Author: Treelife

Sammmm raises INR 10 crore in seed funding led by Fireside Ventures.

Rupeeflo Raises $1M from Piper Serica to Improve Financial Access for NRIs

A Snapshot of the Concert Economy: Insights from Coldplay

Concerts aren’t just about music—they’re multi-billion-dollar economic engines that impact multiple industries, from ticketing platforms to tourism, hospitality, taxation, and sustainability.

As Coldplay’s 2025 India tour took the country by storm, we at Treelife took a closer look at the numbers, stakeholders, and economic impact behind this massive event. With revenue numbers, total attendees, and a ripple effect across various sectors, this was more than just a concert—it was a case study in how live events fuel economy and growth.

What’s the Concert Economy?

A concert economy refers to the ripple effect large-scale music events have on multiple industries, including hospitality, transport, food & beverages, merchandise, and other local businesses.

When a global artist like Coldplay performs in India, the financial impact extends far beyond ticket sales. The entire event ecosystem—from airlines and hotels to restaurants, transport, and local businesses—experiences a surge in revenue.

Concerts drive employment, generate tax revenue, and contribute to the growth of industries like ticketing, event management, and streaming platforms. The Indian live events market was valued at ₹88 billion in 2023 and is projected to reach ₹143 billion by 2026, reflecting a compound annual growth rate (CAGR) of 17.6%. The ticketed live music segment alone is expected to reach ₹1,864 crore ($223 million) in 2025. Music events form a substantial part of this ecosystem, with concert numbers expected to double from 8,000 in 2018 to over 16,700 by 2025.

Key Components of the Concert Economy

- Ticketing Revenue – The biggest driver of revenue, shared between artists, event promoters, and ticketing platforms.

- Sponsorship & Brand Partnerships – Brands pay crores to associate with global tours (e.g., BMW & DHL for Coldplay).

- Media Rights & Streaming – Platforms like Disney+ Hotstar acquire streaming rights, adding a new revenue channel.

- Tourism & Hospitality Boost – Hotels, flights, and local businesses benefit from concert-driven travel.

- Government Earnings – GST, venue permits, and licensing fees contribute to the public economy.

- Local Business Growth – Restaurants, cafés, shopping malls, transport services, and even street vendors see a surge in demand, with metro stations in Ahmedabad handling over 4,05,000 passengers during Coldplay’s concerts.

- Government Earnings – GST, venue permits, entertainment taxes, and licensing fees contribute to state and national revenue. Coldplay’s concerts alone generated an estimated ₹58 crore in GST revenue from ticket sales.

In essence, a concert isn’t just a musical event—it’s a massive business operation that impacts multiple industries.

Coldplay’s India Tour by the Numbers

Here’s a breakdown of the financial impact Coldplay’s concerts had in India:

- Revenue from ticket sales – ₹322+ crore across five shows in Mumbai & Ahmedabad

- BookMyShow’s earnings from convenience fees – ₹32.2 crore

- GST collection for the government – ₹58 crore at 18% GST (ticket sales)

- Metro revenue spike – ₹66 lakh in additional earnings (during concert days)

- Metro passenger surge – 4,05,264 passengers to Motera Stadium during Ahmedabad concerts

- Disney+ Hotstar streaming numbers – 8.3 million views during concert days

- Total concert attendance – 400,000+ fans across five shows

Coldplay’s concerts didn’t just impact the fans inside the stadiums—it boosted local businesses, increased hospitality demand, and drove digital engagement across streaming platforms.

Who Makes Money in the Concert Economy?

A concert of this scale involves multiple stakeholders working together to create a profitable and smooth experience.

- Tour Promoters & Event Organizers – Live Nation (Coldplay’s global promoter), BookMyShow (ticketing & event organization in India)

- Ticketing Platforms – BookMyShow, Paytm Insider, District by Zomato

- Venue Operators – DY Patil Stadium (Mumbai), Narendra Modi Stadium (Ahmedabad)

- Sponsorship & Branding – BMW (Battery Partner), DHL (Logistics Partner), Mastercard, Disney+ Hotstar (Streaming Rights)

- Media & Streaming Rights – Disney+ Hotstar exclusively streamed the concerts in India

- Production & Logistics –responsible for stage design, sound, and lighting

- Sustainability & Energy Partners – BMW-powered show batteries, kinetic floors for energy generation

- Government & Regulatory Bodies – Earnings from GST, licensing fees, and event permits

From ticketing to brand partnerships, venue revenues to tax collections, the concert economy is an interconnected web of businesses, governments, and event specialists working together.

The Challenges & Future of India’s Concert Economy

While concerts bring massive economic benefits, they also come with significant challenges that impact the overall experience for fans, organizers, and businesses. Addressing these barriers is essential for the growth of India’s live music industry.

- Ticket Scalping & Resale – Black-market ticket prices surged up to ₹80,000, highlighting the need for stricter regulations.

- Infrastructure Gaps – Venue congestion, inadequate public transport, and lack of large-scale arenas limit event scalability.

- Taxation & Licensing Complexities – High GST rates (18%), multiple permits, and regulatory approvals make organizing large concerts more challenging.

- Sustainability Issues – While Coldplay introduced kinetic floors and battery-powered shows, most concerts still rely on diesel generators.

What’s Next for India’s Concert Economy?

India’s live concert economy is on the verge of massive expansion, driven by increasing demand, rising disposable incomes, and global interest in music tourism. Here’s what lies ahead:

Projected Market Growth

- India accounted for 27,000 live events, from music to comedy shows and theatre, in 2024, 35% more than in the same period last year.

- Estimated concert-linked spending is expected to reach 60 billion rupees and 80 billion rupees on an annual basis over the next 12 months.

- Aggregate revenue from India’s live entertainment market is projected to be around $1.7 billion by 2026, growing at a CAGR of nearly 20% over the next three to five years.

More Concerts, Bigger Events

- In 2018, India hosted 8,000+ concerts—by 2025, this is expected to double to 16,700+.

- Large-scale music & food festivals are expected to attract 1.5 million unique visitors annually—Ziro Festival, Hornbill Festival, NH7 Weekender, Zomaland, Nykaaland, and more.

Expanding Revenue Streams

- OTT Platforms live-stream digital platforms and sponsorships will further boost industry revenues (e.g., Disney Hotstar x Coldplay – 8.3 million views).

- Growth in regional concerts will create new revenue opportunities in Tier 2 & 3 cities.

Better Infrastructure & Investments

- Modern multi-purpose venues are being developed across major cities.

- Improved logistics, ticketing technology, and audience experience will drive higher attendance.

India’s concert economy is poised to become a global leader, benefiting from strong growth, technological advancements, and an increasing global appetite for music tourism. As the industry evolves, it presents a wealth of opportunities for businesses, brands, and fans alike.

Read our report for more information on how India’s concert economy is evolving and the opportunities it presents for businesses and artists alike.

Compliance Calendar 2025 – A Complete Checklist

This page covers Compliance Calendar for FY 2025-26. Access the latest Compliance Calendar FY 2026-27, here.

In today’s fast-paced corporate world, the cost of non-compliance can be severe, ranging from hefty financial penalties to significant reputational damage. For any business, understanding and adhering to regulatory requirements is not just a legal obligation but a crucial aspect of operational integrity. To assist companies in navigating this complex landscape, we’ve developed a detailed Compliance Calendar for the year 2025-26. Following this schedule meticulously can safeguard your business from unwanted legal consequences and ensure that you meet all necessary regulatory deadlines.

Staying compliant with India’s regulatory framework is crucial for businesses to avoid legal penalties and maintain operational integrity. Treelife’s “Compliance Calendar 2025” offers a comprehensive checklist of essential monthly, quarterly, and annual compliance tasks, including GST return filings, TDS deposits, and advance tax payments. This meticulously curated guide covers essential deadlines across various domains, including Income Tax, Goods and Services Tax (GST), Ministry of Corporate Affairs (MCA) compliances, Employees’ Provident Fund (EPF), Employees’ State Insurance (ESI), and more.

What is a Compliance Calendar?

Think of a compliance calendar as your personalized roadmap to regulatory bliss. It outlines key deadlines for filings, reports, and other obligations mandated by various governing bodies. From taxes and accounting to industry-specific regulations, a comprehensive compliance calendar ensures you meet all your requirements on time, every time.

Why is a Compliance Calendar Important for your Business?

A well-structured compliance calendar is more than just a list of dates; it’s a strategic tool that offers numerous benefits:

- Avoid Penalties & Fines: Timely adherence to deadlines prevents the imposition of late fees, interest, and other statutory penalties, directly impacting your bottom line.

