Blog Content Overview

- 1 Summary

- 2 The Gensol-BluSmart Nexus: A Symbiotic but Strained Relationship

- 3 The Unravelling: Financial Distress and Deal Collapse

- 4 Regulatory Intervention: The SEBI Investigation

- 5 SEBI’s Interim Order and Immediate Consequences

- 6 Timeline of the Crisis

- 7 Operational Fallout for BluSmart

- 8 Gensol Engineering’s Stock Performance and Market Sentiment

Summary

This report provides an in-depth analysis of the complex relationship and subsequent crisis involving Gensol Engineering Ltd. (GEL), a publicly listed renewable energy and EPC, and BluSmart Mobility Pvt Ltd., a prominent electric vehicle ride-hailing service. It details their intertwined origins under common founders, the critical electric vehicle (EV) leasing arrangement that formed their operational backbone, and the sequence of events leading to Gensol’s financial distress and regulatory intervention by the Securities and Exchange Board of India (SEBI). The report outlines SEBI’s serious allegations of fund diversion, corporate governance failures, and market manipulation against Gensol’s promoters, the Jaggi brothers. It presents a comprehensive overview of the issue, its timeline, current status, and broader implications for India’s startup and EV ecosystem.

The Gensol-BluSmart Nexus: A Symbiotic but Strained Relationship

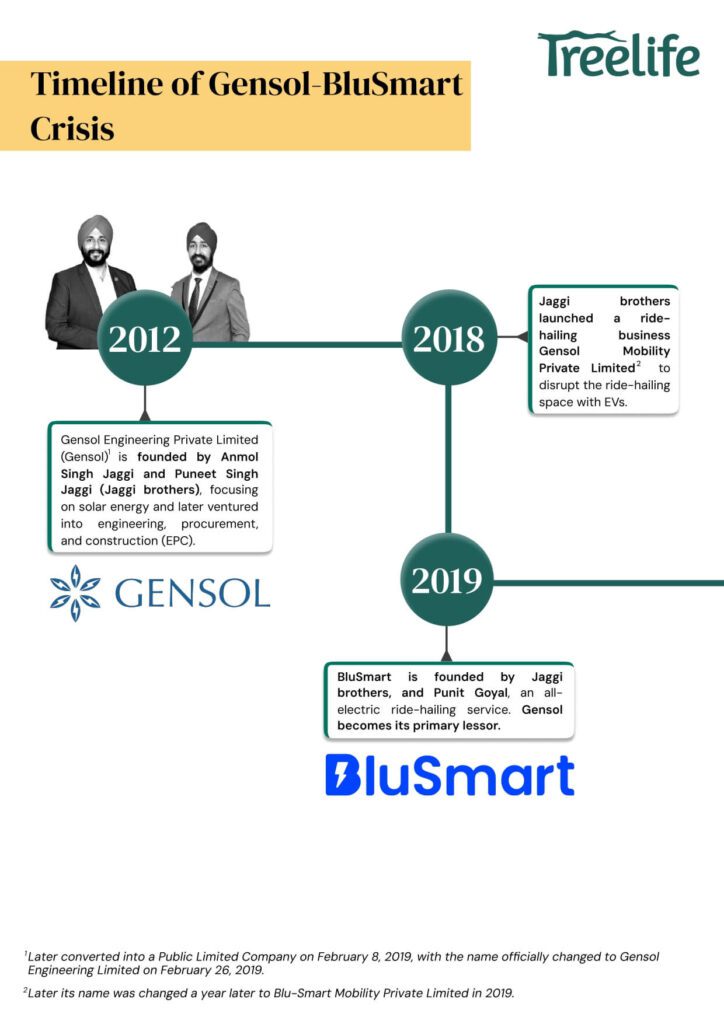

The roots of the Gensol-BluSmart relationship lie in their shared parentage. Gensol Engineering Ltd. was founded in 2012 by brothers Anmol Singh Jaggi and Puneet Singh Jaggi, initially establishing itself as an engineering, procurement, and construction (EPC) company focused on the solar energy sector1. A decade later, around 2018, the Jaggi brothers, sensing an opportunity in the nascent electric mobility space, conceived the idea for an EV-only ride-hailing service. This venture began life under the Gensol umbrella, incorporated as Gensol Mobility Private Limited in October 2018. It was rebranded as Blu-Smart Mobility Private Limited a year later, in 2019, with Punit Goyal joining the Jaggi brothers as a third co-founder.2 This shared founding established deep operational and leadership connections from the outset. Anmol Singh Jaggi served as Chairman and Managing Director of the publicly listed Gensol Engineering while simultaneously being a co-founder of the private entity BluSmart. Puneet Singh Jaggi also held promoter and director roles within Gensol alongside his co-founder status at BluSmart. Even BluSmart’s initial subsidiaries carried the Gensol branding before being renamed.

