Blog Content Overview

- 1 Section 1: Macroeconomic Overview

- 2 Section 2: India’s Economy

- 3 Section 3: India on the Global Stage

- 4 Section 4: GSDP Composition

- 5 Section 5: Fiscal Health

- 6 Section 6: FDI Inflows

- 7 Section 7: Startup Capital of India

- 8 Section 8: Domestic Investment Momentum

- 9 Section 9: Export Performance & Infrastructure Edge

- 10 Section 10: What This Means for Businesses & Investors

- 11 About Treelife:

AI Summary

The India Economic Survey 2025-26 reveals a robust macroeconomic outlook, projecting real GDP growth at approximately 7.4% and emphasizing consumption and investment as core growth drivers. Highlights include a significant rise in private consumption and gross fixed capital formation, alongside a notable decline in inflation. India’s diverse economic structure, featuring a strong services sector and recovering manufacturing, enhances resilience against market fluctuations. The report underscores India's fiscal strategy focused on capital expenditures and sustained foreign direct investment, particularly in technology and services. With improved banking health and intensified domestic investment momentum, the economic environment presents favorable opportunities for businesses and investors while acknowledging a 15-20% risk of global recession.

This report addresses the key points and highlights of the India Economic Survey 2025–26, providing a deep dive of India’s macroeconomic outlook, growth drivers, inflation trends, and financial sector stability. It distils the most relevant insights to help businesses, investors, and policymakers quickly understand the strategic economic direction from FY 2025–26.

Section 1: Macroeconomic Overview

India enters FY 2025–26 with a strong and unusually balanced macroeconomic position. Real GDP growth is estimated at ~7.4%, with real GVA growth at ~7.3%, reaffirming India’s position as the fastest-growing major economy. Growth is broad-based, supported simultaneously by consumption recovery, sustained investment, and improving financial stability.

- Private consumption (PFCE) grew ~7%, accounting for ~61.5% of GDP

- Gross Fixed Capital Formation (investment) grew ~7.8%, with investment intensity around 30% of GDP

- Headline inflation moderated sharply, with average CPI at ~1.7% (Apr–Dec 2025)

- Banking sector health strengthened, with GNPA declining to ~2.2% (Sept 2025)

This combination of growth, low inflation, and financial system resilience creates a more predictable operating environment for businesses and investors.

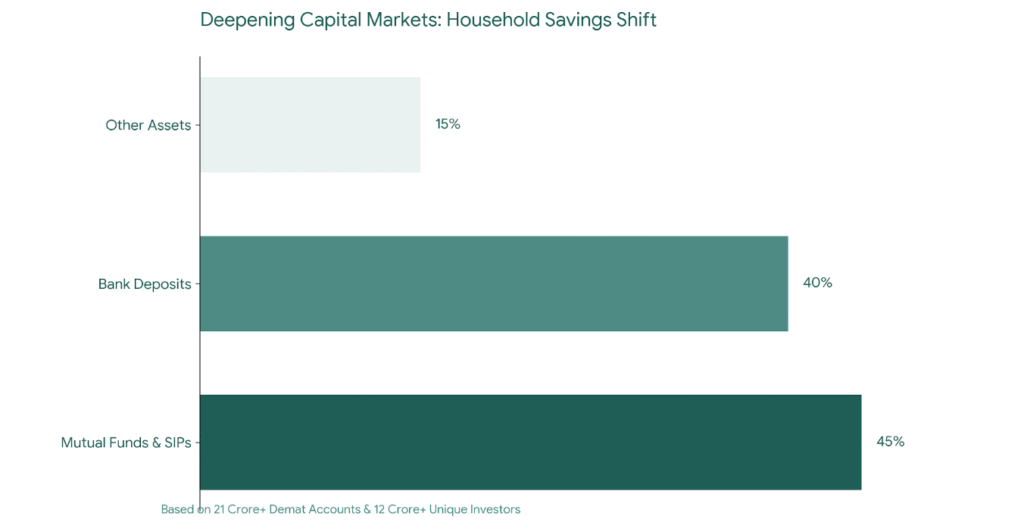

Section 2: India’s Economy

At the national level, India’s economic scale has itself become a structural advantage. The domestic market is now deep enough to support large, scalable businesses without over-dependence on exports or global capital cycles. The Economic Survey characterises FY26 growth as being driven by a “double engine” of consumption and investment, rather than short-term policy stimulus.

