Author: Treelife

Reverse Flipping for Startups: A New Shift Towards India

First Published on 12th September, 2023

In today’s globalized era, the world feels more interconnected than ever. Many companies are expanding internationally, setting up offices worldwide, and seeking new markets for their products. Some startups, including some unicorns, have relocated their holding company outside India in a process known as “flipping” to capitalize on global opportunities.

Understanding the Flipping Phenomenon

Flipping, in the Indian startup realm, refers to the practice where startups, originally based in India, restructure their corporate structure to relocate their holding company and intellectual property (IP) to foreign jurisdictions, usually the United States or Singapore despite having a majority of their market, personnel and founders in India.

The primary reasons for startups to externalize their corporate structure inter-alia are access to deeper pools of venture capital, favorable tax framework, market penetration and brand positioning as an international entity, which can be beneficial in terms of attracting global talent and customers.

However, recent times have seen an emergence of an interesting counter-trend: ‘Reverse Flipping’ or ‘De-externalization’.

However, recent times have witnessed an intriguing counter-trend: ‘Reverse Flipping’ or ‘De-externalization’ i.e. Indian startups are opting to reverse flip back into India due to its favorable economic policies, burgeoning domestic market, and growing investor confidence in the country’s startup ecosystem.

The Emergence of Reverse Flipping

Reverse flipping, as the name suggests, is the antithesis of the flipping trend. Here, startups that once relocated their holding companies outside India are now considering a strategic move back to their home ground, India.

As mentioned above, one of the primary reasons for reverse flipping back to India is the fact that the Indian startup ecosystem has matured significantly in recent years. There is now a large pool of untapped domestic retail investors who want to invest in emerging companies they believe have the potential to grow. Additionally, the Indian government is taking steps to make it easier for startups to go public, which could make it more attractive for startups to reverse flip.

Take, for example, PhonePe. Originally an Indian entity, it flipped its structure to Singapore but has now moved its base back to India. In doing so, the founders have gone on record to say that the investors had to pay almost INR 8,000 crore of taxes to the Indian Government. It also stands to lose the chance to offset its accumulated losses of almost INR 7,000 crore against future profits due to this restructuring. Also, all employees had to be migrated to a new India-level ESOP plan which stipulates a minimum 1 year cliff thereby resetting the vesting status to zero with a 1 year cliff.

PhonePe is not alone. Several startups like Razorpay and Groww are also evaluating this shift, acknowledging the promise that the Indian market holds.

How to Reverse Flip?

Structuring a reverse flip is not easy and startups considering this reverse journey have to navigate a maze of regulations. Some popular methods include share swaps, mergers, etc and could also require approval from NCLT.

Startups need to be aware of the potential tax and exchange control implications that come with such a restructuring exercise.

When a startup’s valuation has increased significantly since its initial flip, there can be significant tax consequences upon reverse flipping. The process can be perceived as a ‘transfer of assets’, leading to capital gains tax implications in India and possibly even in foreign jurisdictions. This can also technically lead to a change in beneficial ownership, thereby risking the accumulated losses for setoff against future profits. Startups also need to navigate the exchange control regulations when repatriating funds or assets to India, ensuring all compliances are met.

While the above provides a birds-eye view, it’s imperative for startups to consult experts for a tailor-made approach, aligning with their unique business needs and ensuring compliance with the tax and regulatory framework.

What is the Government saying?

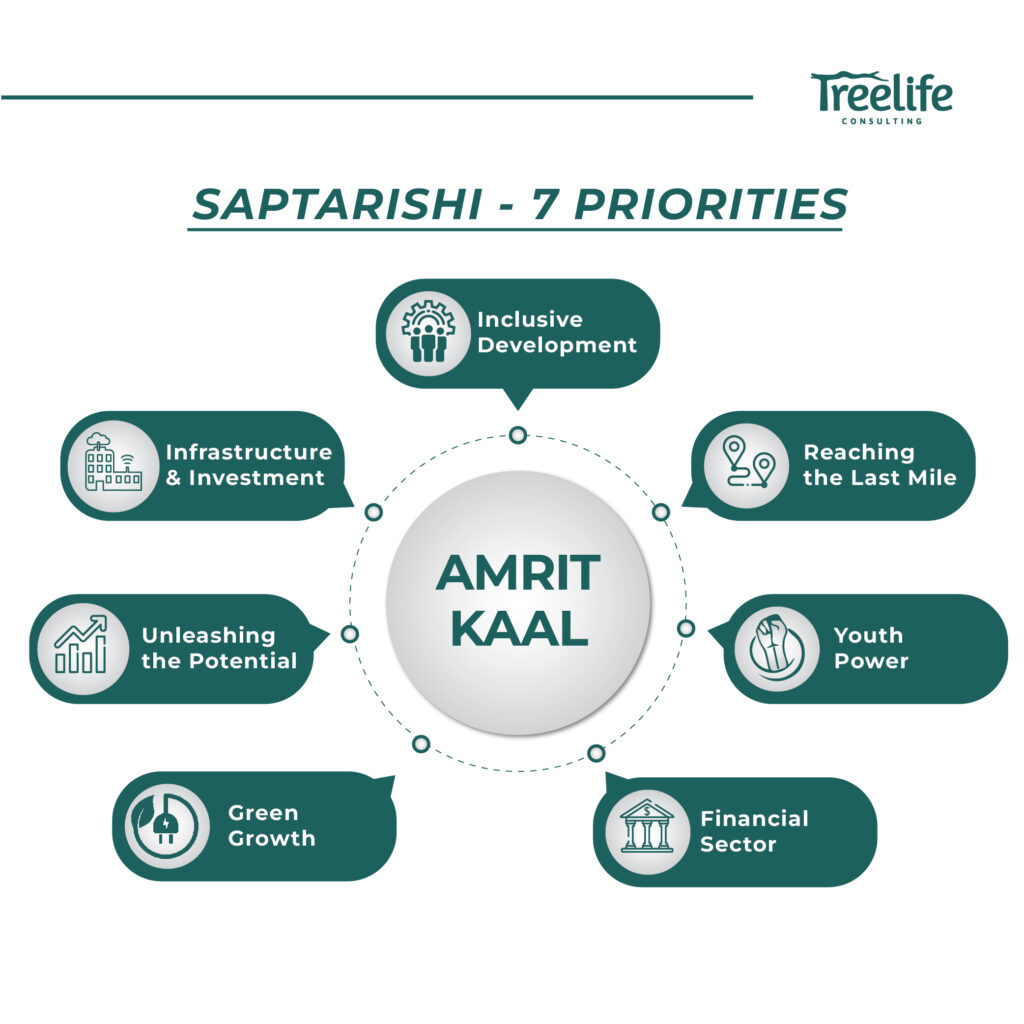

Indian Economic Survey 2022-23 acknowledged the concept of reverse flipping and has listed possible measures that can accelerate the reverse flipping process for startups including simplifying the process for granting tax holidays to start-ups, simplification of taxation of ESOPs, simplifying multiple layers of tax and uncertainty due to tax litigation, simplifying procedures for capital flows, etc.

The International Financial Services Centres Authority i.e. IFSCA has also constituted an expert committee to formulate a roadmap to ‘Onshore the Indian innovation to GIFT IFSC’. IFSCA plans to make GIFT City, India’s first IFSC, the preferred location for startups to reverse flip into. This expert committee submitted its report1 on 25 August 2023 with recommended measures to be undertaken by various stakeholders such as ministries and regulatory bodies in implementing the idea of onshoring the Indian innovation to GIFT IFSC.

In Conclusion

The trend of reverse flipping underscores the belief in India’s potential as a global startup hub. While challenges exist, the long-term benefits of tapping into the domestic market, coupled with the strengthening startup ecosystem, are compelling many to look homeward. It will be intriguing to witness how this trend evolves and shapes the future.

Looking for expert contract advice? Call us at +91 99301 56000 today.

Gaming Law Judgement Summaries

1. Play Games24x7 Private Limited v. Reserve Bank of India & Anr.

Factual Matrix

- Play Games24x7 Private Limited (“Petitioner”) is engaged in the business of designing and developing software related to games of skill (“Business”), and offers the games ‘Ultimate Teen Patti’ and ‘Call it Right’ (“Impugned Games”). However, these Impugned Games do not involve any real-money winnings or cash prizes as rewards.

- During the period 2006-2012, the Petitioner received several foreign remittances, for which the necessary reporting with the Reserve Bank of India (“RBI”) under the Foreign Exchange Management Act, 1999 and the rules made thereunder (“FEMA”) was pending from the Petitioner’s end. In 2012, the RBI, directed the Petitioner to file an application such that all the FEMA contraventions could be compounded together (“Compounding Application”).

