Blog Content Overview

- 1 Treelife Resources

- 1.1 Explore our resources to fuel your success and propel your business forward.

- 1.2 Latest Posts

- 1.2.0.1 Decoding the Indemnification Clause

- 1.2.0.2 Know Your Taxes (Basics)

- 1.2.0.3 Tax Efficiency Strategies for Businesses: How to Save Money on Taxes and Maximize Earnings

- 1.2.0.4 The TYKE Case

- 1.2.0.5 Unraveling the concept of “NUE”

- 1.2.0.6 Special Purpose Acquisition Companies (SPACs)

- 1.2.0.7 All you need to know about the E-Commerce Industry in India

- 1.2.0.8 Whether to set up a Private Limited Company or LLP?

- 1.3 Thought Leadership

- 1.3.0.1 Understanding the Draft Digital Personal Data Protection Rules, 2025

- 1.3.0.2 MCA Compliances for Foreign Entities Starting Business in India

- 1.3.0.3 Non Disclosure Agreements in India – NDA Template, Types & Breach

- 1.3.0.4 SaaS Blueprint – Unlocking India’s Potential with Industry Insights

- 1.3.0.5 Mergers & Acquisitions in India – Meaning, Difference, Types, M&A Examples

- 1.3.0.6 DesignX raises pre-series A funding from Piper Serica Angel Fund

- 1.3.1 Related posts:

- 1.3.2 Related posts:

- 1.3.3 Related posts:

- 1.3.4 Related posts:

- 1.3.5 Related posts:

- 1.4 Background: the DPDP Act, 2023

- 1.5 Enabling Mechanisms: the DPDP Rules, 2025

- 1.6 Implications of the Draft Rules

- 1.7 Concluding Thoughts

- 1.8 Introduction

- 1.9 What is a Non-Disclosure Agreement (NDA)?

- 1.10 Types of Non-Disclosure Agreements in India

- 1.11 Essential Clauses in an NDA

- 1.12 Non Disclosure Agreements Format

- 1.13 Legal Validity of NDAs in India

- 1.14 Breach of NDAs: Consequences & Remedies

- 1.15 Importance of Customized NDAs for Businesses

- 1.16 FAQs on Non-Disclosure Agreements (NDAs) in India

- 1.16.0.1 1. What is an NDA, and why is it important in business?

- 1.16.0.2 2. What are the types of NDAs commonly used in India?

- 1.16.0.3 3. What happens if someone breaches an NDA in India?

- 1.16.0.4 4. How can businesses draft an effective NDA?

- 1.16.0.5 5. Are NDAs legally enforceable in India?

- 1.16.0.6 7. Why is it essential to customize an NDA instead of using a generic one?

- 1.16.0.7 8. How long does an NDA remain valid?

- 1.16.1 Related posts:

- 1.17 Introduction

- 1.18 What are Mergers and Acquisitions?

- 1.19 Key Differences Between Mergers and Acquisitions

- 1.20 Types of Mergers and Acquisitions

- 1.21 Merger and Acquisition Process

- 1.22 Benefits and Challenges of Mergers and Acquisitions

- 1.23 Recent and Latest Mergers and Acquisitions in India

- 1.24 Legal and Regulatory Framework Governing M&A in India

- 1.25 Examples of Successful M&A Deals in India

- 1.26 Reasons for Mergers and Acquisitions

- 1.27 Future of Mergers and Acquisitions in India

- 1.28 Conclusion

- 1.29 FAQs on Mergers & Acquisitions in India

- 1.29.0.1 1. What is the meaning of mergers and acquisitions in India?

- 1.29.0.2 2. What is the difference between a merger and an acquisition?

- 1.29.0.3 3. What are the main types of mergers and acquisitions?

- 1.29.0.4 4. Why do companies pursue mergers and acquisitions in India?

- 1.29.0.5 6. What are the challenges in the M&A process in India?

- 1.29.0.6 7. How do synergies work in mergers and acquisitions?

- 1.29.1 Related posts:

- 1.30 Introduction to Trademark Registration in India

- 1.31 What is Trademark Registration?

- 1.32 Types of Trademarks in India

- 1.33 Procedure for Online Trademark Registration in India

- 1.33.1 Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- 1.33.2 Step 2: Prepare and Submit the Application (Online/Offline)

- 1.33.3 Step 3: Verification of Application and Documents

- 1.33.4 Step 4: Trademark Journal Publication and Opposition

- 1.33.5 Step 5: Approval and Issuance of Trademark Registration Certificate

- 1.33.6 Additional Points to Note

- 1.34 Documents Required for Trademark Registration in India

- 1.34.1 1. Business Registration Proof

- 1.34.2 2. Identity and Address Proof

- 1.34.3 3. Trademark Representation

- 1.34.4 4. Power of Attorney (Form TM-48)

- 1.34.5 5. Proof of Prior Usage (If Applicable)

- 1.34.6 6. Udyog Aadhaar or MSME Certificate

- 1.34.7 7. Class-Specific Details

- 1.34.8 8. Address Proof of Business

- 1.35 Costs and Fees for Trademark Registration in India

- 1.36 How to Check Trademark Registration Status

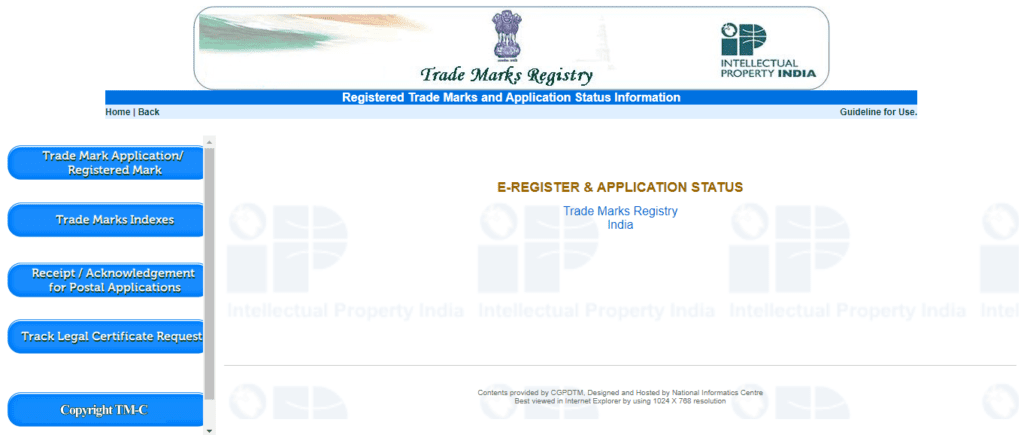

- 1.37 Common Grounds for Refusal of Trademark Registration in India

- 1.38 Renewing a Trademark in India

- 1.39 Frequently Asked Questions (FAQs) on Trademark Registration in India

- 1.40 What is a Trademark?

- 1.41 Why is Trademark Registration Important in India?

- 1.42 Key Industries Benefiting from Trademark Registration

- 1.43 Conclusion

- 1.44 MCA Streamlines Cross-border Mergers for Reverse Flipping

- 1.45 Understanding Sovereign Green Bonds

- 1.46 Key Features of the IFSCA’s SGrB Scheme

- 1.47 We Are Problem Solvers. And Take Accountability.

