Quick Summary

Maintaining compliance is crucial for Limited Liability Partnerships (LLPs) in India to ensure smooth operations and avoid legal penalties. Key annual obligations include filing Form 11 (Annual Return) by May 30th, detailing management affairs, and Form 8 (Statement of Account & Solvency) by October 30th, summarizing financial status. LLPs must also submit Income Tax Returns (ITR-5) by July 31st if not subject to audit, or by September 30th if an audit is required. Non-compliance can result in penalties up to ₹5 lakhs. Adhering to these compliance requirements not only avoids fines but also enhances the LLP’s credibility and legal standing.

Blog Content Overview

- 1 Introduction

- 2 What is LLP in India?

- 3 What are Compliances for LLP in India?

- 4 Importance of LLP Compliance

- 5 One-Time Mandatory Compliance for LLPs

- 6 Mandatory Compliances for LLPs in India

- 7 Compliances for Limited Liability Partnership (LLP) in India (Checklist)

- 8 Benefits of LLP Compliance

- 9 Steps to Ensure LLP Compliance

- 10 How to File LLP Compliances in India

Introduction

In today’s fast-paced business environment, choosing the right legal structure is pivotal for business owners in India. One such popular structure is the Limited Liability Partnership (LLP) which essentially functions as a hybrid of a partnership and a corporate entity. The key benefit to the LLP structure is that the business can retain the benefits of limited liability while retaining operational flexibility. Consequently, LLPs have gained immense traction among entrepreneurs and professionals for their simplicity and efficiency in operation.

However, with this flexibility comes the responsibility of maintaining LLP compliances in India, which are mandatory for safeguarding the legal standing and operational credibility of the entity. Adhering to these compliances for LLPs ensures that the LLP operates within the framework of the law, avoids hefty penalties, and maintains its goodwill among stakeholders and regulatory bodies. Failing to comply with these regulations can lead to severe repercussions, including financial penalties, legal disputes, and even the dissolution of the LLP. Therefore, understanding and adhering to LLP filing requirements and deadlines is not just a legal obligation but also a cornerstone of sustainable business management. This blog serves as a comprehensive guide to LLP annual compliance and filing requirements in India, detailing the steps, benefits, and consequences of non-compliance.

What is LLP in India?

LLPs in India are governed by the Limited Liability Partnership Act, 2008 (“LLP Act”). As defined thereunder, an LLP is a separate legal entity distinct from its partners. This means that the LLP can own assets, incur liabilities, and enter into contracts in its name, providing a level of security and independence not found in traditional partnerships. One of its hallmark features is limited liability, ensuring that the personal assets of the partners are not at risk beyond their agreed contributions to the business.

An LLP is further governed by an LLP agreement executed between the partners and filed as part of the incorporation documents to be provided to the Ministry of Corporate Affairs under the LLP Act. Accordingly, critical terms such as the extent of liability, obligations of each partner and their capital contributions to the LLP are captured therein.

Key Characteristics of an LLP

- Separate Legal Entity: An LLP has its own legal identity, distinct from its partners, allowing it to function independently.

- Limited Liability: The partners’ liabilities are limited to their contributions, offering a layer of financial protection.

- Flexibility in Management: Unlike corporations, LLPs provide greater flexibility in internal operations and decision-making processes.

- No Minimum Capital Requirement: LLPs do not mandate a minimum capital requirement, making them accessible for startups and small businesses.

How is an LLP Different from a Private Limited Company?

While both LLPs and Private Limited Companies offer limited liability protection, they differ in various ways:

- Ownership and Control: In an LLP, the partners manage the business directly, whereas in a Private Limited Company, directors manage operations on behalf of shareholders.

- Compliance Burden: LLPs have fewer compliance requirements and lower operational costs compared to Private Limited Companies.

- Tax Advantages: LLPs generally benefit from a simplified tax structure, avoiding dividend distribution tax applicable to Private Limited Companies.

