Quick Summary

Startup India registration is a government initiative to foster innovation, entrepreneurship, and job creation. The process is simple and can be done through the Startup India portal. First, entrepreneurs need to apply for recognition by registering their business as a startup with the Department for Promotion of Industry and Internal Trade (DPIIT). This involves providing basic details about the company and its founders. Benefits of Startup India Registration include tax exemptions, easier access to funding, and a self-certification mechanism for labor and environmental laws. Additionally, startups are eligible for government schemes, grants, and easier patent filing processes. Eligibility for Startup India Registration requires the business to be incorporated within the last 10 years and having an annual turnover of less than Rs 100 crore. It must also aim for innovation, development, or commercialization of products or services with high potential for employment generation.

Blog Content Overview

- 1 Introduction to Startup India Registration

- 2 Benefits of Startup India Registration

- 3 Eligibility Criteria – Who Can Apply Under the Startup India Scheme?

- 4 Documents Required for Startup India Registration

- 5 Decoding Key Documents for Your Indian Startup: DSC, DIN, MOA, and AOA

- 6 Startup India Registration Process – Step-by-Step Guide

- 6.1 How to Register Your Startup on the Startup India Portal

- 6.2 Step 1: Incorporate Your Business Entity (Prerequisite for Startup India)

- 6.3 Step 2: Create Your Profile on the Official Startup India Portal

- 6.4 Step 3: Complete the DPIIT Recognition Application Form (Detailed Business Information)

- 6.5 Step 4: Upload All Mandatory Supporting Documents

- 6.6 Step 5: Self-Certify the Eligibility Criteria

- 6.7 Step 6: Submit Your Application for DPIIT Review

- 6.8 Step 7: Receive Your Startup India DPIIT Recognition Certificate

- 7 Startup India Registration Fees – What Does It Cost?

- 8 Startup India Registration Timeline – How Long Does It Take?

- 9 Common Mistakes to Avoid in Startup India Registration

- 10 Conclusion – Why Startup India Registration is a Smart Move

Introduction to Startup India Registration

If you’re an entrepreneur looking to scale your business in India, Startup India registration is your gateway to a host of benefits. Launched by the Government of India, the Startup India Scheme aims to foster innovation, support budding startups, and boost job creation by simplifying regulatory hurdles and offering tax exemptions.

What is the Startup India Scheme?

The Startup India Scheme is a flagship initiative by the Department for Promotion of Industry and Internal Trade (DPIIT) that provides recognition and benefits to eligible startups. With a focus on innovation and economic growth, the scheme helps startups access funding, legal support, mentorship, and fast-track regulatory approvals.

Who Should Register Under Startup India?

Any business entity—Private Limited Company, Limited Liability Partnership (LLP), or Partnership Firm—that is less than 10 years old, has an annual turnover below ₹100 crores, and is working on an innovative product, service, or process can apply for Startup India registration. Whether you’re just starting up or scaling your venture, getting recognized under this scheme can be a game-changer.

Importance of DPIIT Recognition Certificate

One of the most critical aspects of Startup India registration is obtaining the DPIIT Recognition Certificate. This certificate validates your business as a recognized startup and makes you eligible for key benefits like:

- Income Tax and Capital Gains Exemptions

- Faster IP (Trademark & Patent) Processing

- Access to Government Tenders and Grants

- Self-Certification under Labour and Environmental Laws

Without DPIIT recognition, your startup won’t be able to avail these benefits, even if it’s incorporated under MCA.

Company Incorporation vs Startup India Registration

Many founders confuse company incorporation with Startup India recognition. It’s important to understand that:

- Company registration is the legal formation of your business entity under the Companies Act or LLP Act.

- Startup India registration (via DPIIT) is an additional recognition that provides government-backed startup benefits.

In short, incorporation is the first step, and Startup India recognition is the growth booster that follows.

Benefits of Startup India Registration

Wondering why so many businesses are opting for Startup India registration? Getting DPIIT recognition under the Startup India Scheme unlocks a range of benefits that can significantly ease your startup journey. From tax exemptions to funding support, the scheme is designed to empower entrepreneurs and foster innovation.