- In early 2013, the foreign exchange department of the RBI returned directed the Petitioner to approach the then Department of Industrial Policy and Promotion (now the Department from Promotion of Industry and Internal Trade (“DPIIT”)), to seek a clarification whether the Petitioner was eligible to legally receive FDI (“DPIIT Clarification”), which the Petitioner had applied for, but to no avail.

- Thereafter, in March 2020, the Petitioner filed yet another Compounding Application with the RBI, which the RBI returned to Petitioner, citing that the DPIIT Clarification was still not obtained by the Petitioner.

- Despite multiple communications with the RBI, there was no tangible outcome with regards to the DPIIT Clarification. In light of the same, in May 2021, the Petitioner filed the present petition against the RBI before the Hon’ble Bombay High Court alleging that the Compounding Application was being unreasonably delayed by the RBI.

Contentions and the question in point

| Party | Contentions |

| Petitioner | The Impugned Games were casual/ social games which did not involve any real-money winnings or cash prizes as rewards. The Petitioner earned revenue through the Impugned Games only through in-app purchases by players and through in-game advertisements. Since the Impugned Games, although ‘games of skill’, did not have any real-money winnings or rewards, they could not be construed as ‘gambling’ under gaming laws in India. |

| RBI | It was not concerned with the assessment of the Petitioner’s nature of Business and that it just required for its records, the DPIIT to state that the Petitioner’s Business was not illegal in nature. If the DPIIT Clarification would identify the Petitioner’s Business as permissible, the Compounding Application would be processed by the RBI. |

| DPIIT | The Impugned Games, being ‘games of chance’ under Indian laws, fell under the purview of ‘gambling’, which is a prohibited sector under the FDI Policy 2020 (“FDI Policy”). |

| Question in point before the Hon’ble Bombay High Court |

| Whether the Petitioner’s Business would constitute ‘gambling’ (which is a prohibited sector under the FDI Policy) and thus, disqualify the Petitioner from being entitled to FDI. |

Judgement and Key Takeaways

JUDGEMENT

- The Hon’ble Bombay High Court primarily placed reliance on the Hon’ble Supreme Court of India’s decisions in RMD Chamarbaugwala v. Union of India (AIR 1957 SC 628) and Dr. K.R. Laxmanan v. State of Tamil Nadu & Anr. [1996 (2) SCC 226] in order to determine the legality of the Petitioner’s Business and whether the same constitutes ‘gambling’.

- The Hon’ble Bombay High Court held that in order to be construed as ‘gambling’, the game shall: (i) predominantly be a ‘game of chance; and (ii) be played for a reward. Since there was no real-money reward involved, the Impugned Games could not be brought under the purview of ‘gambling’.

- The Hon’ble Bombay High Court also directed the RBI consider the Petitioner’s Compounding Application in an expedited manner.

KEY TAKEAWAYS

- FDI in entities offering games with no real-money rewards is legal and shall not be prohibited under the FDI Policy.

- For an online game to be considered ‘gambling’, it shall: (i) predominantly be a ‘game of chance’; and (ii) be played for a real-money reward.

2. Gameskraft Technologies Private Limited v. Directorate General of Goods Services Tax Intelligence & Ors.

Factual Matrix

- Gameskraft Technologies Private Limited (“Petitioner”) is a company engaged in developing skill-based online games such as ‘Rummyculture’.

- In November 2021, the GST authorities (“Respondents”) having conducted search and seizure operations at the Petitioner’s premises, alleged that the Petitioner had suppressed taxable amounts and passed certain orders (“Attachment Orders”) attaching the Petitioner’s bank accounts (“Attached Accounts”), to which the Petitioner filed several objections in the Hon’ble High Court of Karnataka, but to no avail.

- In December 2021, the Petitioner challenged the Respondent’s orders attaching the Attached Accounts pursuant to which, the Hon’ble High Court of Karnataka issued an order, allowing the Petitioner to operate the Attached Accounts for limited purposes.

- In August 2022, the Hon’ble High Court of Karnataka directed that no further action be initiated against the Petitioner by the Respondents. However, soon thereafter, in September 2022, the Respondents issued an intimation notice to the Petitioner under the applicable GST provisions, demanding that the Petitioner deposit a sum of approximately INR 21,000 crores along with applicable interest and penalty (“Intimation Notice”).

- Thereafter, in March 2020, the Petitioner filed yet another Compounding Application with the RBI, which the RBI returned to Petitioner, citing that the DPIIT Clarification was still not obtained by the Petitioner.

- Despite multiple communications with the RBI, there was no tangible outcome with regards to the DPIIT Clarification. In light of the same, in May 2021, the Petitioner filed the present petition against the RBI before the Hon’ble Bombay High Court alleging that the Compounding Application was being unreasonably delayed by the RBI.

Contentions and the question in point

| Party | Contentions |

| Petitioner | – The Petitioner merely hosts the ‘rummy’ game and the discretion to play a game and the stake for which it is to be played lies entirely with the players. The Petitioner merely charges 10% of the players’ winnings as ‘platform fees’. – The Respondents’ contentions under the Impugned Notice were completely false, perverse, malicious and deserved to be disregarded on the following grounds: the game ‘rummy’ is a ‘game of skill’ as per well-established judgements of the Hon’ble Supreme Court of India and thus, the Petitioner cannot be said to have been engaged in betting/ gambling. – The Respondents had maliciously inflated the ‘buy-in’ amounts for the ‘rummy’ game and had shown the same as revenue derived by the Petitioner, whereby in reality, the ‘buy-in’ amount is not the Petitioner’s property and the same is reimbursed to the winner by the Petitioner, once the game is over. – The Terms & Conditions mentioned on the Petitioner’s portal, which were not referred to by the Petitioner, clearly mention that the monies deposited by the players are held in ‘trust’ by the Petitioner and that the same completely negated the Respondent’s contention that the entire ‘buy-in’ amount was the Petitioner’s income. |

| Respondents | – The Petitioner’s provision of the platform, which allows users to play online ‘rummy’ and from which the Petitioner derives profits and gains, amounts to ‘betting and gambling’ under the CGST Act, since rummy is a ‘game of chance’. – The Petitioner’s contention that it charged 10% of the stakes placed by users as ‘platform fees’ was not acceptable, as the same shall be only collected in order to meet expenses and shall not be in the nature of commission. – In light of the above points, the Petitioner’s contention that ‘rummy’ is a ‘game of skill’ shall be rejected. |

| Question in point before the Hon’ble High Court of Karnataka |

| Whether games such as ‘rummy’, being predominantly ‘games of skill’, would tantamount to ‘gambling or betting’ as contemplated under the CGST Act. |

Judgement and Key Takeaways

JUDGEMENT

- The Hon’ble High Court of Karnataka held that ‘rummy’ would predominantly be a ‘game of skill’ and not a ‘game of chance’.

- A ‘game of skill’ whether played with or without stakes would not amount to ‘gambling’.

- The meaning of the terms “lottery, betting and gambling” under the CGST Act shall not include games of skill, and thus the same shall not apply to ‘rummy’, whether played with or without stakes. In light of the same, the game ‘rummy’ on the Petitioner’s platform, shall not be taxable as “betting and gambling” as contended by the Respondents under the Impugned Notice.

- The Hon’ble High Court of Karnataka, finding the Impugned Notice illegal, arbitrary and without jurisdiction or authority of law, passed orders to quash the same.

KEY TAKEAWAYS

- A game of skill whether played with or without stakes and whether played online/ offline does not amount to gambling. Thus, ‘rummy’, predominantly being a ‘game of skill’, whether played with or without stakes and whether played offline/ online, is not gambling.

- A game of chance and played with stakes, is gambling.

- A game of mixed chance and skill is not gambling, if it is predominantly a game of skill and not of chance.

- A game of mixed chance and skill is gambling, if it is predominantly a game of chance and not of skill.

Liquidation Preference in Venture Capital Deals

What is Liquidation Preference?

A Liquidation Preference provision sets out the level of priority that an investors’ shares receive for the purpose of recovering their initial investment (or a multiple thereof) upon trigger of a liquidation event. A liquidation event typically includes winding up, sale of substantial assets of a company, change of control, merger, acquisition, reorganization and other corporate transactions, among others.

How Liquidation Preference Helps an Investor?

| 1 | Recovery of Initial | A liquidation preference allows the investors to recover at least their initial investment in a company. |

| 2 | Multiple on the Initial Investment | A liquidation preference provision also allows the investors to earn a multiple on their initial investment, i.e., instead of 1x, investors may seek 2x or more, if so agreed. |

| 3 | Distribution in order of seniority | A liquidation preference clause allows the distribution of the proceeds to be in an order of priority on the basis of the series of securities held by the investors. |

.