Regulatory Oversight

LLPs in India fall under the purview of the Ministry of Corporate Affairs (MCA), as designated by the LLP Act. Key regulations include registration, annual filings, and periodic updates for changes in partnership structure or business operations. The Registrar of Companies (RoC) monitors compliance, ensuring that LLPs adhere to the legal framework established under the LLP Act.

By combining the best aspects of partnerships and corporations, LLPs have emerged as a favored structure for entrepreneurs seeking a balance of flexibility, liability protection, and operational efficiency.

What are Compliances for LLP in India?

Compliances for Limited Liability Partnerships (LLPs) in India refer to the set of mandatory legal, financial, and procedural obligations that LLPs must adhere to in order to maintain their legal standing and operational credibility. Governed by the Limited Liability Partnership Act, 2008, these compliances ensure that LLPs operate transparently, fulfill their tax obligations, and align with the regulations set by the Ministry of Corporate Affairs (MCA).

Importance of LLP Compliance

Maintaining compliance for a Limited Liability Partnership (LLP) is not just a legal obligation—it’s a cornerstone for ensuring the smooth operation and longevity of the business. LLP compliance encompasses all the mandatory filings and procedural requirements that safeguard the LLP’s legal standing and financial integrity.

Why Compliance is Crucial for an LLP

- Preserving Legal Status

Timely compliance is essential to uphold an LLP’s status as a legally recognized entity. Non-compliance can lead to severe consequences, such as disqualification of partners, restrictions on business activities, and even the dissolution of the LLP by regulatory authorities. - Ensuring Smooth Business Operations

Compliance helps in maintaining organized and transparent business practices. Adhering to LLP filing requirements, such as submitting financial statements and annual returns, ensures that the LLP operates within the boundaries of the law, minimizing disruptions. - Avoiding Penalties and Legal Complications

Non-compliance with mandatory LLP requirements can result in hefty penalties, with additional penalty levied on a per day basis for any delays/contraventions that are not rectified. Additionally, prolonged non-compliance can escalate into legal complications, tarnishing the LLP’s reputation and creating obstacles for future business dealings. It is crucial to note that the ROC through the LLP Act, is empowered to strike off LLPs that are deemed to be defunct or not carrying on operations in accordance with the LLP Act.

The Role of Timely Filings

- Maintaining Transparency

Filing annual returns (Form 11) and financial statements (Form 8) on time fosters transparency in financial and operational activities. This builds trust among stakeholders, clients, and regulatory bodies. - Enhancing Credibility

A compliant LLP is viewed as reliable and trustworthy, which can be a critical factor when securing investments, loans, or partnerships. Timely compliance reflects professionalism and adherence to business ethics. - Tax Benefits

Compliance also plays a significant role in tax planning and benefits. Filing accurate income tax returns on time helps avoid interest, penalties, and scrutiny from tax authorities. LLPs that adhere to tax filing requirements can also access incentives and deductions applicable to compliant businesses.

One-Time Mandatory Compliance for LLPs

When establishing a Limited Liability Partnership (LLP) in India, there are specific one-time compliance requirements that ensure a strong legal and operational foundation. These steps must be completed immediately after incorporation to maintain transparency and align with regulatory expectations.

1. LLP Form-3: Filing the LLP Agreement

The LLP Agreement serves as the governing document for the partnership, outlining the roles, responsibilities, and operational rules for the partners. As per the Limited Liability Partnership Act, 2008, this agreement must be filed using Form-3 with the Registrar of Companies (ROC) within 30 days of incorporation.

- Why it’s important: Filing the LLP Agreement ensures clarity in the partnership’s functioning and establishes legal protections for all partners.

- Failure to file: Delays in filing Form-3 attract penalties, which can escalate daily until the agreement is submitted.

2. Opening a Current Bank Account

To streamline financial transactions and maintain accountability, every LLP must open a current bank account in its name with a recognized bank in India.

- Purpose: This account is essential for conducting all business-related financial activities, from payments to receipts.

- Transparency in operations: Using a dedicated LLP bank account ensures clear separation of personal and business transactions, reducing the risk of financial discrepancies.

