Blog Content Overview

- 1 Overview: Why Budget 2026 Is a Structural Inflection Point

- 2 1. Macroeconomic Baseline: The Digital State of the Nation (2025–26)

- 3 2. Data Centres as Strategic National Infrastructure

- 4 3. The 21-Year Tax Holiday Till 2047: Mechanism, Conditions, and Strategic Intent

- 5 4. Safe Harbour and Transfer Pricing Predictability: De-risking Scale

- 6 5. Hyperscalers and India’s Emerging Role as a Global Compute Base

- 7 6. AI: From Innovation Narrative to Governance Utility

- 8 7. Cybersecurity: From Compliance to Decision-Grade Governance

- 9 8. Infrastructure Nexus: Energy, Water, Cooling, Materials, and Real Estate

- 10 9. Semiconductors & ISM 2.0: Owning the Physical AI Stack

- 11 10. IT & GCC Ecosystem: Moving Up the Value Chain

- 12 11. Talent Mobility & Global Expertise: Attracting Specialists and Cleaning Legacy Compliance

- 13 12. Startups, MSMEs, and the “Champion” Manufacturing Pivot

- 14 13. Comparative Analysis: India as an Emerging Regional Powerhouse (vs Malaysia, Vietnam, Japan)

- 15 14. “What India Is Set to Witness”: Five Major Transformations

- 16 15. Investor Lens: Where Capital Will Flow (2026–2047)

- 17 16. Final Synthesis: India’s New Digital Contract (Founders • Businesses • Investors)

A Strategic Blueprint for Data Sovereignty, AI Utility, and Global Tech Leadership

Overview: Why Budget 2026 Is a Structural Inflection Point

Union Budget 2026–27 signals a decisive strategic pivot: India is moving from being a consumer and services executor of global digital technologies to becoming a producer, owner, and exporter of AI-driven digital infrastructure.

Three structural themes dominate the budget’s technology agenda:

- Data centres elevated as Strategic National Infrastructure (not merely IT “support” assets).

- Artificial Intelligence operationalised as governance and productivity utility (“AI as infrastructure,” not lab experimentation).

- Long-horizon fiscal certainty anchored to 2047 designed to unlock hyperscale capital and irreversible infrastructure commitments. This is linked to Viksit Bharat @ 2027 vision of Govt. of India.

The macro logic

India currently generates ~20% of the world’s data, yet ~95% of Indian-origin data is processed or stored overseas creating security, competitiveness, latency, and economic leakage risks.

Budget 2026–27 directly targets this mismatch through tax architecture, compliance simplification, and infrastructure constraints (power, water, materials) that govern real-world feasibility.

