Page Contents

The rapidly evolving financial landscape has placed India on the map for its forward-thinking initiatives. The International Financial Services Centre (IFSC) conceptualized by the Indian government seeks to make India a magnet for both domestic and international investment in the financial arena. Gujarat International Finance Tech-City (GIFT City) stands as a testament to this vision, being the only operational IFSC in India at present. Overseeing its operations, the International Financial Services Centre Authority (IFSCA) maintains a vigilant eye on the financial products, services, and institutions established there.

The Birth of the FinTech Framework

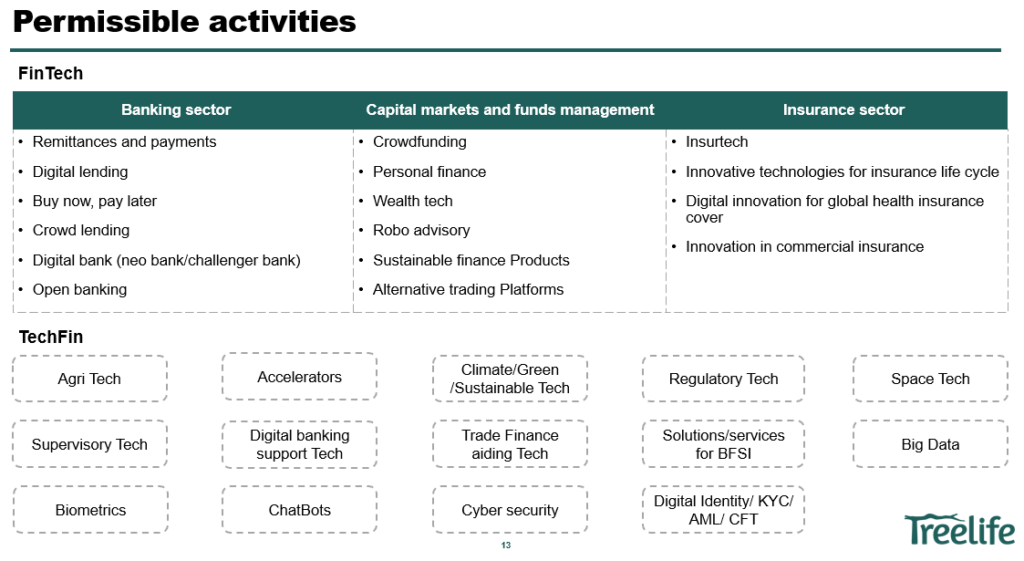

Understanding the need to encourage innovation, IFSCA on 27 April 2022 published a detailed ‘Framework for Fintech Entity in the IFSCs.’ The framework aims to boost the establishment of a world-class fintech hub at the IFSC GIFT City and encourage the promotion of financial technologies across the spectrum of banking, insurance, securities and fund management activities. The framework covers the following:

- Fintech solutions resulting in new business models, applications, processes or products in areas/activities linked to financial services regulated by the IFSCA

- Advanced/innovative technological solutions that aid and assist activities in relation to financial products, financial services and financial institutions

Entities offering innovative solutions or emerging technologies directly related to financial products and services are welcome to seek authorization under this FinTech Framework. It casts a wide net, encompassing areas such as digital lending, neo banking, crowd funding, Insure Tech, Agri tech, and even niche sectors like Defense tech.

How to register with IFSCA as a fintech entity?

The framework broadly prescribes the following two modes for fintech(s) to register with the IFSCA as a fintech entity (FE):

a. Direct entry (Authorisation by IFSCA)

The framework enables some class/categories of technology entities to obtain direct entry having:

- A deployable advanced/innovative technology solution that aids and assists activities in relation to financial products, financial services and financial institutions

- A revenue-earning track record in at least 1 of the last 3 financial years

b. Sandbox

An applicant shall be permitted to undertake one or more of the following activities under the IFSCA sandbox:

- Test fintech ideas or solutions in the IFSCA fintech regulatory sandbox

- Develop and test fintech ideas or solutions in the IFSCA fintech innovation sandbox

- Test fintech ideas or solutions in an inter-operable regulatory sandbox

- Provide fintech ideas or solutions in the overseas regulatory referral mechanism/fintech bridge offered by the IFSCA

Who can apply?

