Introduction

In today’s digital age, the way we conduct business has fundamentally transformed. Gone are the days of paper-based workflows and physical signatures. As businesses embrace the efficiency of electronic transactions, e-signatures have emerged as a critical tool for streamlining operations and ensuring legal certainty. The legal landscape surrounding electronic signatures has undergone a fascinating evolution. With the rise of digital technologies, the validity of eSign in India has been a topic of much debate. In a contemporary perspective, electronic signatures have gained legal recognition due to protection demanded by online procedure requisites of legal transactions such as e-contracts, cross-border MOUs (memorandum of understanding), transnational deals between corporations, online dispute resolution methods etc.

The conventional way of signing was hand-written and served a distinct unique representation of one’s identity. Marking a signature on a document has always been a legal requisite, without which the authenticity and legality of the document comes into question. Prior to the digital age, the validity of contracts relied heavily on physical signatures. However, the Information Technology Act (IT Act) of 2000 revolutionized the legal landscape in India by introducing a framework for electronic signatures (e-signatures). The IT Act established the legal validity of e-signatures, provided they meet specific criteria. The IT Act, along with other relevant laws like the Indian Contract Act (ICA), the Electronic Securities Act (ESA), the Information Technology (Electronic Signature Certificate Authorities) Rules (ESECAR), and the Indian Stamp Act, 1899, create a comprehensive legal framework governing the use of e-signatures in India. From the global lens, The UNCITRAL Model Law on Electronic Signatures of 2001 is the foundation stone that transmitted the hybrid concept of electronic signatures into legal systems of various nations. This article will delve into the world of e-signatures in India, exploring their legal validity, use cases, and the benefits they offer.

What is eSign?

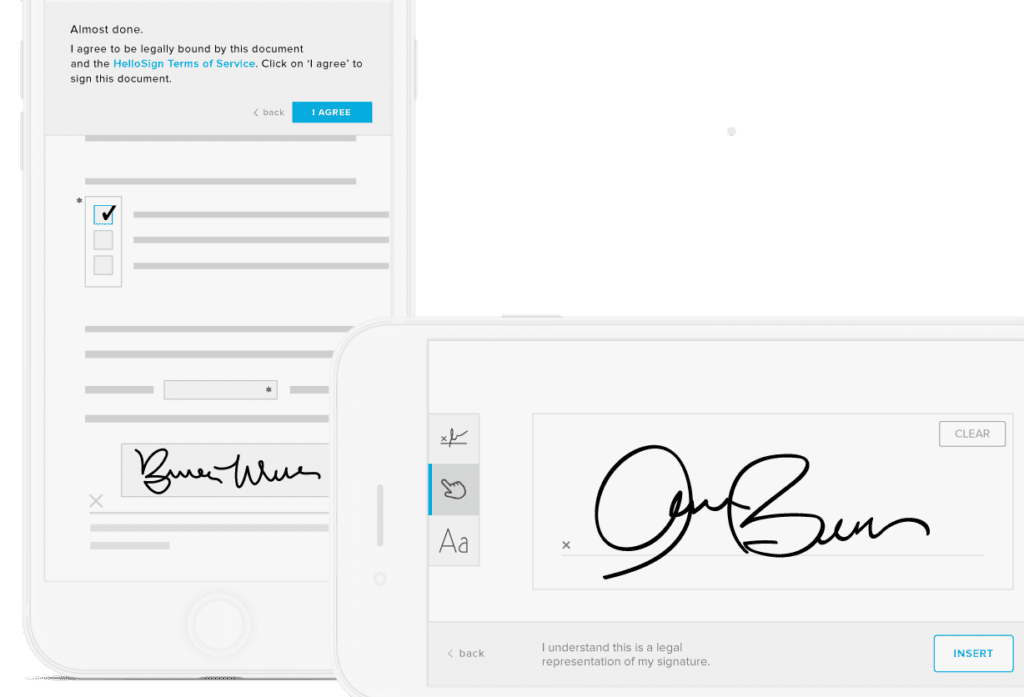

eSign, or electronic signature, is the digital equivalent of a traditional handwritten signature. It’s a secure way to approve documents and transactions online, eliminating the need for printing, signing, and scanning physical paperwork. Instead, eSign utilizes electronic methods to verify your identity and bind you to the document. This can involve Typing your name, Drawing your signature or Using dedicated eSign software.

