Quick Summary

Stock Appreciation Rights (SARs) in India are a form of employee compensation that allows employees to benefit from the increase in a company’s stock value over a predetermined period, without the need to purchase actual shares. Upon vesting, employees receive the monetary equivalent of the stock’s appreciation, which can be settled in cash, equity, or a combination of both. This structure offers flexibility and aligns employee interests with company performance. SARs are particularly advantageous for startups and private companies seeking to incentivize employees without diluting equity. However, it’s essential to consider the legal framework governing SARs in India, especially for private and unlisted companies, to ensure compliance and effective implementation.

Blog Content Overview

Stock Appreciation Rights (“SARs”) offer a compelling form of employee compensation, allowing beneficiaries to enjoy an increase in the company’s valuation over time without the necessity to purchase or own actual shares. This predetermined timeframe for appreciation has seen SARs become increasingly popular in India as a viable alternative to traditional Employee Stock Option Plans (ESOPs). They offer flexibility to both employers and employees and are quickly gaining traction in the startup ecosystem. For example, employees at Jupiter (Amica Financial) experienced significant appreciation in their grants when the company’s valuation surged by 67% to INR 720 crores in 20201.

In this article, we break down what SARs are, how they work and what the key advantages are to offering this form of employee compensation, from the perspective of both employers and employees.

What are Stock Appreciation Rights (SARs)?

SARs are typically defined as the right to receive the benefit of increase/appreciation of the value of a company’s stock. This appreciation can be monetised by way of cash or stock and does not require the employee to invest their own money to purchase the stocks (as is the case with traditional ESOPs).

How are SARs issued?

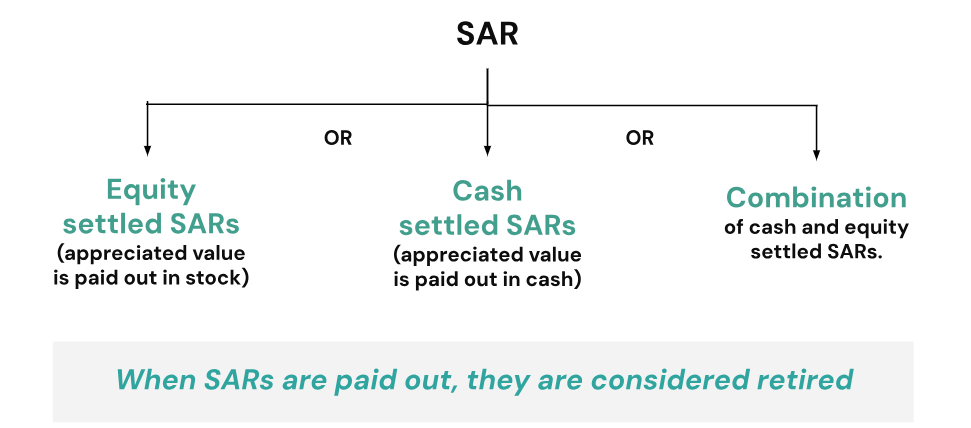

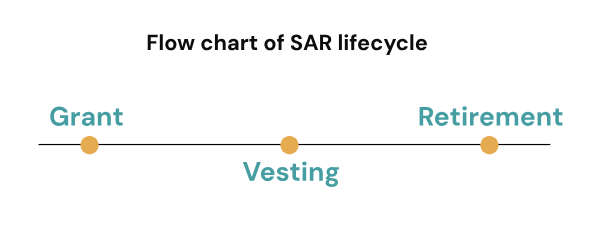

SARs follow a lifecycle similar to that of ESOPs2, but differ in how these entitlements are earned. Unlike ESOPs, which require an employee to purchase the option and thereby exercise their right to the shares, SARs require no upfront payment from employees. Only the difference between the SAR price on the grant date and the market price on the settlement date will be paid out in cash, equity, or a combination of both. Once settled, SARs are considered retired.

How do SARs work?

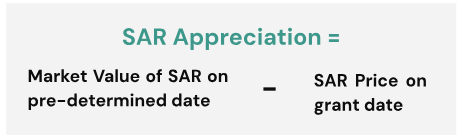

Stock Appreciation Rights (SARs) in India are a popular employee benefit that allows employees to gain from the appreciation in a company’s stock price without purchasing shares. The appreciation is calculated as the difference between the market value of the SAR on a predetermined date and its price on the grant date. This gain is typically settled in cash or equity, providing employees with financial incentives tied to the company’s growth. SARs offer a tax-efficient and flexible alternative to stock options, making them an attractive tool for employee retention and motivation in India’s corporate landscape.