This structure inherently blurred the lines between the interests of Gensol’s public shareholders and the promoters’ significant private stake in BluSmart. Decisions within Gensol regarding resource allocation, such as EV leasing terms or direct financial support, could directly influence the valuation and success of the privately held BluSmart. This raised questions about potential conflicts of interest and the true independence of transactions between the two entities, despite claims and audits suggesting they were conducted at arm’s length. Gensol’s annual reports continued to disclose significant related-party transactions with BluSmart entities, underscoring the ongoing financial entanglement. Although BluSmart maintained that Gensol held no direct equity stake, the influence exerted by the common promoters remained substantial. This arrangement, where public company resources could potentially be leveraged to build a private enterprise benefiting the same promoters, laid the groundwork for the governance challenges later highlighted by regulatory authorities.

The EV Leasing Model: Operational and Financial Dependencies

The core operational link between Gensol and BluSmart was a large-scale EV leasing arrangement. Gensol diversified into the EV leasing business, becoming a primary financier, owner, and lessor of electric vehicles specifically for BluSmart’s ride-hailing fleet. This model was designed to allow BluSmart to scale rapidly with a relatively asset-light approach, avoiding the significant upfront capital expenditure required to purchase thousands of EVs. Gensol effectively took on the responsibility of procuring and owning the vehicles, offering them to BluSmart on a “pay-per-use” basis.

This structure, however, created profound mutual dependencies and significant financial exposure for Gensol. Media reports indicated that Gensol’s balance sheet was heavily utilized to finance BluSmart’s expansion. In the fiscal year 2024 alone, Gensol reportedly spent over Rs 500 crore in supporting BluSmart. At one point, Gensol owned more than 5,000 vehicles out of BluSmart’s total fleet of approximately 8,000, making it by far the largest fleet supplier. Consequently, BluSmart became Gensol’s single biggest customer, establishing a critical reliance where the downfall of one could significantly impact the other.

