Blog Content Overview

- 1 Treelife Resources

- 1.1 Explore our resources to fuel your success and propel your business forward.

- 1.2 Latest Posts

- 1.2.0.1 Cash Flow Statement – Meaning, Structure, How to Make

- 1.2.0.2 Environmental, Social, and Governance (ESG) in India – Handbook

- 1.2.0.3 Forensic Accounting in India – Meaning, Usage & Features

- 1.2.0.4 Private Limited vs. LLP vs. OPC – Which to Setup

- 1.2.0.5 GST Compliance Calendar for 2025 (Checklist)

- 1.2.0.6 Difference between Capital Expenditure and Revenue Expenditure

- 1.2.0.7 Cash Flow Optimization – Meaning, Techniques, Forecasting

- 1.2.0.8 Cap Table for Startups – Overview, Types, How to Create

- 1.3 Thought Leadership

- 1.4 Introduction

- 1.5 What are Mergers and Acquisitions?

- 1.6 Key Differences Between Mergers and Acquisitions

- 1.7 Types of Mergers and Acquisitions

- 1.8 Merger and Acquisition Process

- 1.9 Benefits and Challenges of Mergers and Acquisitions

- 1.10 Recent and Latest Mergers and Acquisitions in India

- 1.11 Legal and Regulatory Framework Governing M&A in India

- 1.12 Examples of Successful M&A Deals in India

- 1.13 Reasons for Mergers and Acquisitions

- 1.14 Future of Mergers and Acquisitions in India

- 1.15 Conclusion

- 1.16 FAQs on Mergers & Acquisitions in India

- 1.16.0.1 1. What is the meaning of mergers and acquisitions in India?

- 1.16.0.2 2. What is the difference between a merger and an acquisition?

- 1.16.0.3 3. What are the main types of mergers and acquisitions?

- 1.16.0.4 4. Why do companies pursue mergers and acquisitions in India?

- 1.16.0.5 6. What are the challenges in the M&A process in India?

- 1.16.0.6 7. How do synergies work in mergers and acquisitions?

- 1.16.1 Related posts:

- 1.17 Introduction

- 1.18 What is LLP in India?

- 1.19 What are Compliances for LLP in India?

- 1.20 Importance of LLP Compliance

- 1.21 One-Time Mandatory Compliance for LLPs

- 1.22 Mandatory Compliances for LLPs in India

- 1.23 Compliances for Limited Liability Partnership (LLP) in India (Checklist)

- 1.24 Benefits of LLP Compliance

- 1.25 Steps to Ensure LLP Compliance

- 1.26 How to File LLP Compliances in India

- 1.27 FAQs on Compliances for Limited Liability Partnership in India

- 1.28 Introduction to Trademark Registration in India

- 1.29 What is Trademark Registration?

- 1.30 Types of Trademarks in India

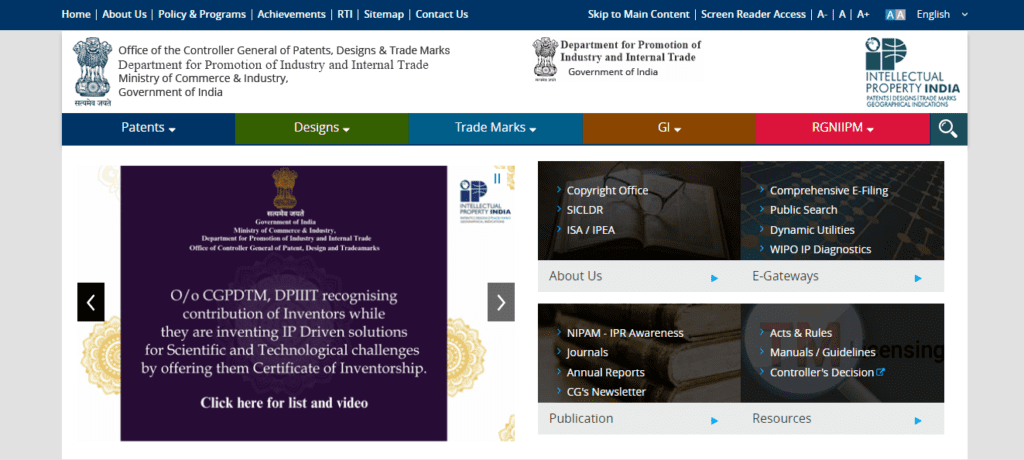

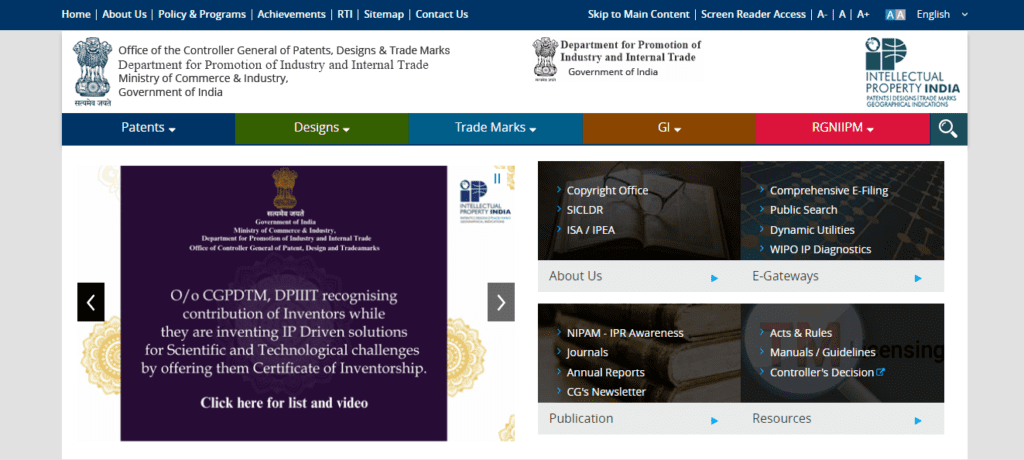

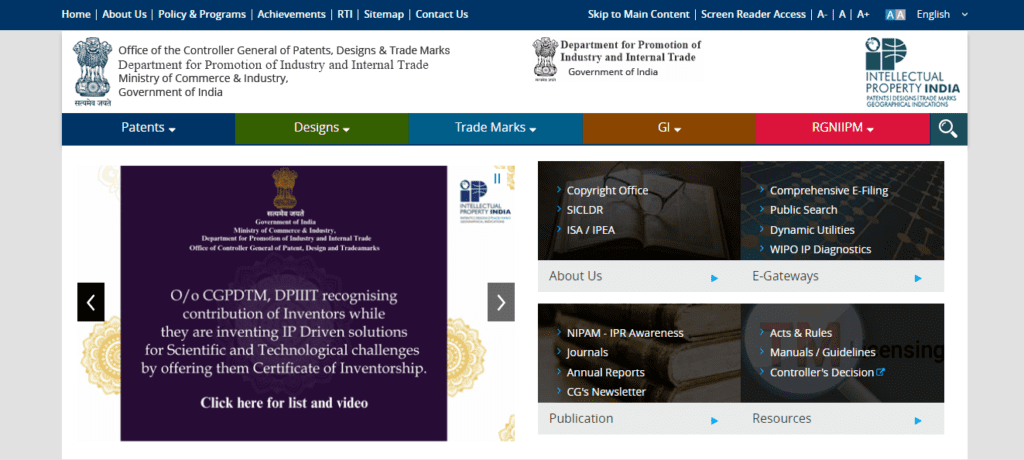

- 1.31 Procedure for Online Trademark Registration in India

- 1.31.1 Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- 1.31.2 Step 2: Prepare and Submit the Application (Online/Offline)

- 1.31.3 Step 3: Verification of Application and Documents

- 1.31.4 Step 4: Trademark Journal Publication and Opposition

- 1.31.5 Step 5: Approval and Issuance of Trademark Registration Certificate

- 1.31.6 Additional Points to Note

- 1.32 Documents Required for Trademark Registration in India

- 1.32.1 1. Business Registration Proof

- 1.32.2 2. Identity and Address Proof

- 1.32.3 3. Trademark Representation

- 1.32.4 4. Power of Attorney (Form TM-48)

- 1.32.5 5. Proof of Prior Usage (If Applicable)

- 1.32.6 6. Udyog Aadhaar or MSME Certificate

- 1.32.7 7. Class-Specific Details

- 1.32.8 8. Address Proof of Business

- 1.33 Costs and Fees for Trademark Registration in India

- 1.34 How to Check Trademark Registration Status

- 1.35 Common Grounds for Refusal of Trademark Registration in India

- 1.36 Renewing a Trademark in India

- 1.37 Frequently Asked Questions (FAQs) on Trademark Registration in India

- 1.38 What is a Trademark?

- 1.39 Why is Trademark Registration Important in India?

- 1.40 Key Industries Benefiting from Trademark Registration

- 1.41 Conclusion

- 1.42 Introduction to Trademarks

- 1.43 Background of Trademarks in India

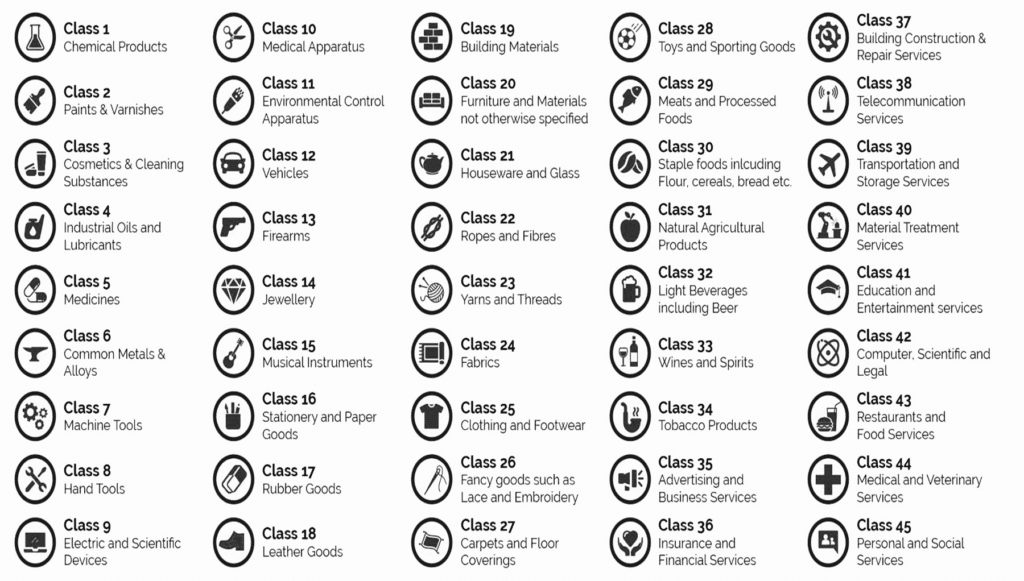

- 1.44 What is a Trademark Class?