Key numbers at a glance

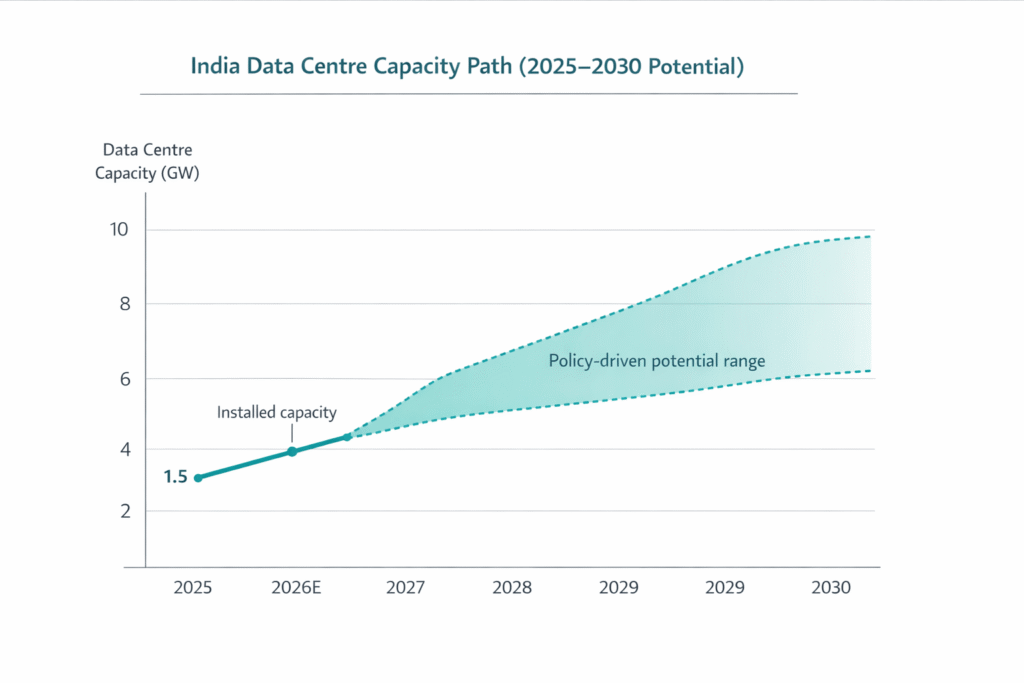

- Data centre capacity: 1.5 GW installed (2025); expected to exceed ~1.7 GW by end-2026.

- India’s DC capacity footprint is concentrated across 7 major clusters: Mumbai, Chennai, Hyderabad, NCR, Bengaluru, Pune, Noida.

- Global cloud infrastructure concentration: ~63% controlled by AWS, Microsoft Azure, and Google Cloud.

- Hyperscaler announced investments in India: >$30 billion over 14 years.

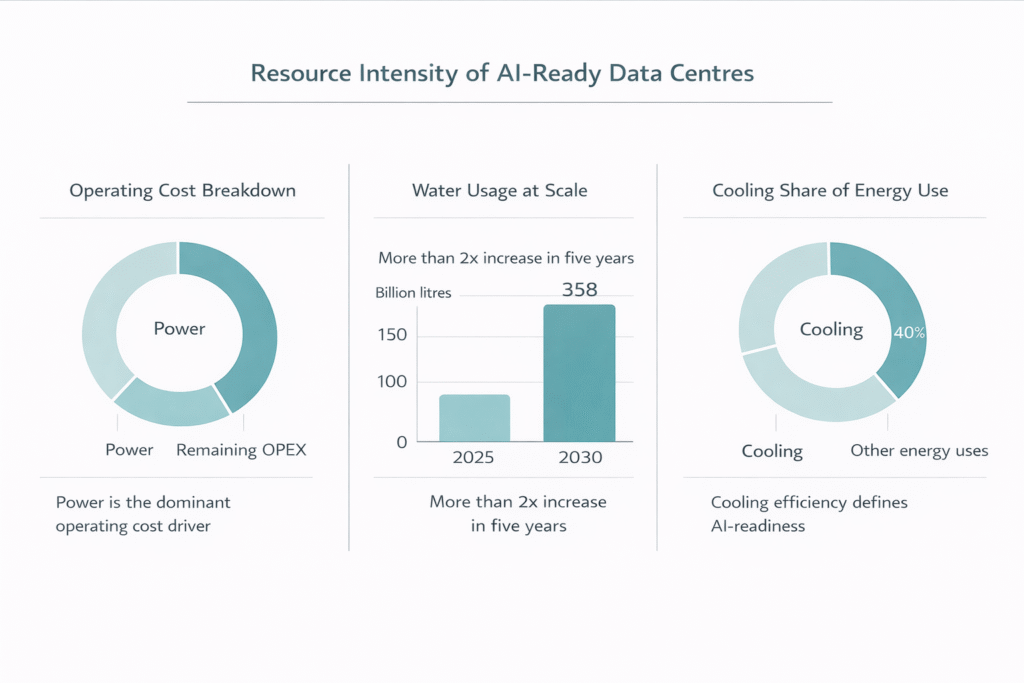

- Data centre resource constraints: power is ~50% of operating cost; water consumption 150+ billion litres in 2025, projected to rise to ~358 billion litres within five years.

- Tax + compliance era shift: Income Tax Act, 2025 effective April 1, 2026, with simplification and automation.

What this means for stakeholders

- Founders: compute economics and infrastructure risk improve over time; AI-native businesses operate on nationally prioritised infrastructure (not rented policy space).

- Investors: the budget creates a long-duration compounding window, but returns will be shaped as much by power/water/material constraints as by tax incentives.

- Businesses and GCCs: India is positioned to move from execution hubs to ownership centres for mission-critical platforms, enabled by stable transfer pricing and simplified compliance.

