Blog Content Overview

- 1 Treelife Resources

- 1.1 Explore our resources to fuel your success and propel your business forward.

- 1.2 Latest Posts

- 1.2.0.1 AIF (Alternative Investment Funds) in India – Framework, Types Taxability for 2025

- 1.2.0.2 What is GST Compliance : Meaning, Benefits & Rating

- 1.2.0.3 Why Convertible Debentures are Investor Friendly – Types & Taxability

- 1.2.0.4 DesignX raises pre-series A funding from Piper Serica Angel Fund

- 1.2.0.5 Quick Commerce in India: Disruption, Challenges, and Regulatory Crossroad

- 1.2.0.6 “JioHotstar” – An enterprising case of Cybersquatting

- 1.2.0.7 Treelife featured and authored a chapter in a report, “Funds in GIFT City- Scaling New Heights” by Eleveight

- 1.2.0.8 Blinkit 2.0: Can Zomato’s Juggernaut Fight Off Quick Commerce Rivals?

- 1.3 Thought Leadership

- 1.4 Introduction to Trademark Registration in India

- 1.5 What is Trademark Registration?

- 1.6 Types of Trademarks in India

- 1.7 Procedure for Online Trademark Registration in India

- 1.7.1 Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- 1.7.2 Step 2: Prepare and Submit the Application (Online/Offline)

- 1.7.3 Step 3: Verification of Application and Documents

- 1.7.4 Step 4: Trademark Journal Publication and Opposition

- 1.7.5 Step 5: Approval and Issuance of Trademark Registration Certificate

- 1.7.6 Additional Points to Note

- 1.8 Documents Required for Trademark Registration in India

- 1.9 Costs and Fees for Trademark Registration in India

- 1.10 How to Check Trademark Registration Status

- 1.11 Common Grounds for Refusal of Trademark Registration in India

- 1.12 Renewing a Trademark in India

- 1.13 Frequently Asked Questions (FAQs) on Trademark Registration in India

- 1.14 What is a Trademark?

- 1.15 Why is Trademark Registration Important in India?

