Blog Content Overview

- 1 Executive Summary

- 2 What Are Net Payment Terms?

- 3 What Are Net 30, Net 60, and Net 90 Payment Terms?

- 4 Key Benefits of Net 30/60/90 Payment Terms

- 5 1. The Real Problem: Payment Terms Are a Strategy Decision, Not a Collections Task

- 6 2. The Framework: Who Gets Net 30, Net 60, or Net 90

- 7 3. Policy Design That Sales Teams Can Live With

- 8 4. The Data Behind the Decision

- 9 DSO Sensitivity to Cash Tied Up

- 10 5. Implementation Plan: 30–60 Days to a Functioning Policy

- 11 6. Four India Scenarios – Terms in Practice

- 12 7. Failure Modes and Controls

- 13 8. How Treelife Implements This: Diagnostic to Ongoing Review

For Indian founders, CFOs, and Finance heads at Growth-stage B2B businesses.

Sectors: SaaS | Services | Manufacturing | Wholesale Distribution

Executive Summary

Most Indian B2B businesses are unknowingly financing their customers. They offer Net 60 or Net 90 terms to close deals, let exceptions pile up without scrutiny, and then wonder why the bank balance is tight despite strong revenue. The problem is not the customers it is the absence of a payment terms strategy.

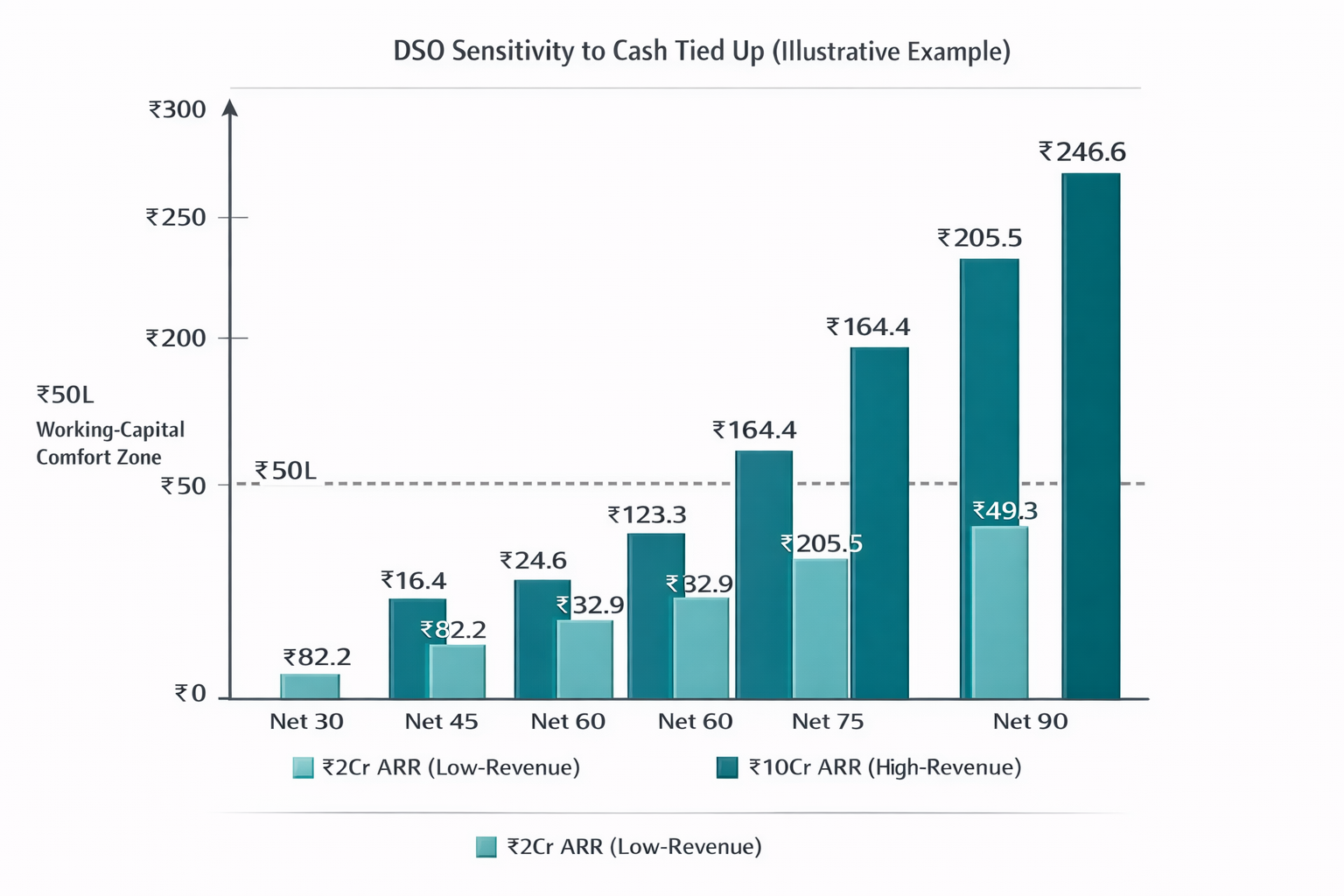

This report makes the case that payment terms are a capital allocation decision. Every additional 30 days of DSO traps meaningful cash in receivables. A ₹10Cr ARR business moving from Net 30 to Net 90 locks up approximately ₹1.6Cr extra at a financing cost of roughly ₹19L per year if you are servicing an overdraft. That cost is invisible on the P&L but very visible on your cash flow.