Types and Mechanics of Liquidation Preference

Types of Liquidation Preference

| Type of LP | Particulars |

| Non-participating Liquidation Preference | |

| 1x | Allows the investors to recover only their initial investment in the company. |

| 1x or pro-rata, whichever is higher* (single dip) | Allows the investors to recover their initial investment or entitles them to the proceeds from the liquidation event, basis their pro-rata shareholding in the company (on an as-if converted basis), whichever is higher. |

| Participating Liquidation Preference | |

| 1x (double-dip) | Allows the investor to recover their initial investment (or a multiple thereof) in addition to a right to participate in the remaining proceeds basis their pro-rata shareholding in the company. |

*Note:The multiple on the liquidation preference may be more than 1x and the amount of distribution of the liquidation preference shall be determined basis such a multiple.

Let us understand the mechanism of different types of liquidation preference through the below illustration:

| Investment Amount | INR 10cr |

| Percentage shareholding in the Company | 10% |

.

Scenario 1: Non-participating liquidation preference

1x or pro rata, whichever is higher

| Total Liquidation proceeds* | Investors’ liquidation entitlement (2x) | Investors’ liquidation entitlement (pro-rata) | Actual entitlement |

| INR 20cr | INR 10cr | INR 2cr | INR 10cr. |

| INR 200cr | INR 10cr | INR 20cr | INR 20cr. |

*Note: The total liquidation proceeds are the total proceeds from a liquidation event which are subject to distribution between the shareholders.

2x or pro rata, whichever is higher

| Total Liquidation proceeds* | Investors’ liquidation entitlement (2x) | Investors’ liquidation entitlement (pro-rata) | Actual entitlement |

| INR 20cr | INR 20cr | INR 2cr | INR 20cr. |

| INR 400cr | INR 20cr | INR 40cr | INR 40cr. |

.

This form of liquidation preference is most desirable as, while it allows the investors to recover their initial investment, it also enables them to take advantage of the upside in case the larger proceeds are accumulated from a liquidation event.

It is however, not recommend signing up for a multiple on the investment amount.

Scenario 2: 1x (participating liquidation preference)

| Total Liquidation proceeds* | Investors’ liquidation entitlement (1x) | Investors’ liquidation entitlement (pro-rata) | Actual Entitlement |

| INR 20cr | INR 10cr | INR 2cr | INR 12cr |

| INR 500cr | INR 10cr | INR 50cr | INR 60cr. |

.

While this may seem like a desirable form of liquidation preference, in the event the structure of a liquidation is not pari passu, i.e., in case the liquidation clause provides for a seniority, this may lead to disadvantage to the holders of equity shares (in most cases, the founders).

Conclusion

In conclusion, while liquidation preference is a crucial right for the investors, it is important for the founders to be mindful about the construct of this provision.

Early stage founders are recommended to consider the 1x non-participating liquidation preference, preferably provided in Scenario 1. Excessive or stringent liquidation preferences can deter future investment rounds and put the founders at risk of reduced share in the liquidation proceeds.

Treelife Consulting – One Stop Solution for All Your Finance Needs

Treelife Consulting strengthens business operations pan India and expands geographical footprint to Delhi and Bengaluru

Data protection bill will compel companies to review their current working ways, make investments in new processes: Experts

Opinion | Validity of WhatsApp Documents as Court Service: A Changing Landscape

WITH THEIR FINANCIAL AND LEGAL AID, TREELIFE CONSULTING SOLVES A BIG PROBLEM FOR STARTUPS

PhonePe Reverse Flip to India: Unraveling the Strategic Shift and its Impact

First Published on 21st August, 2023

The Reverse Flip

What is Reverse Flip?

“Reverse flip” or “re-domiciliation” refers to a corporate restructuring process in which a company changes its country of domicile or legal registration from one jurisdiction to another.

Background

- PhonePe was incorporated in 2015 in India

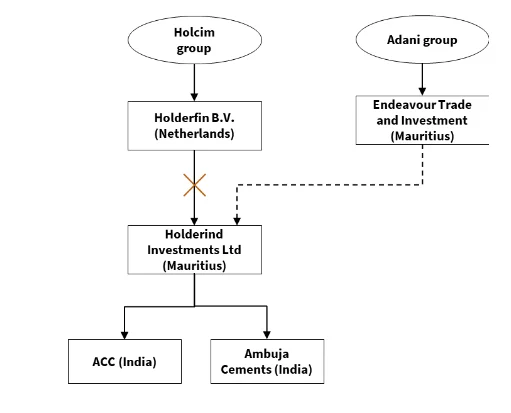

- In April 2016, PhonePe was acquired by Flipkart. As part of the acquisition, PhonePe flipped its structure to Singapore

- In 2018, PhonePe became a part of Walmart after it acquired Flipkart

- In October 2022, PhonePe announced that it has moved its domicile to India (reverse flip) for following key reasons:

- PhonePe wants to focus on India markets for the next couple of decades. PhonePe is a digital payments company that operates primarily in India. By redomiciling to India, PhonePe can be more responsive to the needs of its customers and partners.

- The Indian government has been tightening regulations for digital payments companies in recent years. By redomiciling to India, PhonePe can be more easily compliant with these regulations.

- To be better positioned for an IPO. PhonePe is expected to go public in the next few years

What Happened?

Steps undertaken

- PhonePe moved all businesses and subsidiaries of PhonePe Singapore to PhonePe India directly

- PhonePe created a new ESOP plan at India level and migrated all group employees to this new plan

- IndusOS, owned by PhonePe, also shifted operations from Singapore to PhonePe India

Key Consequences of Reverse Flip to India

- Lapse of accumulated losses of USD 900 million

- PhonePe stands to lose the chance to offset its USD 900 million (~INR 7,380 crore) of accumulated losses against future profits as shifting the domicile from Singapore to India is viewed as a restricting event under Section 79 of the Income Tax Act, 1961

- As per the provisions of Section 79, a company is not allowed to carry forward the losses if the change in beneficial ownership of shareholding of more than 50% occurred at the end of year in which losses were incurred

- Reset of ESOPs to zero vesting with 1 year cliff

- All employees of PhonePe were migrated to the new India level ESOP plan which stipulates a minimum 1 year cliff.

- Thus, the employees vesting status was reset to zero with a 1 year cliff

- Tax payout by investors of almost INR 8,000 cr

- PhonePe investors, led by Walmart, sold their stake in the Singapore entity and invested in PhonePe India

- This means that there was a capital gains tax event in India for the the investors leading to a tax-pay-out of almost INR 8,000 cr

Other Startups looking at Reverse Flip

- Razorpay is in process to move its parent entity from the US to India

- Groww is planning to move its domicile from the US to India

- Pepperfry has reverse flipped their structure to India via amalgamation

Source:

https://www.bqprime.com/business/after-phonepe-razorpay-kicks-off-reverse-flipping-process

https://inc42.com/features/unicorn-desh-wapsi-reverse-flipping-is-the-new-startup-sensation

Selligion Technologies Raises INR 5 Crore In Pre-Series A Funding

Compliance with the Indian Digital Personal Data Protection Act, 2023

For: B2B SaaS businesses

The Digital Personal Data Protection Act, 2023 (“Act”) is intended to safeguard and protect digital personal data, and (inter alia) govern the manner in which it can be collected, stored, processed, transferred, and erased. The Act imposes requirements on data fiduciaries/collectors and data processors, as well as certain duties on the data subject/individual with respect to personal data.

“Personal Data” under the Act includes any digital or digitized data about an individual (including any data which can be used to identify an individual). This excludes any non-digital data, or any data which cannot be used to identify an individual in any manner (including in concert with any other data).

This document is intended to provide a summary of the obligations of B2B-based SaaS business, which arise from the Act.

An Overview

The key obligations of businesses towards complying with the Act include:

- Identify the extent of Personal Data collection, storage and processing which your business undertakes, and how much is necessary.

- Prepare notices for procuring consents from individuals whose Personal Data you collect, store, and process (including those individuals whose Personal Data has already been collected and/or is being stored or processed), specifying:

- Type/s of Personal Data you will use;

- The specific purpose/s you will use it for;

- The manner in which they can withdraw consent or raise grievances; and

- The manner in which they can make a complaint to the Data Protection Board of India.