- 1.16 Key Industries Benefiting from Trademark Registration

- 1.17 Conclusion

- 1.18 Introduction to Trademarks

- 1.19 Background of Trademarks in India

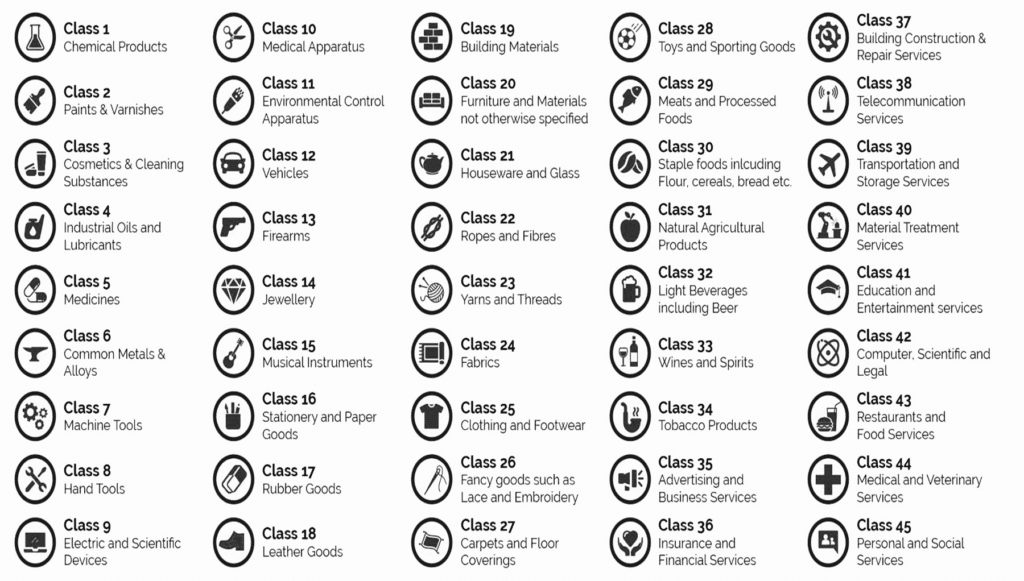

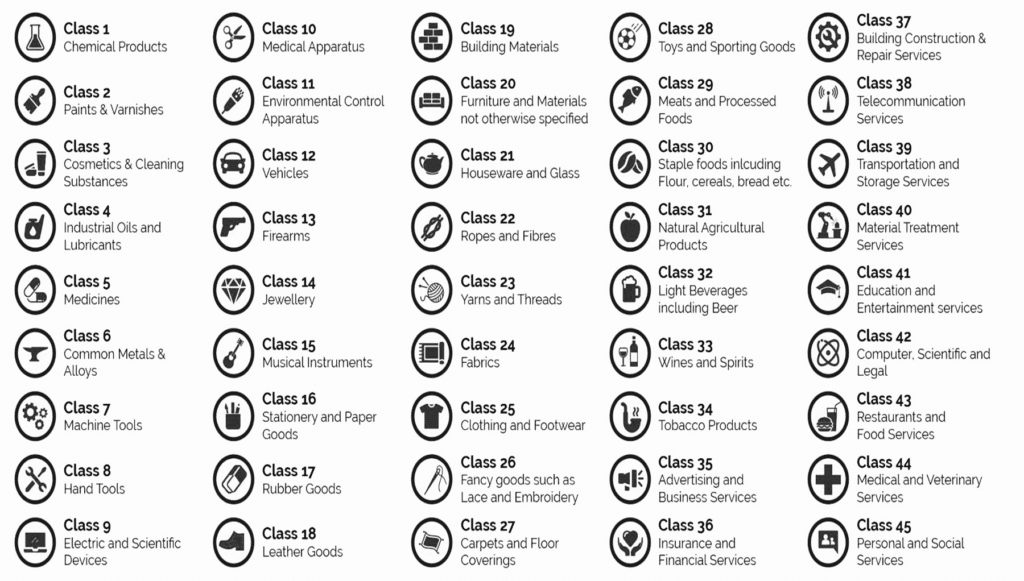

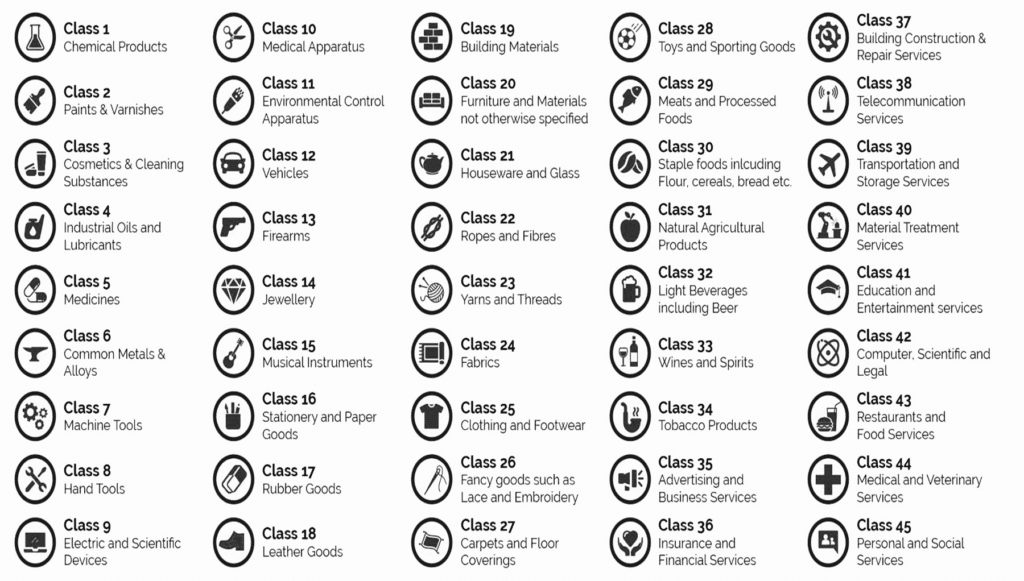

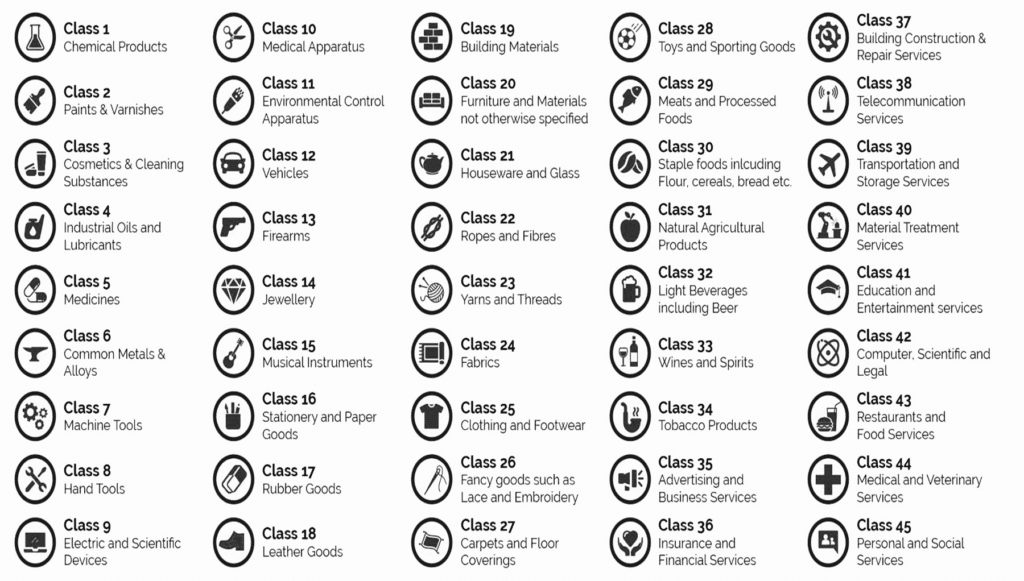

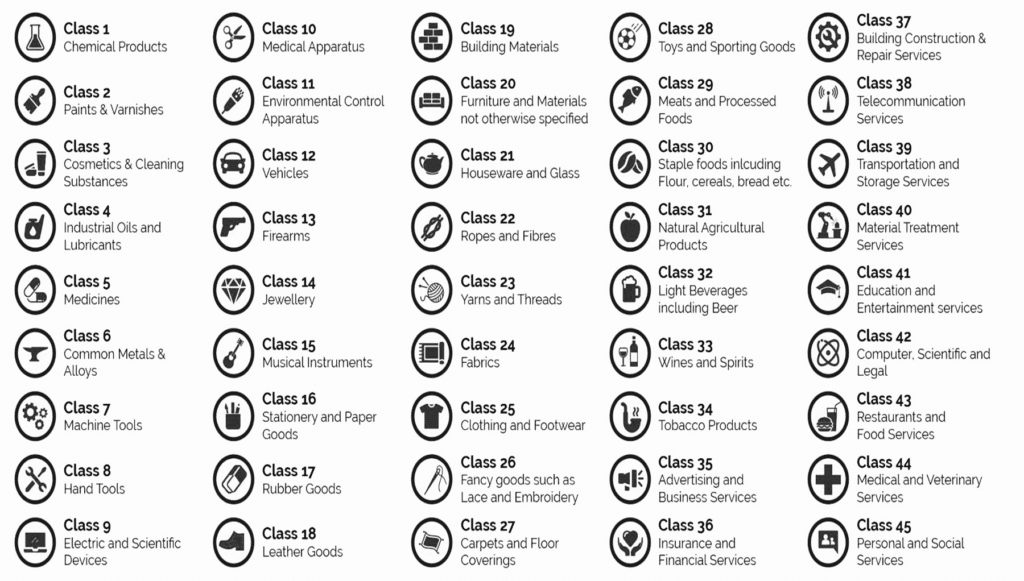

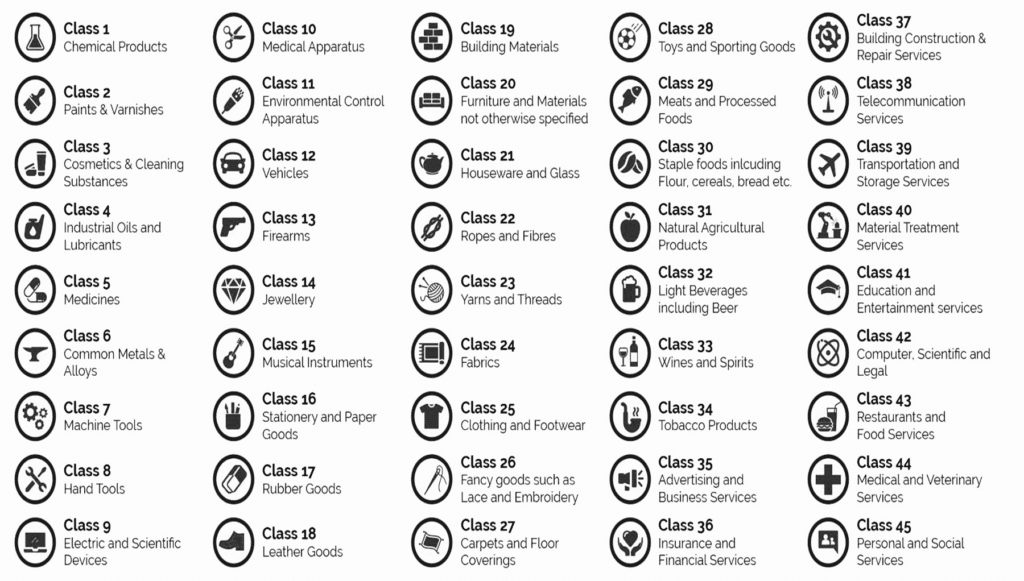

- 1.20 What is a Trademark Class?

- 1.21 Importance of Trademark Classification

- 1.22 Trademark Classification List

- 1.23 List of Trademark Classes of Goods in India (1-34 Classes)

- 1.24 List of Trademark Classes of Services in India (35-45 Classes)

- 1.25 Online Tools available for Classifying Trademarks

- 1.26 Conclusion

- 1.27 FAQs on Trademark Classification in India

- 1.27.0.1 2. How are goods and services categorized under trademark classification?

- 1.27.0.2 3. Why is trademark classification essential during the registration process?

- 1.27.0.3 4. Can a trademark be registered under multiple classes?

- 1.27.0.4 5. What tools are available for trademark classification in India?

- 1.27.0.5 6. How does trademark classification help prevent legal conflicts?

- 1.27.0.6 7. What is the significance of the NICE classification system?

- 1.27.0.7 8. What are the benefits of correct trademark classification?

- 1.27.1 Related posts:

- 1.28 Introduction

- 1.29 Cross Border Payments Ecosystem

- 1.30 RBI Guidelines on Cross Border Payments

- 1.31 Indian Landscape for Cross Border Payments

- 1.32 Future of Cross Border Payments

- 1.33 Conclusion

- 1.34 Frequently Asked Questions for Cross Border Payments

- 1.34.0.1 2. What are the primary types of cross-border payments?

- 1.34.0.2 3. What are the benefits of cross-border payments?

- 1.34.0.3 4. What challenges are associated with cross-border payments?

- 1.34.0.4 5. How does the RBI regulate cross-border payments in India?

- 1.34.0.5 6. How has UPI impacted cross-border payments in India?

- 1.34.0.6 7. What technological advancements are driving cross-border payments?

- 1.34.0.7 8. What are the RBI guidelines for startups and businesses handling cross-border payments?

- 1.34.1 Related posts:

- 1.35 What is Market Size?

- 1.36 What is ‘Total Addressable Market’ (TAM)?

- 1.37 What is ‘Serviceable Available Market’ (SAM)?

- 1.38 What is ‘Serviceable Obtainable Market’ (SOM)?

- 1.39 How is Market Sizing Determined?

- 1.40 Formula and Examples: Calculation of TAM, SAM and SOM

- 1.41 Illustration: Mepto’s Market Size Analysis

- 1.42 Conclusion

- 1.43 Frequently Asked Questions on Market Size

- 1.43.0.1 2. What do TAM, SAM, and SOM stand for, and how do they differ?

- 1.43.0.2 3. How is the Total Addressable Market (TAM) calculated?

- 1.43.0.3 4. What is the significance of SAM in market sizing?

- 1.43.0.4 5. What methods can be used for market sizing?

- 1.43.0.5 6. Which approach—Top-Down or Bottom-Up—is better for market sizing?

- 1.43.0.6 7. How is the Serviceable Obtainable Market (SOM) determined?

- 1.43.0.7 8. Can you provide an example of TAM, SAM, and SOM calculation?

- 1.43.0.8 9. Why is market sizing critical for businesses?

- 1.43.1 Related posts:

- 1.43.2 Related posts:

- 1.43.3 Related posts:

- 1.43.4 Related posts:

- 1.43.5 Related posts:

- 1.43.6 Related posts:

- 1.44 Introduction to Trademark Registration in India

- 1.45 What is Trademark Registration?

- 1.46 Types of Trademarks in India

- 1.47 Procedure for Online Trademark Registration in India

- 1.47.1 Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- 1.47.2 Step 2: Prepare and Submit the Application (Online/Offline)

- 1.47.3 Step 3: Verification of Application and Documents

- 1.47.4 Step 4: Trademark Journal Publication and Opposition

- 1.47.5 Step 5: Approval and Issuance of Trademark Registration Certificate

- 1.47.6 Additional Points to Note

- 1.48 Documents Required for Trademark Registration in India

- 1.48.1 1. Business Registration Proof

- 1.48.2 2. Identity and Address Proof

- 1.48.3 3. Trademark Representation

- 1.48.4 4. Power of Attorney (Form TM-48)

- 1.48.5 5. Proof of Prior Usage (If Applicable)

- 1.48.6 6. Udyog Aadhaar or MSME Certificate

- 1.48.7 7. Class-Specific Details

- 1.48.8 8. Address Proof of Business

- 1.49 Costs and Fees for Trademark Registration in India

- 1.50 How to Check Trademark Registration Status

- 1.51 Common Grounds for Refusal of Trademark Registration in India

- 1.52 Renewing a Trademark in India

- 1.53 Frequently Asked Questions (FAQs) on Trademark Registration in India

- 1.54 What is a Trademark?

- 1.55 Why is Trademark Registration Important in India?

- 1.56 Key Industries Benefiting from Trademark Registration

- 1.57 Conclusion

- 1.58 Introduction to Trademarks

- 1.59 Background of Trademarks in India

- 1.60 What is a Trademark Class?

- 1.61 Importance of Trademark Classification

- 1.62 Trademark Classification List

- 1.63 List of Trademark Classes of Goods in India (1-34 Classes)

- 1.64 List of Trademark Classes of Services in India (35-45 Classes)

- 1.65 Online Tools available for Classifying Trademarks

- 1.66 Conclusion

- 1.67 FAQs on Trademark Classification in India

- 1.67.0.1 2. How are goods and services categorized under trademark classification?

- 1.67.0.2 3. Why is trademark classification essential during the registration process?

- 1.67.0.3 4. Can a trademark be registered under multiple classes?

- 1.67.0.4 5. What tools are available for trademark classification in India?

- 1.67.0.5 6. How does trademark classification help prevent legal conflicts?

- 1.67.0.6 7. What is the significance of the NICE classification system?

- 1.67.0.7 8. What are the benefits of correct trademark classification?

- 1.67.1 Related posts:

- 1.68 Introduction

- 1.69 What is Buyback of Shares?

- 1.70 Reasons for Buyback of Shares

- 1.71 Types of Buyback of Shares

- 1.72 Legal Framework and Procedure for Buyback of Shares in India

- 1.73 Taxability and Financial Implications of Buyback of Shares

- 1.74 Advantages and Disadvantages of Buyback of Shares

- 1.75 Dividend vs. Share Buyback: Key Differences Explained

- 1.76 Frequently Asked Questions (FAQs) on the Buyback of shares in India

- 1.77 Introduction

- 1.78 Timeline

- 1.79 Legal Backdrop: Intellectual Property Rights

- 1.80 What is Cybersquatting?