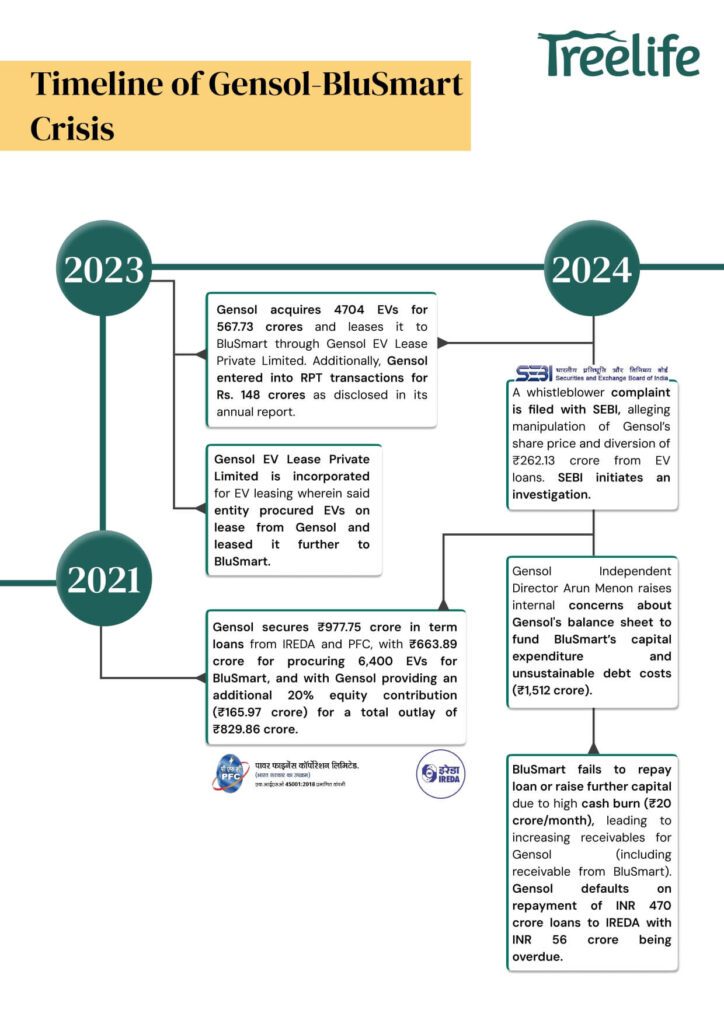

The inherent structure of this leasing model created a direct financial feedback loop. Gensol secured substantial loans, often from public financial institutions like the Indian Renewable Energy Development Agency (IREDA) and the Power Finance Corporation (PFC), specifically to purchase EVs destined for BluSmart’s fleet3. BluSmart’s operational revenue from its ride-hailing service was intended to cover the lease rental payments back to Gensol. Gensol, in turn, depended heavily on these lease payments as a primary income stream to service its own significant debt obligations incurred for the vehicle purchases. Any disruption in BluSmart’s ability to generate revenue and make timely lease payments – due to factors like high cash burn or operational challenges – would directly impede Gensol’s cash flow. This, as events later demonstrated, directly threatened Gensol’s capacity to meet its own loan repayment commitments, creating a clear pathway for financial distress to spread from the private entity (BluSmart) to the public one (Gensol).

Related Party Transactions and Early Warning Signs

The close financial relationship was explicitly documented in Gensol’s regulatory filings. The company’s annual report for FY24 disclosed substantial contracts classified as related party transactions with BluSmart entities.

Beyond the formal disclosures, signs of strain began to emerge. Reports indicated that BluSmart experienced delays in making its lease payments to Gensol, leading to a significant increase in Gensol’s receivables. This put direct pressure on Gensol’s working capital and balance sheet, as the company still needed to service the debt taken on for the EVs. Credit rating agency ICRA explicitly highlighted that delayed payments by BluSmart on its non-convertible debentures (NCDs) could adversely impact Gensol’s own financial flexibility and capital-raising ability, demonstrating the recognized contagion risk.

Internal concerns also existed prior to the public crisis. Arun Menon, who served as an independent director on Gensol’s board, later revealed in his resignation letter that he had expressed growing concern internally, as early as mid-2024, about “the leveraging of GEL balance sheet to fund the capex of other business’s” and questioned “the sustainability of servicing such high debt costs by GEL”4.

These indicators suggested that the operational interdependencies were translating into tangible financial stress and potential governance weaknesses well before the full-blown crisis erupted following regulatory intervention.

The Unravelling: Financial Distress and Deal Collapse

Gensol’s Mounting Financial Pressures (Debt, Downgrades)

By late 2024 and early 2025, Gensol Engineering was facing severe financial headwinds. The company was grappling with significant liquidity challenges and mounting debt concerns. Reports indicated that by the end of 2024, Gensol had substantial unpaid loans, including an outstanding amount of Rs 470 crore owed to IREDA5. At one stage, the company’s total debt was reported at Rs 1,146 crore, significantly exceeding its reserves of Rs 589 crore6.

