Introduction

Employee equity compensation plans are structured programs that allow companies to reward employees with a stake in the business instead of or in addition to cash. These plans link employee performance and loyalty with the company’s long-term growth. Two of the most common equity incentives worldwide are Employee Stock Option Plans (ESOPs) and Restricted Stock Units (RSUs). Increasingly, Employee Stock Purchase Plans (ESPPs) are also being used, but ESOPs and RSUs remain the most dominant forms.

Why Companies Use RSUs and ESOPs

1. Startups: Driving Growth and Retention

- ESOPs are the preferred choice in startups because they:

- Help conserve cash while rewarding employees with future ownership.

- Motivate early employees to work toward higher company valuations.

- Offer potentially large upside if the startup scales or exits (IPO/acquisition).

- Help conserve cash while rewarding employees with future ownership.

- Example: Several Indian unicorns, including Swiggy, Zomato, and Paytm, have created large ESOP pools to attract and retain high-value talent.

2. Global & Large Companies: Ensuring Stability and Loyalty

- RSUs are more common in multinational corporations and listed companies because they:

- Provide employees with guaranteed share ownership (no upfront cost).

- Reduce financial risk for employees compared to stock options.

- Align employee interests with steady, long-term performance.

- Provide employees with guaranteed share ownership (no upfront cost).

- Example: Global tech companies like Google, Amazon, and Microsoft regularly grant RSUs as part of annual compensation packages.

Quick Snapshot: Why RSU vs ESOP?

| Company Type | Preferred Plan | Why? |

| Early-Stage Startup | ESOP | Motivates employees to build value, offers high upside potential. |

| Large/Public Company | RSU | Provides predictable rewards, encourages retention without cash drain. |

In short: Startups use ESOPs to share future growth, while global companies prefer RSUs for stability and guaranteed ownership. This distinction forms the foundation for deeper discussions around RSU vs ESOP taxation, differences, and which is better.

What is an ESOP (Employee Stock Option Plan)?

Definition

An Employee Stock Option Plan (ESOP) gives employees the right, but not the obligation, to purchase company shares at a predetermined price (called the exercise price or strike price) after completing a defined vesting period. Unlike direct stock grants, ESOPs require employees to actively exercise their option if they wish to become shareholders.

How ESOPs Work – Step by Step

The lifecycle of ESOPs follows four clear stages:

- Grant – Company offers employees a fixed number of stock options.

- Vesting – Employees earn ownership rights gradually (e.g., 25% per year for 4 years).

- Exercise – Employees buy shares at the pre-decided exercise price.

- Sale – Employees sell shares in secondary markets or at IPO/liquidity events.

This sequence Grant → Vesting → Exercise → Sale ensures long-term employee retention and commitment.

Example with Numbers

Suppose an employee is granted 1,000 ESOPs at an exercise price of ₹100 per share.

- At vesting, the market value (FMV) of the share = ₹150.

- Employee decides to exercise: Buys 1,000 shares at ₹100 = ₹1,00,000.

- Market value = ₹1,50,000 → unrealized gain of ₹50,000.

- If later sold at ₹200, final value = ₹2,00,000 → capital gain of ₹1,00,000.

This shows how ESOPs can convert into significant wealth creation if the company scales.

Purpose of ESOPs

- Talent Retention: Encourages employees to stay through multi-year vesting schedules.

- Alignment of Interests: Employees think like owners, driving company performance.

- Cash Conservation: Startups use ESOPs instead of high salaries to attract talent.

- Wealth Creation: Employees benefit directly from company growth and valuation increases.

Case Study – ESOPs in Indian Unicorns

- Swiggy: Conducted multiple ESOP buybacks worth ₹900+ crore (2022), rewarding thousands of employees.

- Zomato: Expanded its ESOP pool significantly before IPO, allowing employees to benefit from listing gains.

- Paytm & Ola: Structured large ESOP programs, enabling employees to monetize during fundraising rounds and public listings.

According to industry reports, over 70% of Indian unicorns have created or expanded ESOP pools in the last five years, highlighting their role as a strategic compensation tool.

In summary: ESOPs are a high-risk, high-reward equity compensation plan, best suited for startups and growth-stage companies. They allow employees to purchase ownership at a fixed price and benefit if the company scales, making them one of the most powerful tools for employee motivation and retention.