- 1.81 Legal Treatment of Cybersquatting

- 1.82 Notable Examples of Cybersquatting in India

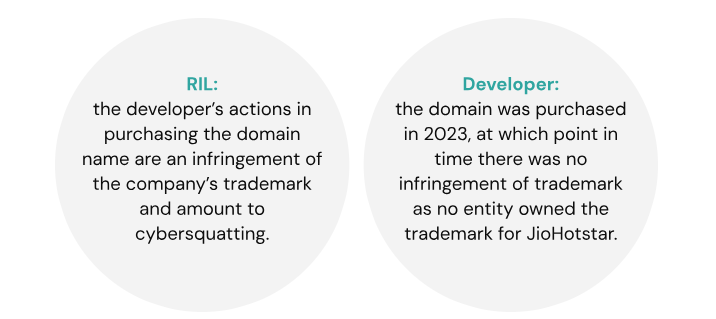

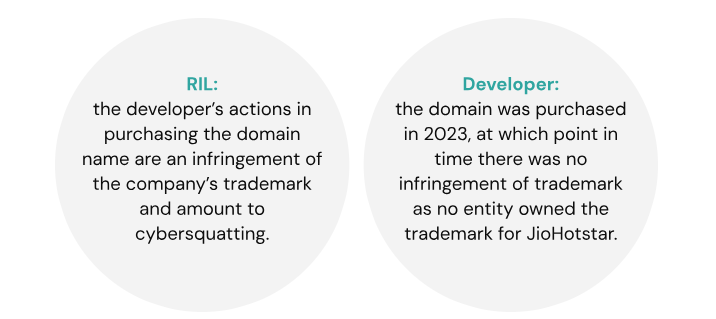

- 1.83 The JioHotstar Case

- 1.84 Conclusion

- 1.85 FAQs on the JioHotstar Cybersquatting Case

- 1.86 MCA Streamlines Cross-border Mergers for Reverse Flipping

- 1.87 Understanding Sovereign Green Bonds

- 1.88 Key Features of the IFSCA’s SGrB Scheme

- 1.89 We Are Problem Solvers. And Take Accountability.

Latest Posts

December 3, 2024 | Finance

AIF (Alternative Investment Funds) in India – Framework, Types Taxability for 2025

Read More

November 29, 2024 | Finance

Why Convertible Debentures are Investor Friendly – Types & Taxability

Read More

November 26, 2024 | Deal Street

DesignX raises pre-series A funding from Piper Serica Angel Fund

Read More

November 21, 2024 | Startups

Quick Commerce in India: Disruption, Challenges, and Regulatory Crossroad

Read More

November 13, 2024 | Media Feature

Blinkit 2.0: Can Zomato’s Juggernaut Fight Off Quick Commerce Rivals?

Read More

Thought Leadership

Trademark Registration in India – Meaning, Online Process, Documents

Blog Content Overview

- 1 Introduction to Trademark Registration in India

- 2 What is Trademark Registration?

- 3 Types of Trademarks in India

- 4 Procedure for Online Trademark Registration in India

- 4.1 Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- 4.2 Step 2: Prepare and Submit the Application (Online/Offline)

- 4.3 Step 3: Verification of Application and Documents

- 4.4 Step 4: Trademark Journal Publication and Opposition

- 4.5 Step 5: Approval and Issuance of Trademark Registration Certificate

- 4.6 Additional Points to Note

- 5 Documents Required for Trademark Registration in India

- 6 Costs and Fees for Trademark Registration in India

- 7 How to Check Trademark Registration Status

- 8 Common Grounds for Refusal of Trademark Registration in India

- 9 Renewing a Trademark in India

- 10 Frequently Asked Questions (FAQs) on Trademark Registration in India

Introduction to Trademark Registration in India

In today’s competitive market, building a strong brand identity is vital for success. It is in this context that trademarks become a critical asset to distinguish a business’ products or services from others, ensuring they stand out and are instantly recognizable to a consumer. Consequently, protection of the trademark through trademark registration in India is a crucial step for businesses aiming to protect their brand identity and establish legal ownership over their logos, names, and symbols – all of which constitute intellectual property of the business. As a result, whether it’s a logo, name, slogan, or unique design, registering a trademark provides legal protection against infringement of intellectual property and legitimizes the brand’s ownership of such intellectual property.

In India, the process of registering a trademark is governed by the Trade Marks Act, 1999, and is overseen by the Trade Marks Registry. The Trade Marks Registry was established in 1940, and was followed by the passing of the Trademark Act in 1999. The Head Office of the Trade Marks Registry is located in Mumbai and regional offices in Ahmedabad, Chennai, Delhi, and Kolkata.

A registered trademark offers exclusive rights of use to the owner, preventing unauthorized use of the mark by others and providing a legal mechanism to pursue recourse against infringement. Additionally, registration helps avoid potential legal conflicts or claim of the mark by a third party, and protects the business from unfair competition.

The answer to question – How to Register Trademark in India? is relatively straightforward, but it requires careful attention to detail to ensure compliance with legal requirements. It involves several steps, including a trademark search, filing the application, examination, publication, and ultimately the issuance of the registration certificate. Throughout this process, it is crucial to ensure that the trademark is distinct, does not conflict with existing marks, and is used in a way that is representative of the business’ activities.

What is Trademark Registration?

Trademark registration is a legal process that grants exclusive rights to a brand or business to use a specific mark, symbol, logo, name, or design to distinguish its products or services from others in the market. A registered trademark becomes an integral part of a company’s intellectual property portfolio, offering both legal protection and a competitive edge.

In India, trademarks are governed by the Trade Marks Act, 1999, which provides the framework for registering, protecting, and enforcing trademark rights.

Definition of a Trademark

A trademark is a distinct sign, symbol, word, or combination of these elements that represents a brand and differentiates its offerings from others. Trademarks are not just limited to logos or names; they can include slogans, colors, sounds, or even packaging styles that uniquely identify a product or service. In India, trademarks are protected under the Trade Marks Act, 1999, offering exclusive rights to the owner.

For example:

- The golden arches of McDonald’s are a globally recognized logo trademark.

- The tagline “Just Do It” is an example of a registered “wordmark” by Nike.

Trademarks are classified into 45 trademark classes, which group various goods and services to streamline the registration process. Businesses must choose the relevant class that aligns with their offerings during registration.

Intellectual Property Rights Symbols and Their Significance: ™, ℠, ®

Understanding the symbols associated with trademarks is crucial for businesses and consumers alike:

- ™ (Trademark):

- This symbol indicates that the mark is being used as a trademark, but it is not yet registered.

- It signifies intent to protect the brand and discourages misuse.

- ℠ (Service Mark):

- Used for service-based businesses to highlight unregistered marks.

- Common in industries like hospitality, consulting, and IT services.

- ® (Registered Trademark):

- Denotes that the trademark is officially registered with the government.

- Provides legal protection and exclusive rights to use the mark in its registered category.

Using the correct symbol helps businesses communicate their trademark status while deterring infringement and ensuring legal enforceability.

Importance of Trademark Registration

Trademark registration is essential for businesses looking to secure their brand identity. It ensures legal protection and provides exclusive rights to the owner to use the mark for their goods or services. Key reasons why trademark registration is important include:

- Brand Protection: Prevents competitors from using similar names, logos, or designs that could mislead customers.

- Legal Recognition: Grants official ownership under Indian law, ensuring your rights are safeguarded.

- Customer Trust: A trademark adds credibility to your brand, making it easier for customers to identify and trust your products or services.

- Asset Creation: Registered trademarks are intangible assets that can be licensed, franchised, or sold for business growth.

- Global Reach: Trademark registration in India can facilitate international trademark recognition, helping businesses expand globally.

Benefits of Registering a Trademark in India

The benefits of trademark registration extend beyond legal protection. Here are the key advantages:

- Exclusive Rights: Registration provides exclusive rights to the owner, ensuring the trademark cannot be legally used by others in the registered class.

- Competitive Edge: A trademark helps establish a distinct identity in the market, giving your business a competitive advantage.

- Prevention of Infringement: Protects against unauthorized use of your brand name, logo, or design.

- Market Goodwill: Builds trust and goodwill with customers, enhancing brand loyalty.

- Ease of Business Expansion: A registered trademark facilitates licensing or franchising, opening doors for business growth.

- Strong Legal Position: In the event of disputes, a registered trademark provides a strong legal standing.

Brief Overview of the Trademark Registration Process in India

The procedure for trademark registration in India is systematic and straightforward. Here’s a quick overview:

- Trademark Search: Conduct a trademark registration search to ensure the desired trademark is unique and not already registered.

- Application Filing: Submit the trademark application online or offline with all required documents, including ID proofs, business registration details, and the logo (if applicable).

- Examination and Review: Authorities review the application and may raise objections, which must be addressed within the stipulated time.

- Publication: The trademark is published in the Trademark Journal, allowing for public objections.

- Approval and Registration: If no objections are raised or resolved satisfactorily, the trademark is approved and the trademark registration certificate is issued.

Registering a trademark not only provides legal protection but also secures your brand’s future, ensuring long-term growth and recognition in the market.

Types of Trademarks in India

Trademarks in India are categorized into general and specific types, each serving different purposes to protect distinct aspects of a brand’s identity.

General Trademarks

- Generic Mark: Refers to common terms or names that describe a product or service. These marks are not eligible for registration as they lack uniqueness (e.g., “Milk” for dairy products).

- Suggestive Mark: Indicates the nature or quality of the goods or services indirectly, requiring imagination to connect with the product (e.g., “Netflix” suggests internet-based flicks).

- Descriptive Mark: Describes the product or service but must acquire distinctiveness to qualify for registration (e.g., “Best Rice”).

- Arbitrary Mark: Uses common words in an unrelated context, making them distinctive (e.g., “Apple” for electronics).