Key Benefits of Startup India Registration

- Tax Exemptions (Income Tax & Capital Gains)

Recognized startups are eligible for a 3-year income tax holiday and exemption on long-term capital gains, helping you reinvest profits back into your business. - Self-Certification for Labour & Environmental Laws

Avoid unnecessary inspections—DPIIT-recognized startups can self-certify under six labour laws and three environment laws, reducing compliance burden. - Access to Government Grants, Funds & Tenders

Gain access to a ₹10,000 crore Fund of Funds, and exclusive government tenders reserved for startups—no prior experience required. - Fast-track IPR Filing (Trademarks & Patents)

Get up to 80% rebate on patent fees and expedited processing for trademarks and intellectual property filings. - Startup India Hub & Mentorship Support

Get connected to incubators, mentors, investors, and corporate partners via the Startup India platform to accelerate your growth. - Easier Public Procurement Access

Startups recognized under the scheme get relaxed criteria for public procurement, making it easier to secure government projects.

Eligibility Criteria – Who Can Apply Under the Startup India Scheme?

Before you start the Startup India registration process, it’s essential to ensure your business meets the eligibility norms defined by the government. The DPIIT recognition is granted only to startups that fulfill certain criteria related to business structure, innovation, and turnover.

Startup India Registration Eligibility – Key Requirements

| Criteria | Description |

| Business Type | Your entity must be a Private Limited Company, Limited Liability Partnership (LLP), or Partnership Firm. |

| Business Age | The business should be less than 10 years old from the date of incorporation. |

| Annual Turnover | The company’s turnover must not exceed ₹100 crores in any financial year since incorporation. |

| Innovation Requirement | The startup must be working towards innovation, development, or improvement of products, services, or processes. It can also be a scalable business model with potential for employment generation or wealth creation. |

| Not Formed by Splitting | The entity must not be formed by splitting or restructuring an existing business. Only genuinely new ventures qualify. |

Meeting these Startup India registration eligibility criteria is the first step toward gaining access to exclusive startup benefits and government support.

Documents Required for Startup India Registration

Before applying for Startup India registration, make sure you have all the necessary documents in place. A well-prepared application with the right paperwork increases your chances of quick DPIIT recognition approval.

Here’s a quick checklist of documents required for Startup India registration:

Startup India Registration Document Checklist

- Certificate of Incorporation

Incorporation or registration certificate issued by MCA (for Private Limited, LLP, or Partnership Firm). - Company PAN Card

Permanent Account Number (PAN) issued in the name of the entity. - Founders’ KYC Documents

PAN, Aadhaar card, and contact details of all directors or partners. - Brief Description of Business/Product/Service

Clearly mention your business idea, innovation, or product offering. - Pitch Deck / Website / Patent (if available)

Supporting documents that highlight your innovation or scalability. - MSME Registration Certificate (Optional)

While not mandatory, an MSME certificate can help strengthen your application. - Authorization Letter (If applying via consultant)

A signed letter authorizing a consultant to file the application on your behalf.

Submitting these documents accurately will ensure a smooth and faster approval process from DPIIT. Missing or incorrect documents can lead to unnecessary delays.

Decoding Key Documents for Your Indian Startup: DSC, DIN, MOA, and AOA

Registering a startup in India involves navigating several crucial documents and designations. Understanding the purpose and significance of each – the Digital Signature Certificate (DSC), Director Identification Number (DIN), Memorandum of Association (MOA), and Articles of Association (AOA) – is fundamental for a smooth and compliant registration process.

1. Digital Signature Certificate (DSC): Your Digital Identity

In an increasingly digital landscape, the Digital Signature Certificate (DSC) acts as your secure online identity. It’s the electronic equivalent of a physical signature, providing both authentication and integrity for electronic documents.

- What it is: A DSC is a cryptographically secured digital certificate issued by certifying authorities (CAs) authorized by the Indian government. It contains your identity details (name, email, public key) and is used to digitally sign documents.

- Why it’s essential for startups: For startup registration, a DSC is mandatory for all proposed directors. It’s used to digitally sign e-forms submitted to the Ministry of Corporate Affairs (MCA), ensuring the authenticity of the information provided. This eliminates the need for physical presence and manual signatures for numerous filings.