The report covers four things a growth-stage business needs to get right: a risk-based segmentation framework to decide who deserves which terms; a policy design that sales teams will actually follow, including exception governance and GST invoice hygiene standards; a 30–60 day implementation plan with a collections cadence and dispute management protocol; and the failure modes that cause even well-designed policies to quietly collapse. Four India-specific scenarios SaaS, manufacturing/dealer network, professional services, and PSU wholesale show how the framework applies in practice.

The businesses that manage this well do not just collect faster. They reduce bad debt, improve fundraising readiness, and gain optionality on working capital financing because their AR book is clean enough to pledge or discount at favourable rates.

What Are Net Payment Terms?

Net payment terms are predefined credit conditions that specify the number of days a buyer has to pay an invoice after it is issued. In B2B transactions, these terms function as short-term trade credit extended by the supplier to the buyer.

Unlike advance payments or cash-on-delivery models, net terms allow buyers to receive goods or services first and pay later within an agreed timeframe. This structure supports commercial flexibility while maintaining formal payment discipline. In the B2B ecosystem, net terms are a foundational element of procurement contracts, vendor agreements, and enterprise supply chains.

What Are Net 30, Net 60, and Net 90 Payment Terms?

The numbers attached to “Net” indicate the number of calendar days within which payment must be made from the invoice date.

Net 30

Payment is due within 30 calendar days from the invoice date.

If an invoice is raised on 1 April, payment is expected by 30 April.

Net 60

Payment is due within 60 calendar days.

An invoice dated 1 April would be payable by 31 May.

Net 90

Payment is due within 90 calendar days.

An invoice issued on 1 April would be due by 30 June.

These standardized credit terms are widely used across industries such as:

- Manufacturing and industrial supply chains

- FMCG distribution networks

- Infrastructure and EPC projects

- IT services and SaaS companies

- Wholesale trade and enterprise procurement

They act as structured trade credit arrangements between suppliers and buyers, enabling smoother commercial operations without immediate cash exchange.

Key Benefits of Net 30/60/90 Payment Terms

Well-structured net payment terms deliver strategic advantages for Indian B2B finance leaders by balancing growth with financial discipline.

- Stronger customer acquisition and retention – Flexible credit terms reduce upfront payment pressure and encourage long-term B2B partnerships.

- Competitive advantage in enterprise deals – Extended payment windows act as a non-price differentiator in competitive Indian markets.

- Optimized working capital management – Buyers gain liquidity flexibility, while suppliers maintain predictable receivables with disciplined Net 30 cycles.

- Improved financial visibility and forecasting – Clear timelines enhance tracking of cash inflows, receivable aging, collections, and credit exposure.

- Scalable growth enablement – Standardized Net 30/60/90 structures align with enterprise procurement norms, supporting operational scalability.

1. The Real Problem: Payment Terms Are a Strategy Decision, Not a Collections Task

Most Indian B2B businesses discover their payment terms are a problem when the bank balance dips unexpectedly and collections start chasing seven different customers simultaneously. By that point, the policy is already costing them money. The phrasing ‘we’ll sort it out after the deal closes’ has become embedded culture and it is expensive culture.

Payment terms are not a collections instrument. They are a working capital strategy decision with direct implications for your Days Sales Outstanding (DSO), Cash Conversion Cycle (CCC), fundraising readiness, and the effective cost of your business. The CFO who treats them as an afterthought is implicitly subsidising customers with cheap capital their customers’ working capital, funded from their own balance sheet.

The DSO and CCC Connection

Two formulas matter here. Commit them to memory – or at least to your monthly dashboard.

| DSO = (Total Receivables ÷ Total Revenue) × Number of Days A DSO of 75 on Net 45 terms means customers are taking 30 extra days on average. That gap is your enforcement problem or your policy problem. | CCC = DIO + DSO – DPO(Days Inventory Outstanding + Days Sales Outstanding – Days Payable Outstanding). Every day of DSO reduction compresses CCC meaning faster cash recycling and lower dependence on external credit. |

For service businesses with minimal inventory, DSO is essentially CCC. A 30-day DSO reduction at ₹10Cr ARR frees approximately ₹82L in cash – cash that otherwise sits with customers earning returns in their treasury while you service your OD account at 11–13%.

| Critical Insight: DSO is your single most actionable working capital metric. Before you discuss payment terms with any customer, know your current DSO per customer segment. Most finance heads discover they have never calculated it at the account level. |

Why This is Important for Fundraising

Investors, whether PE, venture debt, or institutional lenders use your DSO and receivables aging as a direct proxy for business quality. A company presenting for Series A or a working capital line with 25% of AR in the 90+ days bucket will face sharper questions, higher interest rates, or reduced limits. Receivables quality is also a due diligence point in M&A and secondary transactions. The discipline you impose on payment terms today shapes your valuation narrative tomorrow.

