Content Overview

- What are Loans?

- What are Shares?

- What is a Rights Issue?

- What is Preferential Allotment of Shares?

- Why Convert Loans to Shares?

- Things to Consider Before Conversion

- Conversions of Loans Into Shares (Detailed Process)

- Case Study of Conversion of Loan to Shares

- Conclusion

- FAQs on Conversions of Loans into Shares

In the dynamic world of finance, companies constantly seek innovative ways to raise capital and manage their financial health. One such strategy, often overlooked but potentially advantageous, is the conversion of loans into shares. This process essentially transforms a lender from a creditor to a partial owner of the company, offering unique benefits for both parties. Whether aiming to alleviate cash flow pressures, reduce debt, or signal confidence to potential investors, loan-to-share conversion can be a powerful tool.

What are Loans?

A loan is a sort of credit arrangement wherein a certain quantity of money is extended to a third party with the expectation that the principal (or value) will be repaid at a later date. The borrower must return the principal amount plus, frequently, interest or finance charges added by the lender to the principal value. Loans can be made available as an open-ended line of credit with a predetermined maximum, or they can be made for a fixed, one-time sum. There are several varieties of loans, such as personal, business, secured, and unsecured loans. A loan is a type of debt that someone or something else has to pay back. The borrower receives an advance of funds from the lender, which is typically a government agency, financial institution, or company. The borrower accepts a certain set of terms in exchange, including the payment date, interest rate, and any additional stipulations. Collateral may occasionally be needed by the lender in order to guarantee loan security and repayment. Bonds and certificates of deposit (CDs) are other forms of loans.

What are Shares?

A company’s shares are its ownership units. Despite their frequent interchangeability, the phrases “stocks” and “shares” have different meanings when referring to a firm. It all depends on how you talk about a firm and how much ownership you have, despite the fact that this may sound complicated. Let’s take a scenario where the XYZ corporation issued stock and you bought ten shares. You own 10% of the business if each share is worth 1% of the total. Shares of the stock that the firm issued were purchased by you. You don’t buy stock; instead, you buy shares of a stock, to put it another way. Shares are what you actually purchase; stock is a broader phrase used to describe the financial instruments a firm produces. Owners of corporations may decide to issue shares in order to raise funds. Next, businesses split their stock into shares, which are offered for sale to investors. These buyers are typically brokers or investment banks who then sell the shares to other buyers directly or through intermediaries like exchange-traded funds or mutual funds. In a corporation, ownership is represented by shares. The shareholders are not legally obligated to receive their money back from the firm in the event that something goes wrong because they are a representation of ownership rather than debt.

What is a Rights Issue?

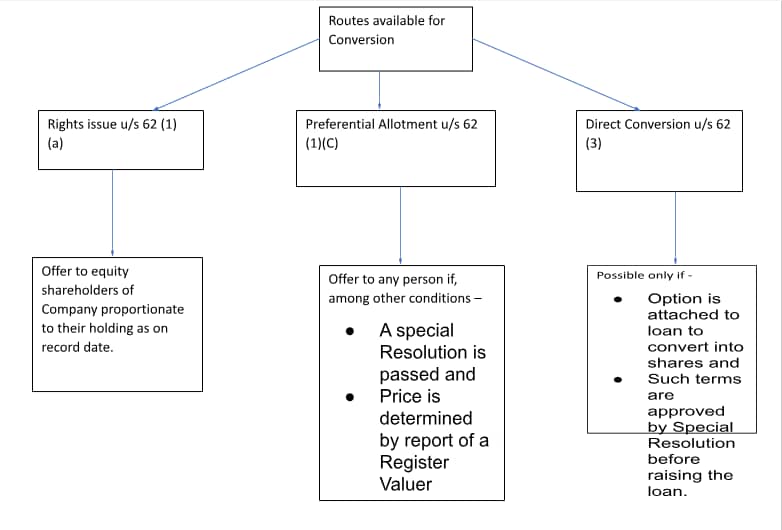

A rights issue is a request for current shareholders to buy more shares of the business. Existing shareholders get securities referred to as rights in this kind of offering. With the rights, the shareholder can buy new shares at a future period at a price below market value. The firm is offering discounted stock to stockholders who would like to enhance their exposure to it. Shareholders may trade the rights on the market in the same manner as they would regular shares up to the day on which the new shares are available for purchase. A shareholder’s rights are valuable, making up for any future erosion of the value of their existing shares for present shareholders. Dilution happens when a business distributes its net profit over a higher number of shares through a rights issue. As a result of share dilution caused by the allocated earnings, the company’s earnings per share, or EPS, declines. A company may issue more shares under Section 62(1) of the Companies Act of 2013 if it intends to raise its subscribed capital by new share issuance. By submitting a letter of offer pursuant to the following terms, such shares should be initially made available to current shareholders who, as of the offer date, are holders of equity shares of the firm in proportion.