- Fanciful Mark: Invented words with no prior meaning, offering the highest level of protection (e.g., “Google”).

Specific Trademarks

- Service Mark: Identifies and protects services rather than goods (e.g., logos of consulting firms).

- Certification Mark: Indicates that the product meets established standards (e.g., ISI mark).

- Collective Mark: Used by a group of entities to signify membership or collective ownership (e.g., “CA” for Chartered Accountants).

- Trade Dress: Protects the visual appearance or packaging of a product, such as color schemes or layouts (e.g., Coca-Cola bottle shape).

- Sound Mark: Protects unique sounds associated with a brand (e.g., the Nokia tune).

Other types include Pattern Marks, Position Marks, and Hologram Marks, which add further layers of protection to unique brand elements.

Who can Apply for Trademark?

Anyone can apply for trademark registration, including individuals, companies, and LLPs. The person listed as the applicant in the trademark registration form will be recognized as the trademark owner once the registration is complete. This process allows businesses and individuals to protect their brand identity under trademark law.

Procedure for Online Trademark Registration in India

Trademark registration in India involves a detailed and systematic process that ensures legal protection for your brand. Below is a step-by-step guide to the procedure:

Step 1: Choose a Unique Trademark and Conduct a Trademark Registration Search

- Begin by selecting a unique and distinctive trademark that effectively represents your brand. It could be a logo, wordmark, slogan, or even a combination of elements.

- Ensure your trademark aligns with your business’s trademark class. There are 45 classes under which trademarks can be registered:

- Classes 1-34 cover goods.

- Classes 35-45 cover services.

- Conduct a trademark registration search using the Controller General of Patents, Designs, and Trademarks’ online database. This ensures your chosen mark isn’t already in use or similar to an existing trademark, avoiding potential objections or rejections.

Step 2: Prepare and Submit the Application (Online/Offline)

- Application Form: File Form TM-A, which allows registration for one or multiple classes.

- Required Documents:

- Business Registration Proof (e.g., GST certificate or incorporation document).

- Identity and address proof of the applicant (e.g., PAN, Aadhaar).

- A clear digital image of the trademark (dimensions: 9 cm x 5 cm).

- Proof of claim, if the mark has been used previously in another country.

- Power of Attorney, if an agent is filing on your behalf.

- Filing Options:

- Manual Filing: Submit the form at the nearest Trademark Registry Office (Delhi, Mumbai, Kolkata, Chennai, or Ahmedabad).

- Acknowledgment takes 15-20 days.

- Online Filing: Faster and efficient, with instant acknowledgment via the IP India portal (https://ipindia.gov.in/).

- Manual Filing: Submit the form at the nearest Trademark Registry Office (Delhi, Mumbai, Kolkata, Chennai, or Ahmedabad).

- Government Fees for Trademark Registration (as on date):

- ₹4,500 (e-filing) or ₹5,000 (manual filing) for individuals, startups, and small businesses.

- ₹9,000 (e-filing) or ₹10,000 (manual filing) for others.

Step 3: Verification of Application and Documents

- The Registrar of Trademarks examines the application to ensure compliance with the Trademark Act of 1999 and relevant guidelines.

- If any issues arise, such as incomplete information or similarity with an existing mark, the Registrar raises an objection and sends a notice to the applicant.

- Applicants must respond to objections within the stipulated timeframe, providing justifications or additional documentation.

Step 4: Trademark Journal Publication and Opposition

- Once cleared, the trademark is published in the Indian Trademark Journal, inviting public feedback.

- Opposition Period:

- Third parties have four months to file an opposition if they believe the trademark conflicts with their rights.

- If opposition arises, both parties present their evidence, and the Registrar conducts a hearing to resolve the matter.

Step 5: Approval and Issuance of Trademark Registration Certificate

- If there are no objections or oppositions (or they are resolved), the Registrar approves the trademark.

- A Trademark Registration Certificate is issued, officially granting the applicant the right to use the ® symbol alongside their trademark.

Additional Points to Note

- The entire trademark registration process in India can take 6 months to 2 years, depending on the objections or oppositions.

- During the registration process, you can use the ™ symbol to indicate a pending trademark application. Once the certificate is issued, switch to the ® symbol, denoting a registered trademark.

By following this step-by-step guide, businesses can protect their brand, build trust, and enjoy exclusive rights to their trademark in India. Ensure proper documentation and legal assistance for a smoother registration process.

Documents Required for Trademark Registration in India

To successfully register a trademark in India, specific documents must be submitted. These documents establish the applicant’s identity, business details, and trademark uniqueness. Here’s a concise list with key details:

1. Business Registration Proof

- Sole Proprietorship: GST Certificate or Business Registration Certificate.

- Partnership Firm: Partnership Deed or Registration Certificate.

- Company/LLP: Incorporation Certificate and Company PAN card.

2. Identity and Address Proof

- Individuals/Sole Proprietors: PAN Card, Aadhaar Card, or Passport.

- Companies/LLPs: Identity proof of directors/partners and registered office address proof.

3. Trademark Representation

- A clear digital image of the trademark (logo, wordmark, or slogan) with dimensions of 9 cm x 5 cm.

4. Power of Attorney (Form TM-48)

- A signed Power of Attorney authorizing an agent or attorney to file the trademark application.

5. Proof of Prior Usage (If Applicable)

- Evidence such as invoices, advertisements, or product labels showing prior use of the trademark.

6. Udyog Aadhaar or MSME Certificate

- Required for startups, small businesses, and individuals to avail reduced trademark registration fees.

7. Class-Specific Details

- Declaration of the class of goods or services (from 45 available trademark classes).

8. Address Proof of Business

- Recent utility bills, lease agreements, or ownership documents as proof of the business location.

By ensuring all these documents for trademark registration are complete and accurate, applicants can avoid delays and simplify the registration process. Proper documentation is key to protecting your brand identity in India.

Costs and Fees for Trademark Registration in India

Understanding of the costs involved in trademark registration in India is needed for businesses and individuals planning to protect their intellectual property. Here’s a detailed breakdown:

1. Government Fees for Trademark Registration (as on date)

- Individuals, Startups, and Small Enterprises:

- ₹4,500 for e-filing.

- ₹5,000 for physical filing.

- Others (Companies, LLPs, etc.):

- ₹9,000 for e-filing.

- ₹10,000 for physical filing.

2. Additional Costs for Professional Services

- Hiring a trademark attorney or agent may involve additional charges depending on the complexity of the application and services provided.

3. Factors Affecting Trademark Registration Costs

- Number of Classes: Registering under multiple trademark classes increases the fees.

- Type of Trademark: Filing for a collective trademark or series mark incurs higher costs.

- Opposition Proceedings: If objections are raised, handling opposition can add to the expenses.

Planning your trademark registration carefully can help you manage costs effectively while ensuring maximum protection for your brand.

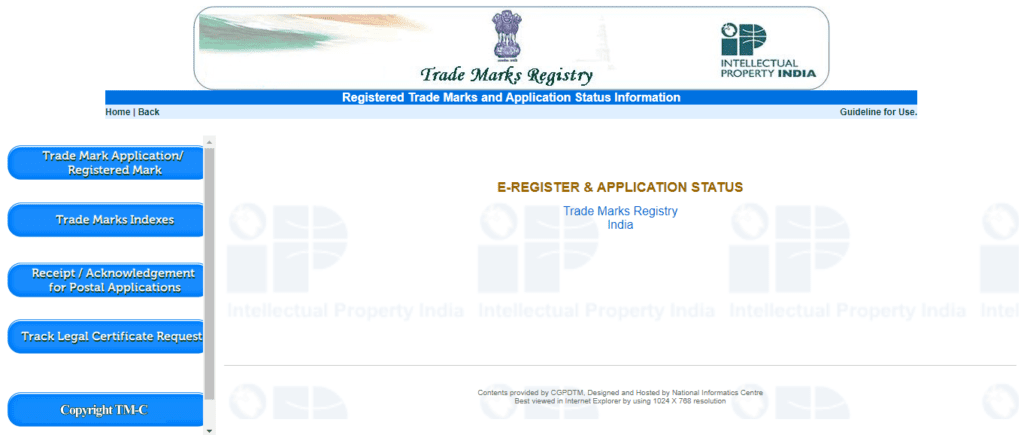

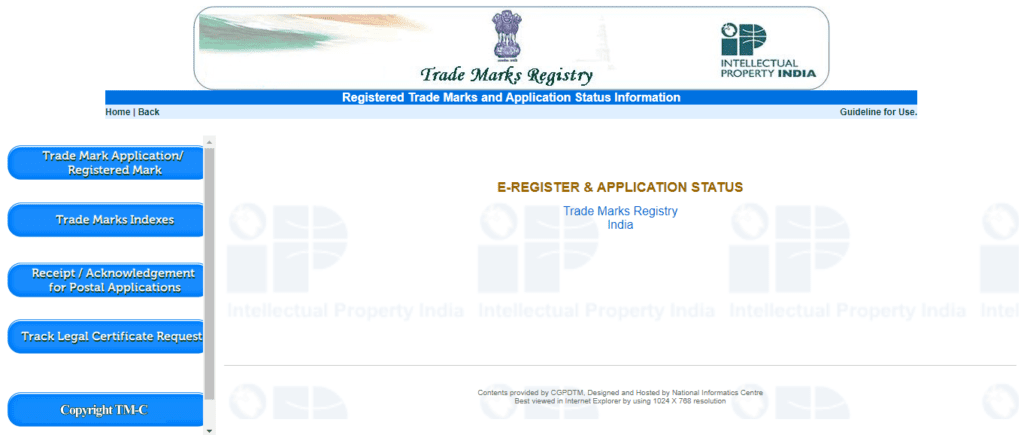

How to Check Trademark Registration Status

After filing your application, it’s essential to monitor its status regularly to avoid delays. Here’s how you can do it:

1. Online Methods to Check Trademark Status

- Visit the official website of the Controller General of Patents, Designs, and Trademarks.