Additionally, many NBFCs and banks offering invoice discounting or factoring in India price their rates based on aging quality. Businesses with clean AR mostly current, low overdue access capital at 9–11% versus 14–18% for those with messy books. The spread is significant at any meaningful scale.

2. The Framework: Who Gets Net 30, Net 60, or Net 90

The single most common mistake is setting payment terms based on what the customer asks for – or what sales believes will close the deal. The correct approach is a risk-adjusted segmentation framework that balances revenue importance, credit quality, margin profile, and tenure. Once built, this framework does two things: it removes the subjectivity that sales teams exploit, and it gives finance a defensible basis for pushback.

The Four-Axis Segmentation Model

Assign every customer (or customer segment) along four axes before deciding on terms:

- Revenue Importance: What is the account’s annual contribution, and how concentrated is your revenue? A customer representing 20%+ of revenue may deserve operational flexibility but that concentration itself is a risk you should be managing, not rewarding with loose terms.

- Payment History: The cleanest predictor of future behaviour. A customer who has consistently paid within terms, even if they occasionally request extensions, is fundamentally different from one who treats 90-day terms as a 120-day starting point.

- Gross Margin on the Account: Net 60 terms cost you the time-value of money. If a customer is a 12% gross margin account, that carrying cost is a meaningful chunk of your profit. High-margin accounts can justify extended terms; low-margin accounts cannot, the math simply does not work.

- Customer Tenure and Relationship Depth: New customers default to conservative terms. This is not about distrust; it is about data. You have no payment behaviour to evaluate. Tenure earns trust incrementally.

Customer Segmentation Scorecard – Payment Terms Eligibility

Ready-to-use template. Score each customer. Total score determines maximum terms tier.

| Criterion | Score 1 | Score 2 | Score 3 | Score 4 | Score 5 | Weight |

| Annual Revenue with You (₹) | <5L | 5–20L | 20–75L | 75L–2Cr | >2Cr | 25% |

| Payment History (last 12M) | 3+ late>60d | 2 late>60d | 1 late>30d | Occasional delay | Always on time | 30% |

| Customer Tenure | New (<3M) | 3–6M | 6–12M | 1–3 yrs | >3 yrs | 15% |

| Creditworthiness / CIBIL / References | Unknown | Poor (<650) | Fair (650–700) | Good (700–750) | Excellent (>750) | 20% |

| Gross Margin on Account | <10% | 10–20% | 20–35% | 35–50% | >50% | 10% |

| Scoring Key: Weighted score 1–2.4 → Net 30 max | 2.5–3.4 → Net 60 max | 3.5+ → Net 90 eligible (with CFO sign-off) | ||||||

New customers default to Net 30 regardless of score. All Net 90 approvals require CFO countersignature and quarterly review. Score resets trigger automatic downgrade to lower tier on next renewal.

The MSME Buyer Reality in India

A specific India consideration: if your buyers include MSME-registered entities, you are legally subject to MSMED Act provisions that cap payment timelines at 45 days (or as agreed, not exceeding 45 days) for MSME suppliers. However, if you are the MSME supplier being paid by a large enterprise buyer, the same law protects you and the MSME Samadhaan portal offers a dispute resolution mechanism. Know which side of this equation you sit on for each relationship.

For wholesale and manufacturing businesses, PO-to-GRN (Goods Receipt Note) timelines also affect effective payment days. An invoice dated at dispatch, where GRN is only signed 7–12 days later, effectively means your Net 45 is functioning as Net 33. Build GRN timelines into your terms negotiation, not just the payment days.

| India-Specific Watch Point: Standard practice for enterprise buyers in India: their payment terms run from the date of GRN acceptance, not invoice date. If you are invoicing on dispatch and they are counting from GRN, negotiate the GRN SLA explicitly – or your ‘Net 45’ is actually Net 55+. |

Margin vs Terms: The Hard Trade-off

The cleanest decision rule: if your gross margin on an account does not comfortably absorb the financing cost of extended terms, you should not offer them without a compensatory adjustment, either a price increase, an early payment discount, or a security deposit. A 15% gross margin account on Net 90 terms, financed at 12% COD, means your effective margin is approximately 11%. Offer that account Net 90 routinely and you may be serving a relationship at near-zero economic value.