- Maintain Legal Standing: Regular compliance ensures your business operates within the legal framework, safeguarding its reputation and credibility.

- Streamline Operations: A clear roadmap of compliance tasks allows for better planning, resource allocation, and efficient workflow management.

- Enhanced Audit Readiness: Being consistently compliant means your records are always up-to-date and audit-ready, reducing stress and potential issues during inspections.

- Informed Decision-Making: Understanding upcoming obligations helps in financial planning and strategic business decisions.

Key Compliance Requirements for 2025: A Month-by-Month Breakdown

Here’s a detailed, month-by-month breakdown of critical compliance deadlines for the financial year 2025-26, presented in an easy-to-read table format for maximum clarity and featured snippet potential.

April 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (March 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-1 (QRMP) | Quarterly outward supply (sales) details for taxpayers opting for the QRMP scheme (Jan-Mar 2025). | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | EPF Payment | Monthly Provident Fund contributions for March 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for March 2025. | Employees’ State Insurance Act, 1948 |

| 18th | GST – CMP-08 | Quarterly statement-cum-challan for composition taxpayers (Jan-Mar 2025). | CMP-08 / CGST Act, 2017 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 22nd | GST – GSTR-3B (QRMP – Category X States) | Quarterly summary return for QRMP taxpayers in specified states (Jan-Mar 2025). | GSTR-3B / CGST Act, 2017 |

| 24th | GST – GSTR-3B (QRMP – Category Y States) | Quarterly summary return for QRMP taxpayers in other specified states (Jan-Mar 2025). | GSTR-3B / CGST Act, 2017 |

| 25th | GST – ITC-04 | Quarterly statement of goods/capital goods sent to job worker and received back (Oct-Mar 2025). | ITC-04 / CGST Rules, 2017 |

| 30th | TDS Challan-cum-Statement | For payments made under Sections 194IA, 194IB, and 194M during March 2025. | Form 26QB, 26QC, 26QD / Income Tax Act, 1961 |

| 30th | MSME-1 (Half-yearly) | For outstanding payments to Micro and Small Enterprises (Oct 2024 – Mar 2025). | Form MSME-1 / MSMED Act, 2006 |

| 30th | Professional Tax | Payment for March 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

| 30th | GST – GSTR-4 (Composition) | Annual return for composition taxpayers (FY 2024-25). | GSTR-4 / CGST Act, 2017 |

May 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (April 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | EPF Payment | Monthly Provident Fund contributions for April 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for April 2025. | Employees’ State Insurance Act, 1948 |

| 15th | TDS Certificates | Issuance of TDS certificates (Form 16B, 16C, 16D) for tax deducted under Sections 194IA, 194IB, and 194M during FY 2024-25. | Form 16B, 16C, 16D / Income Tax Act, 1961 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 30th | TDS Challan-cum-Statement | For payments made under Sections 194IA, 194IB, and 194M during April 2025. | Form 26QB, 26QC, 26QD / Income Tax Act, 1961 |

| 30th | LLP Form 11 | Annual return for LLPs (FY 2024-25). | Form 11 / LLP Act, 2008 |

| 30th | PAS-6 (Half-yearly) | Reconciliation of Share Capital Audit Report for unlisted public companies (Oct 2024 – Mar 2025). | Form PAS-6 / Companies Act, 2013 |

| 31st | TDS Return – Q4 FY24-25 | Quarterly statement of TDS for the quarter ending March 31, 2025 (Forms 24Q, 26Q, 27Q). | Form 24Q, 26Q, 27Q / Income Tax Act, 1961 |

| 31st | Form 10BD & 10BE | Statement of donations received and certificate for eligible donations for FY 2024-25. | Form 10BD, 10BE / Income Tax Act, 1961 |

| 31st | Professional Tax | Payment for April 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

June 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (May 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | Advance Tax Installment | First installment of advance tax for FY 2025-26. | Section 208, Income Tax Act, 1961 |

| 15th | EPF Payment | Monthly Provident Fund contributions for May 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for May 2025. | Employees’ State Insurance Act, 1948 |

| 15th | TDS Certificates | Issuance of Form 16 (for salary) and Form 16A (for non-salary) for FY 2024-25. | Form 16, 16A / Income Tax Act, 1961 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 30th | DPT-3 | Return of deposits or particulars of transactions not considered as deposits (for FY 2024-25). | Form DPT-3 / Companies Act, 2013 |

| 30th | Professional Tax | Payment for May 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

| 30th | MBP-1 | Disclosure of interest by directors for the first Board Meeting of FY 2025-26. | Form MBP-1 / Companies Act, 2013 |

| 30th | DIR-8 | Intimation by Director of disqualification or non-disqualification. | Form DIR-8 / Companies Act, 2013 |

July 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (June 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-1 (QRMP) | Quarterly outward supply (sales) details for taxpayers opting for the QRMP scheme (Apr-Jun 2025). | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | EPF Payment | Monthly Provident Fund contributions for June 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for June 2025. | Employees’ State Insurance Act, 1948 |

| 15th | TCS Return – Q1 FY25-26 | Quarterly statement of TCS (Form 27EQ) for the quarter ending June 30, 2025. | Form 27EQ / Income Tax Act, 1961 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 22nd | GST – GSTR-3B (QRMP – Category X States) | Quarterly summary return for QRMP taxpayers in specified states (Apr-Jun 2025). | GSTR-3B / CGST Act, 2017 |

| 24th | GST – GSTR-3B (QRMP – Category Y States) | Quarterly summary return for QRMP taxpayers in other specified states (Apr-Jun 2025). | GSTR-3B / CGST Act, 2017 |

| 30th | TDS Challan-cum-Statement | For payments made under Sections 194IA, 194IB, and 194M during June 2025. | Form 26QB, 26QC, 26QD / Income Tax Act, 1961 |

| 31st | Income Tax Return (ITR) | For individuals and entities not requiring tax audit (AY 2025-26 / FY 2024-25). | ITR Forms / Income Tax Act, 1961 |

| 31st | TDS Return – Q1 FY25-26 | Quarterly statement of TDS for the quarter ending June 30, 2025 (Forms 24Q, 26Q). | Form 24Q, 26Q / Income Tax Act, 1961 |

| 31st | Professional Tax | Payment for June 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

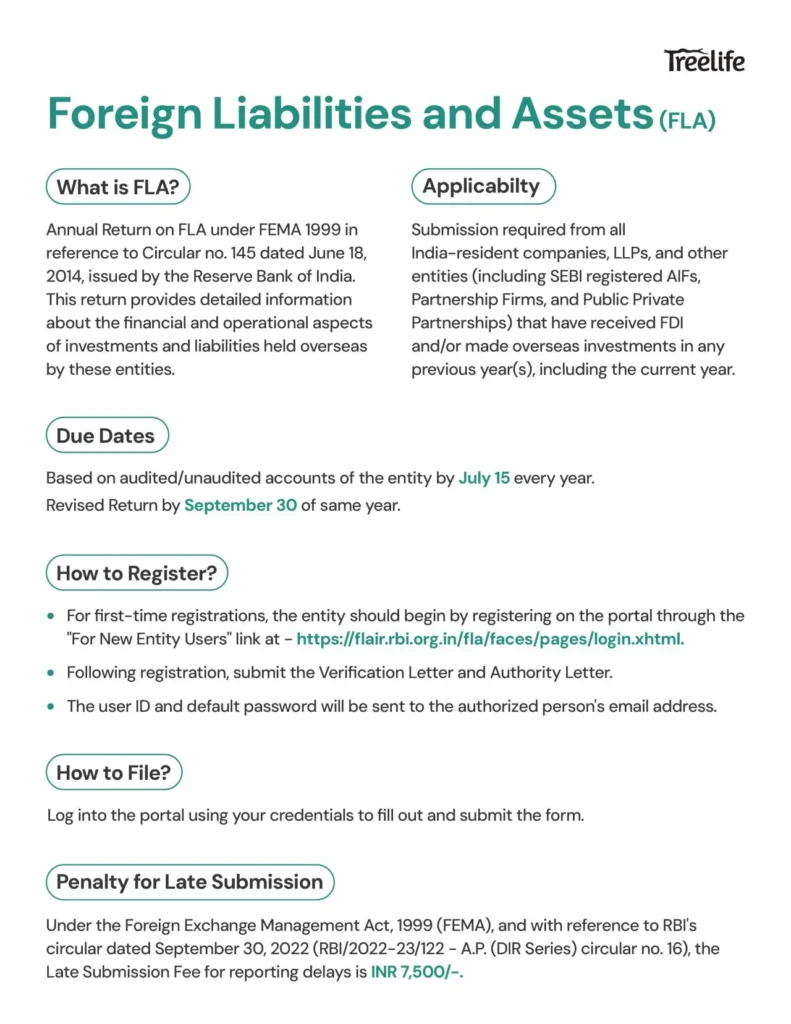

| 31st | FLA Return | Foreign Liabilities and Assets (FLA) return for companies with FDI/ODI (FY 2024-25). | FLA Return / FEMA, 1999 |