3. Obtaining PAN and TAN Numbers

Each LLP must obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

- Ease of compliance: With the introduction of the LLP (Second Amendment) Rules, 2022, PAN and TAN numbers are now automatically generated and issued alongside the Certificate of Incorporation, simplifying this step.

- Purpose of PAN and TAN: PAN is required for income tax filings, while TAN is mandatory for deducting and remitting tax at source (TDS) when applicable.

4. GST Registration (If Applicable)

While not mandatory at the time of incorporation, an LLP must obtain GST registration if its annual turnover exceeds ₹40 lakhs (or ₹20 lakhs for service providers).

- When to register: LLPs can register under the Goods and Services Tax (GST) Act as soon as their turnover threshold is crossed.

- Benefits of GST compliance: Timely GST registration allows LLPs to claim input tax credits and ensures they comply with tax collection and remittance requirements.

Mandatory Compliances for LLPs in India

For Limited Liability Partnerships (LLPs) in India, adhering to mandatory compliance requirements is crucial for maintaining their legal standing and ensuring smooth operations. These obligations, governed by the Limited Liability Partnership Act, 2008, apply to all LLPs, irrespective of their business activity or scale. Below is a comprehensive list of the mandatory filings and compliance requirements that every LLP must meet.

1. Annual Return Filing (Form 11)

Every LLP must file Form 11 annually, even if it has not conducted any business during the year.

- What it includes: Form 11 provides a summary of the LLP’s management affairs, including details about its partners.

- Deadline: This form must be filed by May 30th each year.

- Penalty for non-compliance: Failing to file Form 11 on time results in a fine of ₹100 per day until compliance is achieved.

2. Statement of Accounts and Solvency (Form 8)

Form 8 is a critical compliance requirement, documenting the LLP’s financial performance and solvency status.

- What it includes: It covers profit-and-loss statements, balance sheets, and a declaration of solvency.

- Audit requirement: LLPs with a turnover exceeding ₹40 lakhs or a contribution exceeding ₹25 lakhs must get their accounts audited by a Chartered Accountant (CA).

- Deadline: Form 8 must be filed within 30 days from the end of six months of the financial year, i.e., by October 30th.

- Penalty for non-compliance: Missing the deadline incurs a penalty of ₹100 per day, which continues until the filing is completed.

3. Income Tax Filing (ITR-5)

Filing Income Tax Returns (ITR-5) is mandatory for all LLPs, with deadlines varying based on the need for a tax audit.

- Deadline for non-audited LLPs: LLPs not requiring a tax audit must file their ITR by July 31st.

- Deadline for audited LLPs: LLPs requiring an audit must complete their ITR filing by September 30th after the audit is performed by a practicing CA.

- Special cases: LLPs engaged in international or specified domestic transactions must file Form 3CEB and complete their tax filing by November 30th.

4. Other Miscellaneous Compliances

In addition to the major filings, LLPs must meet several routine compliance requirements, including:

- Director Identification Number (DIN) Updates: Ensuring that DINs of all designated partners remain active and updated.

- Event-Based Filings: Filing relevant forms with the Ministry of Corporate Affairs (MCA) for changes such as partner additions or exits, amendments to the LLP agreement, or changes in contributions.

- Maintenance of Statutory Records: LLPs must maintain accurate and updated records of financial transactions, partner details, and minutes of meetings.

Compliances for Limited Liability Partnership (LLP) in India (Checklist)

| Compliance Requirement | Form Associated | Deadline | Frequency | Penalties for Non- Compliance | Other Remarks |

|---|---|---|---|---|---|

| Annual Return Filing | Form 11 | May 30th every year | Annual | ₹100 per day until compliance | Mandatory for all LLPs, irrespective of business activity. Provides a summary of LLP’s management affairs. |

| Statement of Accounts and Solvency | Form 8 | October 30th every year | Annual | ₹100 per day until compliance | Must include profit-and-loss statements and balance sheets. Audit required for LLPs with turnover > ₹40 lakhs or contribution > ₹25 lakhs. |