3. Policy Design That Sales Teams Can Live With

Payment terms policy fails when it is either too rigid (sales works around it) or too vague (everyone makes exceptions). The design goal is a policy that is specific enough to enforce, flexible enough to accommodate genuine strategic accounts, and governed enough to prevent exception creep.

The Policy Architecture

A functional payment terms policy has five components:

- Default Terms by Segment: Published, clear, non-negotiable starting position for each customer tier. Example: new customers get Net 30 regardless of size. SMB accounts get Net 30 as standard. Mid-market gets Net 45. Enterprise accounts with 2+ year tenure and clean history may qualify for Net 60.

- Approval Tiers for Exceptions: Net 30 extensions up to Net 45 – Account Manager with Finance Ops sign-off. Net 60 – Finance Head approval required. Net 90 – CFO countersignature and documented business case. No exceptions beyond Net 90 without board-level disclosure.

- Expiry and Review: All exception approvals expire at contract renewal or after 12 months, whichever is earlier. The burden of re-approval lies with sales, not finance. Terms approved once do not auto-renew.

- Credit Limits: Every account with extended terms must have a defined credit exposure limit. Breach of credit limit triggers automatic hold on new orders/deliveries regardless of relationship history. Finance sets limits; sales cannot override.

- Early Payment Incentives: Offer a 1–2% discount for payment within 7–10 days on accounts that are margin-healthy. This converts a concession (extended terms) into an active lever. Document it clearly in the invoice and contract.

The GST Invoice Hygiene Requirement

In India, a payment dispute frequently begins with an invoice hygiene problem not a customer relationship problem. Enterprise buyers routinely delay payment citing missing or incorrect GSTINs, wrong HSN codes, mismatched PO references, or invoices not linked to the correct supply state. Every delayed invoice costs you money. Build a pre-invoice checklist into your billing process:

- Buyer GSTIN verified and matched against the PO or MSA.

- Supply state correctly identified – IGST vs CGST/SGST applied correctly.

- HSN/SAC code aligned with current GST classification for your product or service.

- E-invoice (IRN) generated on IRP for applicable turnovers (currently mandatory above ₹5Cr).

- PO number, GRN reference (for product), and contract reference included on invoice face.

- Bank details and payment instructions clearly stated on every invoice.

A buyer’s accounts payable team that has to chase your GST details is a buyer whose 7-day internal approval cycle just became 21 days. Invoice hygiene is a collections strategy.

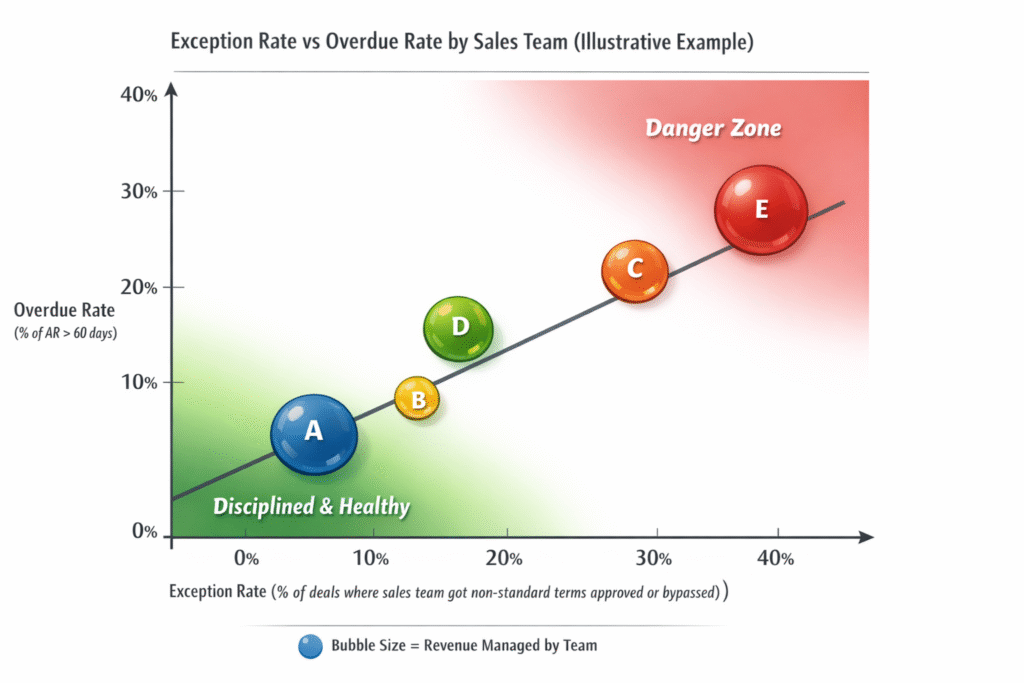

The Exception Management Trap

Chart (below) illustrates the relationship between exception rate and overdue rate across sales teams. The data is illustrative but the pattern is real: teams with high exception rates where sales regularly negotiates beyond standard terms consistently show disproportionately high overdue rates. The causality is direct. Extended terms granted without credit assessment are extended terms that customers have not demonstrated the discipline to honour.

