Introduction

In the contemporary competitive job market, companies are constantly seeking innovative ways to attract and retain top talent. Employee Stock Option Plans (hereinafter ESOPs) have emerged as a popular tool, offering employees a stake in the company’s success and fostering a sense of ownership. ESOPs have become a game-changer, offering employees a chance to foster a sense of ownership in the company and to partake in its success. But ESOPs are more than just a fancy perk in a landscape where talent reigns supreme; understanding how the process flow works, the tax implications involved in India, and the factors that influence the exercise price – the price employees pay for the stock – is crucial for both employers and employees.

What Are ESOPs (Employee Stock Ownership Plans)?

An Employee Stock Ownership Plan (ESOP) is a powerful financial tool that enables employees to purchase shares of the company they work for at a predetermined price, known as the exercise price, within a specific time frame, referred to as the vesting period. This structured program is often used by companies, particularly startups, to offer equity-based compensation to their employees.

ESOPs are not just financial incentives; they are designed to create a strong sense of ownership among employees, aligning their goals with those of the company’s shareholders. This alignment can significantly enhance employee engagement, productivity, and overall company performance. In addition to fostering a high-performance culture, ESOPs serve as an effective strategy for attracting top talent and retaining employees by providing long-term financial benefits.

By offering stock options as part of a compensation package, ESOPs can incentivize employees to contribute to the company’s growth and success. Moreover, these plans help companies build a committed workforce with a shared vision of the organization’s future.

Benefits of ESOPs

Employee Stock Ownership Plans (ESOPs) offer numerous advantages for both employees and companies. One of the primary benefits of ESOPs is their ability to align the interests of employees with the company’s shareholders. By granting employees ownership stakes in the company, ESOPs incentivize them to focus on the long-term success and growth of the organization.

Key Benefits of ESOPs

- Boosts Company Culture and Loyalty

By empowering employees with equity, ESOPs build a stronger company culture rooted in collaboration and loyalty. Employees who are invested in the company’s future are more likely to contribute to a positive work environment and align with the company’s mission. - Enhanced Employee Engagement

ESOPs help foster a sense of ownership and accountability among employees. When employees have a direct stake in the company’s success, they are more likely to stay motivated, work efficiently, and contribute to achieving company goals. - Increased Productivity and Company Performance

Employees with stock options are more inclined to go above and beyond in their roles. By tying their compensation to company performance, ESOPs encourage employees to take initiatives that directly benefit the company’s profitability, leading to sustained growth. - Attract and Retain Top Talent

As one of the most effective tools for employee retention, ESOPs provide valuable financial incentives. They serve as a competitive edge for businesses looking to attract skilled talent, especially in industries where top candidates are highly sought after. ESOPs also encourage long-term commitment, reducing employee turnover. - Tax Advantages for Employees and Employers

ESOPs can offer tax benefits for both employees and employers. Employees may benefit from tax deferrals on the appreciation of stock, and companies can often deduct the cost of stock contributions, making ESOPs an efficient tool for both parties.

Why Companies Choose ESOPs

Companies leverage ESOPs not only as an employee incentive but also as a strategy for succession planning and ownership transition. ESOPs can help business owners transfer ownership gradually, ensuring continuity and stability within the organization.

How do ESOPs Work?

