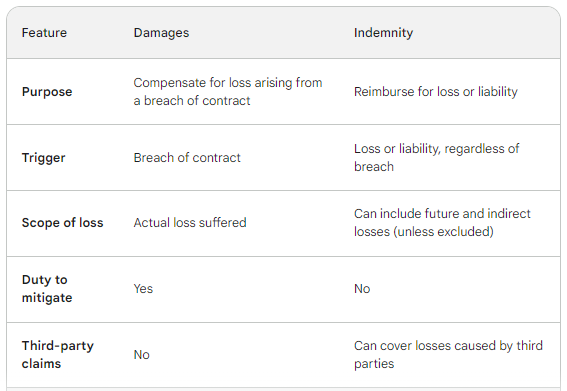

| Damages | Indemnity |

| Defined under Section 73 and 74 of the Act. Damages can be liquidated or unliquidated, and refer to the losses incurred. | Indemnity is an undertaking to make good loss caused by one party to another. The act describes indemnity as “ A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor, himself or by the conduct of any other person.” |

| In cased of monetary damages, award may be awarded for more than the actual loss occurred or even less than the actual loss occurred. | The primary objective behind indemnity is to restore the original position of the party aggrieved by the breach. |

| The concepts of foreseeability, reasonability and remoteness bring a duty to mitigate, covering two broad principles: a) The claimant must take all reasonable steps to reduce or contain his loss; and b) The claimant must not act unreasonably so as to increase his loss. | Such an obligation to mitigate may not arise in an indemnity unless specifically stated so in the indemnity clause. |

| Damages can only be claimed when there is a breach of contract by either party | Relief may be claimed for loss caused by the action of a third party which may not necessarily result from the breach of contract. |

| Represent a secondary obligation awarded by a court in response to a proven wrongful act. The liable party only incurs the obligation to pay damages after a finding of wrongdoing. | Creates a primary obligation, meaning the indemnifying party is directly responsible for compensating the indemnified party for losses regardless of any other obligations. |

| Involves at least two parties: the injured party (who suffered the harm) and the liable party (who caused the harm). Courts determine the amount of damages awarded. | Typically involves two parties: the indemnifier (who promises to reimburse) and the indemnified party (who receives the reimbursement). |

| The liable party must be found to have caused the loss through their wrongful act or breach of duty. They are only liable for the damages directly attributable to their actions. | The indemnifier may not necessarily be the direct cause of the loss. The obligation can arise due to contractually agreed-upon scenarios, even if the indemnifier had no role in causing the loss. |

| Limited to the actual losses suffered by the injured party due to the specific wrongful act. Courts aim to restore the injured party to their pre-loss position, not provide excessive windfalls. | Can potentially encompass all losses incurred by the indemnified party that fall within the scope of the agreement, even if the losses exceed the actual wrongdoing. |

| Can be express (written in a formal agreement) or implied (inferred from the circumstances and conduct of the parties). | No formal agreement is involved. Damages are awarded through a court order based on the evidence presented during a lawsuit. |

| Judges and juries hold greater discretion in determining the appropriate amount of damages based on the specific facts of the case and legal precedents relevant to similar situations. | Limited by contractual terms and established legal principles regarding contract interpretation. |

- Basis for claim: Damages are awarded for a breach of contract, while indemnity can be claimed for a loss arising from various situations, including a breach of contract, a third-party action, or even a potential future loss.

- Scope of recovery: Damages are limited to the actual loss suffered by the injured party, while indemnity can cover a wider range of losses, including consequential, remote, indirect, and third-party losses, unless specifically excluded in the indemnity clause.

- Duty to mitigate: The injured party has a duty to mitigate their losses when claiming damages, while there is no such duty for the indemnified party.

- Timing of claim: Damages can only be claimed after a breach of contract has occurred, while an indemnity claim may be brought even before a breach occurs, if the potential for loss exists.

- Objective vs. contractual: Damages are awarded based on the objective loss suffered by the injured party, while indemnity is based on the specific terms of the indemnity clause in the contract.

We draft effective contracts and protect against damages Let’s Talk

Conclusion

Damages on breach of contracts are considered to be advantageous than other remedies that may be available to parties suffering losses from breach of contracts. Liquidated damages play a significant role in cases where it is difficult to ascertain the quantum of damages since that is predetermined by inserting a clause on ‘liquidated damages’ in the contract itself. Such clauses for liquidated damages aim at the prevention of litigation to the extent possible. This would also help in reducing the burden to prove actual damage suffered pursuant to breach, in order to claim damages.

However, in certain cases, damages may not suffice in respect of the losses or damage suffered by a party. This may lead to a situation which warrants a specific performance by the other party instead of damages to enable restoration of the position of the party prior to such contractual breach. Such situations may arise if the subject matter of the contract is of rare quality or indispensable for the aggrieved party. Thus, courts may opt to award damages in addition to or in substitution of specific performance, depending on what is warranted by a given situation. Moreover, stipulation for liquidated damages would not be a bar to specific performance.

FAQs on Indemnity v/s Damages

- What is the difference between “damage” and “damages”?

- Damage: This refers to the harm or loss suffered, both financial (pecuniary) and non-financial (non-pecuniary), such as damage to reputation, physical or mental suffering.

- Damages: This specifically refers to the monetary compensation awarded for the harm or loss suffered.

- What are damages?

Damages are a form of compensation awarded in situations like breach of contract, loss, or injury. In India, they are covered under the Indian Contract Act, 1872. There are two types:

- Actual damages: Compensation for the actual loss incurred.

- Liquidated damages: A predetermined amount agreed upon in the contract to compensate for potential future losses.

- What is indemnity?

Indemnity is a contractual agreement where one party (indemnifier) promises to compensate another party (indemnitee) for any losses incurred due to the actions of the indemnifier, another person, or even a third party. This essentially shifts the risk of future loss to the indemnifier. - What are the circumstances where damages might not be sufficient?

Damages might not be enough if the subject matter of the breach is unique or irreplaceable, in which case, specific performance might be sought. - When is indemnity more advantageous than damages?

Indemnity can be more advantageous because:

- It covers losses caused by third parties, beyond just breach of contract.

- It may not require proving the extent of the loss suffered.

- The duty to mitigate losses might not apply, potentially leading to higher compensation.

- What are the drawbacks of indemnity clauses?

- Poorly negotiated clauses can expose the indemnifier to unexpected liabilities.

- They can be complex and require careful drafting to avoid ambiguity.

- Can damages and indemnity be claimed together?

It depends on the specific situation and the contract terms. In certain cases, the court might award both damages and specific performance (fulfilling the contract) depending on what best restores the aggrieved party’s position. - What are some situations where specific performance might be preferred over damages?

Specific performance might be preferred when:

- The subject matter of the contract is unique or irreplaceable.

- Monetary compensation wouldn’t adequately address the loss.

- What role do liquidated damages play in contracts?

Liquidated damages clauses pre-determine the compensation amount for potential future losses, avoiding the need to prove actual damages in case of breach. This helps:

- Prevent litigation.

- Reduce the burden of proving actual losses.

- What are some important considerations when drafting indemnity clauses?

- Clearly define the scope of losses covered.

- Specify whether the duty to mitigate applies.

- Consider potential for future legal disputes and ensure the clause is enforceable.

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More