Exception Rate vs Overdue Rate by Sales Team (Illustrative Example)

| Sales Team | Exception Rate % | Overdue Rate % (>60d) | AR Managed (₹L) | Zone |

| Team A — Enterprise | 6% | 7% | 320 | ✓ Healthy |

| Team B — Mid-Market | 14% | 18% | 180 | ⚠ Watch |

| Team C — SMB | 28% | 32% | 90 | ✕ Danger |

| Team D — Channel | 9% | 11% | 140 | ✓ Healthy |

| Team E — Govt/PSU | 41% | 38% | 210 | ✕ Danger |

How to interpret: Exception rate is the leading indicator; overdue rate is the lagging outcome. Teams with exception rates above 20% consistently show 2-3x the overdue rate of disciplined teams. This is not coincidence it is a policy enforcement problem dressed as a customer problem.

The control mechanism is not to eliminate exceptions, strategic accounts genuinely warrant flexibility. The control is to make exceptions visible, time-bound, and tied to accountability. When a sales person requests Net 90 for a new customer, the approval process should require them to document the strategic rationale and accept co-accountability if the account goes overdue. This single change shifts the culture from ‘finance is the obstacle’ to ‘we share the credit risk together’.

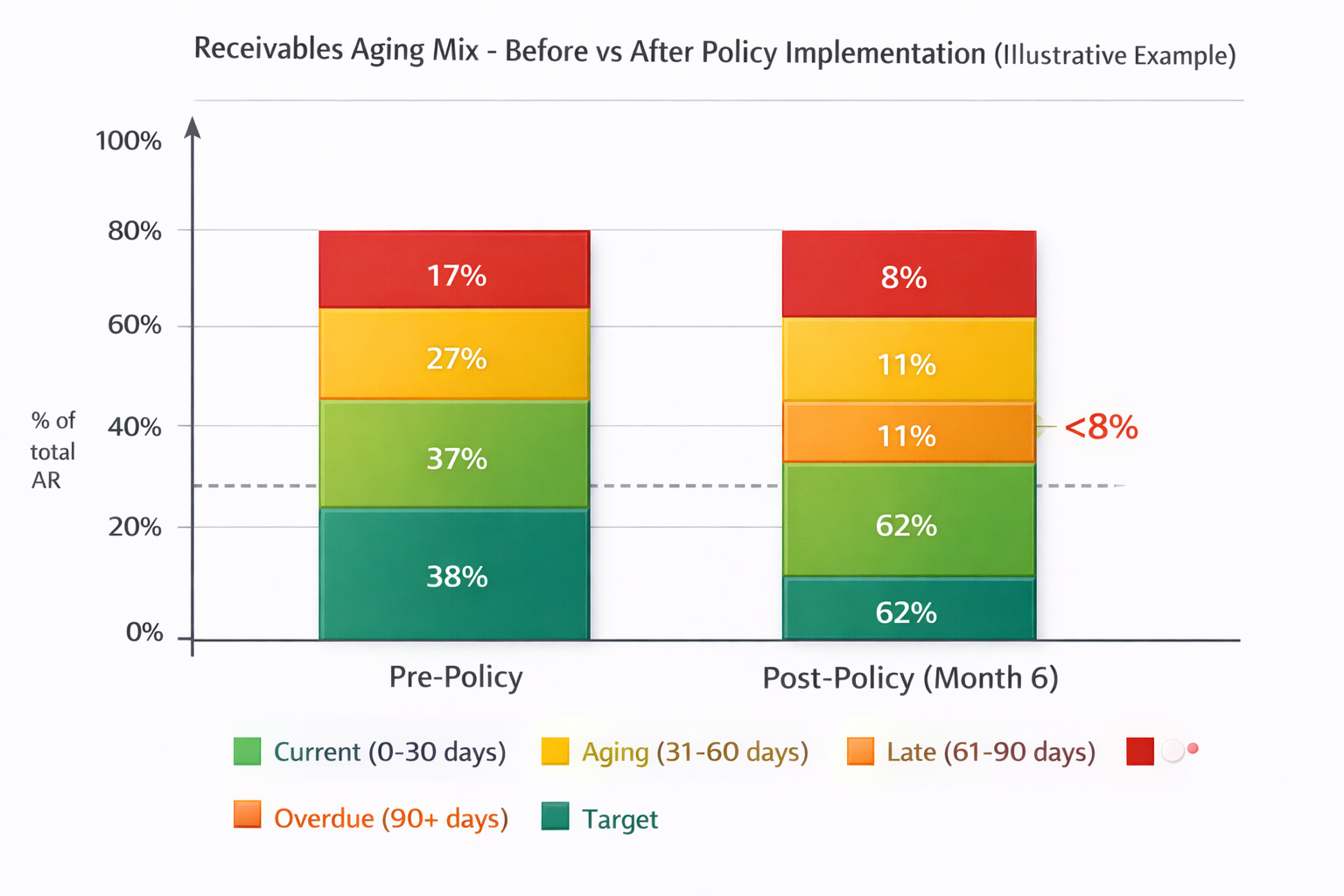

4. The Data Behind the Decision

The charts in this section are designed for your next finance or board review. Use them to anchor the business case for policy change or to illustrate the cost of the status quo.