| Income Tax Filing | ITR-5 | July 31st (non-audited LLPs) | Annual | Interest on due tax, penalties, and legal consequences for non-filing | Tax-audited LLPs must file by September 30th. LLPs with international/domestic transactions must file Form 3CEB and complete filing by November 30th. |

| LLP Agreement Filing | Form-3 | Within 30 days of incorporation | One-Time | ₹100 per day until compliance | Filing the LLP Agreement ensures clarity in roles, responsibilities, and rules of operation. |

| GST Registration | GST Registration Form | Upon reaching turnover threshold of ₹40L/₹20L | Event-Based | Penalty of 10% of the tax amount due (minimum ₹10,000) | Not mandatory at incorporation. Registration is required when annual turnover exceeds ₹40 lakhs (₹20 lakhs for service providers). |

| DIN Updates | NA | As required | Event-Based | NA | Ensure Director Identification Numbers (DINs) are active and updated for all designated partners. |

| Event-Based Filings | Various MCA Forms | Within the prescribed timeline | Event-Based | ₹100 per day until compliance | Applies to changes in LLP agreement, partner details, or contributions. |

| Form 3CEB Filing | Form 3CEB | November 30th (if applicable) | Annual (if applicable) | Penalties and scrutiny by tax authorities | Mandatory for LLPs engaged in international or specific domestic transactions. |

Key Insights:

- Timeliness is critical: Most filings have daily penalties for delays, so adhering to deadlines is crucial to avoid unnecessary financial burdens.

- Audit requirements: LLPs with higher turnover or contributions must have their accounts audited by a Chartered Accountant.

- Professional assistance recommended: Engaging a CA or compliance expert, like Treelife can help LLPs stay on top of all legal and tax obligations.

Benefits of LLP Compliance

Timely compliance with regulatory requirements offers several advantages for an LLP:

- Legal Protection: Compliance helps maintain the limited liability status of partners, ensuring the business remains a separate legal entity and protecting personal assets.

- Credibility: Meeting filing deadlines boosts the credibility of the LLP with clients, investors, and regulatory bodies, enhancing trust and reputation.

- Avoiding Penalties: Adhering to compliance prevents costly fines, interest charges, and legal consequences, helping avoid disruptions to business operations.

- Tax Benefits: Timely filing of income tax returns and maintaining proper records can provide tax advantages, including deductions and exemptions, reducing the business’s tax liability.

Steps to Ensure LLP Compliance

To maintain a compliant LLP, following a structured approach is crucial. Here’s an LLP compliance safety checklist to help your business stay on track:

- Regular Bookkeeping: Accurate financial record-keeping is essential. Even if no business activity occurs, LLPs must maintain detailed books throughout the year. This ensures readiness for filings and audits, and helps avoid penalties for non-compliance.

- Set Reminders for Filing Deadlines: It’s important to establish a system to track key filing dates. Use calendar alerts or professional services to ensure timely submission of required returns and documents to avoid delays and fines.

- Engage Professionals: Consult with a Chartered Accountant (CA) or compliance expert to manage filings, audits, and overall compliance. Professionals can guide you through complex regulatory requirements, ensuring that your LLP adheres to all legal obligations.

- Stay Updated: Regularly update your LLP’s forms with the Ministry of Corporate Affairs (MCA) whenever there are changes in partners, capital contributions, or corporate structure. Timely updates prevent issues with legal filings and keep your records accurate.

By following these steps to ensure LLP compliance, you can avoid legal pitfalls and maintain smooth business operations.

How to File LLP Compliances in India

Filing LLP compliances in India involves several important steps to ensure your business adheres to regulatory requirements. Here’s a guide on how to file LLP returns and the LLP compliance filing process:

- Filing the Statement of Accounts & Solvency (Form 8):

To file Form 8 online on the Ministry of Corporate Affairs (MCA) portal, follow these steps:- Login to the MCA portal (https://www.mca.gov.in/content/mca/global/en/home.html) using your credentials.

