India’s taxation framework for Virtual Digital Assets (VDAs), introduced via the Finance Act, 2022, imposes a flat 30% tax on gains from VDAs like cryptocurrencies and NFTs, with limited deductions and no loss set-off. A 1% Tax Deducted at Source (TDS) applies to transactions above specified thresholds, with Indian exchanges handling TDS. Resident Indians are taxed on global VDA gains, while Non-Resident Indians (NRIs) face similar taxation for Indian exchanges but may have exemptions for offshore transactions. Special provisions exist for cryptocurrency mining and crypto-to-crypto transactions, while Bitcoin ETFs offer potential tax advantages. Investors must comply with new Income Tax Return (ITR) reporting requirements and may explore strategies like timing transactions or using alternative investment vehicles for tax efficiency.

Introduction

Virtual Digital Assets (VDAs) have emerged as a significant investment avenue in India, with cryptocurrencies, non-fungible tokens (NFTs), and other digital assets gaining substantial traction among investors. To regulate this burgeoning sector, the Indian government introduced a comprehensive taxation framework through the Finance Act, 2022, which came into effect from April 1, 2022. With India’s growing adoption of cryptocurrencies, NFTs, and tokens, it’s critical for investors and traders to understand how these Virtual Digital Assets (VDAs) are taxed and reported. Since FY 2022-23, the Income Tax Department has rolled out strict guidelines, leaving no room for guesswork. This blog provides an in-depth analysis of the taxation provisions applicable to VDAs in India, examining various investor scenarios based on residency status and investment platforms.

Understanding Virtual Digital Assets (VDAs)

Definition and Scope

The Finance Act, 2022 introduced Section 2(47A) to the Income Tax Act, 1961, which defines VDAs broadly to include:

- Any information, code, number, or token (not being Indian or foreign currency) generated through cryptographic means or otherwise, providing a digital representation of value

- Non-fungible tokens (NFTs) or any other token of similar nature

- Any other digital asset notified by the Central Government

This expansive definition encompasses cryptocurrencies like Bitcoin and Ethereum, NFTs, and potentially other digital tokens that may emerge in the future. The government has also explicitly excluded certain items from the VDA definition, including gift cards, vouchers, reward points, and airline miles.

Types of VDAs Covered

The Indian taxation regime for VDAs applies to:

- Cryptocurrencies: Including Bitcoin, Ethereum, Litecoin, Dogecoin, Ripple, Matic, etc.

- Non-Fungible Tokens (NFTs): Digital assets representing ownership of unique items

- Other Digital Tokens: Any token that provides a digital representation of value

However, where an NFT involves the transfer of an underlying tangible property, such NFTs are excluded from the scope of VDAs.

General Taxation Framework for VDAs

Income Tax Provisions

Section 115BBH of the Income Tax Act imposes a flat 30% tax on income derived from the transfer of VDAs, effective from April 1, 2022. Key aspects of this provision include:

- Tax Rate: A flat 30% tax (plus applicable surcharge and cess) on gains from the transfer of VDAs

- Limited Deductions: No deduction is allowed for any expenditure or allowance except for the cost of acquisition.

- No Set-Off of Losses: Losses arising from the transfer of VDAs cannot be set off against any other income, nor can they be carried forward to subsequent assessment years.

- Individual Asset Class: Each VDA is considered a separate asset class, meaning losses from one VDA cannot offset gains from another VDA.

Tax on VDAs – Section 115BBH

| Tax Treatment | Details |

| Tax Rate | Flat 30% on gains from VDAs |

| Deductions | Only cost of acquisition allowed (No deduction for gas fees, brokerage, etc.) |

| Losses | Cannot be set off or carried forward |

| Effective From | FY 2022–23 (AY 2023–24 onwards) |

Tax Deducted at Source (TDS) Provisions

Section 194S, introduced by the Finance Act, 2022 and effective from July 1, 2022, requires a 1% TDS on the transfer value of VDAs above specified thresholds:

- TDS Rate: 1% of the transaction value

- Threshold Limits:

- Rs. 50,000 during a financial year for specified persons (individuals/HUFs not subject to tax audit)

- Rs. 10,000 during a financial year for other persons.