- Maintain a record of consents procured and provide the following rights:

- Right to request for (i) summary of their Personal Data being used; and (ii) identities of parties to whom their Personal Data has been transferred;

- Right to correct, update and/or delete Personal Data (unless required to be retained for compliance with law);

- Right to redressal for grievances and complaints;

- Right to nominate another individual to exercise their rights (in the event of death or incapacity)

Action Items

While B2B SaaS platforms have limited Personal Data collection, Personal Data can still be collected and processed in case of user accounts for individuals/employees/representatives of enterprise customers. Businesses can take the following actions towards compliance with the Act:

- Data audit: Carry out an internal data audit, including identifying Personal Data collection, storage and processing requirements;

- Limit Personal Data usage: Erase or anonymize Personal Data to the extent feasible to reduce the compliance and associated risks, or limit the Personal Data points which are collected;

- Update your product to enable privacy rights: Businesses should therefore make available on the SaaS tool / platform functionalities to:

- Issue notices for procuring consent for Personal Data collection, storage and processing prior to any such collection, storage or processing. These notices can be worded in simple and clear terms so as to enable individuals to know their rights, and should include language which clearly states that consent is provided for collection, storage, and processing (including processing by third-parties); specify the purpose/s for the type or types of processing. For example – in case the processing will be done for purposes A, B and C, consent will have to procured specific for each of A, B and C; mention that consent can be withdrawn

- Request modification, correction, updating, or erasure of Personal Data. Other than any Personal Data which is necessary for providing the services (for example, corporate email IDs), all Personal Data should be subject to modification or erasure pursuant to withdrawal of consent.

- Appoint person/s who can handle complaints, grievances, or requests from individuals. This can be an individual assigned specifically for this task or a team responsible for ensuring speedy response.

- Implement technical measures to protect against and mitigate data breaches and their consequences. The Act requires fiduciaries/collectors to “take reasonable security safeguards to prevent personal data breach”, which can include cloud monitoring, penetration testing, ISO certification, etc., depending on the sensitivity and extent of Personal Data.

THE DRAFT NATIONAL DEEP TECH STARTUP POLICY

The Office of Principal Scientific Advisor to the Government of India published the Draft National Deep Tech Startup Policy (NDTSP) for public recommendations. According to Startup India’s database, as of May 2023, more than 10,000 startups in India can be classified within the deep tech space and it is imperative to address the complex problems in the ecosystem.

Deep tech Definition

Deep tech refers to technologies which are based on pioneering scientific breakthroughs, which help providing solutions to complex problems. Deep tech conceptually includes the segment of Artificial Intelligence, Big data and analytics, Robotics, Internet of Things, Blockchain, etc., however, it is seldom difficult to make that identification.

The NDTSP recognizes that in order to understand the issues in the ecosystem, it is important to focus on identifying what qualifies as ‘deep tech’. While doing so may be challenging, the NDTSP aims to establish a framework of a working group that would be responsible in identifying the techno-commercially viable startups, which would further enable the creation of a definitive criterion for determining whether a startup can be qualified as ‘deep tech’.

Objective of the NDTSP

The NDTSP seeks to address the needs, complex challenges and strengthen the deep tech startup ecosystem by complimenting the current Start-up India policies and initiatives. The NDTSP aims to thematically prioritize the areas that require intervention and propose policy level changes in order to create a conducive ecosystem for the deep tech startups in the following manner:

Nurturing Research, Development & Innovation

The NDTSP aims to bolster research, development and innovation by incentivizing researchers, facilitate seamless dissemination of knowledge and set up platforms for protection and commercialization of IP. The primary priority of the policy is to increase gross expenditure on research and development by encouraging public and private investment through patient capital.

Strengthening Intellectual Property Regime

The NDTSP recognizes that the deep tech ecosystem lacks specialized support in obtaining patents required for such cutting-edge technology. In order to streamline the process of obtaining IP registrations, the NDTSP focuses on building framework for obtaining and managing the IP specifically in the deep tech space, capacity building for patent landscaping, monetary incentive for developing technologies with the government and other amendments in the current IPR Policy, 2016.

Facilitating Access to Funding

The NDTSP aims to enhance the already existing policies and programs of the government in order to tailor them for the requirements of the deep tech space by various initiatives such as setting up a centralized window to capture the lifecycle of government grant payments, assessment of the current CSR laws in order to facilitate CSR funding into the deep tech sector, building a dedicated deep tech guidance fund with longer tenure to match the gestation period of the deep tech startups, to mobilise the government, private and foreign funding in the ecosystem, reducing the compliance burden and onerous taxation in order to curb the relocation of startups to other countries with better taxation regimes, among others.

Enabling Infrastructure Access and Resource Sharing

The NDTSP recognizes the high cost required for the primary R&D in the frontier technology space and hence, it endeavours to provide access to shared infrastructure to deep tech startups at nominal fees. The NDTSP also aims to build other resource sharing mechanisms for dissemination of data to such startups, as well as dissemination of data expertise.

Creating Conducive Regulations, Standards and Certifications

The NDTSP encourages establishment of mechanisms such as regulatory sandboxes that would help startups, end-users, industry, and regulatory experts to test the technology in a controlled environment while gathering evidence on functionality and potential risks of the technology. The NDTSP also focuses on providing subsidies and exemption in certification and accreditation costs for deep tech startups. This enables experimentation of frontier technology to comply with existing regulatory frameworks.

Attracting Human Resource & Initiate Capacity Building

The NDTSP places great impetus on capacity building vis-à-vis encourages establishment of knowledge dissemination mechanisms in different segments of frontier technology, creation of accessibility to the educational resources and building inclusive framework for encouraging involvement of women and people from tier II and tier III cities in augmenting the deep tech ecosystem.

Promoting Procurement & Adoption

The NDTSP advocates for public procurement as a market for deep tech startups and aims to enhance the current programs and initiatives by implementing targeted interventions. The NDTSP urges the government to take a higher risk on such deep tech startups and enable public procurement to be the first market for such startups.

Enhancing Policy & Program Interlinkages

While many policies to encourage the deep tech segment are already established, the NDTSP encourages enhancing the policies and creating interlinkages in already existing initiatives in order to create a larger impact.

Sustenance of Deep Tech Startups

Lastly, considering the gestation period of deep tech startups, the policy aims to set mechanisms and provide a roadmap to the startups engaged in building frontier technology to ensure sustainable growth by implementation of funding sensitization programs, facilitation of meaningful partnerships, among many other initiatives.

While the initiative of formulating a policy for the deep tech ecosystem is meritorious, it would be interesting to witness how the policy shapes up. Considering the nascent stage of the deep tech ecosystem in India and the multitudes of benefits that the deep tech actually offers, it is pertinent to encourage experimentation and high-risk investments in this ecosystem.

The Draft National Deep Tech Startup Policy is open for public recommendation until September 15, 2023.

5 Common Legal Blunders Startup Founders Make And How They Can Be Avoided

Validity of WhatsApp Documents as Court Service: A Changing Landscape

Introduction

WhatsApp has become a ubiquitous messaging platform, with millions of users worldwide relying on it for personal and professional communication. With the legal system having already embraced technology and digital transformation to streamline their processes and enhance accessibility and electronic filing systems, digital signatures, and online platforms for case management, it has now also started accepting WhatsApp as a tool to enhance client communication and flow of information. Courts in India have also started accepting service of documents sent through WhatsApp to be valid service in certain situations.

Here is an analysis of accepting WhatsApp as a valid platform for service:

- Proof of Delivery

One of the primary requirements for accepting WhatsApp documents as valid court service is the ability to prove delivery. Traditionally, a clear paper trail was created through registered mail or in-person delivery to demonstrate that the documents were received by the intended recipient. With WhatsApp, the challenge lies in establishing irrefutable evidence of delivery.

- Acknowledgment and Read Receipts

WhatsApp offers features like read receipts and acknowledgment indicators, which can serve as evidence of delivery and receipt of documents. When a recipient opens and reads a message, the sender can receive a read receipt, providing a timestamp as proof of delivery. Additionally, if the recipient acknowledges receiving the message or responds to it, it further strengthens the case for the validity of WhatsApp documents as court service.

- Authentication and Integrity

Courts place a high value on document authenticity and integrity. When considering WhatsApp documents as valid court service, it becomes crucial to establish the authenticity of the sender and the integrity of the document. Verification mechanisms, such as digital signatures or encryption, can help ensure that the documents have not been tampered with and that they originate from the identified sender. Confidentiality of documents and service is another concern faced by courts, however, WhatsApp claims to incorporate end-to-end encryption.

- Legal Framework and Precedents

Courts in India have explicitly started recognizing WhatsApp as a valid platform of communication and service of documents related to court proceedings. However, burden of proof of service lies entirely on the party claiming service to have been completed through WhatsApp.

- Cost-Effective Solution

Adopting WhatsApp as a communication tool can be a cost-effective solution for legal service providers and helps reduce wastage of paper.