- 1.45 Importance of Trademark Classification

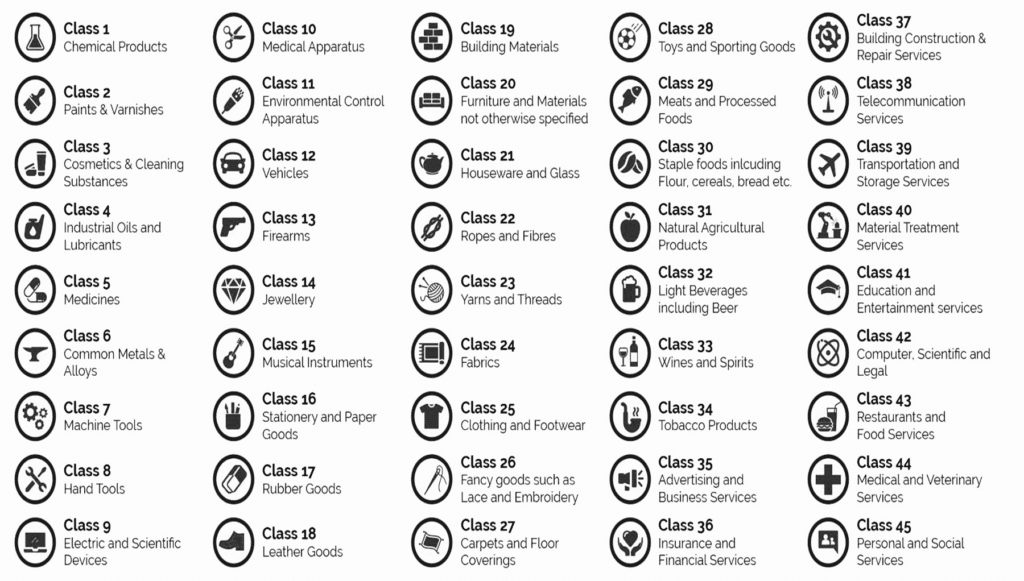

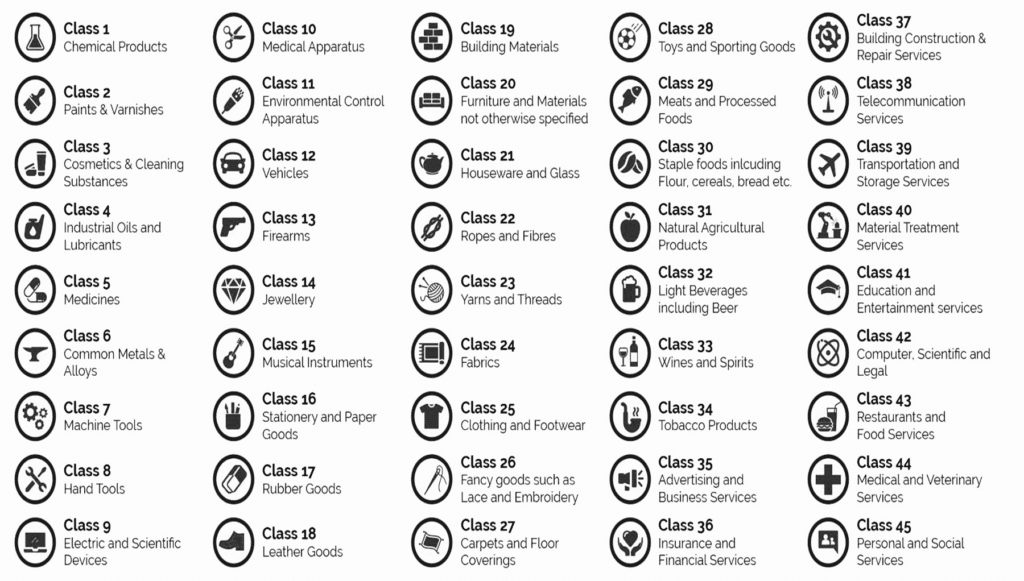

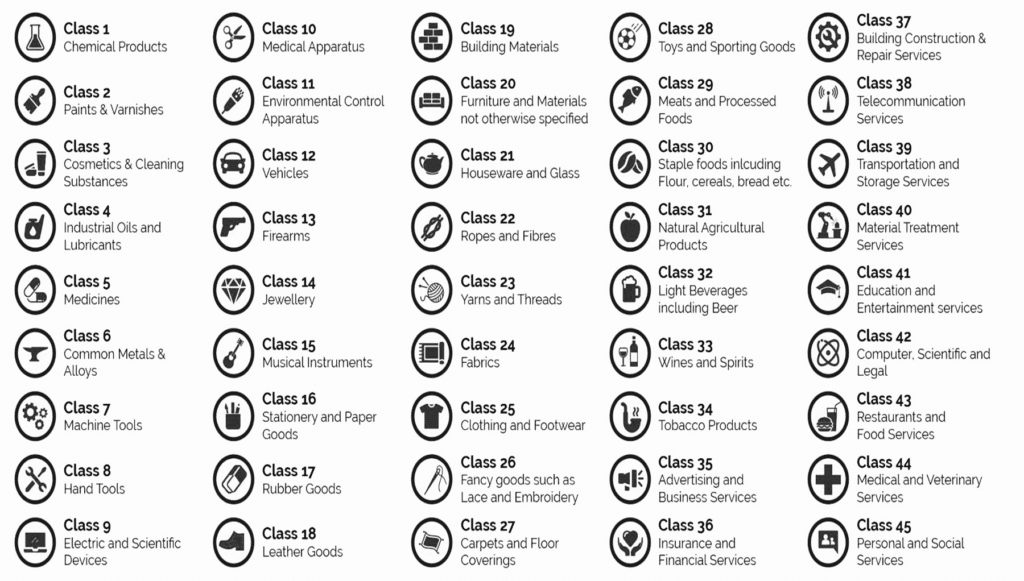

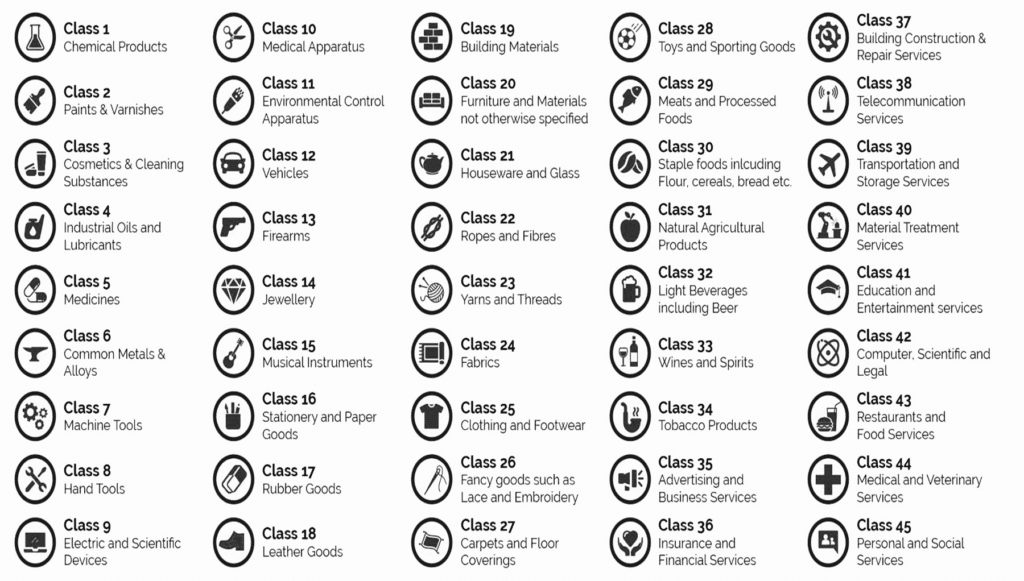

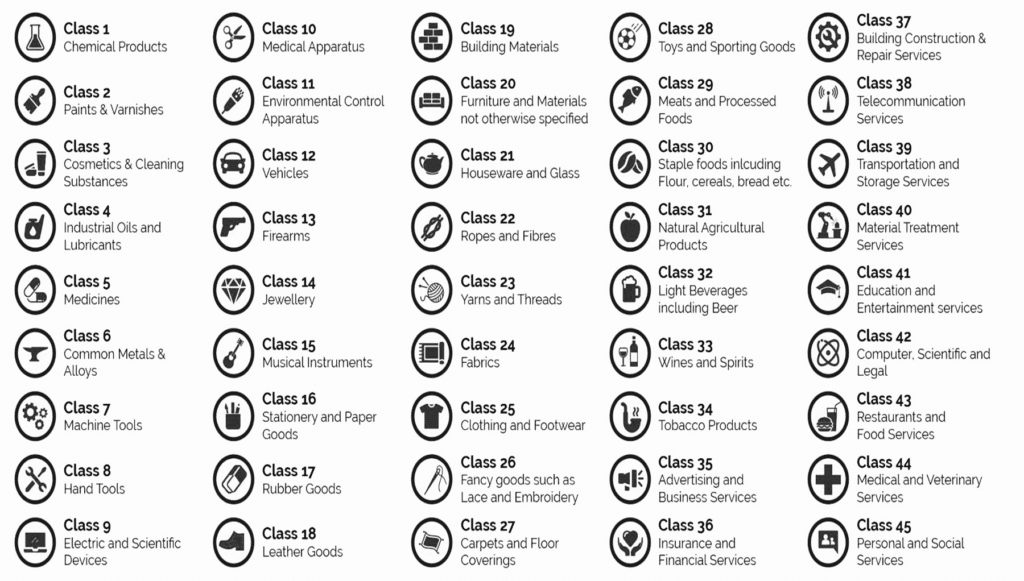

- 1.46 Trademark Classification List

- 1.47 List of Trademark Classes of Goods in India (1-34 Classes)

- 1.48 List of Trademark Classes of Services in India (35-45 Classes)

- 1.49 Online Tools available for Classifying Trademarks

- 1.50 Conclusion

- 1.51 FAQs on Trademark Classification in India

- 1.51.0.1 2. How are goods and services categorized under trademark classification?

- 1.51.0.2 3. Why is trademark classification essential during the registration process?

- 1.51.0.3 4. Can a trademark be registered under multiple classes?

- 1.51.0.4 5. What tools are available for trademark classification in India?

- 1.51.0.5 6. How does trademark classification help prevent legal conflicts?