- Navigate to the ‘e-Forms’ section and select Form 8.

- Fill in details like LLP’s financial status, assets, liabilities, and solvency.

- Attach the certification from a practicing Chartered Accountant (CA) confirming the accuracy of the details.

- Submit the form and pay the filing fees.

This form must be filed annually to confirm the financial health of the LLP.

- Filing Annual Return (Form 11):

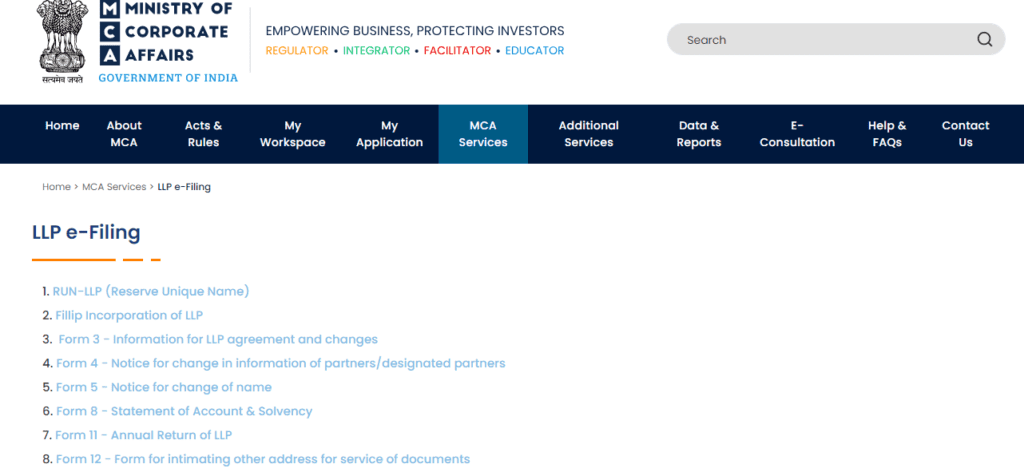

To file Form 11, follow these steps:- Log in to the MCA portal (https://www.mca.gov.in/content/mca/global/en/mca/llp-e-filling.html).

- Select Form 11 under the ‘e-Forms’ section.

- Fill in details about the LLP’s registered office, partners, and capital contributions.

- Submit the form along with the prescribed fees. This form provides the government with an annual update on the LLP’s operational status and structure.

- Income Tax Filing (ITR-5):

For filing income tax returns for an LLP, follow these steps:- Prepare the financial records and details for ITR-5, which is specifically designed for LLPs.

- Ensure that the LLP’s digital signature is ready for filing.

- Visit the Income Tax Department’s e-filing portal and log in.

- Choose ITR-5 from the available forms and fill in the necessary details.

- Submit the return after ensuring all the required information is accurately entered.

LLPs must file their tax returns by the due date to avoid penalties.

- Form 3CEB Filing:

If your LLP is involved in international or domestic transactions subject to transfer pricing regulations, you may need to file Form 3CEB. To file this form:- Engage a CA to certify the transfer pricing report.

- Prepare the form by providing details on the transactions with related parties.

- Submit the form through the MCA portal as part of your compliance.

LLP e-filing streamlines these processes, making it easier for businesses to stay compliant. By following these steps and filing the necessary forms, you ensure that your LLP remains in good standing with regulatory authorities in India.

Filing and Audit Requirements Under the Income Tax Act

Understanding the filing requirements for LLPs under the Income Tax Act is crucial for maintaining compliance and avoiding penalties. Here’s a breakdown of key LLP tax audit and filing requirements:

- Audit Requirements for LLPs:

According to the LLP Act, 2008, any LLP with a turnover exceeding Rs. 40 lakhs or capital contributions exceeding Rs. 25 lakhs is required to have its books audited. The audit must be conducted by a qualified Chartered Accountant (CA) to ensure financial transparency and compliance with statutory regulations. - Income Tax Filing Deadlines:

LLPs must adhere to specific deadlines for filing income tax returns:- For audited LLPs, the filing deadline is September 30th of the assessment year.