August 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (July 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 14th | TDS Certificates | Issuance of TDS certificates (Form 16B, 16C, 16D) for tax deducted under Sections 194IA, 194IB, and 194M during June 2025. | Form 16B, 16C, 16D / Income Tax Act, 1961 |

| 15th | EPF Payment | Monthly Provident Fund contributions for July 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for July 2025. | Employees’ State Insurance Act, 1948 |

| 15th | TDS Certificates (Non-Salary) | Issuance of TDS certificates (Form 16A) for non-salary payments for the quarter ending June 2025. | Form 16A / Income Tax Act, 1961 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 30th | TDS Challan-cum-Statement | For payments made under Sections 194IA, 194IB, and 194M during July 2025. | Form 26QB, 26QC, 26QD / Income Tax Act, 1961 |

| 31st | Professional Tax | Payment for July 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

September 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (August 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | Advance Tax Installment | Second installment of advance tax for FY 2025-26. | Section 208, Income Tax Act, 1961 |

| 15th | EPF Payment | Monthly Provident Fund contributions for August 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for August 2025. | Employees’ State Insurance Act, 1948 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 30th | DIR-3 KYC | Every individual holding a DIN as of March 31, 2025, must complete e-KYC to maintain active status. | Form DIR-3 KYC / Companies (Appointment and Qualification of Directors) Rules, 2014 |

| 30th | AGM of Companies | Last date for holding Annual General Meeting for companies whose financial year ended on March 31, 2025 (unless extended). | Section 96, Companies Act, 2013 |

| 30th | Professional Tax | Payment for August 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

| 30th | Tax Audit Report | Submission of Tax Audit Report (Form 3CD) for companies and individuals requiring audit (FY 2024-25). | Form 3CD / Income Tax Act, 1961 |

October 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (September 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-1 (QRMP) | Quarterly outward supply (sales) details for taxpayers opting for the QRMP scheme (Jul-Sep 2025). | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | EPF Payment | Monthly Provident Fund contributions for September 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for September 2025. | Employees’ State Insurance Act, 1948 |

| 15th | TCS Return – Q2 FY25-26 | Quarterly statement of TCS (Form 27EQ) for the quarter ending September 30, 2025. | Form 27EQ / Income Tax Act, 1961 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 22nd | GST – GSTR-3B (QRMP – Category X States) | Quarterly summary return for QRMP taxpayers in specified states (Jul-Sep 2025). | GSTR-3B / CGST Act, 2017 |

| 24th | GST – GSTR-3B (QRMP – Category Y States) | Quarterly summary return for QRMP taxpayers in other specified states (Jul-Sep 2025). | GSTR-3B / CGST Act, 2017 |

| 30th | Form AOC-4 | Filing of financial statements with ROC (within 30 days of AGM). | Form AOC-4 / Companies Act, 2013 |

| 31st | MSME-1 (Half-yearly) | For outstanding payments to Micro and Small Enterprises (Apr 2025 – Sep 2025). | Form MSME-1 / MSMED Act, 2006 |

| 31st | Professional Tax | Payment for September 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

| 31st | LLP Form 8 | Statement of Account & Solvency for LLPs (FY 2024-25). | Form 8 / LLP Act, 2008 |

| 31st | Income Tax Return (ITR) | For companies and individuals requiring tax audit (AY 2025-26 / FY 2024-25). | ITR Forms / Income Tax Act, 1961 |

| 31st | TDS Return – Q2 FY25-26 | Quarterly statement of TDS for the quarter ending September 30, 2025 (Forms 24Q, 26Q). | Form 24Q, 26Q / Income Tax Act, 1961 |

November 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (October 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | EPF Payment | Monthly Provident Fund contributions for October 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | TDS Certificates (Non-Salary) | Issuance of TDS certificates (Form 16A) for non-salary payments for the quarter ending September 2025. | Form 16A / Income Tax Act, 1961 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for October 2025. | Employees’ State Insurance Act, 1948 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 29th | PAS-6 (Half-yearly) | Reconciliation of Share Capital Audit Report for unlisted public companies (Apr 2025 – Sep 2025). | Form PAS-6 / Companies Act, 2013 |

| 29th | Form MGT-7/7A | Annual Return of Company / Abridged Annual Return for One Person Company (OPC) and Small Company (within 60 days of AGM). | Form MGT-7/7A / Companies Act, 2013 |

| 30th | Professional Tax | Payment for October 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

| 30th | Transfer Pricing Report | For entities undertaking international or specified domestic transactions (FY 2024-25). | Form 3CEB / Income Tax Act, 1961 |

| 30th | ITR for TP cases | Income Tax Return filing for entities with international/specified domestic transactions (AY 2025-26 / FY 2024-25). | ITR Forms / Income Tax Act, 1961 |

December 2025

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (November 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | Advance Tax Installment | Third installment of advance tax for FY 2025-26. | Section 208, Income Tax Act, 1961 |

| 15th | EPF Payment | Monthly Provident Fund contributions for November 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for November 2025. | Employees’ State Insurance Act, 1948 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 31st | GST – GSTR-9 | Annual Return for registered taxpayers (FY 2024-25). | GSTR-9 / CGST Act, 2017 |

| 31st | GST – GSTR-9C | Reconciliation Statement (Self-certified) for taxpayers with turnover exceeding ₹5 crores (FY 2024-25). | GSTR-9C / CGST Act, 2017 |

| 31st | Professional Tax | Payment for November 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

| 31st | Annual Report (POSH) | Annual report on Prevention of Sexual Harassment at Workplace (POSH) for companies employing 10 or more people. | Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 |

| 31st | FC-4 (FCRA Annual Return) | Annual Return under Foreign Contribution (Regulation) Act, 2010 (FCRA) for NGOs/entities receiving foreign contributions. | Form FC-4 / FCRA, 2010 |

January 2026

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (December 2025). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS) by government entities/specified persons. | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators to report supplies and tax collected at source (TCS). | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores (or those not opting for QRMP). | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-1 (QRMP) | Quarterly outward supply (sales) details for taxpayers opting for the QRMP scheme (Oct-Dec 2025). | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | EPF Payment | Monthly Provident Fund contributions (both employer and employee share) for December 2025. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for December 2025. | Employees’ State Insurance Act, 1948 |

| 18th | GST – CMP-08 | Quarterly statement-cum-challan for composition taxpayers (Oct-Dec 2025). | CMP-08 / CGST Act, 2017 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and Input Tax Credit (ITC) utilization. | GSTR-3B / CGST Act, 2017 |

| 22nd | GST – GSTR-3B (QRMP – Category X States) | Quarterly summary return for QRMP taxpayers in specified states (Oct-Dec 2025). | GSTR-3B / CGST Act, 2017 |

| 24th | GST – GSTR-3B (QRMP – Category Y States) | Quarterly summary return for QRMP taxpayers in other specified states (Oct-Dec 2025). | GSTR-3B / CGST Act, 2017 |

| 31st | TDS/TCS Return | Filing quarterly TDS/TCS returns for Q3 (Oct-Dec 2025) | Form 27EQ / Income Tax Act, 1961 Form 24Q, 26Q, 27Q / Income Tax Act, 1961 |

| 31st | Professional Tax | Payment for December 2025 (State-specific due dates apply). | State-specific Professional Tax Acts |

February 2026

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (January 2026). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | TDS Certificates (Non-Salary) | Issuance of TDS certificates (Form 16A) for non-salary payments for December 31, 2025 (Q3) | Form 16A / Income Tax Act, 1961 |

| 15th | EPF Payment | Monthly Provident Fund contributions for January 2026. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for January 2026. | Employees’ State Insurance Act, 1948 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