- India remains the fastest-growing large economy for the fourth consecutive year

- Financial participation continues to widen, with 12+ crore unique investors

- Household savings are gradually shifting from traditional bank fixed deposits toward mutual funds and SIP-led investments, improving risk capital availability for businesses

- Demat accounts exceed 21 crore, reflecting deepening capital markets and household formalisation

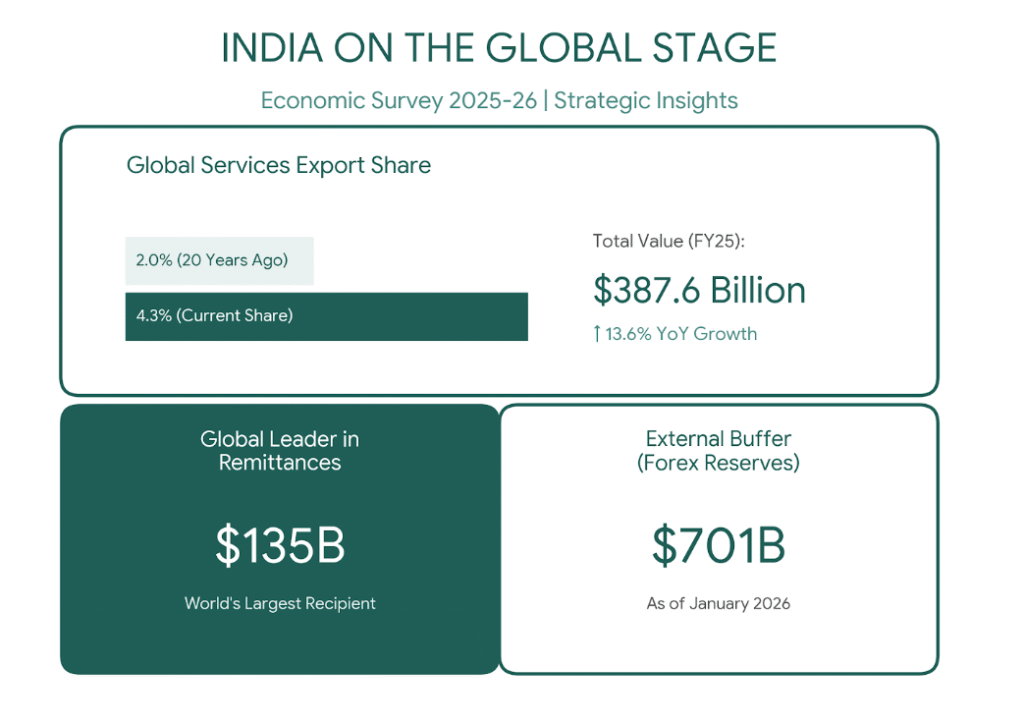

Section 3: India on the Global Stage

India’s global economic position continues to strengthen, particularly through services, remittances, and capital inflows. While global trade remains fragmented, India’s services-led model provides relative insulation from external shocks.

Section 4: GSDP Composition

India’s growth composition remains structurally diversified, with services continuing to lead while manufacturing shows clear signs of revival. This diversification reduces vulnerability to sector-specific or cyclical shocks.

- Services GVA grew ~9%+ in FY26, remaining the primary growth driver

- Manufacturing GVA accelerated, growing ~7.7% in Q1 and ~9.1% in Q2 FY26

- Agriculture provided stability supported by normal monsoons and steady output

Section 5: Fiscal Health

India’s fiscal strategy reflects a deliberate shift toward asset creation and long-term productivity enhancement. Public finances are increasingly geared toward capital expenditure rather than consumption-led spending, while medium-term debt sustainability indicators have improved.