Just like traffic laws differ by country, the definition and legal framework for eSignatures vary around the globe. In India, the IT Act Information Technology Act (IT Act) of 2000 established the legal foundation for e-Sign, ensuring its validity and widespread adoption. By using eSignatures, businesses can significantly streamline record management. Documents are signed electronically, stored securely in a digital format, and easily retrievable whenever needed. This eliminates the need for physical storage and simplifies the entire document lifecycle.

While the core function remains the same (signifying your intent to agree), the technicalities of eSignatures can differ.

eIDAS (EU): Defines an eSignature as “data in electronic form which is attached to or logically associated with other data in electronic form and which is used by the signatory to sign.” eIDAS recognizes three types of eSignatures – simple, advanced, and qualified – each with varying levels of security and legal weight.

ESIGN & UETA (US): Both define an eSignature as “an electronic sound, symbol, or process, attached with a contract or other record and executed or adopted by a person with the intent to sign the record.”

This essentially means that your eSignature can take various forms, from typing your name to using a digital pen on a touchscreen or dedicated eSignature software. The key factor is that the chosen method securely links your eSignature to the document, creating an auditable record of your agreement.

India has taken eSign a step further with Aadhaar-based eSign. This innovative system leverages the Aadhaar identification platform to simplify the e-Signing process for Aadhaar holders. Here’s how it works:

- If you possess an Aadhaar card and a linked mobile number, you can digitally sign documents with ease.

- The e-Sign service verifies your identity through Aadhaar eKYC, ensuring a secure and reliable experience.

Legal Validity of eSign in India – Laws and Compliance

Remember the days of printing, signing, and physically mailing documents for every agreement? Thankfully, those days are fading with the rise of eSign. But a crucial question remains: Are eSignatures legally valid in India? The answer is Yes, eSignatures are legally valid in India! The Information Technology Act (IT Act) of 2000, established the legal framework for eSignatures, ensuring they hold the same weight as traditional handwritten signatures when used correctly. This act, along with other relevant laws like the Indian Contract Act (ICA) and the Information Technology (Electronic Signature Certificate Authorities) Rules (ESECAR), create a comprehensive legal framework for eSign in India. You can also use Digital Signature Certificates (DSCs) for enhanced security or leverage Aadhaar eSign for a simpler signing experience – both recognized under the legal framework.

Here’s a breakdown of the key aspects that ensure the legal validity of eSignatures in India:

- Equivalence to Handwritten Signatures: The IT Act explicitly states that a contract cannot be denied enforceability solely because it was conducted electronically, provided it fulfills the essential elements of a valid contract under the ICA. In simpler terms, an eSignature has the same legal weight as a traditional handwritten signature.

- Digital Signature Certificates (DSCs): For enhanced security, the IT Act recognizes Digital Signature Certificates (DSCs) issued by licensed certifying authorities. These certificates act as a digital identity verification tool, adding an extra layer of trust and security to eSignatures.

- Aadhaar eSign: India has further simplified eSigning with the introduction of Aadhaar eSign. This innovative system leverages the Aadhaar identification platform to allow Aadhaar holders to digitally sign documents easily. The e-Sign service verifies the signer’s identity through Aadhaar eKYC, ensuring a secure and reliable experience.

Legal Provisions concerning E-signatures in India

- Section 2(1)(ta) of Information Technology Act, 2000 provides for the definition of e-signature as “Authentication of any electronic record by a subscriber by means of the electronic technique specified in the second schedule and includes digital signature.” The said definition of electronic signature is inclusive of digital signature and other techniques in electronic form which are specified on the second schedule of the Act. The incorporation of such a definition recognized two methods of signing digitally which are a) cryptography technique (hash functions etc) and b) marking e-signature using other technologies.

- Any individual can digitally sign an e-contract in accordance with Section 3 of the IT Act, 2000. Furthermore, section 10A of the IT Act makes contracts created by electronic records and communication legally binding.

- Section 5 of the IT Act provides legal recognition to digital signatures based on asymmetric cryptosystems.

- Section 65B of the Indian Evidence Act is a significant provision in terms of implicitly providing admissibility to electronic records. Regarding the admissibility of electronically signed documents, the Evidence Act states that they will be allowed as evidence as long as the signer can demonstrate in court the integrity and originality of the electronic or digital signature. Additionally, the Evidence Act establishes an assumption regarding the veracity of electronic signatures and records. But only in relation to a secure electronic signature or record would there be such an assumption.

- Section 85A of the Evidence Act, 1872 presumes that all contracts containing electronic signatures are presumed to be final and there shall be no question arising on the validity of such a document on the grounds of it being signed and authenticated digitally . According to Section 85B of the Evidence Act, the court must assume that the person to whom the secure electronic or digital signature pertains is the one who attached it in any process involving such signatures.