This financial strain culminated in sharp credit rating downgrades in early 2025. Major rating agencies, including CARE Ratings and ICRA, downgraded Gensol’s debt instruments and bank facilities to ‘D’, signifying default or junk status. The rationale provided by the agencies pointed to critical issues: persistent delays in servicing debt obligations, as flagged by Gensol’s own lenders; significant liquidity stress within the company; and, most damagingly, allegations that Gensol had submitted falsified data and documents to mislead stakeholders. SEBI later noted that Gensol had submitted forged ‘Conduct Letters’ purportedly issued by its lenders (IREDA, PFC), which the lenders subsequently denied issuing.

The allegation of submitting forged documents represented a critical escalation beyond mere financial difficulty. While liquidity issues and defaults are serious, the act of allegedly falsifying information suggested a deliberate attempt to conceal the company’s true financial condition, severely breaching trust with lenders, investors, and regulators. This likely accelerated the crisis, triggering harsher responses than financial mismanagement alone might have provoked, contributing significantly to the subsequent regulatory actions and market collapse.

In an attempt to stabilize its finances amidst these pressures, Gensol’s board approved a Rs 600 crore fundraising plan in March 2025, comprising Rs 400 crore through Foreign Currency Convertible Bonds (FCCBs) and Rs 200 crore via warrants issued to promoters. However, this plan was soon overshadowed by further negative developments.

The Aborted Refex EV Fleet Sale: A Critical Blow

A key component of Gensol’s strategy to alleviate its debt burden was the proposed sale of a significant portion of its EV fleet. In January 2025, Gensol announced an agreement with Refex Green Mobility Limited (RGML), a subsidiary of Chennai-based Refex Industries. Under the deal, RGML would acquire 2,997 electric cars currently owned by Gensol and leased to BluSmart. Crucially, RGML was also set to take over the associated outstanding loan facility of nearly INR 315 crore from Gensol, providing immediate debt relief. The plan involved RGML continuing to lease these acquired vehicles back to BluSmart, ensuring operational continuity for the ride-hailing service.

However, this vital transaction collapsed just two months later. In late March 2025, Refex Industries announced in an exchange filing that RGML and Gensol had mutually decided not to proceed with the proposed takeover of vehicles7. The official reason cited was “evolving commitments at both ends, which would make it challenging to conclude the transaction within the originally envisaged timeline”.

The failure of the Refex deal represented a major setback for Gensol. It eliminated a critical pathway for reducing its substantial debt load at a time when the company desperately needed financial relief. Furthermore, the cancellation, particularly if driven by concerns over BluSmart’s ability to pay leases, served as a public market signal questioning the financial viability of BluSmart itself. It suggested that the perceived risk associated with BluSmart’s operations and financial health had become too significant for an external party like Refex to take on, effectively validating the concerns about the sustainability of the BluSmart model and its negative spillover effects onto Gensol. This collapse removed a crucial financial buffer and likely intensified the pressure leading to the subsequent regulatory intervention and BluSmart’s operational halt.

Regulatory Intervention: The SEBI Investigation

Trigger and Scope of the SEBI Probe

The intervention by the Securities and Exchange Board of India (SEBI) marked a critical turning point in the Gensol-BluSmart saga. The regulator initiated its examination of Gensol Engineering Ltd. after receiving a specific complaint in June 20248. The complaint alleged manipulation of Gensol’s share price and diversion of funds from the company.

As SEBI delved deeper, the scope of the investigation expanded significantly beyond the initial allegations. It came to encompass a wide range of potential irregularities, including severe corporate governance lapses, the alleged misuse and diversion of substantial loan funds procured for specific purposes (EV acquisition), questionable related-party transactions primarily involving BluSmart, and the submission of misleading disclosures or potentially forged documents to regulators, lenders, and credit rating agencies.