DSO Sensitivity to Cash Tied Up

| DSO / Terms | Net 30 | Net 45 | Net 60 | Net 75 | Net 90 |

| ₹2Cr ARR — Cash locked (₹L) | 16.4 | 24.6 | 32.9 | 41.1 | 49.3 |

| ₹10Cr ARR — Cash locked (₹L) | 82.2 | 123.3 | 164.4 | 205.5 | 246.6 |

| ₹25Cr ARR — Cash locked (₹L) | 205.5 | 308.2 | 410.9 | 513.7 | 616.4 |

Formula: Cash locked = (Annual Revenue ÷ 365) × DSO. Assumes consistent monthly billing, no early payment.

How to interpret: Every 30-day extension of your payment terms is not a relationship favour it is a capital allocation decision. A ₹10Cr ARR business moving from Net 30 to Net 90 traps an additional ₹1.6Cr in receivables. At a cost of debt of 12%, that is ₹19L in annual financing cost absorbed quietly unless you measure it.

Receivables Aging Mix – Before vs After Policy Implementation (Illustrative Example)

| Aging Bucket | Pre-Policy % | Month 2 % | Month 4 % | Month 6 % | Target |

| Current (0–30 days) | 38% | 44% | 51% | 62% | 65%+ |

| Aging (31–60 days) | 27% | 25% | 22% | 19% | <20% |

| Late (61–90 days) | 18% | 16% | 14% | 11% | <12% |

| Overdue (90+ days) | 17% | 15% | 13% | 8% | <8% |

How to interpret: A well-implemented policy compresses the overdue bucket within 60–90 days. The gains show first in Month 4 as systematic follow-up and escalation protocols kick in. Businesses with >20% in the 90+ bucket typically have a policy gap, not a customer quality gap.

5. Implementation Plan: 30–60 Days to a Functioning Policy

A payment terms policy that exists in a document but does not change behaviour is not a policy, it is a filing exercise. Implementation requires sequencing: first, get the data right; then, design the policy; then, operationalise collections; finally, automate.

Week 1–2: Diagnostic and Baseline

- Pull your AR aging report by customer, segment, and invoice date (not due date).

- Calculate DSO per customer segment. Identify your top 20 overdue accounts by value.

- Map every active customer’s current terms against the scorecard in Table 1. Identify mismatches – accounts on Net 90 that score below 3.0.

- Identify invoice hygiene failures in the last 6 months: how many invoices were disputed for non-payment-related reasons (GSTIN error, PO mismatch, etc.)? This number will surprise most finance teams.

- Interview sales heads: what is the actual exception rate, and for which customers? Get the anecdotal data before you build the formal process.

Week 3–4: Policy Design and Stakeholder Alignment

- Draft the segmentation scorecard (Table 1 as baseline). Calibrate cutoffs with finance head and one senior sales leader – buy-in matters.

- Write the exception approval SOP. Single page. Approval tiers, timelines, expiry rules. Publish to all sales and finance staff.

- Design the collections cadence (Table 2 as baseline). Assign named owners to each step. Ambiguity about who sends the Day +15 email is why it never gets sent.

- Set credit limits for top 30 accounts. Build the discipline of credit limit monitoring into your AR review.

- Review and update all standard contract templates to include: payment terms, late payment interest clause (MSMED Act reference where applicable), dispute resolution timeline, and credit limit breach triggers.

Week 5–8: Rollout and Collections Operationalisation

- Notify customers of any terms changes with minimum 30-day notice. For strategic accounts, have the finance head or CFO make a brief call this positions it as governance, not penalty.

- Activate the collections cadence. In the first month, do this manually before automating you will identify gaps in the cadence design that automation would have locked in.

- Implement a weekly AR review meeting: 30 minutes, Finance + Sales Ops. Review overdue accounts, agree on owner actions for each, record commitments. This meeting is your enforcement mechanism.

- Build or configure basic automation: automated invoice dispatch, pre-due reminders (Day -5), and overdue notifications (Day +1, +7).

- Track your first-month metrics: DSO change, overdue rate by aging bucket, exception rate vs prior quarter.

Dispute Management: The Overlooked Bottleneck

A dispute whether about invoice accuracy, delivery quality, or GST computation pauses payment without pausing your cost base. Most businesses handle disputes reactively, which means they sit unresolved for 30–60 days while your aging clock ticks. Implement a structured dispute fast-track:

- All disputes acknowledged within 48 hours. Assign a named resolver.