- 1.51.0.6 7. What is the significance of the NICE classification system?

- 1.51.0.7 8. What are the benefits of correct trademark classification?

- 1.51.1 Related posts:

- 1.51.2 Related posts:

- 1.51.3 Related posts:

- 1.51.4 Related posts:

- 1.51.5 Related posts:

- 1.51.6 Related posts:

- 1.52 Introduction

- 1.53 What are Mergers and Acquisitions?

- 1.54 Key Differences Between Mergers and Acquisitions

- 1.55 Types of Mergers and Acquisitions

- 1.56 Merger and Acquisition Process

- 1.57 Benefits and Challenges of Mergers and Acquisitions

- 1.58 Recent and Latest Mergers and Acquisitions in India

- 1.59 Legal and Regulatory Framework Governing M&A in India

- 1.60 Examples of Successful M&A Deals in India

- 1.61 Reasons for Mergers and Acquisitions

- 1.62 Future of Mergers and Acquisitions in India

- 1.63 Conclusion

- 1.64 FAQs on Mergers & Acquisitions in India

- 1.64.0.1 1. What is the meaning of mergers and acquisitions in India?

- 1.64.0.2 2. What is the difference between a merger and an acquisition?

- 1.64.0.3 3. What are the main types of mergers and acquisitions?

- 1.64.0.4 4. Why do companies pursue mergers and acquisitions in India?

- 1.64.0.5 6. What are the challenges in the M&A process in India?

- 1.64.0.6 7. How do synergies work in mergers and acquisitions?

- 1.64.1 Related posts:

- 1.65 Introduction to Trademark Registration in India

- 1.66 What is Trademark Registration?

- 1.67 Types of Trademarks in India

- 1.68 Procedure for Online Trademark Registration in India

- 1.68.1 Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- 1.68.2 Step 2: Prepare and Submit the Application (Online/Offline)

- 1.68.3 Step 3: Verification of Application and Documents

- 1.68.4 Step 4: Trademark Journal Publication and Opposition

- 1.68.5 Step 5: Approval and Issuance of Trademark Registration Certificate

- 1.68.6 Additional Points to Note

- 1.69 Documents Required for Trademark Registration in India

- 1.69.1 1. Business Registration Proof

- 1.69.2 2. Identity and Address Proof

- 1.69.3 3. Trademark Representation

- 1.69.4 4. Power of Attorney (Form TM-48)

- 1.69.5 5. Proof of Prior Usage (If Applicable)

- 1.69.6 6. Udyog Aadhaar or MSME Certificate

- 1.69.7 7. Class-Specific Details

- 1.69.8 8. Address Proof of Business

- 1.70 Costs and Fees for Trademark Registration in India

- 1.71 How to Check Trademark Registration Status

- 1.72 Common Grounds for Refusal of Trademark Registration in India

- 1.73 Renewing a Trademark in India

- 1.74 Frequently Asked Questions (FAQs) on Trademark Registration in India

- 1.75 What is a Trademark?

- 1.76 Why is Trademark Registration Important in India?

- 1.77 Key Industries Benefiting from Trademark Registration

- 1.78 Conclusion

- 1.79 Introduction to Trademarks

- 1.80 Background of Trademarks in India

- 1.81 What is a Trademark Class?

- 1.82 Importance of Trademark Classification

- 1.83 Trademark Classification List

- 1.84 List of Trademark Classes of Goods in India (1-34 Classes)

- 1.85 List of Trademark Classes of Services in India (35-45 Classes)

- 1.86 Online Tools available for Classifying Trademarks

- 1.87 Conclusion

- 1.88 FAQs on Trademark Classification in India

- 1.88.0.1 2. How are goods and services categorized under trademark classification?

- 1.88.0.2 3. Why is trademark classification essential during the registration process?

- 1.88.0.3 4. Can a trademark be registered under multiple classes?

- 1.88.0.4 5. What tools are available for trademark classification in India?

- 1.88.0.5 6. How does trademark classification help prevent legal conflicts?

- 1.88.0.6 7. What is the significance of the NICE classification system?

- 1.88.0.7 8. What are the benefits of correct trademark classification?

- 1.88.1 Related posts:

- 1.89 Introduction

- 1.90 What is Buyback of Shares?

- 1.91 Reasons for Buyback of Shares

- 1.92 Types of Buyback of Shares

- 1.93 Legal Framework and Procedure for Buyback of Shares in India

- 1.94 Taxability and Financial Implications of Buyback of Shares

- 1.95 Advantages and Disadvantages of Buyback of Shares

- 1.96 Dividend vs. Share Buyback: Key Differences Explained

- 1.97 Frequently Asked Questions (FAQs) on the Buyback of shares in India

- 1.98 MCA Streamlines Cross-border Mergers for Reverse Flipping

- 1.99 Understanding Sovereign Green Bonds

- 1.100 Key Features of the IFSCA’s SGrB Scheme

- 1.101 We Are Problem Solvers. And Take Accountability.

Latest Posts

December 11, 2024 | Reports

Environmental, Social, and Governance (ESG) in India – Handbook

Read More

Thought Leadership

Mergers & Acquisitions in India – Meaning, Difference, Types, M&A Examples

Blog Content Overview

- 1 Introduction

- 2 What are Mergers and Acquisitions?

- 3 Key Differences Between Mergers and Acquisitions

- 4 Types of Mergers and Acquisitions

- 5 Merger and Acquisition Process

- 6 Benefits and Challenges of Mergers and Acquisitions

- 7 Recent and Latest Mergers and Acquisitions in India

- 8 Legal and Regulatory Framework Governing M&A in India

- 9 Examples of Successful M&A Deals in India

- 10 Reasons for Mergers and Acquisitions

- 11 Future of Mergers and Acquisitions in India

- 12 Conclusion

- 13 FAQs on Mergers & Acquisitions in India

- 13.0.1 1. What is the meaning of mergers and acquisitions in India?

- 13.0.2 2. What is the difference between a merger and an acquisition?

- 13.0.3 3. What are the main types of mergers and acquisitions?

- 13.0.4 4. Why do companies pursue mergers and acquisitions in India?

- 13.0.5 6. What are the challenges in the M&A process in India?

- 13.0.6 7. How do synergies work in mergers and acquisitions?

Introduction

Mergers and Acquisitions (M&A) have emerged as transformative business strategies in the Indian economic landscape, reshaping industries and fostering innovation. At its core, mergers involve the integration of two companies into a single entity, while acquisitions refer to one company taking control over another. Together, these strategies drive growth, create synergies, and enhance competitiveness in an increasingly dynamic marketplace.

India, with its burgeoning economy and government initiatives such as Ease of Doing Business, offers a fertile ground for M&A activities. Key factors driving this trend include globalization, technological advancements, and the need for businesses to scale operations and access new markets. From tech startups to traditional manufacturing giants, M&A plays a pivotal role in aligning businesses with evolving market demands.

As a result, the importance of M&A in the Indian economy cannot be overstated. It enables companies to achieve operational efficiencies, expand product portfolios, and enter untapped markets. For the Indian economy at large, M&A fosters job creation, encourages foreign investments, and enhances the global standing of Indian enterprises. Notable examples like the Flipkart-Walmart deal and the Disney India-Reliance (JioCinema) mergers highlight how such transactions have not only transformed the businesses involved but also impacted entire industries and consequently, the Indian consumer experience.

As India continues to position itself as a global economic powerhouse, mergers and acquisitions remain a cornerstone of its corporate strategy, driving innovation, market consolidation, and economic progress.

What are Mergers and Acquisitions?

Mergers and Acquisitions (M&A) are strategic corporate actions that businesses undertake to achieve growth, gain competitive advantages, or drive value creation. While often discussed together, mergers and acquisitions have distinct definitions and implications in the corporate world.

Definition of Mergers

A merger occurs when two companies combine to form a single, unified entity. This is often done to pool resources, share expertise, and achieve operational efficiencies, or to expand the reach a business has in the relevant market. In a merger, the entities involved are typically of similar size, and the integration is seen as a collaborative effort. For example, the merger of Vodafone India and Idea Cellular created one of the largest telecom operators in India, Vodafone Idea.

Definition of Acquisitions

An acquisition, on the other hand, happens when one company takes control of another. This can involve purchasing a majority stake or acquiring the entire business. Acquisitions can be either friendly or hostile, depending on whether the target company agrees to the deal. A well-known acquisition in India is Walmart’s takeover of Flipkart, which helped Walmart enter the Indian e-commerce market.

Reasons for Mergers and Acquisitions

Companies pursue mergers and acquisitions for several strategic reasons, including:

- Market Expansion:

M&A enables businesses to enter new geographical regions, tap into different customer bases, and expand their market share. For example, in the financial year of 2023-2024, Reliance Industries acquired the retail, wholesale, logistics and warehousing businesses of Future Group. This deal is projected to consequently expand the reach of Reliance Industries’ retail arm in India. - Cost Savings:

Consolidation often results in economies of scale, reducing production costs, streamlining operations, and enhancing profitability. - Diversification:

By acquiring companies in different sectors, businesses reduce risk and ensure a steady revenue flow even in volatile markets. This trend can be seen in Zomato’s acquisition of grocery delivery company Blinkit (formerly known as Grofers). The acquisition greatly benefited Zomato, leading to 169% returns in the trailing year. - Access to Technology and Talent:

M&A helps organizations acquire cutting-edge technology, intellectual property, and skilled workforce without building these capabilities from scratch. For example, in F.Y. 2023-2024, Tata Motors announced a strategic partnership with Tesla Inc. whereby Tesla’s advanced battery technology and autonomous driving features could be introduced into Tata Motors’ EV lineup in India, in exchange for a 20% stake valued at USD 2 billion. - Synergies:

Perhaps the most significant reason for M&A is achieving synergies—the enhanced value generated when two companies combine.

Synergies in Mergers and Acquisitions

Synergies in mergers and acquisitions refer to the financial and operational benefits derived from combining two businesses. Synergies can take several forms:

- Cost Synergies:

Achieved by eliminating duplicate roles, sharing resources, and optimizing operations to reduce overall expenses. - Revenue Synergies:

Created when the combined entity generates higher sales due to a broader customer base, complementary products, or better market positioning. - Financial Synergies:

Resulting from better access to funding, improved credit ratings, and enhanced financial stability.

For example, the merger of Daimler-Benz and Chrysler aimed to combine their expertise and resources, creating one of the largest automotive manufacturers with significant operational and cost synergies. Similarly in India, the Disney India-Reliance media asset merger will see not only continued survival of the streaming platform offered by Disney India, but will also enable the merged entity to provide a more comprehensive service to Indian consumers, thereby ensuring a steady synergy between the two companies.