- Navigate to the “Trademark Status” option or visit https://tmrsearch.ipindia.gov.in/eregister/eregister.aspx .

- Enter your application number or trademark details.

- View the current status, including examination, opposition, or registration updates.

2. Common Reasons for Delays

- Incomplete Documentation: Missing or incorrect documents can lead to processing delays.

- Objections or Oppositions: Objections raised by the Trademark Office or third-party oppositions require resolution, prolonging the process.

- Backlog at Trademark Office: High volume of applications can slow down the approval process.

3. Resolving Delays

- Ensure that all documents are complete and accurate during submission.

- Respond promptly to objections or opposition notices.

- Seek professional assistance to expedite the process.

By staying informed about the trademark registration status and addressing issues proactively, you can secure your trademark efficiently and avoid unnecessary complications.

Common Grounds for Refusal of Trademark Registration in India

When applying for trademark registration in India, the application may be refused based on certain grounds. It’s essential to understand these absolute grounds for refusal to avoid issues during the process.

1. Absolute Grounds for Refusal

These are the reasons that may lead to the rejection of a trademark application even if no other parties oppose it. They include:

- Lack of Distinctiveness: A trademark must be unique and capable of distinguishing the goods or services of one entity from another. Generic or descriptive marks are often refused.

- Deceptive or Misleading Marks: Trademarks that mislead consumers about the nature or quality of the goods or services are not eligible for registration.

- Conflict with Public Order or Morality: Trademarks that go against public morality or religious beliefs can be refused.

- Confusion with Existing Trademarks: Trademarks that are too similar to an already registered mark or a pending application will be rejected.

2. Examples of Trademarks That May Be Rejected

- Descriptive Marks: For example, “Sweet Cake” for a bakery.

- Generic Terms: Words like “Apple” for computer-related products or “Coffee” for coffee-related services.

- Marks That Resemble Flags, Emblems, or National Symbols: Trademarks that resemble state or national flags or symbols.

By understanding these grounds, applicants can avoid common mistakes and improve their chances of approval.

Renewing a Trademark in India

Once your trademark is registered, it remains valid for a specific period. However, it must be renewed to continue enjoying protection under the law.

1. Validity Period of a Trademark

In India, a trademark is valid for 10 years from the date of registration. After this period, the trademark owner must renew the registration to maintain its exclusive rights.

2. Procedure and Timeline for Trademark Renewal

- Filing for Renewal: The application for renewal must be filed before the expiration of the 10-year validity period. It can be done within 6 months before or after the expiration date.

- Online Filing: The process can be done through the official website of the Controller General of Patents, Designs, and Trademarks. You need to fill out the appropriate form (Form TM-R) and pay the renewal fees.

- Timeline: The renewal process is typically completed within 1–2 months, depending on the workload of the Trademark Office.

3. Costs Involved in Trademark Renewal

- The renewal fees for individuals, startups, and small businesses are typically ₹4,500 for e-filing and ₹5,000 for physical filing.

- For companies, LLPs, and other organizations, the renewal fees are ₹9,000 for e-filing and ₹10,000 for physical filing.

By renewing your trademark on time, you ensure continued protection and exclusive rights to your brand name and logo in India. Regular renewal is key to maintaining the integrity of your intellectual property and protecting your business identity.

Hence, trademark registration in India is essential for businesses aiming to protect their intellectual property and strengthen their brand presence. Registering a trademark provides exclusive rights to your brand name, logo, or symbol, preventing unauthorized use and offering legal protection. The trademark registration process is simple, starting with a trademark search, followed by filing an application and addressing any objections or oppositions. Renewing your trademark ensures ongoing protection and secures your brand’s identity for years to come. With trademark registration in India, businesses, whether startups or established companies, can build trust, create valuable assets, and safeguard their brand in the competitive market.

Frequently Asked Questions (FAQs) on Trademark Registration in India

1. Is trademark registration mandatory in India?

No, trademark registration is not mandatory in India. However, registering your trademark provides several benefits, such as legal protection, exclusive rights to use the mark, and the ability to take legal action in case of infringement. It also prevents others from using a similar mark and adds value to your brand by enhancing its credibility.

2. Who can apply for trademark registration in India?

Any individual, business entity, or legal entity claiming to be the proprietor of the trademark can apply for registration. The application can be filed either on a “used” or “proposed to be used” basis. Trademark applications can be filed online through the official IP India portal or at one of the regional trademark offices located in Delhi, Mumbai, Ahmedabad, Kolkata, or Chennai.

3. What are the benefits of trademark registration in India?

Trademark registration offers exclusive rights to use the trademark for the registered goods or services. It protects your brand from unauthorized use, provides legal backing in case of infringement, and allows you to use the ™ and ® symbols. It also enhances brand recognition and helps in building a trustworthy reputation in the market.

4. How long does it take to register a trademark in India?

Trademark registration in India typically takes between 8-15 months. This duration may vary depending on the complexity of the case and whether any objections or oppositions are raised during the process. If there are no complications, registration is usually completed within this time frame.

5. What documents are required for trademark registration in India?

Key documents required include a clear representation of the trademark (logo or wordmark), proof of business registration, identity and address proof (e.g., PAN, Aadhaar), and relevant certificates (for startups or small enterprises). If filing through an agent, a Power of Attorney may also be required.

6. How much does trademark registration cost in India?

The trademark registration fee varies based on the type of applicant. For individuals, startups, and small enterprises, the fee is ₹4,500 for e-filing and ₹5,000 for physical filing. For others, the fee is ₹9,000 for e-filing and ₹10,000 for physical filing. Additional professional fees may apply if you choose to hire legal assistance.

7. Where do I apply for trademark registration in India?

Trademark registration applications can be submitted online through the official IP India website or filed at one of the regional trademark offices in Delhi, Mumbai, Ahmedabad, Kolkata, or Chennai. E-filing provides instant acknowledgment, while physical filing may take 15-20 days to receive acknowledgment.

8. Why should I register my trademark if it’s not mandatory?

Although not mandatory, trademark registration offers several advantages, including legal protection, exclusive rights to your mark, and the ability to use the ® symbol. It also boosts your brand’s credibility and safeguards your intellectual property against infringement.

9. What is the typical timeline for trademark registration in India?

Trademark registration generally takes 8-15 months in uncomplicated cases. However, if objections or oppositions arise, the process may take longer due to the need to resolve these issues.

10. How can I check the status of my trademark registration application?

You can easily check the status of your trademark registration online through the IP India website. It will provide updates on the status of your application, including any objections or progress on its approval.

11. What are common reasons for the refusal of trademark registration?

Trademarks may be refused on absolute grounds if they are too generic, descriptive, offensive, or conflict with an already registered trademark. Marks that lack distinctiveness or mislead the public may also face rejection by the authorities.

12. How do I renew my trademark in India?

Trademark registration in India is valid for 10 years. To renew your trademark, you need to file a renewal application before the expiry date and pay the renewal fee. Renewing your trademark on time ensures continued protection of your intellectual property rights.

The Importance of Trademark Registration in India

Blog Content Overview

In today’s competitive business landscape, protecting intellectual property is crucial for building a strong brand and maintaining a competitive edge. Trademark registration is one of the most effective ways to safeguard your brand’s identity, ensuring that it remains unique and protected from infringement. In India, where the economy is booming with startups, small businesses, and large corporations alike, understanding the importance of trademark registration is paramount.

What is a Trademark?

A trademark is a unique symbol, word, phrase, logo, design, or combination thereof that identifies and distinguishes the goods or services of one entity from others. It is a vital aspect of branding and helps create a distinct identity in the minds of consumers.

For instance, iconic logos like the golden arches of McDonald’s or the swoosh of Nike are registered trademarks that symbolize their respective brands globally. Similarly, Indian brands like Tata, Reliance, and Flipkart rely heavily on trademarks to maintain their market dominance and consumer trust.

Why is Trademark Registration Important in India?

1. Legal Protection Against Infringement

Trademark registration provides legal protection under the Trademarks Act, 1999. If another business attempts to use your registered trademark without authorization, you can take legal action against them. This protection ensures that your brand’s identity remains intact and safeguarded.

2. Exclusive Rights

A registered trademark grants the owner exclusive rights to use the trademark for the goods or services it represents. It also prevents competitors from using similar marks that could confuse consumers.

3. Brand Recognition and Goodwill

A trademark acts as an asset that enhances brand recognition and builds consumer trust. Over time, a strong trademark becomes synonymous with quality and reliability, which contributes to long-term goodwill.

4. Market Differentiation

In a saturated market, a trademark helps distinguish your products or services from those of competitors. It establishes your brand’s unique identity and strengthens customer loyalty.

5. Asset Creation

A registered trademark is an intangible asset that can be sold, licensed, or franchised. This adds financial value to your business, making it an attractive proposition for investors or partners.

6. Global Expansion

Trademark registration in India can serve as the foundation for international trademark registration under treaties like the Madrid Protocol. This is especially important for businesses planning to expand globally.

Consequences of Not Registering a Trademark

Failure to register a trademark can expose your business to several risks:

- Risk of Infringement: Without registration, proving ownership of a trademark becomes challenging.

- Brand Dilution: Competitors might use similar marks, leading to loss of distinctiveness and consumer trust.

- Limited Legal Remedies: Unregistered trademarks are harder to defend in court.

- Missed Opportunities: A lack of trademark protection can hinder global expansion plans.

Steps to Register a Trademark in India

- Trademark Search: Conduct a thorough search to ensure that the trademark is unique and not already registered by someone else.

- Application Filing: Submit a trademark application with the necessary details, including the logo, class of goods or services, and owner details.

- Examination: The Trademark Registry examines the application to ensure compliance with legal requirements.

- Publication: The trademark is published in the Trademark Journal to invite objections, if any.

- Registration Certificate: If no objections are raised, or if objections are resolved, the trademark is registered, and a certificate is issued.

Costs and Duration

Trademark registration in India is a cost-effective process. The official fees depend on the nature of the applicant, with reduced fees for startups, individuals, and small businesses. The registration process typically takes 12-18 months, but the protection is valid for 10 years and can be renewed indefinitely.