- Simple disputes (invoice errors, GSTIN corrections) resolved within 5 business days.

- Complex disputes (quality, delivery, contractual) escalated to a joint buyer-seller working group with a 15-business-day resolution SLA.

- Partial payments on undisputed invoice amounts should not wait for dispute resolution on disputed portions. Build this into your contract language.

6. Four India Scenarios – Terms in Practice

Scenario A: B2B SaaS, ₹8Cr ARR, Mixed Customer Base

A 4-year-old SaaS business sells to a mix of mid-size enterprises and SMBs. Current DSO is 68 days against standard Net 45 terms. Top 5 enterprise customers represent 55% of revenue and are all on informal ‘Net 60–90’ terms that were never documented. SMB customers are on Net 30 but average payment is Day 42.

Recommended approach: Formalise enterprise terms at Net 60 with documented credit limits and annual review. Apply the scorecard to identify which of the 5 accounts should be on Net 45 vs Net 60 based on payment history. For SMB accounts, implement automated reminders at Day -5 and Day +1 most SMB late payments are reminder failures, not cash problems. Target: DSO to 52 days within 90 days, releasing approximately ₹62L in cash.

Scenario B: Industrial Manufacturing, ₹35Cr Revenue, Dealer Network

A mid-size manufacturer sells through 80+ dealers across 3 states. Trade credit is the norm dealers expect 60–90 days as a competitive necessity. Bad debt write-offs have averaged 1.8% of revenue annually over 3 years. GST input credit delays at the dealer level are routinely cited as payment excuses.

Recommended approach: Segment dealers into Tier 1 (high volume, clean history) and Tier 2 (smaller, patchy history). Tier 1 gets Net 60; Tier 2 gets Net 30 with an option to earn Net 45 after 6 clean months. Introduce a security deposit equivalent to 30 days of purchases for Tier 2 dealers. Tie inventory allocation priorities to payment compliance this is a powerful lever manufacturers underuse. Implement a dealer portal for e-invoicing that eliminates GSTIN disputes at source.

Scenario C: Professional Services Firm (CA/Legal/Consulting), ₹4Cr Revenue

A growing consulting firm bills on project milestones. Current practice: single invoice at project end after 3–4 months of work. DSO is effectively 120+ days. Two clients from last year are still unpaid at 9 months.

Recommended approach: Restructure billing to milestone-based invoicing 30% on engagement, 40% at mid-project, 30% on delivery. This converts a DSO problem into a structural fix. For any project above ₹10L, require a retainer upfront equal to 20% of project value. Build late payment interest clauses (2% per month) into engagement letters most professional services firms do not have these and have no legal mechanism for pursuit. Net 30 from each milestone invoice, enforced.

Scenario D: Wholesale Distributor, Large Enterprise Buyer (PSU/MNC)

A distributor supplies a large PSU that has a rigid 90-day payment cycle baked into their procurement policy. The distributor’s own supplier terms are Net 30. The structural mismatch creates a 60-day financing gap on every transaction.

Recommended approach: This is a DPO-DSO mismatch problem. Three levers: (1) Negotiate extended terms with your own suppliers to 60 days reduce the gap. (2) Use invoice discounting or bill discounting against the PSU receivables PSU paper is typically high-quality and discountable at 9–10.5%. (3) Price the financing cost into your margin with the PSU if the 60-day gap costs you 1.5% per transaction, recover it in your pricing. Treat the relationship as a standalone P&L and ensure it is actually profitable after financing costs.

7. Failure Modes and Controls

Every policy has predictable failure points. Knowing them in advance is your best defence.

Failure Mode 1: Exception Creep

Sales teams approve exceptions informally (‘I’ll just let this one go as Net 75’), which bypasses the formal approval chain. Within two quarters, exceptions are the norm and the policy exists only on paper. Control: monthly exception rate tracking by team and manager, published in the AR review. Set a hard ceiling if the team-level exception rate exceeds 15%, no further exceptions are approved that month.

Failure Mode 2: Disputed Invoices as a Stall Tactic

Some buyers particularly large enterprises raise technical disputes (GST mismatches, PO reference errors) as a cash management tactic, not a genuine concern. They delay payment across 50 vendors simultaneously at quarter-end. Control: track dispute-to-resolution time per buyer. A buyer who raises disputes consistently in months 2 and 3 of every quarter is managing their payables, not genuinely disputing your invoices. Adjust your credit terms and negotiation posture accordingly.

Failure Mode 3: Collections Cadence Breaks Down

The Day +7 call does not happen because the AR executive is busy. The Day +15 escalation email is never sent because no one owns it. Within 6 weeks, the cadence has quietly collapsed. Control: automate the first three touchpoints. The remaining human-touch escalations should be calendar-blocked, not ad hoc.