Key Differences Between Mergers and Acquisitions

Mergers and acquisitions are often used interchangeably, but they are fundamentally different in their structure, purpose, and impact. Understanding these differences is essential for businesses evaluating their growth strategies and for stakeholders aiming to interpret these corporate moves.

What is the Difference Between a Merger and an Acquisition?

Mergers and acquisitions differ across several dimensions, including their operational goals, legal requirements, and financial implications. Below is a detailed table explaining these differences:

| Aspect | Merger | Acquisition |

| Definition | Combining two companies into a single, unified entity. | One company takes control of another by purchasing its shares or assets. |

| Objective | To achieve mutual growth by sharing resources and market opportunities. | To expand market presence, gain assets, or eliminate competition. |

| Legal Process | Involves mutual agreement and shareholder approval from both entities. A scheme of merger will also require approval from the National Company Law Tribunal and (where the applicable thresholds are attracted) approval from the Competition Commission of India and/or the Reserve Bank of India/Securities and Exchange Board of India. | The acquiring company gains ownership, which can be friendly or hostile. This is typically done by way of business transfer agreements or slump sales. |

| Control and Ownership | Ownership is typically shared between the merged companies. | The acquiring company retains control; the target company loses autonomy erstwhile enjoyed. |

| Cultural Impact | Requires integration of organizational cultures and systems. | The target company often adopts the culture and processes of the acquirer. |

| Size of Companies | Usually, companies of similar size merge. | The acquiring company is generally larger and financially stronger. |

| Financial Impact | Often viewed as a collaborative growth strategy with shared benefits. | Can lead to financial domination by the acquiring company over the acquired. |

| Examples in India | Vodafone & Idea Cellular (merger to form Vodafone Idea). | Walmart acquiring Flipkart for market entry into India. |

Real-Life Examples to Highlight the Differences

Merger Example: Vodafone & Idea Cellular

The merger between Vodafone India and Idea Cellular in 2018 created Vodafone Idea Limited, a single entity to counter the rising competition in India’s telecom sector. This was a collaborative decision to combine their resources and customer base, resulting in a larger market share and operational synergies.

Acquisition Example: Walmart & Flipkart

In 2018, Walmart acquired a 77% stake in Flipkart for $16 billion. This acquisition marked Walmart’s entry into the Indian e-commerce space, allowing it to compete with Amazon and leverage Flipkart’s established market presence. The acquisition was strategic, as Walmart gained complete control while Flipkart operated under its umbrella.

The difference between merger and acquisition lies in their structure, purpose, and execution. While mergers aim for collaboration and mutual growth, acquisitions are often driven by strategic takeovers to enhance competitiveness or expand market reach.

Types of Mergers and Acquisitions

Depending on the strategic goals of the companies involved, M&A transactions are classified into various types. These types not only reflect the nature of the deal but also its potential impact on the market, operations, and competitive positioning.

a. Types of Mergers

- Horizontal Merger

- A horizontal merger occurs when two companies operating in the same industry and often as direct competitors combine forces.

- Objective: To gain market share, eliminate competition, and achieve economies of scale.

- Example: The merger of Vodafone India and Idea Cellular to create Vodafone Idea aimed to strengthen their position in the telecom market.

- Vertical Merger

- A vertical merger involves the combination of companies operating at different levels of the supply chain (e.g., a supplier and a buyer).

- Objective: To ensure better control over the supply chain, reduce costs, and improve efficiency.

- Example: Reliance Industries’ acquisition of Den Networks and Hathway Cable to expand its Jio broadband services.

- Conglomerate Merger

- A conglomerate merger happens between companies from completely unrelated industries.

- Objective: To diversify business operations and mitigate risks associated with a single market.

- Example: The Tata Group’s acquisition of Tetley Tea, which diversified its operations into the beverage sector.

- Market Extension Merger

- Combines companies offering similar products in different geographical markets.

- Objective: To expand market reach and access new customer bases.

- Example: Airtel acquiring Zain Telecom’s African operations.

- Product Extension Merger

- Involves companies that deal with related products merging to expand their product lines.

- Objective: To offer complementary products and enhance market penetration.

- Example: Facebook’s acquisition of Instagram to broaden its social media portfolio.

b. Types of Acquisitions

- Friendly Acquisitions

- These are mutually agreed deals where the acquiring and target companies collaborate on the transaction.

- Example: Tata Steel’s acquisition of Bhushan Steel to enhance its production capacity.

- Hostile Takeovers

- Occur when the acquiring company takes control of the target company without its consent, often by purchasing a majority of its shares.

- Example: L&T’s hostile takeover of Mindtree.

- Reverse Mergers

- In this scenario, a private company acquires a public company to bypass the lengthy IPO process and become publicly traded.

- Example: The reverse merger of Vedanta Resources into Sterlite Industries.

c. Theories of Mergers and Acquisitions

- Efficiency Theory

- Suggests that M&A transactions are driven by the desire to increase operational efficiency.

- Focus: Cost reduction, revenue enhancement, and resource optimization.

- Example: Companies merging to reduce redundant departments and cut costs.

- Monopoly Theory

- Argues that M&As are often pursued to eliminate competition and gain a dominant market position.

- Focus: Market power and the ability to influence pricing and industry standards.

- Example: The acquisition of WhatsApp by Facebook to dominate the messaging space.

- Valuation Theory

- Suggests that companies engage in M&A when the target company’s market value is lower than its perceived intrinsic value.

- Focus: Acquiring undervalued businesses to create financial gains.

- Example: Reliance Industries acquiring multiple startups to tap into high-growth sectors.

Merger and Acquisition Process

The merger and acquisition process is a multifaceted journey that requires meticulous planning and execution. Each phase of the process plays a vital role in ensuring the success of the transaction, minimizing risks, and maximizing value. Here’s a step-by-step breakdown of the key stages involved:

1. Strategic Planning

- This is the foundational stage where companies identify their objectives for the merger or acquisition.

- Key Activities:

- Define clear goals: market expansion, cost efficiency, or diversification.

- Identify potential target companies.

- Assess alignment with long-term business strategies.

- Importance: Strategic clarity ensures the M&A aligns with the company’s vision and delivers value.

2. Due Diligence

- A critical stage involving an in-depth evaluation of the target company.

- Key Areas of Assessment:

- Financial performance, including revenue and debt.

- Legal compliance and potential liabilities.

- Market position, competition, and operational efficiency.

- Importance: Identifies potential risks and validates the decision to proceed with the transaction.

3. Valuation and Negotiation

- This phase determines the value of the target company and sets the terms of the deal.

- Key Activities:

- Assess the company’s intrinsic and market value.

- Negotiate terms such as purchase price, payment structure, and contingencies.

- Importance: Accurate valuation prevents overpayment and ensures the deal’s financial viability.

4. Legal and Regulatory Approvals

- Securing necessary permissions from governing bodies to ensure compliance with local and international laws.

- Key Activities:

- Review by legal teams for compliance with corporate, tax, and antitrust laws.

- Obtain approvals from regulatory bodies like National Company Law Tribunal, SEBI, RBI, or the Competition Commission of India (CCI).

- Importance: Ensures the deal is legally sound and avoids future legal challenges.

5. Integration Planning

- Preparing a roadmap to merge the operations, cultures, and systems of the two entities.

- Key Activities:

- Define integration objectives and timelines.

- Plan the merging of HR, IT, operations, and finance systems.

- Importance: Effective planning minimizes disruptions and facilitates a seamless transition.

6. Post-Merger Integration

- The final and often most challenging phase where the actual integration takes place.

- Key Activities:

- Align organizational cultures and team structures.

- Monitor and evaluate the performance of the combined entity.

- Address stakeholder concerns and maintain morale.

- Importance: Ensures the realization of synergies and the success of the M&A.

Benefits and Challenges of Mergers and Acquisitions

a. Benefits of Mergers and Acquisitions

- Increased Market Share

- M&A allows companies to consolidate their position in existing markets and expand into new ones.

- Example: The Flipkart-Walmart acquisition strengthened Walmart’s presence in India’s e-commerce sector.

- Operational Synergies

- Combining resources and expertise leads to cost savings, improved efficiency, and higher productivity.

- Example: The Vodafone-Idea merger achieved economies of scale in operations.

- Enhanced Financial Performance

- M&A enables companies to leverage combined assets for greater profitability and improved cash flow.

- Example: HDFC Bank and HDFC Limited merger enhanced their financial services portfolio.

b. Advantages and Disadvantages of Mergers and Acquisitions

| Advantages | Disadvantages |

| Economies of Scale: Cost reduction through shared resources and streamlined operations. | Cultural Clashes: Differences in organizational cultures can disrupt operations. |

| Access to New Markets: Entering untapped geographical or demographic markets. | High Costs: Significant financial investment for valuations, legal fees, and integrations. |

| Improved Competitiveness: Enhanced ability to compete in global or local markets. | Regulatory Hurdles: Compliance with complex legal and antitrust requirements can take a significant period of time to obtain approvals, causing delays in closing deals. |

Recent and Latest Mergers and Acquisitions in India

Mergers and acquisitions (M&A) in India have become a pivotal part of the business landscape, reflecting the country’s growing economy and diverse industry sectors. The latest M&A deals in India showcase how companies are using strategic consolidations to enhance market presence, strengthen financials, and expand their portfolios. Here are a few significant recent and latest mergers and acquisitions in India:

1. Walmart & Flipkart

- Overview: Walmart’s acquisition of Flipkart in 2018 for $16 billion was one of the largest deals in India’s e-commerce sector.

- Strategic Impact: Walmart gained a significant foothold in the Indian market, enabling it to compete with Amazon in the growing online retail space. Flipkart benefited from Walmart’s deep financial resources and global supply chain expertise.

- Importance: This acquisition exemplifies a classic example of market expansion and securing a dominant position in the Indian e-commerce market.

2. HDFC Bank & HDFC Ltd.

- Overview: In 2022, HDFC Bank announced the acquisition of HDFC Ltd., creating India’s largest private sector bank by assets.

- Strategic Impact: This merger aims to create synergies in banking and housing finance, providing integrated financial services to customers and improving operational efficiencies.

- Importance: The merger is expected to drive substantial growth for the bank, enabling cross-selling opportunities and increasing market share in financial services.

3. Tata Consumer & Bisleri (Proposed)

- Overview: Tata Consumer Products, which owns Tata Tea and other popular brands, is in talks to acquire Bisleri, a leading bottled water brand in India.

- Strategic Impact: The acquisition would strengthen Tata Consumer’s position in the beverage sector, particularly in the bottled water market, one of the fastest-growing segments in India.

