India’s capital markets have matured rapidly. Yet for years, sophisticated investors operated within a structural gap.

On one side were Mutual Funds transparent, tax-efficient, tightly regulated, but strategically constrained.

On the other were Category III AIFs flexible and strategy-rich, but operationally complex and often tax-heavy.

For high-net-worth individuals (HNIs), the real challenge was not access to strategies. It was access to the right structure for those strategies.

The introduction of Specialized Investment Funds (SIFs) as a new asset class by the Securities and Exchange Board of India marks a structural shift in how sophisticated capital can be deployed.

This is not about inventing new strategies. It is about allowing similar strategies to compound differently.

The Investment Puzzle India’s HNIs Faced

For a long time, the decision tree looked like this:

Option 1: Mutual Funds

- Strong governance and disclosure

- Taxation at redemption

- Low minimums

- Limited derivatives and short exposure

- Mandates designed for broad retail suitability

Option 2: Category III AIFs

- Flexible long–short and derivatives-heavy strategies

- Higher entry thresholds (often ₹1 crore or more)

- Performance-linked fees

- Transaction-level taxation in many cases

- Operational and structural complexity

Neither option was flawed.But neither perfectly suited sophisticated capital seeking both flexibility and tax efficiency.

What Are SIFs In Practical Terms?

SIFs are positioned as a “middle layer” between mutual funds and AIFs.

They offer:

- Entry thresholds often cited around ₹10 lakh (significantly below AIF minimums)

- Strategic flexibility beyond traditional mutual funds

- Governance, disclosure, and regulatory oversight aligned closer to mutual fund frameworks

In essence: More strategy freedom than mutual funds. Less structural friction than AIFs.

This positioning allows SIFs to run strategies such as:

- Long–short equity

- Absolute return frameworks

- Market-neutral allocations

- Volatility-based strategies

The strategy toolkit overlaps with Category III AIFs. The taxation and compounding experience may not.

The Real Differentiator: Structural Tax Arbitrage

Here is where the conversation becomes meaningful.

Assume three vehicles run broadly similar long–short equity strategies with moderate to high portfolio churn.

Pre-tax performance may look similar.

Post-tax outcomes can diverge significantly.

Mutual Funds: Efficient but Guardrailed

Mutual funds typically:

- Tax investors at redemption

- Do not create transaction-level tax leakage for investors

- Operate under defined derivative limits

This makes them tax-efficient from a structure standpoint.

However, their regulatory guardrails restrict full strategy expression in aggressive long–short or derivatives-heavy approaches.

Tax efficiency is high. Strategy freedom is limited.

Category III AIFs: Flexible but Tax-Drag Prone

Category III AIFs are designed for sophisticated strategies.

They allow:

- Active shorting

- High derivative exposure

- Rapid portfolio turnover

- Complex positioning

However:

- Gains may be taxed at the transaction level.

- High turnover can trigger repeated tax events.

- Performance fees may further affect net outcomes.

- Compounding happens on a progressively reduced base.

Even if pre-tax alpha is strong, transaction-level taxation creates “tax leakage.”

Over multi-year horizons, this leakage compounds.

The investor does not just pay tax they lose the ability to reinvest that taxed capital.

SIFs: Strategy Flexibility + Redemption-Based Taxation

SIFs effectively combine:

- Flexibility closer to Category III AIFs

- Taxation mechanics more aligned with mutual funds

Meaning:

- Internal trades typically do not trigger investor-level tax each time.

- Tax is applied at redemption.

- Capital compounds inside the structure until exit.

If two managers run similar long–short strategies one inside a Category III AIF and one inside a SIF the SIF structure may allow capital to compound more efficiently due to deferred taxation.

This is the structural arbitrage.

Not a new strategy. A different compounding pathway.