- Instances where courts have accepted service done via WhatsApp to be valid

- The Delhi High Court set a precedent in 2017 in Tata Sons Limited & Ors Vs John Does, by allowing service of summons through WhatsApp after the Defendants evaded service though regular modes.

- Thereafter, in SBI Cards and Payments Services Pvt Ltd Versus Rohidas Jadhav, the Bombay High Court accepted the service of notice in an execution application after finding that the PDF file containing the notice had not only been served but the attachment had also been opened by the opposite party. Justice G.S. Patel observed that “For the purposes of service of Notice under Order XXI Rule 22, I will accept this. I do so because the icon indicators clearly show that not only was the message and its attachment delivered to the Respondent’s number but that both were opened.

- Justice G.S. Patel at Bombay High Court in Kross Television India Pvt Ltd & Anr Vs. Vikhyat Chitra Production & Ors. has also held that the purpose of service is to put the other party to notice. Where an alternative mode (email and WhatsApp) is used and service is shown to be effected and acknowledged, it cannot be suggested that there was ‘no notice’.

- The Rohini Civil Court at Delhi in a case has also accepted the blue double-tick sign in a WhatsApp message as valid proof that the message’s recipients had seen a case-related notice.

Conclusion

As the Supreme Court is yet to lay down a precedent or ruling accepting Whatsapp as valid medium of service. The acceptance of WhatsApp documents as valid court service is a complex issue that requires careful consideration of factors such as proof of delivery, acknowledgment, authentication, and adherence to legal frameworks. As the Indian courts continue to navigate the digital landscape and embrace technology, it is essential for legal professionals, lawmakers, and technology providers to work together to establish clear guidelines and standards that safeguard the integrity of court proceedings while embracing the efficiencies offered by modern communication platforms like WhatsApp. The courts incorporating WhatsApp as part of the legal service workflow demonstrates the industry’s commitment to adapting to the evolving needs of clients in an increasingly digital world.

Social networking app for gamers Qlan secures ₹1.7 crore in pre-seed round

Merge Ahead: Fast-Track Your Way to Competitive Advantage!

Meaning

A fast-track merger is a streamlined process for combining two or more companies. It is typically designed to expedite the merger process, reduce administrative burdens, and facilitate efficient integration of the merging entities. It involves simplifying certain procedural steps and regulatory approvals, allowing the merger to be completed quickly.

Eligibility Criteria

A scheme of merger or amalgamation under section 233 of the Companies Act, 2013 may be entered into between any of the following classes of companies, namely:-

- A holding company and its wholly-owned subsidiary company or such other class or classes of companies;

- Two or more start-up companies; or

- One or more start-up companies with one or more small companies*.

*Small Company means a company whose paid up capital is maximum Rs 4 crore and turnover is maximum Rs 40 crore

Highlights of Recent Amendment

The Ministry of Corporate Affairs (“MCA”) made amendments to Rule 25 of the Companies (Compromises, Arrangements and Amalgamations) Rules, 2016, on 15th May, 2023 which states that the Central Government (CG) now has a specific timeframe to approve merger and amalgamation schemes, addressing the previous absence of a defined time frame for approval from the Registrar of Companies (“ROC”) or Official Liquidator (“OL”).

The purpose of these amendments is to streamline and expedite the merger and amalgamation process specifically for start-up companies and small companies under section 233 of the Companies Act, 2013.

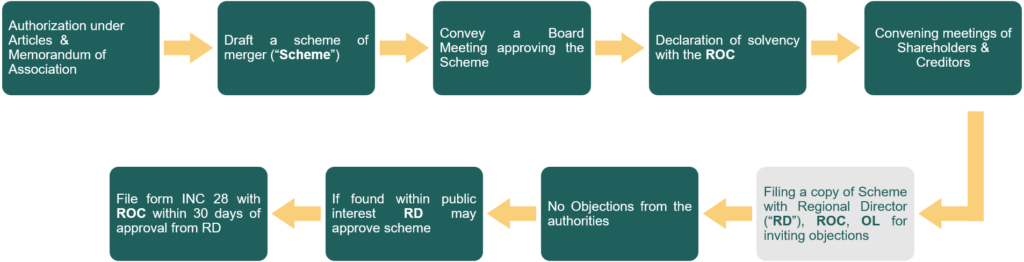

Step Plan for a Fast-track Merger

- Step 1: Authorization under Articles & Memorandum of Association

- Step 2: Draft a scheme of merger (“Scheme”)

- Step 3: Convene a Board Meeting approving the Scheme

- Step 4: Declaration of solvency with the ROC

- Step 5: Convening meetings of Shareholders & Creditors

- Step 6: Filing a copy of Scheme with Regional Director (“RD”), ROC, OL for inviting objections

- Step 7: No Objections from the authorities

- Step 8: If found within public interest RD may approve the scheme

- Step 9: File form INC 28 with ROC within 30 days of approval from RD

Amendments are as follows

Note: The Scheme in each of the aforementioned situations shall be approved or deemed to be approved only if the same is in the public interest or in the interest of the creditors

| IF | THEN |

|---|---|

| No objection/ suggestion received by the CG from ROC/OL within 30 days of the receipt of copy of scheme. | CG shall confirm and approve the scheme within 15 days after the expiry of 30 days. |

| No confirmation from CG within 60 days from the receipt of the scheme. | The scheme shall be deemed to be approved. |

| On receipt of objections/ suggestions from ROC/ OL where such objection/ suggestion are not sustainable. | CG shall approve the scheme and issue confirmation order within 30 days after the expiry of 30 days.If no confirmation order is issued within the aforementioned period, it shall be deemed that it has no objection to the scheme and a confirmation order shall be issued accordingly. |

| On receipt of objections/ suggestions from ROC/ OL where CG is of opinion that the scheme is not in the public interest or in the interest of creditors. | CG shall file an application with the tribunal within 60 days of receipt of the scheme, requesting the tribunal to consider the scheme in the regular manner. If CG does not file the application within the aforesaid period, it shall be deemed that it has no objection to the scheme and a confirmation order shall be issued accordingly. |

Incorporation of an Indian company

Pre-requisites for incorporation

| Proposed Name | •Name to be available and unique. Should contain the nature of business •Minimum 2 names to be proposed |

| Share Capital | •Authorized and paid-up share capital to be determined •Sample capital structure: -10,000 equity shares of INR 10 per share -Total paid-up capital of INR 100,000 -Total authorized capital of INR 1,000,000 |

| Directors | •Minimum 2 directors required •Minimum 1 director to mandatorily be Indian resident |

| Shareholders | •Minimum 2 shareholders required |

| Registered Office Address | •Commercial property/office location required as registered address •Services of co-working office spaces can also be availed for virtual office address |

Incorporation process

Step 1 – Obtain DSC of directors & shareholders

Approx TAT: 2 Days Key documents/information required to be filed: Aadhar/PAN card, contact no. & email address and photo of individual

Step 2 – File for name application

Approx TAT: 3 Days Form: Spice+ Part-A Key documents/information required to be filed:

a. 2 proposed names of company b. NIC code along with 2-3 sentences about proposed business of company

Step 3 – File incorporation documents

Approx TAT: 1 Days Form: Spice+ Part-B Key documents/information required to be filed:

A. Shareholder and director details + KYC proofs

- KYC documents of foreign director and shareholder need to be apostilled and notarized in home country

B. Company details – Share capital (authorized and paid up), registered office address, email address and contact no.

Note: TAT is subject to MCA website

- On approval of spice forms, company incorporation is complete

- Certificate of incorporation, PAN, and TAN are issued to the company

- Company can open bank account

Post – incorporation process

STEP 1 – Post incorporation filings

A. FORM ADT 1 Approx TAT: 2 Days Key documents and information required to be filed:

– Auditor details – Name of auditor/auditor’s firm along with partner’s name, PAN, Membership no., registered address, email address, written consent & certificate stating he/she is not disqualified for appointment

– Company’s board resolution appointing such auditor B. FORM INC 20A Approx TAT: 2 Days Key documents/information required to be file: Bank statement of company showing inward receipt of subscription money from subscribers

- Company can issue share certificates to its shareholders

STEP 2 – RBI filing in case of foreign investor

Form: FC-GPR Approx TAT: 2 Days* (*2 days from receipt of FIRC and KYC from AD bank) Key documents/information required to be filed: FIRC and KYC for the fund transfer in foreign exchange entity master registration and business user registration to be obtained on FIRMS portal

Obtain initial registrations:

- Shops & establishment registration

- Profession tax registration

- GST registration

- Udyog Aadhar/MSME registration

- Startup India registration

- Angel tax exemption

For further details on licenses and registrations, refer to the document attached here.

