Blog Content Overview

First Published on 3rd February, 2023

Vision for Budget 2023

Amrit Kaal – an empowered and inclusive economy

Our nation will enter a 25-year period wherein India will go from India@75 to India@100. Amrit Kaal marks the blueprint to steer the Indian economy for the upcoming years. The vision for the Amrit Kaal includes technology-driven and knowledge-based economy with strong public finances, and a robust financial sector. The economic agenda for achieving this vision focuses on three things:

- Facilitating ample opportunities for citizens, especially the youth, to fulfil their aspirations;

- Providing strong impetus to growth and job creation;

- Strengthening macro-economic stability

The Budget in Amrit Kaal presented by Hon’ble Finance Minister Smt. Nirmala Sitharaman adopts 7 priorities as ‘Saptarishi’

Green Growth

The Government has proposed to implement many programs for green fuel, green energy, green farming, green mobility, green buildings, and green equipment, and policies for efficient use of energy across various economic sectors. These green growth efforts help in reducing carbon intensity of the economy and provides for largescale green job opportunities. The following key programs have been proposed apart from many other initiatives

- PM PRANAM – To incentivize States/ UTs to promote usage of alternative fertilizers

- MISHTI – To ensure Mangrove plantation along the coastline

- Amrit Dharohar – To implement optimal usage of wetlands

- GOBARdhan Scheme – To establish 500 “Waste to Wealth” plants to promote circular economy

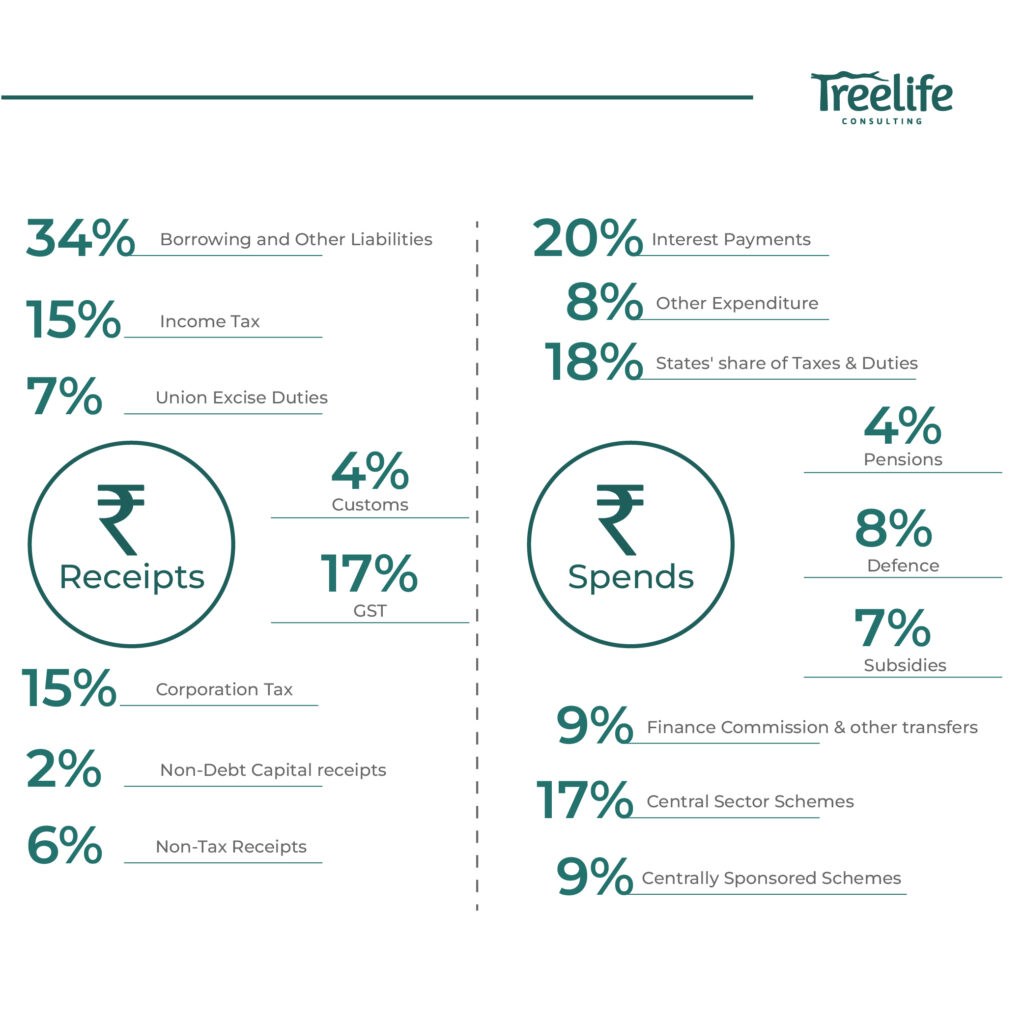

Flow of Money in Budget 2023

Economic Growth Indicators

- Per Capita income has increased to ` 1.97 lakh pa

- GDP growth is estimated at 7%, highest amongst largest economies

- The fiscal deficit is estimated to be 5.9% of GDP. The government intending to bring the fiscal deficit below 4.5% of GDP by 2025-26.

- Capital Investment outlay increased to INR 10 Lakh Crores. Increase of 33% which is ~ 3.3% of GDP.

- Effective capex to be INR 13.7 Lakh crores. ~ 4.5% of GDP

- This year around 6.5 crore Income tax returns were filed and nearly 45% of returns were processed within 24 hours. The average processing period reduced from 93 days in financial year 13-14 to 16 days now.

- Digital payments has widened by 76% in transactions and 91% in value over the last year.

Savings Scheme Proposals

- A new scheme for Women called Mahila Samman Savings Certificate, will be available for 2 year up to March 2025. This will offer deposit upto INR 2 lakh at fixed interest rate of 7.5%.

- The deposit limit for Senior Citizen Savings Scheme (SCSS) is proposed to enhanced from 15 lakh to 30 lakh subject to the prescribed conditions. The maximum deposit limit for Monthly Income Account Scheme will be enhanced from 4.5 lakh to 9 lakh for single account and from 9 lakh to 15 lakh for joint account.

- Reduction in the TDS rate from 30% to 20% on EPF taxable withdrawal in non-PAN cases.

- KYC process will be streamlined and PAN card will be adopted as a single identifier.

Health, Education & Transport initiatives

- 157 New Nursing colleges to be started

- National Digital Library to be for children and adolescents

- 38,800 teachers to be recruited for the 740 Ekalvya Model Residential schools serving for tribal students

- To empower the youth and help the ‘Amrit Peedhi’, the government have formulated the National Education Policy, focused on skilling, adopted economic policies that facilitate job creation at scale, and have supported business opportunities.

- 50 additional airports, heliports, water aerodromes and advance landing grounds will be revived for improving regional air connectivity.

- Highest ever capital outlay of INR 2.4 lakh crores for railways

Other key announcements

- A system of ‘Unified Filing Process’ will be set-up by the government to share the information or filed return in simplified forms on a common portal, across the agencies.

- An integrated IT portal will be established for investors to reclaim unclaimed shares and unpaid dividends from the Investor Education and Protection Fund Authority.

- A one stop solution for reconciliation and updating of identity and address of individuals maintained by various government agencies, regulators and regulated entities will be established using DigiLocker service and Aadhaar as foundational identity.

- A Central Processing Centre will be setup for faster response to companies through centralized handling of various forms filed with field offices under the Companies Act.

- At present, India is the largest producer and second largest exporter of Millets. Efforts are made to make India a global hub for Millets.

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More