Key Industries Benefiting from Trademark Registration

- E-commerce and Retail: Trademarks protect brand identity in a highly competitive digital marketplace.

- Pharmaceuticals: Ensures safety and trust by preventing counterfeit products.

- Technology Startups: Safeguards innovations and unique business models.

- Food and Beverage: Builds trust and loyalty through distinctive branding.

Conclusion

Trademark registration is not just a legal formality but a strategic move to protect and enhance your brand’s value. In a thriving economy like India, securing a trademark ensures that your brand stands out, builds trust, and enjoys long-term growth.

Investing in trademark registration today is a step toward safeguarding your business’s future. Don’t wait for competitors to claim what’s rightfully yours. Secure your brand’s identity and take it to new heights with the power of trademarks. If you’re ready to register your trademark or need expert guidance, reach out to Treelife for a consultation today.

Trademark Classification in India – Goods & Service Class Codes

Blog Content Overview

- 1 Introduction to Trademarks

- 2 Background of Trademarks in India

- 3 What is a Trademark Class?

- 4 Importance of Trademark Classification

- 5 Trademark Classification List

- 6 List of Trademark Classes of Goods in India (1-34 Classes)

- 7 List of Trademark Classes of Services in India (35-45 Classes)

- 8 Online Tools available for Classifying Trademarks

- 9 Conclusion

- 10 FAQs on Trademark Classification in India

- 10.0.1 2. How are goods and services categorized under trademark classification?

- 10.0.2 3. Why is trademark classification essential during the registration process?

- 10.0.3 4. Can a trademark be registered under multiple classes?

- 10.0.4 5. What tools are available for trademark classification in India?

- 10.0.5 6. How does trademark classification help prevent legal conflicts?

- 10.0.6 7. What is the significance of the NICE classification system?

- 10.0.7 8. What are the benefits of correct trademark classification?

Introduction to Trademarks

A trademark is a unique term, symbol, logo, design, phrase, or a combination of these elements that distinguishes a business’s products or services from those of its competitors in the market. Trademarks can take the form of text, graphics, or symbols and are commonly used on company letterheads, service banners, publicity brochures, and product packaging. By creating a distinct identity, trademarks play a vital role in building customer trust, enhancing brand recognition, and establishing a competitive edge.

As a form of intellectual property, a trademark grants its owner the exclusive rights to use the registered term, symbol, or design. No other individual, company, or organization can legally use the trademark without the owner’s consent. If unauthorized use occurs, the trademark owner can take legal action under the Trade Marks Act of 1999.

Registering your trademark as per trademark classification not only safeguards your brand identity but also prevents third parties from using it without authorization. It is a straightforward process in India, allowing businesses to protect their intellectual property and ensure their products or services stand out in the market.

Trademarks are categorized into various classes based on the goods or services they represent. Understanding the classification system is crucial to ensure proper protection. In this article, we will explore the legal framework for trademarks, the classification system, and the online tools available to identify the correct trademark class for your registration.

Background of Trademarks in India

The Trade Marks Registry, established in 1940, administers trademark regulations under the Trademarks Act of 1999 in India. This Act aims to protect trademarks, regulate their use, and prevent infringement. Registering a trademark is essential for businesses to safeguard their name, reputation, and goodwill, as well as to strengthen brand identity and build customer trust. Trademarks can be in the form of graphics, symbols, text, or a combination, commonly used on letterheads, service banners, brochures, and product packaging to stand out in the market.

The Trade Marks Registry has offices in Mumbai, Ahmedabad, Chennai, Delhi, and Kolkata to handle trademark applications. To apply for protection, businesses must classify their products or services under the NICE Classification (10th edition), a global system that ensures clarity in trademark registration.

The importance of trademark classification was emphasized in the Nandhini Deluxe v. Karnataka Co-operative Milk Producers Federation Ltd. (2018) case, where the Supreme Court clarified that visually distinct trademarks for unrelated goods or services are not “deceptively similar” and may be registered, even if they fall under the same class.

What is a Trademark Class?

Trademark classes are the categories into which goods and services are classified under the NICE Classification (NCL), an internationally recognized system created by the World Intellectual Property Organization (WIPO). This classification system is essential for businesses seeking trademark registration, as it ensures that each trademark application accurately reflects the nature of the goods or services it represents.

Types of Trademark Classes

The NICE Classification divides goods and services into 45 distinct trademark classes:

- Goods: Classes 1 to 34.

Goods type trademark classes, numbered 1 to 34, categorize products based on their nature. 1 This classification system helps businesses protect their brands by ensuring clear identification and preventing confusion in the marketplace. - Services: Classes 35 to 45.

Trademark classes 35-45 are dedicated to services, ranging from advertising and business management to education, healthcare, and legal services.

Each class represents a specific category of goods or services. For example: Class 13 for Firearms and explosives. Class 36 for Financial and insurance services.

How to Choose the Right Trademark Class?

When filing a trademark application, the applicant must carefully select the correct class that corresponds to the goods or services their business offers. This choice is crucial for avoiding potential trademark infringement and conducting effective trademark searches. During the trademark registration process, specifying the trademark classes or categories of products and services for which the trademark will be used is essential. It defines the mark and determines its usage in the industry, acting as an identifier for the mark. Choosing the right category and classification for a trade name is highly beneficial. The applicant can also apply for protection of the same mark under multiple classes if applicable.

Services are typically identified from the alphabetical list provided, using the divisions of operations indicated in the headers and their explanatory notes. For instance, rental facilities are categorized in the same class as the rented items.

Multiple Classes for Comprehensive Protection

Applicants can file for trademark protection under multiple classes if their goods or services span across different categories. For example, a business dealing in both clothing (Class 25) and retail services (Class 35) should register under both classes to ensure complete coverage.

Importance of Trademark Classification

The significance of a trademark class search to safeguarding a business’ intellectual property and brand cannot be overstated. In 2018, the Hon’ble Supreme Court highlighted the significance of categorizing trademarks under different classes in a landmark case involving the popular dairy brand “Nandhini Deluxe”1 in Karnataka. The court observed that two visually distinct and different marks cannot be called deceptively similar, especially when they are used for different goods and services. The Court also concluded that there is no provision of law that expressly prohibits the registration of a trademark which is similar to an existing trademark used for dissimilar goods, even when they fall under the same class.

Benefits of Classification

- Preventing Conflicts: Using a trademark class search makes it easier to find already-registered trademarks that could clash with your intended mark. This averts any legal conflicts and expensive lawsuits.

- Registration Success: You increase the likelihood of a successful registration by classifying your trademark correctly. The possibility of being rejected by the trademark office is reduced with an appropriate categorization.

- Protection of Brand Identity: You may operate with confidence knowing that your brand is protected within your industry by registering it in the correct class.

- Market Expansion: When your company develops, you may use a well-classified trademark to launch additional goods and services under the same way.

Trademark Classification List

The trademark class list consists of two types :-

- Trademark Classification for Goods

- Trademark Classification for Services

1. Trademark Classification for Goods

This trademark registration class of goods contains 34 classes.

- If a final product does not belong in any other class, the trademark is categorized according to its function and purpose.

- Products with several uses can be categorized into various types based on those uses.

- The categories list is classified according to the mode of transportation or the raw materials if the functions are not covered by other divisions.

- Based on the substance they are composed of, semi-finished goods and raw materials are categorised.

- When a product is composed of many components, it is categorized according to the substance that predominates.

2. Trademark Classification for Services

This trademark registration class of services contains 10 classes.

- The trademark class for services is divided into branches of activity. The same categorization applies to rental services.

- Services connected to advice or consultations are categorized according to the advice, consultation, or information’s subject.

Search Trademark Classes in India

List of Trademark Classes of Goods in India (1-34 Classes)

| Trademark Class | Description |

|---|---|

| Trademark Class 1 | Chemicals used in industry, science, and photography. |

| Trademark Class 2 | Paints, varnishes, lacquers, and preservatives against rust. |

| Trademark Class 3 | Cleaning, polishing, scouring, and abrasive preparations. |

| Trademark Class 4 | Industrial oils, greases, and fuels (including motor fuels). |

| Trademark Class 5 | Pharmaceuticals and other preparations for medical use. |

| Trademark Class 6 | Common metals and their alloys, metal building materials. |

| Trademark Class 7 | Machines, machine tools, and motors (except vehicles). |

| Trademark Class 8 | Hand tools and implements, cutlery, and razors. |

| Trademark Class 9 | Scientific, photographic, and measuring instruments. |

| Trademark Class 10 | Medical and veterinary apparatus and instruments. |

| Trademark Class 11 | Apparatus for lighting, heating, and cooking. |

| Trademark Class 12 | Vehicles and parts thereof. |

| Trademark Class 13 | Firearms and explosives. |

| Trademark Class 14 | Precious metals and jewelry. |

| Trademark Class 15 | Musical instruments. |

| Trademark Class 16 | Paper, stationery, and printed materials. |

| Trademark Class 17 | Rubber, gutta-percha, and plastics in extruded form. |

| Trademark Class 18 | Leather and imitation leather goods. |

| Trademark Class 19 | Non-metallic building materials. |

| Trademark Class 20 | Furniture and furnishings. |

| Trademark Class 21 | Household utensils and containers. |

| Trademark Class 22 | Ropes, string, nets, and tarpaulins. |

| Trademark Class 23 | Yarns and threads for textile use. |

| Trademark Class 24 | Textiles and textile goods. |

| Trademark Class 25 | Clothing, footwear, and headgear. |

| Trademark Class 26 | Lace, embroidery, and decorative textiles. |

| Trademark Class 27 | Carpets, rugs, mats, and floor coverings. |

| Trademark Class 28 | Toys, games, and sporting goods. |

| Trademark Class 29 | Meat, fish, poultry, and other food products. |

| Trademark Class 30 | Coffee, tea, spices, and other food products. |

| Trademark Class 31 | Agricultural, horticultural, and forestry products. |

| Trademark Class 32 | Beers, mineral waters, and soft drinks. |

| Trademark Class 33 | Alcoholic beverages (excluding beers). |

| Trademark Class 34 | Tobacco, smokers’ articles, and related products. |

List of Trademark Classes of Services in India (35-45 Classes)

| Trademark Class | Description |

|---|---|

| Trademark Class 35 | Business management, advertising, and consulting services. |

| Trademark Class 36 | Financial, banking, and insurance services. |

| Trademark Class 37 | Construction and repair services. |

| Trademark Class 38 | Telecommunications services. |

| Trademark Class 39 | Transport, packaging, and storage services. |

| Trademark Class 40 | Treatment of materials and manufacturing services. |

| Trademark Class 41 | Education, training, and entertainment services. |

| Trademark Class 42 | Scientific and technological services, including IT. |

| Trademark Class 43 | Food, drink, and temporary accommodation services. |

| Trademark Class 44 | Medical, beauty, and agricultural services. |

| Trademark Class 45 | Legal services, security services, and social services. |

Online Tools available for Classifying Trademarks

Classifying products and services accurately is a crucial step in the trademark registration process in India. Several reliable online tools are available to simplify the trademark categories listing process:

- NICE Classification Tool: Developed by the World Intellectual Property Organization (WIPO), this tool provides a comprehensive guide to the classification of goods and services under the NICE system.

- TMclass Tool: Offered by the European Union Intellectual Property Office (EUIPO), TMclass helps users determine the appropriate trademark class for their goods or services with ease.

Trademark classification is vital for the Trademark Registry to understand the scope of the trademark, its market segment, and the target audience it aims to address. It establishes the trademark’s value in the competitive market and serves as a unique identifier for the registrant.

Conclusion

Trademark classification is a foundational step in the trademark registration process, ensuring that a business’s intellectual property is accurately categorized and effectively protected. By adhering to the NICE classification system, businesses can prevent conflicts, enhance brand identity, and expand their market presence with confidence. Proper classification streamlines the registration process, minimizes legal risks, and safeguards brand equity. As trademarks play a pivotal role in defining a company’s market presence, leveraging expert guidance for classification is vital for long-term success.

FAQs on Trademark Classification in India

1. What is trademark classification, and why is it important?

Trademark classification is a system that organizes goods and services into 45 specific categories under the NICE classification. It is essential for ensuring accurate registration, avoiding conflicts, and securing protection for a business’s intellectual property in its relevant industry.

2. How are goods and services categorized under trademark classification?

Goods fall under the first 34 classes, and services fall under classes 35 to 45. The classification is based on the function, purpose, or material of the goods and the activity or purpose of the services.

3. Why is trademark classification essential during the registration process?

Proper classification:

- Helps prevent conflicts by identifying existing trademarks that may clash with the new mark.

- Ensures the trademark application is correctly filed, reducing the likelihood of rejection.

- Protects brand identity by categorizing trademarks accurately within their industry.

4. Can a trademark be registered under multiple classes?

Yes, businesses can register their trademark under multiple classes if their goods or services span across different categories. This ensures comprehensive protection.

5. What tools are available for trademark classification in India?

The following online tools are helpful:

- NICE Classification Tool by the World Intellectual Property Organization (WIPO).

- TMclass Tool by the European Union Intellectual Property Office.

6. How does trademark classification help prevent legal conflicts?

By conducting a trademark class search, businesses can identify existing trademarks in the same category and avoid conflicts, reducing the risk of legal disputes and costly lawsuits.

7. What is the significance of the NICE classification system?

The NICE classification, created by the World Intellectual Property Organization (WIPO), standardizes the categorization of goods and services worldwide. It streamlines trademark registration processes and ensures consistency.

8. What are the benefits of correct trademark classification?

- Prevention of Conflicts: Avoids disputes by identifying existing trademarks in the same class.

- Enhanced Brand Identity: Safeguards the brand within its industry.

- Streamlined Registration: Increases the likelihood of successful trademark registration.

- Market Expansion: Facilitates the introduction of new products and services under the same brand.

9. What happens if someone infringes my registered trademark?

- You can take legal action to stop the infringement and seek damages.

- Registration makes legal enforcement easier and more effective.

10. Where can I find more information and resources on trademark registration?

- The Controller General of Patents, Designs and Trademarks website: https://ipindia.gov.in/

- Start-up India resources: https://www.startupindia.gov.in/

- Consult a trademark attorney for personalized guidance.

References:

- [1] Nandhini Deluxe v Karnataka Co-operative Milk Producer Federation Ltd. 2018 (9) SCC 183

↩︎

Cross Border Payments in India – Wholesale, Retail & RBI Guidelines

Blog Content Overview

- 1 Introduction

- 2 Cross Border Payments Ecosystem

- 3 RBI Guidelines on Cross Border Payments

- 4 Indian Landscape for Cross Border Payments

- 5 Future of Cross Border Payments

- 6 Conclusion

- 7 Frequently Asked Questions for Cross Border Payments

- 7.0.1 2. What are the primary types of cross-border payments?

- 7.0.2 3. What are the benefits of cross-border payments?

- 7.0.3 4. What challenges are associated with cross-border payments?

- 7.0.4 5. How does the RBI regulate cross-border payments in India?

- 7.0.5 6. How has UPI impacted cross-border payments in India?

- 7.0.6 7. What technological advancements are driving cross-border payments?

- 7.0.7 8. What are the RBI guidelines for startups and businesses handling cross-border payments?

Introduction

Financial transactions involving two parties with distinct national bases—the payer and the recipient—are referred to as cross border payments. These transactions can be conducted through various methods, such as bank transfers, credit card payments, e-wallets, and mobile payment systems, and encompass wholesale payments and retail payments.

What Are Cross-Border Payments in India?

Cross-border payments refer to financial transactions where money is transferred from one country to another. In the context of India, cross-border payments involve the movement of funds across international borders for trade, remittances, investments, or other financial activities. These payments play a crucial role in facilitating global commerce and economic integration, enabling businesses, individuals, and governments to settle debts, transfer funds, or make investments beyond their national boundaries.

Cross-border payments play an indispensable role in connecting businesses, governments, and individuals across the globe, enabling international trade, remittances, and financial cooperation. In India, the cross-border payments ecosystem has evolved significantly, influenced by regulatory changes, technological advancements, and global integration. This #TreelifeInsights article explores the current state of cross-border payments in India, the challenges faced, and the trends shaping the future of this critical sector.

Cross Border Payments Ecosystem

Types of Cross Border Payments in India

Simply put, cross-border transactions are transfers of assets or funds from one jurisdiction to another. Correspondent banks, payment aggregators act as intermediaries between the involved financial institutions. The cross-border payments ecosystem includes B2B, B2P, P2B and P2P merchants. Common methods of cross-border payments include wire transfers, International Money Orders, Credit card transactions. In India, such payments encompass wholesale (between financial institutions and large corporates) and retail (individual and business transactions like e-commerce payments or remittances) payments:

Wholesale Cross Border Payments

Wholesale cross-border payments in India refer to large-value financial transactions made between financial institutions, businesses, and corporations across international borders. These payments typically involve high-value transactions for international trade, investment, and financing. In India, wholesale cross-border payments are vital for settling large sums related to imports, exports, corporate mergers, and foreign investments.

Wholesale Cross Border Payments involve high-value transactions among financial institutions, corporates, and governments. These payments are critical for: (i) trade and commerce (including import and export); (ii) interbank settlements for foreign exchange and derivative trading; and (iii) government to government transactions, often tied to international aid or agreements.

Retail Cross Border Payments

Retail cross-border payments in India refer to smaller financial transactions made by individuals or businesses for goods, services, or remittances across international borders. These payments typically involve lower amounts compared to wholesale payments and are commonly used for e-commerce purchases, international remittances, and payments for services like travel, education, and online subscriptions.

Retail Cross Border Payments cater to smaller-scale transactions and include: (i) remittances; (ii) person-to-business payments (for e-commerce, online services or overseas educational expenses); and (iii) business-to-business payments between SMEs and international suppliers or partners.

Benefits of Cross Border Payments in India

- Access to international markets: Reduces complexity related to international fund transfer, enabling accessibility on a real time basis

- Cost savings: cross-border payment methods can be more cost effective than others, allowing businesses to save money on transaction fees, currency exchange rates, and other related costs

- Increased revenue and growth opportunities: By selling goods and services internationally, businesses can increase their revenue and tap into new growth opportunities.

Features of Cross-Border Payments in India

- Currency Exchange: Cross-border payments often require conversion of local currency (INR) into foreign currencies like USD, EUR, or GBP, making foreign exchange a critical aspect of these transactions.

- Regulatory Framework: The Reserve Bank of India (RBI) plays a pivotal role in regulating and overseeing cross-border payment systems in the country. These regulations ensure transparency, security, and compliance with international financial standards.

- Payment Systems: Platforms such as SWIFT, NEFT, and RTGS are commonly used for cross-border transactions. The introduction of Blockchain technology and Real-Time Gross Settlement (RTGS) systems is further streamlining these payments in India.

Key Roadblocks

- Regulatory compliances: Applicable laws, rules and procedures vary in every jurisdiction. As such, compliances may become challenging to follow.

- Currency conversion risks: When conducting business in foreign currencies, companies are exposed to the risk of fluctuating exchange rates

- Fraud and security risks: Lack of stringent laws to regulate banking institutions leads to organized criminals target vulnerabilities at certain banks in certain jurisdictions to use them to access wider networks.

RBI Guidelines on Cross Border Payments

India’s cross-border payment framework is heavily regulated by the Reserve Bank of India (RBI) to ensure transparency, compliance, and the safe movement of funds. This brings fintech platforms engaged in cross border payments within its ambit as well, and includes any Authorized Dealer (AD) banks, Payment Aggregators (PAs), and PAs-CB involved in the processing of cross-border payment transactions.

The important guidelines include:

- Payment Aggregators and Payment Gateways Regulation (2020)1:

- Payment aggregators (PAs) and gateways facilitating cross-border transactions must comply with stringent governance and net-worth criteria.