Latest Posts

March 20, 2023 | Taxation

Tax Efficiency Strategies for Businesses: How to Save Money on Taxes and Maximize Earnings

Read More

Thought Leadership

Understanding the Draft Digital Personal Data Protection Rules, 2025

On January 3, 2025, the Union Government released the draft Digital Personal Data Protection Rules, 2025 1 (“Draft Rules”). Formulated under the Digital Personal Data Protection Act, 2023 (“DPDP Act”), the Draft Rules have been published for public consultation, with objections and suggestions on the same to be provided to…

MCA Compliances for Foreign Entities Starting Business in India

Introduction India has emerged as a global hub for business and investment, attracting foreign entities eager to tap into its dynamic and growing market. Whether it’s multinational corporations expanding operations or startups venturing into new territories, establishing a presence in India offers immense opportunities. However, along with these opportunities come…

Non Disclosure Agreements in India – NDA Template, Types & Breach

Introduction Security of sensitive business information, protection of intellectual property and trade secrets and trust in collaborations are critical aspects of business security in an increasingly competitive and data-driven market today. It is to this effect that businesses typically execute non disclosure agreement (“NDA”), which imposes a contractual obligation on…

SaaS Blueprint – Unlocking India’s Potential with Industry Insights

DOWNLOAD PDF The Software as a Service (SaaS) industry is transforming how businesses operate, enabling organizations to scale rapidly, reduce costs, and enhance accessibility. India’s SaaS story is particularly compelling: once a nascent segment, the Indian SaaS market is now projected to reach $50 billion by 2030, contributing significantly to…

Mergers & Acquisitions in India – Meaning, Difference, Types, M&A Examples

Introduction Mergers and Acquisitions (M&A) have emerged as transformative business strategies in the Indian economic landscape, reshaping industries and fostering innovation. At its core, mergers involve the integration of two companies into a single entity, while acquisitions refer to one company taking control over another. Together, these strategies drive growth,…

Understanding the Draft Digital Personal Data Protection Rules, 2025

Blog Content Overview

On January 3, 2025, the Union Government released the draft Digital Personal Data Protection Rules, 2025 1 (“Draft Rules”). Formulated under the Digital Personal Data Protection Act, 2023 (“DPDP Act”), the Draft Rules have been published for public consultation, with objections and suggestions on the same to be provided to the Ministry of Electronics and Information Technology by February 18, 2025. Formulated to further safeguard citizens’ rights to protect their personal data, the Draft Rules seek to operationalize the DPDP Act, furthering India’s commitment to create a robust framework to protect digital personal data.

In this blog, we break down the key provisions of the Draft Rules having regard to their background in the DPDP Act, and highlight certain challenges found in the draft legislation.

Background: the DPDP Act, 2023

The DPDP Act was a revolutionary step towards India’s adoption of a robust data protection regime. This legislation marks the first comprehensive law dedicated to the protection of personal data and received presidential assent on August 11, 2023. However, the Act itself is yet to be notified for enforcement and the implementation is expected in a phased manner. To understand the impact of the Draft Rules2, it is crucial to first understand the key terms and legal framework introduced by the DPDP Act.

A. Key Terms:

- Board: the Data Protection Board of India established by the Central Government.

- Consent Manager: a person registered with the Board who acts as a single point of contact to enable a Data Principal to give, manage, review, and withdraw consent through an accessible, transparent and interoperable platform.

- Data Fiduciary: any person who alone or in conjunction with other persons determines the purpose and means of processing personal data.

- Data Principal: the individual to whom the personal data relates. The ambit of this definition is expanded where the Data Principal is: (i) a child, to include their parents and/or lawful guardian; and (ii) a person with disability, to include their lawful guardian.

- Data Processor: person processing personal data on behalf of a Data Fiduciary.

- Personal Data: any data about an individual who can be identified by or in relation to such data.

- Processing: (in relation to personal data) wholly or partly automated operation(s) performed on digital personal data. Includes collection, recording, organisation, structuring, storage, adaptation, retrieval, use, alignment or combination, indexing, sharing, disclosure by transmission, dissemination or otherwise making available, restriction, erasure or destruction.

B. Legal Framework:

- Scope and Applicability: Applies to the processing of personal data within India and to entities outside India offering goods/services to individuals in India. Covers personal data collected in digital form or data that is digitized after collection and excludes personal data processed for a personal or domestic purpose and data made publicly available by the Data Principal.

- Data Processing: Statutory requirement for clear, informed and unambiguous consent from Data Principals including a notice of rights. Certain scenarios (such as compliance with legal obligations or during emergencies) allow data processing without explicit consent – i.e., for a legitimate purpose3.

- Data Principals: Given rights that include access to information, correction and erasure of data, grievance redressal, and the ability to nominate representatives for exercising rights in case of incapacity or death.

- Data Fiduciaries: Obligated to implement data protection measures, establish grievance redressal mechanisms, and ensure data security. Significant Data Fiduciaries4 are required to additionally conduct Data Protection Impact Assessments (DPIAs), and appoint Data Protection Officer and an independent data auditor evaluating compliance with the DPDP Act.

- Cross-Border Data Transfer: In a departure from the earlier regime requiring data localisation, the DPDP Act permits cross-border transfer of data unless explicitly restricted by the Indian government.

- Organisational Impact: Organizations must assess and enhance their data protection frameworks to comply with the DPDPA. Key steps include appointing Data Protection Officers (for significant data fiduciaries), implementing robust security measures, establishing clear data processing agreements, and ensuring mechanisms for data principals to exercise their rights.

- Penalties: Monetary penalty can be imposed by the Board based on the circumstances of the breach and the resultant impact (including whether any gain/loss has been realised/avoided by a person).

Enabling Mechanisms: the DPDP Rules, 2025

Under Section 40 of the DPDP Act, the Central Government is empowered to formulate rules to enable the implementation of the Act. Pursuant to this, the Draft Rules seek to provide guidance on compliance, operational aspects, administration and enforcement of the DPDP Act. The Draft Rules are to come into force upon publication however, certain critical provisions will only become effective at a later date5.

Key Provisions:

- Notice Requirements for Data Fiduciaries: The notice for consent required to be provided to the Data Principal should be clear, standalone, simple and understandable. Most crucially, the Draft Rules specify that the notice should include an itemized list of personal data being collected and a clear description of the goods/services/uses which are enabled by such data processing. The Data Principal should also be informed of the manner in which they can withdraw their consent, exercise their rights and file complaints. Data Fiduciaries should provide a communication link and describe applicable methods that will enable the Data Principal to withdraw their consent or file complaints with the Board.

- Consent Managers: Strict eligibility criteria have been prescribed for persons who can be appointed as Consent Managers – this must be an India-incorporated company with sound financial and operational capacity, with a minimum net worth of INR 2,00,00,000, a reputation for fairness and integrity and certified interoperable platform enabling Data Principals to manage their consent. These Consent Managers must uphold high standards of transparency, security and fiduciary responsibility and are additionally required to be registered with the Board and act as a single point of contact for Data Principals. Any transfer of control of such entities will require the prior approval of the Board.

- Data Processing by the State: The government can process personal data to provide subsidies, benefits, certificates, services, licenses or permits. However such processing must comply with the standards prescribed in the Draft Rules6 and the handling of personal data is lawful, transparent and secure.

- Reasonable Security Safeguards: The Draft Rules call for the implementation of ‘reasonable security measures’ by Data Fiduciaries to protect personal data. This includes encryption of data, access control, monitoring of access (particularly for unauthorised access), backup of data, etc. The safeguards should also include provisions to detect and address breach of data, maintenance of logs, and ensure that appropriate safety measures are built into any contracts with Data Processors.

- Data Breach Notification: Data Fiduciaries are required to promptly notify all affected Data Principals in the event of a breach. This notification shall include a clear explanation of the breach, the nature, extent, timing, potential consequences, mitigation measures and safety recommendations to safeguard the data. The Board is also required to be informed of such breach (including a description of the breach, nature, extent, timing, location and likely impact) within 72 hours of the Data Fiduciary being aware. Longer intimation timelines may be permitted upon request.

- Accountability and Compliance: Grievance redressal mechanisms are mandated to be published on Data Fiduciary’s platforms and the obligation is borne by such persons to ensure lawful processing of personal data. Processing is required to be limited to ‘necessary purposes’ and the data is only permitted to be retained for ‘as long as needed’.

- Data Retention by E-Commerce Entities and Online Gaming and Social Media Intermediaries: The Draft Rules require the deletion of user data after 3 years7 by: (i) e-commerce entities having minimum 2,00,00,000 registered users in India; (ii) online gaming intermediaries having minimum 50,00,000 registered users in India; and (iii) social media intermediaries having minimum 2,00,00,000 registered users in India.

- Consent for Children and Persons with Disabilities: The DPDP Act and Draft Rules envisage greater protection of personal data of children and persons with disabilities. Verifiable consent must be obtained from parents or legal guardians in accordance with the requirements set out in the Draft Rules. Critically, a Data Fiduciary is required to implement measures to ensure that the person providing consent on behalf of a child/person with disabilities is in fact, that child/person’s parent or legal guardian, who is identifiable. The Data Fiduciary is further required to verify that the parent is an adult by using reliable identity details or virtual tokens mapped to such details.