March 2026

| Due Date | Compliance Type | Description | Applicable Form/Act |

| 7th | TDS/TCS Deposit | Deposit of TDS/TCS collected for the preceding month (February 2026). | Income Tax Act, 1961 |

| 10th | GST – GSTR-7 | Monthly return for Tax Deducted at Source (TDS). | GSTR-7 / CGST Act, 2017 |

| 10th | GST – GSTR-8 | Monthly return for E-commerce Operators. | GSTR-8 / CGST Act, 2017 |

| 11th | GST – GSTR-1 | Monthly outward supply (sales) details for taxpayers with turnover exceeding ₹5 crores. | GSTR-1 / CGST Act, 2017 |

| 13th | GST – GSTR-5 | Monthly return for Non-Resident Taxable Persons. | GSTR-5 / CGST Act, 2017 |

| 13th | GST – GSTR-6 | Monthly return for Input Service Distributors (ISDs). | GSTR-6 / CGST Act, 2017 |

| 15th | Advance Tax Installment | Fourth and final installment of advance tax for FY 2025-26. | Section 208, Income Tax Act, 1961 |

| 15th | EPF Payment | Monthly Provident Fund contributions for February 2026. | Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 |

| 15th | ESI Payment | Monthly Employees’ State Insurance contributions for February 2026. | Employees’ State Insurance Act, 1948 |

| 20th | GST – GSTR-3B | Monthly summary return for tax payment and ITC utilization. | GSTR-3B / CGST Act, 2017 |

| 31st | Professional Tax | Payment for February 2026 (State-specific due dates apply). | State-specific Professional Tax Acts |

| 31st | LUT for FY 2026-27 | Filing of Letter of Undertaking (LUT) for FY 2026-27 for zero-rated supplies without payment of IGST. | Rule 96A, CGST Rules, 2017 |

We take care of all your compliance requirements Let’s Talk

Important Annual & Specific Compliances (Beyond Monthly Calendar)

Beyond the recurring monthly and quarterly obligations, several annual and specific compliances require attention:

- Board Meetings: Companies are required to hold at least 4 (four) Board Meetings in a calendar year, with the gap between two consecutive meetings not exceeding 120 days (Section 173 of the Companies Act, 2013). One Person Companies (OPCs), small companies, dormant companies, and private companies (if start-ups) have relaxed requirements.

- Annual Return and Financial Statements Filings (MCA): These are key documents that need to be filed with the Registrar of Companies (RoC).

- Form AOC-4: Filing of financial statements with the RoC, due within 30 days from the conclusion of the AGM.

- Form MGT-7/7A: Filing of annual return, due within 60 days from the conclusion of the AGM.

- Form ADT-1 (Appointment of Auditor): Intimation to ROC about the appointment of an auditor. For the first auditor, it is not mandatory to file Form ADT-1. For subsequent appointments, it should be filed within 15 days from the date of the Board Meeting in which the auditor is appointed.

- Form GSTR-9 (Annual Return): To be filed by regular taxpayers by 31st December of the next financial year.

- Form GSTR-9C (Reconciliation Statement): To be filed by taxpayers with an aggregate annual turnover exceeding ₹5 crores, along with GSTR-9.

- Form MSME-1: For companies receiving goods or services from micro and small enterprises, where payments exceed 45 days. This form is filed half-yearly.

- CSR Reporting: Companies meeting specific net worth, turnover, or net profit criteria are required to furnish a report on CSR activities as an addendum to Form AOC-4.

Form INC-20A (Commencement of Business): Declaration of commencement of business activities within 180 days of incorporation of the company.

Documents and Provisions

Each compliance requirement comes with specific documentation needs and legal provisions. For instance:

- Form MBP-1 for the disclosure of interest by directors should be handled annually and at every new appointment.

- Compliance with Section 139 of the Companies Act, 2013 for auditor appointments ensures legality and adherence to corporate governance standards.

Conclusion

Adhering to a structured compliance calendar helps in mitigating risks associated with non-compliance. This guide serves as a roadmap to help your business navigate through the maze of statutory requirements efficiently.

By leveraging a compliance calendar and following these tips, you can transform compliance from a burden into a manageable process. Remember, staying compliant protects your business, saves you money, and allows you to focus on growth and success. So, take control, conquer compliance, and make 2025 your year of regulatory mastery!

Union Budget 2025 – Startups, Investors & GIFT IFSC

Budget 2025: Key Highlights and Analysis

The Union Budget 2025 presents a reform-driven and growth-focused vision for India’s economic trajectory, aligning with the government’s long-term goal of Viksit Bharat 2047. With a strong emphasis on fiscal prudence, policy continuity, and structural transformation, the budget outlines measures to accelerate infrastructure growth, economic stability, and private sector participation.

India remains one of the fastest-growing major economies, with a real GDP growth forecast of 6.4% for FY 2025 and a fiscal deficit target of 4.4% for FY 2026. The budget’s total expenditure stands at ₹50.65 lakh crore, reflecting a 14% increase, largely focused on investment-led growth.

The government reiterates its commitment to inclusive development for GYAN, centering its initiatives around Garib (poor), Yuva (youth), Annadata (farmers), and Nari (women). The budget also prioritizes MSMEs, exports, energy security, and employment generation, ensuring long-term economic resilience.

Budget 2025 – Key Growth Drivers

The Union Budget 2025 is structured around six core reform domains:

- Taxation – Simplified tax policies to enhance compliance.

- Power Sector – Boosting clean energy investments.

- Urban Development – Expanding infrastructure.

- Mining – Strategic development of natural resources.

- Financial Sector – Policy predictability and economic stability.

- Regulatory Reforms – Improving ease of doing business.

Additionally, the budget introduces sector-specific funds, regulatory overhauls, and incentives for startups and MSMEs to drive innovation and economic growth.

Key Policy Announcements in Budget 2025

The Union Budget 2025 highlights several major reforms and policy announcements:

1. Introduction of a New Income Tax Bill

A new Income Tax Bill will be introduced to modernize and simplify India’s tax laws, promoting efficiency and predictability in the tax regime.

2. Startup and MSME Incentives

- ₹10,000 crore Fund of Funds to support startups.

- Deep Tech Fund of Funds for next-gen technology startups.

- MSME classification limits revised for investment and turnover, expanding opportunities for small businesses.

- National Manufacturing Mission to enhance ease of business, support a future-ready workforce, and drive clean tech manufacturing.

3. Investment and Business-Friendly Policies

- FDI in the insurance sector increased to 100% (from 74%).

- Fast-track merger procedures streamlined to boost corporate consolidation.

- Investor Friendliness Index to be launched for states in 2025.

4. Financial Sector and Compliance Easing

- Rationalization of TDS & TCS provisions, including:

- Higher TDS exemption limits for various income categories.

- Removal of higher TDS/TCS for non-filers of ITR.

- TCS exemption threshold for overseas remittances increased from ₹7 lakh to ₹10 lakh.

- Simplified transfer pricing framework – 3-year ALP (Arm’s Length Price) assessment period to reduce litigation.

- Introduction of a revamped Central KYC registry in 2025.

