Quick Summary

A Limited Liability Partnership (LLP) is a hybrid business structure that combines the flexibility of a partnership with the limited liability benefits of a corporation. In India, LLPs are governed by the Limited Liability Partnership Act, 2008, which provides a framework for their formation and regulation. Recent amendments to the LLP Rules, 2009, aim to enhance transparency and accountability within LLPs. Notably, the Limited Liability Partnership (Third Amendment) Rules, 2023, introduced on October 27, 2023, mandate LLPs to maintain detailed records of their partners and disclose information about individuals with significant financial interests. These changes are designed to increase scrutiny and ensure compliance within the LLP structure.

Blog Content Overview

- 1 What is a Limited Liability Partnership (LLP)?

- 2 Amendment to LLP Rules: Increased Transparency and Scrutiny

- 3 List of Important Amendments to the Limited Liability Partnership Rules, 2009

- 4 Conclusion

- 5 Impact and Beyond: Building a More Equitable Ecosystem

- 6 FAQs on Amendments to the Limited Liability Partnership Rules, 2009

What is a Limited Liability Partnership (LLP)?

A limited liability partnership (LLP) is a kind of general partnership in which each partner’s personal responsibility for the firm’s obligations is strictly restricted. In accordance with the state, partners may be held accountable for contractual debts but not for the tortious damages of other partners. Larger partnerships and professionals in particular frequently employ limited liability companies (LLPs); in fact, several jurisdictions restrict the use of LLPs to professionals. An LLP, like ordinary partnerships, must consist of two or more partners; however, the structure of the amount of control and profits that each partner keeps is flexible. With the exception of choices involving the modification of the partnership agreement, which call for the consent of all partners, almost all decisions in an LLP can be delegated to specific partners. Limited liability is permitted under LLPs, unlike limited partnerships, even in cases where partners continue to have managerial control over the company. The court may, however, pierce the veil of limited liability to reclaim funds for creditors in cases where it determines that the partners attempted to undermine creditors, for example, through improper distributions. However, the specific actions that would prompt such treatment need to be examined on a case-by-case basis in accordance with applicable state laws. In contrast, consider limited liability companies (LLCs) and limited partnerships. The members (partners) of a limited liability partnership are solely accountable for the money they contribute plus any personal guarantees; the partnership is a distinct legal entity. It is mandatory for partners to furnish the firm with a registered location and preserve a membership registry. The maximum number of partners is unrestricted; nevertheless, upon incorporation, there must be a minimum of two members, who may be either people or limited businesses. An LLP can also be established by one person and a defunct business. Now let us understand Important Amendments to the LLP.

Amendment to LLP Rules: Increased Transparency and Scrutiny

On October 27, 2023, the Ministry of Corporate Affairs (MCA) of the Indian government notified the Limited Liability Partnership (Third Amendment) Rules, 2023. These amendments introduce significant changes aimed at increasing transparency and accountability within Limited Liability Partnerships (LLPs). These changes require LLPs to maintain a record of their partners and disclose information about individuals with a significant financial stake in the partnership.

Who is Affected?

These amendments apply to all Limited Liability Partnerships, both existing and newly incorporated, effective from October 27, 2023.

Impact:

These changes are expected to enhance transparency and accountability within LLPs by:

- Providing a clear record of ownership: The register of partners and disclosure of beneficial interest allows for a clearer picture of who ultimately controls and benefits from the LLP.

- Combating potential misuse: Increased transparency can help prevent the misuse of LLPs for illegal activities, such as money laundering or tax evasion.

- Improving investor confidence: Greater transparency can boost investor confidence in LLPs by ensuring a clearer understanding of ownership and risk profiles.

List of Important Amendments to the Limited Liability Partnership Rules, 2009

- Maintaining a Register of Partners in Form 4A (similar to the concept of a Register of Members in a Company).