1. Macroeconomic Baseline: The Digital State of the Nation (2025–26)

Budget 2026–27 builds on a digital economy that already has scale but is constrained by physical and regulatory dependencies.

1.1 Data centre baseline and geographic clustering

As of Q3 2025, India’s data centre capacity reached 1.5 GW, distributed primarily across seven urban clusters: Mumbai, Chennai, Hyderabad, NCR, Bengaluru, Pune, GIFT City and Noida.

Interpretation:

- Capacity clustering is a strategic advantage for connectivity and enterprise proximity, but also concentrates grid and water stress.

- Next-phase growth (toward 8–10 GW potential by 2030 referenced in the material) will likely depend on extending infrastructure corridors beyond current cluster saturation and enabling tier-1 periphery buildouts.

1.2 Sector market dynamics and scaling projections

The attached Report provides a concise sector table with market sizes, projections, and growth drivers.

Table 1: India Technology Segment Outlook

| Sector | 2025 Market Size (Estimated) | 2030–2033 Projection | Anticipated CAGR | Primary Growth Driver |

| Artificial Intelligence | $13.05B | $325.3B (by 2033) | 38.1%–39% | Social AI, Enterprise GenAI, GPU clusters |

| Cybersecurity Products | $4.46B | $6.0B (by 2026) | 25% annual | DPDP Act, AI-powered threat defense |

| Data Center Services | $3.88B | $21.03B (by 2031) | 13.59%–15.3% | Data localisation, 5G, hyperscale cloud |

| IT Spending (Total) | $159B | $176.3B (by 2026) | 10.6% | Software + data centre systems |

| SaaS Market | $15.5B | $50.0B (by 2030) | High (Trend) | AI integration, global SMB demand |

Implications for strategy:

- AI’s projected expansion is not purely a software story; it is a compute, storage, networking, and energy story.

- Cybersecurity growth is tied to enforcement readiness and DPDP-era accountability (see Section 7).

- Data centre services growth is structurally linked to tax certainty, safe harbour predictability, and physical constraints.

1.3 India’s AI talent base: scale and pressure points

India is cited as having the second-highest AI talent base globally, with 420,000+ employees in AI-specific job functions, expected to grow at ~15% CAGR till 2027, with demand rising to ~1.25 million professionals.

What this signals for businesses:

- Talent availability is a competitive edge, but the constraint shifts to “where the models run” (compute access), “how they are governed” (risk/accountability), and “how quickly deployments scale” (public utility and enterprise integration).

Founder lens (practical):

- If your product requires GPU/accelerator-intensive workloads, you should treat infrastructure access and energy resilience as core components of product viability not procurement afterthoughts.

2. Data Centres as Strategic National Infrastructure

Budget 2026–27 reframes data centres from support facilities into the foundational layer for digital architecture across sectors.

2.1 Strategic infrastructure status: why it changes the investment equation

The report explicitly positions technology infrastructure data centres, cloud platforms, cybersecurity, and digital public infrastructure on the same footing as roads, power, and logistics.

This implies:

- Longer policy horizons and lower midstream regulatory surprise

- Governance-first design expectations, including security-by-default

- A clearer path for long-duration infrastructure capital

2.2 The sovereignty gap: “India produces data, others process value”

The documents highlight a structural mismatch:

- India generates ~20% of the world’s data

- Yet ~95% of Indian-origin data is stored/processed overseas

Why it matters beyond compliance:

- Security and resilience: externalised processing increases systemic dependency risk

- Economic capture: compute and storage value accrues outside India

- Startup economics: higher latency and higher costs reduce domestic innovation efficiency

2.3 Capacity trajectory: from 1.5 GW to a multi-GW decade

Capacity snapshot:

- 1.5 GW installed (2025)

- Expected to cross ~1.7 GW by end-2026

The Report references a policy-driven expectation of capacity expansion citing a shift from ~1 GW baseline in the projection logic toward ~10 GW potential under investment attraction expectations.

3. The 21-Year Tax Holiday Till 2047: Mechanism, Conditions, and Strategic Intent

The budget’s headline move is a 21-year tax holiday until March 31, 2047 for foreign companies providing global cloud services via India-based data centres.