What is an RSU (Restricted Stock Unit)?

Definition

A Restricted Stock Unit (RSU) is a form of equity compensation where a company promises to grant shares to employees at no upfront cost, subject to specific vesting conditions. Unlike stock options, RSUs are not rights to purchase they are direct stock grants once vesting criteria are met, making them less risky for employees.

How RSUs Work – Step by Step

The RSU lifecycle is straightforward and designed to ensure loyalty:

- Grant – Company commits to awarding a fixed number of shares.

- Vesting – Shares are released gradually:

- Time-based vesting: e.g., 25% RSUs each year for 4 years.

- Milestone-based vesting: triggered by performance goals (e.g., revenue target).

- Hybrid vesting: a mix of time + performance conditions.

- Settlement – On vesting, RSUs convert into company shares (or sometimes cash equivalents).

- Sale – Employee can sell shares in the open market (if listed) or during company-approved liquidity events.

In short: Grant → Vesting → Settlement → Sale.

Purpose of RSUs

- Retention Tool: Encourages employees to stay through multi-year vesting schedules.

- Risk-Free Entry: Employees do not pay any exercise price shares are awarded outright.

- Alignment of Interests: Ensures employees benefit only when the company performs.

- Preferred by MNCs: Particularly common in large, publicly listed companies where stock liquidity is readily available.

Example – Google RSU Program

- Scenario: An employee is granted 1,000 RSUs by Google, vesting over 4 years.

- Schedule: 25% (250 shares) vest annually.

- Stock Price at Vesting: If Google’s share price is $120 at the end of Year 1, the employee receives 250 shares worth $30,000 (without paying a dime upfront).

- Outcome: Over 4 years, the employee receives all 1,000 shares, benefiting directly from Google’s stock appreciation.

Quick Comparison – RSUs vs Stock Options

| Feature | RSUs | Stock Options (ESOPs) |

| Upfront Cost | None | Exercise price payable |

| Risk | Low (direct share grant) | High (depends on market value) |

| Vesting | Time/milestone-based | Time/milestone-based |

| Best For | MNCs, listed companies | Startups, growth-stage firms |

In summary: RSUs are a low-risk equity incentive where employees gain ownership without upfront costs. This makes them particularly attractive in multinational corporations and publicly listed companies (e.g., Google, Amazon, Microsoft), where shares are liquid and employees can monetize rewards steadily over time.