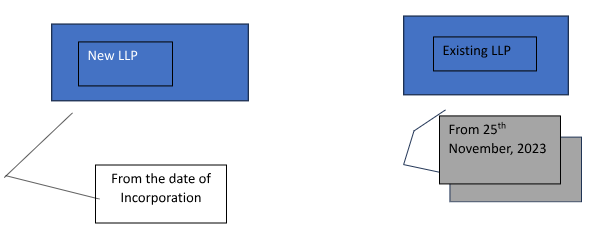

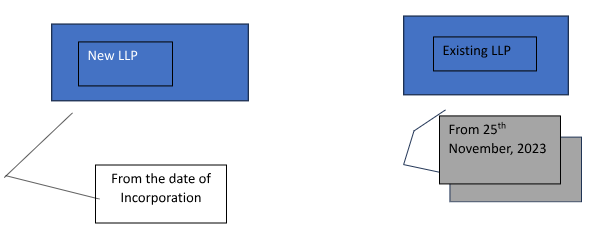

Every LLP is now required by Rule 22A of the LLP Rules to keep a register of its partners in Form 4A (annexed to the modified LLP Rules); this record should be maintained at the LLP’s registered office. Existing LLPs must comply with this obligation within 30 (thirty) days following the start of the modified LLP Rules, even though the LLP Rules now mandate that any new LLP keep such a register from the date of its creation. The following information about each partner must be included in the register of partners: (i) PAN or CIN; (ii) name, address, and email address;; (iii) Unique Identification Number (if any); (iv) father’s, mother’s, or spouse’s name; (v) occupation, status, nationality, and the name and address of their nominee; (vi) date of partnership formation; (vii) date of cessation; (viii) type and amount of contribution with monetary value thereof; (ix) any other interest (if any). Any modification to the amount of the contribution, the name and contact information of the LLP’s partners, or the termination of a partnership interest must be recorded in the register within seven (seven) days.

- Declaration regarding Beneficial Interest in the Contribution of LLPs (similar to the applicability of Companies under Section 89 of the Companies Act, 2013).

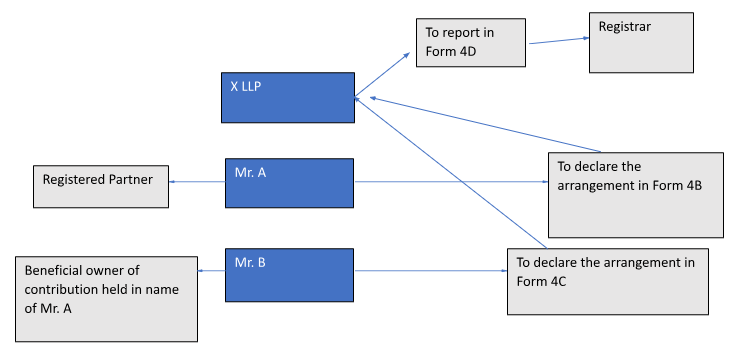

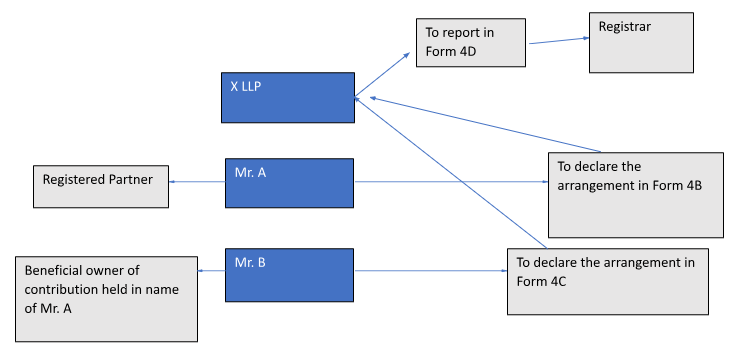

Within 30 (thirty) days of the date on which their name was entered in the aforementioned register of partners, each registered partner of the LLP that does not have a beneficial interest (fully or partially) in any contribution is required to file a declaration with the LLP in Form 4B (annexed to the amended LLP Rules), stating the name and details of the person who actually holds any beneficial interest in such contributions. In addition, any modifications to the beneficial interest must be disclosed on Form 4B within 30 (thirty) days of the modification date. In addition, within 30 (thirty) days of acquiring their beneficial interest in the LLP’s contribution, anyone who has a benefit interest in the LLP’s contribution but is not listed in the LLP’s partner registry must file a declaration in Form 4C, which is annexed to the amended LLP Rules, with the LLP, outlining their specifics and the nature of their interest. In addition, any modification to the beneficial interest must be recorded in Form 4C within 30 (thirty) days of the new information being available The LLP must enter the aforementioned declarations (if applicable) in the register of partners and submit a Form 4D report to the Registrar of Companies (“ROC”) within thirty (30) days after receiving the declarations, together with any necessary costs.