- Key uses in startup registration:

- Signing e-forms like SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) for company incorporation.

- Filing various compliance documents with the MCA post-incorporation.

- Types: DSCs are typically issued in different classes (e.g., Class 2, Class 3), with Class 3 being commonly required for company registration and e-filing with the MCA due to its higher level of security.

2. Director Identification Number (DIN): A Unique Identifier for Directors

The Director Identification Number (DIN) is a unique 8-digit identification number assigned by the Ministry of Corporate Affairs (MCA) to individuals who intend to be or are already directors of a company.

- What it is: A permanent and unique identification number for every director, akin to a social security number for directors in other countries.

- Why it’s essential for startups: Every individual who wishes to be appointed as a director in a company in India must possess a valid DIN. It’s a prerequisite for applying for company incorporation and for any subsequent director appointments.

- Key uses in startup registration:

- Mandatory for all proposed directors in the incorporation forms.

- Ensures that a director’s information is uniquely tracked across various companies.

- Acquisition: A DIN can be obtained by filing an application with the MCA (e-form DIR-3). However, often, it is applied for simultaneously with the company incorporation application (SPICe+ form) if the individual does not already have one.

3. Memorandum of Association (MOA): The Company’s Charter

The Memorandum of Association (MOA) is a foundational legal document that defines the scope of a company’s activities and its relationship with the outside world. It’s often referred to as the company’s “charter.”

- What it is: A public document outlining the fundamental objectives, powers, and limitations of the company. It essentially states what the company is allowed to do.

- Why it’s essential for startups: The MOA is a mandatory document for company incorporation. It informs the public, shareholders, and creditors about the company’s core business and its boundaries.

- Key Clauses: The MOA typically includes the following crucial clauses:

- Name Clause: States the full name of the company.

- Registered Office Clause: Specifies the state where the company’s registered office will be located.

- Objects Clause: This is the most critical part, detailing the main business activities the company intends to undertake and any ancillary activities necessary to achieve those main objects.

- Liability Clause: Declares the limited liability of the company’s members (shareholders).

- Capital Clause: Specifies the authorized share capital of the company and its division into shares.

- Subscription Clause: Lists the names of the first subscribers (promoters) to the memorandum and the number of shares they agree to take.

- Significance: Any action taken by the company outside the scope defined in its MOA can be deemed ultra vires (beyond its powers) and potentially void.

4. Articles of Association (AOA): The Company’s Internal Rulebook

While the MOA defines the company’s external scope, the Articles of Association (AOA) lays down the internal rules and regulations for the management and governance of the company. It’s the company’s “internal constitution.”

- What it is: A legal document that governs the internal management of the company and defines the rights, duties, and powers of its members (shareholders) and directors.

- Why it’s essential for startups: The AOA is a mandatory document for company incorporation, working in conjunction with the MOA. It provides a framework for how the company will operate on a day-to-day basis.

- Key areas covered: The AOA typically includes provisions related to:

- Share capital: Issuance, transfer, and forfeiture of shares.

- Directors: Appointment, removal, powers, and duties of directors.

- Meetings: Procedures for holding board meetings and general meetings (AGMs, EGMs).

- Voting rights: Rights of shareholders to vote at meetings.

- Dividends: Declaration and payment of dividends.

- Accounts and audit: Maintenance of books of accounts and auditing procedures.

- Borrowing powers: The company’s ability to borrow funds.

- Common seal: Usage of the company’s common seal.

- Relationship with MOA: The AOA is subordinate to the MOA. If there’s any conflict between the MOA and AOA, the MOA prevails. The AOA cannot contain anything contrary to the MOA or the provisions of the Companies Act, 2013.

By understanding these four foundational elements – DSC, DIN, MOA, and AOA – aspiring entrepreneurs can confidently navigate the initial stages of company registration in India, setting a strong and compliant foundation for their startup’s journey.