- Importance: If the deal goes through, it would mark a major consolidation in the FMCG sector, combining two strong brands and expanding Tata Consumer’s portfolio of products.

Trends in Recent Mergers and Acquisitions in India

- Industry Consolidation: M&A deals in India are becoming more common in sectors such as e-commerce, banking, and FMCG, as companies look to diversify and expand their offerings.

- Cross-border Acquisitions: Increasingly, Indian companies are acquiring foreign firms to access international markets and new technologies. For instance, Tata Group’s acquisition of Air India was a major step toward reviving the airline and increasing global market reach.

- Strategic Alliances: Companies are forming alliances through mergers and acquisitions to enhance competitive advantages, such as better financial performance and market entry in new regions.

Legal and Regulatory Framework Governing M&A in India

Mergers and acquisitions (M&A) in India are governed by a complex and detailed legal and regulatory framework. Companies looking to execute M&A transactions must comply with various laws and regulations to ensure that the deal is legally sound and does not face any future legal challenges. Below is an overview of the key legislations, regulatory bodies, and tax implications involved in M&A in India.

Key Legislations Governing M&A in India

- Companies Act, 2013

- The Companies Act, 2013 serves as the principal legislation for governing corporate transactions, including mergers and acquisitions, in India. It outlines the procedures for mergers, demergers, and corporate restructuring, including the approval process by shareholders, creditors, and the National Company Law Tribunal (NCLT).

- Important Provisions:

- Sections 230 to 232 of the Companies Act deal with the process of mergers and demergers. Robust mechanisms are put in place to ensure greater transparency and accountability, ensuring protection of stakeholders.

- Provisions related to the protection of minority shareholders and creditors during the M&A process.

- SEBI Guidelines

- The Securities and Exchange Board of India (SEBI) regulates M&A deals involving listed companies to ensure transparency and protect the interests of investors.

- Key SEBI Regulations:

- SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011: Governs the process of acquiring control or a substantial amount of shares in a listed company.

- SEBI (Issue of Capital and Disclosure Requirements) Regulations: Applies to the issuance of securities in the case of mergers, especially if the transaction involves a public offer.

- SEBI ensures that M&A deals involving public companies comply with disclosure norms and prevent market manipulation. This ensures greater accountability and transparency to protect the ultimate public interest in such entities and deals.

- Competition Act, 2002

- The Competition Act regulates mergers and acquisitions to prevent any anti-competitive practices that may harm the market or consumers.

- Key Provisions:

- Section 5 and Section 6: Deals with the merger control provisions, ensuring that any M&A transaction does not create a dominant market position that could reduce competition.

- Role of CCI: The Competition Commission of India (CCI) reviews mergers and acquisitions crossing a certain financial threshold to evaluate their impact on market competition and consumer welfare.

- FEMA (Foreign Exchange Management Act), 1999

- The Foreign Exchange Management Act (FEMA) governs foreign investments in India and controls the cross-border flow of capital.

- Important Provisions:

- FEMA regulations come into play when foreign companies or individuals are involved in the M&A transaction.

- Approval from the Reserve Bank of India (RBI) is required for foreign investments exceeding certain thresholds.

Regulatory Bodies Overseeing M&A in India

- Securities and Exchange Board of India (SEBI)

- SEBI plays a pivotal role in overseeing M&A transactions involving publicly traded companies. It ensures compliance with disclosure norms and regulates takeover bids, ensuring fair practices and transparency in the securities market.

- Reserve Bank of India (RBI)

- RBI regulates foreign investment in Indian companies under the FEMA guidelines. Any cross-border mergers, acquisitions, or investments require approval from RBI, especially if the transaction exceeds the prescribed limit.

- Competition Commission of India (CCI)

- The CCI examines and evaluates the competition aspects of M&A transactions to ensure that such deals do not result in market monopolies or anti-competitive behavior. The CCI has the authority to block or modify deals that are deemed detrimental to market competition.

- National Company Law Tribunal (NCLT)

- The NCLT is a judicial body that adjudicates disputes related to mergers, demergers, and corporate restructuring. It is also the final authority in approving the merger or acquisition process once shareholders and creditors approve the deal. Any appeals against a ruling of the NCLT will be taken up to the National Company Law Appellate Tribunal (authority on par with jurisdictional high courts in India) and thereafter, to the Supreme Court by way of special leave petitions.

Tax Implications and Compliance Challenges in M&A

M&A transactions in India also involve significant tax implications that businesses must navigate carefully to avoid penalties and ensure compliance.

- Income Tax Act, 1961

- Capital Gains Tax: If the target company’s shares are sold or transferred during the M&A, capital gains tax may be levied based on the holding period and the value of the shares.

- Tax-Free Reorganization: Certain mergers and acquisitions can qualify as tax-free reorganizations under Section 47 of the Income Tax Act if the transaction meets specific conditions.

- GST (Goods and Services Tax)

- M&A Transactions: Goods and Services Tax (GST) applies to the transfer of business assets during mergers or acquisitions. However, the transfer of shares in a merger is generally exempt from GST.

- Stamp Duty

- M&A transactions involving the transfer of shares or assets are subject to stamp duty, which varies based on the state in which the deal is executed.

Examples of Successful M&A Deals in India

Mergers and acquisitions (M&A) in India have played a significant role in shaping the country’s business landscape. Successful M&A deals have not only expanded market share but also led to innovation, enhanced competitiveness, and strategic growth. Below are some notable mergers and acquisitions in India that have been instrumental in transforming industries.

1. Tata Steel & Corus

- Deal Overview:

In 2007, Tata Steel, one of India’s largest steel manufacturers, acquired Corus, a UK-based steel giant, for approximately $12 billion. This acquisition was one of the largest overseas acquisitions by an Indian company at the time. - Strategic Impact:

- Tata Steel gained access to Corus’s advanced steel technology, expanding its presence in Europe.

- The deal allowed Tata Steel to diversify its product offerings and strengthen its position as a global player in the steel industry.

- Lessons Learned:

- Cultural Integration: While the deal was strategically sound, cultural integration was a challenge, as Tata Steel had to align its operations with the Western approach to business.

- Long-Term Vision: Tata Steel’s vision of becoming a global leader in steel was achieved by securing Corus’s resources, expanding its production capacity, and penetrating the European market.

2. Vodafone & Idea (Vi)

- Deal Overview:

In 2018, Vodafone India and Idea Cellular merged to create Vi (Vodafone Idea), one of India’s largest telecom operators, with a combined market share of over 40%. The deal was valued at approximately $23 billion. - Strategic Impact:

- The merger allowed both companies to compete effectively with industry leaders Airtel and Reliance Jio, especially in the face of declining revenue and increasing competition.

- By pooling resources, both companies were able to share infrastructure, reduce costs, and focus on customer acquisition.

- Lessons Learned:

- Regulatory Hurdles: The deal was subject to regulatory scrutiny and approval from the Competition Commission of India (CCI). It highlighted the importance of navigating regulatory challenges in large-scale M&A transactions.

- Post-Merger Integration: Post-merger challenges included integrating networks, streamlining operations, and retaining customers amidst fierce competition.

3. Zomato & Blinkit

- Deal Overview:

In 2022, Zomato, the food delivery giant, acquired Blinkit (formerly Grofers), an online grocery delivery platform, for $568 million. This move aimed to enhance Zomato’s presence in the rapidly growing quick commerce (Q-commerce) space. - Strategic Impact:

- The acquisition enabled Zomato to diversify its portfolio by venturing into grocery delivery, tapping into the expanding demand for fast delivery services.

- Blinkit’s established customer base and supply chain expertise in grocery logistics complemented Zomato’s food delivery network, making it a strong contender in the Q-commerce market.

- Lessons Learned:

- Diversification: Zomato’s move into the grocery segment shows the importance of diversification in capturing new growth opportunities.

- Market Trends: Understanding market trends, like the increasing demand for faster grocery delivery, helped Zomato gain a competitive edge in an emerging segment.

Reasons for Mergers and Acquisitions

Here are the common reasons for mergers and acquisitions that drive companies to pursue such deals:

1. Expanding Market Reach

One of the most common reasons for mergers and acquisitions is to expand market reach. By acquiring or merging with another company, businesses can enter new geographical regions, reach untapped customer segments, or gain access to a broader market.

- Example: A company may merge with a local competitor in a different region to increase its presence without having to build an entirely new distribution network.

2. Diversifying Product Portfolio

M&A allows companies to diversify their product portfolio by adding complementary or entirely new products to their offerings. This helps reduce dependence on a single product line and spreads business risk.

- Example: A tech company acquiring a software company to offer a full suite of products, from hardware to software, providing customers with a complete solution.

3. Reducing Operational Costs

By merging with or acquiring another business, companies can achieve economies of scale, streamline operations, and reduce overall costs. This can include sharing infrastructure, cutting redundant staff, or integrating supply chains for better efficiency.

- Example: Two manufacturing companies may merge to optimize production facilities, reduce supply chain costs, and achieve higher purchasing power.

Future of Mergers and Acquisitions in India

The future of mergers and acquisitions in India looks promising, driven by evolving market dynamics and global trends. As the country continues to grow economically, M&A activities are expected to remain a key strategy for companies looking to expand, diversify, and optimize operations.

Trends and Predictions in M&A Activities

- Increased Cross-Border M&As: With India’s growing influence on the global stage, cross-border mergers and acquisitions are expected to rise, especially in sectors like technology and finance.

- Private Equity and Venture Capital: The involvement of private equity firms and venture capitalists in M&A is expected to grow as they seek opportunities in high-growth sectors.

Emerging Sectors for M&A

- Technology: The digital transformation wave in India will drive M&A in the tech sector, particularly in software, fintech, and AI startups.

- Finance: The growing demand for financial products and services will lead to consolidation in the banking, insurance, and fintech sectors.

- Healthcare: With rising healthcare needs, mergers and acquisitions in healthcare services, pharmaceuticals, and biotechnology are expected to surge.

Impact of Globalization and Technology on M&A Deals

- Globalization: As Indian companies expand globally, M&A will continue to be a preferred route for market entry and acquiring new capabilities.

- Technology: Advancements in digital platforms and AI will streamline M&A processes, making them faster and more efficient while opening new avenues for innovation.

Conclusion

Mergers and acquisitions (M&A) in India are pivotal to the growth and evolution of businesses, offering opportunities for market expansion, cost reduction, and increased competitiveness. Understanding the meaning of mergers and acquisitions, the key differences between mergers and acquisitions, and the various types of M&A can provide valuable insights for companies looking to optimize their strategies. Real-world examples, such as the Tata Steel & Corus deal and Vodafone & Idea merger, highlight the strategic importance of M&A in India’s business landscape.

