Blog Content Overview

Background

Founded with a vision to revolutionize the hyperlocal delivery space, Zepto has rapidly grown into a major player in the quick commerce segment. With its focus on ultra-fast delivery and a robust operational model, it has carved a niche in the competitive landscape.

Now, as it gears up for an IPO in 2025, they are taking decisive steps to streamline its structure and enhance its market position.

Reverse Flip for IPO Readiness

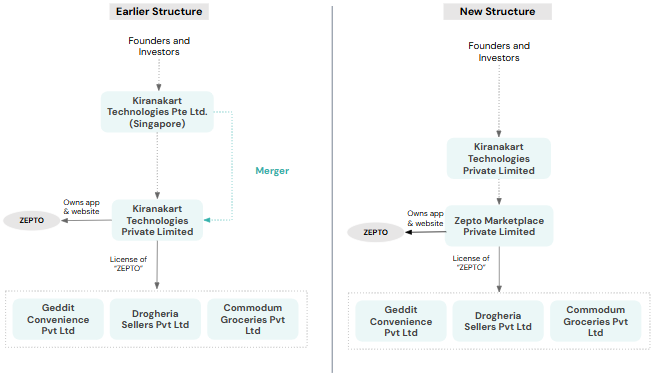

Kiranakart Technologies Pte Ltd., based in Singapore, has successfully secured approvals from the Singapore authorities1 and India’s NCLT to merge with its Indian subsidiary, Kiranakart Technologies Private Limited.

This reverse flip is a crucial step as the company gears up for its much-anticipated IPO launch in 2025.

What does it mean for investors from a tax perspective?

Singapore: It is unlikely that this merger will have any capital gains implications for the investors as Singapore doesn’t generally tax capital gains

India: The transaction is expected to be tax-neutral under Indian tax laws. The cost of acquisition and the holding period for the shares of the Singapore Hold Co. i.e. Kiranakart Technologies Pte Ltd should carry over to the shares of the merged Indian company, received pursuant to merger.

RBI approval to be obtained for this merger?

No prior RBI approval will be required for such in-bound merger as it fulfils the conditions mentioned under the Foreign Exchange Management (Cross Border Merger) Regulations 2018

Business Model Rejig: Introduction of Zepto Marketplace Private Limited

As part of its pre-IPO optimization, Zepto has restructured its business model by incorporating a wholly owned subsidiary, Zepto Marketplace Private Limited, under Kiranakart Technologies Private Limited. Key points to note here as per publicly available data2:

- Transfer of IP Ownership: The intellectual property rights for the Zepto app and website, previously owned by Kiranakart Technologies Private Limited, appear to have been transferred to Zepto Marketplace Private Limited. Consequently, Geddit Convenience Private Limited, Drogheria Sellers Private Limited, and Commodum Groceries Private Limited, which previously held licenses to the “Zepto” app and website from Kiranakart Technologies Private Limited, will now license the same through Zepto Marketplace Private Limited.

- Market Comparability: By adopting this structure, the business model aligns more closely with established players like Swiggy Instamart and Blinkit (Zomato).

These developments underscore Zepto’s commitment to streamlining its operations and solidifying its market position as it prepares to enter the public domain. The strategic nature of these moves reflects the ambition to not just compete but lead in the fast-paced world of quick commerce.

Please refer to the comparative structure outlined below for a clearer understanding.

References:

- [1] https://timesofindia.indiatimes.com/technology/tech-news/zepto-gets-singapores-approval-set-to-become-an-indian-company-with-/articleshow/116950996.cms ↩︎

- [2] https://www.moneycontrol.com/news/business/startup/zepto-streamlines-structure-ahead-of-ipo-with-new-marketplace-entity-12901986.html ↩︎

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More