- Section 67A of the Indian Evidence Act, 1872 stipulates that in circumstances of a dispute concerning the native authorship (authenticity) of an e-signature, the individual whose e-signature is in question has to provide the proof of the originality.

The Madras High Court decided in the Tamil Nadu Organic Pvt. Ltd. vs. State Bank of India that contracts may be enforced by law and that contractual duties might emerge by electronic methods. Furthermore, the Court had declared that, as stipulated in section 3-A of the IT Act, digital signatures are typically used to authenticate electronic records, and that section 10-A of the IT Act permits the use of electronic records and electronic means for the execution of contracts, agreements, and other purposes.

The necessity of digital signatures in electronic transactions was highlighted by the Delhi High Court in the 2010 case of Trimex International FZE Ltd. vs. Vedanta Aluminum Ltd. and Ors. The court decided that digital signatures have the same legal standing as handwritten signatures as long as they are utilized in accordance with the IT Act of 2000. The importance of digital signatures in guaranteeing the reliability and validity of computer-generated records and financial transactions was emphasized by this decision.

Is eSign secure?

While eSign offers undeniable convenience, security is a top priority for any electronic transaction. Concerns might arise around the possibility of forgery or tampering with documents after they’ve been signed electronically.

However, eSignatures often incorporate robust security measures that can even surpass traditional handwritten signatures. Here’s why:

- Many eSignature platforms employ encryption technology to scramble the data within the signed document. This makes it virtually impossible for someone to intercept and alter the document without detection.

- e-Sign solutions typically create a detailed audit trail that records the entire signing process. This trail includes timestamps, signer identity verification details, and any changes made to the document. This detailed log provides a clear picture of who signed the document, when, and if any modifications were made.

- For transactions requiring the highest level of security, Digital Signature Certificates (DSCs) can be used. These act like digital passports, verifying the signer’s identity and adding an extra layer of tamper-proof security to the eSignature.

eSign utilizes a combination of encryption, audit trails, and optional features like DSCs to ensure the security and integrity of electronic documents. This makes eSignatures a reliable and secure way to conduct business electronically.

What documents can I legally eSign in India? – Use Cases

From streamlining business processes to simplifying life for individuals, eSign is making its mark across various sectors.

Boosting Efficiency and Security in Businesses:

- Effortless Sales & Procurement: Close deals faster and manage purchase orders efficiently with eSigned sales agreements, invoices, trade and payment terms, and order acknowledgements. eSign ensures secure and legally binding transactions, eliminating the need for physical copies and manual approvals.

- Enhanced Security for Contracts & Agreements: Securely manage non-disclosure agreements (NDAs), certificates, and other sensitive documents with eSignatures. eSign creates a tamper-proof audit trail, providing a clear record of who signed the document and when.

- Streamlined HR Management: Onboard new employees, manage contracts, and facilitate approvals electronically. eSign allows for pre-approved HR templates and easy updates for each employee, saving valuable time and resources.

Simplifying Life for Individuals:

- Faster Banking & Financial Services: Sign loan documents, account opening forms, and investment agreements from anywhere, anytime with eSign. This eliminates the need to visit branches and ensures a secure and convenient experience.

- Hassle-Free Real Estate Transactions: Sign lease agreements for both residential and commercial properties electronically. eSign offers a faster and more secure alternative to traditional paper-based signing.

- Efficient Government Services: Access and sign government documents like permits, applications, and licenses electronically. eSign makes interacting with government agencies faster and more user-friendly.

The use cases for eSign in India are vast and ever-expanding. From healthcare to education, and from legal contracts to insurance applications, eSign is transforming document management across various sectors.

Limitations of eSign: Inappropriate Use Cases

Here’s a list of situations where a traditional handwritten signature remains the preferred method:

Documents Requiring Physical Possession:

- Negotiable Instruments (except cheques): Instruments like promissory notes and bills of exchange often require physical possession for negotiation and enforcement. The IT Act specifically excludes these documents from the purview of eSignatures.

Documents with Specific Formalities:

- Power of Attorney: Power of attorney documents often involve specific legal requirements, such as witnessing or notarization, which may not be readily replicated in the digital realm. Currently, the IT Act doesn’t recognize eSignatures on power of attorney documents.

- Trust Deeds: Establishing a trust often involves a high degree of formality, and the IT Act doesn’t currently encompass trust deeds signed electronically.