- Effective capital expenditure increased from ~2.7% of GDP (pre-pandemic) to ~4%

- Central government capex expanded nearly 4× since FY18

- Combined government debt-to-GDP has declined by ~7 percentage points since 2020

- State-level fiscal deficits remain broadly stable in the post-pandemic period

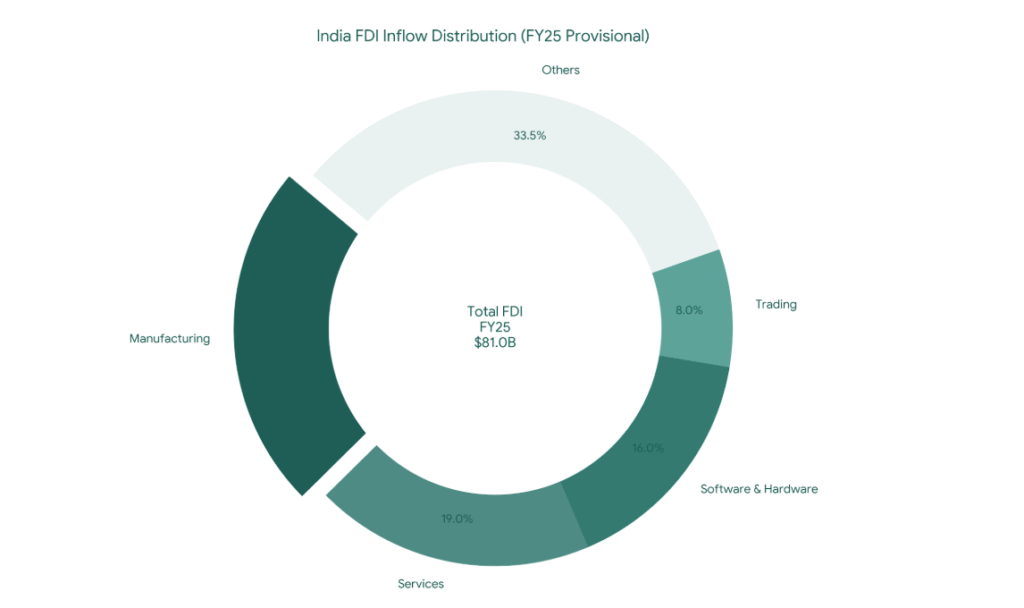

Section 6: FDI Inflows

India continues to attract sustained foreign capital, with inflows increasingly directed toward services, manufacturing, and technology-led sectors.

- Total FDI inflows (FY25 provisional): ~USD 81.0 billion, ~14% YoY growth

- Manufacturing FDI: ~USD 19.0 billion, ~18% YoY growth

- Key recipient sectors include services, software & hardware, trading, and manufacturing

Section 7: Startup Capital of India

India’s startup ecosystem has transitioned from rapid expansion to a phase of consolidation and maturity.

- 200,000+ DPIIT-recognised startups (as of Dec 2025)

- ~125 unicorns across fintech, SaaS, consumer internet, and deep tech

- Increased focus on unit economics, governance, and sustainable growth

Section 8: Domestic Investment Momentum

Domestic investment remains a central pillar of India’s medium-term growth trajectory, supported by policy-led manufacturing and infrastructure creation.

- Investment (GFCF) growth: ~7.8% in FY26

- Investment intensity sustained at ~30% of GDP

- PLI schemes (14 sectors) have delivered:

- India Semiconductor Mission: 10 approved projects with ~₹1.6 lakh crore committed investment