Capital 2B, IIFL fintech fund lead $5 million investment round in Castler

Diversity & Inclusion Policy in India

Introduction

The Constitution of India explicitly prohibits discrimination based on sex, race, religion, or on any other ground, but it has taken some time for this protection to be extended to LGBTQ+ individuals. The landmark judgment in NALSA v. Union of India case in 2014 marked a progressive interpretation by the Supreme Court, which recognized that discrimination based on sexual orientation and gender identity falls within the ambit of “discrimination on the grounds of sex.” The court emphasized that such discrimination violates the fundamental right to equality enshrined in the Constitution.

In a subsequent case, Navtej Singh Johar v. Union of India, the Supreme Court took one step forward by acknowledging that the freedom to choose one’s sexual orientation and express one’s gender identity, including through dress, speech, and mannerisms, is at the core of an individual’s identity.

Although there is an absence of standalone anti-discrimination legislations in India, certain laws such as the Rights of Persons with Disabilities Act, 2016, the Equal Remuneration Act, 1976 (along with the Code on Wages, 2019), the Human Immunodeficiency Virus and Acquired Immune Deficiency Syndrome (Prevention and Control) Act, 2017, and the Transgender Persons (Protection of Rights) Act, 2019, do contain provisions addressing discrimination against individuals falling under the ambit of the aforementioned laws.

A major drawback of the Equal Remuneration Act, 1976 is that while it encourages pay parity at workplaces, however its scope is restricted to merely two genders, i.e., men and women thereby alienating an individual with a different sexual orientation from obtaining the benefits under this legislation.

This piece highlights the various workplace policies in India and the need to make them more inclusive for the disabled persons and those belonging to LGBTQ+ communities.

Equal Opportunity Policy under Rights of Persons with Disabilities Act, 2016

The Rights of Persons with Disabilities Act (“Act”) requires all establishments to have an equal opportunity policy (EOP) specifically for individuals with disabilities. This policy must be made publicly available, preferably on the establishment’s website or in conspicuous locations within the premises. The EOP should outline the facilities and services that will be provided to enable individuals with disabilities to fulfill their responsibilities effectively in the establishment.

Furthermore, if the organization employs 20 or more individuals, the EOP must include the following details:

- A comprehensive list of positions within the establishment that are deemed suitable for individuals with disabilities;

- The procedure for selecting individuals with disabilities for different positions, as well as providing post-recruitment and pre-promotion training, prioritizing them in transfers and job assignments, granting special leave, allocating residential accommodation if available, and offering other necessary facilities.

- Provisions for assistive devices, ensuring barrier-free accessibility, and implementing other necessary measures to accommodate individuals with disabilities.

- Information about the designated liaison officer. It is mandatory for every establishment with 20 or more employees to appoint a liaison officer responsible for overseeing the recruitment of individuals with disabilities and ensuring the provision of necessary facilities and amenities.

- A copy of the EOP must be registered with the relevant authority (whether a Chief Commissioner or State Commissioner, as the case may be) specified by the law.

Can POSH Policy be Gender Neutral?

The Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (“POSH Act”) is an Indian legislation designed to address workplace sexual harassment and ensure a safe working environment for women. Although the law primarily aims to protect women due to the widespread gender-based discrimination they face, it does not exclude or expressly/impliedly prohibit inclusion of men or individuals of other gender identities from receiving protection. It is important to recognize and address the experiences of all individuals who may encounter sexual harassment, regardless of their gender identity.

It is important to note that in the POSH Act, there is no bar on gender for the respondent, i.e., although the victim can only be a woman, but there is no specific gender mentioned for the respondent. Therefore, the term “respondent” encompasses all genders.

During the legislative process, the idea of enacting a gender-neutral law was discussed. However, this discussion primarily centered around men’s rights groups advocating for equal treatment and was framed as a debate between men and women. In response to this, the Parliamentary Standing Committee in 2011 proposed that the law should remain specific to one gender, citing the historical disadvantages, discrimination, abuse, and harassment faced by women. The committee based its recommendation on the belief that women are particularly vulnerable to workplace harassment, which hinders their ability to work. The primary objective of maintaining a gender-specific law was to increase female participation in the workforce and establish a robust mechanism to safeguard women’s employment rights.

In Anamika v Union of India, the Delhi High Court ruled that transgender individuals can utilize the protection under provisions related to sexual harassment, (which are commonly resorted to in cases of harassment by men against women), to file complaints. It is pertinent to note that in this case, although the aggrieved person was a transgender, however she identified herself as a woman and possessed a legally sanctioned identity document as evidence.

Provisions under Transgender Persons (Protection of Rights) Act, 2019

In 2014, the Supreme Court of India made a significant ruling in the case of National Legal Services Authority v. Union of India. This ruling played a crucial role in establishing the rights of transgender individuals in India. The court recognized the category of “transgender” as the “third gender” and introduced various measures to prevent discrimination against transgender individuals and protect their rights. The judgment also suggested that reservations should be made for transgender individuals in employment and educational institutions. Additionally, it affirmed the right of transgender individuals to identify their gender based on their self-perception, without the requirement of undergoing a sex reassignment surgery.

The Transgender Persons Act requires all establishments, including private employers, to adhere to certain regulations:

- Prohibition of discrimination: Ensure a safe working environment and prevent any form of discrimination against transgender individuals in all aspects of employment, such as recruitment, promotions, infrastructure adjustments, employment benefits, and related matters.

- Equal opportunity policy: Develop and publish an equal opportunity policy specifically for transgender persons. Display this policy on the company website, and if there is no website, post it at a conspicuous place within the premises.

- Infrastructural facilities: Provide necessary infrastructure adjustments, including unisex toilets, to cater to the needs of transgender employees. Take measures to ensure their safety and security, such as transportation arrangements and security guards. Additionally, ensure the availability of amenities like hygiene products for transgender employees.

- Confidentiality of identity of the transgender employees to be ensured at workplaces.

- Appointment of Complaint Officers: Establishments are obligated to assign a complaint officer who will handle any grievances concerning the infringement of the regulations stated in the Transgender Persons Act. The designated complaint officer is entrusted with the responsibility of investigating the complaints, and it is mandatory for the head of the establishment to act upon the report produced by the complaint officer within the specified timeframes.

Got a question? Call us on 9930156000

References

Constitution of India, Article 14

Rights of Persons with Disabilities Act, 2016, Section 21

Rights of Persons with Disabilities Rules, 2017

Case Summary: LGBTQ+ Marriage Rights in India

Supriyo @ Supriya Chaktraborty & Anr. v. Union of India

For a presentation view, click here!

Factual Matrix

• The nature of the subject matter of the case at hand has been weighed and adjudicated upon around the world across various jurisdictions. In order to observe the case at hand more objectively and illuminate the grounds and discussions which have been placed before the Honourable Supreme Court thus far, we have laid out a summary of the facts of the case:

• The Petitioners identify themselves as gay men and are Indian citizens. Both petitioners, presently aged about 32 and 35 years respectively, have been in a committed relationship for almost a decade.

• On 17.08.2021, the Petitioners held a ceremony in the presence of their families, friends and colleagues.

• However, despite a decade long committed relationship, the Petitioners are unmarried in the eyes of law as the legal regime around recognition and solemnization of marriages excludes marriage between a same-sex couple.

• Despite the ceremony, the Petitioners realized that they are legally incapable of exercising the rights of married individuals and strangers in the eyes of the law, such as securing health insurance which would include their partner, nominating each other for life insurance, mutual funds, PPF, pension scheme, or any other financial instruments. Legally, they do not have the right to inheritance, property, to take medical or end-of-life decisions pertaining to each other.

• In light of the same, the Petitioners filed their PIL before the Hon’ble Supreme Court seeking recognition and solemnization of same-sex marriage.

Questions In Point

The Hon’ble Supreme Court is hearing the matter based involving the following issues:

• Recognition of Same-Sex Marriage: Whether same-sex marriage or non-heterosexual marriage can be recognized and solemnized under the Special Marriage Act, 1954?

• Constitutionality of the Special Marriage Act: Whether the Special Marriage Act, 1954 can be declared to be unconstitutional and violative of Articles 14, 15, 19 and 21 of the Constitution of India to the extent that it does not provide for solemnization of marriage between a same sex couple?