4.2 Allegations of Fund Diversion and Misappropriation

SEBI’s interim order detailed extensive allegations of fund diversion and misappropriation by Gensol’s promoters, Anmol Singh Jaggi and Puneet Singh Jaggi. The core of the allegations revolved around the misuse of large term loans obtained by Gensol from public financial institutions, IREDA and PFC, between 2021 and 2024, amounting to a total of Rs 977.75 crore.

A significant portion of this debt, specifically Rs 663.89 crore, was explicitly earmarked for the procurement of 6,400 electric vehicles, which were intended to be leased primarily to the related party, BluSmart Mobility. However, SEBI’s investigation, corroborated by Gensol’s own admission in February 2025 and confirmation from the EV supplier (Go-Auto Private Limited), found that only 4,704 EVs had actually been procured to date, at a total cost of Rs 567.73 crore.

Factoring in Gensol’s required 20% equity contribution towards the EV procurement, the total expected outlay for the planned 6,400 vehicles was approximately Rs 829.86 crore. Comparing this expected outlay with the actual expenditure on the 4,704 vehicles procured, SEBI calculated that approximately Rs 262.13 crore remained unaccounted for from the funds specifically designated for EV purchases. SEBI alleged that this substantial amount was systematically diverted for purposes unrelated to the loan’s sanctioned use.

The regulator traced the alleged methods of diversion, finding that funds transferred from Gensol to the EV supplier (Go-Auto) were often routed back, either directly to Gensol or through a complex web of transactions involving other related entities (such as Wellray Solar Solutions and Capbridge Ventures, linked to the promoters).

SEBI’s order provided specific details of how these allegedly diverted funds were utilized for the personal enrichment of the promoters and their families, painting a picture of corporate funds being treated as personal assets.

Summary of Alleged Fund Diversion by Gensol Promoters (Based on SEBI Findings)

| Category of Misuse | Alleged Amount / Detail | Destination/Purpose |

| Total Loans (IREDA/PFC, 2021-24) | Rs 977.75 crore | Primarily for EV procurement and other corporate purposes |

| Amount Earmarked for EVs | Rs 663.89 crore | Purchase of 6,400 EVs |

| EVs Actually Procured (Number / Value) | 4,704 units / Rs 567.73 crore | EVs supplied by Go-Auto, leased to BluSmart |

| Unaccounted / Allegedly Diverted EV Loan Funds | Approx. Rs 262.13 crore | Funds diverted from intended EV procurement |

Findings on Governance Failures and Misleading Disclosures

Beyond the specific allegations of fund diversion, SEBI’s investigation uncovered what it described as profound failures in corporate governance and internal controls within Gensol Engineering. The regulator concluded there was a “complete breakdown” of established norms, suggesting a systemic issue rather than isolated infractions. A recurring theme in SEBI’s commentary was the assertion that the promoters, Anmol and Puneet Jaggi, operated the publicly listed company as if it were their “personal piggy bank” or a “proprietary firm”9. This pointed to a fundamental disregard for the fiduciary duties owed to public shareholders and other stakeholders, where personal benefit appeared to supersede corporate integrity and financial prudence. This underlying culture of weak governance likely created the environment that enabled the alleged large-scale fund diversions to occur.

The investigation also flagged specific instances of misleading stakeholders. As mentioned earlier, SEBI accused Gensol of attempting to mislead regulators, lenders, and credit rating agencies by submitting forged or falsified documents, specifically ‘Conduct Letters’ supposedly from lenders IREDA and PFC, which the lenders later denied issuing.

Furthermore, SEBI found evidence of misleading claims made to the market. Gensol had publicly announced securing orders for 30,000 EVs, a statement that likely boosted investor confidence10. However, SEBI’s probe revealed these were merely non-binding expressions of interest, not firm contractual orders. This discrepancy was further highlighted when exchange officials visited Gensol’s purported EV manufacturing facility in Pune and found minimal operational activity, indicating a significant gap between public claims and reality.