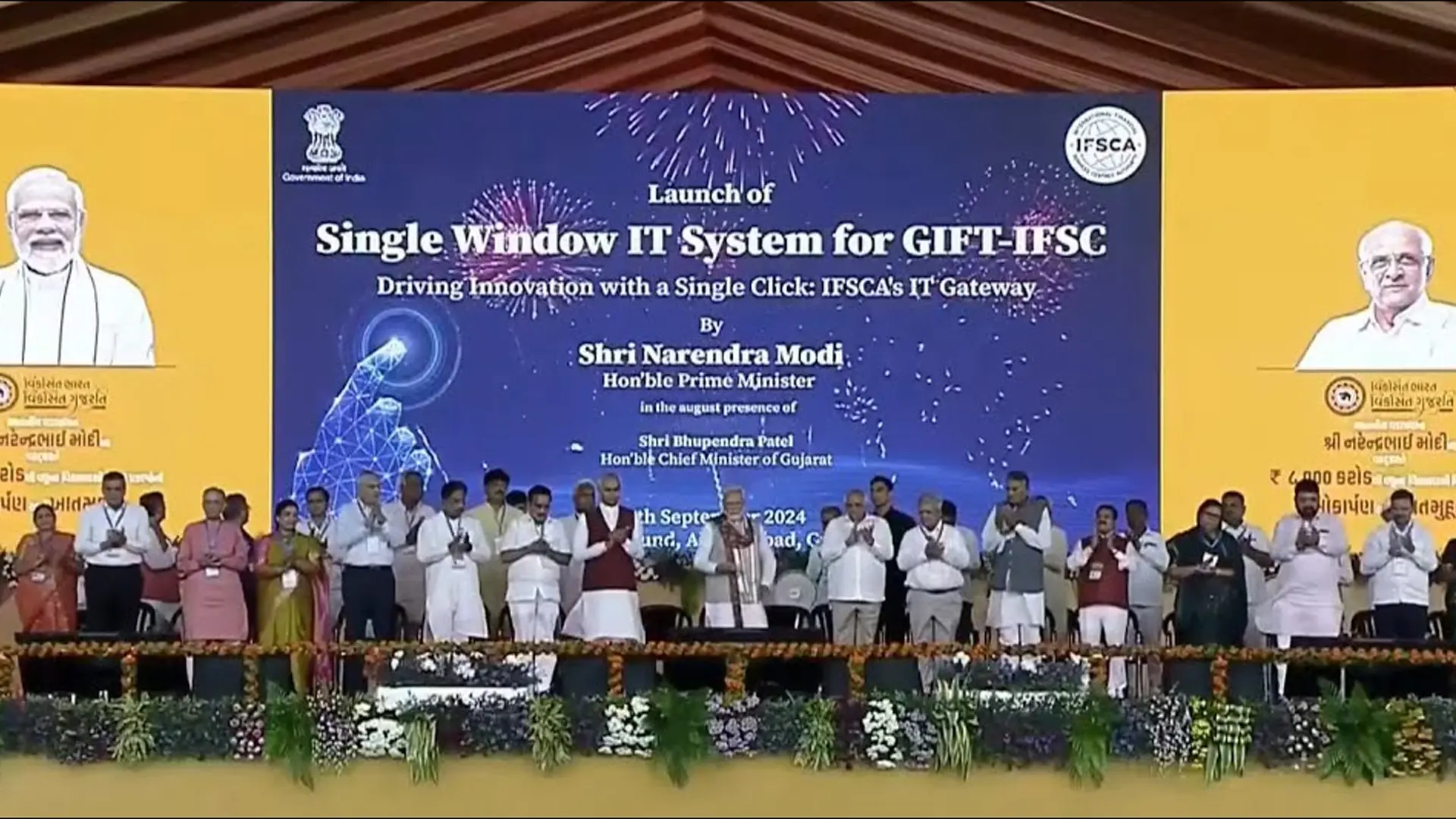

5. Boosting Investments through GIFT IFSC

- Enhanced tax benefits for offshore funds relocating to GIFT IFSC.

- Exemption on capital gains and dividends for ship leasing units in IFSC, aligning it with aircraft leasing benefits.

- Simplification of fund manager compliance rules, making GIFT IFSC a more attractive financial hub.

Decoding Tax Reforms in Budget 2025

I. Startups and Other Businesses

Budget 2025 brings notable tax reforms aimed at boosting the startup ecosystem and improving business ease. Key highlights include:

- Extension of Startup Tax Holiday: The 100% tax deduction under Section 80-IAC has been extended till March 31, 2030, supporting early-stage startups. However, the low utilization rate of this benefit (only ~2.36% of DPIIT-registered startups) signals a need for further streamlining.

- Restrictions on Loss Carry Forward in Amalgamations: Startups and businesses undergoing mergers will now be restricted from indefinitely carrying forward losses, ensuring tax compliance and preventing evergreening of losses.

- Rationalization of TCS on LRS & Tour Bookings: The TCS threshold under the Liberalized Remittance Scheme (LRS) has been increased from ₹7 lakh to ₹10 lakh, easing overseas transactions for businesses and individuals.

- Higher TDS Thresholds to Improve Compliance: Businesses benefit from higher TDS applicability limits across multiple categories, reducing compliance burdens. For instance, TDS on professional services and rent has been revised, making compliance more streamlined.

📌 Treelife Insight: While these changes improve compliance efficiency, the impact on startup liquidity and cash flow management will be key to watch.

II. AIFs and Other Investors

The Budget introduces critical reforms for Alternative Investment Funds (AIFs) and institutional investors, ensuring regulatory clarity and tax stability.

- Clarity on Tax Treatment of Securities Held by AIFs: Category I & II AIFs will have their securities classified as capital assets, ensuring uniform capital gains tax treatment rather than business income taxation.

- Removal of TCS on Sale of Goods (Including Securities): The 0.1% TCS on sales above ₹50 lakh has been abolished, significantly reducing tax compliance burdens for investment funds and capital market transactions.

- Reduced TDS on Securitization Trust Distributions: The TDS rate for residents receiving payments from securitization trusts has been slashed from 25%-30% to 10%, ensuring smoother fund flow within investment structures.

- Streamlined Tax Rate for FPIs & Specified Funds: Long-term capital gains (LTCG) tax for FPIs has been standardized at 12.5%, reducing disparities and bringing tax certainty.

📌 Treelife Insight: These reforms simplify fund structures and reduce compliance friction, making India’s investment ecosystem more competitive.

III. Personal Taxation

Personal taxation changes in Budget 2025 focus on increasing exemptions, easing compliance, and rationalizing TDS/TCS:

- Higher Basic Exemption & Rebate Under the New Tax Regime:

- Basic exemption limit raised to ₹4 lakh (from ₹3 lakh).

- Rebate under Section 87A increased to ₹12 lakh, reducing tax outgo for middle-income taxpayers.

- Crypto Asset Reporting Mandate: Section 285BAA introduces strict reporting requirements for cryptocurrency transactions, increasing transparency in digital asset taxation.

- Extension of Time Limit for Filing Updated Returns: Taxpayers now have up to 48 months (from 24 months) to file updated ITRs, subject to additional tax payments.

- Tax Deduction for NPS Vatsalya Scheme: A new deduction of ₹50,000 under Section 80CCD is introduced for contributions towards NPS for minors, encouraging long-term savings.

📌 Treelife Insight: While these changes offer tax relief for middle-income earners, the lack of direct income tax cuts may leave higher-income taxpayers wanting more.

IV. GIFT-IFSC

Budget 2025 strengthens GIFT City’s role as a global financial hub with extended tax incentives and new opportunities:

- Extension of Tax Exemptions Till 2030: Sunset clauses for tax benefits on aircraft leasing, ship leasing, and offshore banking units have been extended to March 31, 2030, boosting investor confidence.

- Leveling the Playing Field for Category III AIFs: Non-residents investing in offshore derivative instruments (ODIs) through Category III AIFs in GIFT IFSC will now enjoy tax exemptions, making GIFT City more attractive for international funds.

- Tax-Free Life Insurance Proceeds from IFSC Insurance Offices: Policies issued by IFSC insurers are now fully exempt from tax, driving more offshore participation in India’s insurance market.

- Simplified Fund Management in IFSC: Investment funds based in GIFT IFSC now have relaxed compliance thresholds, making India’s first International Financial Services Centre (IFSC) more competitive with global financial hubs.

📌 Treelife Insight: These reforms strengthen India’s global positioning in financial services, but long-term success will depend on ease of implementation and market response.

Conclusion

Budget 2025 introduces progressive tax reforms aimed at simplifying compliance, encouraging investment, and driving economic growth. With reforms as the fuel, inclusivity as the guiding spirit, and Viksit Bharat as the destination, the government reaffirms its commitment to policy stability and long-term transformation.

By reducing administrative burdens, improving tax certainty, and fostering a business-friendly environment, these reforms create a strong foundation for India’s evolving economic landscape. While some measures may require further refinements, the overall direction of Budget 2025 marks a positive shift towards a predictable, stable, and globally competitive tax regime.

With the new Income Tax Bill set to be unveiled soon, anticipation is high for further transformative reforms that will shape India’s tax landscape and its emergence as a global economic powerhouse.

Stock Appreciation Rights in India – Meaning & Working

Stock Appreciation Rights (“SARs”) offer a compelling form of employee compensation, allowing beneficiaries to enjoy an increase in the company’s valuation over time without the necessity to purchase or own actual shares. This predetermined timeframe for appreciation has seen SARs become increasingly popular in India as a viable alternative to traditional Employee Stock Option Plans (ESOPs). They offer flexibility to both employers and employees and are quickly gaining traction in the startup ecosystem. For example, employees at Jupiter (Amica Financial) experienced significant appreciation in their grants when the company’s valuation surged by 67% to INR 720 crores in 20201.

In this article, we break down what SARs are, how they work and what the key advantages are to offering this form of employee compensation, from the perspective of both employers and employees.

What are Stock Appreciation Rights (SARs)?

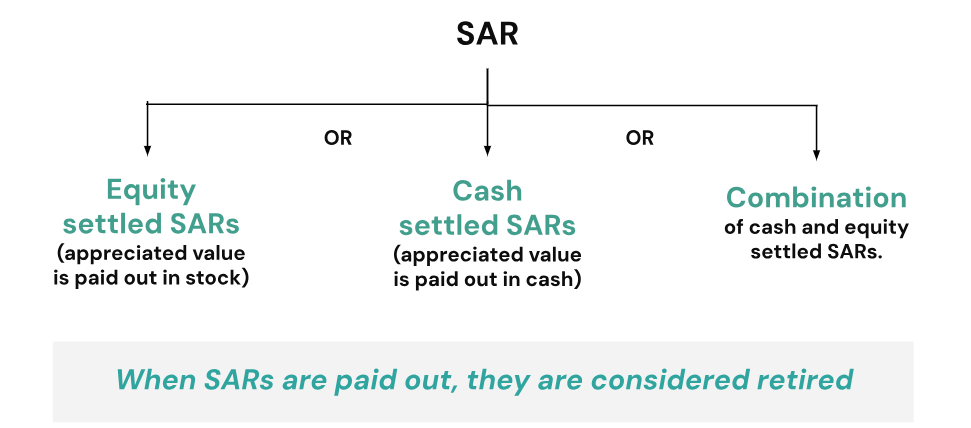

SARs are typically defined as the right to receive the benefit of increase/appreciation of the value of a company’s stock. This appreciation can be monetised by way of cash or stock and does not require the employee to invest their own money to purchase the stocks (as is the case with traditional ESOPs).

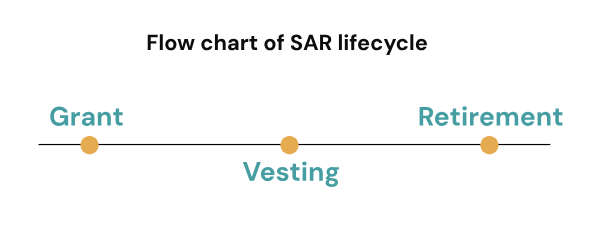

How are SARs issued?

SARs follow a lifecycle similar to that of ESOPs2, but differ in how these entitlements are earned. Unlike ESOPs, which require an employee to purchase the option and thereby exercise their right to the shares, SARs require no upfront payment from employees. Only the difference between the SAR price on the grant date and the market price on the settlement date will be paid out in cash, equity, or a combination of both. Once settled, SARs are considered retired.

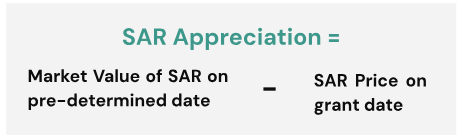

How do SARs work?

Stock Appreciation Rights (SARs) in India are a popular employee benefit that allows employees to gain from the appreciation in a company’s stock price without purchasing shares. The appreciation is calculated as the difference between the market value of the SAR on a predetermined date and its price on the grant date. This gain is typically settled in cash or equity, providing employees with financial incentives tied to the company’s growth. SARs offer a tax-efficient and flexible alternative to stock options, making them an attractive tool for employee retention and motivation in India’s corporate landscape.

Illustration of Stock Appreciation Rights Working

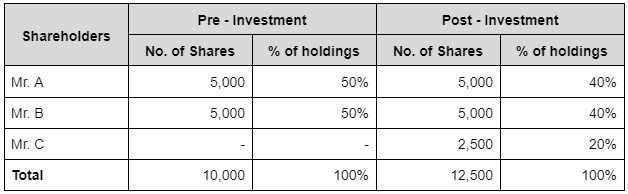

Company A grants 100 SARs to an employee. The SAR Price is fixed at INR 10/- per SAR. The SARs will evenly vest over the next 4 years. The table below shows how the appreciation will be computed. This breakdown will be subject to change depending on how the company decides to settle these SARs – i.e., as Cash Settled SAR or Equity Settled SAR or a combination of both.

| No. | Particulars | End of Year 1 | End of Year 2 | End of Year 3 | End of Year 4 |

| 1 | SAR Price (each; in INR) | 10 | 10 | 10 | 10 |

| 2 | Vested SARs (in nos.) | 25 | 50 | 75 | 100 |

| 3 | % of Vested SARs | 25% | 50% | 75% | 100% |

| 4 | Market Value per SAR(in INR) | 100 | 200 | 300 | 400 |

| 5 | Appreciation per SAR[No. 4 – No. 1] (in INR) | 90 | 190 | 290 | 390 |

| 6 | If Cash Settled SAR[No. 2 * No. 5] (in INR) | 2,250 | 9,500 | 21,750 | 39,000 |

| 7 | If Equity Settled SAR[No. 6/No. 4] (in nos.)* | 23 | 48 | 73 | 98 |

Notes:

- * Numbers are rounded up to prevent fractional computation.

- The amounts and number of shares in rows 6 and 7 above indicate the money/equity to be received by the employee based on the vesting schedule that vests 25% each year for 4 years. Combination of Cash Settled SAR and Equity Settled SAR will result in change to rows 6 and 7 appropriately, basis the relevant % to be applied.

Legal Background of SAR in India

It is pertinent to note that companies that are listed on a recognised stock exchange are subject to certain regulations prescribed from time to time by the Securities and Exchange Board of India (‘SEBI’). While their formation and key foundational principles are contained within the framework of the Companies Act, 2013 (‘CA 2013’), public listed entities are predominantly governed by SEBI regulations issued from time to time. However, only the CA 2013 is applicable to private companies and the provisions of the act read with the rules formulated thereunder, do not explicitly address SARs, leading to uncertainty in the legal framework governing the adoption of employee equity-linked reward schemes by private companies that are alternatives to the traditional ESOP scheme.

SARs issued by Public Listed Companies

SAR is legally defined in the Securities and Exchange Board of India (Share Based Employee Benefits and Sweat Equity) Regulations, 2021 (“SBEB Regulations”), to mean:

“a right given to a SAR grantee entitling him to receive appreciation for a specified number of shares of the company where the settlement of such appreciation may be made by way of cash payment or shares of the company.

Explanation 1 – A SAR settled by way of issue of shares of the company shall be referred to as equity settled SAR.

Explanation 2 – For the purpose of these regulations, any reference to stock appreciation right or SAR shall mean equity settled SARs and does not include any scheme which does not, directly or indirectly, involve dealing in or subscribing to or purchasing, securities of the company.3”

The SBEB Regulations also define “appreciation” to mean “the difference between the market price4 of the share of a company on the date of exercise5 of SAR or the date of vesting of SAR, as the case may be, and the SAR price.6”

The grant of SAR under a scheme by a public company is further governed by Part C of the SBEB Regulations, which impose inter alia, the following restrictions on issuing SARs as employee benefit:

- Cash Settled or Equity Settled SAR: Companies are free to implement cash settled or equity settled SAR schemes. It is notable that where the settlement results in fractional shares, such fractional shares should be settled in cash.

- Disclosures to Grantees: Every SAR grantee is required to be given a disclosure document from the company, including a statement of risks, information about the company and salient features of the scheme.

- Vesting: SARs have a minimum vesting period of 1 year which shall only be inapplicable in the event of death or permanent incapacitation of a grantee.

- Restrictions on Rights: SAR holders will not be entitled to receive dividend or vote or otherwise enjoy the benefits a shareholders would have. These SARs cannot be transferred and are often subject to further conditions through the articles of association of the company. However the SAR grantee will be entitled to all information disseminated to shareholders by the company.

SEBI has in response to requests from Mindtree Limited, Saregama India Limited and JSW Steel Limited previously clarified that the SBEB Regulations are not applicable to Cash Settled SAR schemes7. Further, by virtue of their identity as publicly traded companies, the regulations prescribed by the Securities and Exchange Board of India from time to time prescribe specific limitations on public listed companies that are not extended to private companies. Most critically, the definition of “market price” in the SBEB Regulations is linked to the price on the recognised stock exchange, whereas with private companies, fair market value is not a defined construct, and therefore the determination is often left to a valuation report obtained at the relevant point in time. It is also important to note that by virtue of express identification in the SBEB Regulations, the company is constrained to issue SARs in the manner permitted, leaving less room for flexibility of approach.

SARs issued by Private/Unlisted Companies

The SBEB Regulations and resultant compliances are only applicable to companies whose equity shares are listed on a recognised stock exchange in India. By contrast, the Companies Act, 2013 (“CA 2013”) which governs the operation of unlisted and private companies in India, does not include any provisions on SARs.