As M&A continues to shape industries across sectors like technology, finance, and healthcare, companies must stay informed about M&A processes, legal frameworks, and emerging trends. The future of mergers and acquisitions in India remains bright, driven by evolving market dynamics and technological advancements. Understanding these concepts is essential for businesses aiming to succeed in an increasingly competitive global economy.

FAQs on Mergers & Acquisitions in India

1. What is the meaning of mergers and acquisitions in India?

Mergers and acquisitions (M&A) in India refer to the process where two companies combine (merger) or one company takes over another (acquisition). These transactions are often undertaken to achieve growth, expand market reach, or diversify product portfolios.

2. What is the difference between a merger and an acquisition?

A merger involves two companies combining to form a new entity, while an acquisition occurs when one company takes over another, with the acquired company becoming part of the acquiring company. Mergers are typically seen as a mutual agreement, whereas acquisitions can be friendly or hostile.

3. What are the main types of mergers and acquisitions?

There are several types of mergers and acquisitions:

- Horizontal Merger: Between competitors in the same industry.

- Vertical Merger: Between companies in the supply chain (suppliers and buyers).

- Conglomerate Merger: Between unrelated businesses.

- Friendly Acquisition: Where both companies agree to the deal.

- Hostile Takeover: When one company acquires another against the wishes of the target company’s management.

4. Why do companies pursue mergers and acquisitions in India?

Companies pursue mergers and acquisitions to expand their market reach, diversify their product offerings, achieve economies of scale, reduce operational costs, and stay competitive in the evolving market.

6. What are the challenges in the M&A process in India?

Challenges in the merger and acquisition process in India include regulatory approvals, cultural integration, maintaining brand identity, and aligning the financial goals of both companies. Legal complexities and compliance with various laws like the Competition Act and SEBI regulations can also pose difficulties.

7. How do synergies work in mergers and acquisitions?

Synergies in mergers and acquisitions refer to the combined benefits that result from the merger or acquisition, such as cost savings, improved efficiencies, increased market share, and enhanced revenue generation. Synergies often drive the value of an M&A deal, making it beneficial for both companies involved.

Compliances for LLP in India – List, Benefits, Penalties

Blog Content Overview

- 1 Introduction

- 2 What is LLP in India?

- 3 What are Compliances for LLP in India?

- 4 Importance of LLP Compliance

- 5 One-Time Mandatory Compliance for LLPs

- 6 Mandatory Compliances for LLPs in India

- 7 Compliances for Limited Liability Partnership (LLP) in India (Checklist)

- 8 Benefits of LLP Compliance

- 9 Steps to Ensure LLP Compliance

- 10 How to File LLP Compliances in India

- 11 FAQs on Compliances for Limited Liability Partnership in India

Introduction

In today’s fast-paced business environment, choosing the right legal structure is pivotal for business owners in India. One such popular structure is the Limited Liability Partnership (LLP) which essentially functions as a hybrid of a partnership and a corporate entity. The key benefit to the LLP structure is that the business can retain the benefits of limited liability while retaining operational flexibility. Consequently, LLPs have gained immense traction among entrepreneurs and professionals for their simplicity and efficiency in operation.

However, with this flexibility comes the responsibility of maintaining LLP compliances in India, which are mandatory for safeguarding the legal standing and operational credibility of the entity. Adhering to these compliances for LLPs ensures that the LLP operates within the framework of the law, avoids hefty penalties, and maintains its goodwill among stakeholders and regulatory bodies. Failing to comply with these regulations can lead to severe repercussions, including financial penalties, legal disputes, and even the dissolution of the LLP. Therefore, understanding and adhering to LLP filing requirements and deadlines is not just a legal obligation but also a cornerstone of sustainable business management. This blog serves as a comprehensive guide to LLP annual compliance and filing requirements in India, detailing the steps, benefits, and consequences of non-compliance.

What is LLP in India?

LLPs in India are governed by the Limited Liability Partnership Act, 2008 (“LLP Act”). As defined thereunder, an LLP is a separate legal entity distinct from its partners. This means that the LLP can own assets, incur liabilities, and enter into contracts in its name, providing a level of security and independence not found in traditional partnerships. One of its hallmark features is limited liability, ensuring that the personal assets of the partners are not at risk beyond their agreed contributions to the business.

An LLP is further governed by an LLP agreement executed between the partners and filed as part of the incorporation documents to be provided to the Ministry of Corporate Affairs under the LLP Act. Accordingly, critical terms such as the extent of liability, obligations of each partner and their capital contributions to the LLP are captured therein.

Key Characteristics of an LLP

- Separate Legal Entity: An LLP has its own legal identity, distinct from its partners, allowing it to function independently.

- Limited Liability: The partners’ liabilities are limited to their contributions, offering a layer of financial protection.

- Flexibility in Management: Unlike corporations, LLPs provide greater flexibility in internal operations and decision-making processes.

- No Minimum Capital Requirement: LLPs do not mandate a minimum capital requirement, making them accessible for startups and small businesses.

How is an LLP Different from a Private Limited Company?

While both LLPs and Private Limited Companies offer limited liability protection, they differ in various ways:

- Ownership and Control: In an LLP, the partners manage the business directly, whereas in a Private Limited Company, directors manage operations on behalf of shareholders.

- Compliance Burden: LLPs have fewer compliance requirements and lower operational costs compared to Private Limited Companies.

- Tax Advantages: LLPs generally benefit from a simplified tax structure, avoiding dividend distribution tax applicable to Private Limited Companies.

Regulatory Oversight

LLPs in India fall under the purview of the Ministry of Corporate Affairs (MCA), as designated by the LLP Act. Key regulations include registration, annual filings, and periodic updates for changes in partnership structure or business operations. The Registrar of Companies (RoC) monitors compliance, ensuring that LLPs adhere to the legal framework established under the LLP Act.

By combining the best aspects of partnerships and corporations, LLPs have emerged as a favored structure for entrepreneurs seeking a balance of flexibility, liability protection, and operational efficiency.

What are Compliances for LLP in India?

Compliances for Limited Liability Partnerships (LLPs) in India refer to the set of mandatory legal, financial, and procedural obligations that LLPs must adhere to in order to maintain their legal standing and operational credibility. Governed by the Limited Liability Partnership Act, 2008, these compliances ensure that LLPs operate transparently, fulfill their tax obligations, and align with the regulations set by the Ministry of Corporate Affairs (MCA).

Importance of LLP Compliance

Maintaining compliance for a Limited Liability Partnership (LLP) is not just a legal obligation—it’s a cornerstone for ensuring the smooth operation and longevity of the business. LLP compliance encompasses all the mandatory filings and procedural requirements that safeguard the LLP’s legal standing and financial integrity.

Why Compliance is Crucial for an LLP

- Preserving Legal Status

Timely compliance is essential to uphold an LLP’s status as a legally recognized entity. Non-compliance can lead to severe consequences, such as disqualification of partners, restrictions on business activities, and even the dissolution of the LLP by regulatory authorities. - Ensuring Smooth Business Operations

Compliance helps in maintaining organized and transparent business practices. Adhering to LLP filing requirements, such as submitting financial statements and annual returns, ensures that the LLP operates within the boundaries of the law, minimizing disruptions. - Avoiding Penalties and Legal Complications

Non-compliance with mandatory LLP requirements can result in hefty penalties, with additional penalty levied on a per day basis for any delays/contraventions that are not rectified. Additionally, prolonged non-compliance can escalate into legal complications, tarnishing the LLP’s reputation and creating obstacles for future business dealings. It is crucial to note that the ROC through the LLP Act, is empowered to strike off LLPs that are deemed to be defunct or not carrying on operations in accordance with the LLP Act.

The Role of Timely Filings

- Maintaining Transparency

Filing annual returns (Form 11) and financial statements (Form 8) on time fosters transparency in financial and operational activities. This builds trust among stakeholders, clients, and regulatory bodies. - Enhancing Credibility

A compliant LLP is viewed as reliable and trustworthy, which can be a critical factor when securing investments, loans, or partnerships. Timely compliance reflects professionalism and adherence to business ethics. - Tax Benefits

Compliance also plays a significant role in tax planning and benefits. Filing accurate income tax returns on time helps avoid interest, penalties, and scrutiny from tax authorities. LLPs that adhere to tax filing requirements can also access incentives and deductions applicable to compliant businesses.

One-Time Mandatory Compliance for LLPs

When establishing a Limited Liability Partnership (LLP) in India, there are specific one-time compliance requirements that ensure a strong legal and operational foundation. These steps must be completed immediately after incorporation to maintain transparency and align with regulatory expectations.

1. LLP Form-3: Filing the LLP Agreement

The LLP Agreement serves as the governing document for the partnership, outlining the roles, responsibilities, and operational rules for the partners. As per the Limited Liability Partnership Act, 2008, this agreement must be filed using Form-3 with the Registrar of Companies (ROC) within 30 days of incorporation.

- Why it’s important: Filing the LLP Agreement ensures clarity in the partnership’s functioning and establishes legal protections for all partners.

- Failure to file: Delays in filing Form-3 attract penalties, which can escalate daily until the agreement is submitted.

2. Opening a Current Bank Account

To streamline financial transactions and maintain accountability, every LLP must open a current bank account in its name with a recognized bank in India.

- Purpose: This account is essential for conducting all business-related financial activities, from payments to receipts.

- Transparency in operations: Using a dedicated LLP bank account ensures clear separation of personal and business transactions, reducing the risk of financial discrepancies.

3. Obtaining PAN and TAN Numbers

Each LLP must obtain a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

- Ease of compliance: With the introduction of the LLP (Second Amendment) Rules, 2022, PAN and TAN numbers are now automatically generated and issued alongside the Certificate of Incorporation, simplifying this step.

- Purpose of PAN and TAN: PAN is required for income tax filings, while TAN is mandatory for deducting and remitting tax at source (TDS) when applicable.

4. GST Registration (If Applicable)

While not mandatory at the time of incorporation, an LLP must obtain GST registration if its annual turnover exceeds ₹40 lakhs (or ₹20 lakhs for service providers).

- When to register: LLPs can register under the Goods and Services Tax (GST) Act as soon as their turnover threshold is crossed.

- Benefits of GST compliance: Timely GST registration allows LLPs to claim input tax credits and ensures they comply with tax collection and remittance requirements.

Mandatory Compliances for LLPs in India

For Limited Liability Partnerships (LLPs) in India, adhering to mandatory compliance requirements is crucial for maintaining their legal standing and ensuring smooth operations. These obligations, governed by the Limited Liability Partnership Act, 2008, apply to all LLPs, irrespective of their business activity or scale. Below is a comprehensive list of the mandatory filings and compliance requirements that every LLP must meet.