The regulator also noted failures in adhering to listing norms regarding the disclosure and handling of related-party transactions, suggesting that even transactions with BluSmart may not have been adequately scrutinized or managed at arm’s length. SEBI observed that even funds borrowed from institutional lenders, which should have been ring-fenced for specific purposes, were redirected at the promoters’ discretion, reflecting weak internal controls.

SEBI’s Interim Order and Immediate Consequences

Key Directives: Promoter Bans, Market Restrictions, Stock Split Halt

Based on its prima facie findings of significant financial irregularities and governance failures, SEBI issued a comprehensive interim order against Gensol Engineering and its promoters on April 15, 202511. The order imposed immediate and stringent restrictions:

- Promoter Market Ban: Anmol Singh Jaggi and Puneet Singh Jaggi were immediately barred from buying, selling, or otherwise dealing in securities, either directly or indirectly, until further orders from SEBI.

- Promoter Directorship Ban: The Jaggi brothers were also restrained from holding the position of a director or any Key Managerial Personnel (KMP) in Gensol Engineering Ltd. or any other listed company, pending further orders.

- Stock Split Halted: SEBI directed Gensol to put its recently announced plan for a 1:10 stock split on hold. The regulator expressed concern that the split was likely intended to attract more retail investors to the stock at a time when serious questions about the company’s financial health and governance were emerging.

These directives effectively removed the founding promoters from operational control and market participation related to Gensol and aimed to prevent actions (like the stock split) that could potentially harm unsuspecting investors given the circumstances.

Mandate for Forensic Audit

A crucial component of SEBI’s interim order was the mandate for a comprehensive forensic audit. SEBI stated it would appoint an independent forensic auditor to conduct a thorough examination of the books of accounts of Gensol Engineering Ltd. and its related entities. The audit is expected to provide a detailed and definitive picture of the fund flows, transaction trails, and the full extent of any financial irregularities. The forensic auditor’s report is anticipated within approximately six months of their appointment.

In response to this directive, Gensol Engineering stated in mandatory stock exchange filings that the company would extend its full cooperation to the forensic auditor appointed by SEBI, pledging to provide complete access to records and information to ensure a transparent and comprehensive audit process.

Leadership Changes at Gensol (Promoter and Director Resignations)

The SEBI order triggered an immediate and significant shake-up in Gensol’s leadership. Complying with the regulatory directive, both Anmol Singh Jaggi and Puneet Singh Jaggi stepped down from their positions as directors and Key Managerial Personnel at Gensol Engineering, effectively ceasing their participation in the company’s management.

Timeline of the Crisis

The crisis involving Gensol Engineering and BluSmart Mobility unfolded over several years, escalating significantly in late 2024 and culminating in regulatory action and operational disruption in April 2025. The following table provides a chronological overview of key events:

Chronological Timeline of the Gensol-BluSmart Crisis

(Source: Compiled from various snippets detailing events and dates)

Operational Fallout for BluSmart

The repercussions of the SEBI order against Gensol and its promoters cascaded almost immediately onto BluSmart’s operations. On April 16th and 17th, 2025, just after the SEBI order became public, BluSmart abruptly suspended its electric ride-hailing services across all its operational cities: Delhi-NCR, Bengaluru, and Mumbai.

Gensol Engineering’s Stock Performance and Market Sentiment

The market reaction to Gensol Engineering’s unfolding crisis, particularly following the credit downgrades and the SEBI interim order, was swift and brutal. The company’s share price experienced a dramatic collapse on the stock exchanges.

Gensol’s stock repeatedly hit the lower circuit limit (typically 5% for stocks under surveillance), indicating intense selling pressure with no buyers at higher prices. The share price plummeted to new 52-week lows. The magnitude of the decline was severe: various reports in April 2025 indicated the stock was down over 80-85% year-to-date and had lost nearly 90% of its value compared to its all-time peak. This resulted in a significant erosion of the company’s market capitalization.