RSU vs ESOP – Key Differences (Comparison Table) 2025

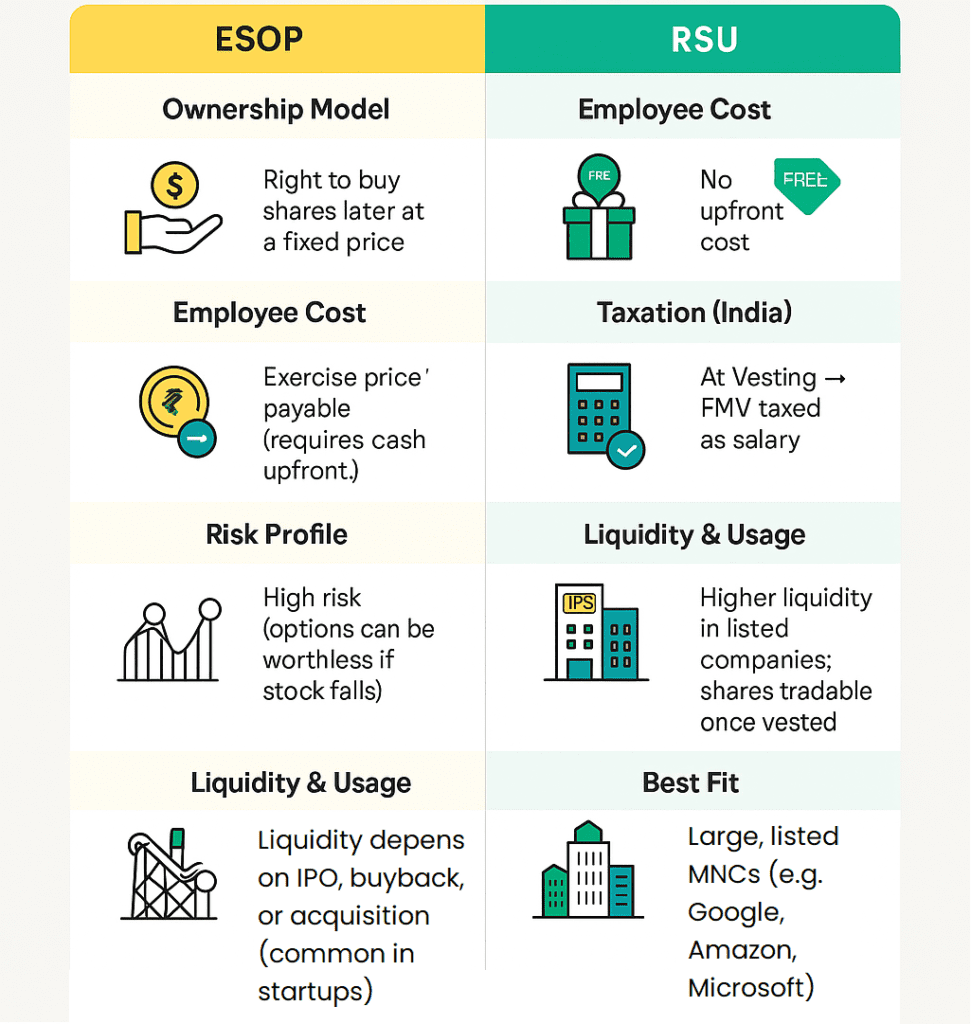

When evaluating RSUs (Restricted Stock Units) vs ESOPs (Employee Stock Option Plans), it’s essential to break down each feature across ownership, cost, taxation, risk, and usage. Below is a detailed comparison table for the difference between RSU and Stock Option.

| Feature | ESOP (Employee Stock Option Plan) | RSU (Restricted Stock Unit) |

| Ownership | Provides the right to purchase shares at a fixed exercise price after vesting. | Direct grant of company shares after vesting, no purchase required. |

| Cost to Employee | Employee must pay the exercise price (strike price), which may be below market value. | No upfront cost; shares are awarded outright once vested. |

| Taxation Point (India) | – At Exercise: FMV – Exercise Price taxed as perquisite under Salary.- At Sale: Further gains taxed as Capital Gains (STCG/LTCG based on holding period). | – At Vesting: FMV taxed as perquisite under Salary.- At Sale: Gains over FMV taxed as Capital Gains. |

| Risk Exposure | High – if market price < exercise price, ESOPs may become worthless (“underwater options”). | Lower – employee always receives shares, even if price falls (though value may decline). |

| Liquidity | Often depends on IPO, buyback, or acquisition for unlisted startups.Limited secondary market. | Higher in publicly listed companies, where vested RSUs convert to tradable shares immediately. |

| Wealth Creation Potential | Very high in high-growth startups if valuations skyrocket (e.g., Flipkart, Zomato ESOP buybacks). | Moderate but stable – value directly tied to stock price at vesting; less speculative upside. |

| Vesting Conditions | Time-based, performance-based, or hybrid. Typically 3–5 years with a 1-year cliff. | Similar vesting structures (time, milestone, hybrid). Commonly annual vesting over 3–4 years. |

| Dilution Impact | Increases company’s share capital when exercised; founders’ holdings get diluted. | Also dilutive, but usually granted in smaller quantities by large listed companies. |

| Upfront Cash Requirement | Yes – employees need liquidity to exercise shares, sometimes before exit events. | None – employees simply receive shares; no cash outflow needed. |

| Dividend & Voting Rights | Only after exercise and becoming a shareholder. | Typically granted once shares vest and are delivered. |

| Valuation Dependency | Strongly tied to future growth and IPO outcomes; employees may face illiquidity until exit. | Tied to current stock market value; predictable, liquid if listed. |

| Popular Among | Startups, early-stage growth companies, Indian unicorns (e.g., Swiggy, Ola, Paytm). | Large, stable, multinational corporations and publicly listed firms (e.g., Google, Amazon, Microsoft). |

Key Insights

- ESOPs = High-risk, high-reward. Best suited for startup employees willing to take long-term bets on company growth.