1. Annual Return Filing (Form 11)

Every LLP must file Form 11 annually, even if it has not conducted any business during the year.

- What it includes: Form 11 provides a summary of the LLP’s management affairs, including details about its partners.

- Deadline: This form must be filed by May 30th each year.

- Penalty for non-compliance: Failing to file Form 11 on time results in a fine of ₹100 per day until compliance is achieved.

2. Statement of Accounts and Solvency (Form 8)

Form 8 is a critical compliance requirement, documenting the LLP’s financial performance and solvency status.

- What it includes: It covers profit-and-loss statements, balance sheets, and a declaration of solvency.

- Audit requirement: LLPs with a turnover exceeding ₹40 lakhs or a contribution exceeding ₹25 lakhs must get their accounts audited by a Chartered Accountant (CA).

- Deadline: Form 8 must be filed within 30 days from the end of six months of the financial year, i.e., by October 30th.

- Penalty for non-compliance: Missing the deadline incurs a penalty of ₹100 per day, which continues until the filing is completed.

3. Income Tax Filing (ITR-5)

Filing Income Tax Returns (ITR-5) is mandatory for all LLPs, with deadlines varying based on the need for a tax audit.

- Deadline for non-audited LLPs: LLPs not requiring a tax audit must file their ITR by July 31st.

- Deadline for audited LLPs: LLPs requiring an audit must complete their ITR filing by September 30th after the audit is performed by a practicing CA.

- Special cases: LLPs engaged in international or specified domestic transactions must file Form 3CEB and complete their tax filing by November 30th.

4. Other Miscellaneous Compliances

In addition to the major filings, LLPs must meet several routine compliance requirements, including:

- Director Identification Number (DIN) Updates: Ensuring that DINs of all designated partners remain active and updated.

- Event-Based Filings: Filing relevant forms with the Ministry of Corporate Affairs (MCA) for changes such as partner additions or exits, amendments to the LLP agreement, or changes in contributions.

- Maintenance of Statutory Records: LLPs must maintain accurate and updated records of financial transactions, partner details, and minutes of meetings.

Compliances for Limited Liability Partnership (LLP) in India (Checklist)

| Compliance Requirement | Form Associated | Deadline | Frequency | Penalties for Non- Compliance | Other Remarks |

|---|---|---|---|---|---|

| Annual Return Filing | Form 11 | May 30th every year | Annual | ₹100 per day until compliance | Mandatory for all LLPs, irrespective of business activity. Provides a summary of LLP’s management affairs. |

| Statement of Accounts and Solvency | Form 8 | October 30th every year | Annual | ₹100 per day until compliance | Must include profit-and-loss statements and balance sheets. Audit required for LLPs with turnover > ₹40 lakhs or contribution > ₹25 lakhs. |

| Income Tax Filing | ITR-5 | July 31st (non-audited LLPs) | Annual | Interest on due tax, penalties, and legal consequences for non-filing | Tax-audited LLPs must file by September 30th. LLPs with international/domestic transactions must file Form 3CEB and complete filing by November 30th. |

| LLP Agreement Filing | Form-3 | Within 30 days of incorporation | One-Time | ₹100 per day until compliance | Filing the LLP Agreement ensures clarity in roles, responsibilities, and rules of operation. |

| GST Registration | GST Registration Form | Upon reaching turnover threshold of ₹40L/₹20L | Event-Based | Penalty of 10% of the tax amount due (minimum ₹10,000) | Not mandatory at incorporation. Registration is required when annual turnover exceeds ₹40 lakhs (₹20 lakhs for service providers). |

| DIN Updates | NA | As required | Event-Based | NA | Ensure Director Identification Numbers (DINs) are active and updated for all designated partners. |

| Event-Based Filings | Various MCA Forms | Within the prescribed timeline | Event-Based | ₹100 per day until compliance | Applies to changes in LLP agreement, partner details, or contributions. |

| Form 3CEB Filing | Form 3CEB | November 30th (if applicable) | Annual (if applicable) | Penalties and scrutiny by tax authorities | Mandatory for LLPs engaged in international or specific domestic transactions. |

Key Insights:

- Timeliness is critical: Most filings have daily penalties for delays, so adhering to deadlines is crucial to avoid unnecessary financial burdens.

- Audit requirements: LLPs with higher turnover or contributions must have their accounts audited by a Chartered Accountant.

- Professional assistance recommended: Engaging a CA or compliance expert, like Treelife can help LLPs stay on top of all legal and tax obligations.

Benefits of LLP Compliance

Timely compliance with regulatory requirements offers several advantages for an LLP:

- Legal Protection: Compliance helps maintain the limited liability status of partners, ensuring the business remains a separate legal entity and protecting personal assets.

- Credibility: Meeting filing deadlines boosts the credibility of the LLP with clients, investors, and regulatory bodies, enhancing trust and reputation.

- Avoiding Penalties: Adhering to compliance prevents costly fines, interest charges, and legal consequences, helping avoid disruptions to business operations.

- Tax Benefits: Timely filing of income tax returns and maintaining proper records can provide tax advantages, including deductions and exemptions, reducing the business’s tax liability.

Steps to Ensure LLP Compliance

To maintain a compliant LLP, following a structured approach is crucial. Here’s an LLP compliance safety checklist to help your business stay on track:

- Regular Bookkeeping: Accurate financial record-keeping is essential. Even if no business activity occurs, LLPs must maintain detailed books throughout the year. This ensures readiness for filings and audits, and helps avoid penalties for non-compliance.

- Set Reminders for Filing Deadlines: It’s important to establish a system to track key filing dates. Use calendar alerts or professional services to ensure timely submission of required returns and documents to avoid delays and fines.

- Engage Professionals: Consult with a Chartered Accountant (CA) or compliance expert to manage filings, audits, and overall compliance. Professionals can guide you through complex regulatory requirements, ensuring that your LLP adheres to all legal obligations.

- Stay Updated: Regularly update your LLP’s forms with the Ministry of Corporate Affairs (MCA) whenever there are changes in partners, capital contributions, or corporate structure. Timely updates prevent issues with legal filings and keep your records accurate.

By following these steps to ensure LLP compliance, you can avoid legal pitfalls and maintain smooth business operations.

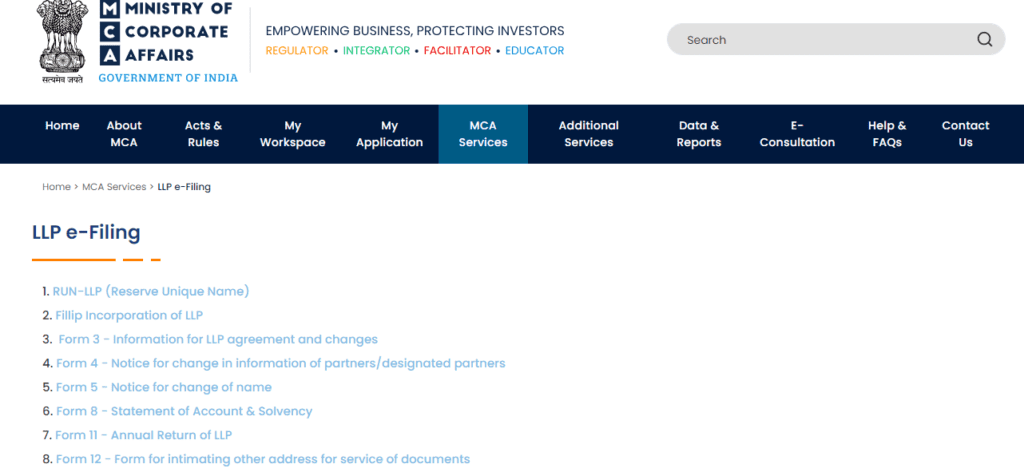

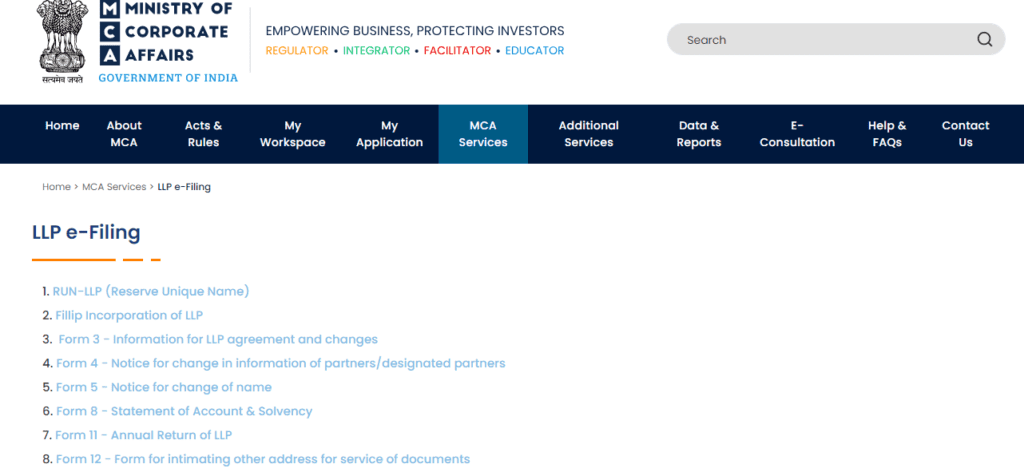

How to File LLP Compliances in India

Filing LLP compliances in India involves several important steps to ensure your business adheres to regulatory requirements. Here’s a guide on how to file LLP returns and the LLP compliance filing process:

- Filing the Statement of Accounts & Solvency (Form 8):

To file Form 8 online on the Ministry of Corporate Affairs (MCA) portal, follow these steps:- Login to the MCA portal (https://www.mca.gov.in/content/mca/global/en/home.html) using your credentials.

- Navigate to the ‘e-Forms’ section and select Form 8.

- Fill in details like LLP’s financial status, assets, liabilities, and solvency.

- Attach the certification from a practicing Chartered Accountant (CA) confirming the accuracy of the details.

- Submit the form and pay the filing fees.

This form must be filed annually to confirm the financial health of the LLP.

- Filing Annual Return (Form 11):

To file Form 11, follow these steps:- Log in to the MCA portal (https://www.mca.gov.in/content/mca/global/en/mca/llp-e-filling.html).

- Select Form 11 under the ‘e-Forms’ section.

- Fill in details about the LLP’s registered office, partners, and capital contributions.

- Submit the form along with the prescribed fees. This form provides the government with an annual update on the LLP’s operational status and structure.