- TDS Collection Method: For transactions through Indian exchanges, the exchange is responsible for deducting TDS.

- Application to In-Kind Payments: TDS applies even when consideration is paid in another VDA, with the acquirer responsible for TDS.

If the deductee fails to provide a PAN, TDS is deducted at a higher rate of 20%.

eg. If you’ve bought or sold crypto above certain thresholds, TDS at 1% kicks in:

| Threshold | Who is Liable? | TDS Required? |

| INR 50,000/year | Individuals or HUFs with business turnover > INR 1 Cr or professional receipts > INR 50L | Yes |

| INR 10,000/year | All other users | Yes |

- Indian Exchanges auto-deduct TDS.

- On foreign exchanges, you must deduct and deposit TDS.

Tip: Check Form 26AS or AIS to confirm TDS has been credited properly.

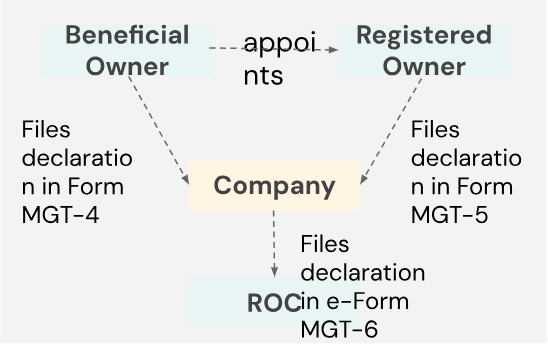

Gift Tax Implications

The Finance Act, 2022 also amended Section 56(2)(x) to include VDAs within the definition of “property.” Consequently, receiving VDAs as a gift valued above Rs. 50,000 can trigger tax implications for the recipient.

Resident Indian Investors: Taxation Scenarios

Investment Through Indian Exchanges

For resident Indians investing in VDAs through Indian cryptocurrency exchanges, the taxation framework operates as follows:

Income Tax: Gains from the transfer of VDAs are taxed at a flat rate of 30% (plus applicable surcharge and cess). Only the cost of acquisition can be deducted when calculating gains.

TDS Mechanism: The Indian exchange is responsible for deducting 1% TDS on each sale transaction. This applies to both cryptocurrency-to-fiat and cryptocurrency-to-cryptocurrency transactions.

Reporting Requirements: From the financial year 2023-2024, Income Tax Return (ITR) forms include a separate section called “Schedule – Virtual Digital Assets” for reporting any gains from VDAs.

Investment Through Foreign Exchanges

When resident Indians invest in VDAs through foreign exchanges, additional complexities arise:

TDS Applicability: Section 194S applies only when purchasing VDAs from an Indian tax resident. When trading on international exchanges, the TDS requirements may be different:

- For direct crypto purchases on foreign exchanges, no TDS under Section 194S may apply if the seller is not an Indian resident.

- For P2P transactions on international platforms where the counterparty is an Indian resident, the buyer needs to collect the PAN from each seller and file a TDS return.

Income Tax Liability: Despite potential TDS exemptions, resident Indians are taxable on their global income, including gains from VDAs purchased on foreign exchanges. The 30% tax rate applies regardless of where the transaction occurs.

Need help with Taxation of VDAs Let’s Talk

Non-Resident Indian (NRI) Investors: Taxation Scenarios

NRIs Investing Through Indian Exchanges

For NRIs investing in VDAs through Indian exchanges, the tax implications are as follows:

Applicability of Section 115BBH: The VDA taxation provisions do not distinguish between tax residents and non-residents. Therefore, NRIs are subject to the same 30% tax rate on gains from VDAs acquired through Indian exchanges.

TDS Provisions: The 1% TDS under Section 194S applies to transactions with Indian residents. For NRIs, this would apply when they sell VDAs on Indian exchanges.

