What is beneficial ownership in generic parlance? It refers to having some interest in any property, goods including securities, or favorable interest may be referred to a “profit, benefit or advantage panning out from a contract, or the ownership of an estate as distinct from the legal possession or control.”

Difference between Registered Owner & Beneficial Owner as per Companies Act, 2013 (‘Act, 2013’)

Under the Companies Act, 2013 (‘Act, 2013’)1, the Registered Owner refers to the person whose name is entered in the register of members or records of the company as the legal owner of the shares. This individual holds the title and has the right to vote and receive dividends. In contrast, the Beneficial Owner is the person who ultimately enjoys the benefits of ownership, such as dividends or control, even though the shares are registered in another person’s name. Section 89 of the Act mandates disclosure when the registered owner and beneficial owner are different, ensuring transparency in ownership structures and preventing misuse through proxy or benami holdings

| Meaning of Registered owner as per the Companies Act? | A person whose name is entered in the Register of Members as the holder of shares in that company but who does not hold the beneficial interest in such shares is called as the registered owner of the shares; |

| Meaning of Beneficial owner as per the Companies Act? | Beneficial interest has been defined in the following manner for section 89 and 90 of the Act, 2013 as follows:”(10) For the purposes of this section and section 90, beneficial interest in a share includes, directly or indirectly, through any contract, arrangement or otherwise, the right or entitlement of a person alone or together with any other person to— (i) exercise or cause to be exercised any or all of the rights attached to such share; or (ii) receive or participate in any dividend or other distribution in respect of such shares.” |

Requirements for Company Ownership under the Act, 2013

| Sections | Requirements | Examples |

| Under Section 89 | Section 89 of the Act, 2013, requires making of declaration in cases where the registered owner and the beneficial owner of shares in a company are two different persons | For acquiring membership by such entities (for example: partnership firm, Hindu Undivided Family (‘HUFs’), etc) who are not allowed to hold shares directly of a company. |

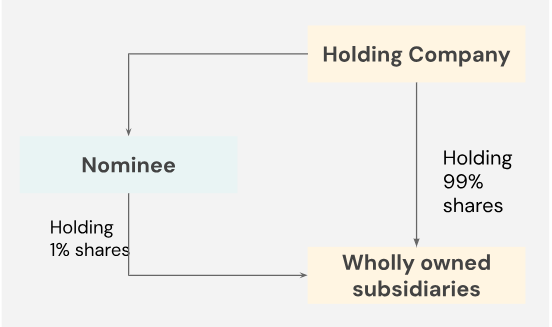

| First proviso to section 187 | The first proviso of section 187 allows a holding company to hold the shares of its wholly- owned subsidiary in the name of nominees, other than in its own name for the purpose of meeting the minimum number of members as per the Act, 2013 | i) To satisfy the requirement of minimum number of members (i.e.) 2 (Two) in case of a private limited company and 7 (Seven) in case of a public limited company. ii) To incorporate or to have a wholly owned subsidiary. |

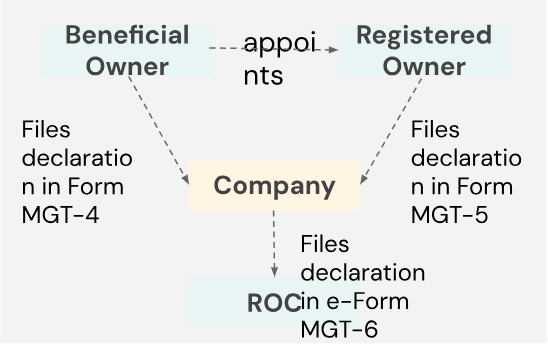

Mandatory Declarations: Under Section 89 read with Rule 9 of the Companies (Management and Administration) Rules, 2014

Section 89 read with rule 9 of the Companies (Management and Administration) Rules, 2014 deals with declaration of beneficial interest in the shares held.

- The person or the company (as the case may be), whose name is to be entered into the register of members of the company shall submit a declaration in Form MGT-4 within thirty days from the date of acquisition or change in beneficial interest to the company

- The person or a company (as the case may be), who holds the beneficial interest in any share shall submit a declaration in Form MGT-5 along with the covering or request letter to the company in which they hold the beneficial interest within thirty days from the date of acquisition or change in beneficial interest.

- On receipt of declaration in Form MGT-4 & MGT-5 by the company, the Company to make note of such declaration in the register of members and intimate the Registrar of Companies (‘ROC’) in e-Form MGT 6 within thirty days from the date of receipt of declaration in Form MGT-4 & 5.

The basic intent behind the above section is to reveal the identity of the beneficial owner who is unknown to the company.

Significant Beneficial Owner (SBO)

Section 90 of the Act, 2013 has the following features in broad:

- SBO has been defined;

- Every individual who is a significant beneficial owner in the reporting company shall file a declaration to the Company in form no. BEN-1;

- Upon receipt of Declaration in the manner specified above, the reporting Company shall file a return of SBO in form BEN-2 with the Registrar of Companies (ROC);

- Register in form no. BEN-3 is to be kept for recording the declarations given under this section;

- Power of companies to seek information from members, believed to be beneficial owners, in form no. BEN-4;

- Power of companies to approach the Tribunal in case of non-receipt or inadequate response from the members and non-members; and

- Serious penal provisions for non-compliances with the provision of the said section.

Section 89 and 90 work in two different fields altogether. While section 89 talks about disclosure of nominal and beneficial interest thereby providing duality / dichotomy of ownership, section 90 indicates the magnitude of holding.

Further, section 89 does not require the disclosure only from individuals but bodies corporate as well. The same is not the case with section 90 which aims at revealing the individuals as significant beneficial owner(s).

Section 187 of the Act, 2013

| Applicable | Brief description |

| For Companies | The proviso to sub-section (1) grants exemption to holding companies in case of holding shares of its subsidiary companies. The exemption allows holding companies to appoint nominees for itself to hold shares in the subsidiary/wholly-owned subsidiary companies in order to meet the statutory minimum limit of members in a company. |

Difference between Section 89 and First proviso to Section 187

| Basis of Difference | Section 89 | First proviso to Section 187 |

| Consists of | It deals with making disclosures by the registered owner, beneficial owner and the company to the ROC | It deals with making and holding investment by a holding company in its subsidiary in the name of nominees. |

| Intention of law | To reveal the identity of the beneficial owner | To allow holding companies to become beneficial owner(s) in case of subsidiaries through a nominee and at the same time comply with the minimum number of members requirement prescribed in the Act. |

| Share Certificates | Share certificates are generally issued in the name of the registered holder.However, in the case of trusts, HUFs, partnership firms holding shares in a company in the beneficial capacity, share certificate contains the name of the registered holder and the name of the trust, HUFs and partnership firms is written in brackets as beneficial owner. | Share certificates are issued in the name of the registered holder (nominee) but the name of the holding company is also mentioned along with the name of the nominee. |

References: