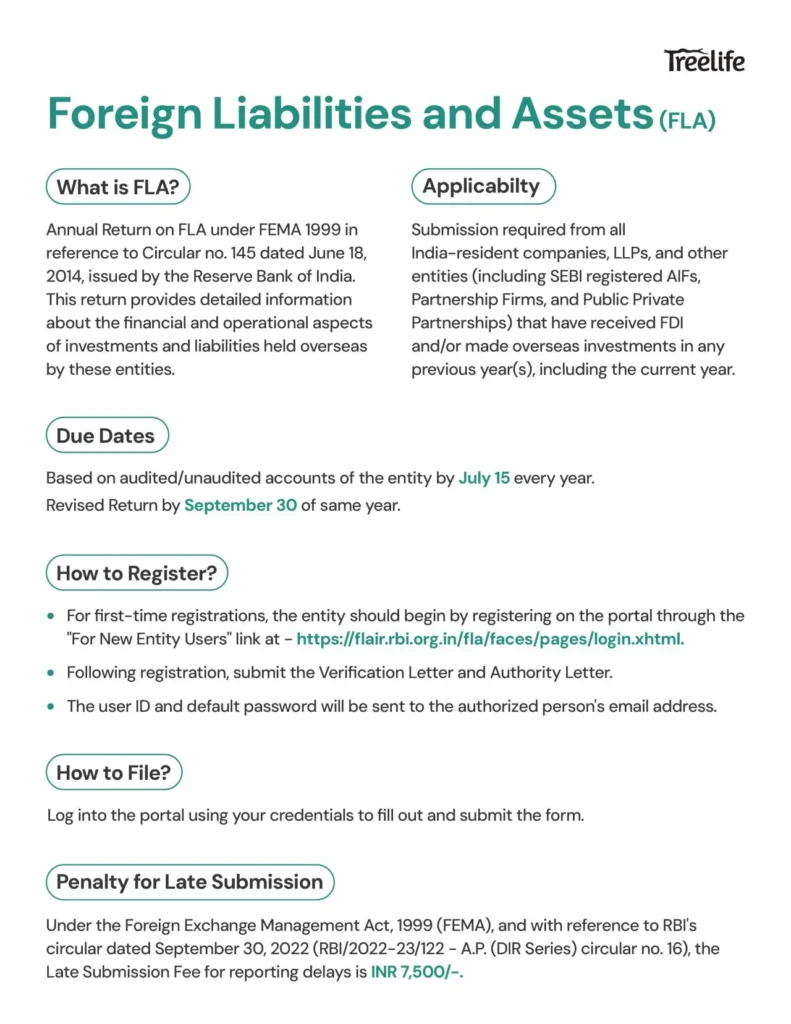

Don’t forget, the FLA annual return under FEMA 1999 is due by 𝐉𝐮𝐥𝐲 15. Ensure timely submission to avoid penalties.

𝐖𝐡𝐨 𝐍𝐞𝐞𝐝𝐬 𝐭𝐨 𝐅𝐢𝐥𝐞?

All India-resident companies, LLPs, and entities with FDI or overseas investments.

𝐊𝐞𝐲 𝐃𝐚𝐭𝐞𝐬:

1. Submission Deadline: July 15

2. Revised Return Deadline: September 30

𝐇𝐨𝐰 𝐭𝐨 𝐅𝐢𝐥𝐞:

1. Register on the RBI portal: FLA Registration Link

2. Submit the required verification documents.

3. Log in and complete the form.

We Are Problem Solvers. And Take Accountability.

Related Posts

The Reverse Flip Playbook – For Indian Founders

DOWNLOAD PDF The landscape for Indian startups has fundamentally shifted. A growing number of founders are making a deliberate choice...

Learn More

Angel Tax Exemption – Eligibility, Declaration, How to Apply

The angel tax, introduced by Section 56(2)(viib) of the Income Tax Act, 1961, applies to unlisted companies (startups whose shares...

Learn More

ESG Compliance in India – BRSR, SEBI Regulations & What Founders Need to Know

ESG used to be something listed enterprises stuck into their annual reports. In 2026, that's no longer true. ESG compliance...

Learn More