Illustration of Stock Appreciation Rights Working

Company A grants 100 SARs to an employee. The SAR Price is fixed at INR 10/- per SAR. The SARs will evenly vest over the next 4 years. The table below shows how the appreciation will be computed. This breakdown will be subject to change depending on how the company decides to settle these SARs – i.e., as Cash Settled SAR or Equity Settled SAR or a combination of both.

| No. | Particulars | End of Year 1 | End of Year 2 | End of Year 3 | End of Year 4 |

| 1 | SAR Price (each; in INR) | 10 | 10 | 10 | 10 |

| 2 | Vested SARs (in nos.) | 25 | 50 | 75 | 100 |

| 3 | % of Vested SARs | 25% | 50% | 75% | 100% |

| 4 | Market Value per SAR(in INR) | 100 | 200 | 300 | 400 |

| 5 | Appreciation per SAR[No. 4 – No. 1] (in INR) | 90 | 190 | 290 | 390 |

| 6 | If Cash Settled SAR[No. 2 * No. 5] (in INR) | 2,250 | 9,500 | 21,750 | 39,000 |

| 7 | If Equity Settled SAR[No. 6/No. 4] (in nos.)* | 23 | 48 | 73 | 98 |

Notes:

- * Numbers are rounded up to prevent fractional computation.

- The amounts and number of shares in rows 6 and 7 above indicate the money/equity to be received by the employee based on the vesting schedule that vests 25% each year for 4 years. Combination of Cash Settled SAR and Equity Settled SAR will result in change to rows 6 and 7 appropriately, basis the relevant % to be applied.

Legal Background of SAR in India

It is pertinent to note that companies that are listed on a recognised stock exchange are subject to certain regulations prescribed from time to time by the Securities and Exchange Board of India (‘SEBI’). While their formation and key foundational principles are contained within the framework of the Companies Act, 2013 (‘CA 2013’), public listed entities are predominantly governed by SEBI regulations issued from time to time. However, only the CA 2013 is applicable to private companies and the provisions of the act read with the rules formulated thereunder, do not explicitly address SARs, leading to uncertainty in the legal framework governing the adoption of employee equity-linked reward schemes by private companies that are alternatives to the traditional ESOP scheme.

SARs issued by Public Listed Companies

SAR is legally defined in the Securities and Exchange Board of India (Share Based Employee Benefits and Sweat Equity) Regulations, 2021 (“SBEB Regulations”), to mean:

“a right given to a SAR grantee entitling him to receive appreciation for a specified number of shares of the company where the settlement of such appreciation may be made by way of cash payment or shares of the company.

Explanation 1 – A SAR settled by way of issue of shares of the company shall be referred to as equity settled SAR.

Explanation 2 – For the purpose of these regulations, any reference to stock appreciation right or SAR shall mean equity settled SARs and does not include any scheme which does not, directly or indirectly, involve dealing in or subscribing to or purchasing, securities of the company.3”

The SBEB Regulations also define “appreciation” to mean “the difference between the market price4 of the share of a company on the date of exercise5 of SAR or the date of vesting of SAR, as the case may be, and the SAR price.6”

The grant of SAR under a scheme by a public company is further governed by Part C of the SBEB Regulations, which impose inter alia, the following restrictions on issuing SARs as employee benefit:

- Cash Settled or Equity Settled SAR: Companies are free to implement cash settled or equity settled SAR schemes. It is notable that where the settlement results in fractional shares, such fractional shares should be settled in cash.

- Disclosures to Grantees: Every SAR grantee is required to be given a disclosure document from the company, including a statement of risks, information about the company and salient features of the scheme.

- Vesting: SARs have a minimum vesting period of 1 year which shall only be inapplicable in the event of death or permanent incapacitation of a grantee.

- Restrictions on Rights: SAR holders will not be entitled to receive dividend or vote or otherwise enjoy the benefits a shareholders would have. These SARs cannot be transferred and are often subject to further conditions through the articles of association of the company. However the SAR grantee will be entitled to all information disseminated to shareholders by the company.