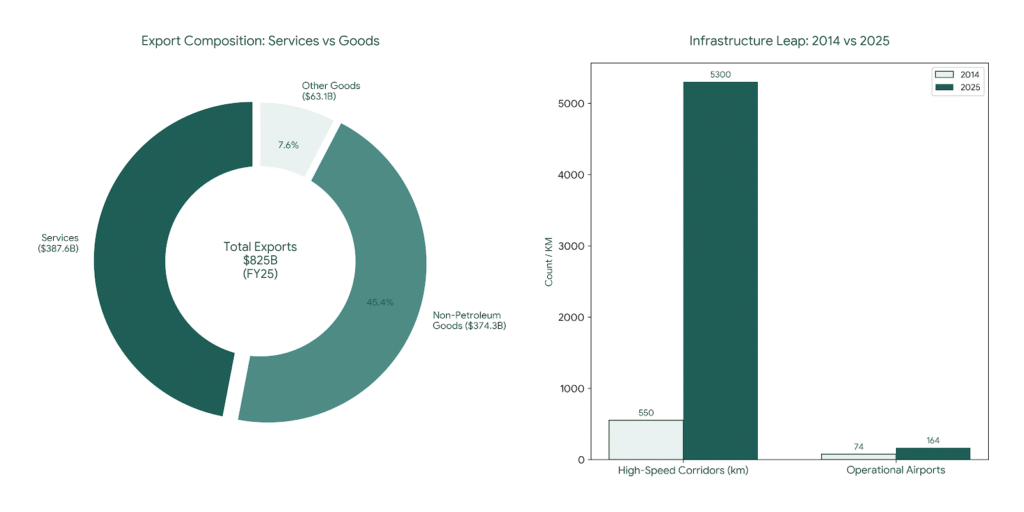

Section 9: Export Performance & Infrastructure Edge

India’s export resilience is increasingly driven by services and supported by large-scale infrastructure upgrades that reduce logistics and transaction costs.

- Total exports (FY25): ~USD 825 billion, a record high

- Services exports: ~USD 387.6 billion

- Non-petroleum exports: ~USD 374.3 billion

- Infrastructure expansion highlights:

- High-speed corridors: ~550 km (2014) → ~5,300+ km (2025)

- Airports: 74 (2014) → 164 (2025)

Section 10: What This Means for Businesses & Investors

India’s FY 2025–26 economic environment offers a rare combination of growth visibility, financial stability, and execution capacity. Strong domestic demand, improving credit conditions, and sustained public and private investment create a favourable backdrop for scaling businesses and deploying long-term capital.

- Lower inflation and healthier banks improve operating and financing conditions

- Policy continuity supports manufacturing, infrastructure, and startups

- Export-oriented businesses benefit from services growth and logistics upgrades

- AI adoption is accelerating globally, and Indian enterprises are increasingly embedding AI into finance, compliance, operations, and decision-making rather than treating it as a pilot layer

- However, the Economic Survey’s probability matrix indicates that a global recession is a plausible worst-case scenario, with an estimated likelihood in the range of 15–20%, based on scenario-driven analysis.

References :-

- https://www.indiabudget.gov.in/economicsurvey/

- https://www.pib.gov.in/economicsurvey/2026/en/index.aspx?reg=3&lang=2

- https://www.thehindu.com/business/budget/highlights-of-economic-survey-2025-26/article70564629.ece

- https://www.indiatoday.in/business/story/economic-survey-2026-news-which-jobs-are-immune-to-artificial-intelligence-india-2859857-2026-01-29

About Treelife:

Treelife is one of India’s most trusted legal and financial consulting firms, we simplify complex legal and financial challenges faced by startups, investors, and global businesses, by offering a wide range of services, including Virtual CFO, Legal Support, Tax & Regulatory, and Global Expansion assistance.

We have our offices in 4 cities, Mumbai, Delhi, Bangalore and GIFT City (Gujarat).

Our clients span diverse sectors such as technology, fintech, D2C, and foreign businesses. A few notable names include CleverTap, Rentomojo, Piper Serica, Snapwork, The Souled Store, and more.

We Are Problem Solvers. And Take Accountability.

Related Posts

Net 30/60/90 Payment Terms : The Playbook for Indian B2B Finance Leaders

For Indian founders, CFOs, and Finance heads at Growth-stage B2B businesses. Sectors: SaaS | Services | Manufacturing | Wholesale Distribution...

Learn More

![Financial Modeling for Startups & Founders – Complete Guide [2026]](https://treelife.in/wp-content/uploads/2024/02/Financial-Modeling-for-Startups-Founders-Complete-Guide.webp)

Financial Modeling for Startups & Founders – Complete Guide [2026]

Financial modeling for startups in 2026 is no longer optional. It is the core operating system that connects vision to...

Learn More