Recognition of same-sex marriage

| Petitioners | UoI |

| • Broad interpretation to be made of the word “spouse” under Special Marriage Act, 1954 (“SMA”) and its meaning should not be confined merely to and be read as “a man and a woman”. Additionally, Section 4, SMA, which refers to a marriage in gender-neutral terms, between ‘any two persons’. However, it was clarified that merely amending the SMA isn’t enough and that a constitutional declaration of marriage, akin to that of the heterogeneous group, is needed. • It is important to remove the 30-day notice period under Section 5 of the SMA on the grounds that it invites unwarranted interference and such notice period violates an individual’s privacy along with their personal and decisional autonomy. • Advocate Abhishek Manu Singhvi, Counsel to the Petitioner stated that “But on the canvas there are two crucial words here. ‘Marriage’ and ‘persons’. ‘Same sex’ is a slight misnomer. The correct word is ‘person’, not ‘same sex’.”* • It was contended that the State could not deny marriage equality on grounds of “impracticality” as the discriminatory laws were created by it • Excluding the LGBTQIA+ community from their right to marry sends a message that it is legitimate to differentiate between the commitments of heterosexual and non-heterosexual couples, by indicating that the latter’s marriages are not as significant as “real” marriages. | • The Supreme Court could not hear this case as it fell under the powers of Parliament. The Respondent’s Counsel argued that there are certain issues which are better left to the discretion of the Parliament. There is no discrimination, no breach of privacy, right of choosing one’s sexual orientation. • It was argued that argued that 160 laws would be impacted in the process of bringing marriage equality. • It was argued that the subject of marriage is in the concurrent list and the possibility of one state agreeing to it and another against it cannot be ruled out. In this scenario, the maintainability of the petition would come into question. • Counsel to the Respondent stated that “Societal acceptance of any relationship in the society is never dependent either on legislation or on judgments. It comes only from within. Let us accept it whether we like to accept it or not.” • It was argued that the legislative intent of the legislature throughout has been a relationship between a biological male and a biological female including Special Marriage Act. • It was argued that the concept of biological man means a biological man and the question of notion does not arise. |

Recognition of same-sex marriage

Constitutionality of the Special Marriage Act

| Petitioners | UoI |

| • The Counsel argued that “The right to marry non-heterosexual unions is implicit in Articles 14, 15, 16, 19 and 21 of the Indian Constitution, especially after the Supreme Court rulings in “Navtej Singh Johar vs. Union of India” and “KS Puttaswamy and Anr. vs. Union of India”. • It was contended that the State could not deny marriage equality on grounds of “impracticality” as the discriminatory laws were created by it. • It is a civil union, as permitted in some countries, is not a solution to what same-sex couples are asking for. civil unions are not an equal alternative and do not address constitutional anomalies presented by excluding non-heterosexual couples from the institution of marriage • Excluding the LGBTQIA+ community from their right to marry sends a message that it is legitimate to differentiate between the commitments of heterosexual and non-heterosexual couples, by indicating that the latter’s marriages are not as significant as “real” marriages. • Adv. Mukul Rohatgi argued that “Gender identity is one of the most fundamental aspects of life and refers to a person’s intrinsic sense of being male, female or transgender or transsexual.” • Inalienable right to privacy must be granted in sanctity of a natural right to privacy in the Constitution as a fundamental right and the soulmate of dignity. Therefore, privacy, dignity go in hand in hand. Dignity is a part of life lived to its fullest under Article 21. | • The lawmakers had a conscious intent to include only heterosexual marriages under the SMA and the said Act’s character and intent cannot be altered. • It was argued that under the SMA, the court cannot give rights to non-heterosexual couples that heterosexual couples don’t have. • The State has a ‘legitimate’ interest in regulating marriages, while citing aspects such as the age of consent, prohibition of bigamy, prescription of prohibited degrees of marriage, judicial separation, and divorce. • While the rulings in Navtej or Shafeen Jahan were monocentric, the present dispute is a “polycentric”, one that will affect several legal provisions, possibly wreaking collateral damage or side effects in its wake. • The Respondent’s Counsel stated that “The question is not right of equality, right of dignity or right of privacy of persons who belong to LGBTQ community. That is first. The question is right of conferment of a socio-legal status and whether that can be done by judicial adjudication. There was no law governing the rights and other rights and other immunities to the LGBTQ community.” • It was argued that the concept of biological man means a biological man and the question of notion does not arise. |

Constitutionality of the Special Marriage Act

Observations by the Hon’ble Supreme Court

| Question | Observations |

| Inclusion of LGBTQ+ in SMA | • Justice D.Y. Chandrachud observed that “Man is not a definition of what your genitals are. It’s far more complex. That’s the point. So even when the Special Marriage Act says man and woman, the very notion of a man and a notion of a woman is not an absolute based on what genitals you have.” • There should be a declaration of the right to marry, then there are two courses of action according to you. Either the court then finds a legislative void in that Parliament has not legislated explicitly to recognize the right of marry, and therefore finding a legislative void, you supplant that deficiency so long as Parliament enacts the law. The other option is, to locate the modalities for implementing that declaration in existing law. • The notice issue is even in a heterosexual marriage, because you are saying that even in a heterosexual marriage, the fact that you have to give a notice and have people object to whether there should be a marriage or not, is unconstitutional. |

| Violation of Fundamental Rights due to marriage inequality | • There are two corresponding rights and perhaps duties and obligations as well. On the one hand the LGBTQ community has or a same sex couple is entitled to say, I have a right to make my own choices. We have our right to make our own choices, to live as we wish together and therefore, that is a part of our dignity our privacy. But equally, society can’t say that. Well, all right. We will recognize that right and we leave you alone. And we will not recognize your relationship. • It’s not enough, in terms of privacy to leave them alone and to make their choices but it is equally important to assert a ride equally, to have the recognition of those social institutions. Because private is an individual concept which allows you to get to the core of your being and to live your life as you want. But equally, each of us are social individuals, social animals, so to speak. And therefore, for society to assert that all right, we’ll leave you alone, or the state will leave you alone. |

Observations by the Hon’ble Supreme Court

Key Takeaways, pending the Supreme Court’s judgment

• Public opinion on various LGBTQ+ rights in India has evolved over the years and verdicts passed by the Judiciary. The progress of laws relating to LGBTQ+ marriage in India has been a complex and evolving journey. While the decriminalization of homosexuality and the recognition of civil partnerships have marked significant milestones, marriage equality remains unrealized. However, the recognition of same-sex marriages has seen progress in certain states.

• The LGBTQIA+ community has averred that it needs an anti-discrimination law that gives them the freedom to forge fulfilling relationships and lives regardless of their gender identity or sexual orientation and places the responsibility for change on the state and society rather than the person. The assertion is that when individuals belonging to the LGBTQ community are granted their complete set of constitutional rights, it is imperative to acknowledge their right to marry the person (and not only a man or a woman) of their choosing.

• However, while there is growing acceptance and support for equality, there is continued opposition to same-sex marriages.

• The arguments made against the petition were on both technical grounds (the jurisdiction of the Supreme Court qua the Parliament to confer rights of a socio-legal status, and the non-joinder of the States for an issue on the concurrent list of the Constitution), and on the grounds of maintainability (considering the provisions of the Transgender Act which already prohibit discrimination, and on the impact on personal laws and their amendment).

• After a hearing that ran for 10 days, the Honourable Supreme Court reserved its verdict on the batch of petitions seeking legal recognition of same-sex marriages.

Inside Indian Premier League

What is Blockchain Technology ?

With the increasing awareness and hype surrounding Cryptocurrency, NFTs, and other Digital Currencies, understanding the concept of Blockchain Technology has become crucial. Blockchain technology is a distributed digital ledger that records data, documents, and transactions securely and transparently.

Key Features of Blockchain Technology:

- Decentralized: Blockchain allows for a decentralized network composed of multiple nodes or participants. This ensures the network is secure and minimizes the risk of malicious interference while providing financial sovereignty and democratic control to participants.

- Peer-to-Peer (P2P): Blockchain technology leverages the power of P2P networks to provide a shared and reliable ledger of transactions. All nodes carry out the same tasks equitably without the presence of a central administrator.

- Transparency: Blockchain makes transaction history more transparent, as all nodes on the network share a copy of the document, enabling all users to see updated records.

- Security: Blockchain is superior to any other recording system, as it ensures all documents of transactions are updated or altered by consensus by the nodes in the network. This decentralized storage of information ensures that no individual holds the right to update records.

- Efficiency: Blockchain streamlines transactional processes through traditional paperwork, minimizes the risk of error, eliminates the involvement of third-party beneficiaries, and makes transactions efficient and faster.

