Blog Content Overview

AI Summary

The Supreme Court's ruling in the Tiger Global case marks a pivotal shift in India’s tax jurisprudence, emphasizing substance over form in offshore investment structures. The judgment clarifies that Tax Residency Certificates (TRCs) are not definitive indicators of treaty protection, allowing tax authorities to investigate the genuine commercial control and decision-making processes behind these entities. Startups and founders must now ensure their structures exhibit real substance, governance design, and comprehensive documentation to avoid being treated as mere conduits for tax evasion. This ruling affects both new and existing offshore structures, signaling a rigorous review of their operational integrity. Founders are encouraged to reassess their strategies in light of these developments to ensure compliance and legitimate business practices.

Over the last couple of days, many of you would have seen headlines around the Supreme Court’s decision in the Tiger Global case. Having read the judgment closely, we felt it would be useful to share a short, practical note on what the Court has actually held and why this matters for startup founders and groups that use offshore holding or investment structures.

This note is not meant to be a legal dissection of the ruling. Instead, it is our attempt to explain, in simple terms, what has changed and what founders should be mindful of going forward.

1. The structure in brief – how Tiger Global invested in Flipkart

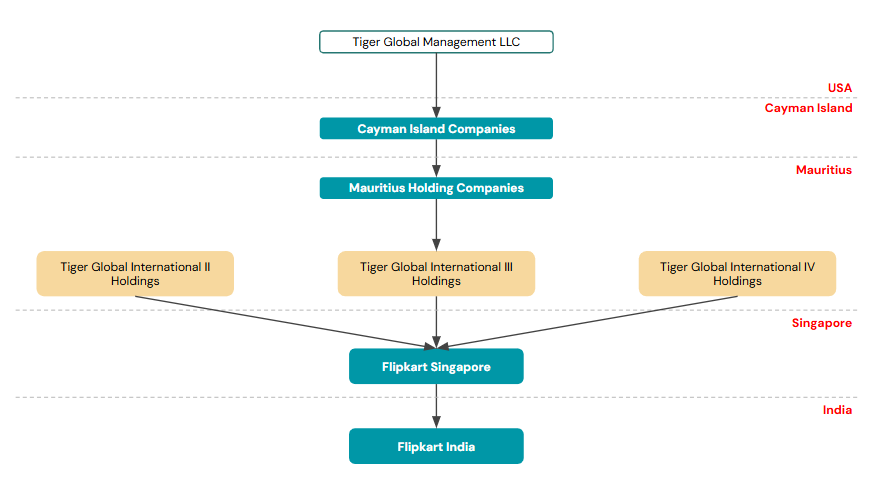

Tiger Global’s investment into Flipkart was not made directly into India. Like many global funds, the investment was routed through a multi-layer offshore structure.

In simple terms, capital was pooled through entities in Cayman and Mauritius. The Mauritius entities (Tiger Global International II, III and IV Holdings) invested into Flipkart’s Singapore holding company, which in turn held Flipkart India. The exit in 2018 happened through the sale of shares of the Singapore entity as part of Walmart’s acquisition of Flipkart.

The Mauritius entities claimed that the capital gains from this sale were not taxable in India under the India–Mauritius tax treaty, relying heavily on the fact that they held valid Tax Residency Certificates (TRCs) and that the investments were made prior to April 2017, which technically speaking, are grandfathered from General Anti Avoidance Rules (GAAR) provisions.

The tax department challenged this at the threshold itself, arguing that the structure was designed for tax avoidance and that the Mauritius entities were not entitled to invoke the treaty at all.

2. What the Supreme Court has now held

The Supreme Court has reversed the Delhi High Court’s decision and has effectively agreed with the tax department’s approach.

At the heart of the ruling are three important messages.

- First, a TRC is not a shield.

The Court has made it clear that a Tax Residency Certificate is relevant, but it is not conclusive. It is only an entry condition. Tax authorities are entitled to go behind the TRC and examine where real control lies, how decisions are taken, and whether the entity has genuine commercial substance. The days of assuming that “TRC = treaty protection” are clearly behind us. - Second, substance and control will drive outcomes.

The Court accepted the AAR’s prima facie findings that effective control and key commercial decision-making were not really in Mauritius. On that basis, it held that the Mauritius entities could be treated as conduit entities and denied treaty entitlement itself, even before going into detailed computation or merits.

In other words, the question is no longer only “where is the entity incorporated?”, but “where is its head and brain actually functioning from?”

- Third, GAAR is very much in play.

A significant part of the judgment deals with GAAR. The Court has affirmed that even if investments were originally made before 1 April 2017, arrangements that continue to yield tax benefits after that date can still be examined under GAAR. Grandfathering is not a blanket immunity. Entire structures and their ongoing tax outcomes can be tested holistically.

3. Why this ruling matters beyond Tiger Global

Although this case arises from a large global fund structure, the principles laid down are directly relevant for startup groups and founders as well.

In our reading, the judgment sends a fairly unambiguous signal: India’s courts are now far more comfortable allowing the tax department to examine offshore structures not just on paper, but on how they actually function in practice.

Treaty benefits can be denied at the starting line itself if a structure appears to be set up mainly to obtain a tax outcome without corresponding commercial and governance substance. This applies not only to new structures, but potentially also to older ones that are approaching exits, secondaries or internal reorganisations.

4. Practical takeaways for founders and management teams

From a founder and group perspective, a few clear themes emerge.

- Structures must be built around real substance, not just location.

Where are key business and investment decisions taken? Who actually controls bank accounts, exits, large transactions and strategic calls? How independent is the offshore board in practice? These questions now matter far more than before. - Governance design is as important as tax design: Board composition, approval thresholds, veto rights, and the role of offshore directors are not cosmetic anymore. They will be examined to see whether the offshore entity truly functions as a decision-making centre or merely signs what is decided elsewhere.

- Documentation will make or break outcomes.

In a GAAR-driven world, contemporaneous records, board minutes, investment rationales, control frameworks, and functional documentation will often determine whether a structure is respected or recharacterised. - Pre-2017 structures should not assume they are “safe”.

Any group with legacy offshore structures and future liquidity events should seriously consider a pre-exit review through a GAAR and treaty entitlement lens.

Closing thoughts

The Tiger Global ruling is not just about Mauritius or one fund. It reflects a broader shift: Indian tax jurisprudence is moving decisively from form-based comfort to substance-based scrutiny.

For founders, this is less about fearing offshore structures and more about building them correctly with commercial logic, credible governance, and defensible substance from day one.

At Treelife, we are already seeing increased interest from founders and investors in reviewing existing holding structures, fund-raise setups and exit pathways in light of this judgment. We will be sharing more detailed guidance as the implications of the ruling continue to evolve.

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More