SEBI has in response to requests from Mindtree Limited, Saregama India Limited and JSW Steel Limited previously clarified that the SBEB Regulations are not applicable to Cash Settled SAR schemes7. Further, by virtue of their identity as publicly traded companies, the regulations prescribed by the Securities and Exchange Board of India from time to time prescribe specific limitations on public listed companies that are not extended to private companies. Most critically, the definition of “market price” in the SBEB Regulations is linked to the price on the recognised stock exchange, whereas with private companies, fair market value is not a defined construct, and therefore the determination is often left to a valuation report obtained at the relevant point in time. It is also important to note that by virtue of express identification in the SBEB Regulations, the company is constrained to issue SARs in the manner permitted, leaving less room for flexibility of approach.

SARs issued by Private/Unlisted Companies

The SBEB Regulations and resultant compliances are only applicable to companies whose equity shares are listed on a recognised stock exchange in India. By contrast, the Companies Act, 2013 (“CA 2013”) which governs the operation of unlisted and private companies in India, does not include any provisions on SARs.

However, employee stock-linked compensation/incentive schemes are not completely excluded from the ambit of the CA 2013. Formulated thereunder, the Companies (Issue of Share Capital and Debentures) Rules, 2014 (“SCD Rules”) prescribe conditions within which a private company can issue ESOPs. This would require the following critical compliances to be completed by the employer/issuer company:

- Special Resolution: The ESOP scheme is approved by shareholders of the company by way of special resolution (including reporting to ROC thereunder). This is also required if any employees are being granted options during one year, that equals or exceeds 1% of the issued capital of the company at such time;

- Eligible Employees: The proposed grantee should be eligible employees in accordance with the criteria prescribed in explanation to Rule 12(1) of the SCD Rules.

- Disclosures to Shareholders: The Company makes the requisite disclosures in the explanatory statement to the notice of shareholders’ meeting to approve the scheme including on total number of stock options to be granted, how the eligibility criteria will be determined (beyond statutory mandates), the requirements of vesting and period thereof, exercise price or formula to arrive at the same; exercise period and process thereof, lock-in, etc.

- Minimum Vesting: 1 year period between grant and vesting of options is mandated by Rule 12(6)(a) of the SCD Rules.

- Restrictions on ESOP Holders: Until exercised, such option holders do not receive dividend or vote or enjoy benefits of shareholders. The options also cannot be transferred, pledged, mortgaged, or encumbered in any manner.

- Compliance by Company: The Company will be required to maintain a register of employee stock options in Form No. SH-6.

Pursuant to a reading of the CA 2013 with the SCD Rules, it is clear that there is no procedure prescribed for the grant and settlement of SARs by private companies. The provisions regarding ESOPs do not lend themselves to be extended for SARs and consequently, as a matter of good governance, it is recommended that private companies issuing SARs take the following considerations into account as good practice:

- Board Approval – The board of the company must approve the terms of the SARs being granted, including grant date, number of SARs, vesting schedule and SAR price.

- Shareholders Approval – Similar to how ESOPs require a special resolution, the shareholders of the company should also approve the issuance of the SAR scheme, and any variation of terms, provided that such variation is not prejudicial to the interests of the SAR holders.

- SAR Grantees – Given that the restrictions applicable to ESOP are not extended to SAR grantees, this leaves the benefit of SARs being extendable to third parties.

- Vesting – a legally mandated vesting period is not applicable for private limited companies; ergo, certain employees may be granted SARs upfront with no vesting requirement, while others may be required to earn the SARs in accordance with a vesting schedule.

- SAR Price – This can vary from grant to grant, and is subject to the price determined by the employer company.

- Retirement – This can be entirely subject to the SAR Scheme, and may thus be retired in such manner as may be prescribed in the Scheme.

- Administration – SARs need not be administered by the Compensation Committee of a board of directors, and may be administered directly by the board itself.

Practical Considerations

ESOPs create practical challenges for private companies as a result of the restrictions imposed by the CA 2013 and the SCD Rules. Consequently, issuance of SARs instead of ESOPs allows companies to circumvent these practical challenges. Some considerations that go into the issue of SARs are:

- Reduced Scope of Dilution: By virtue of settlement of SARs in cash, companies can avoid dilution of their shareholders’ stake in the company. Further, even where SARs are settled with corresponding equity stake, the dilution is only triggered when the shares are purchased by the employee.