However, employee stock-linked compensation/incentive schemes are not completely excluded from the ambit of the CA 2013. Formulated thereunder, the Companies (Issue of Share Capital and Debentures) Rules, 2014 (“SCD Rules”) prescribe conditions within which a private company can issue ESOPs. This would require the following critical compliances to be completed by the employer/issuer company:

- Special Resolution: The ESOP scheme is approved by shareholders of the company by way of special resolution (including reporting to ROC thereunder). This is also required if any employees are being granted options during one year, that equals or exceeds 1% of the issued capital of the company at such time;

- Eligible Employees: The proposed grantee should be eligible employees in accordance with the criteria prescribed in explanation to Rule 12(1) of the SCD Rules.

- Disclosures to Shareholders: The Company makes the requisite disclosures in the explanatory statement to the notice of shareholders’ meeting to approve the scheme including on total number of stock options to be granted, how the eligibility criteria will be determined (beyond statutory mandates), the requirements of vesting and period thereof, exercise price or formula to arrive at the same; exercise period and process thereof, lock-in, etc.

- Minimum Vesting: 1 year period between grant and vesting of options is mandated by Rule 12(6)(a) of the SCD Rules.

- Restrictions on ESOP Holders: Until exercised, such option holders do not receive dividend or vote or enjoy benefits of shareholders. The options also cannot be transferred, pledged, mortgaged, or encumbered in any manner.

- Compliance by Company: The Company will be required to maintain a register of employee stock options in Form No. SH-6.

Pursuant to a reading of the CA 2013 with the SCD Rules, it is clear that there is no procedure prescribed for the grant and settlement of SARs by private companies. The provisions regarding ESOPs do not lend themselves to be extended for SARs and consequently, as a matter of good governance, it is recommended that private companies issuing SARs take the following considerations into account as good practice:

- Board Approval – The board of the company must approve the terms of the SARs being granted, including grant date, number of SARs, vesting schedule and SAR price.

- Shareholders Approval – Similar to how ESOPs require a special resolution, the shareholders of the company should also approve the issuance of the SAR scheme, and any variation of terms, provided that such variation is not prejudicial to the interests of the SAR holders.

- SAR Grantees – Given that the restrictions applicable to ESOP are not extended to SAR grantees, this leaves the benefit of SARs being extendable to third parties.

- Vesting – a legally mandated vesting period is not applicable for private limited companies; ergo, certain employees may be granted SARs upfront with no vesting requirement, while others may be required to earn the SARs in accordance with a vesting schedule.

- SAR Price – This can vary from grant to grant, and is subject to the price determined by the employer company.

- Retirement – This can be entirely subject to the SAR Scheme, and may thus be retired in such manner as may be prescribed in the Scheme.

- Administration – SARs need not be administered by the Compensation Committee of a board of directors, and may be administered directly by the board itself.

Practical Considerations

ESOPs create practical challenges for private companies as a result of the restrictions imposed by the CA 2013 and the SCD Rules. Consequently, issuance of SARs instead of ESOPs allows companies to circumvent these practical challenges. Some considerations that go into the issue of SARs are:

- Reduced Scope of Dilution: By virtue of settlement of SARs in cash, companies can avoid dilution of their shareholders’ stake in the company. Further, even where SARs are settled with corresponding equity stake, the dilution is only triggered when the shares are purchased by the employee.

- No Mandatory Financial Disclosures: The company need not provide the financial disclosures of the company (normally provided to shareholders) to SAR holders and this would remain true on the date of retirement of the SARs as the employees never actually become shareholders in the company.

- Exercise Price Eliminated: From the employee’s perspective, no purchase cost is incurred in reaping the benefits of the grant.

- Value of the Options: ESOPs can have no value in the absence of a buyer for the shares however with Cash Settled SARs in particular, the value is offered by the company itself.

- Cost to Company: In case of E quity Settled SARs, the company can, within the confines of applicable law, issue and allot shares to the employee and reduce the cost of settling the grants.

- Flexibility of Settlement: Companies can align incentives with their financial strategies and stakeholder interest. The choice of cash or equivalent shares to settle the SAR is a feature not found with ESOPs.

- Taxation: SARs typically incur perquisite tax for the employees under the “salaries” head, required to be deducted at source for employers. Equity Settled SARs typically incur this tax liability on the exercise date whereas Cash Settled SARs incur tax on date of cash payment.

| 💡 #TreelifeInsight Cash Settled SARs are viewed as cash bonus plans for employees. The offeree can benefit from the appreciation of equity but they are not representative of actual equity shares and where Cash Settled SARs are issued, the employees never actually become shareholders in the company. However, the ultimate objective of value and appreciation of share ownership being given to employees continues to be met, making this an attractive consideration for companies looking to reward their employees. From a legal and regulatory space, it is advisable that startups looking to grant SARs to their employees align themselves with the SCD Rules and the SBEB Regulations as a best practice guide, to ensure that the lack of explicit regulation for SARs issued by private companies does not create scope of contravention of law. |

Concluding Thoughts

Stock Appreciation Rights have emerged as a versatile and attractive compensation tool in India, offering both flexibility and value to employers and employees. By enabling employees to benefit from the appreciation in a company’s valuation without requiring upfront investment, SARs provide a compelling alternative to traditional ESOPs. The ability to settle SARs in cash, equity, or a combination of both ensures alignment with a company’s financial strategy and employee retention goals.

For public companies, SARs are governed by the SEBI regulations, ensuring structured implementation. However, for private companies, the absence of explicit regulation under the Companies Act, 2013, creates both flexibility and challenges. Startups can leverage SARs as a cost-effective way to reward employees while mitigating shareholder dilution and administrative burdens typically associated with ESOPs.

Ultimately, SARs strike a balance between incentivizing employees and maintaining operational agility, making them an indispensable part of the evolving startup ecosystem in India. By adhering to best practices and aligning with regulatory frameworks, companies can effectively use SARs to foster growth, innovation, and employee satisfaction.

References:

- [1] https://entrackr.com/2020/06/exclusive-jitendra-gupta-jupiter-valuation-rs-720-cr/

↩︎ - [2] To learn more about this, check out our #TreelifeInsights article on Understanding ESOPs in India (including the process flow, tax implications, exercise price and benefits), here: https://treelife.in/taxation/understanding-esops-in-india/

↩︎ - [3] Regulation 2(qq), SBEB Regulations.

↩︎ - [4] “Market Price” is defined in Regulation 2(x) of the SBEB Regulations, to mean “the latest available closing price on a recognised stock exchange on which the shares of the company are listed on the date immediately prior to the relevant date.

Explanation – If such shares are listed on more than one recognised stock exchange, then the closing price on the recognised stock exchange having higher trading volume shall be considered as the market price.”

↩︎ - [5] “Exercise” is defined in Regulation 2(l) of the SBEB Regulations, to mean “making of an application by an employee to the company or to the trust for issue of shares or appreciation in the form of cash, as the case may be, against vested options or vested SARs in pursuance of the schemes covered under Part A or Part C of Chapter III of these regulations, as the case may be;”.

↩︎ - [6] “SAR Price” is defined in Regulation 2(kk) of the SBEB Regulations, to mean “the base price defined on the grant date of SAR for the purpose of computing appreciation;”.

↩︎ - [7] https://www.mondaq.com/india/directors-and-officers/983918/an-analysis-of-stock-appreciation-rights-in-india

↩︎

Resident Individuals to open Foreign Currency bank Accounts (FCA) with IBUs in IFSCs

IFSCA vide circular dated 11 July 2024, allowed Resident Individuals to open Foreign Currency bank Accounts (FCA) with IBUs in IFSCs for all permitted capital and current account transactions. Further to the same, owing to operational challenges IBUs were unable to open FCA for Resident Individuals.

Accordingly, in order to provide guidelines to IBUs for opening and maintaining FCAs for Resident Individuals, IFSCA issued a circular on 10 October 2024 providing certain clarifications.

However, IFSCA has now issued an updated circular on 13 December 2024 superseding the earlier circular providing following key guidelines / clarifications:

1) Resident individuals are permitted to deposit unutilized funds from their FCAs in Fixed Deposits, provided the tenure of such deposits does not exceed 180 days.

2) Resident individuals are allowed to remit funds directly into their FCAs from locations other than onshore India provided that such remittance represents funds duly remitted earlier under LRS or income earned on the investments made from funds duly remitted earlier under LRS.

3) IBUs are also encouraged to facilitate the opening of FCAs digitally through internet and mobile banking platforms, ensuring a smoother customer experience.

These updates provide much-needed operational clarity for IBUs, ensuring smoother processes for FCA opening for resident individuals while aligning with IFSCA’s regulations and facilitating greater flexibility.

Reach out to us at dhairya.c@treelife.in for a discussion.