- RSUs = Low-risk, steady rewards. Best suited for employees in MNCs and listed companies seeking predictable compensation.

- RSU vs Stock Option decisions depend on company maturity, employee’s financial flexibility, and risk appetite.

This table not only clarifies the differences between RSUs and ESOPs but also incorporates real-world usage patterns, taxation nuances, and employee impact making it highly relevant for comparison.

RSU vs. ESOP vs. ESPP: A Comparative Guide for Employee Equity

What is an Employee Stock Purchase Plan (ESPP)?

An Employee Stock Purchase Plan (ESPP) allows employees to purchase company stock, typically at a discount, through regular payroll deductions. . The company sets up an offering period, during which employees can contribute a portion of their salary. At the end of this period, the accumulated funds are used to purchase shares at a predetermined discounted price, often 15% below the market price. The purchase price is usually based on either the price at the start or the end of the offering period, whichever is lower, which can provide a significant advantage if the stock price rises.

Key Features of ESPPs:

- Employee Contribution: You contribute your own money via payroll deductions to buy the stock.

- Discounted Price: The purchase price is typically 5-15% below the market value.

- Offering Period: Contributions are collected over a set period (e.g., 6 months).

- Taxable Event: The discount you receive is generally treated as ordinary income upon the sale of the stock, while any subsequent appreciation is taxed as a capital gain.

RSU vs. ESOP vs. ESPP: A Quick Comparison Table

| Feature | RSU (Restricted Stock Unit) | ESOP (Employee Stock Ownership Plan) | ESPP (Employee Stock Purchase Plan) |

| Upfront Cost | No payment; shares are a grant. | No payment; company contributes to a trust. | Employee contributes via payroll deductions. |

| Source of Stock | Granted by the company to the employee. | Contributed by the company to a trust for employees. | Purchased by the employee at a discount. |

| Taxable Event | When shares vest. Market value is ordinary income. | When shares are distributed or sold (typically at retirement). | When stock is sold. Discount is ordinary income. |

| Purpose | Retaining talent and aligning employee and shareholder interests. | A retirement benefit plan. | Offering employees a simple way to buy company stock at a discount. |

| Control Over Purchase | None. You get shares once they vest. | None. Shares are allocated by the company. | Full control. You decide how much to contribute. |

| Vesting | Common (time-based or performance-based). | Common (typically time-based). | Not applicable; stock is purchased directly. |

An ESPP offers you direct control over how much you invest and provides an immediate discount, making it a low-risk way to acquire stock. RSUs, on the other hand, are a “free” benefit that can be highly valuable if the company’s stock price appreciates. ESOPs are a long-term retirement vehicle where the company does all the heavy lifting. Choosing the right approach depends on your financial goals and risk tolerance.

Taxation of RSUs vs ESOPs in India

Understanding how Restricted Stock Units (RSUs) and Employee Stock Option Plans (ESOPs) are taxed in India is important for employees and startups alike. Both are popular equity-linked compensation tools, but their tax treatment varies significantly. Here’s a clear breakdown:

ESOP Taxation in India

1. At Exercise (when employee buys the shares):

- Taxable Component: Difference between Fair Market Value (FMV) on exercise date and the exercise price paid by the employee.

- Tax Head: Taxed as perquisite under Salary Income.

- TDS: Employers must deduct TDS at source.

2. At Sale (when employee sells the shares):

- Taxable Component: Difference between sale price and FMV on the exercise date.

- Tax Head: Taxed as Capital Gains.

- Type of Gain:

- Short-Term Capital Gain (STCG): If shares are sold within 24 months (for unlisted shares) or 12 months (for listed shares).

- Long-Term Capital Gain (LTCG): If the holding period exceeds the above limits.

RSU Taxation in India

1. At Vesting (when shares are allotted):

- Taxable Component: Entire FMV of shares on vesting date.

- Tax Head: Treated as perquisite under Salary Income.

2. At Sale (when shares are sold):

- Taxable Component: Difference between sale price and FMV on vesting date.

- Tax Head: Taxed as Capital Gains.

- Type of Gain: Determined by holding period (same STCG/LTCG rules as ESOPs).