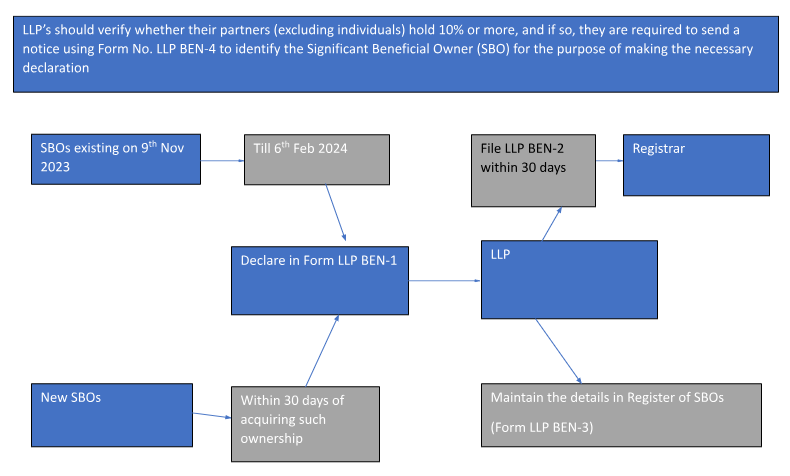

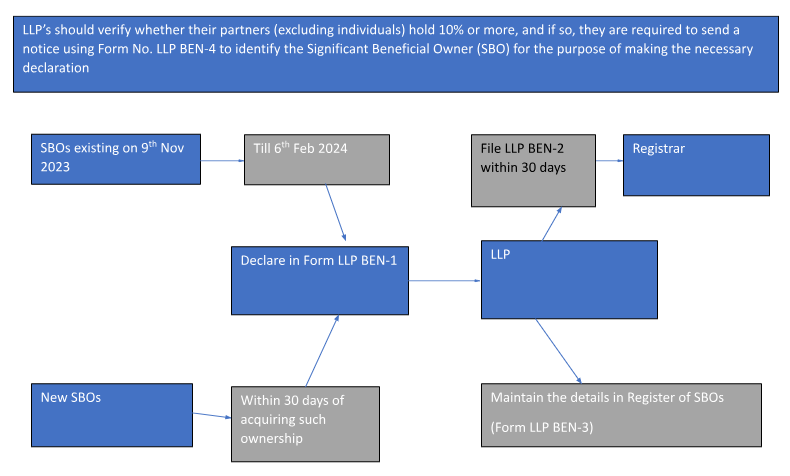

- Declaration regarding Significant Beneficial Owners (“SBOs”) in LLPs (similar to the applicability of Companies under the Companies (Significant Beneficial Owners) Rules, 2018).

According to Rule 22B(4) of the amended LLP Rules, every LLP must designate a designated partner who will cooperate and provide information to the ROC (or any other officer authorized by the Central Government) regarding beneficial interests in the LLP’s contribution. Additionally, it specifies that the previously specified data must be sent in Form 4 (which is appended to the revised LLP Rules) to the ROC. According to the LLP Rules, each designated partner is obligated to provide this information up until a certain designated partner is identified. The Ministry of Corporate Affairs has acted swiftly to incorporate limited liability companies (LLPs) into a regulatory framework that matches their growing usage as a means of conducting business in India. LLPs are nearly as popular as private limited corporations and are far more preferred than traditional partnerships. To prevent the flexibility offered by the LLP structure from being abused to the harm of important stakeholders including financial institutions, creditors, partners, and workers, rules and regulations must be skillfully crafted.

- Maintaining a Register of SBOs in Form LLP BEN – 3 (similar to the concept of Register of SBO in a Company).

Register of Partners in LLP

a) Maintain in Form 4A

b) Any change in particulars to be updated within 7 days.

Declaration w.r.t Beneficial Interest in Contribution

a) Note 1: Form 4B & 4C shall be submitted within 30 days from the date when name is entered in the register of partners & after acquiring such beneficial interest in the contribution respectively.

b) Note 2: Form 4D shall be submitted within 30 days from the date of receipt of declaration.

Declaration w.r.t Significant Beneficial Owners (SBOs)

The SBO rules shall not apply to the extent of contribution held by;

- Central, State or local Authority

- Reporting LLP, Body Corporate or an entity controlled by Central or State Government

- Investment vehicles regulated by SEBI, RBI

Conclusion

In a significant move towards enhancing transparency and accountability within Limited Liability Partnerships (LLPs), the Ministry of Corporate Affairs (MCA) introduced key amendments to the LLP Rules, 2009. These amendments represent a comprehensive update, aligning LLP regulations with best practices and bolstering stakeholder confidence. Let’s delve into the core changes and their potential impact.

- Unveiling the Register of Partners: Bridging the Information Gap

The introduction of Form 4A mandates maintaining a Register of Partners, mirroring the concept of a Register of Members in companies. This readily accessible record offers transparency into LLP ownership structures, facilitating informed decision-making by investors, creditors, and other stakeholders. The requirement to update the register within 7 days of any changes ensures its accuracy and timeliness.