Failure Mode 4: Sales Uses Terms as a Discount

Extended payment terms have measurable financial cost. When a sales person offers Net 90 to close a deal, they are effectively offering a discount one that does not show in the CRM but absolutely shows in your bank account and DSO. Control: build a ‘terms cost calculator’ into your deal approval process. When a deal requests Net 90 instead of Net 30, the approval form should show the estimated financing cost. This one change makes the economic trade-off visible and changes the conversation.

Key KPIs to Monitor Monthly

- DSO: overall and by segment.

- Overdue rate: % of AR beyond due date.

- Aging distribution: % of AR in each bucket (0–30, 31–60, 61–90, 90+).

- Exception rate: % of accounts on non-standard terms by sales team.

- Dispute-to-resolution cycle time: average days.

- Bad debt provision as % of revenue: quarterly.

- CCC: quarterly, compared to prior period.

8. How Treelife Implements This: Diagnostic to Ongoing Review

Most businesses have the intent to fix their payment terms framework. The gap is bandwidth, expertise, and the credibility to push back on sales and customers simultaneously while maintaining relationships. That is where Treelife’s finance consulting practice operates.

We are not a collections agency and we are not generic advisory. We work embedded with your finance team as outsourced CFO, finance controller, or project-based implementation partners to design and operationalise frameworks that actually hold.

What We Deliver, and When

| Phase | Timeline | Deliverables | Success Metric |

| 1. Diagnostic | Weeks 1–2 | AR aging analysis by customer/segment, DSO calculation, invoice hygiene audit, exception rate mapping, current contract terms review. | Baseline DSO, overdue rate, and exception rate documented. Key risk accounts identified. |

| 2. Policy Design | Weeks 3–4 | Customer segmentation scorecard, payment terms policy document, exception approval SOP, credit limit matrix, contract language updates. | Policy ratified by CFO and Sales Head. Exception approval workflow live. |

| 3. Rollout | Weeks 5–8 | Collections cadence operationalisation, automation setup (invoice dispatch, reminders, escalation triggers), customer communication plan, staff training (finance + sales). | Collections cadence live. Automated reminders active. First month AR review completed. |

| 4. Monthly Review | Ongoing | Monthly AR review facilitation, KPI dashboard maintenance, exception rate monitoring, policy enforcement advisory, dispute management support, periodic scorecard recalibration. | DSO reduction of 15–25 days within 90 days. Overdue rate below target. Exception rate controlled. |

Key Takeaway for the Founder

Your payment terms are a silent line of credit you are extending to every customer whether you intended to or not. Unlike a bank loan, this one has no documentation, no interest income, and no enforceable recall mechanism unless your contracts are tight.

The founders who fix this early stop thinking about it as a “collections problem” and start treating it as a financial design problem. The fix is not chasing customers harder. It is building a system a scored segmentation, a policy with teeth, a collections cadence that runs automatically, and a monthly review that keeps the discipline alive.

One number to remember: your DSO should not exceed your stated payment terms by more than 10–12 days. If the gap is larger than that, you do not have a customer quality problem. You have a policy enforcement problem. And that is entirely within your control to solve.

Our Commitment on Outcomes

We do not promise results we cannot control your customers pay when they pay. What we commit to is this: within 90 days of engagement, you will have a functioning policy that your team uses, a collections cadence that is followed, and a monthly review process that keeps the discipline alive. Based on our experience with similar-scale Indian B2B businesses, this translates to DSO improvement of 15–25 days and meaningful reduction in the 90+ days overdue bucket with the cash impact that entails.

We also do not walk away after the framework is built. Our ongoing support model ensures the policy does not decay as new customers are onboarded, new sales hires join, or business conditions change.

Next Step

If your DSO is higher than your stated payment terms, your exception rate is unknown, or your AR aging has not been reviewed in the last 30 days this is the conversation to have now, not after the next cash crunch.

Disclaimer: This report is prepared by Treelife for informational purposes. All illustrative examples and scenario data are constructed for illustration only and do not constitute actual client results or market data. Terms, legal positions, and GST rules referenced reflect publicly available information as of 2026 and should be verified with appropriate advisors for your specific situation.

We Are Problem Solvers. And Take Accountability.

Related Posts

![Financial Modeling for Startups & Founders – Complete Guide [2026]](https://treelife.in/wp-content/uploads/2024/02/Financial-Modeling-for-Startups-Founders-Complete-Guide.webp)

Financial Modeling for Startups & Founders – Complete Guide [2026]

Financial modeling for startups in 2026 is no longer optional. It is the core operating system that connects vision to...

Learn More

LLP Compliance Calendar FY 2026-27: Annual Due Dates & Checklist

Managing Limited Liability Partnership (LLP) compliance in India requires meticulous attention to statutory timelines, regulatory disclosures, tax filings, and governance...

Learn More