Startup India Registration Process – Step-by-Step Guide

Planning to register your innovative venture under the coveted Startup India Scheme? Unlocking government benefits and recognition starts here! This comprehensive, step-by-step breakdown demystifies the Startup India registration process, empowering you to navigate it swiftly and successfully.

Whether you’re a budding entrepreneur or an established founder aiming for official recognition, this guide reveals how to register on the Startup India portal and secure your invaluable DPIIT recognition certificate with ease.

How to Register Your Startup on the Startup India Portal

The journey to becoming a DPIIT-recognized startup is streamlined and entirely online. Follow these clear steps to achieve your Startup India recognition:

Step 1: Incorporate Your Business Entity (Prerequisite for Startup India)

Before applying for Startup India recognition, your business must be legally established. This is a foundational step.

- Action: Officially register your business entity. The most common structures chosen by startups include:

- Private Limited Company: Ideal for scalability and attracting investment, governed by the Companies Act, 2013.

- Limited Liability Partnership (LLP): Offers the benefits of limited liability with the flexibility of a partnership, governed by the LLP Act, 2008.

- Registered Partnership Firm: While less common for startups seeking external funding, it’s a simpler structure for smaller ventures.

- Why it’s crucial: The DPIIT recognition requires a valid incorporation or registration certificate. This step legitimizes your business in the eyes of the law.