3.1 What was announced

- Tax holiday applies whether the foreign firm:

- builds its own India footprint (as part of the structure), or

- procures services from an Indian data centre operator

- Mandatory routing of Indian customer services via local reseller entities.

3.2 Operating framework and eligibility conditions

The Report adds structure to eligibility, including:

- Use of “Specified Data Centers” in India, set up under an approved government scheme and notified by MeitY

- The DC must be owned and operated by an Indian company

- Indian customer services must be routed via an Indian reseller entity, taxed at 25.7% corporate tax

- Foreign entity remains asset-light and does not own/operate physical infrastructure

Table 2: 2047 Tax Holiday Qualification Checklist

| Requirement | What it means for operators | Why it exists |

| Specified DCs notified under MeitY scheme | Use approved/nominated DCs | Ensures compliance and strategic alignment |

| Indian-owned and operated DC | Physical asset anchored in India | Builds domestic infrastructure capability |

| Local Indian reseller for Indian customers | Domestic tax base preserved (25.7%) | Balances investment attraction + revenue |

| Foreign provider asset-light | Cloud provider avoids owning DC assets | Encourages rapid entry + local partnership |

3.3 Investment scale expectations referenced

Reports state an expectation to attract >$70 billion in cumulative investments over 5–7 years, potentially expanding capacity toward ~10 GW (from the baseline cited in the projection logic).

Investor interpretation:

- This is designed to compress the risk premium historically applied to India compute investments.

- However, capital deployment will still be bounded by power availability, water intensity, and supply chain constraints.

4. Safe Harbour and Transfer Pricing Predictability: De-risking Scale

Budget 2026–27 introduces a 15% cost-based safe harbour margin for Indian data centre entities providing services to related foreign companies.

4.1 The 15% data centre safe harbour

Key impact:

- Eliminates transfer pricing uncertainty

- Levels playing field between foreign-owned and Indian-promoted operators

- Encourages faster capacity expansion and pricing competitiveness

4.2 IT services safe harbour modernization and scale expansion

- IT-enabled services grouped under “Information Technology Services”

- Uniform safe harbour margin: 15.5%

- Eligibility threshold raised: ₹300 crore → ₹2,000 crore

- Automated approvals and faster APAs, with APA process concluded within two years

Table 3: Safe Harbour Reform Summary

| Element | Budget 2026–27 Change | Who benefits most |

| DC related-party services | 15% cost-based safe harbour | DC operators, foreign affiliates, infra investors |

| IT services safe harbour | Single category + 15.5% | Mid/large IT + GCC service providers |

| Threshold expansion | ₹300cr → ₹2,000cr | Scaled firms previously outside safe harbour |

| Process | Automated approvals + faster APAs | CFOs and tax teams; improves predictability |

5. Hyperscalers and India’s Emerging Role as a Global Compute Base

5.1 Global cloud concentration and India relevance

AWS, Azure, and Google Cloud control ~63% of global cloud infrastructure.

Combined announced investments in India exceeding $30 billion over 14 years.

5.2 What changes post-budget

Post-budget India becomes viable for:

- AI training

- Inference

- Cross-border workloads

- Disaster recovery zones

Strategic shift: India moves from “regional node” to “global compute base.”

5.3 Takeaway for Founders

A large share of startup unit economics especially in AI-native businesses depends on compute price stability, predictable data localisation, and scalable infrastructure access.

Budget-induced implications:

- Compute cost curve: medium-term improvement as capacity expands and policy risk declines.

- Market access: globally competitive backend capability enables Indian companies to build for cross-border compute use-cases.

5.4 Takeaway for Investors

The structural opportunity is not only in DC real estate, but in:

- power/cooling innovation

- grid storage and renewable PPAs

- optical networking and transceivers

- cybersecurity governance tools

- semiconductor equipment/materials

6. AI: From Innovation Narrative to Governance Utility

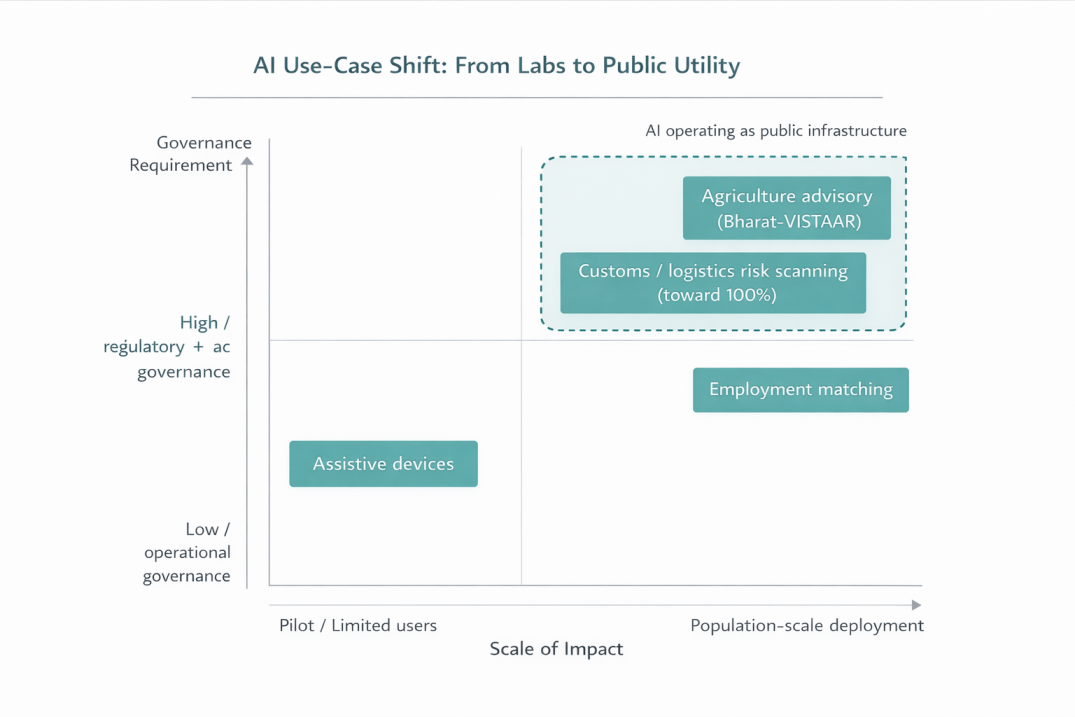

Budget 2026–27 reframes AI as a general-purpose governance and productivity engine a “utility layer,” not a lab experiment.

6.1 “Social AI” and flagship implementation: Bharat-VISTAAR

Bharat-VISTAAR is presented as a multilingual AI integrating AgriStack with ICAR data for farmer advisories.

Why this is strategically meaningful:

- It signals AI deployment at population scale

- It implies that success metrics are operational: accuracy, latency, governance, and trust, not novelty

6.2 AI as a governance engine: applied deployments

The AI-driven use-cases including:

- worker-job matching

- container risk scanning at ports

- assistive devices under Divyang Sahara Yojana

- phased expansion of non-intrusive scanning using advanced AI technology across major ports, targeting 100% container scanning to improve risk assessment and reduce dwell time.

6.3 AI market expansion and compute dependency

AI market scaling cited in the sector outlook table $13.05B (2025) to $325.3B (by 2033) with ~38–39% CAGR implies enormous compute scaling, tightening the coupling between AI growth and data centre buildout, power availability, and cooling innovation.

7. Cybersecurity: From Compliance to Decision-Grade Governance

Budget 2026–27 embeds cybersecurity into digital governance, shifting from compliance checklists to continuous, decision-grade visibility and accountability.

7.1 Structural shift in operating model

- periodic audits → continuous visibility

- checklists → impact/exposure insight

- compliance → accountability

- cybersecurity becomes board-level decision input

7.2 Market growth and enforcement readiness

Growth projected as below:

- cybersecurity product market projected to reach $6B by 2026 (from $4.46B baseline)

- Data Protection Board allocation increased fivefold to ₹10 crore, signalling movement from legislation toward enforcement and adjudication

- AI-driven cyberattacks cited as rising, with projected global losses of $18.6B by end-2025 (threat context)

Table 4: Cybersecurity Shift Governance Implications

| Dimension | Legacy posture | Budget-era posture |

| Visibility | Periodic assessment | Continuous risk visibility |

| Objective | Compliance | Exposure reduction + accountability |

| Stakeholder | IT/security team | Board + business leadership |

| Driver | Audit cycles | DPDP enforcement + AI threat evolution |

8. Infrastructure Nexus: Energy, Water, Cooling, Materials, and Real Estate

The budget recognizes that compute sovereignty cannot be achieved through tax provisions alone; it must be executed through the physical layer.