Entities from India

- An entity registered with the Department for Promotion of Industry and Internal Trade (DPIIT) as a start-up entity relating to fintech

- An entity incorporated as a company under the Companies Act 2013, as a limited liability partnership (LLP) under the Limited Liability Partnership Act, 2008, or the ‘Branch’ of an Indian company or LLP in an IFSC

- An entity working directly or indirectly in the ecosystem regulated by a domestic financial sector regulator

Entities from outside India

- An entity from the Financial Action Task Force (FATF)- compliant countries/jurisdictions

Applicant as a ‘Fintech Entity’ may do the following:

- Separately incorporate an entity in the IFSC

- Establish a branch or a subsidiary of an Indian or foreign incorporated entity in an IFSC

Innovating Within the Sandbox

A ‘Sandbox’ in the fintech context is a controlled environment where businesses can test their novel products or solutions with a limited set of real customers, for a finite duration. This system, prevalent in GIFT City, allows fintech entities to validate their innovations in the capital market, banking, insurance, and other financial spaces in an IFSC.

Fintech Regulatory Sandbox (FRS)

This is a dedicated space for fintech products/solutions, granting them a limited-use authorization. Successful participants can also avail grants from the IFSCA Fintech Incentive Scheme 2022.

Who’s eligible?

- From India:

- Start-ups registered with DPIIT focusing on Fintech.

- Entities under the Companies Act 2013, Limited Liability Partnership Act 2008, or branches in an IFSC.

- Those functioning within the domain regulated by a domestic financial sector regulator.

- From abroad:

- Entities or branches from FATF-compliant countries.

Fintech Innovation Sandbox (FIS) The FIS is an isolated environment away from the live market. Here, fintech entities can experiment with their ideas based on market-related data. A successful journey in FIS paves the way to the FRS.

Who can participate? The eligibility mirrors the criteria set for the FRS.

Inter-operable Regulatory Sandbox (IoRS)

IoRS means a testing environment for innovative hybrid financial products/services falling within the regulatory ambit of more than one domestic financial sector regulator.

The IFSCA will facilitate Indian fintech companies seeking access to foreign markets and foreign fintech companies seeking entry into India. The applications received by the authority from the domestic sector regulator(s)/coordination group of IoRS shall be subjected to the same screening process for entry into IoRS, as given under the fintech regulatory sandbox criteria of this framework.

After a successful exit from IoRS, entities must liaise with the authority and the relevant regulators to obtain necessary permissions before launching the product in the market.

Overseas Regulatory Referral Mechanism by IFSCA

This is a collaboration between the IFSCA and overseas financial regulators. It aids fintech firms that wish to operate reciprocally in each other’s territories. The terms are governed by a mutual agreement or MOU between the IFSCA and the corresponding foreign financial sector regulator(s).

Monetary Incentives for Innovators

Recognizing the potential of FinTech, IFSCA has rolled out an attractive incentive program. Depending on the category of operations, grants can amount to a substantial INR 75 lacs. This scheme caters to a variety of FinTech entities, ranging from those in the Regulatory or Innovation Sandbox to those engaged in any IFSCA-supported programs.

Refer incentive scheme blog for more details

The Upcoming Payments Revolution

Signifying its intent to further boost the FinTech sector, IFSCA has shed light on regulating payment services within the IFSC. Several payment-related projects are already underway, setting the stage for a transformative payment ecosystem.

In conclusion, GIFT City, with its innovative frameworks and conducive environment, is poised to be a global hub for FinTech innovation. With massive opportunities on the horizon, it’s a matter of time before this city becomes synonymous with financial technology excellence.

If you have more questions, reach out to our experts on 9930156000