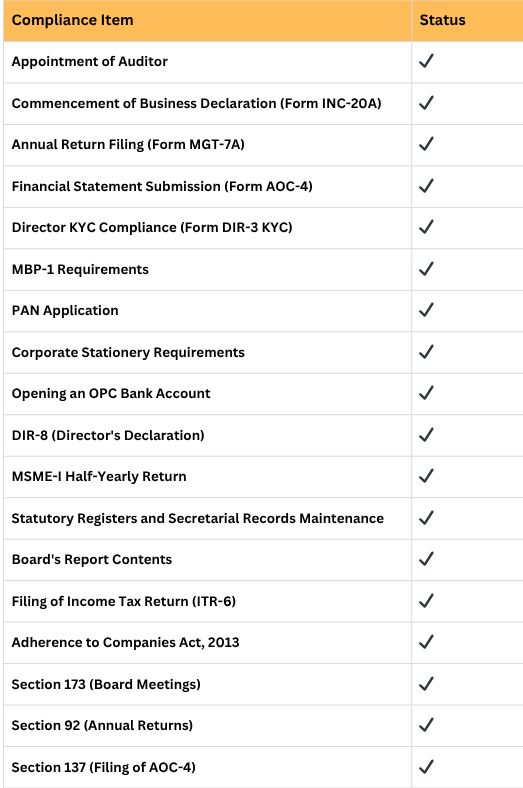

Ensuring compliance for a One Person Company (OPC) in India is essential for maintaining its legal standing and operational efficiency. Key obligations include:

- Appointment of Auditor: Within 30 days of incorporation, an OPC must appoint a practicing Chartered Accountant as its first auditor.

- Commencement of Business Declaration (Form INC-20A): This declaration must be filed within 180 days of incorporation, confirming the receipt of subscription money.

- Annual Return Filing (Form MGT-7A): OPCs are required to file their annual return within 180 days from the end of the financial year, detailing the company’s financial performance and other pertinent information.

- Financial Statement Submission (Form AOC-4): Audited financial statements must be filed within 180 days from the end of the financial year.

- Director KYC Compliance (Form DIR-3 KYC): Directors must complete their KYC process annually by September 30th of the subsequent financial year.

- MBP-1 Requirements: MBP-1 must be filed by the director during the first board meeting of the year to disclose their interest in the company’s assets or financial dealings.

- PAN Application: Once the OPC is incorporated, the next step is to apply for the PAN (Permanent Account Number). This can be done online through the NSDL website. After the allotment, the PAN application letter should be signed by the director and sent along with the company seal to NSDL.

- Corporate Stationery Requirements: After the incorporation of an OPC, it’s mandatory to procure essential stationery, which includes a company name board that should clearly state the company name along with “One Person Company” in brackets. Additionally, an official rubber stamp and a company letterhead with these details should be prepared.

- Opening an OPC Bank Account: For opening a bank account for the OPC, several documents are required, including the certificate of incorporation, the Memorandum and Articles of Association (MOA/AOA), the PAN card, a board resolution for account opening, and the director’s ID proof. It is crucial that these documents are self-attested and include the company seal.

- DIR-8 (Director’s Declaration): DIR-8 is a statutory requirement for OPCs, where the director must file a declaration confirming that they are not disqualified from being a director under the provisions of the Companies Act, 2013. This filing is mandatory and should be done annually.

- MSME-I Half-Yearly Return: OPCs must file an MSME-I form twice a year to report their dues to micro and small enterprises. The deadlines for filing the MSME-I return are 31st October for April-September and 30th April for October-March.

- Statutory Registers and Secretarial Records Maintenance: It is mandatory for OPCs to maintain various statutory registers, including the register of members, directors, and charges. In addition, OPCs must maintain a minute book and keep copies of annual returns and resolutions passed by the company.

- Board’s Report Contents: The Board’s Report of an OPC should include key disclosures such as the company’s web address, director’s responsibility statement, fraud reporting details, auditor’s remarks, and financial highlights. The report should also cover changes in directorship, significant orders passed, and the state of affairs of the company.

- Filing of Income Tax Return (ITR-6): OPCs must file their income tax return (ITR-6) annually by 30th September. This form is specifically designed for companies, and OPCs must disclose all income, deductions, and exemptions in their tax return.

- Adherence to Companies Act, 2013: Relevant sections of the Companies Act, 2013 to ensure legal accuracy and authority.

For instance:- Section 173: Pertains to the board meetings of a company, ensuring that the board meetings are conducted according to legal requirements.

- Section 92: Relates to the filing of annual returns, specifying what should be included and when these filings must occur.

- Section 137: Requires the filing of AOC-4 (Annual Accounts) by the company, ensuring that the company complies with regulatory filing requirements for financial statements.

Adhering to these compliance requirements not only ensures legal conformity but also enhances the credibility and smooth functioning of the OPC.

What is a One Person Company (OPC) in India?

A One Person Company (OPC) in India is a business structure that allows a single individual to establish and operate a company under the provisions of the Companies Act, 2013. This concept was introduced to support entrepreneurs who are capable of starting a venture by allowing them to create a single-person economic entity. Before this Act, at least two directors and shareholders were required to form a company.

Here are some key features of an OPC:

- Single Shareholder: An OPC has only one member or shareholder, distinguishing it from other types of companies which require at least two shareholders.

- Management and Ownership: The same individual holds complete control over the company, managing its operations while also owning all the company’s shares.

- Directors: While an OPC can have only one member, it can appoint up to fifteen directors to facilitate its business operations, a number that can be increased beyond fifteen through a special resolution.

- Legal Status: An OPC is registered as a private limited company. This classification subjects it to all legal provisions applicable to private limited companies, including specific compliance requirements related to annual filings, financial statement audits, and more.

- Advantages Over Sole Proprietorship: An OPC provides limited liability protection to its sole owner, separating personal assets from the business’s liabilities. This is a significant advantage over a sole proprietorship, where personal assets can be at risk in case of business failure.

- Compliance Requirements: Like other private limited companies, an OPC must comply with various statutory requirements set out by the Companies Act. These include filing annual returns, maintaining books of accounts, and other regulatory compliances.

In essence, an OPC combines the simplicity of a sole proprietorship with the protective features of a company, making it an attractive option for entrepreneurs who prefer to work independently while enjoying the corporate veil.

What are Compliances for One Person Company (OPC) in India?

Compliances for a One Person Company (OPC) in India are legal requirements that every company with a single owner must meet to maintain its status as a separate legal entity. These obligations, overseen by the Ministry of Corporate Affairs (MCA), are essential for the company to uphold its operational integrity and meet the regulatory standards established by the government. Annually, every registered OPC is required to fulfill these duties, which include the filing of an annual return and audited financial statements that provide a detailed account of the company’s activities and financial status over the previous financial year. The deadlines for these filings are determined by the date of the Annual General Meeting (AGM). Failure to comply can result in severe repercussions, including the removal of the company from the Registrar of Companies (RoC) register and the disqualification of its directors. Therefore, adhering to these annual compliance requirements is crucial for the sustainability and legal compliance of an OPC in India.

List of Important Compliances for One Person Company in India

| Compliance Name | Compliance Description | Associated Forms | Deadline | Penalty | Additional Notes |

| Appointment of First Auditor | Appoint a practicing Chartered Accountant as the first auditor within 30 days of incorporation. | ADT-1 (for subsequent auditors only) | Within 30 days of incorporation | Not Applicable (for first auditor) | |

| Commencement of Business (Form INC-20A) | File a declaration for commencement of business within 180 days of OPC incorporation. | INC-20A | Within 180 days of incorporation | The Company shall be liable to a penalty of Rs. 50,000/- and every officer who is in default shall be liable to a penalty of Rs. 1,000/- for each day during which such default continues but not exceeding Rs. 1,00,000/-. If no such declaration has been filed with the RoC and the RoC has reasonable cause to believe that the Company is not carrying on any business or operations, he may initiate action for the removal of the name of the Company From the register of Companies | |

| Annual Board Meetings | Conduct a minimum of one board meeting in each half of the calendar year, with a gap of at least 90 days between the meetings. | Not Applicable | – At least once a year – Minimum 90 days gap between meetings | – Every officer whose duty was to give notice of Board Meeting and who fails to do so shall be liable to a penalty of Rs. 25,000/- Rs. 25,000 for the company – Rs. 5,000 for officer in default | Not mandatory to hold Board Meeting where there is only one director in such One Person CompanyNot mandatory to hold an AGM, but recommended for good corporate governance. |

| Annual Return (Form MGT-7A) | File the annual return with the Registrar of Companies (ROC) within 60 days 180 days of the September 30 of every year financial year-end. Includes details about shareholders/members and directors. | MGT-7A | Within 60180 days of September 30financial year-end | Company and every officer who is in default shall be liable to a penalty of Rs. 10,000/- and in case of continuing failure, with a further penalty of Rs. 100/- for each day during which such failure continues subject to a maximum of Rs. 2,00,000/- in case of Company and Rs. 50,000/- in case of an officer who is in default. Not Specified | |

| Appointment of Subsequent Auditor | Appoint a new auditor using Form ADT-1 within 15 days of the conclusion of the first Annual General Meeting (AGM). | ADT-1 | Within 15 days of concluding the first AGM | The Company shall be punishable with fine which shall not be less than Rs. 25,000/- but which may extend to Rs. 5,00,000/- and every officer who is in default shall be punishable with fine which shall not be less than Rs. 10,000/- but may extend to Rs. 1,00,000/-Not Applicable | |

| Auditor Tenure | The appointed auditor holds office until the conclusion of the 6th AGM. | Not Applicable | Not Applicable | Auditor rotation provision doesn’t apply to OPCs. | |

| Director KYC (Form DIR-3 KYC) | Individuals holding Director Identification Number (DIN) as of March 31st of the financial year must submit KYC for the respective financial year by September 30th of the next financial year. | DIR-3 KYC | By September 30th of the next financial year | Rs. 5,000/-Not Specified | |

| Disclosure of Interest (Form MBP-1) | Directors must disclose their interest in other entities at the first board meeting in each financial year. | MBP-1 | First board meeting of the financial year | The Director shall be liable to a Penalty of Rs. 1,00,000/-Up to 1 year imprisonment for non-compliance | |

| E-form DPT-3 (Return of Deposits) | File a return annually detailing deposits and particulars not considered deposits as of March 31st. Deadline for filing is on or before June 30th. | DPT-3 | On or before June 30th | The Company and every officer of the Company who is in default or such other person shall be liable to a penalty of Rs. 10,000/- and in case of continuing contravention, with a further penalty of Rs. 1000/- for each day after the first during which the contravention continues, subject to a maximum of Rs. 2,00,000/- in case of a Company and Rs. 50,000/- in case of an officer who is in default or any other person. Not Specified | |

| Financial Statements (Form AOC-4) | File audited financial statements electronically with the ROC within 180 days of the financial year-end. Includes balance sheet, profit and loss account, audit report, and notes to accounts. | AOC-4 | Within 180 days of financial year-end | The Company shall be liable to a penalty of Rs. 10,000/- and in case of a continuing failure, with a further penalty of Rs. 100/- per day during which such failure continues, subject to a maximum of Rs. 2,00,000/- and the managing director and the Chief Financial Officer, any other director who is charged by the Board with the responsibility of complying with the provisions of this section, and in the absence of any such director, all the directors of the Company, shall be liable to a penalty of Rs. 10,000/- and in case of a continuing failure, with further penalty of Rs. 100/- for each day after the first during which such failure continues subject to a maximum of Rs. 50,000/- Rs. 100 daily (maximum Rs. 10,000,000) | OPC statutory audit involves a review report certification. |

| Income Tax Filing | File income tax returns (ITR) annually by the due date (July 31st for individuals, September 30th for businesses). Reports income, expenses, and deductions for the financial year. | Not Applicable | – July 31st for individuals – September 30th for businesses | Rs. 10,000 for non-filing | OPC requires a valid Permanent Account Number (PAN). |

| Maintenance of Statutory Registers | Maintain statutory registers as required by Section 88 of the Companies Act 2013. Update for events like share transfer, director changes, etc. | Respective provisions of the Companies Act, 2013Not Applicable | These are the internal documents of the Company and are to be maintained and updated by the Company.Ongoing | Not Specified | Non Maintenance of such registers can attract liabilities under respective provisions of the Companies Act, 2013Includes registers like Register of Members, Register of Directors, and Register of Share Certificates. |

| Payment of Stamp Duty on Share Certificates | Pay stamp duty on share certificates within 30 days from the date of issue. | Not Applicable | Within 30 days of issuing share certificates | Not Specified | |

| Statutory Audit | A Chartered Accountant firm conducts an audit of the company’s accounts and issues a review report certification using Form AOC-4 for filing. | AOC-4 | Before filing the accounts of OPC in Form AOC-4 Not Applicable (but filing of AOC-4 is mandatory) | The Auditor shall be punishable with fine which shall not be less than Rs. 25,000/- but which may extend to Rs. 1,00,000/-Not Applicable | OPCs are exempt from a full statutory audit, but a review report is required. |

| TDS, GST, PF, and ESI Compliance | Comply with regulations concerning Tax Deducted at Source (TDS), Goods and Services Tax (GST), Provident Fund (PF), and Employees’ State Insurance (ESI) based on the |

We take care of all your OPC Compliances Let’s Talk

Detailed List of OPC Compliances in India

Board Meeting Requirements for OPC

According to Section 173 of the Companies Act 2013, a One-Person Company (OPC) is required to hold at least 1 meeting of the Board of Directors in each half of a calendar year and the gap between 2 meetings shall be not less than 90 days. must conduct at least one Board meeting annually. These meetings should occur every six months and be spaced at least 90 days apart. It is important to note that the usual requirements regarding the quorum for meetings of the Board of Directors do not apply if the OPC has only one director. Every officer whose duty is to give notice of Board meeting and who fails to do so shall be liable to a penalty of Rs. 25,000/-. Should an OPC fail to meet compliance requirements, the company faces a penalty of ₹25,000. Additionally, any officer in default will incur a penalty of ₹5,000.

Note: An OPC is not required to hold any Board meeting if there is only one Director on its Board of Directors

Appointment of Auditor

Under Section 139 of the Companies Act, an OPC must appoint an auditor. This auditor, typically a Chartered Accountant firm, is responsible for auditing the company’s accounts and issuing an audit report. The rules regarding auditor rotation do not apply to OPCs.

Filing of Annual Return

Under the Section 92 of the Companies Act, An OPC is required to file its Annual Return within 180 days from the end of the Financial Year using Form MGT-7. This return includes details about the company’s shareholders or members and its directors.

Financial Statement Submission

Under the Section 137 of the Companies Act, OPCs must file Financial Statements including the Balance Sheet, Profit and Loss Account, and Director’s Report using Form AOC-4, within 180 days from the financial year-end.

Disclosure of Interest by Directors

Directors must disclose any interest in other entities annually, during the first Board meeting of the year, using Form MBP-1. Failure in compliance could lead to imprisonment for up to one year for any director in default.

KYC Compliance for Directors

Directors holding a Director Identification Number (DIN) must submit Form DIR-3-KYC by September 30th of the following financial year.

Filing Form DPT-3

Form DPT-3, detailing returns of deposits and particulars not considered as deposits as of March 31st, must be filed by June 30th annually.

Maintaining Statutory Registers

OPCs must maintain statutory registers and comply with event-based requirements such as share transfers, director appointments or resignations, register of members, directors, and charges, changes in nominee or bank signatories, and auditor changes. Non-compliance in filing the annual financial statements using Form AOC-4 can attract a daily penalty of ₹100, with a maximum fine up to ₹10,00,000. In addition, OPCs must maintain a minute book and keep copies of annual returns and resolutions passed by the company.

Commencement of Business Declaration (Form INC-20A)

After incorporating a One Person Company (OPC), the company must file a Commencement of Business Declaration (Form INC-20A) within 180 days. This form confirms that the company has received the subscription money for its shares and is ready to commence operations. Failing to file this form within the stipulated period may result in penalties and could affect the company’s legal status.

PAN Application

Once your One Person Company (OPC) is officially incorporated, the next crucial step is applying for a Permanent Account Number (PAN). This can be done online through the NSDL website. After the PAN is allotted, the company’s director must sign the PAN application letter, affix the company’s seal, and send it to NSDL for final processing. Obtaining a PAN is necessary for conducting financial transactions and for tax purposes.

Corporate Stationery Requirements

After registering an OPC, it is mandatory to procure specific corporate stationery. This includes creating a name board that clearly displays the company name along with the words “One Person Company” in brackets. Additionally, the company must create an official rubber stamp and letterhead, both of which must contain the company’s name and details, ensuring legal and professional branding.

Opening an OPC Bank Account

Opening a bank account for a One Person Company (OPC) involves submitting key documents, including the certificate of incorporation, MOA/AOA (Memorandum and Articles of Association), PAN card, a board resolution for account opening, and proof of identity of the director. It is essential that these documents are self-attested and bear the official company seal. These documents are necessary for the smooth operation of the company’s financial activities.

DIR-8 (Director’s Declaration)

As per the Companies Act, 2013, it is mandatory for the director of an OPC to submit a DIR-8 declaration annually. This form confirms that the director is not disqualified from holding office as per the provisions of the Companies Act. The DIR-8 filing ensures compliance with statutory regulations and confirms that the company is operating within the legal framework.

MSME-I Half-Yearly Return

Every One Person Company (OPC) must file an MSME-I form twice a year. This return provides details about the company’s outstanding dues to micro and small enterprises. The MSME-I return must be filed by 31st October for the period April to September, and by 30th April for the period October to March. Timely filing helps maintain transparency and avoid penalties.

Board’s Report Contents

The Board’s Report of an OPC is an essential document that should provide comprehensive details about the company’s activities and financial health. It should include the company’s website address, a director’s responsibility statement, auditor’s remarks, financial highlights, and fraud reporting details. The report must also cover any changes in the directorship, significant orders passed, and the overall state of affairs of the company. This report ensures transparency and regulatory compliance.

Income Tax Filing

OPCs must file income tax returns (ITR-6) annually by July 31st for individuals and September 30th for businesses, reporting their income, expenses, and deductions. Failure to file ITR can result in a fee of ₹10,000. This form is specifically designed for companies, and OPCs must disclose all income, deductions, and exemptions in their tax return.

GST Compliance

OPCs registered under GST must file returns periodically through the GST portal. OPCs with an annual turnover up to ₹5 crores file quarterly returns, while those above ₹5 crores file monthly. If annual turnover exceeds ₹2 crores, OPCs must also file an annual return and have their accounts audited. Timely and accurate filing is essential to avoid penalties and interest charges.

Annual Compliance Checklist for One Person Company (OPC)

Annual compliance for a One Person Company (OPC) in India involves fulfilling a set of mandatory regulatory obligations to maintain its legal standing and operational legitimacy. These requirements include the filing of annual returns and financial statements with the Registrar of Companies (RoC), tax filings, and ensuring adherence to statutory record-keeping practices. This guide outlines the critical annual tasks that OPCs must complete, aiming to help business owners navigate through these legal complexities efficiently and effectively.

✔ Form INC-20A – Declaration for commencement of business within 180 days of incorporation.

✔ Board Meetings – Minimum one meeting annually, with at least 90 days gap between meetings. (Not mandatory to hold an AGM, but recommended for good corporate governance)

✔ Statutory Registers – Maintain registers as required by the Companies Act, including register of members, directors, and share certificates.

✔ E-form DPT-3 (Return of Deposits) – File annually, detailing deposits and particulars not considered deposits as of March 31st. Deadline for filing is on or before June 30th.

✔ DIR-3 KYC – KYC for Directors (by September 30th of the next financial year for DIN holders as of March 31st).

✔ Income Tax Return of the Company – File annually by the due date (July 31st for individuals, September 30th for businesses).

✔ Form AOC-4 – Financial Statements – File audited financial statements electronically within 180 days of the financial year-end (includes balance sheet, profit/loss, and director report).

✔ ADT-1 (for subsequent auditors only) – Appointment of Auditor – Appoint a new auditor within 15 days of concluding the first AGM (not required for the first auditor).

Benefits of Compliances for One Person Company

There are numerous advantages to ensuring your One-Person Company (OPC) adheres to all required compliances. Here’s a breakdown of the key benefits:

- Enhanced Credibility and Investor Confidence: Following compliance regulations, including those related to the Companies Act, Income Tax, and GST, demonstrates transparency and good governance. This builds trust with potential investors, making it easier to secure financial backing for your OPC.

- Smoother Operations and Active Status: Timely and proper compliance helps maintain your OPC’s active status with the government. This ensures smooth business operations and avoids potential disruptions.

- Accurate Financial Records and Reduced Penalties: Regular compliance procedures necessitate accurate data collection and record-keeping. This not only provides valuable insights for your own decision-making but also helps you avoid hefty fines and penalties associated with non-compliance.

- Easier Access to Funds: Financial institutions are more likely to consider loan applications from OPCs that demonstrate a history of compliance. Proper annual filings project a responsible image and make it easier to raise capital.

- Simplified Compliance Burden: Compared to other company structures, OPCs benefit from fewer compliance requirements. The Companies Act of 2013 offers exemptions for certain tasks, reducing administrative burdens for the director.

- Perpetual Succession: Even with a single member, OPCs must follow the principle of perpetual succession. This ensures business continuity by designating a nominee who takes over company operations in case of the sole member’s absence or demise.

- Straightforward Incorporation Process: Setting up an OPC is relatively simple. It requires only a director (who can also be the nominee) and a minimum authorized capital of Rs. 1 lakh, with no mandatory paid-up capital requirement. This makes OPCs a more accessible structure compared to other company types.

- Increased Funding Opportunities: Compliance opens doors to various funding options. OPCs that demonstrate responsible compliance practices are more likely to attract venture capital, angel investors, and even secure loans from financial institutions with a streamlined process.

Documents Required for One Person Company(OPC) Compliance in India

For a One Person Company (OPC) in India, adhering to annual compliance is essential for maintaining its legal standing and financial transparency. The following documents are crucial for OPC compliance:

- Receipts of Purchases and Sales: All receipts related to purchases and sales throughout the financial year must be documented and submitted. This helps in verifying the financial transactions the company has engaged in.

- Invoices of Expenses: All invoices for expenses incurred during the year need to be collected and submitted. These invoices provide a clear account of the outflows and are necessary for financial audits and tax calculations.

- Bank Statements: Bank statements from April 1st to March 31st for all bank accounts held in the name of the company are required. These statements are used to reconcile financial records and verify the cash flows of the company.

- Details of GST Returns: If the OPC is registered under GST, details of all GST returns filed during the year must be submitted. This includes sales and purchase invoices linked to GST filings.

- Details of TDS Challans and TDS Returns: If applicable, details of all TDS (Tax Deducted at Source) challans deposited and TDS returns filed need to be submitted. This is essential for compliance with the tax laws and helps in claiming tax credits.

- Financial Statements: The preparation and submission of financial statements, including a balance sheet and a profit & loss account, are mandatory. These documents provide a snapshot of the company’s financial health and performance over the financial year.

- Director’s Report: A director’s report is required, outlining the overall health of the company, its compliance with various statutory requirements, and other relevant details concerning the company’s operations during the year.

- Details of the Member/Shareholder: Since an OPC usually has a single member, detailed information about the member/shareholder, including their shareholding pattern, must be maintained and submitted.

- Details of Directors: Information about the director(s) of the OPC, including their responsibilities and activities throughout the year, must be documented.

These documents collectively help in maintaining a transparent and compliant operational framework for the OPC. They are crucial not only for fulfilling statutory obligations but also for enhancing the credibility of the company with financial institutions, investors, and other stakeholders.

Conclusion and Way Ahead

Compliance for One Person Companies (OPCs) in India represents a vital aspect of maintaining the integrity and operational efficacy of these entities. The streamlined compliance requirements, while simpler than those of larger corporations, play a crucial role in safeguarding the legal and financial aspects of the company. Through meticulous documentation and adherence to regulatory norms, OPCs ensure limited liability protection, increased investor confidence, and enhanced opportunities for financial growth. The systematic approach to maintaining detailed financial records, annual filings, and transparency not only fortifies the company’s standing but also builds a foundation of trust with stakeholders.

Looking ahead, the landscape for OPCs in India is poised for evolution. With ongoing reforms in corporate governance and compliance regulations, OPCs can anticipate more streamlined processes and perhaps even further reductions in compliance burdens. This could encourage more entrepreneurs to adopt the OPC structure as it becomes increasingly conducive to innovative business models and rapid scaling. Additionally, as digital transformation continues to permeate the regulatory framework, OPCs might find it easier to manage their compliances through automated systems, reducing manual effort and increasing accuracy. The future holds a promising prospect for OPCs to not only flourish in a dynamic economic environment but also to drive forward the entrepreneurial spirit of India with robust compliance and governance as their backbone.