- Impact Assessment: Predominantly an obligation on Significant Data Fiduciaries, the Draft Rules impose a mandate to conduct yearly DPIAs to evaluate the risks associated with the data processing activities. This requires observance of due diligence to verify the algorithmic software8 to ensure there is no risk to the rights of Data Principals.

- Data Transfer Outside India: Discretion is left to the Central Government to set any requirements in respect of making personal data available to a foreign state or its entities. Data Fiduciaries processing data within India or in connection with goods or services offered to Data Principals from outside India must comply with these requirements as may be prescribed from time to time.

- Exemptions: The Draft Rules prescribe exemptions from the applicability of the DPDP Act for processing of personal data carried out: (i) for research, archival or statistical purposes, subject to compliance with the standards set out in Schedule II of the Draft Rules9; and (ii) by healthcare professionals, educational institutions, creche or day care facilities and their transporters, subject to compliance with conditions set out in Schedule IV of the Draft Rules.

- Enforcement: Including establishment of the regulatory authority (i.e., the Board), appointment of its chairperson, members, etc. and the appellate framework for decisions of the Board, the Draft Rules prescribe the mechanism for enforcement of the DPDP Act, including redressal of grievances and any consequent penalties imposed for contraventions of the law.

Implications of the Draft Rules

While the Draft Rules have been long awaited, there is still no clarity on the implementation timeline. Further, while the Ministry of Electronics & Information Technology have requested public comments on the Draft Rules, it is unlikely that the same would be released to the public. At the outset, it is apparent that the Draft Rules will require organisations to make significant investment in compliance measures to meet the requirements outlined. Including robust consent management systems, enhanced security protocols and transparent communication mechanisms with users, this will increase the overall compliance costs borne by businesses – particularly impacting smaller scale entities. Some of the key issues found in this framework as below:

- Operational Costs: Businesses may be required to restructure their platforms at a design and architecture level of application, leading to increased costs. With the added compliance burdens, this will also result in increased costs related to conducting regular audits and verifying algorithmic software (particularly by Significant Data Fiduciaries) and can lead to stifled innovation and limit market entry for upcoming businesses.

- Vagueness: Terms such as “reasonable safeguards”, “appropriate measures” or “necessary purposes” are used liberally in the Draft Rules however the same have not been adequately defined in the law, leaving a lack of clarity on what constitutes “reasonable”, “appropriate” or “necessary” standards. Further, use of phrasing such as “likely to pose a risk to the rights of data principals” does not provide clarity in satisfaction of due diligence obligations, which can lead to subjective enforcement.

- Significant reliance on discretionary authority: The Union Government has been given significant authority in determining exemptions, processing standards, data transfer and government functions involving data processing. There is consequently a lot of power given to the Government to determine the limits of the law and there is no clear criteria provided for an objective assessment, leading to questions on fairness and transparency. The Draft Rules also do not appear to adhere with the directions of the Supreme Court in the landmark judgment of K.S. Puttaswamy v Union of India 10 which explicitly states that: “the matter shall be dealt with appropriately by the Union Government, with due regard to what has been set out in this judgment” (emphasis supplied). Further, large parts of the implementation and enforcement will be administered per the discretion of the competent government ministry, leaving a lack of clarity in the foundational framework.

- Potential for mandatory universal registration: Verifiable parental consent requirements for children’s data can be used to require every online user to verify their age through governmental credentials, while seemingly placing reliance on self-verification. Consequently, parents/legal guardians would be required to provide government-issued identity to verify their credentials. Further, this mechanism not only violates the principles of data minimization and retention limitations but risks over-collection, prolonged storage and potential mass surveillance11.

- Lack of clarity in the law: In addition to a lack of guiding frameworks for mode of delivery of issuance of notices12, the Draft Rules create further ambiguity in legislations such as the Rights of Persons with Disabilities Act, 2016, Guardians and Wards Act, 1890, National Trust for the Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities Act, 1999, or the Mental Health Act, 2017 with respect to consent notices issued to persons with disabilities/children. The DPDP Act also does not consider regulation of non-personal data (such as traffic) and defined procedures for processes such as appointment of nominees or appeal timeline for orders of the Board, are not clearly outlined in the Draft Rules. The Draft Rules are also required to be harmonized with existing legislations such as the Information Technology Act, 2000 and the CERT-In directions issued thereunder, where the mandated reporting of cyber incidents is required to be made within 6 hours.

Concluding Thoughts

The Draft Digital Personal Data Protection Rules, 2025, represent a significant step toward operationalizing India’s ambitious DPDP Act, 2023, and businesses can use the Draft Rules as guidelines to determine the extent of revision of their existing data protection framework that may be required. While the Draft Rules aim to create a robust framework for safeguarding personal data, their implementation will require businesses to overhaul their data protection systems, leading to increased compliance costs and operational challenges. However, despite progressive provisions like Consent Managers and enhanced security measures, the Draft Rules leave room for ambiguity, particularly with undefined terms and broad discretionary powers. As stakeholders await further clarity and finalization, it is evident that achieving a balance between privacy rights, operational feasibility, and fostering innovation will be crucial for the success of this legislation.

India’s journey toward a comprehensive data protection regime has begun, but a clear roadmap for implementation, harmonization with existing laws, and addressing key gaps will be pivotal in building trust and driving compliance across sectors. For businesses, the time to prepare is now—building compliant frameworks will not just ensure legal adherence but also enhance user confidence in the digital ecosystem.

Stay tuned for more #TreelifeInsights as the Draft Rules evolve into actionable mandates.

References

- [1] https://pib.gov.in/PressReleasePage.aspx?PRID=2090271

↩︎ - [2] https://pib.gov.in/PressReleasePage.aspx?PRID=2090271

↩︎ - [3] This marks a change from the earlier regime which included a concept of “deemed consent”. The DPDP Act creates a category of permitted use that does not require explicit consent. See Section 7 of the DPDP Act.

↩︎ - [4] Data Fiduciaries notified by the Central Government under Section 10 of the DPDP Act, on the basis of factors such as: (i) volume and sensitivity of personal data processed; (ii) risk to the rights of the Data Principal; (iii) potential impact on the sovereignty and integrity of India; (iv) risk to electoral democracy; (v) security of the state; and (vi) public order. Significant Data Fiduciaries have additional obligations under the DPDP Act.

↩︎ - [5] Rules 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 21 and 22. See: Explanatory Note to Digital Personal Data Protection Rules, 2025 published by the Ministry of Electronics & Information Technology on January 3, 2025 here:

https://www.meity.gov.in/writereaddata/files/Explanatory-Note-DPDP-Rules-2025.pdf

↩︎ - [6] See Schedule II of the Draft Rules.

↩︎ - [7] Subject to users actively maintaining their accounts.

↩︎ - [8] The verification exercise focuses on software deployed for hosting, display, uploading, modification, publishing, transmission, storage, updation or sharing of personal data processed by the Data Fiduciary.

↩︎ - [9] This exemption is granted to ensure necessary data processing for academic and policy research can occur while maintaining safeguards and standards to protect such data.

↩︎ - [10] (2018) 8 S.C.R. 1, where principles of “proportionality” and “necessity” were held to be essential safeguards of any data protection regime.

↩︎ - [11] https://internetfreedom.in/statement-on-the-draft-dpdp-rules-2025/

↩︎ - [12] https://www.fortuneindia.com/macro/draft-dpdp-rules-2025-a-closer-look-at-the-hits-and-misses/119825

↩︎

Non Disclosure Agreements in India – NDA Template, Types & Breach

Blog Content Overview

- 1 Introduction

- 2 What is a Non-Disclosure Agreement (NDA)?

- 3 Types of Non-Disclosure Agreements in India

- 4 Essential Clauses in an NDA

- 5 Non Disclosure Agreements Format

- 6 Legal Validity of NDAs in India

- 7 Breach of NDAs: Consequences & Remedies

- 8 Importance of Customized NDAs for Businesses

- 9 FAQs on Non-Disclosure Agreements (NDAs) in India

- 9.0.1 1. What is an NDA, and why is it important in business?

- 9.0.2 2. What are the types of NDAs commonly used in India?