High-Value Transactions and Inheritance:

- Sale of Immovable Property: For high-value transactions like the sale of land or property, the law in India still necessitates a physically signed document. The IT Act doesn’t apply to contracts involving the sale or conveyance of immovable property.

- Wills and Testaments: Documents related to inheritance, such as wills and testaments, traditionally require a handwritten signature for legal validity. The IT Act specifically excludes wills and testamentary dispositions from the scope of eSignatures.

Advantages Of eSign

- eSign saves time and money by eliminating printing, scanning, and mailing physical documents.

- Aadhaar eSign simplifies the process with Aadhaar KYC-based verification.

- eSign expedites transactions and improves customer experience.

- No need for physical documents; eSign works with any device and internet connection.

- Easy to use – apply your signature electronically with a typed name, drawn signature, or dedicated software.

- Secure signing process with biometric or OTP verification.

- Creates a clear audit trail with obvious electronic signatures and identification of the signatory.

- Versatile and integrates seamlessly with various applications.

- Enhances security – eSignatures are tamper-proof and more difficult to forge than traditional signatures.

How does eSign work?

eSign utilizes a combination of technologies to ensure a secure and legally binding signing process. The document to be signed is first converted into a digital format, typically a PDF. The signer is then presented with various signing methods depending on the chosen security level. Simple signatures might involve typing a name or uploading a pre-defined image, while advanced eSignatures leverage digital certificates issued by trusted authorities to verify the signer’s identity and bind the signature to the document using encryption techniques. In high-security scenarios, biometric authentication through fingerprint or facial recognition can be an additional layer of verification.

Once the signing method is chosen, the eSign solution verifies the signer’s identity. This might involve a simple password or one-time code for basic signatures. For advanced eSignatures, a more complex verification process validates the digital certificate, ensuring its authenticity and validity. After successful verification, the chosen signing method creates a unique electronic signature embedded within the document. This signature is accompanied by a timestamp and other data points. Additionally, a tamper-proof audit trail is generated, meticulously recording the entire signing process – who signed, how they were verified, and the exact time of signature. This combination of measures ensures the integrity and authenticity of eSignatures, making them a secure and reliable alternative to traditional pen-and-paper signatures.

Digital Signature vs Electronic Signature: What’s the Difference?

| Feature | Digital Signature | Electronic Signature |

| Security Level | Higher | Lower |

| Technology | Uses public key infrastructure (PKI) and digital certificates | Can involve various methods like typed name, drawn signature, or image upload |

| Verification Process | Verifies signer’s identity using a digital certificate issued by a trusted authority | May or may not verify signer’s identity |

| Tamper Detection | Any alteration to the document after signing invalidates the signature | May not inherently detect tampering, although some eSign solutions offer audit trails |

| Legal Validity | Generally considered more legally secure due to stronger verification | Can be legally valid depending on the method used and local regulations |

| Common Use Cases | High-value contracts, financial agreements, government documents | Less critical documents, contracts with lower risk, user agreements |

Legal Admissibility of eSign in Other Countries

UNCITRAL’s Model Law on Electronic Signatures, 2001

In 1996, the United Nations Commission on International Trade Law (UNCITRAL) adopted the Model Law on Electronic Commerce which encompasses an apt foundation regarding electronic signature with an aim to bring about uniformity in cross-border trades and transnational agreements. The General Assembly of UNCITRAL eventually adopted a Model Law on Electronic Signatures in 2001 as an addendum to the preexisting Model Law.

In accordance with the Model Law’s Article 2(a), electronic signatures are as follows: An “electronic signature” is any data in electronic form attached to, logically connected to, or included in a data message. It can be used to identify the signatory in connection with the data message and to show that the signatory approves of the content inside. After examining with an eagle-eye at the distinct methods of electronic signatures in use, the Model Law recognized two main types of electronic signatures: digital signatures that utilize public-key cryptography and electronic signatures that use alternative methods.

England and Wales (UK)

Electronic signatures are recognized by English law in instances where there is no formality requirement or duty to use a signature. It’s not necessary for the signature to be highly technical. Under English law, a scanned signature or something as casual as a name scribbled at the conclusion of an email might be considered a signature.

In the case of Bassano v Toft, the judge determined that the necessity of an admissible form of electronic signature was met by clicking the ‘I accept’ button on the digital consumer loan agreement and the same is enforceable in consumer credit laws of the state. An electronic signature administered by a third party (like an assistant) would not be acceptable if the law mandates that the signatory personally apply the signature (as a procedural formality) as held in Kassam v Gill.