Comparative Table – ESOPs vs RSUs Taxation

| Stage | ESOPs Taxable Value | RSUs Taxable Value | Tax Head |

| Grant | No tax | No tax | – |

| Exercise / Vesting | FMV – Exercise Price = Taxed as perquisite | FMV at vesting = Taxed as perquisite | Salary Income |

| Sale | Sale Price – FMV = Capital Gains | Sale Price – FMV = Capital Gains | STCG / LTCG |

Example Calculation (Numerical Case Study)

Case 1 – ESOPs Taxability

- Granted at: ₹100

- FMV at Exercise: ₹200

- Sale Price: ₹250

Tax Impact:

- Salary Income (Perquisite) = ₹200 – ₹100 = ₹100

- Capital Gain = ₹250 – ₹200 = ₹50

Total Taxable Income = ₹150 (split between Salary & Capital Gains).

Case 2 – RSUs Taxability

- Granted: 100 RSUs

- FMV at Vesting: ₹200 per share

- Sale Price: ₹250 per share

Tax Impact:

- Salary Income (Perquisite) = ₹200 × 100 = ₹20,000

- Capital Gain = (₹250 – ₹200) × 100 = ₹5,000

Total Taxable Income = ₹25,000 (split between Salary & Capital Gains).

Key Insights

- ESOPs defer taxation until exercise, giving employees flexibility.

- RSUs trigger taxation at vesting, even if shares are not sold, which may create a cash flow burden.

- Both instruments eventually attract capital gains tax on sale, but timing of salary taxation is the big differentiator.

If you’re a startup employee or founder, understanding these differences helps in planning tax liabilities, timing of exercise/sale, and liquidity management.

Pros and Cons of ESOPs vs RSUs in India

When evaluating Employee Stock Option Plans (ESOPs) and Restricted Stock Units (RSUs), it’s important to weigh their benefits and drawbacks. Both can be powerful wealth-creation tools, but they impact employees differently depending on a company’s growth stage, liquidity, and tax structure.

Pros and Cons of ESOPs

Advantages of ESOPs

- Attractive in high-growth startups – Employees can benefit significantly if the company scales rapidly.

- Potential for massive wealth creation – Many success stories, like Flipkart’s multi-crore ESOP buybacks, highlight how ESOPs can change financial futures.

- Alignment with company growth – Employees directly benefit from the rising valuation of the startup, motivating long-term commitment.

Disadvantages of ESOPs

- Requires upfront payment – Employees must pay the exercise price to convert options into shares.

- Tax at exercise without liquidity – Tax liability arises at the time of exercise even if there’s no immediate chance to sell shares, creating a cash flow challenge.

- Risk of depreciation – If the company underperforms, exercised ESOPs may lose value.

Pros and Cons of RSUs

Advantages of RSUs

- No upfront cost – Employees don’t need to pay to acquire shares; they are granted automatically after vesting.

- Guaranteed ownership – Once vested, RSUs convert into shares, giving employees assured equity ownership.

- Simplicity – Easier to understand and administer compared to ESOPs, making them popular with multinational corporations (MNCs).

Disadvantages of RSUs

- Taxable at vesting – Employees must pay tax on the fair market value (FMV) at vesting, even if they can’t sell the shares.

- Limited upside vs ESOPs – In hyper-growth startups, ESOPs may provide far greater gains due to lower exercise prices and higher appreciation potential.

- Liquidity mismatch – Employees may face taxation before realizing actual cash from a sale.

Quick Comparison Table – ESOPs vs RSUs

| Factor | ESOPs | RSUs |

| Upfront Cost | Yes (exercise price) | No |

| Ownership Guarantee | Depends on exercise decision | Guaranteed after vesting |

| Tax Trigger | At exercise + at sale | At vesting + at sale |

| Best for | High-growth startups with exponential upside | Stable companies/MNCs offering steady equity |

Bottom line:

- ESOPs work best for employees willing to take higher risk for potentially higher rewards in startups.

- RSUs are safer and simpler, but may not deliver outsized wealth in rapidly growing companies.

Real-World Case Study: ESOPs vs RSUs

ESOP Case Study – Flipkart’s Wealth Creation Story

- Background: Flipkart, one of India’s biggest startup success stories, is often cited for its record-breaking ESOP buybacks.

- Scale: Over the years, Flipkart has conducted multiple ESOP buybacks, cumulatively crossing $700 million in payouts to employees.