- PAs must ensure robust security measures and grievance redressal mechanisms.

- Latest Regulatory Update: Non-bank entities providing cross-border services must have a net worth of ₹25 crore by March 2026.

- Liberalized Remittance Scheme (LRS):

- Under the LRS, resident individuals can remit up to USD 250,000 annually for investments, travel, education, and gifting.

- Facilitates individual access to global markets and services2.

- Foreign Exchange Management Act (FEMA):

- FEMA governs the compliance of foreign exchange transactions, ensuring alignment with anti-money laundering (AML) and Know Your Customer (KYC) norms.

- Supports smooth cross-border fund transfers under permissible categories.

- Additional Measures:

- Mandatory reporting of cross-border transactions through authorized dealer banks.

- RBI approval required for startups and entities dealing with large-scale cross-border payments.

Indian Landscape for Cross Border Payments

India has witnessed a digital payments revolution. The ubiquitous Unified Payments Interface (UPI) has transformed domestic transactions, boasting transaction values reaching INR 200 lakh crore in FY 23-243. Some notable achievements include:

- Unified Payments Interface (UPI) Expansion:

- UPI-PayNow is a cross-border connection between India’s Unified Payments Interface (UPI) and Singapore’s PayNow that allows for real-time, cost-effective money transfers between the two countries. The UPI-PayNow collaboration with Singapore sets the stage for India’s digital payment system to gain global recognition4.

- Cross-border UPI integration is expected to reduce transaction costs and enable real-time remittances.

- Real Time Payment Systems (RTPs):

- With transaction volumes projected to grow annually by 35.5%5, real-time systems are set to revolutionize cross-border payments, ensuring near-instant settlements.

- FinTech Innovations:

- FinTech platforms are driving efficiency by offering competitive rates, lower transaction fees, and enhanced transparency6.

- Blockchain technology, used by companies like Ripple, is becoming a preferred tool for secure and cost-efficient transactions7.

- RegTech Advancements:

- Regulatory technology (RegTech) simplifies compliance by automating reporting and monitoring requirements for cross-border transactions8.

Benefits and Challenges to the Road Ahead

| Benefits | Challenges |

|---|---|

| Access to Global Markets: Simplifies international trade by enabling seamless fund transfers. Cost Efficiency: Innovative payment solutions minimize transaction and currency conversion costs. Real-Time Transparency: Enhanced traceability and updates instill confidence among users. Financial Inclusion: Expands access to global banking services for individuals and SMEs. | Regulatory Complexity: Different jurisdictions impose diverse regulations, complicating compliance for businesses. Frequent updates to laws add to the burden on smaller players. Currency Volatility: Exchange rate fluctuations can erode transaction values, especially for high-volume transfers. Fraud and Security Risks: Vulnerabilities in the global payment ecosystem make cross-border transactions a target for cybercriminals. Infrastructure Gaps: Disparities in payment processing systems across countries can delay transaction settlement. |

Future of Cross Border Payments

The future of India’s cross-border payment landscape hinges on leveraging cutting-edge technology and regulatory collaboration. Some promising developments include:

- Increased Collaboration: Partnerships like UPI-PayNow will set the blueprint for India’s integration with global real-time payment networks.

- Blockchain Adoption: Blockchain is likely to drive down costs and enhance transparency for high-value wholesale payments.

- Improved User Experience: With streamlined platforms and reduced costs, businesses and individuals will enjoy faster, simpler transactions.

What to Expect for Individuals and Businesses

- Faster and Cheaper Transactions: With advancements in technology and regulations, expect faster settlement times and potentially lower fees for cross-border payments.

- Greater Transparency: Improved traceability and real-time transaction updates will enhance transparency, giving users more control over their money.

- More Payment Options: A wider range of payment options, including mobile wallets and digital platforms, will cater to different user preferences.

Conclusion

India’s cross-border payment ecosystem is at a transformative juncture, with innovations in digital payments, blockchain, and RegTech paving the way for a more secure and efficient system. The RBI’s guidelines ensure compliance and transparency, while collaborations like UPI’s global integration promise to enhance India’s footprint in the global economy. While challenges remain, the combined efforts of the government, regulatory bodies, and innovative fintech companies promise a future of faster, more affordable, and user-friendly cross-border transactions. This will not only benefit businesses but also empower individuals to participate more actively in the global economy. All in all, India is poised to lead the next wave of cross-border payment innovations, empowering businesses and individuals to thrive in a connected world.

Frequently Asked Questions for Cross Border Payments

1. What are cross-border payments, and why are they significant?

Cross-border payments refer to financial transactions between parties in different countries. They are crucial for international trade, remittances, and global financial cooperation, connecting businesses, governments, and individuals worldwide.

2. What are the primary types of cross-border payments?

- Wholesale Payments: High-value transactions between financial institutions, corporations, and governments, such as interbank settlements and international trade payments.

- Retail Payments: Smaller transactions including remittances, e-commerce payments, and person-to-business or business-to-business payments.

3. What are the benefits of cross-border payments?

- Access to global markets for businesses and individuals.

- Cost efficiency with competitive transaction fees and exchange rates.

- Increased revenue opportunities through international sales.

- Real-time transparency and enhanced trust among users.

4. What challenges are associated with cross-border payments?

- Regulatory Complexity: Diverse compliance requirements across jurisdictions.

- Currency Volatility: Risks due to fluctuating exchange rates.

- Fraud Risks: Vulnerabilities to cybercrime and inadequate security measures.

- Infrastructure Gaps: Inefficient systems in certain regions delaying settlements.

5. How does the RBI regulate cross-border payments in India?

The Reserve Bank of India (RBI) ensures compliance and security through:

- Payment Aggregators and Gateways Regulation (2020): Enforcing governance and security standards.

- Liberalized Remittance Scheme (LRS): Allowing individuals to remit up to USD 250,000 annually for investments, travel, and education.

- Foreign Exchange Management Act (FEMA): Regulating foreign exchange transactions and adhering to anti-money laundering (AML) norms.

6. How has UPI impacted cross-border payments in India?

UPI’s domestic success is now extending globally:

- UPI-PayNow Collaboration: Enables seamless, real-time, and low-cost transfers between India and Singapore.

- Global Expansion: Expected to reduce transaction costs and enhance the efficiency of cross-border payments.

7. What technological advancements are driving cross-border payments?

- Blockchain Technology: Ensures secure, cost-efficient transactions for wholesale payments.

- Real-Time Payment Systems (RTPs): Facilitates near-instant settlements.

- RegTech Innovations: Automates compliance and reporting for smoother operations.

8. What are the RBI guidelines for startups and businesses handling cross-border payments?

Startups and businesses must:

- Report all cross-border transactions via authorized dealer banks.

- Obtain RBI approval for large-scale cross-border payment activities.

- Ensure adherence to AML and KYC norms.

References:

- [1] https://www.rbi.org.in/commonman/English/scripts/Notification.aspx?Id=724

↩︎ - [2] https://pib.gov.in/PressReleasePage.aspx?PRID=2057013

↩︎ - [3] https://pib.gov.in/PressReleasePage.aspx?PRID=2057013

↩︎ - [4] https://pib.gov.in/PressReleasePage.aspx?PRID=2057013

↩︎ - [5] https://www.fsb.org/uploads/P211024-1.pdf

↩︎ - [6] https://www.pwc.in/assets/pdfs/consulting/financial-services/fintech/point-of-view/pov-downloads/the-evolving-landscape-of-cross-border-payments.pdf

↩︎ - [7] https://ibsintelligence.com/blogs/fintech-revolutionises-cross-border-payments-fueling-indias-rise-in-global-trade/

↩︎ - [8] https://www.pwc.in/assets/pdfs/cross-border-payment-aggregatorsregulations-and-business-use-cases.pdf

↩︎

What’s your Market Size? Understanding TAM, SAM, SOM

Blog Content Overview

- 1 What is Market Size?

- 2 What is ‘Total Addressable Market’ (TAM)?

- 3 What is ‘Serviceable Available Market’ (SAM)?

- 4 What is ‘Serviceable Obtainable Market’ (SOM)?

- 5 How is Market Sizing Determined?

- 6 Formula and Examples: Calculation of TAM, SAM and SOM

- 7 Illustration: Mepto’s Market Size Analysis

- 8 Conclusion

- 9 Frequently Asked Questions on Market Size

- 9.0.1 2. What do TAM, SAM, and SOM stand for, and how do they differ?

- 9.0.2 3. How is the Total Addressable Market (TAM) calculated?

- 9.0.3 4. What is the significance of SAM in market sizing?

- 9.0.4 5. What methods can be used for market sizing?

- 9.0.5 6. Which approach—Top-Down or Bottom-Up—is better for market sizing?

- 9.0.6 7. How is the Serviceable Obtainable Market (SOM) determined?

- 9.0.7 8. Can you provide an example of TAM, SAM, and SOM calculation?

- 9.0.8 9. Why is market sizing critical for businesses?

What is Market Size?

Simply put, market size refers to the total number of potential customers/buyers for a product or service and the revenue they may generate. The broad concept of “market sizing” is broken down further into the following sets in order to estimate what the total potential market is, vis-a-vis the realistic goals that the business can set by determining what is achievable and what can be potentially captured:

(i) TAM – Total Addressable Market

(ii) SAM – Serviceable Available Market

(iii) SOM – Serviceable Obtainable Market

What is ‘Total Addressable Market’ (TAM)?

TAM represents the total demand or revenue opportunity available for a product or service, in a specific market. It refers to the total market size without any consideration for competition or market share. TAM is an estimation of the maximum potential for a particular product or service if there were no constraints or limitations.

Remember: TAM represents the total market size!

What is ‘Serviceable Available Market’ (SAM)?

SAM is a subset of the TAM and represents the portion of the total market that a business can realistically target and serve with its products or services. It takes into account factors such as geographical restrictions, customer segmentation, and the company’s ability to reach and effectively serve a specific segment of the market.