8.1 Power: the dominant operating constraint

- Power accounts for ~50% of data centre operating cost

- Data centres may consume ~2% of total electricity supply

- Data centres are expected to consume ~3% of India’s national power supply by 2030, up from less than 1% currently.

8.2 Nuclear + renewables + storage: policy measures cited

Key measures described include:

- customs duty exemption for nuclear power equipment till 2035

- solar allocation increased 32% to ₹30,539 crore

- duty exemptions on capital goods for BESS cell manufacturing, plus ₹10,000 crore allocation strengthening container manufacturing, supporting modular BESS and edge DC solutions

Investor implication:

The investable universe expands from DC shells into integrated energy + compute platforms: PPAs, grid storage, modular edge units, and cooling innovation.

- Data centres consumed 150+ billion litres of water in 2025

- Projected to reach 358 billion litres within five years

- cooling can account for nearly 40% of total energy use

- a 1 MW data centre consumes roughly 26 million liters of water annually

8.4 Materials and real estate: secondary constraints that become primary at scale

Table 5: Materials and Real Estate Demand Linked to DC Expansion

| Material/Resource | Projected Demand/Impact | Strategic relevance |

| Copper | 330,000–420,000 tonnes annually by 2030 | Supply constraint; 5x–6x higher than standard buildings |

| Fiber optic cable | 36x higher demand for AI clusters | Transceivers + optical networking boom |

| Real estate | 50–55 million sq ft by 2030 | Shift toward tier-1 peripheries + dedicated tech parks |

| Power consumption | ~3% of national grid by 2030 | Renewable PPAs + industrial grid storage opportunity |

9. Semiconductors & ISM 2.0: Owning the Physical AI Stack

Budget 2026–27 strengthens the thesis that AI sovereignty is not only about models; it is about compute, storage, and hardware control.

9.1 ISM 2.0 direction of travel

ISM 2.0 is positioned as moving beyond assembly toward:

- equipment manufacturing

- materials

- full-stack Indian IP

9.2 Outlay and strategic intent

The Electronic Component Scheme outlay is cited as increased to ₹40,000 crore.

Investor lens:

The opportunity is not limited to fabs; it includes equipment, materials, and supply chain resilience layers that reduce exposure to global disruptions.

10. IT & GCC Ecosystem: Moving Up the Value Chain

Budget 2026–27 includes reforms that encourage India’s IT sector and GCC ecosystem to evolve from execution to ownership design, build, run, and govern mission-critical platforms globally.

10.1 IT service classification and safe harbour coherence

The data states:

- all IT-enabled services grouped under “Information Technology Services”

- common safe harbour: 15.5%

- threshold raised: ₹300 crore to ₹2,000 crore

- automated approvals + faster APAs

10.2 GCC implication

GCCs increasingly become:

- product and platform ownership centres

- deep-tech and R&D nodes

- operational governance hubs for global infrastructure

Business takeaway:

For multinationals, India’s positioning becomes less “cost centre” and more “operational command centre,” supported by regulatory simplification and tax predictability.

11. Talent Mobility & Global Expertise: Attracting Specialists and Cleaning Legacy Compliance

Budget 2026–27 introduces targeted measures to attract global expertise and remove friction for returning Indians and non-resident professionals.

11.1 Global Talent Exemption (5-year overseas income exemption)

Non-resident professionals relocating to India under government-notified schemes receive:

- five-year tax exemption on income earned outside India

- eligibility condition: must have been non-resident for five consecutive tax years preceding arrival

11.2 FAST-DS 2026 (Foreign Asset Disclosure Scheme)

The Report describes:

- a six-month window allowing voluntary disclosure of previously unreported foreign assets

- thresholds referenced: up to ₹1 crore or ₹5 crore (category dependent)

- payment: 30% tax + 30% additional tax (in lieu of penalty), with immunity from criminal prosecution

This is positioned as a mechanism to clean up legacy compliance issues tied to foreign bank accounts, RSUs, ETFs, and other overseas holdings.