- Impact: Many early employees became crorepatis through ESOPs, thanks to exponential valuation growth from early-stage entry to Walmart’s acquisition.

- Key Learning: ESOPs in high-growth startups can be life-changing, but they require patience, upfront exercise, and belief in the company’s long-term trajectory.

RSU Case Study – Global MNC Example (Google, Microsoft, Amazon)

- Background: Large multinationals like Google, Microsoft, and Amazon commonly issue RSUs as part of compensation packages.

- Structure: RSUs vest gradually (often 4 years with yearly/quarterly vesting schedules) and are granted without upfront cost.

- Employee Benefit: Employees receive guaranteed equity, ensuring predictable wealth creation, though upside is tied to stock market performance.

- Key Learning: RSUs are low-risk and ideal for employees in stable companies where share prices are less volatile than startups.

Key Takeaways – Flipkart ESOPs vs MNC RSUs

| Aspect | Flipkart ESOP Buyback | MNC RSU Grants (e.g., Microsoft) |

| Risk-Reward | High risk, high reward (requires exercise) | Lower risk, steady equity |

| Liquidity | Liquidity via buybacks/acquisition events | Liquidity depends on stock market sales |

| Wealth Creation | Crorepati outcomes in buybacks | Stable, consistent payouts with less upside |

| Tax Timing | At exercise + at sale | At vesting + at sale |

| Best Fit For | Startup employees ready for long-term bets | Employees in MNCs seeking predictable equity |

Final Insight

- ESOPs can create massive upside in unicorns or soon-to-be-acquired startups but come with upfront cost and tax risks.

- RSUs provide assured ownership without upfront costs, making them ideal for employees seeking stability in established companies.

For startup employees, the decision often comes down to risk appetite and liquidity planning.

RSU vs Stock Options: Which is Better?

Choosing between RSUs (Restricted Stock Units) and Stock Options (ESOPs) depends on the company’s stage, the employee’s risk appetite, and the availability of liquidity or exit opportunities. Both structures aim to align employees with company growth, but they work differently and suit different contexts.

For Employees in Startups – ESOPs as High-Reward Bets

- Upside Potential: ESOPs can generate significant wealth if the company achieves rapid growth or goes public.

- Example: An employee holding 5,000 ESOPs at ₹100 exercise price could see gains of ₹20 lakh if the company lists at ₹500/share.

- Why Better in Startups:

- Startups often conserve cash by offering ESOPs.

- They create strong ownership culture and incentivize employees to stay through the scaling journey.

- Risk Factor: ESOPs can become worthless if the company underperforms or delays IPO/liquidity events.

For Employees in Large Companies – RSUs as Safer Alternatives

- Guaranteed Value: RSUs are granted at no cost, so employees own shares once they vest no upfront payment required.

- Stability: In listed firms like Google, Amazon, or Infosys, RSUs provide steady, predictable wealth creation.

- Why Better in MNCs:

- Higher liquidity: Shares can be sold immediately after vesting.

- Lower risk compared to stock options, which may be underwater if stock prices fall below strike price.

- Trade-off: RSUs offer less speculative upside than ESOPs but greater certainty.

Decision Factors – How to Choose?

- Company Stage

- Early-Stage Startup: ESOPs more rewarding if the company achieves strong exits.

- Mature/Public Company: RSUs are more practical, ensuring employees benefit regardless of market volatility.

- Risk Appetite of Employee

- High Risk, High Reward: ESOPs suit those who can wait for a big liquidity event.

- Low Risk, Predictable Return: RSUs suit employees seeking steady wealth creation.

- Liquidity & Exit Opportunities

- ESOPs: Liquidity depends on IPO, buybacks, or acquisitions.

- RSUs: More liquid in listed companies, shares can be sold on exchanges after vesting.

RSU vs Stock Options: Which is Better from a Founder’s Perspective?

While employees focus on wealth creation and liquidity, founders and company leadership need to evaluate RSUs and ESOPs in terms of cost, compliance, dilution, and talent strategy. The choice directly impacts the company’s capital structure, investor perception, and ability to retain top talent.