- For non-audited LLPs, the deadline is July 31st.

Filing after these dates can result in penalties and interest charges, so it’s essential to keep track of these important dates.

- Tax Audit Threshold:

The threshold for a tax audit under the Income Tax Act has changed in recent years. Starting from the financial year 2020-21, the limit has increased from Rs. 1 crore to Rs. 5 crore for LLPs with cash receipts and payments exceeding the specified limit. This change means that LLPs with a turnover of Rs. 5 crore or less may not require a tax audit, provided their cash transactions remain within the prescribed limits. - Form 3CEB Filing:

If your LLP engages in specified transactions (such as international or domestic transactions involving related parties), you are required to file Form 3CEB. This form, certified by a Chartered Accountant, provides details on the transfer pricing policies and transactions. It must be filed along with the income tax return.

Wrapping things up, LLP compliance in India is essential for ensuring smooth business operations and legal protection. By adhering to the required compliances, such as filing annual returns, maintaining proper financial records, and conducting audits, an LLP can enjoy significant benefits, including legal protection, increased credibility, and tax advantages. Timely compliance also helps avoid penalties and legal consequences that could disrupt business growth. Understanding the LLP compliance checklist and meeting the necessary filing deadlines is crucial for maintaining regulatory adherence and safeguarding your business’s future in India.

FAQs on Compliances for Limited Liability Partnership in India

-

What are the key compliances for LLP in India?

Key compliances for LLPs in India include filing the annual return (Form 11), submitting the Statement of Accounts & Solvency (Form 8), income tax filings (ITR-5), and conducting an annual audit if required.

-

What are the benefits of LLP compliance in India?

LLP compliance offers several benefits, including legal protection for partners, enhanced credibility with clients and investors, tax advantages, and the avoidance of penalties and legal issues.

-

What are the penalties for non-compliance by an LLP in India?

Non-compliance with LLP regulations can result in penalties, fines, interest charges, or legal consequences, which can harm the business’s reputation and disrupt operations.

-

How do I ensure timely compliance for my LLP in India?

To ensure timely compliance, maintain regular bookkeeping, set reminders for filing deadlines, consult professionals like Chartered Accountants (CAs), and stay updated with regulatory changes from the Ministry of Corporate Affairs (MCA).

-

What is the tax audit threshold for an LLP in India?

The tax audit threshold for LLPs under the Income Tax Act has been increased from Rs. 1 crore to Rs. 5 crore for financial transactions involving cash receipts and payments, starting from FY 2020-21.

-

What forms are required for LLP compliance in India?

Essential forms for LLP compliance include Form 11 (Annual Return), Form 8 (Statement of Accounts & Solvency), Form 3CEB (for transfer pricing), and ITR-5 (Income Tax Return).

-

How do I file LLP returns in India?

LLP returns in India can be filed online through the Ministry of Corporate Affairs (MCA) portal. The process includes submitting Form 11 (Annual Return), Form 8 (Statement of Accounts & Solvency), and ITR-5 (Income Tax Return) with the necessary certifications, such as from a Chartered Accountant (CA).

-

What is the deadline for filing LLP compliance documents in India?

The deadline for filing LLP compliance documents varies: Form 11 (Annual Return) must be filed by May 30th, Form 8 (Statement of Accounts & Solvency) by October 30th, and income tax returns (ITR-5) by July 31st for non-audited LLPs and September 30th for audited LLPs.

We Are Problem Solvers. And Take Accountability.

Related Posts

Memorandum of Association – MoA Clauses, Format & Types

The Memorandum of Association (MOA) is one of the most essential documents in the company incorporation process, forming the foundation...

Learn More

POSH Compliance Checklist in India – Complete Guide

The POSH Act, formally known as the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013, is...

Learn More

ESOP Taxation in India – A Complete Guide (2025)

Employee Stock Option Plans (ESOPs) have become an essential tool for businesses, especially startups and growth-stage companies, to attract, retain,...

Learn More