DTAA Benefits: Non-residents who are residents of countries with which India has signed a Double Taxation Avoidance Agreement (DTAA) may have the option to be taxed as per the DTAA or the Income Tax Act, whichever is more beneficial. However, most DTAAs do not have specific provisions for VDAs, creating potential ambiguities in interpretation.

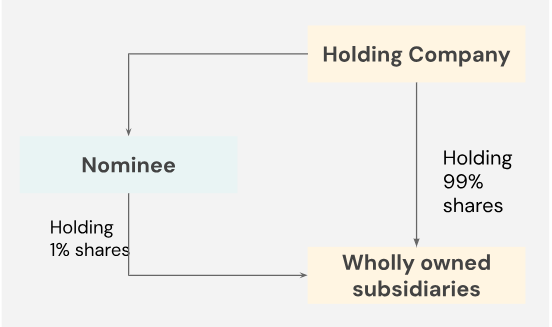

NRIs Investing Through Foreign Exchanges

For NRIs investing in VDAs through foreign exchanges, the tax implications depend on the location of the transaction and the source of income:

Offshore Transactions: If an NRI transfers VDAs on exchanges located outside India, from VDA wallets located outside India, and the proceeds are received in bank accounts outside India, such gains may not be taxable in India. This is because the income neither accrues nor arises in India.

Source-Based Taxation: Non-residents are taxed in India on income deemed to accrue or arise in India. The determination of whether income from VDAs accrues in India depends on the situs (location) of the VDA.

As per judicial precedents, the situs of an intangible asset like a VDA owned by a non-resident may be considered to be outside India based on the principle of ‘mobilia sequuntur personam,’ which states that the situs of the owner of an intangible asset would be the closest approximation of the situs of the intangible asset itself.

However, if the VDA transactions occur on an Indian exchange or if the VDAs are issued by an Indian issuer, it becomes difficult to claim that the income does not accrue or arise in India.

Special Considerations for Specific VDA Investments

Cryptocurrency Mining

For individuals engaged in cryptocurrency mining in India, the following tax implications apply:

Taxation of Mining Rewards: Mining income received is taxed at the flat 30% rate under Section 115BBH.

Cost of Acquisition: The cost of acquisition for mined cryptocurrencies is considered “Zero” for computing gains at the time of sale.

Infrastructure Expenses: No expenses such as electricity costs or infrastructure costs can be included in the cost of acquisition or deducted from mining income.

Crypto-to-Crypto Transactions

When exchanging one cryptocurrency for another, both parties may have tax implications:

TDS Obligations: A 1% TDS would be applicable on the transaction value. For example, if using 2000 Ethereum to buy Bitcoin worth the same value, 1% of the Ethereum’s INR value would be payable as TDS.

Capital Gains Calculation: Each exchange is considered a taxable event, requiring calculation of gains based on the INR value of the cryptocurrencies at the time of the transaction.

Bitcoin ETFs and Indirect Exposure

With the recent approval of spot Bitcoin ETFs in the United States, Indian investors now have alternative avenues for crypto exposure:

Investment Route: Indian investors can invest in US-listed Bitcoin ETFs through the Liberalized Remittance Scheme (LRS), which allows remittances up to $250,000 per financial year.

Tax Benefits: Investing in Bitcoin ETFs rather than direct cryptocurrency holdings may offer certain tax advantages:

- The 1% TDS on crypto transactions would not be applicable since no actual crypto is being purchased

- Capital gains tax would likely be lower than the 30% flat rate applicable to direct VDA holdings

LRS Considerations: A 20% Tax Collected at Source (TCS) may apply on deposits above Rs. 7 lakhs via LRS. Unlike TDS, this TCS can be used to offset other tax liabilities.

There is ongoing debate about whether Bitcoin ETF units might themselves be classified as VDAs under Indian tax law. However, based on current interpretations, such ETF units may not fall within the definition of VDAs as they don’t meet all the criteria specified in Section 2(47A).