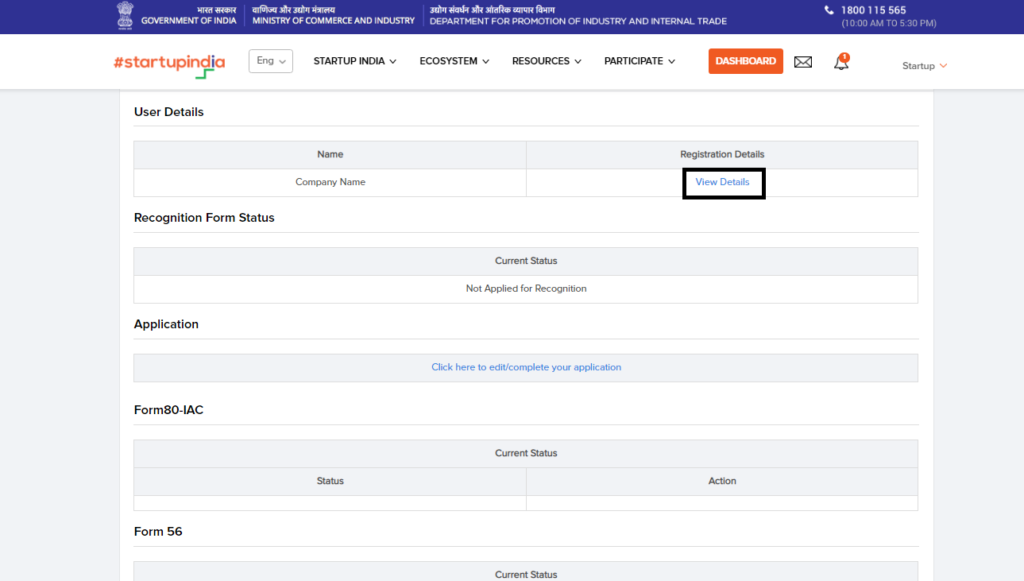

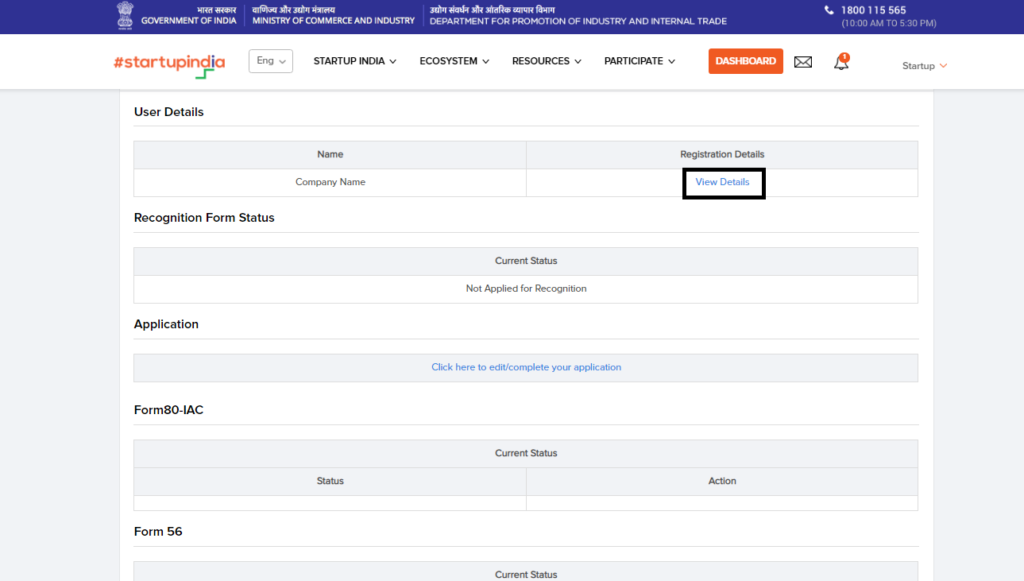

Step 2: Create Your Profile on the Official Startup India Portal

Your digital gateway to Startup India benefits begins with portal registration.

- Action: Visit the official Startup India website (startupindia.gov.in). Click on “Register” or “Sign Up” and choose the “Startup” user type.

- Information Required: You’ll need to provide basic details such as your name, email address, and phone number to create your user account.

- Why it’s crucial: This establishes your online identity within the Startup India ecosystem, allowing you to access the application forms and track your status.

Homepage of Startup India Website

Register & Signup Page

Step 3: Complete the DPIIT Recognition Application Form (Detailed Business Information)

This is where you showcase your startup’s potential and innovation.

- Action: Log in to your newly created account and navigate to the “DPIIT Recognition” section. Fill out the comprehensive application form with accurate and detailed information about your venture.

- Key Sections to Focus On:

- Entity Details: Legal name, CIN/LLPIN, date of incorporation/registration.

- Address Details: Your registered office address.

- Directors/Partners Details: Information about all founders and directors/partners, including their DIN/DPIN and PAN.

- Startup Details:

- Industry & Sector: Clearly categorize your business.

- Innovation & Scalability: This is critical. Explain how your product, process, or service is new or significantly improved. Describe your business model’s potential for high employment generation or wealth creation.

- Problem Solved: Articulate the problem your startup addresses and how your solution provides value.

- Product/Service Description: A clear overview of what you offer.

- Team Information: Details about your core team’s experience and expertise.

- Why it’s crucial: This form is your primary submission for assessment. A well-articulated application demonstrating genuine innovation and scalability is key to approval.

DPIT Form for Information of Startups

Step 4: Upload All Mandatory Supporting Documents

Accuracy and completeness of documents are paramount for a smooth application.

- Action: Digitally upload all required supporting documents as specified on the portal. Ensure all documents are clear, legible, and in the prescribed format (usually PDF).

- Essential Documents Typically Include:

- Certificate of Incorporation/Registration: Your company’s legal birth certificate (e.g., Certificate of Incorporation for a Private Limited Company, LLP Registration Certificate).

- PAN Card: Of the company/LLP.

- Director/Partner Details: PAN and Aadhar of all directors/partners.

- Memorandum of Association (MOA) and Articles of Association (AOA) for companies, or LLP Agreement for LLPs.

- Proof of Innovation: This is a crucial element. It could be a brief pitch deck, a detailed business plan, a patent application, a screenshot of your website/app, or a link to a video demonstrating your product/service. Clearly highlight the innovative aspects.

- Authority Letter: If the application is being submitted by an authorized signatory.

- Why it’s crucial: These documents validate the information provided in your application and prove your eligibility. Incomplete or incorrect submissions can lead to delays or rejection.

Step 5: Self-Certify the Eligibility Criteria

Confirming your adherence to the scheme’s guidelines is a critical step.

- Action: Carefully review the Startup India registration eligibility norms on the portal. You will need to self-certify that your business meets all the defined criteria.

- Key Eligibility Criteria to Verify (as of current guidelines, subject to change):

- Age of Entity: Not older than 10 years from the date of incorporation/registration.