- 9.0.3 3. What happens if someone breaches an NDA in India?

- 9.0.4 4. How can businesses draft an effective NDA?

- 9.0.5 5. Are NDAs legally enforceable in India?

- 9.0.6 7. Why is it essential to customize an NDA instead of using a generic one?

- 9.0.7 8. How long does an NDA remain valid?

Introduction

Security of sensitive business information, protection of intellectual property and trade secrets and trust in collaborations are critical aspects of business security in an increasingly competitive and data-driven market today. It is to this effect that businesses typically execute non disclosure agreement (“NDA”), which imposes a contractual obligation on the party receiving the protected information to not only keep the same confidential but to not disclose or divulge such information without permission from the disclosing party.

NDAs can relate to trade secrets, business models, or intellectual property; all of which help to ensure confidentiality and security in business partnerships. Fundamentally, this agreement ensures that the recipient of such confidential information is obligated to keep the same protected. As such, any breach of an NDA would typically build in mechanisms for compensation for damages caused by the party in breach of the NDA.

Overview of NDAs in Indian Law / Legal Environment

NDAs in India are enforceable as per the Indian Contract Act, 1872. They are very commonly employed across sectors and can be used for purposes ranging from technology/manufacturing to consulting to even labour or critical events requiring protection of sensitive information. An airtight NDA defines what is and is not confidential information, limits the use of such information, and outlines the consequences for a breach of the obligations. NDAs are widely used in India to guard proprietary information involving in commercial transactions, employment, or partnership. NDAs keep the most important business information private by:

- Security of proprietary information from unauthorized use or leakage.

- Developing intellectual property, trade secrets, and business plans protection laws.

- Establishing trust in relationships while going through mergers, acquisitions or negotiations.

NDAs by ensuring confidentiality preserve a business’s competitive edge and eliminate litigation.such as technology, manufacturing, and consulting. NDAs can be unilateral, mutual or multilateral, but for it to be effective they should meet Indian laws. The success of an NDA depends on its definitions, enforceable provisions and jurisdiction. A breach of an NDA can be financially and reputationally disastrous.

What is a Non-Disclosure Agreement (NDA)?

A Non-Disclosure Agreement (NDA) is a legally binding contract designed to safeguard sensitive and proprietary information shared between two or more parties. It establishes a confidential relationship by outlining the type of information that must remain undisclosed, the purpose of sharing the information, and the consequences of any breach. NDAs are integral to protecting intellectual property, trade secrets, and other business-critical data.

Definition of a Non-Disclosure Agreement

In simple terms, an NDA is a formal agreement where one party agrees not to disclose or misuse the confidential information provided by the other party. Colloquially also referred to as a confidentiality agreement, an NDA ensures that the disclosed information is used solely for the intended purpose and remains secure. NDAs are enforceable under the Indian Contract Act, 1872, making them a vital tool in safeguarding sensitive data in India.

Key Purposes and Objectives of NDAs

The primary goal of an NDA is to maintain the confidentiality of information and prevent its unauthorized use. Key objectives include:

- Protecting Intellectual Property: Ensuring that trade secrets, patents, and proprietary processes remain secure.

- Establishing Trust: Building a reliable relationship between parties, particularly in mergers, acquisitions, or joint ventures.

- Avoiding Misuse of Data: Preventing employees, contractors, or partners from sharing confidential details with competitors.

- Defining Legal Recourse: Outlining the consequences of a breach, including penalties and legal actions.

By clearly defining the scope of confidentiality, NDAs reduce the likelihood of disputes and offer a framework for resolution if a breach occurs.

Real-Life Examples of NDA Use in Business Scenarios

NDAs are widely used across various industries and situations, such as:

- Employment Agreements: Employers often require NDAs to protect internal policies, client lists, and proprietary methods from being disclosed by employees.

- Mergers and Acquisitions: During due diligence, NDAs secure sensitive financial and operational data exchanged between companies. This can also include restrictions on disclosure of investment by a party and prevention of any media release (as typically required by incubators).

- Technology and Innovation: Startups and tech companies frequently use NDAs to safeguard unique ideas, algorithms, or software codes when pitching to investors or collaborating with developers.

- Freelance and Consulting Projects: Freelancers or consultants working with confidential client data are bound by NDAs to prevent misuse.

- Vendor or Supplier Relationships: NDAs protect sensitive pricing strategies, product designs, or supply chain details shared with third-party vendors.

For example, a startup seeking funding may share its business model, product specifications and financial projections with potential investors under an NDA, ensuring these details remain confidential and protected from competitors.

Types of Non-Disclosure Agreements in India

Non-Disclosure Agreements (NDAs) come in various forms depending on the nature of the relationship and the flow of confidential information between parties. Understanding the types of NDAs is essential for selecting the most suitable agreement to safeguard sensitive information. Typically, an NDA will impose a total ban on disclosure, except where such disclosure is required by law or on order of any statutory authority. Below are the primary types of NDAs used in India:

1. Unilateral NDAs

A Unilateral NDA is a one-sided agreement where only one party discloses confidential information, and the receiving party agrees to protect it. This type of NDA is commonly used when a business shares proprietary information with employees, contractors, or third-party vendors who are not expected to reciprocate with their own confidential data.

Common Use Cases:

- Protecting trade secrets during product development.

- Sharing sensitive business data with potential investors.

- Securing intellectual property shared with a freelancer or consultant.

Example: A tech startup providing details of its proprietary algorithm to a marketing agency under a unilateral NDA.

2. Bilateral/Mutual NDAs

A Bilateral NDA, also known as a mutual NDA, involves two parties sharing confidential information with each other and agreeing to protect it. This type of agreement is ideal when both parties need to exchange sensitive data, such as in partnerships, collaborations, or joint ventures.

Common Use Cases:

- Collaborations between companies on a new product or service.

- Mergers and acquisitions where both entities share financial and operational data.

- Negotiations between two businesses for a potential partnership.

Example: Two pharmaceutical companies working together on developing a new drug may use a mutual NDA to safeguard their research and development data.

3. Multilateral NDAs

A Multilateral NDA is used when three or more parties need to share confidential information among themselves while ensuring mutual protection. This type of NDA simplifies the process by consolidating multiple bilateral agreements into a single document, reducing legal complexities and administrative overhead.

Common Use Cases:

- Consortiums or alliances in large-scale projects like infrastructure development.

- Joint ventures involving multiple stakeholders.

- Collaborative research projects between academic institutions and private companies.

Example: A group of IT companies collaborating on a government project to develop a unified digital platform may use a multilateral NDA to protect their individual contributions.

Essential Clauses in an NDA

A well-drafted Non-Disclosure Agreement (NDA) is only as strong as the clauses it includes. Each clause serves a specific purpose in defining the rights and obligations of the parties, ensuring comprehensive protection of confidential information. Here are the key clauses every NDA should have:

1. Confidentiality Clause

The confidentiality clause is the cornerstone of an NDA. It explicitly defines what constitutes “confidential” or “privileged” or “sensitive” information, how it can be used, and the obligations of the receiving party to protect it.

Key Points to Include:

- Clearly specify the information considered confidential.

- Outline permissible uses of the information.

- Prohibit unauthorized sharing, reproduction, or disclosure.

2. Non-Compete Clause

A Non-Compete Clause prevents the receiving party from using the confidential information to gain a competitive advantage or engage in competing activities.

Key Points to Include:

- Define the duration of the non-compete obligation.

- Specify the geographic scope where competition is restricted.

- Ensure compliance with Indian laws to avoid enforceability issues.

Example: An NDA between a software company and a vendor may include a non-compete clause to prevent the vendor from replicating or selling similar software.

3. Duration and Scope of Confidentiality

This clause specifies how long the confidentiality obligation will remain in effect and the extent to which it applies.

Key Points to Include:

- Duration: Specify whether confidentiality is time-bound (e.g., 3-5 years) or indefinite.

- Scope: Clearly define the level of protection and the limitations of disclosure.

Tip: While most NDAs in India enforce confidentiality for a limited period, indefinite clauses are often used for trade secrets.

4. Dispute Resolution Clause

This clause outlines how disputes related to the NDA will be resolved. It ensures a smooth resolution process and avoids lengthy litigation.