Argentina

Agreements and collaborations that are not subject to a particular legal form requirement under Argentine law may be carried out in any way that the parties agree upon, including orally, electronically, or in hard copy. Requests for specific legal documents may be made in the form of public deeds or handwritten signatures. For the purpose of satisfying any handwritten requirements mandated by local legislation, digital signatures are deemed effective but it solely will not be viable for substitution as requirements of public deed. Digitally signed documents are assumed to have been signed by the signatory listed with the certifying licensee, and that the content has not been changed, hence the position of admissibility of electronic signatures is partially similar to India. In both the jurisdictions, If a party disputes the authorship of the digital signature, they will need to provide proof to support their claim.

The Future of eSign in India: A Secure and Efficient Path Forward

The COVID-19 pandemic has served as a catalyst for the widespread adoption of eSignatures in India. With the need for remote transactions and the disruption of traditional document processes, e-Sign has emerged as a critical tool for ensuring business continuity. This has paved the way for potential advancements in the legal framework. We can expect updates to the IT Act of 2000 and the online document registration process. These changes could involve streamlining the registration process, expanding the applicability of eSignatures to a wider range of transactions, and creating a more user-friendly experience.

As India embraces this new era of digital transactions, public awareness is crucial. The IT Information Technology Act provides a clear definition and legal framework for eSignatures. However, further efforts are needed to improve user-friendliness and enhance authentication mechanisms. Developing fraud-resistant methods and eliminating security vulnerabilities will be essential for building trust and confidence in eSignatures for the long term. By focusing on legal clarity, user experience, and robust security measures, India can solidify eSign’s position as a cornerstone of a secure and efficient digital future.

Frequently Asked Questions (FAQs) on e-Sign in India

- What is eSign and is it legal in India?

eSign, or electronic signature, is a secure way to approve documents electronically. India has a robust legal framework around eSignatures, established by the IT Act Information Technology Act (IT Act) of 2000. This act recognizes eSignatures as legally valid when they meet specific criteria. - How secure are eSignatures?

eSign solutions often employ encryption and digital signatures to ensure document security. These measures can be even more secure than traditional handwritten signatures. Additionally, eSign creates a detailed audit trail that records the entire signing process, providing a clear record of who signed and when. - What are the benefits of using eSign in India?

eSign offers a multitude of benefits, including:

- Increased Efficiency: Streamline workflows and expedite document management.

- Enhanced Security: Utilize encryption and audit trails for secure transactions.

- Reduced Costs: Save on printing, scanning, and postage expenses.

- Convenience: Sign documents from anywhere, anytime, using any device.

- Environmental Friendliness: Reduce paper usage and contribute to a greener planet.

- What are some common use cases for eSign in India?

eSign is transforming various sectors in India. Here are some examples:

- Business: Sales agreements, invoices, NDAs, HR documents

- Finance: Loan documents, account opening forms, investment agreements

- Real Estate: Lease agreements for residential and commercial properties

- Government: Permits, applications, licenses

- Can I use eSign for all types of documents in India?

While eSign is widely applicable, there are exceptions. The IT Act doesn’t cover documents requiring a wet signature, such as:

- Negotiable instruments (except cheques)

- Power of attorney

- Trust deeds

- Wills and testaments

- Contracts for sale of immovable property

- How does eSign work in India?

The eSign process is simple:

- Receive an eSign request for a document.

- Review the document and choose your signing method (typed name, drawn signature, or dedicated software).

- Verify your identity through password, OTP, or biometrics (depending on security level).

- The document is signed electronically, and a tamper-proof audit trail is created.

- What are the different types of eSignatures in India?

There are two main types of eSignatures:

- Simple Electronic Signature: Typing your name or uploading a pre-defined image. Offers basic convenience but lower security.

- Advanced Electronic Signature: Utilizes a digital certificate issued by a trusted authority for stronger verification and tamper detection.

- What is Aadhaar eSign and how does it work?

Aadhaar eSign is a simplified signing process for Aadhaar holders in India. It leverages the Aadhaar identification platform to verify the signer’s identity through eKYC, making eSigning fast and convenient. - What are the requirements for using eSign in India?

There are no specific requirements to use eSign, but the legal validity of the signature depends on the chosen method and adherence to the IT Act. For maximum security, consider using advanced eSignatures with digital certificates. - Where can I find more information about eSign in India?

You can find detailed information about eSign on the websites of the Ministry of Electronics and Information Technology (MeitY) and the Controller of Certifying Authorities (CCA) in India. These government websites offer official guidelines and resources.