- Type of Entity: Must be a Private Limited Company, LLP, or Registered Partnership Firm.

- Annual Turnover: Turnover must not have exceeded INR 100 Crores in any of the preceding financial years.

- Originality & Innovation: Must be working towards innovation, development, or improvement of products, processes, or services, or be a scalable business model with a high potential for employment generation or wealth creation.

- Not Formed by Splitting/Reconstruction: Should not be a result of a split or reconstruction of an existing business.

- Why it’s crucial: This self-declaration is a legal affirmation of your compliance with the scheme’s requirements.

Step 6: Submit Your Application for DPIIT Review

The final click initiates the official review process.

- Action: Once all sections of the form are completed, documents uploaded, and eligibility self-certified, click the “Submit” button.

- What happens next: Your application will be sent to the Department for Promotion of Industry and Internal Trade (DPIIT) for verification and approval. You will typically receive an acknowledgment of your submission.

Step 7: Receive Your Startup India DPIIT Recognition Certificate

The culmination of your efforts – official recognition!

- Action: Upon successful verification and approval by the DPIIT, your Startup India DPIIT Recognition Certificate will be issued. This certificate is typically available for download directly from your Startup India portal dashboard.

- Timeline: While processing times can vary, many applicants receive their certificate within 7-10 working days if all information and documents are accurate and complete.

- Why it’s crucial: This certificate is your official proof of Startup India recognition, unlocking a multitude of government-backed benefits, including tax exemptions, intellectual property (IP) benefits, funding opportunities, and simplified compliance.

Startup India Registration Certificate

The entire Startup India registration online process is designed to be smooth, paperless, and free of cost. This invaluable recognition not only legitimizes your startup but also opens doors to a powerful ecosystem of government support, tax incentives, and crucial funding avenues, propelling your venture forward.

Startup India Registration Fees – What Does It Cost?

One of the biggest advantages of the Startup India Scheme is its cost-effectiveness. If you’re wondering about the Startup India registration fees, here’s a quick breakdown to help you plan better.

Cost Structure for Startup India Registration

| Service | Fees |

| DPIIT Recognition Certificate | ₹0 (Completely Free of Cost) |

| Company Incorporation (MCA Filing) | As per Ministry of Corporate Affairs (MCA) norms |

| Consultant/Professional Assistance (Optional) | ₹2,000 – ₹10,000 approx. |

You don’t need to pay any government fee to get your DPIIT recognition certificate. The only mandatory cost is company incorporation, which varies based on the type of entity and MCA filings.

If you choose to seek help from experts or legal consultants, the professional fees may vary depending on the services offered.

So, if you’re a bootstrapped founder or early-stage entrepreneur, rest assured — the Startup India registration fees are minimal, and the process offers maximum benefits at zero cost from the government side.

Startup India Registration Timeline – How Long Does It Take?

One of the key advantages of the Startup India registration process is its quick turnaround time. Once you submit your application with the required documents, the recognition is typically granted within a few working days.

How Much Time Does Startup India Registration Take?

- Average Processing Time: 7–10 working days

- Factors That May Affect Timeline:

- Accuracy of submitted documents

- Quality of your business description or pitch deck

- Any additional clarification requested by DPIIT

If all documents are in order and eligibility criteria are met, most startups receive their DPIIT recognition certificate within a week.

So, if you’re planning to get your startup registered, you won’t have to wait long to access all the benefits of the scheme.

Common Mistakes to Avoid in Startup India Registration

While the Startup India registration process is simple and online, even minor errors can lead to application rejection or delays. Avoiding these common mistakes can help you get your DPIIT recognition certificate without hassles.

Top Startup India Registration Mistakes to Avoid

- Incomplete or Incorrect Documentation

Missing or inaccurate documents are the most common reason for application rejections. Ensure your incorporation certificate, PAN, and business description are submitted correctly. - Wrong Business Category Selection

Choosing the incorrect entity type (e.g., Sole Proprietorship instead of Pvt Ltd/LLP/Partnership Firm) can make you ineligible under the Startup India Scheme. - Poor Innovation Summary or Missing Pitch Deck

DPIIT focuses on innovation. A weak or unclear business summary, or not uploading a pitch deck or product overview, may lead to rejection. - Not Checking Self-Certification Boxes

The portal requires you to self-declare eligibility. Missing out on these checkboxes is a common oversight that can delay approval.