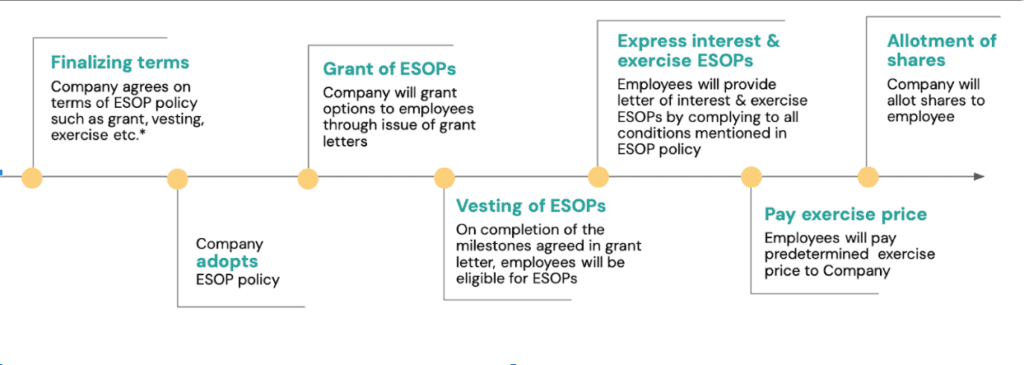

An Employee Stock Ownership Plan (ESOP) is a powerful financial tool that provides employees with an opportunity to own a part of the company they work for. The ESOP implementation process involves several well-defined stages, from the initial agreement on terms to the final allotment of shares. Here’s a detailed breakdown of how ESOPs work:

1. Finalizing ESOP Terms

The first step in implementing an ESOP is defining the terms of the ESOP policy. This includes:

- Granting Conditions: Determining the total number of options to be issued and the eligibility criteria (who can receive options).

- Vesting Schedule: Setting the timeline for when employees can begin exercising their options (often based on years of service or performance milestones).

- Exercise Price: Deciding on the price at which employees can purchase the shares (this is typically set at the fair market value at the time of granting).

These terms must be carefully negotiated and finalized, ensuring they align with company goals and legal requirements.

2. Adoption of ESOP Policy

Once the terms are finalized, the company must adopt the ESOP policy. This involves:

- Board Approval: The company’s board of directors reviews and approves the ESOP policy.

- Shareholder Resolution: A resolution must be passed by the shareholders to formally adopt the policy.

- Legal Compliance: Ensure that the ESOP policy complies with regulatory requirements, such as those laid out by SEBI and other governing bodies.

This step ensures that the ESOP structure is legally binding and officially approved by the company’s governing bodies.

3. Granting of ESOPs

Eligible employees (as per the policy) are granted stock options. This is done through the issuance of grant letters, which clearly outline:

- The number of options granted.

- The vesting schedule.

- The exercise price.

- Any additional terms and conditions.

This stage marks the formal beginning of the ESOP process for each employee.

4. Vesting of ESOPs

Vesting refers to the process by which employees become eligible to exercise their ESOP options. The vesting schedule determines when and how employees can unlock their stock options. Vesting can occur based on:

- Time-based criteria: Employees earn stock options over a period (e.g., 4 years with a 1-year cliff).

- Performance-based criteria: Vesting is tied to meeting specific company or individual performance goals.

The vesting schedule helps retain employees by encouraging long-term commitment to the company.

5. Exercising ESOPs

After vesting, employees can choose to exercise their options and purchase the shares at the pre-set exercise price. This process involves:

- Submitting Exercise Requests: Employees submit a request to exercise their options, following the procedures outlined in the grant letter and ESOP policy.

- Payment of Exercise Price: Employees must pay the exercise price to convert their options into actual shares.

Exercising options allows employees to convert their stock options into ownership in the company, benefiting from the company’s growth.

6. Payment of Exercise Price

Employees are required to pay the exercise price to purchase the shares. The payment can be made through:

- Cash Payment: Employees pay the set exercise price in cash.

- Stock Swap: Employees may use any previously held company stock to exercise their options (if permitted).

This step is crucial for employees to convert their stock options into actual ownership.

7. Allotment of Shares

Once the exercise price is paid, the company issues shares to the employee. The shares are allotted from the ESOP pool, which is the set number of shares reserved for employee stock options. Key points to note include:

- ESOP Pool Management: If the ESOP pool is exhausted, the company may increase the pool to grant more shares.

- Share Issuance: The company officially transfers the shares to the employee’s name.

Upon completion of this process, the employee becomes a shareholder in the company, holding actual equity.