12. Startups, MSMEs, and the “Champion” Manufacturing Pivot

Budget 2026–27 signals a deliberate shift toward manufacturing-led entrepreneurship and scalable, compliance-forward MSMEs.

12.1 Capital allocation and intent

The Report references:

- approximately ₹32,000 crore allocated for the startup and small business sector

12.2 The ₹10,000 crore SME Growth Fund (equity-first intervention)

This fund is presented as a move from credit-heavy interventions to equity and structured support:

- objective: identify and nurture “future champions” capable of global competition

- nature of capital: longer-tenure funding, flexible repayment, plus mentoring and governance advisory

- “champion status”: preferential access linked to compliance standards and growth potential

12.3 Funding pipeline via SIDBI-anchored routes

The Report lists three primary entry routes:

- SIDBI-anchored VC funds

- sector-focused venture funds (manufacturing, agribusiness, clean technology)

- structured debt or quasi-equity for asset-heavy MSMEs with predictable cash flows

12.4 Startup tax holiday extension (Section 80-IAC)

The report notes:

- Section 80-IAC tax holiday (100% deduction for 3 years) extended to entities incorporated until March 31, 2030

This functions as a financial cushion during formative years, but it is most valuable when paired with improved compute access, governance readiness, and scalable infrastructure.

13. Comparative Analysis: India as an Emerging Regional Powerhouse (vs Malaysia, Vietnam, Japan)

13.1 Cost and yield dynamics

India’s development costs for data centres are stated as:

- 40–50% lower per MW compared with the US

- up to 60% cheaper than Japan

Power costs are cited as 30–40% cheaper than mature markets due to high renewable components.

13.2 Incentives, stability, and renewable headroom

The report provides comparative indicators, including:

- India’s primary incentive: 21-year tax holiday

- renewable headroom advantage: “substantial headroom” referenced

- competitor markets facing tighter renewable output growth vs demand

Table 6: Regional Competitive Snapshot

| Metric | India (2026) | Malaysia (Johor) | Vietnam | Japan |

| Primary tax incentive | 21-year tax holiday | 5–10 year ITA/PS | Effective ~1% tax | Limited |

| Yield on cost | Moderate (7–8% cap rate) | ~6–7% | High (17.5–18.8%) | Moderate |

| Renewable capacity | High headroom (10% demand headroom) | Tight supply (grid pressure) | 30% pledges | Transitioning |

| Regulatory stability | New IT Act 2025 | Established | Evolving | High |

| Digital sovereignty stance | Strong Data-in-India focus | Emerging | Emerging | Moderate |

14. “What India Is Set to Witness”: Five Major Transformations

This hereby frames the budget as catalysing a “re-contracting” between the state and the technology ecosystem.

14.1 The “Orange Economy” (AVGC) as a strategic employment engine

The report cites:

- 15,000 secondary school labs and 500 college creator labs

- industry projected to require ~2 million professionals by 2030

Business opportunity implication:

This creates structured pipeline conditions for:

- creative tech tooling

- immersive storytelling platforms

- gaming and real-time engines

- creator economy infrastructure

14.2 Transition from assembling to owning the stack

ISM 2.0 plus the 2047 horizon signals India is building for the next quarter century moving from service destination to “intelligence engine room” framing.

14.3 Integrated energy–digital infrastructure

Future infrastructure will integrate:

- dedicated power corridors

- BESS systems

- modular containerised facilities

enabling rapid “edge” DC deployment closer to point-of-use.

14.4 Precision logistics and AI-managed trade

AI-powered scanning expansion targets full container scanning across major ports, with implications for logistics costs, risk, dwell times, and export competitiveness for “Champion MSMEs.”

14.5 GIFT City as a global financial hub

The report cites:

- tax holiday extension for IFSC units to 20 consecutive years

- positioning GIFT City as an alternative to Singapore and Hong Kong for aircraft leasing, treasury centres, and international banking units.

15. Investor Lens: Where Capital Will Flow (2026–2047)

The data sources provide a clear investor framing of high-conviction themes.