What is Preferential Allotment of Shares?

A sort of equity issuance known as preferential allotment occurs when a business provides shares at a discount to a certain set of investors. Usually, these investors are preferred investors, strategic partners, or current shareholders. Preferential allocation is usually done to raise funds for the business, and the lower price is meant to entice investors to get involved. Preferring allotment shares are not usually traded on a stock market, and investors may be subject to limitations on how easily they may sell their shares.

Why Convert Loans to Shares?

There are several reasons a company might choose to convert a loan to shares:

- Cash Flow Relief: This can free up cash the company would have used for loan repayments, allowing them to invest in growth.

- Debt Reduction: Conversion reduces the company’s overall debt burden, improving its financial health.

- Attracting New Investors: Existing lenders with a stake in the company’s success can be a good sign for potential future investors.

Things to Consider Before Conversion

- Agreement with Lender: Not all loans can be converted. The loan agreement should explicitly mention the option to convert into shares.

- Share Price: At what price will the shares be issued? This needs careful consideration to be fair to both the company and the lender.

- Shareholder Approval: Most jurisdictions require shareholder approval for such conversions, usually through a special resolution.

Conversions of Loans Into Shares (Detailed Process)

*The same provision is also applicable for the conversion of debt securities.

-

Review Loan Agreement: Carefully examine the original loan agreement to ensure conversion is allowed and understand the terms.

-

Negotiate Conversion Terms: Discuss the conversion details with the lender, including the number of shares issued, share price, and any other relevant conditions.

-

Board Approval: The company’s board of directors needs to formally approve the conversion proposal.

-

Shareholder Approval: Depending on your location, a special shareholder meeting might be required to vote on the conversion. A majority vote is typically needed for approval.

-

Legal and Tax Implications: Consult with legal and tax professionals to ensure compliance with all regulations and potential tax consequences for both the company and the lender.

-

Finalize Conversion Documents: Draft and finalize the necessary legal documents for the conversion, including share issuance certificates.

-

Record Keeping: Ensure all records related to the loan conversion are properly documented and maintained for future reference.

Case Study of Conversion of Loan to Shares

To better understand the above concepts, lets examine a recent adjudication order passed by the Registrar of Companies, Karnataka (ROC) dated September 09, 2023 (Adjudication order 454-62(3))

Background of the Case:

Dhiomics Analytics Solutions Private Limited filed a suo-moto application to the ROC, acknowledging that they committed a default under section 62(3) of the Companies Act, 2013, while converting loans from their promoter-cum-directors into Equity Shares. They did not pass the Special Resolution required prior for the conversion. Additionally, the company mentioned that they had mistakenly passed a Board Resolution for a Rights Issue under section 62(1)(a), instead of conversion of loans into Equity under section 62(3).

The Decision:

The ROC observed that since the Company did not obtain shareholder approval through a Special Resolution before raising the loans, section 62(3) would not be applicable in this case. Consequently, If a company intends to increase the subscribed capital in accordance with section 62(1)(c), it may be offered to any person provided it is authorized by a special resolution. This offer can be either for cash or for consideration other than cash, with the share price determined by a valuation report from a registered valuer. Additionally, this process is treated as a preferential issue and must comply with section 42. The ROC further clarified that the Company incorrectly issued shares in lieu of the loan under section 62(1)(a) as a Right Issue, which is offered to the holders of Equity Shares in proportion to the paid-up share capital by sending them a letter of offer.

Conclusion

The main conclusions from the previous debate are summarized in this conclusion, which also covers the legal framework, potential advantages and disadvantages, and useful tips for lenders and businesses alike.

- Understanding the Fundamentals: Establishing a clear understanding of loans, shares, rights issues, and preferential allotment is crucial for navigating the conversion process effectively. Loans represent borrowed funds with repayment obligations, while shares embody ownership units in a company. Rights issues and preferential allotment are methods for companies to raise capital by offering discounted shares to specific investors.

- Legal Framework: The Companies Act, 2013, specifically Section 62(3), governs the conversion of loans into shares. This section mandates a special resolution passed by shareholders before converting a loan into equity. Additionally, regulations pertaining to preferential allotment (Section 42) may apply depending on the circumstances.