Please see the image below describing the process flow of ESOPs:

We have provided a brief description of the important terms used in the ESOP process flow below:

| Term | Brief description |

| Grant date | Date on which agreement is entered into between the company and employee for grant of ESOPs by issuing the grant letter |

| Vesting period | The period between the grant date and the date on which all the specified conditions of ESOP should be satisfied |

| Vesting date | Date on which conditions of granting ESOPs are met |

| Exercise | The process of exercising the right to subscribe to the options granted to the employee |

| Exercise price | Price payable by the employee for exercising the right on the options granted |

| Exercise period | The period after the vesting date provided to an employee to pay the exercise price and avail the options granted under the plan |

Quantitative Guidelines for ESOPs: Pool Size & Vesting Periods

When structuring an Employee Stock Ownership Plan (ESOP), it’s essential to define the ESOP pool size and vesting periods clearly. Here are the key guidelines:

- ESOP Pool Size:

- Typically, companies allocate 5-15% of total equity for the ESOP pool, depending on the company’s size and stage.

- The size of the pool should balance between incentivizing employees and maintaining control for existing shareholders.

- Vesting Periods:

- Standard Vesting: Usually spans 4 years, with a 1-year cliff. This means no options vest in the first year, and thereafter, 25% of the options vest annually.

- Vesting periods can be adjusted based on company needs, but gradual vesting ensures employees are committed for the long term.

What is the eligibility criteria for the grant of ESOPs?

The eligibility criteria for the grant of ESOPs vary depending on whether the company is publicly listed or privately held. Here’s a breakdown of how ESOPs are governed and who is eligible to receive them:

For Publicly Listed Companies

For publicly listed companies, the Securities and Exchange Board of India (SEBI) regulates the grant of ESOPs. These companies must comply with strict guidelines to issue stock options to employees. SEBI’s regulations ensure that public companies follow a structured approach while granting ESOPs, including transparency and fairness in allocation.

For Private Companies

Private companies are governed by the Companies Act, 2013 and the Companies (Share Capital and Debenture) Rules, 2014. Under these regulations, private companies can grant ESOPs to the following categories of individuals:

- Permanent Employees:

- Employees working in India or abroad.

- Full-time permanent employees who contribute significantly to the company’s growth.

- Directors:

- Whole-time directors (excluding independent directors).

- Directors who are directly involved in the day-to-day operations of the company.

- Subsidiary and Holding Companies:

- Employees and directors of subsidiary companies (both in India and outside India).

- Employees and directors of the holding company.

Exclusions from ESOP Eligibility

The legal definition of an employee under the Companies Act excludes the following categories from being eligible for ESOPs:

- Promoters and Promoter Group:

- Employees who are part of the promoter group or are promoters of the company are not eligible for ESOPs.

- Employees who are part of the promoter group or are promoters of the company are not eligible for ESOPs.

- Directors with Significant Shareholding:

- Any director who holds, either directly or indirectly, more than 10% of the company’s equity shares (through themselves or their relatives or any associated body corporate) is not eligible for stock options.

- Any director who holds, either directly or indirectly, more than 10% of the company’s equity shares (through themselves or their relatives or any associated body corporate) is not eligible for stock options.

Special Exemption for Startups

Startups are granted a special exemption. For the first 10 years from their incorporation/registration, promoters and directors with significant shareholding (holding more than 10% equity) can still be eligible for ESOPs, despite the usual exclusion under the Companies Act.

Key Takeaways:

- Public companies are governed by SEBI’s regulations, while private companies follow the Companies Act, 2013.

- Employees, directors, and subsidiary staff can qualify for ESOPs under certain conditions.

- Promoters and large shareholders (over 10%) are generally excluded, except for startups in their first 10 years.

Tax Implication of ESOPs – Explained through an Example

Understanding the tax implications of Employee Stock Ownership Plans (ESOPs) is important for both employees and employers. Below is a detailed example illustrating how ESOPs are taxed in India, along with the concept of tax deferrals for eligible startups.

Example: Mr. A’s ESOP Tax Calculation

Let’s assume Mr. A, an employee of Company X (not classified as an eligible startup under Section 80-IAC of the Income Tax Act, 1961), has been granted 100 ESOPs, each granting the right to purchase one equity share in the company.

