Blog Content Overview

In the start-up ecosystem, equity distribution is a crucial aspect of wealth creation and value generation. With such importance on the valuation aspect, stakeholders are continuously looking for varied structures to define equity distribution of the company. As such, founders must strike a balance between controlling costs and distributing equity. Although equity distribution has no fixed principles, industry practices offer some broad structures that founders can follow. This post answers frequently asked questions about equity dilution, which is one of the most critical aspects of a start-up.

What is dilution of equity?

Equity dilution means the reduction of a shareholder’s percentage of ownership in the company as new shareholders are added. Consider a company as a piece of land where two shareholders or founders share the land. Then you bring on board an advisor and an ESOP pool is also created.,the founders will have to share the same land with them, reducing the founders’ percentage of ownership. When new investors come in, they will have to share the same land too. The same principle applies to a company, as new shareholders come in, the founders’ share in the company gets reduced. The reduction of your space/ percentage of shareholding as a shareholder is termed as dilution of equity.

What is primary sale vs. secondary sale?

This question often comes across that founders are skeptical about giving away their shares when anyone wants a piece of the company. To address this issue, it’s important to understand two primary concepts – primary and secondary sale.

Primary Sale – Primary sale happens when an investor invests money in a company and seeks new shares to be allotted from the company. In primary investment, everyone gets diluted in proportion to their shareholding unless special conditions are mentioned.

Secondary Sale – Secondary sale, on the other hand, occurs when the investor is looking to buy already existing shares of the founder or any other existing shareholders by paying money directly to them. There is no dilution or change in the share of other parties, except the buyer and seller.

How does it work?

Every company has 100% shares, and the number of shares can be increased based on the ratio to post-investment.

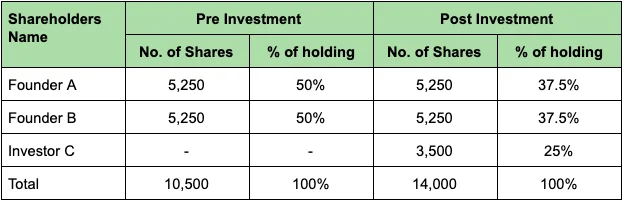

For example, if two founders (founder A and B) hold 5,250 shares each with a 50% controlling interest in the company, and an investor comes in with an investment of $1 million considering the pre-money valuation of $3 million, the number of shares will increase based on the ratio to post-investment. In this case, 25% (1Mn/4Mn). The post-investment round will dilute the holding of the founders, reducing their controlling interest from the original hold.

How much to dilute?

The amount of dilution depends on the stage of the business and other factors. Too much dilution can be a concern for future incoming investors, while too little is concerning to investors as they should have skin in the game. The ultimate goal is to grow the business, so even if the dilution numbers are skewed from the expected dilution, the growth of the business is the primary concern.

Pre-money vs. post-money Valuation

Pre-money valuation is the value of the company before it receives the investment amount, while Post-money valuation is the value of the company after it receives the investment amount. Investors offer equity based on pre-money valuation, but the percentage sought is based on the post-money valuation.

Post Money Valuation = Pre Money Valuation + Investment Amount

In conclusion, understanding equity dilution and the cap table is a pertinent metric of fundraising and talking to investors. We often see founders neglect it due to a lack of clarity of these concepts. A grasp on these concepts enables the founder to have better control of the shareholding.

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More