- Benefits and Drawbacks: Converting loans into shares can offer benefits for both companies and lenders. Companies can avoid debt repayments and potentially improve their financial ratios. Lenders can potentially acquire ownership stakes in the company, aligning their interests with the company’s success. However, it is essential to weigh these advantages against potential drawbacks such as dilution of existing shareholders’ ownership and potential volatility associated with equity ownership for lenders.

- Practical Considerations: Companies contemplating converting loans into shares should carefully consider several factors. These include:

- Terms of the Loan Agreement: Some loan agreements may explicitly prohibit conversion into shares. Examining the agreement meticulously is essential.

- Financial Health: The company’s financial health and future prospects significantly impact the decision. Conversion may be disadvantageous if the company’s future is uncertain.

- Shareholder Approval: Obtaining the necessary shareholder approval through a special resolution is paramount. Communication with shareholders and transparent presentation of the conversion rationale are crucial.

- Tax Implications: Both companies and lenders should consider the potential tax implications of the conversion. Consulting with a tax professional is advisable.

- Valuation: Determining the fair value of the shares to be issued during the conversion process is essential. Utilizing a registered valuer ensures fairness and transparency.

Converting loans into shares can be a strategic financial maneuver, but it requires careful analysis and adherence to legal and regulatory frameworks. Understanding the benefits and drawbacks, meticulously considering practicalities, and seeking professional guidance are crucial steps for ensuring a successful and compliant conversion process. By navigating these complexities effectively, companies and lenders can potentially leverage the unique advantages offered by converting loans into shares while mitigating associated risks.

FAQs on Conversions of Loans into Shares

- What is the conversion of loans into shares?

It is a process where a company replaces outstanding debt (loan) owed to a lender with shares of the company’s ownership (equity). The lender becomes a shareholder in exchange for forgiving the loan.

- Why do companies convert loans into shares?

There are several reasons:

- Improve financial health: Converting debt to equity reduces the company’s debt burden, improving its financial ratios and potentially making it more attractive to lenders and investors.

- Resolve debt issues: If a company is struggling to repay a loan, conversion can be a solution to avoid default.

- Attract investment: Offering equity instead of cash can be an incentive for lenders to invest in the company’s future growth.

- What are the legal requirements for conversion?

The specific requirements vary depending on the jurisdiction, but generally involve:

- Shareholder approval: Most jurisdictions require the company to obtain shareholder approval through a special resolution before converting loans.

- Valuation: The shares issued in exchange for the loan must be valued fairly, often using a professional valuation report.

- Compliance with other regulations: Companies need to ensure the conversion complies with relevant company law and accounting standards.

- What are the advantages and disadvantages of converting loans to shares for lenders

Advantages:

- Potential for higher returns if the company’s share price increases.

- May be easier to exit the investment by selling shares on the market (if applicable).Disadvantages:

- Shares are subject to market risks, unlike loans with guaranteed repayments.

- Lenders may lose voting rights and other privileges typically associated with being a creditor.

- What are the advantages and disadvantages of converting loans to shares for companies

Advantages:

- Reduces debt burden and improves financial health.

- Can be an alternative to raising additional capital through traditional methods.

- May incentivize lenders to become invested in the company’s long-term success.

Disadvantages:

- May dilute existing shareholders’ ownership and voting rights.

- Can be complex and time-consuming to implement.

- What is the difference between a conversion of loans to shares and a rights issue?

A rights issue is a method for existing shareholders to purchase additional shares at a discounted price, proportionally to their existing holdings.

In contrast, conversion of loans to shares involves issuing new shares to a specific lender in exchange for forgiving a debt, not offered to existing shareholders.

- What is the role of the Registrar of Companies (ROC) in loan-to-share conversions?

The ROC ensures companies comply with legal requirements during the conversion process. They may review the process, ensure proper shareholder approval, and verify the valuation of shares issued.

- What happened in the case study mentioned?

The company mistakenly converted a loan from its directors to shares through a rights issue (meant for existing shareholders) instead of the proper conversion method under Section 62(3) of the Companies Act, 2013. As they didn’t obtain prior shareholder approval, the ROC ruled the conversion invalid.

- What are some key takeaways from the case study?

- Companies must carefully follow the correct legal procedures for converting loans to shares.

- Choosing the right method (conversion vs. rights issue) is crucial based on the situation.

- Seeking professional guidance is advisable to ensure compliance and avoid legal issues.

- Where can I find more information on conversions of loans to shares?

You can consult with a qualified financial advisor, legal professional, or research relevant company law regulations and accounting standards in your jurisdiction. Additionally, professional organizations and financial institutions may offer resources and guidance on this topic.