- Number of ESOP options granted: 100

- Exercise price: INR 10 per share

- Fair Market Value (FMV) on exercise date: INR 500 per share

- FMV on the date of sale: INR 600 per share

Now, let’s calculate the tax implications at two key stages: Exercise of ESOPs and Sale of ESOPs.

1. Tax on Exercise of ESOPs

When Mr. A exercises his options, the difference between the FMV at exercise and the exercise price is treated as salary income, which will be taxed accordingly.

2. Tax on Sale of ESOPs

When Mr. A sells the shares, the capital gain is calculated as the difference between the sale price and the FMV at exercise. Since the FMV at exercise (INR 500) is used to determine the cost of acquisition for capital gain tax purposes, the sale of shares results in a capital gains tax liability.

Tax Calculation Summary for Mr. A

| Stage | Details | Amount (INR) | Tax Type |

| On Exercise of ESOPs | FMV on exercise date | INR 500 per share | Salary Income (Taxable) |

| Exercise Price | INR 10 per share | ||

| Gain per Share | INR 490 | ||

| Total Taxable Income (100 shares) | INR 49,000 | Salary Income | |

| On Sale of ESOPs | Sale Price per share | INR 600 | Capital Gains (Taxable) |

| FMV on exercise date (Cost of Acquisition) | INR 500 | ||

| Gain per Share | INR 100 | ||

| Total Capital Gain (100 shares) | INR 10,000 | Short-Term Capital Gains (STCG) |

Total Taxable Income:

Total Taxable Income: INR 59,000

Salary Income (Exercise): INR 49,000

Capital Gains (Sale): INR 10,000

Deferred Tax Liability for Startups

For employees working in eligible startups, there is an option to defer tax payment, reducing the immediate financial burden when exercising ESOPs.

Eligibility for Tax Deferral:

For eligible startups, the following conditions must be met:

- The company must be registered as a startup under Section 80-IAC of the Income Tax Act.

- The startup must obtain an Inter-Ministerial Board Certificate.

- Tax deferral is available for ESOPs granted by these eligible startups.

How Tax Deferral Works:

For employees of eligible startups, tax is not immediately payable when the options are exercised. Instead, the tax liability will arise at the earliest of the following events:

- 48 months from the end of the relevant financial year.

- The date the employee sells the shares.

- The date the employee ceases to be employed by the company granting the ESOPs.

This provision ensures that employees in eligible startups can defer taxes until a later date, helping startups offer ESOPs without imposing immediate tax liabilities on their employees.

Detailed ESOP Calculation Example

Understanding the valuation and taxation of Employee Stock Ownership Plans (ESOPs) is crucial for both employees and employers. Below is a comprehensive example illustrating how to calculate the value of ESOPs, incorporating key factors such as exercise price, fair market value (FMV), and vesting schedules.

Scenario: ESOP Grant Details

- Number of ESOPs Granted: 1,000

- Exercise Price: ₹150 per share

- Fair Market Value (FMV) at Exercise: ₹500 per share

- Vesting Period: 4 years (25% per year)

- Exercise Date: End of Year 4

1. Determining the Value of ESOPs at Exercise

The value of ESOPs at the time of exercise is calculated by subtracting the exercise price from the FMV at exercise:

Per Share Gain = FMV at Exercise – Exercise Price

Per Share Gain = ₹500 – ₹150 = ₹350

Total Gain = Per Share Gain × Number of Shares

Total Gain = ₹350 × 1,000 = ₹3,50,000

2. Accounting for Vesting Schedule

Given the 4-year vesting period, 25% of the total ESOPs vest each year. Assuming all options have vested by the end of Year 4, the total gain is fully realized in that year.

3. Tax Implications at Exercise

The gain realized upon exercise is considered a perquisite and is taxed as salary income. Assuming a tax rate of 30%, the tax liability at exercise would be:

Tax Liability = Total Gain × Tax Rate

Tax Liability = ₹3,50,000 × 30% = ₹1,05,000

4. Sale of Shares and Capital Gains

If the shares are sold at a later date, the capital gain is calculated as the difference between the sale price and the FMV at exercise. Assuming the shares are sold for ₹600 per share after 1 year:

Capital Gain per Share = Sale Price – FMV at Exercise

Capital Gain per Share = ₹600 – ₹500 = ₹100

Total Capital Gain = Capital Gain per Share × Number of Shares

Total Capital Gain = ₹100 × 1,000 = ₹1,00,000

If the holding period exceeds 24 months, the gain qualifies as long-term capital gain (LTCG), which is taxed at 20%.

LTCG Tax = Total Capital Gain × LTCG Tax Rate

LTCG Tax = ₹1,00,000 × 20% = ₹20,000

Summary Table

| Stage | Details | Amount (₹) |

| Exercise Price | Price paid per share | ₹150 |

| FMV at Exercise | Fair Market Value at exercise | ₹500 |

| Per Share Gain | Gain per share | ₹350 |

| Total Gain | Total gain (1,000 shares) | ₹3,50,000 |

| Tax at Exercise | Salary tax (30%) | ₹1,05,000 |

| Sale Price | Price at which shares sold | ₹600 |

| Capital Gain per Share | Gain per share upon sale | ₹100 |

| Total Capital Gain | Total gain from sale (1,000 shares) | ₹1,00,000 |

| LTCG Tax | Long-term Capital Gains Tax (20%) | ₹20,000 |

Determining the exercise price of a stock option

The exercise price is a crucial element of a stock option and denotes the predetermined rate at which an employee can procure the company’s shares as per the ESOP agreement. This price is established at the time of granting the option and remains fixed over the tenure of the option.

Factors Influencing Exercise Price

- Fair Market Value (FMV): This is a key benchmark. Ideally, the exercise price should be set close to the FMV of the stock on the grant date. However, there can be variations depending on the company’s life stage, liquidity, and overall ESOP strategy. The exercise price is often tethered to the prevailing market value of the company’s shares. If the existing market value exceeds the exercise price, the option is considered “in the money,” rendering it more lucrative for the employee. Conversely, if the market value falls below the exercise price, the option is “out of the money,” potentially reducing its attractiveness.

- Company Objectives: The ESOP policy outlines the rationale behind granting stock options and the intended benefits for employees. A lower exercise price can incentivize employees and align their interests with the company’s growth.

- Dilution Impact: Granting options increases the company’s outstanding shares. The exercise price should consider the dilution impact on existing shareholders. The inherent volatility in Indian stock markets significantly impacts the exercise price. Heightened volatility tends to inflate option premiums, including the exercise price, owing to the increased likelihood of significant price fluctuations in the underlying shares.

- Accounting and Legal Considerations: Indian Accounting Standards (Ind AS) and tax implications need to be factored in to ensure proper financial reporting and tax treatment. Tax consequences can vary based on the timing of the exercise and the type of ESOP.

Deep Dive into the Indian Legal Framework Governing ESOPs

Employee Stock Ownership Plans (ESOPs) in India are governed by a robust legal framework comprising the Companies Act, 2013, Securities and Exchange Board of India (SEBI) Regulations, and the Foreign Exchange Management Act (FEMA). These regulations ensure that ESOPs are implemented transparently, fairly, and in compliance with Indian laws.

1. Companies Act, 2013

The Companies Act, 2013 serves as the primary legislation governing the issuance of ESOPs in India. Key provisions include:

- Section 2(37): Defines an “employee stock option” as a right granted to directors, officers, or employees of a company or its holding or subsidiary company, allowing them to purchase or subscribe to the company’s securities at a future date at a predetermined price.

- Section 62(1)(b): Mandates that the company must obtain shareholder approval through a special resolution for issuing ESOPs.

- The Companies (Share Capital and Debentures) Rules, 2014: Specifies the procedure for issuing ESOPs by unlisted companies, including the requirement for a special resolution and compliance with prescribed disclosures.

2. SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021

For listed companies, SEBI’s regulations provide a comprehensive framework for ESOPs:

- Regulation 4: Outlines the eligibility criteria for employees to participate in ESOP schemes.

- Regulation 5: Requires companies to obtain shareholder approval through a special resolution for implementing ESOP schemes.

- Regulation 6: Mandates the disclosure of the ESOP scheme details to the stock exchanges and the public.

- Regulation 7: Specifies the pricing mechanism for the securities to be issued under the ESOP scheme.

- Regulation 8: Sets forth the vesting and exercise conditions for the options granted.

- Regulation 9: Addresses the treatment of ESOPs in case of resignation, termination, or death of the employee.

3. Foreign Exchange Management Act (FEMA), 1999

FEMA governs the issuance of ESOPs to non-resident employees and the repatriation of funds:

- Regulation 8: Allows Indian companies to issue ESOPs to employees or directors of holding companies, joint ventures, or wholly owned subsidiaries outside India, subject to compliance with sectoral caps and other conditions.

- Regulation 9: Specifies the conditions under which non-resident employees can exercise their stock options and the repatriation of proceeds.

- Regulation 10: Requires companies to submit reports to the Reserve Bank of India (RBI) regarding the issuance and exercise of ESOPs.

4. Startup India Initiative

Recognizing the importance of ESOPs in attracting and retaining talent, the Government of India has introduced relaxations for startups:

- Tax Deferral: Eligible startups can defer the tax liability on ESOPs until the sale of shares or 48 months from the end of the relevant financial year, whichever is earlier.

- Eligibility Criteria: Startups must be incorporated for less than 10 years, have an annual turnover not exceeding ₹100 crore, and work towards innovation, development, or improvement of products or processes.

Disadvantages of ESOPs

While Employee Stock Ownership Plans (ESOPs) offer significant benefits, they come with certain disadvantages:

- Dilution of Equity: Issuing ESOPs increases the number of shares, which dilutes existing shareholders’ equity and control.

- Complex Administration: Managing an ESOP scheme involves complex legal, financial, and regulatory requirements, making it time-consuming and costly.

- Tax Implications: Employees face tax liabilities at both the exercise and sale stages, which could lead to financial strain.

- Stock Price Volatility: The value of ESOPs is tied to the company’s stock price, which can fluctuate, potentially reducing their value over time.

- Retention Risk: ESOPs may not always lead to long-term retention if employees fail to see the long-term benefits or if the stock price does not grow as expected.

Comparison of ESOPs vs RSUs vs Phantom Shares

| Aspect | ESOPs | RSUs (Restricted Stock Units) | Phantom Shares |

| Ownership Type | Actual ownership in the company’s equity | No actual ownership until vesting | No actual ownership; cash-equivalent value |

| Vesting Period | Typically 3-4 years with a cliff (e.g., 1 year) | Typically 3-4 years with gradual vesting | Often linked to company performance or time |

| Exercise Price | Employees pay an exercise price to buy shares | No exercise price; shares are granted at no cost | N/A – cash value is paid based on company value |

| Taxation | Taxed at exercise (on gain) and sale (capital gain) | Taxed as ordinary income when vested, then capital gains on sale | Taxed as ordinary income when paid out |

| Dilution | Dilutes existing shareholders when options are exercised | Dilutes equity when shares are granted | No dilution, as no actual shares are issued |

| Cash Out | Employees must pay to exercise the option | Employees receive shares or cash when vested | Employees receive cash equivalent to the value of shares |

| Employee Incentive | Strong, as employees own actual shares | Strong, as employees receive shares in the company | Weaker than ESOPs, as employees do not own actual equity |

This comparison helps clarify the key differences between ESOPs, RSUs, and Phantom Shares, enabling companies to choose the best option for incentivizing employees based on their goals and financial structure.

Conclusion

In a nutshell, ESOPs have emerged as a significant instrument in India’s corporate landscape, fostering a sense of ownership and alignment between employees and companies. Understanding the key features including the process flow, tax implications and exercise price determination associated with ESOPs is paramount for companies to highlight maximized potential benefits to employees.