Reflecting the heightened risk perception, stock exchanges placed Gensol’s shares under the Enhanced Surveillance Mechanism (ESM) Stage 1, which involves stricter trading rules like a narrow price band and trade-for-trade settlement (requiring same-day settlement for all trades). Brokers also imposed a 100% applicable margin rate, making margin trading unavailable for the stock, further indicating perceived high risk12. Market sentiment turned overwhelmingly negative, with analysts advising investors to avoid the stock and anticipating further corrections. Investor confidence was described as having “crumbled”.

Future Outlook: The trajectory for both companies is fraught with uncertainty. Gensol faces a lengthy period of scrutiny and potential further penalties that could fundamentally alter its structure and viability. BluSmart’s path forward seems tied to integrating its fleet operations with Uber, a move that signals survival through consolidation rather than independent growth. Beyond the two companies, this crisis serves as a significant case study for the Indian startup ecosystem, likely prompting stricter governance expectations, enhanced investor due diligence, and potentially more cautious approaches to complex corporate structures involving public and private entities under common control. The long-term impact on investor confidence and regulatory frameworks within the clean energy and EV mobility sectors remains to be seen.

References:

- [1] https://www.business-standard.com/markets/gensol-engineering-ltd-share-price-74100.html ↩︎

- [2] https://www.outlookbusiness.com/planet/electric-vehicle/blusmarts-bumpy-ride-inside-anmol-jaggis-fund-diversion-gensols-crisis-potential-sell-off ↩︎

- [3] https://www.ndtv.com/india-news/anmol-singh-jaggi-puneet-singh-jaggi-gensol-blusmart-begins-shutting-operations-as-promoters-face-sebi-order-report-8184516 ↩︎

- [4] https://www.business-standard.com/companies/news/gensol-engineering-director-arun-menon-resigns-sebi-probe-jaggi-brothers-125041700368_1.html ↩︎

- [5] https://finshots.in/archive/blusmart-is-knee-deep-in-trouble-gensol/ ↩︎

- [6] https://yourstory.com/2025/03/refex-green-mobility-drops-asset-takeover-plan-gensol-blusmart ↩︎

- [7] https://www.moneycontrol.com/news/business/refex-green-withdraws-plan-to-takeover-gensol-s-3-000-evs-cites-challenges-to-conclude-deal-12978885.html ↩︎

- [8] https://www.business-standard.com/markets/capital-market-news/gensol-engg-slumps-as-sebi-unplugs-promoters-over-alleged-fraud-125041700568_1.html ↩︎

- [9] https://www.sebi.gov.in/enforcement/orders/apr-2025/interim-order-in-the-matter-of-gensol-engineering-limited_93458.html ↩︎

- [10] https://www.financialexpress.com/business/industry/blusmart-rebrands-itself-as-uber-green-in-bengaluru-report/3813471/ ↩︎

- [11] https://www.sebi.gov.in/enforcement/orders/apr-2025/interim-order-in-the-matter-of-gensol-engineering-limited_93458.html ↩︎

- [12] https://www.outlookbusiness.com/markets/sebi-action-drives-gensol-to-fresh-lows-stock-down-90-from-all-time-peak

↩︎

We Are Problem Solvers. And Take Accountability.

Related Posts

Tiger Global Ruling: Supreme Court on TRCs, Treaty Protection and Offshore Structures

Over the last couple of days, many of you would have seen headlines around the Supreme Court’s decision in the...

Learn More

Setting Up a Wholly Owned Subsidiary in India – Incorporation Guide

Setting up a wholly owned subsidiary in India has emerged as the most preferred market-entry strategy for foreign companies seeking...

Learn More

![Foreign Company Registration in India – Complete Guide [2026]](https://treelife.in/wp-content/uploads/2025/09/foreign-company-and-business-registration-in-india.webp)

Foreign Company Registration in India – Complete Guide [2026]

In 2026, India presents a highly dynamic and lucrative business environment for foreign companies. With a rapidly growing economy, diverse...

Learn More