Key Points to Include:

- Specify the jurisdiction under which disputes will be resolved.

- Choose between arbitration, mediation, or court proceedings.

- Define the governing laws (e.g., Indian Contract Act, 1872).

Example: An NDA might state that disputes will be resolved through arbitration under the Arbitration and Conciliation Act, 1996.

5. Exclusions from Confidentiality

This clause identifies situations where confidentiality obligations do not apply.

Common Exclusions:

- Information already in the public domain.

- Information disclosed with prior consent.

- Data independently developed without using confidential information.

Including clear exclusions prevents ambiguity and protects the receiving party from unwarranted liability.

Tips for Drafting a Legally Sound NDA in India

- Be Specific: Avoid vague terms; clearly define confidential information and obligations.

- Customize the NDA: Tailor the agreement to the specific needs of your business and the type of relationship.

- Include Remedies for Breach: Specify monetary penalties or injunctive relief for violations.

- Use Simple Language: Avoid overly complex legal jargon to ensure all parties fully understand their obligations.

- Seek Professional Help: Consult legal experts to ensure compliance with Indian laws and enforceability in courts.

Adding these essential clauses strengthens the NDA, ensuring that confidential information remains secure and disputes are minimized.

Non Disclosure Agreements Format

Overview of an NDA Template in India

An NDA template serves as a standard framework for creating confidentiality agreements tailored to specific needs. While the format can vary depending on the context, every NDA must clearly define the scope of confidentiality, the parties involved, and the remedies in case of a breach. A professionally drafted NDA ensures enforceability under the Indian Contract Act, 1872.

Key Elements to Include in an NDA

- Parties to the Agreement

- Clearly identify the disclosing party and the receiving party.

- Include details such as names, designations, and addresses to eliminate ambiguity.

- For multilateral NDAs, list all parties involved.

Example: “This Agreement is entered into by ABC Pvt. Ltd. (Disclosing Party) and XYZ Pvt. Ltd. (Receiving Party) on [date].”

- Definition of Confidential Information

- Specify the information considered confidential, such as trade secrets, business strategies, or technical data.

- Use precise language to avoid disputes about the scope of confidentiality. The more detailed the scope of what constitutes “confidential information”, the better clarity that is brought about on the non-disclosure obligation.

Example: “Confidential Information includes but is not limited to financial data, client lists, marketing strategies, and proprietary software.”

- Obligations of the Receiving Party

- Detail the receiving party’s responsibilities to safeguard the information.

- Prohibit disclosure to third parties and unauthorized use.

Example: “The Receiving Party agrees not to disclose the Confidential Information to any third party without prior written consent of the Disclosing Party.”

- Consequences of Breach

- Define the penalties for unauthorized disclosure or misuse of confidential information.

- Specify remedies such as monetary damages, injunctions, or termination of the agreement.

Example: “In the event of a breach, the Receiving Party shall indemnify the Disclosing Party for all losses, including legal fees and damages.”

- Jurisdiction and Governing Law

- Specify the jurisdiction under which disputes will be resolved.

- Include the applicable legal framework, such as Indian Contract Act, 1872.

Example: “This Agreement shall be governed by and construed in accordance with the laws of India, and disputes shall be subject to the exclusive jurisdiction of the courts in [city].”

Sample NDA Template for Download

To make the process easier, here’s a downloadable sample Non Disclosure Agreement PDF template for Indian businesses. The NDA Document includes all the main elements mentioned , ensuring compliance and clarity.

Download Sample Non Disclosure Agreement Format.

Legal Validity of NDAs in India

Non-Disclosure Agreements (NDAs) are widely used to protect sensitive information in India, but their enforceability depends on how well they align with the legal framework. Understanding the legal validity of NDAs is crucial for ensuring that these agreements hold up in a court of law.

Enforceability Under the Indian Contract Act, 1872

NDAs in India are governed by the Indian Contract Act, 1872, which mandates that:

- Lawful Consideration and Object: The agreement must not violate any existing laws or public policy.

- Free Consent: All parties must willingly agree to the terms without coercion, fraud, or misrepresentation.

- Definite and Certain Terms: The NDA must clearly define the confidential information, obligations, and consequences of a breach.

Key Point: NDAs with overly broad or vague clauses may be deemed unenforceable. Clauses such as “indefinite confidentiality for all types of information” are likely to be rejected by Indian courts.

Relevant Case Laws Supporting NDA Breaches in India

Case laws play a significant role in determining the enforceability of NDAs. Below are some landmark cases that highlight how Indian courts address NDA breaches, which have informed and clarified the interpretation of the Indian Contract Act, 1872 and its governance of non-disclosure agreements, including the enforceability of such agreements and their legal validity. These case laws have also informed the principle of “reasonableness” in enforcing such restrictions, from the perspective of protecting a business and its data:

- Niranjan Shankar Golikari v. Century Spinning & Manufacturing Co. Ltd. (1967):

- The Supreme Court upheld the validity of confidentiality clauses in employment contracts, ruling that such restrictions must be reasonable and protect legitimate business interests.

- Superintendence Company of India v. Krishan Murgai (1980):

- This case emphasized that NDAs and restrictive covenants must strike a balance between protecting business interests and not imposing unreasonable restrictions on an individual’s right to work.

- American Express Bank Ltd. v. Priya Puri (2006):

- The Delhi High Court ruled that NDAs signed by employees are enforceable, particularly when the disclosed information constitutes trade secrets or proprietary knowledge.

- Gujarat Bottling Co. Ltd. v. Coca-Cola Co. (1995):

- The court underscored that an injunction can be granted to prevent further disclosure of confidential information in case of a breach of an NDA.

Key Point: Courts often evaluate the reasonableness of the NDA’s terms and whether the breach caused material harm to the disclosing party.

Breach of NDAs: Consequences & Remedies

A breach of a Non-Disclosure Agreement (NDA) is a serious violation that can lead to significant legal, financial, and reputational damage. NDAs are legally binding contracts that ensure the confidentiality of sensitive information. Breaching an NDA can result in severe consequences, including legal actions, fines, and loss of business trust. This section explores common types of NDA breaches, legal remedies available in India, and ways to mitigate risks.

Common Types of Breaches

- Intentional Disclosure of Confidential Information

- This occurs when the receiving party intentionally discloses confidential information to unauthorized third parties.

- Example: An employee shares proprietary business strategies with a competitor to gain personal benefits.

- Accidental Breaches

- These breaches occur due to negligence, such as sending an email to the wrong person or failing to secure confidential files.

- Example: A company accidentally discloses confidential client information in an unsecured email.

What Happens If You Breach a Confidentiality Agreement?

A breach of the NDA is considered a civil offense in India. NDAs are legally enforceable contracts, and the receiving party is obligated to keep the disclosed information confidential. If the confidentiality clause is breached, several legal consequences may follow:

Legal Remedies for Breach of NDA

In the event of a breach, the NDA itself may outline remedies such as termination, injunctions, and indemnification.

- Injunctions

- The non-breaching party may seek a court order to stop the breaching party from further disclosing confidential information. Injunctions may be interim (temporary) or perpetual (permanent).

- Legal Basis: Governed by Order XXXIX Rule 1 and 2 of the Code of Civil Procedure, 1908, and Section 38 of the Specific Relief Act, 1963.

- Indemnification and Damages

- The breaching party may be required to indemnify the non-breaching party for any losses, including court fees, legal costs, and actual damages incurred. This can include both compensatory and consequential damages.

- Compensatory Damages: These are calculated based on the actual financial loss suffered due to the breach.

- Example: If a business loses ₹50,000 due to a breach, compensatory damages may cover that loss.

- Consequential Damages: These damages include losses that occurred indirectly due to the breach, such as lost profits or opportunities.

- Example: A tour company loses potential sales after a breach prevents them from securing a necessary asset.

- Criminal Remedies

- In certain cases, criminal remedies may apply, particularly under the Indian Penal Code (IPC) and the Information Technology Act, 2000.

- Section 72A of the IT Act, 2000 provides for imprisonment up to 3 years or fines up to ₹5 lakh for the unlawful disclosure of information obtained during a contractual relationship.

- In certain cases, criminal remedies may apply, particularly under the Indian Penal Code (IPC) and the Information Technology Act, 2000.