15.1 High-conviction themes (as stated)

- hyperscale and edge data centres

- power and cooling innovation

- AI infrastructure platforms

- cybersecurity governance tools

- semiconductor equipment and materials

- GCC-led deep-tech R&D

15.2 Why the opportunity is durable

- 2047 fiscal horizon

- multi-party policy continuity positioning

- infrastructure-led strategy (not incentive-only)

15.3 Risk pricing: what investors must model explicitly

The data sources collectively signal that investors must price “infrastructure externalities,” not just tax benefits.

Key risk variables:

- grid availability and reliability

- energy cost volatility and PPA structure

- water access and cooling tech maturity

- materials supply (copper, optical)

- compliance enforcement trajectory (DPDP + cybersecurity governance)

- execution capability for MeitY-notified “specified DC” frameworks

16. Final Synthesis: India’s New Digital Contract (Founders • Businesses • Investors)

Budget 2026–27 functions as a declaration of intent and a scaffolding for execution:

- Data is a strategic asset

- AI is national infrastructure

- Cloud is sovereign capability

- Technology is no longer optional policy it is the growth substrate

Action implications by stakeholder

For founders

Prioritise opportunities where budget architecture reduces structural friction:

- AI-native products that benefit from domestic compute expansion

- governance-first solutions (cybersecurity, DPDP-ready architectures)

- power/cooling/water efficiency tooling for DC ecosystems

- B2G and infrastructure-aligned platforms that ride population-scale utility deployments

Founder operating principle: build on nationally prioritised infrastructure with security and governance baked in not bolted on later.

For business owners and GCC leaders

Use the tax and compliance simplification to accelerate structural upgrades:

- adopt continuous risk governance models for cybersecurity

- redesign data architectures for sovereignty and resilience

- treat AI governance and security as board-level capability

- leverage safe harbour certainty to expand global delivery ownership

For investors

The compounding window is real, but returns will favour players that integrate policy advantage with physical execution:

- DC + energy-integrated platforms

- sustainable cooling and water resilience stacks

- semiconductor equipment/material ecosystems

- governance-grade cybersecurity and compliance tooling

- long-duration infra capital aligned to 2047 certainty

References:

- https://www.pwc.in/budget/union-budget-2026.html

- https://www.financialexpress.com/money/your-income-tax-this-year-will-still-be-assessed-under-old-rules-despite-new-law-coming-from-april-1-4131064/

- https://www.marknteladvisors.com/research-library/india-data-center-market.html

- https://www.businesstoday.in/technology/news/story/economic-survey-2026-projects-indias-data-centre-boom-to-8-gw-by-2030-513504-2026-01-29

- https://www.ipsr.org/blog/indian-it-industry-heads-to-350-billion-by-2025-nasscom

- https://www.einpresswire.com/article/889295838/india-data-center-market-size-to-hit-usd-21-03-bn-by-2031-growth-concentrated-in-mumbai-noida-chennai-and-bengaluru

- https://economictimes.indiatimes.com/news/india/digital-infra-emerges-as-indias-defining-opportunity/articleshow/128082630.cms

- https://www.fortunebusinessinsights.com/india-artificial-intelligence-market-113969

- https://www.grandviewresearch.com/horizon/outlook/artificial-intelligence-market/india

- https://economictimes.indiatimes.com/tech/technology/cybersecurity-product-companies-revenue-to-reach-6-billion-by-2026-dsci/articleshow/125761300.cms

- https://www.ibef.org/news/india-s-it-spending-to-hit-us-176-billion-in-2026-on-data-centre-ai-boom-gartner

- https://www.aninews.in/news/business/as-ai-reshapes-indian-business-iim-raipur-launches-ai-integrated-advanced-general-management-programme20260209111834

- https://www.resiindia.org/post/billions-in-investments-emerging-projects-and-policy-pathways-for-economic-growth-in-india-s-data

- https://www.india-briefing.com/news/india-union-budget-2026-cloud-data-centers-tax-incentives-42311.html/

- https://www.thehindu.com/business/budget/budget-2026-government-to-provide-tax-holiday-for-foreign-companies-offering-cloud-services-using-india-datacentres/article70577258.ece

- https://economictimes.indiatimes.com/tech/technology/foreign-cloud-companies-will-get-20-year-tax-rebate-but-conditions-apply/articleshow/127918162.cms

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More