Understanding the Draft Digital Personal Data Protection Rules, 2025

On January 3, 2025, the Union Government released the draft Digital Personal Data Protection Rules, 2025 1 (“Draft Rules”). Formulated under the Digital Personal Data Protection Act, 2023 (“DPDP Act”), the Draft Rules have been published for public consultation, with objections and suggestions on the same to be provided to the Ministry of Electronics and Information Technology by February 18, 2025. Formulated to further safeguard citizens’ rights to protect their personal data, the Draft Rules seek to operationalize the DPDP Act, furthering India’s commitment to create a robust framework to protect digital personal data.

In this blog, we break down the key provisions of the Draft Rules having regard to their background in the DPDP Act, and highlight certain challenges found in the draft legislation.

Background: the DPDP Act, 2023

The DPDP Act was a revolutionary step towards India’s adoption of a robust data protection regime. This legislation marks the first comprehensive law dedicated to the protection of personal data and received presidential assent on August 11, 2023. However, the Act itself is yet to be notified for enforcement and the implementation is expected in a phased manner. To understand the impact of the Draft Rules2, it is crucial to first understand the key terms and legal framework introduced by the DPDP Act.

A. Key Terms:

- Board: the Data Protection Board of India established by the Central Government.

- Consent Manager: a person registered with the Board who acts as a single point of contact to enable a Data Principal to give, manage, review, and withdraw consent through an accessible, transparent and interoperable platform.

- Data Fiduciary: any person who alone or in conjunction with other persons determines the purpose and means of processing personal data.

- Data Principal: the individual to whom the personal data relates. The ambit of this definition is expanded where the Data Principal is: (i) a child, to include their parents and/or lawful guardian; and (ii) a person with disability, to include their lawful guardian.

- Data Processor: person processing personal data on behalf of a Data Fiduciary.

- Personal Data: any data about an individual who can be identified by or in relation to such data.

- Processing: (in relation to personal data) wholly or partly automated operation(s) performed on digital personal data. Includes collection, recording, organisation, structuring, storage, adaptation, retrieval, use, alignment or combination, indexing, sharing, disclosure by transmission, dissemination or otherwise making available, restriction, erasure or destruction.

B. Legal Framework:

- Scope and Applicability: Applies to the processing of personal data within India and to entities outside India offering goods/services to individuals in India. Covers personal data collected in digital form or data that is digitized after collection and excludes personal data processed for a personal or domestic purpose and data made publicly available by the Data Principal.

- Data Processing: Statutory requirement for clear, informed and unambiguous consent from Data Principals including a notice of rights. Certain scenarios (such as compliance with legal obligations or during emergencies) allow data processing without explicit consent – i.e., for a legitimate purpose3.

- Data Principals: Given rights that include access to information, correction and erasure of data, grievance redressal, and the ability to nominate representatives for exercising rights in case of incapacity or death.

- Data Fiduciaries: Obligated to implement data protection measures, establish grievance redressal mechanisms, and ensure data security. Significant Data Fiduciaries4 are required to additionally conduct Data Protection Impact Assessments (DPIAs), and appoint Data Protection Officer and an independent data auditor evaluating compliance with the DPDP Act.

- Cross-Border Data Transfer: In a departure from the earlier regime requiring data localisation, the DPDP Act permits cross-border transfer of data unless explicitly restricted by the Indian government.

- Organisational Impact: Organizations must assess and enhance their data protection frameworks to comply with the DPDPA. Key steps include appointing Data Protection Officers (for significant data fiduciaries), implementing robust security measures, establishing clear data processing agreements, and ensuring mechanisms for data principals to exercise their rights.

- Penalties: Monetary penalty can be imposed by the Board based on the circumstances of the breach and the resultant impact (including whether any gain/loss has been realised/avoided by a person).

Enabling Mechanisms: the DPDP Rules, 2025

Under Section 40 of the DPDP Act, the Central Government is empowered to formulate rules to enable the implementation of the Act. Pursuant to this, the Draft Rules seek to provide guidance on compliance, operational aspects, administration and enforcement of the DPDP Act. The Draft Rules are to come into force upon publication however, certain critical provisions will only become effective at a later date5.

Key Provisions:

- Notice Requirements for Data Fiduciaries: The notice for consent required to be provided to the Data Principal should be clear, standalone, simple and understandable. Most crucially, the Draft Rules specify that the notice should include an itemized list of personal data being collected and a clear description of the goods/services/uses which are enabled by such data processing. The Data Principal should also be informed of the manner in which they can withdraw their consent, exercise their rights and file complaints. Data Fiduciaries should provide a communication link and describe applicable methods that will enable the Data Principal to withdraw their consent or file complaints with the Board.

- Consent Managers: Strict eligibility criteria have been prescribed for persons who can be appointed as Consent Managers – this must be an India-incorporated company with sound financial and operational capacity, with a minimum net worth of INR 2,00,00,000, a reputation for fairness and integrity and certified interoperable platform enabling Data Principals to manage their consent. These Consent Managers must uphold high standards of transparency, security and fiduciary responsibility and are additionally required to be registered with the Board and act as a single point of contact for Data Principals. Any transfer of control of such entities will require the prior approval of the Board.

- Data Processing by the State: The government can process personal data to provide subsidies, benefits, certificates, services, licenses or permits. However such processing must comply with the standards prescribed in the Draft Rules6 and the handling of personal data is lawful, transparent and secure.

- Reasonable Security Safeguards: The Draft Rules call for the implementation of ‘reasonable security measures’ by Data Fiduciaries to protect personal data. This includes encryption of data, access control, monitoring of access (particularly for unauthorised access), backup of data, etc. The safeguards should also include provisions to detect and address breach of data, maintenance of logs, and ensure that appropriate safety measures are built into any contracts with Data Processors.

- Data Breach Notification: Data Fiduciaries are required to promptly notify all affected Data Principals in the event of a breach. This notification shall include a clear explanation of the breach, the nature, extent, timing, potential consequences, mitigation measures and safety recommendations to safeguard the data. The Board is also required to be informed of such breach (including a description of the breach, nature, extent, timing, location and likely impact) within 72 hours of the Data Fiduciary being aware. Longer intimation timelines may be permitted upon request.

- Accountability and Compliance: Grievance redressal mechanisms are mandated to be published on Data Fiduciary’s platforms and the obligation is borne by such persons to ensure lawful processing of personal data. Processing is required to be limited to ‘necessary purposes’ and the data is only permitted to be retained for ‘as long as needed’.

- Data Retention by E-Commerce Entities and Online Gaming and Social Media Intermediaries: The Draft Rules require the deletion of user data after 3 years7 by: (i) e-commerce entities having minimum 2,00,00,000 registered users in India; (ii) online gaming intermediaries having minimum 50,00,000 registered users in India; and (iii) social media intermediaries having minimum 2,00,00,000 registered users in India.

- Consent for Children and Persons with Disabilities: The DPDP Act and Draft Rules envisage greater protection of personal data of children and persons with disabilities. Verifiable consent must be obtained from parents or legal guardians in accordance with the requirements set out in the Draft Rules. Critically, a Data Fiduciary is required to implement measures to ensure that the person providing consent on behalf of a child/person with disabilities is in fact, that child/person’s parent or legal guardian, who is identifiable. The Data Fiduciary is further required to verify that the parent is an adult by using reliable identity details or virtual tokens mapped to such details.

- Impact Assessment: Predominantly an obligation on Significant Data Fiduciaries, the Draft Rules impose a mandate to conduct yearly DPIAs to evaluate the risks associated with the data processing activities. This requires observance of due diligence to verify the algorithmic software8 to ensure there is no risk to the rights of Data Principals.

- Data Transfer Outside India: Discretion is left to the Central Government to set any requirements in respect of making personal data available to a foreign state or its entities. Data Fiduciaries processing data within India or in connection with goods or services offered to Data Principals from outside India must comply with these requirements as may be prescribed from time to time.

- Exemptions: The Draft Rules prescribe exemptions from the applicability of the DPDP Act for processing of personal data carried out: (i) for research, archival or statistical purposes, subject to compliance with the standards set out in Schedule II of the Draft Rules9; and (ii) by healthcare professionals, educational institutions, creche or day care facilities and their transporters, subject to compliance with conditions set out in Schedule IV of the Draft Rules.

- Enforcement: Including establishment of the regulatory authority (i.e., the Board), appointment of its chairperson, members, etc. and the appellate framework for decisions of the Board, the Draft Rules prescribe the mechanism for enforcement of the DPDP Act, including redressal of grievances and any consequent penalties imposed for contraventions of the law.

Implications of the Draft Rules