Why Should You Not Break a Confidentiality Agreement?

Breaking an NDA can lead to severe consequences, including:

- Legal and Financial Penalties

- NDAs often specify penalties for violations, including injunctions, indemnifications, and damages.

- A breach could result in substantial financial loss, not only in direct damages but also in reputational harm and loss of future business.

- Job Termination and Reputational Damage

- For employees or contractors, breaching an NDA may result in termination from their position and loss of professional reputation.

- Businesses that breach NDAs risk losing client trust and face the possibility of damaging their public image, which could lead to a loss of clients and future opportunities.

Different Types of Contract Breach Remedies

The remedy for a breach of NDA depends on the specific provisions in the agreement, the nature of the violation, and the facts of the case. Common remedies include:

- Damages for Compensation

- Compensatory Damages: The most common remedy, compensatory damages are calculated based on the actual losses suffered due to the breach, including expectation damages and consequential damages.

- Example: A business loses potential profits from a deal that fell through due to a breach.

- Specific Performance

- Courts may order the breaching party to fulfill its contractual obligations if monetary damages are insufficient. This remedy is more common for contracts involving unique or irreplaceable items.

- Example: A company may seek specific performance if the item breached is a unique asset that cannot be replaced.

- Injunctions

- Injunctions prevent the breaching party from further disclosing confidential information. These can be temporary or permanent, depending on the severity of the breach.

- Liquidated Damages

- A set amount specified in the NDA to cover the breach, particularly where it is difficult to quantify actual damages. Liquidated damages clauses are often used in construction contracts, real estate deals, and partnerships.

- Revocation

- The non-breaching party can rescind the contract, returning both parties to their original position. This remedy is typically used for significant breaches that go to the heart of the agreement.

How to Mitigate the Risk of NDA Breaches

- Draft Clear and Precise NDAs

- Ensure that the NDA clearly defines the scope of confidentiality and the consequences of a breach. Consider incorporating clauses for arbitration to resolve disputes efficiently.

- Implement Security Measures

- Use encryption, access restrictions, and secure systems to prevent accidental breaches.

- Regular Audits and Training

- Conduct periodic reviews of compliance and train employees and third parties on proper handling of confidential information.

- Legal Preparation

- Ensure that any breach is met with swift legal action through well-defined remedies in the NDA.

This proactive approach helps mitigate risks and maintain business integrity.

Importance of Customized NDAs for Businesses

A generic NDA may not always be effective in addressing the specific needs and risks of a business. Customized NDAs are essential for ensuring that the confidentiality, legal obligations, and remedies align with the unique aspects of each business relationship.

Benefits of Tailoring NDAs for Specific Business Needs

- Enhanced Protection of Sensitive Information

Custom NDAs allow businesses to define confidential information more precisely, ensuring better protection for proprietary data, trade secrets, and strategic plans. - Addressing Unique Business Risks

A tailored NDA can address the unique risks associated with different types of business relationships, such as vendor contracts, partnerships, or employee agreements, ensuring that all specific scenarios are covered. - Clearer Terms and Obligations

By customizing the terms and obligations, businesses can ensure both parties have a clear understanding of their responsibilities, reducing the potential for disputes. - Better Enforcement of Terms

A well-crafted NDA that aligns with business needs is easier to enforce in case of breach, as it clearly defines the scope of confidential information, obligations, and penalties for violation. - Minimized Legal Loopholes

Customization helps eliminate ambiguities and potential legal loopholes that could undermine the NDA’s effectiveness in protecting confidential information.

Wrapping up, Non-Disclosure Agreements (NDAs) are a vital tool for businesses in India to protect confidential information and ensure that sensitive data remains secure. Whether it’s a unilateral, bilateral, or multilateral NDA, having the right type tailored to your specific needs is essential for safeguarding trade secrets, business strategies, and proprietary information. A well-drafted NDA template can serve as a solid foundation for any business relationship, offering clarity on obligations and consequences in case of breach. Understanding the legal framework surrounding NDAs, including remedies for breach, is crucial to ensure enforceability under Indian law. To maximize protection, it’s highly recommended to consult with a legal professional to draft a customized NDA that best suits your business’s unique requirements.

FAQs on Non-Disclosure Agreements (NDAs) in India

1. What is an NDA, and why is it important in business?

A Non-Disclosure Agreement (NDA) is a legally binding contract that protects confidential information shared between parties during business dealings. It ensures sensitive data like trade secrets, strategies, or intellectual property remains secure, preventing unauthorized disclosure and fostering trust in business relationships.

2. What are the types of NDAs commonly used in India?

The three main types of NDAs are:

- Unilateral NDA: One party discloses information to another.

- Bilateral (Mutual) NDA: Both parties share confidential information.

- Multilateral NDA: Multiple parties are involved in the agreement.

Each type caters to different business scenarios and ensures tailored protection.

3. What happens if someone breaches an NDA in India?

A breach of NDA can lead to serious consequences, including:

- Civil remedies: Injunctions, monetary damages, or compensation under the Indian Contract Act, 1872.

- Criminal penalties: Punishments under laws like the IT Act, 2000 for unauthorized data disclosure.

Legal actions ensure accountability and protect the affected party’s interests.

4. How can businesses draft an effective NDA?

Businesses should seek legal assistance to draft customized NDAs that address their specific needs. This includes tailoring clauses for confidentiality, scope, and remedies for breach, ensuring compliance with Indian laws for enforceability.

5. Are NDAs legally enforceable in India?

Yes, NDAs are enforceable under Indian laws, including the Indian Contract Act, 1872, Specific Relief Act, 1963, and other relevant statutes. Courts uphold NDAs as long as the terms are fair, reasonable, and not overly broad.

7. Why is it essential to customize an NDA instead of using a generic one?

A customized NDA addresses the unique risks and requirements of your business, ensuring better protection of sensitive information. Tailoring an NDA minimizes legal loopholes, clarifies obligations, and provides effective remedies for breach.

8. How long does an NDA remain valid?

The validity of an NDA depends on the terms set in the agreement. It can be for a fixed duration (e.g., 2-5 years) or remain indefinite, especially for trade secrets or proprietary information that requires long-term protection.

Mergers & Acquisitions in India – Meaning, Difference, Types, M&A Examples

Blog Content Overview

- 1 Introduction

- 2 What are Mergers and Acquisitions?

- 3 Key Differences Between Mergers and Acquisitions

- 4 Types of Mergers and Acquisitions

- 5 Merger and Acquisition Process

- 6 Benefits and Challenges of Mergers and Acquisitions

- 7 Recent and Latest Mergers and Acquisitions in India

- 8 Legal and Regulatory Framework Governing M&A in India

- 9 Examples of Successful M&A Deals in India

- 10 Reasons for Mergers and Acquisitions

- 11 Future of Mergers and Acquisitions in India

- 12 Conclusion

- 13 FAQs on Mergers & Acquisitions in India

- 13.0.1 1. What is the meaning of mergers and acquisitions in India?

- 13.0.2 2. What is the difference between a merger and an acquisition?

- 13.0.3 3. What are the main types of mergers and acquisitions?

- 13.0.4 4. Why do companies pursue mergers and acquisitions in India?

- 13.0.5 6. What are the challenges in the M&A process in India?

- 13.0.6 7. How do synergies work in mergers and acquisitions?

Introduction

Mergers and Acquisitions (M&A) have emerged as transformative business strategies in the Indian economic landscape, reshaping industries and fostering innovation. At its core, mergers involve the integration of two companies into a single entity, while acquisitions refer to one company taking control over another. Together, these strategies drive growth, create synergies, and enhance competitiveness in an increasingly dynamic marketplace.

India, with its burgeoning economy and government initiatives such as Ease of Doing Business, offers a fertile ground for M&A activities. Key factors driving this trend include globalization, technological advancements, and the need for businesses to scale operations and access new markets. From tech startups to traditional manufacturing giants, M&A plays a pivotal role in aligning businesses with evolving market demands.