Decision Matrix – Founder’s Lens

| Factor | ESOP (Stock Options) | RSU (Restricted Stock Units) |

| Best Fit | Startups, growth-stage firms raising VC rounds | Publicly listed companies, large MNCs |

| Dilution Impact | Dilution only if employees exercise | Immediate dilution as shares vest |

| Cash Flow Impact | No upfront cash outflow for company | Must expense RSUs at FMV (higher accounting cost) |

| Employee Motivation | High – rewards linked to company valuation | Moderate – guaranteed but less linked to performance |

| Compliance | Requires MCA/RBI filings, valuation certificates in India | Requires fair value accounting, complex tax reporting |

| Investor Perception | Standard in VC-backed startups | Expected in listed/global firms |

Key Takeaway for Founders

- Choose ESOPs if you’re a founder of an early-stage or VC-backed startup. They conserve cash, motivate employees to work for valuation growth, and are aligned with investor expectations.

- Choose RSUs if you’re running a listed company or late-stage business. They provide certainty, reduce attrition, and are easier to implement where liquidity is already available.

Global Perspective – RSUs vs ESOPs

Equity compensation plans look very different in developed markets like the US compared to emerging markets like India. The primary distinction lies in taxation rules, liquidity availability, and company maturity, which influence whether RSUs (Restricted Stock Units) or ESOPs (Employee Stock Option Plans) dominate.

US vs India – Taxation Differences

| Aspect | United States | India |

| ESOP Taxation | – Taxed at exercise: Difference between FMV and strike price is ordinary income.- At sale: Capital Gains (short-term or long-term depending on holding period). | – Taxed at exercise: FMV – Exercise Price as perquisite under “Salary.”- At sale: Capital Gains (STCG = 15% for listed; LTCG = 10% above ₹1 lakh, holding >12 months). |

| RSU Taxation | – Taxed at vesting: FMV treated as ordinary income.- At sale: Capital Gains. | – Taxed at vesting: FMV treated as salary perquisite.- At sale: Capital Gains (same rules as ESOPs). |

| Employee Cash Flow Impact | ESOPs can require upfront cash to exercise, RSUs settle automatically. | Similar, but ESOP exercise in India is often harder due to illiquid startups; RSUs less common except in listed MNCs. |

| Employer Reporting | Companies must expense options/RSUs at fair value under US GAAP. | Companies comply with Indian Accounting Standards (Ind-AS 102), with stricter FEMA/MCA filings for ESOPs. |

Case Studies – Global Giants vs Indian Unicorns

US Tech Giants – RSUs Dominate

- Amazon & Google: Widely use RSUs because:

- Shares are listed and liquid.

- Employees value predictable, risk-free ownership.

- Vesting aligns with retention strategies (3–4 years).

- Example: Google grants RSUs annually, with staggered vesting schedules, ensuring employees stay long-term.

Indian Unicorns – ESOPs as the Default Choice

- Ola, Paytm, Swiggy, Zomato: Rely heavily on ESOP pools to reward employees.

- ESOPs fit startups that are not yet public and need to conserve cash.

- Liquidity is offered through buybacks (e.g., Swiggy’s ₹900+ crore ESOP buyback in 2022) or IPO exits (e.g., Paytm IPO in 2021).

- Why ESOPs over RSUs in India?

- RSUs require listed equity and are tax-heavy at vesting.

- ESOPs provide flexibility in structuring startup compensation, even pre-IPO.

Key Takeaway – Global Trends

- US: RSUs are the preferred model in large, listed companies because they are liquid, stable, and tax-efficient for employees in predictable environments.

- India: ESOPs remain the go-to strategy for startups and unicorns, offering employees high-risk, high-reward opportunities aligned with company growth and IPOs.

In conclusion, the choice between RSUs and ESOPs ultimately depends on the company’s stage and the employee’s goals: ESOPs are a high-risk, high-reward tool favored by startups and Indian unicorns to attract and retain talent, while RSUs are a lower-risk, predictable option widely used by global tech giants and listed companies. From a taxation perspective, both have clear triggers for ESOPs and vesting for RSUs with capital gains applicable at sale in both India and the US. For employees, the decision comes down to risk appetite, liquidity needs, and long-term financial planning, while for founders, it’s about balancing dilution, compliance, and retention strategy. Ultimately, understanding the differences between RSUs and ESOPs allows both employers and employees to align expectations and maximize the value of equity compensation.