- No Mandatory Financial Disclosures: The company need not provide the financial disclosures of the company (normally provided to shareholders) to SAR holders and this would remain true on the date of retirement of the SARs as the employees never actually become shareholders in the company.

- Exercise Price Eliminated: From the employee’s perspective, no purchase cost is incurred in reaping the benefits of the grant.

- Value of the Options: ESOPs can have no value in the absence of a buyer for the shares however with Cash Settled SARs in particular, the value is offered by the company itself.

- Cost to Company: In case of E quity Settled SARs, the company can, within the confines of applicable law, issue and allot shares to the employee and reduce the cost of settling the grants.

- Flexibility of Settlement: Companies can align incentives with their financial strategies and stakeholder interest. The choice of cash or equivalent shares to settle the SAR is a feature not found with ESOPs.

- Taxation: SARs typically incur perquisite tax for the employees under the “salaries” head, required to be deducted at source for employers. Equity Settled SARs typically incur this tax liability on the exercise date whereas Cash Settled SARs incur tax on date of cash payment.

| 💡 #TreelifeInsight Cash Settled SARs are viewed as cash bonus plans for employees. The offeree can benefit from the appreciation of equity but they are not representative of actual equity shares and where Cash Settled SARs are issued, the employees never actually become shareholders in the company. However, the ultimate objective of value and appreciation of share ownership being given to employees continues to be met, making this an attractive consideration for companies looking to reward their employees. From a legal and regulatory space, it is advisable that startups looking to grant SARs to their employees align themselves with the SCD Rules and the SBEB Regulations as a best practice guide, to ensure that the lack of explicit regulation for SARs issued by private companies does not create scope of contravention of law. |

Concluding Thoughts

Stock Appreciation Rights have emerged as a versatile and attractive compensation tool in India, offering both flexibility and value to employers and employees. By enabling employees to benefit from the appreciation in a company’s valuation without requiring upfront investment, SARs provide a compelling alternative to traditional ESOPs. The ability to settle SARs in cash, equity, or a combination of both ensures alignment with a company’s financial strategy and employee retention goals.

For public companies, SARs are governed by the SEBI regulations, ensuring structured implementation. However, for private companies, the absence of explicit regulation under the Companies Act, 2013, creates both flexibility and challenges. Startups can leverage SARs as a cost-effective way to reward employees while mitigating shareholder dilution and administrative burdens typically associated with ESOPs.

Ultimately, SARs strike a balance between incentivizing employees and maintaining operational agility, making them an indispensable part of the evolving startup ecosystem in India. By adhering to best practices and aligning with regulatory frameworks, companies can effectively use SARs to foster growth, innovation, and employee satisfaction.

References:

- [1] https://entrackr.com/2020/06/exclusive-jitendra-gupta-jupiter-valuation-rs-720-cr/

↩︎ - [2] To learn more about this, check out our #TreelifeInsights article on Understanding ESOPs in India (including the process flow, tax implications, exercise price and benefits), here: https://treelife.in/taxation/understanding-esops-in-india/

↩︎ - [3] Regulation 2(qq), SBEB Regulations.

↩︎ - [4] “Market Price” is defined in Regulation 2(x) of the SBEB Regulations, to mean “the latest available closing price on a recognised stock exchange on which the shares of the company are listed on the date immediately prior to the relevant date.

Explanation – If such shares are listed on more than one recognised stock exchange, then the closing price on the recognised stock exchange having higher trading volume shall be considered as the market price.”

↩︎ - [5] “Exercise” is defined in Regulation 2(l) of the SBEB Regulations, to mean “making of an application by an employee to the company or to the trust for issue of shares or appreciation in the form of cash, as the case may be, against vested options or vested SARs in pursuance of the schemes covered under Part A or Part C of Chapter III of these regulations, as the case may be;”.

↩︎ - [6] “SAR Price” is defined in Regulation 2(kk) of the SBEB Regulations, to mean “the base price defined on the grant date of SAR for the purpose of computing appreciation;”.

↩︎ - [7] https://www.mondaq.com/india/directors-and-officers/983918/an-analysis-of-stock-appreciation-rights-in-india

↩︎

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More