As a result, the importance of M&A in the Indian economy cannot be overstated. It enables companies to achieve operational efficiencies, expand product portfolios, and enter untapped markets. For the Indian economy at large, M&A fosters job creation, encourages foreign investments, and enhances the global standing of Indian enterprises. Notable examples like the Flipkart-Walmart deal and the Disney India-Reliance (JioCinema) mergers highlight how such transactions have not only transformed the businesses involved but also impacted entire industries and consequently, the Indian consumer experience.

As India continues to position itself as a global economic powerhouse, mergers and acquisitions remain a cornerstone of its corporate strategy, driving innovation, market consolidation, and economic progress.

What are Mergers and Acquisitions?

Mergers and Acquisitions (M&A) are strategic corporate actions that businesses undertake to achieve growth, gain competitive advantages, or drive value creation. While often discussed together, mergers and acquisitions have distinct definitions and implications in the corporate world.

Definition of Mergers

A merger occurs when two companies combine to form a single, unified entity. This is often done to pool resources, share expertise, and achieve operational efficiencies, or to expand the reach a business has in the relevant market. In a merger, the entities involved are typically of similar size, and the integration is seen as a collaborative effort. For example, the merger of Vodafone India and Idea Cellular created one of the largest telecom operators in India, Vodafone Idea.

Definition of Acquisitions

An acquisition, on the other hand, happens when one company takes control of another. This can involve purchasing a majority stake or acquiring the entire business. Acquisitions can be either friendly or hostile, depending on whether the target company agrees to the deal. A well-known acquisition in India is Walmart’s takeover of Flipkart, which helped Walmart enter the Indian e-commerce market.

Reasons for Mergers and Acquisitions

Companies pursue mergers and acquisitions for several strategic reasons, including:

- Market Expansion:

M&A enables businesses to enter new geographical regions, tap into different customer bases, and expand their market share. For example, in the financial year of 2023-2024, Reliance Industries acquired the retail, wholesale, logistics and warehousing businesses of Future Group. This deal is projected to consequently expand the reach of Reliance Industries’ retail arm in India. - Cost Savings:

Consolidation often results in economies of scale, reducing production costs, streamlining operations, and enhancing profitability. - Diversification:

By acquiring companies in different sectors, businesses reduce risk and ensure a steady revenue flow even in volatile markets. This trend can be seen in Zomato’s acquisition of grocery delivery company Blinkit (formerly known as Grofers). The acquisition greatly benefited Zomato, leading to 169% returns in the trailing year. - Access to Technology and Talent:

M&A helps organizations acquire cutting-edge technology, intellectual property, and skilled workforce without building these capabilities from scratch. For example, in F.Y. 2023-2024, Tata Motors announced a strategic partnership with Tesla Inc. whereby Tesla’s advanced battery technology and autonomous driving features could be introduced into Tata Motors’ EV lineup in India, in exchange for a 20% stake valued at USD 2 billion. - Synergies:

Perhaps the most significant reason for M&A is achieving synergies—the enhanced value generated when two companies combine.

Synergies in Mergers and Acquisitions

Synergies in mergers and acquisitions refer to the financial and operational benefits derived from combining two businesses. Synergies can take several forms:

- Cost Synergies:

Achieved by eliminating duplicate roles, sharing resources, and optimizing operations to reduce overall expenses. - Revenue Synergies:

Created when the combined entity generates higher sales due to a broader customer base, complementary products, or better market positioning. - Financial Synergies:

Resulting from better access to funding, improved credit ratings, and enhanced financial stability.

For example, the merger of Daimler-Benz and Chrysler aimed to combine their expertise and resources, creating one of the largest automotive manufacturers with significant operational and cost synergies. Similarly in India, the Disney India-Reliance media asset merger will see not only continued survival of the streaming platform offered by Disney India, but will also enable the merged entity to provide a more comprehensive service to Indian consumers, thereby ensuring a steady synergy between the two companies.

Key Differences Between Mergers and Acquisitions

Mergers and acquisitions are often used interchangeably, but they are fundamentally different in their structure, purpose, and impact. Understanding these differences is essential for businesses evaluating their growth strategies and for stakeholders aiming to interpret these corporate moves.

What is the Difference Between a Merger and an Acquisition?

Mergers and acquisitions differ across several dimensions, including their operational goals, legal requirements, and financial implications. Below is a detailed table explaining these differences:

| Aspect | Merger | Acquisition |

| Definition | Combining two companies into a single, unified entity. | One company takes control of another by purchasing its shares or assets. |

| Objective | To achieve mutual growth by sharing resources and market opportunities. | To expand market presence, gain assets, or eliminate competition. |

| Legal Process | Involves mutual agreement and shareholder approval from both entities. A scheme of merger will also require approval from the National Company Law Tribunal and (where the applicable thresholds are attracted) approval from the Competition Commission of India and/or the Reserve Bank of India/Securities and Exchange Board of India. | The acquiring company gains ownership, which can be friendly or hostile. This is typically done by way of business transfer agreements or slump sales. |

| Control and Ownership | Ownership is typically shared between the merged companies. | The acquiring company retains control; the target company loses autonomy erstwhile enjoyed. |

| Cultural Impact | Requires integration of organizational cultures and systems. | The target company often adopts the culture and processes of the acquirer. |

| Size of Companies | Usually, companies of similar size merge. | The acquiring company is generally larger and financially stronger. |

| Financial Impact | Often viewed as a collaborative growth strategy with shared benefits. | Can lead to financial domination by the acquiring company over the acquired. |

| Examples in India | Vodafone & Idea Cellular (merger to form Vodafone Idea). | Walmart acquiring Flipkart for market entry into India. |

Real-Life Examples to Highlight the Differences

Merger Example: Vodafone & Idea Cellular

The merger between Vodafone India and Idea Cellular in 2018 created Vodafone Idea Limited, a single entity to counter the rising competition in India’s telecom sector. This was a collaborative decision to combine their resources and customer base, resulting in a larger market share and operational synergies.

Acquisition Example: Walmart & Flipkart

In 2018, Walmart acquired a 77% stake in Flipkart for $16 billion. This acquisition marked Walmart’s entry into the Indian e-commerce space, allowing it to compete with Amazon and leverage Flipkart’s established market presence. The acquisition was strategic, as Walmart gained complete control while Flipkart operated under its umbrella.

The difference between merger and acquisition lies in their structure, purpose, and execution. While mergers aim for collaboration and mutual growth, acquisitions are often driven by strategic takeovers to enhance competitiveness or expand market reach.

Types of Mergers and Acquisitions

Depending on the strategic goals of the companies involved, M&A transactions are classified into various types. These types not only reflect the nature of the deal but also its potential impact on the market, operations, and competitive positioning.

a. Types of Mergers

- Horizontal Merger

- A horizontal merger occurs when two companies operating in the same industry and often as direct competitors combine forces.

- Objective: To gain market share, eliminate competition, and achieve economies of scale.

- Example: The merger of Vodafone India and Idea Cellular to create Vodafone Idea aimed to strengthen their position in the telecom market.

- Vertical Merger

- A vertical merger involves the combination of companies operating at different levels of the supply chain (e.g., a supplier and a buyer).

- Objective: To ensure better control over the supply chain, reduce costs, and improve efficiency.

- Example: Reliance Industries’ acquisition of Den Networks and Hathway Cable to expand its Jio broadband services.

- Conglomerate Merger

- A conglomerate merger happens between companies from completely unrelated industries.

- Objective: To diversify business operations and mitigate risks associated with a single market.

- Example: The Tata Group’s acquisition of Tetley Tea, which diversified its operations into the beverage sector.

- Market Extension Merger

- Combines companies offering similar products in different geographical markets.

- Objective: To expand market reach and access new customer bases.

- Example: Airtel acquiring Zain Telecom’s African operations.

- Product Extension Merger

- Involves companies that deal with related products merging to expand their product lines.

- Objective: To offer complementary products and enhance market penetration.

- Example: Facebook’s acquisition of Instagram to broaden its social media portfolio.

b. Types of Acquisitions

- Friendly Acquisitions

- These are mutually agreed deals where the acquiring and target companies collaborate on the transaction.

- Example: Tata Steel’s acquisition of Bhushan Steel to enhance its production capacity.

- Hostile Takeovers

- Occur when the acquiring company takes control of the target company without its consent, often by purchasing a majority of its shares.

- Example: L&T’s hostile takeover of Mindtree.