- Income Tax Filing (ITR-5):

For filing income tax returns for an LLP, follow these steps:- Prepare the financial records and details for ITR-5, which is specifically designed for LLPs.

- Ensure that the LLP’s digital signature is ready for filing.

- Visit the Income Tax Department’s e-filing portal and log in.

- Choose ITR-5 from the available forms and fill in the necessary details.

- Submit the return after ensuring all the required information is accurately entered.

LLPs must file their tax returns by the due date to avoid penalties.

- Form 3CEB Filing:

If your LLP is involved in international or domestic transactions subject to transfer pricing regulations, you may need to file Form 3CEB. To file this form:- Engage a CA to certify the transfer pricing report.

- Prepare the form by providing details on the transactions with related parties.

- Submit the form through the MCA portal as part of your compliance.

LLP e-filing streamlines these processes, making it easier for businesses to stay compliant. By following these steps and filing the necessary forms, you ensure that your LLP remains in good standing with regulatory authorities in India.

Filing and Audit Requirements Under the Income Tax Act

Understanding the filing requirements for LLPs under the Income Tax Act is crucial for maintaining compliance and avoiding penalties. Here’s a breakdown of key LLP tax audit and filing requirements:

- Audit Requirements for LLPs:

According to the LLP Act, 2008, any LLP with a turnover exceeding Rs. 40 lakhs or capital contributions exceeding Rs. 25 lakhs is required to have its books audited. The audit must be conducted by a qualified Chartered Accountant (CA) to ensure financial transparency and compliance with statutory regulations. - Income Tax Filing Deadlines:

LLPs must adhere to specific deadlines for filing income tax returns:- For audited LLPs, the filing deadline is September 30th of the assessment year.

- For non-audited LLPs, the deadline is July 31st.

Filing after these dates can result in penalties and interest charges, so it’s essential to keep track of these important dates.

- Tax Audit Threshold:

The threshold for a tax audit under the Income Tax Act has changed in recent years. Starting from the financial year 2020-21, the limit has increased from Rs. 1 crore to Rs. 5 crore for LLPs with cash receipts and payments exceeding the specified limit. This change means that LLPs with a turnover of Rs. 5 crore or less may not require a tax audit, provided their cash transactions remain within the prescribed limits. - Form 3CEB Filing:

If your LLP engages in specified transactions (such as international or domestic transactions involving related parties), you are required to file Form 3CEB. This form, certified by a Chartered Accountant, provides details on the transfer pricing policies and transactions. It must be filed along with the income tax return.

Wrapping things up, LLP compliance in India is essential for ensuring smooth business operations and legal protection. By adhering to the required compliances, such as filing annual returns, maintaining proper financial records, and conducting audits, an LLP can enjoy significant benefits, including legal protection, increased credibility, and tax advantages. Timely compliance also helps avoid penalties and legal consequences that could disrupt business growth. Understanding the LLP compliance checklist and meeting the necessary filing deadlines is crucial for maintaining regulatory adherence and safeguarding your business’s future in India.

FAQs on Compliances for Limited Liability Partnership in India

- What are the key compliances for LLP in India?

Key compliances for LLPs in India include filing the annual return (Form 11), submitting the Statement of Accounts & Solvency (Form 8), income tax filings (ITR-5), and conducting an annual audit if required. - What are the benefits of LLP compliance in India?

LLP compliance offers several benefits, including legal protection for partners, enhanced credibility with clients and investors, tax advantages, and the avoidance of penalties and legal issues. - What are the penalties for non-compliance by an LLP in India?

Non-compliance with LLP regulations can result in penalties, fines, interest charges, or legal consequences, which can harm the business’s reputation and disrupt operations. - How do I ensure timely compliance for my LLP in India?

To ensure timely compliance, maintain regular bookkeeping, set reminders for filing deadlines, consult professionals like Chartered Accountants (CAs), and stay updated with regulatory changes from the Ministry of Corporate Affairs (MCA). - What is the tax audit threshold for an LLP in India?

The tax audit threshold for LLPs under the Income Tax Act has been increased from Rs. 1 crore to Rs. 5 crore for financial transactions involving cash receipts and payments, starting from FY 2020-21. - What forms are required for LLP compliance in India?

Essential forms for LLP compliance include Form 11 (Annual Return), Form 8 (Statement of Accounts & Solvency), Form 3CEB (for transfer pricing), and ITR-5 (Income Tax Return). - How do I file LLP returns in India?

LLP returns in India can be filed online through the Ministry of Corporate Affairs (MCA) portal. The process includes submitting Form 11 (Annual Return), Form 8 (Statement of Accounts & Solvency), and ITR-5 (Income Tax Return) with the necessary certifications, such as from a Chartered Accountant (CA). - What is the deadline for filing LLP compliance documents in India?

The deadline for filing LLP compliance documents varies: Form 11 (Annual Return) must be filed by May 30th, Form 8 (Statement of Accounts & Solvency) by October 30th, and income tax returns (ITR-5) by July 31st for non-audited LLPs and September 30th for audited LLPs.

Trademark Registration in India – Meaning, Online Process, Documents

Blog Content Overview

- 1 Introduction to Trademark Registration in India

- 2 What is Trademark Registration?

- 3 Types of Trademarks in India

- 4 Procedure for Online Trademark Registration in India

- 4.1 Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- 4.2 Step 2: Prepare and Submit the Application (Online/Offline)

- 4.3 Step 3: Verification of Application and Documents

- 4.4 Step 4: Trademark Journal Publication and Opposition

- 4.5 Step 5: Approval and Issuance of Trademark Registration Certificate

- 4.6 Additional Points to Note

- 5 Documents Required for Trademark Registration in India

- 6 Costs and Fees for Trademark Registration in India

- 7 How to Check Trademark Registration Status

- 8 Common Grounds for Refusal of Trademark Registration in India

- 9 Renewing a Trademark in India

- 10 Frequently Asked Questions (FAQs) on Trademark Registration in India

Introduction to Trademark Registration in India

In today’s competitive market, building a strong brand identity is vital for success. It is in this context that trademarks become a critical asset to distinguish a business’ products or services from others, ensuring they stand out and are instantly recognizable to a consumer. Consequently, protection of the trademark through trademark registration in India is a crucial step for businesses aiming to protect their brand identity and establish legal ownership over their logos, names, and symbols – all of which constitute intellectual property of the business. As a result, whether it’s a logo, name, slogan, or unique design, registering a trademark provides legal protection against infringement of intellectual property and legitimizes the brand’s ownership of such intellectual property.

In India, the process of registering a trademark is governed by the Trade Marks Act, 1999, and is overseen by the Trade Marks Registry. The Trade Marks Registry was established in 1940, and was followed by the passing of the Trademark Act in 1999. The Head Office of the Trade Marks Registry is located in Mumbai and regional offices in Ahmedabad, Chennai, Delhi, and Kolkata.

A registered trademark offers exclusive rights of use to the owner, preventing unauthorized use of the mark by others and providing a legal mechanism to pursue recourse against infringement. Additionally, registration helps avoid potential legal conflicts or claim of the mark by a third party, and protects the business from unfair competition.

The answer to question – How to Register Trademark in India? is relatively straightforward, but it requires careful attention to detail to ensure compliance with legal requirements. It involves several steps, including a trademark search, filing the application, examination, publication, and ultimately the issuance of the registration certificate. Throughout this process, it is crucial to ensure that the trademark is distinct, does not conflict with existing marks, and is used in a way that is representative of the business’ activities.

What is Trademark Registration?

Trademark registration is a legal process that grants exclusive rights to a brand or business to use a specific mark, symbol, logo, name, or design to distinguish its products or services from others in the market. A registered trademark becomes an integral part of a company’s intellectual property portfolio, offering both legal protection and a competitive edge.

In India, trademarks are governed by the Trade Marks Act, 1999, which provides the framework for registering, protecting, and enforcing trademark rights.

Definition of a Trademark

A trademark is a distinct sign, symbol, word, or combination of these elements that represents a brand and differentiates its offerings from others. Trademarks are not just limited to logos or names; they can include slogans, colors, sounds, or even packaging styles that uniquely identify a product or service. In India, trademarks are protected under the Trade Marks Act, 1999, offering exclusive rights to the owner.

For example:

- The golden arches of McDonald’s are a globally recognized logo trademark.

- The tagline “Just Do It” is an example of a registered “wordmark” by Nike.

Trademarks are classified into 45 trademark classes, which group various goods and services to streamline the registration process. Businesses must choose the relevant class that aligns with their offerings during registration.

Intellectual Property Rights Symbols and Their Significance: ™, ℠, ®

Understanding the symbols associated with trademarks is crucial for businesses and consumers alike:

- ™ (Trademark):

- This symbol indicates that the mark is being used as a trademark, but it is not yet registered.

- It signifies intent to protect the brand and discourages misuse.

- ℠ (Service Mark):

- Used for service-based businesses to highlight unregistered marks.

- Common in industries like hospitality, consulting, and IT services.

- ® (Registered Trademark):

- Denotes that the trademark is officially registered with the government.

- Provides legal protection and exclusive rights to use the mark in its registered category.

Using the correct symbol helps businesses communicate their trademark status while deterring infringement and ensuring legal enforceability.

Importance of Trademark Registration

Trademark registration is essential for businesses looking to secure their brand identity. It ensures legal protection and provides exclusive rights to the owner to use the mark for their goods or services. Key reasons why trademark registration is important include:

- Brand Protection: Prevents competitors from using similar names, logos, or designs that could mislead customers.

- Legal Recognition: Grants official ownership under Indian law, ensuring your rights are safeguarded.

- Customer Trust: A trademark adds credibility to your brand, making it easier for customers to identify and trust your products or services.

- Asset Creation: Registered trademarks are intangible assets that can be licensed, franchised, or sold for business growth.

- Global Reach: Trademark registration in India can facilitate international trademark recognition, helping businesses expand globally.

Benefits of Registering a Trademark in India

The benefits of trademark registration extend beyond legal protection. Here are the key advantages:

- Exclusive Rights: Registration provides exclusive rights to the owner, ensuring the trademark cannot be legally used by others in the registered class.

- Competitive Edge: A trademark helps establish a distinct identity in the market, giving your business a competitive advantage.

- Prevention of Infringement: Protects against unauthorized use of your brand name, logo, or design.

- Market Goodwill: Builds trust and goodwill with customers, enhancing brand loyalty.

- Ease of Business Expansion: A registered trademark facilitates licensing or franchising, opening doors for business growth.

- Strong Legal Position: In the event of disputes, a registered trademark provides a strong legal standing.

Brief Overview of the Trademark Registration Process in India