By avoiding these mistakes, you can ensure a smooth Startup India registration online experience and get access to benefits faster.

Conclusion – Why Startup India Registration is a Smart Move

Registering your business under the Startup India Scheme is more than just a formality — it’s a growth catalyst. From tax exemptions and funding access to IPR benefits and regulatory ease, the advantages are both strategic and practical.

The Startup India registration process is simple, online, and free — making it an easy first step to scale your startup efficiently and professionally.

So, if you’re building a startup that’s innovative and growth-driven, don’t miss the opportunity to get DPIIT recognition and unlock exclusive government support.

FAQs on How to Register in Startup India Scheme

-

What is Startup India Hub?

A platform that connects startups, investors, mentors, and enablers to collaborate and grow.

-

How can I register my startup under Startup India?

You can register your startup by creating a profile on the Startup India portal, filling the DPIIT recognition form, uploading the required documents, and submitting your application online.

-

Is Startup India registration free?

Yes, DPIIT recognition under Startup India is completely free. There are no government charges for the registration process.

-

Who is eligible for Startup India registration?

Startups incorporated as Private Limited Companies, LLPs, or Partnership Firms with turnover below ₹100 crore and not older than 10 years are eligible, provided they are working on innovation or scalable business models.

-

Can a sole proprietorship register under Startup India?

No, sole proprietorships are not eligible for Startup India registration. Only Private Limited Companies, LLPs, and Partnership Firms can apply.

-

How long does Startup India registration take?

On average, DPIIT recognition is granted within 7–10 working days, provided all documents are in order.

-

How do investors support startups?

Investors help with fundraising, talent acquisition, marketing, mergers & acquisitions, and business structuring.

-

Why do investors invest in startups?

Startups offer high growth potential, with venture capital often yielding higher returns than public equities.

-

Is Startup India registration mandatory?

No, Startup India registration is not mandatory. However, it is highly beneficial for startups looking to access government incentives, tax exemptions, and funding support.

-

How to create a profile on Startup India Hub?

Register via “mygov,” verify your email, and log in to create your profile.

-

How do startups connect with enablers?

The platform suggests relevant connections, and startups can request to connect (limited to three per week).

-

Can foreign companies register?

Only entities with an office in India can register, but global access may be available in the future.

-

Where can I track the status of my application?

You can log in to your Startup India dashboard and monitor your DPIIT recognition status under your profile.

-

Can an existing business register under Startup India?

Yes, as long as it meets the eligibility criteria related to age of incorporation, turnover limits, and innovation-driven business model.

-

What are the main documents required for DPIIT recognition?

- Certificate of Incorporation/Registration

- Details of Directors/Partners

- Brief write-up on business innovation

- Optional: Pitch deck, website, product video

-

What are the tax benefits available under Startup India?

Recognized startups can avail:

- Income tax exemption for 3 consecutive years under Section 80-IAC

- Capital gains tax exemption under Sections 54EE/54GB

-

Can a startup apply for government funding through Startup India?

Yes, DPIIT-recognized startups can apply for schemes like:

- Startup India Seed Fund Scheme (SISFS)

- Fund of Funds for Startups (FFS)

We Are Problem Solvers. And Take Accountability.

Related Posts

ESOP Taxation in India – A Complete Guide (2025)

Employee Stock Option Plans (ESOPs) have become an essential tool for businesses, especially startups and growth-stage companies, to attract, retain,...

Learn More

ESOPs in India: Process, Tax Implications, Exercise Price, Benefits

In the contemporary competitive job market, companies are constantly seeking innovative ways to attract and retain top talent. Employee Stock...

Learn More

Tax Exemption for Startups in India (2025)

In India, tax exemptions for startups are crucial for encouraging innovation and promoting the growth of new businesses. These exemptions...

Learn More