India’s fast changing consumer landscape is best represented by the disruption caused by the quick commerce (“QCom”) sector. QCom has risen rapidly in the country post the Covid-19 pandemic, led by brands like BlinkIt, Swiggy Instamart and Zepto. Consequently, these QCom companies have seen rapid growth and success since 2020, attracting investors witnessing a slowdown in major sectors like fintech and online education. This shift has rattled established players and has created sizable challenges for traditional Kirana and mom-and-pop stores in the country.

The rising pressure came to a head in August 2024, when the All India Consumer Products Distributors Federation (AICPDF) wrote to the Commerce and Industry Minister, Piyush Goyal, urging government security of quick commerce platform, citing threats to small retailers and potential FDI violations1. Seeking an immediate investigation into the operational models of these QCom platforms, the AICPDF urged implementation of protective measures for traditional distributors. With the release of a white paper by the Confederation of All India Traders (CAIT) alleging unfair trade practices and potential violation of Foreign Direct Investment (FDI) policy by QCom players, immediate regulatory intervention has been urged, leading to speculation on the continued growth of these QCom platforms2.

In these Treelife Insights pieces, we break down how QComs like Blinkit and Swiggy Instamart work, the impact of this sector on traditional distributors, the issues raised by AICPDF and CAIT and what the future for QCom could hold.

How does Quick Commerce work?

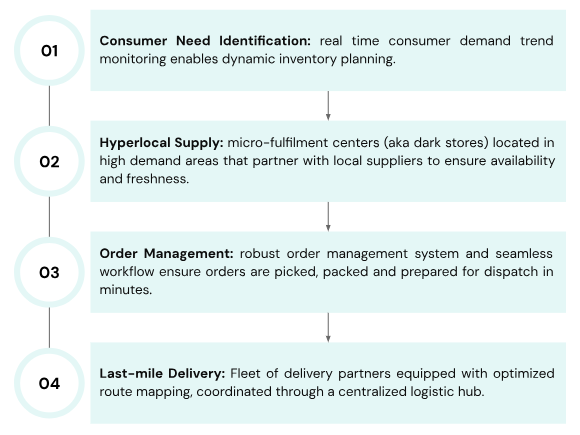

Fundamentally, QCom is an innovative retail model that emphasizes speed and convenience in delivery of goods, designed to meet consumers’ immediate needs. The process chart below showcases how the QCom model operates:

However, QCom is limited in its ability to replicate value focused items available in traditional stores or larger retailers, such as staples (with higher price sensitivity) or open stock keeping units, or personalized khata systems for customers3.

Impact of QCom on Traditional Distributors

The rapid expansion of QCom taps into the consumer’s need for instant gratification in the Fast Moving Consumer Goods (FMCG) sector. Leveraging significant funding, advanced technology, and a network of dark stores, these platforms expanded from metros to Tier-2 cities, offering essentials within 10–15 minutes, and eliminating the need to approach traditional mom-and-pop shops or kirana stores to purchase their daily needs.

- Loss of Business for Traditional Distributors: Given the consumer preference for convenience, wide product range and speedy delivery, there is a decline in foot traffic for traditional stores. Further, AICPDF in its August 2024 letter cited a shift in the FMCG distribution landscape itself, with QCom platforms being increasingly appointed as director distributors by major FMCG companies, sidelining traditional distributors4.

- Pricing Competition: When backed by heavy investment, QCom platforms are able to offer deep discounts on the products, which make it difficult for traditional distributors to compete.

- Inventory Turnover: Given the lack of sales, these traditional stores are sitting on high levels of inventory which results in delayed payments to distributors. This is impacted further by the fact that traditional stores cater to the impulse purchase vertical of consumers, who are now turning to QCom5.

- Technology Gap: QCom fundamentally employs advanced technology to analyze trends, manage inventory and logistics, and boost customer retention. Traditional stores are unable to invest in such infrastructural developments.

Legal Background

Further to its August 2024 letter, AICPDF filed a complaint with the Department of Promotion of Industry and Internal Trade (DPIIT) in September 2024, which was forwarded to the Competition Commission of India (CCI)6. AICPDF then formally complained to the CCI in October 20247 following which, CAIT released a white paper calling for a probe into the top 3 QCom players in the country8 for possible violations of the FDI Policy and the Competition Act, 20029. 10

Background of FDI Policy as applicable to e-commerce sector

1. Permissible Transactions

- Marketplace e-commerce entities are permitted to enter into B2B transactions with registered sellers.

- E-commerce marketplace entities may provide support services to sellers (e.g., logistics, warehousing, marketing).

2. Ownership and Control

- Marketplace e-commerce entities must not exercise ownership over the inventory.

- Control is deemed if over 25% of a vendor’s purchases are from the marketplace entity or its group companies.

- Entities with equity participation or inventory control by a marketplace entity cannot sell on that entity’s platform.

3. Seller Responsibility

- Seller details (name, address, contact) must be displayed for goods/services sold online.

- Delivery and customer satisfaction post-sale are the seller’s responsibility.

- Warranty/guarantee of goods/services rests solely with the seller.

4. Fair Competition

- Marketplace entities cannot influence pricing of goods/services and must ensure fair competition.

- Services like fulfillment, logistics, and marketing must be provided fairly and at arm’s length.

- Cashbacks by group companies must be fair and non-discriminatory.

- Sellers cannot be forced to sell products exclusively on any platform.