- Demystifying Beneficial Interests: Lifting the Veil

Similar to the provisions of Section 89 of the Companies Act, 2013, LLPs must now file declarations regarding beneficial interests in contributions through Form 4B and 4C. This crucial step sheds light on the ultimate economic beneficiaries of LLP holdings, mitigating potential risks associated with hidden ownership and promoting responsible financial conduct.

- Identifying Significant Beneficial Owners (SBOs): Shining a Light on Complex Structures

Building upon the beneficial interest disclosures, the amendments introduce SBO regulations, echoing the Companies (Significant Beneficial Owners) Rules, 2018. LLPs are now required to identify and verify SBOs, defined as individuals with significant control or ownership (exceeding 10%) over partners holding non-individual interests. This additional layer of transparency empowers regulators and stakeholders to hold ultimate beneficiaries accountable, combating financial crime and enhancing market integrity.

- Establishing the SBO Register: Centralizing Information

LLPs are mandated to maintain a dedicated Register of SBOs in Form LLP BEN-3. This centralized repository acts as a one-stop shop for accessing crucial information about the ultimate beneficiaries, streamlining due diligence and regulatory oversight.

- Strengthening Compliance Mechanisms: Ensuring Timely Adherence

These amendments are accompanied by stringent compliance timelines. Declaration regarding beneficial interests must be submitted within 30 days of entry into the register and acquiring such interest, respectively. Further, LLPs have 30 days to file form 4D after receiving declarations. These timeframes ensure prompt information disclosure and facilitate effective enforcement.

Impact and Beyond: Building a More Equitable Ecosystem

The revamped LLP Rules offer a multi-pronged approach towards fostering a more transparent and accountable LLP ecosystem. By demystifying ownership structures, identifying ultimate beneficiaries, and establishing robust compliance mechanisms, these amendments empower stakeholders, bolster regulatory effectiveness, and ultimately contribute to a healthier financial landscape. However, the journey doesn’t end here. Continuous stakeholder engagement, capacity building initiatives, and regulatory fine-tuning remain crucial to ensure the successful implementation and long-term impact of these amendments. As the LLP landscape evolves, adapting regulations to best practices will be vital in solidifying India’s position as a global leader in fostering a transparent and responsible financial environment.

FAQs on Amendments to the Limited Liability Partnership Rules, 2009

- What are the major changes introduced in the revised LLP Rules?

The major amendments to the Limited Liability Partnership Rules, 2009 are

- Register of Partners (Rule 22A),

- Declaration of Beneficial Interest (Rule 22B),

- Designated Partner for Providing Information

- What is the purpose of maintaining a Register of Partners in Form 4A?

The register provides detailed information about each partner, including their contribution, contact details, and status. It enhances transparency and facilitates communication with stakeholders. - When do existing LLPs need to comply with the Register of Partners requirement?

Existing LLPs have 30 days from the implementation date to create and maintain this register. New LLPs must have it from the date of incorporation. - What happens if a partner doesn’t have a beneficial interest in their contribution?

They need to file a declaration (Form 4B) disclosing the name and details of the actual beneficiary within 30 days of joining the register. - Who are Significant Beneficial Owners (SBOs), and how are they reported?

SBOs are individuals with ultimate control or significant influence over the LLP. They are identified and reported by a designated partner using Form 4 to the Registrar of Companies (ROC). - What is the penalty for non-compliance with these new requirements?

Non-compliance may lead to penalties and fines as specified by the ROC. - Do these amendments apply to all types of LLPs?

Yes, these amendments apply to all LLPs registered in India, regardless of size or industry. - How will these changes benefit LLPs and stakeholders?

Increased transparency and disclosure foster trust, attract investors, and improve corporate governance. - What are the challenges in implementing these changes?

Ensuring proper record-keeping and timely reporting within short time frames might require adaptation and support for smaller LLPs. - Where can I find more information about these amendments?

One can find information related to the new amendment of LLP’S on The Ministry of Corporate Affairs website and official notifications related to the revised LLP Rules offer detailed information.

We Are Problem Solvers. And Take Accountability.

Related Posts

Compliance Calendar – July 2025 (Checklist & Deadlines)

Sync with Google CalendarSync with Apple Calendar As we enter the second half of 2025, staying compliant with various financial,...

Learn More

Conversion of Partnership Firm to LLP – Complete Process

Converting a Partnership Firm to a Limited Liability Partnership (LLP) is a strategic decision that offers several advantages for businesses...

Learn More

Memorandum of Association – MoA Clauses, Format & Types

The Memorandum of Association (MOA) is one of the most essential documents in the company incorporation process, forming the foundation...

Learn More