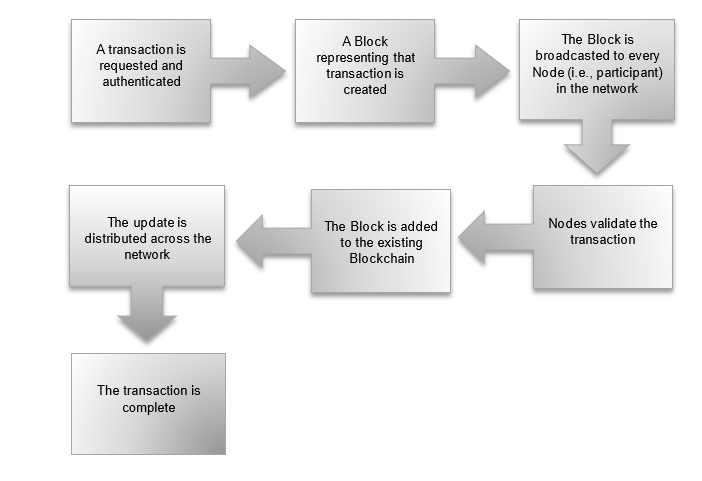

How Blockchain Technology Works:

Blockchain technology is the concept of digitally storing data in the most transparent, secure, and efficient way. The data is recorded on blocks and chained together cryptographically to create an unalterable digital ledger. Each participant on the Blockchain network has access to the entire database and its history, ensuring transparency, security, and efficiency. Let us now try to understand the working of the Blockchain technology from the flowchart below:

Types of Blockchains:

- Public Blockchain: Also known as Permissionless Blockchains, Public blockchains are open networks that allow anyone to participate in the network. The data on a public blockchain is secure as it is not possible to modify the data or interfere with the same once it is validated on the blockchain.

- Private Blockchain: Private blockchains, also known as authorized blockchains, are managed by the network administrator and only a single organization has authority over the network.

Potential Use Cases:

- Cryptocurrency: The most well-known use of Blockchain Technology is for cryptocurrency exchanges. When people exchange or spend cryptocurrency, the transactions are recorded on a blockchain, with each block representing a separate transaction that is validated by the participants in the network.

- Financial Exchanges: Blockchains can also be used for traditional exchanges to allow for faster and less expensive transactions. Decentralized exchanges provide better management and security because investors do not have to deposit their assets with a central authority.

- Banking: Blockchain may be used to process transactions in fiat currency such as dollars and euros to make such transfers secure, quick, and more economical, especially for processing cross-border transactions.

- Insurance: Using smart contracts on the blockchain can increase the transparency of customers and insurers. Recording all claims on the blockchain would prevent duplicate claims for the same event and speed up the process for applicants to receive payments.

- Lending: Smart contracts built on the blockchain allow for secure lending, triggering the payment of services, margin calls, full repayment of loans, the release of collateral, etc. on the happening of certain events.

- Real Estate: By recording real estate transactions using blockchain technology, a safer and more accessible way to identify and transfer real estate can be provided, speeding up transactions, reducing paperwork, and saving costs.

- Healthcare: Blockchain can be used to protect medical records, health records, and other related electronic records, ensuring that medical professionals have accurate and up-to-date information about their patients and improve treatment.

Drawbacks of Blockchain Technology:

- Power Consumption: The power consumption in the blockchain is high due to mining activities, maintaining a real-time ledger, and communicating with other nodes.

- Scalability: The size of the block equals the data it stores, which poses serious difficulties for practical use, as each participant node needs to verify and approve a transaction.

- Storage: Blockchain databases are stored indefinitely on all network nodes, causing storage space issues.

- Privacy and Security: The public blockchain is not entirely secure as anyone on the network can legally access data, leading to privacy concerns.

- Regulations: Regulatory regimes in the financial arena are a challenge for blockchain implementation, as blockchain applications need to establish a process to identify the culprit in the event of a scam.

In conclusion, Blockchain Technology is a powerful tool with numerous potential use cases and benefits, especially in the rapidly growing field of Cryptocurrency, NFTs, and digital currencies. However, there are also drawbacks to be considered, such as power consumption, scalability, storage, privacy and security, and regulatory challenges. Despite these challenges, the potential benefits of blockchain technology make it an important development to watch as it continues to evolve and adapt to new regulatory regimes. As the world becomes more technologically advanced, it is essential to stay informed about the latest developments in blockchain technology, as it has the potential to revolutionize how we store and exchange data in the future.

FAQs about Blockchain Technology

- What are the main benefits of using blockchain technology?

Blockchain technology offers several benefits, including decentralization, transparency, security, and efficiency. By providing a decentralized network, blockchain ensures that the network is secure and minimizes the risk of malicious interference while giving participants control and financial sovereignty. Additionally, blockchain offers transparency by making transaction history more visible to all participants, and it provides security by ensuring that documents of transactions are updated or altered by consensus by the nodes in the network.

- How is blockchain technology different from traditional database technology?

Blockchain technology differs from traditional database technology in several ways. First, blockchain is a distributed ledger that is shared among participants in a decentralized network, while traditional databases are often centralized, controlled by a single party or authority. Additionally, blockchain is more secure due to its decentralized nature, while traditional databases are more vulnerable to malicious interference. Lastly, while traditional databases require specific permissions to access and modify data, blockchain enables participants to access records while maintaining security and transparency.

- How does blockchain technology and cryptocurrencies work together?

Blockchain technology and cryptocurrencies work together as blockchain is the underlying technology that allows cryptocurrencies to operate securely, transparently, and efficiently. Each cryptocurrency uses a specific blockchain to record transactions, where each transaction is verified and then added to a new block in the chain.

- Can blockchain technology be used in industries beyond finance?

Yes, blockchain technology has a wide range of potential applications beyond finance, including industries like healthcare, insurance, supply chain management, and more. For example, blockchain technology can be used to protect medical records, ensuring that medical professionals have accurate and up-to-date information about their patients.

- How do you ensure the security of blockchain technology?

Blockchain technology is inherently secure due to its decentralized nature, making it incredibly difficult for malicious actors to interfere with the network. Additionally, several other security measures can be taken to make sure blockchain technology is secure, such as encrypting data, using multi-factor authentication, and implementing measures to prevent unauthorized access to the network.

The Co-Founders’ Questionnaire

SAMPLE RESPONSES

I. GENERAL

| Particulars | Responses | Remarks / Examples |

| Name of the Business | – | – |

| Registered office address (to be skipped if the Business is yet to be set up) | – | – |

| Brief Description of the Business | – | Note: This can be a 2-3 line description of the industry/sector where the Company currently operates and any differentiating factors. |

| Face Value of Equity Shares | – | – |

| Chairman of the Board | – | – |

II. FOUNDERS

| Particulars | Responses | Remarks / Examples |

| Name and Address of the Founders | Founder 1: – | |

| Founder 2: – | ||

| PAN/ Tax Registration Number of the Founders | Founder 1: – | |

| Founder 2: – | ||

| Founders who are a party to a pre-existing Shareholders Agreement (if any) | – | |

| Monetary Contribution of each Founder (if any) | Founder 1: – | |

| Founder 2: – | ||

| Shareholding Pattern of the Founders before the execution of the Co-Founders’ Agreement (to be skipped if the Business is yet to be set up) | Founder 1: – | |

| Founder 2: – | ||

| Shareholding Pattern of the Founders as on the execution of the Co-Founders’ Agreement | Founder 1: – | |

| Founder 2: – | ||

| Maximum amount of financial assistance that can be provided by the Business to each of the Founders during the course of Business | – |

III. DECISION MAKING AND DISPUTE RESOLUTION

| Particulars | Responses | Remarks / Examples |

| Founder whose opinion will hold more weight in case of any conflict with respect to the Business | – | Note: This can be an internal ‘veto’ right granted to one or more Founders, and is extremely customizable to the relationships between the Founders and their responsibilities. For example, one Founder may hold the deciding vote in general or have the final say on specific parts of the business such as design, costs, funding, or hires. |

| How will the day-to-day and major decisions of the Business be taken? | – | Note: Similar to the ‘veto’ mentioned above, this is customizable to match the working relationship between Founders. While one Founder may control day-to-day operations, another may be the decision-maker for the long-term direction. Alternatively, a voting mechanism can be set up for multiple Founders. |

| How will a sale of the Business be decided? | – | Example: To be decided by the Board/mutual agreement of the Founders. In case the parties have executed a SHA, this will ideally also be covered under reserved matters to be taken upon consent from the investor. |

| Dispute resolution in case one of the Founders is not performing his duties in accordance with the Co-Founders’ Agreement | – | Example: To be decided by the Board/such Founder may be terminated upon a simple majority of the other Founders. While this is difficult to account for at an early stage, it’s important to set checks and balances to avoid any disconnect in goals, ideals, and responsibilities. |

IV. EXIT OPTIONS

| Particulars | Responses | Remarks / Examples |

| Procedure to be followed by the Founders in case of resignation | – | Example: Prior written notice of 60 (sixty) days is to be provided to the Company. The Founder may not, in lieu of notice, pay the company his salary for the notice period, and may not also avail leave. |