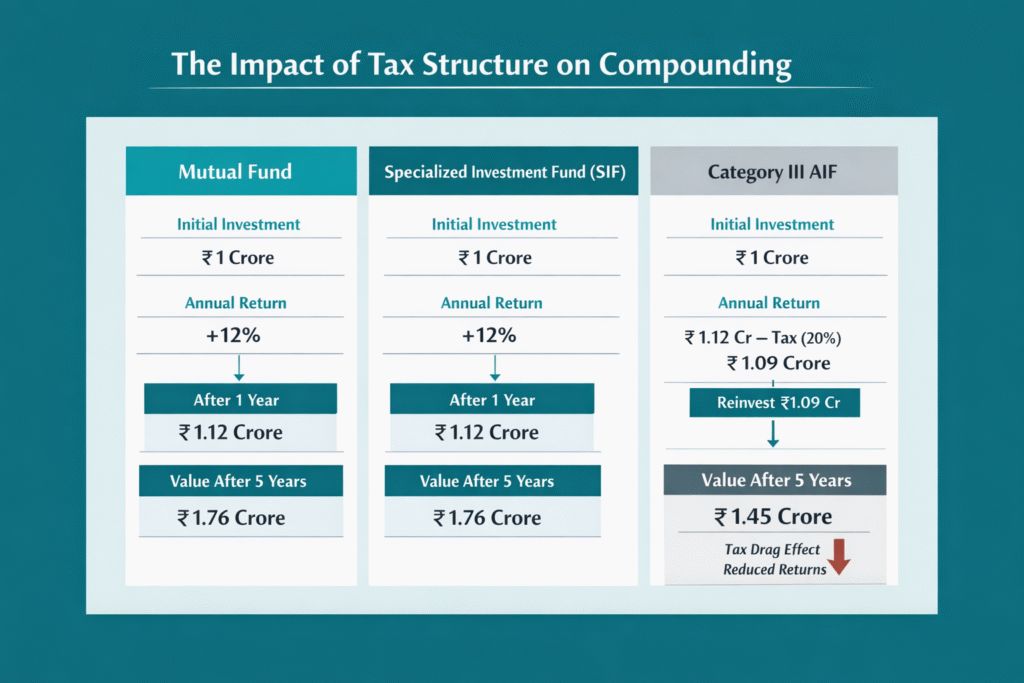

Tax Impact on Compounding: Mutual Fund vs SIF vs Category III AIF

Even if three vehicles generate the same pre-tax return, the tax structure changes how capital compounds.

Assumptions (Illustrative)

- Investment: ₹1 Crore

- Annual Return: 12%

- Tenure: 5 Years

- Category III AIF: 20% tax applied annually on gains

- Mutual Fund & SIF: Tax only at redemption

Year 1 – Reinvestment Base

| Structure | Value Before Tax | Tax During Year | Amount Reinvested |

| Mutual Fund | ₹1.12 Cr | Nil | ₹1.12 Cr |

| SIF | ₹1.12 Cr | Nil | ₹1.12 Cr |

| Category III AIF | ₹1.12 Cr | ₹2.4 Lakh | ₹1.096 Cr |

Key Difference: Mutual Funds and SIFs reinvest full gross returns. Category III AIF reinvests post-tax returns.

5-Year Outcome (Illustrative)

| Structure | Approx. Value After 5 Years |

| Mutual Fund | ₹1.76 Cr |

| SIF | ₹1.76 Cr |

| Category III AIF | ~₹1.45 Cr |

What This Shows

- Mutual Funds and SIFs allow deferred taxation, improving compounding efficiency.

- Category III AIFs may face transaction-level taxation, reducing reinvestable capital each year.

- Over time, this creates measurable tax drag.

Why This Matters More Over Time

Tax drag does not hurt in a single year.

It hurts over multiple years.

Consider a high-turnover strategy generating consistent gains:

- In an AIF, taxes reduce reinvestable capital every cycle.

- In a SIF, gains remain invested until redemption.

Even small differences in reinvested capital can create meaningful divergence over 5–7 years.

Compounding magnifies structural efficiency.

Reducing Strategy Risk Without Going Solo

Another dimension often overlooked is execution risk.

Regulatory observations have consistently shown that a large majority of retail futures and options traders incur losses.

Sophisticated investors may want exposure to:

- Volatility

- Tactical positioning

- Long–short strategies

But they may not want:

- Execution mistakes

- Operational burdens

- Tax inefficiencies

- Compliance complexities

SIFs provide institutional management of complex strategies within a monitored regulatory framework.

The investor gains strategy exposure without self-trading risk or structural drag.

Why Mutual Funds Alone Weren’t Enough

Mutual funds are built for scale and retail protection.

This means:

- Derivatives largely limited to hedging frameworks

- Strict exposure caps

- Uniform mandates suitable for mass investors

Many HNIs trusted fund managers.

They simply did not want the structural limits placed on those managers.

SIFs loosen those constraints without removing oversight.

Why AIFs Alone Weren’t Optimal for Everyone

AIFs serve an important role in India’s ecosystem.

But for many HNIs:

- ₹1 crore minimums restrict allocation flexibility

- Fee structures can be layered

- Taxation can be transaction-sensitive

- Documentation and administration add friction

SIFs reduce entry barriers while maintaining sophistication.

A Signal of Ecosystem Maturity

SIFs are not startup funding vehicles.

Yet they signal something broader about India’s financial markets.

As the Securities and Exchange Board of India refines asset categories:

- Capital becomes more tax-aware

- Structures become more efficient

- Sophisticated investors receive better-aligned tools

- The gap between global and domestic frameworks narrows

For founders and executives managing post-exit wealth, this evolution matters.

It strengthens the personal wealth management ecosystem.

The Core Insight: Structure Drives Outcome

If strategy is the engine,Structure is the chassis.

Two identical strategies placed inside different regulatory and tax frameworks will not compound identically.

SIFs represent a structural evolution:

- Strategy flexibility closer to AIFs

- Tax mechanics closer to mutual funds

- Entry thresholds more accessible to sophisticated capital

They do not replace mutual funds. They do not eliminate AIFs. They fill the gap between them.

For India’s HNIs, that missing layer may be the most important addition to the investment puzzle in recent years.