- Reverse Mergers

- In this scenario, a private company acquires a public company to bypass the lengthy IPO process and become publicly traded.

- Example: The reverse merger of Vedanta Resources into Sterlite Industries.

c. Theories of Mergers and Acquisitions

- Efficiency Theory

- Suggests that M&A transactions are driven by the desire to increase operational efficiency.

- Focus: Cost reduction, revenue enhancement, and resource optimization.

- Example: Companies merging to reduce redundant departments and cut costs.

- Monopoly Theory

- Argues that M&As are often pursued to eliminate competition and gain a dominant market position.

- Focus: Market power and the ability to influence pricing and industry standards.

- Example: The acquisition of WhatsApp by Facebook to dominate the messaging space.

- Valuation Theory

- Suggests that companies engage in M&A when the target company’s market value is lower than its perceived intrinsic value.

- Focus: Acquiring undervalued businesses to create financial gains.

- Example: Reliance Industries acquiring multiple startups to tap into high-growth sectors.

Merger and Acquisition Process

The merger and acquisition process is a multifaceted journey that requires meticulous planning and execution. Each phase of the process plays a vital role in ensuring the success of the transaction, minimizing risks, and maximizing value. Here’s a step-by-step breakdown of the key stages involved:

1. Strategic Planning

- This is the foundational stage where companies identify their objectives for the merger or acquisition.

- Key Activities:

- Define clear goals: market expansion, cost efficiency, or diversification.

- Identify potential target companies.

- Assess alignment with long-term business strategies.

- Importance: Strategic clarity ensures the M&A aligns with the company’s vision and delivers value.

2. Due Diligence

- A critical stage involving an in-depth evaluation of the target company.

- Key Areas of Assessment:

- Financial performance, including revenue and debt.

- Legal compliance and potential liabilities.

- Market position, competition, and operational efficiency.

- Importance: Identifies potential risks and validates the decision to proceed with the transaction.

3. Valuation and Negotiation

- This phase determines the value of the target company and sets the terms of the deal.

- Key Activities:

- Assess the company’s intrinsic and market value.

- Negotiate terms such as purchase price, payment structure, and contingencies.

- Importance: Accurate valuation prevents overpayment and ensures the deal’s financial viability.

4. Legal and Regulatory Approvals

- Securing necessary permissions from governing bodies to ensure compliance with local and international laws.

- Key Activities:

- Review by legal teams for compliance with corporate, tax, and antitrust laws.

- Obtain approvals from regulatory bodies like National Company Law Tribunal, SEBI, RBI, or the Competition Commission of India (CCI).

- Importance: Ensures the deal is legally sound and avoids future legal challenges.

5. Integration Planning

- Preparing a roadmap to merge the operations, cultures, and systems of the two entities.

- Key Activities:

- Define integration objectives and timelines.

- Plan the merging of HR, IT, operations, and finance systems.

- Importance: Effective planning minimizes disruptions and facilitates a seamless transition.

6. Post-Merger Integration

- The final and often most challenging phase where the actual integration takes place.

- Key Activities:

- Align organizational cultures and team structures.

- Monitor and evaluate the performance of the combined entity.

- Address stakeholder concerns and maintain morale.

- Importance: Ensures the realization of synergies and the success of the M&A.

Benefits and Challenges of Mergers and Acquisitions

a. Benefits of Mergers and Acquisitions

- Increased Market Share

- M&A allows companies to consolidate their position in existing markets and expand into new ones.

- Example: The Flipkart-Walmart acquisition strengthened Walmart’s presence in India’s e-commerce sector.

- Operational Synergies

- Combining resources and expertise leads to cost savings, improved efficiency, and higher productivity.

- Example: The Vodafone-Idea merger achieved economies of scale in operations.

- Enhanced Financial Performance

- M&A enables companies to leverage combined assets for greater profitability and improved cash flow.

- Example: HDFC Bank and HDFC Limited merger enhanced their financial services portfolio.

b. Advantages and Disadvantages of Mergers and Acquisitions

| Advantages | Disadvantages |

| Economies of Scale: Cost reduction through shared resources and streamlined operations. | Cultural Clashes: Differences in organizational cultures can disrupt operations. |

| Access to New Markets: Entering untapped geographical or demographic markets. | High Costs: Significant financial investment for valuations, legal fees, and integrations. |

| Improved Competitiveness: Enhanced ability to compete in global or local markets. | Regulatory Hurdles: Compliance with complex legal and antitrust requirements can take a significant period of time to obtain approvals, causing delays in closing deals. |

Recent and Latest Mergers and Acquisitions in India

Mergers and acquisitions (M&A) in India have become a pivotal part of the business landscape, reflecting the country’s growing economy and diverse industry sectors. The latest M&A deals in India showcase how companies are using strategic consolidations to enhance market presence, strengthen financials, and expand their portfolios. Here are a few significant recent and latest mergers and acquisitions in India:

1. Walmart & Flipkart

- Overview: Walmart’s acquisition of Flipkart in 2018 for $16 billion was one of the largest deals in India’s e-commerce sector.

- Strategic Impact: Walmart gained a significant foothold in the Indian market, enabling it to compete with Amazon in the growing online retail space. Flipkart benefited from Walmart’s deep financial resources and global supply chain expertise.

- Importance: This acquisition exemplifies a classic example of market expansion and securing a dominant position in the Indian e-commerce market.

2. HDFC Bank & HDFC Ltd.

- Overview: In 2022, HDFC Bank announced the acquisition of HDFC Ltd., creating India’s largest private sector bank by assets.

- Strategic Impact: This merger aims to create synergies in banking and housing finance, providing integrated financial services to customers and improving operational efficiencies.

- Importance: The merger is expected to drive substantial growth for the bank, enabling cross-selling opportunities and increasing market share in financial services.

3. Tata Consumer & Bisleri (Proposed)

- Overview: Tata Consumer Products, which owns Tata Tea and other popular brands, is in talks to acquire Bisleri, a leading bottled water brand in India.

- Strategic Impact: The acquisition would strengthen Tata Consumer’s position in the beverage sector, particularly in the bottled water market, one of the fastest-growing segments in India.

- Importance: If the deal goes through, it would mark a major consolidation in the FMCG sector, combining two strong brands and expanding Tata Consumer’s portfolio of products.

Trends in Recent Mergers and Acquisitions in India

- Industry Consolidation: M&A deals in India are becoming more common in sectors such as e-commerce, banking, and FMCG, as companies look to diversify and expand their offerings.

- Cross-border Acquisitions: Increasingly, Indian companies are acquiring foreign firms to access international markets and new technologies. For instance, Tata Group’s acquisition of Air India was a major step toward reviving the airline and increasing global market reach.

- Strategic Alliances: Companies are forming alliances through mergers and acquisitions to enhance competitive advantages, such as better financial performance and market entry in new regions.

Legal and Regulatory Framework Governing M&A in India

Mergers and acquisitions (M&A) in India are governed by a complex and detailed legal and regulatory framework. Companies looking to execute M&A transactions must comply with various laws and regulations to ensure that the deal is legally sound and does not face any future legal challenges. Below is an overview of the key legislations, regulatory bodies, and tax implications involved in M&A in India.

Key Legislations Governing M&A in India

- Companies Act, 2013

- The Companies Act, 2013 serves as the principal legislation for governing corporate transactions, including mergers and acquisitions, in India. It outlines the procedures for mergers, demergers, and corporate restructuring, including the approval process by shareholders, creditors, and the National Company Law Tribunal (NCLT).

- Important Provisions:

- Sections 230 to 232 of the Companies Act deal with the process of mergers and demergers. Robust mechanisms are put in place to ensure greater transparency and accountability, ensuring protection of stakeholders.

- Provisions related to the protection of minority shareholders and creditors during the M&A process.

- SEBI Guidelines

- The Securities and Exchange Board of India (SEBI) regulates M&A deals involving listed companies to ensure transparency and protect the interests of investors.

- Key SEBI Regulations:

- SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011: Governs the process of acquiring control or a substantial amount of shares in a listed company.

- SEBI (Issue of Capital and Disclosure Requirements) Regulations: Applies to the issuance of securities in the case of mergers, especially if the transaction involves a public offer.