5. Restrictions

- FDI is not allowed in inventory-based e-commerce models.

Alleged Violations of the FDI Policy

- Misuse of FDI Funds: The white paper states that the top 3 QCom platforms have collectively received over INR 54,000 crore in FDI, with only a minimal portion allocated to infrastructure development. Instead, a substantial amount is purportedly used to subsidize operational losses and fund deep discounts, which CAIT argues is a deviation from the intended use of FDI for asset creation and long-term growth.

- Inventory Control via Preferred Sellers: The white paper states that QCom platforms operate dark stores through a network of preferred sellers, effectively controlling inventory. This practice is seen as a circumvention of FDI regulations that prohibit foreign-backed marketplaces from holding inventory or influencing pricing directly.

Alleged Violations of the Competition Act

- Predatory Pricing and Market Distortion: Through the deep discounts (funded by FDI) offered by these QCom players, CAIT alleges undermining of traditional retailers and distortion of fair market competition. Such practices are viewed as detrimental to the survival of small businesses, including the estimated 30 million kirana stores in India.

- Restricted Market Access: The white paper highlights that exclusive agreements with a select group of sellers limit market access for other vendors, thereby reducing competition and consumer choice. This strategy is alleged to create an uneven playing field, favoring certain sellers and marginalizing others.

Concluding Thoughts

CAIT’s white paper calls for immediate regulatory intervention to address these issues, emphasizing the need to protect the interests of small traders and maintain a fair competitive environment in India’s retail sector. However, formal updates in the regulatory space are still pending, any regulatory intervention would likely arise from the potential contravention of the FDI policy. The fundamental issue of whether or not the QCom model operates as an inventory-based e-commerce model will need to be determined to assess whether or not there has been a violation of the FDI Policy. As such, any regulatory intervention will have a sizeable impact on the market, and the Central Government has yet to formally respond to the CAIT and AICPDF calls for intervention.

FAQs on Quick Commerce in India

- What is Quick Commerce (QCom)?

QCom refers to an innovative retail model that delivers goods to consumers within a short time frame, often 10–15 minutes, leveraging hyperlocal supply chains, advanced logistics, and micro-fulfillment centers (dark stores). - What impact does QCom have on traditional Kirana stores and distributors?

QCom has disrupted traditional retail by reducing foot traffic to Kirana stores, introducing aggressive pricing competition, and capturing consumer preference for speed and convenience. This shift has led to inventory turnover challenges, delayed payments, and reduced profitability for traditional distributors. - What are the key legal concerns raised against QCom platforms?

Key concerns include:- Misuse of FDI funds for operational losses and deep discounts instead of infrastructure development.

- Predatory pricing practices that distort market competition.

- Restricted market access through exclusive agreements with select sellers.

- Alleged circumvention of FDI regulations by controlling inventory via preferred sellers.

- What is the role of AICPDF and CAIT in addressing these concerns?

The All India Consumer Products Distributors Federation (AICPDF) and the Confederation of All India Traders (CAIT) have highlighted the challenges posed by QCom platforms. They have filed complaints and published a white paper, urging regulatory intervention to protect traditional retailers and ensure compliance with FDI and competition laws. - How does the QCom model differ from traditional retail?

QCom focuses on hyperlocal supply chains, real-time inventory management, and last-mile delivery using advanced technology, whereas traditional retail relies on physical storefronts, human-driven processes, and personalized consumer relationships like credit-based “khata” systems.

- [1] https://economictimes.indiatimes.com/industry/cons-products/fmcg/quick-commerce-fmcg-distributors-raise-red-flags-seek-scrutiny-over-rapid-expansion-of-platforms-like-blinkit-zepto-instamart-fdi-rule-violations/articleshow/112763093.cms?from=mdr

↩︎ - [2] https://www.lokmattimes.com/business/cait-releases-white-paper-with-allegations-of-unfair-trade-practices-against-quick-commerce-companies/

↩︎ - [3] https://www.moneycontrol.com/news/business/startup/is-quick-commerce-eating-into-kiranas-or-e-commerce-blinkit-swiggy-zepto-dmart-delhivery-weigh-in-12795319.html

↩︎ - [4] https://economictimes.indiatimes.com/industry/cons-products/fmcg/quick-commerce-fmcg-distributors-raise-red-flags-seek-scrutiny-over-rapid-expansion-of-platforms-like-blinkit-zepto-instamart-fdi-rule-violations/articleshow/112763093.cms?from=mdr

↩︎ - [5] https://retail.economictimes.indiatimes.com/news/e-commerce/e-tailing/kirana-stores-hit-hard-as-quick-commerce-surges-distributors-struggle-to-recover-dues-report/114461769#:~:text=Traditional%20Kirana%20stores%20in%20India,millions%20of%20small%20business%20owners.

↩︎ - [6] https://www.cnbctv18.com/business/quick-commerce-companies-violate-fdi-norms-aicpdf-19480198.htm

↩︎ - [7] https://www.cnbctv18.com/business/quick-commerce-companies-violate-fdi-norms-aicpdf-19480198.htm

↩︎ - [8] Including Blinkit, Zepto and Swiggy Instamart.

↩︎ - [9] https://www.deccanherald.com/business/quick-commerce-platforms-using-fdi-to-fund-deep-discounts-cait-3275356

↩︎ - [10] Guidelines on cash and carry wholesale trading to apply ↩︎