Recent Regulatory Developments and Future Outlook

Recent Regulatory Developments

Several recent developments may impact the taxation of VDAs in India:

G20 Crypto Regulatory Framework: The G20 summit in September 2023 laid the groundwork for a comprehensive regulatory framework for crypto-assets, adopting the Crypto-Asset Reporting Framework (CARF) and amendments to the Common Reporting Standard (CRS).

Spot Bitcoin ETF Approval: The U.S. Securities and Exchange Commission’s approval of spot Bitcoin ETFs in January 2024 has created new investment avenues for Indian investors seeking exposure to crypto assets.

CBDT Clarifications: The Central Board of Direct Taxes has issued clarifications regarding the obligations of exchanges with respect to withholding tax under Section 194S and the mechanism for conversion of tax withheld in VDA to fiat currency.

New Income Tax Bill 2025

The proposed New Income Tax Bill 2025 may bring further changes to VDA taxation:

- Broader Definition: The bill proposes a broader definition of Virtual Digital Assets to encompass evolving digital assets

- Enhanced Compliance Mechanisms: New provisions for digital access during search operations, including access to virtual spaces, social media accounts, email servers, cloud storage, and trading accounts

- Undisclosed Income: The bill explicitly includes Virtual Digital Assets within the scope of undisclosed income

Future Outlook

The taxation framework for VDAs in India continues to evolve, with several potential developments on the horizon:

- Comprehensive Crypto Regulation: A dedicated regulatory framework for cryptocurrencies and other VDAs may emerge, potentially influencing the taxation approach

- DTAA Amendments: Future amendments to Double Taxation Avoidance Agreements may include specific provisions for VDAs, providing greater clarity for non-resident investors

- TDS Thresholds Revision: Recent budget proposals have revised thresholds for various TDS provisions, and similar revisions may be considered for Section 194S in the future

Practical Considerations for Investors

Tax Compliance and Reporting

Investors in VDAs should be aware of the following compliance requirements:

- ITR Filing: A dedicated schedule for VDAs is now included in Income Tax Return forms from FY 2023-24 onwards.

- TDS Compliance: For P2P transactions where TDS is applicable, Form 26QE must be submitted within 30 days from the end of the month when the deduction is made.

- Documentation: Maintaining proper records of all VDA transactions, including acquisition costs and transfer details, is essential for accurate tax reporting

Tax Planning Strategies

Given the strict tax provisions for VDAs, investors may consider the following strategies:

- Timing of Transactions: Since each VDA transaction is taxable, planning the timing of acquisitions and disposals can help manage tax liabilities

- Alternative Investment Vehicles: Investing in crypto ETFs or similar products may offer more favorable tax treatment compared to direct cryptocurrency holdings.

- Jurisdictional Considerations: For NRIs, understanding the interplay between Indian tax laws and tax treaties can help optimize tax outcomes.

How to Report VDAs in Your ITR?

What is Schedule VDA?

A new section in ITR forms introduced for declaring:

- Date of acquisition and sale

- Type of VDA (Crypto/NFT/etc.)

- Platform/Exchange used

- Cost and sale value

Which ITR Form Should You Use?

| Nature of Holding | ITR Form | Tax Head |

| Investment | ITR-2 | Capital Gains |

| Trading (Business income) | ITR-3 | Business & Profession |

Foreign VDAs & FEMA/Black Money Compliance

If you hold VDAs on foreign wallets or exchanges, you must report them in Schedule FA of your ITR.

Non-disclosure can trigger:

- Penalty under the Black Money Act

- FEMA scrutiny for violation of cross-border investment norms

- Declare all foreign crypto assets even if no transaction was made during the year.

Final Checklist for VDA Reporting

✔ Maintain detailed records of:

- Wallet IDs

- Dates of buy/sell

- Transaction values

- Cost of acquisition

✔ Match TDS entries in Form 26AS

✔ File accurate ITR (use ITR-2/ITR-3 as needed)

✔ Disclose foreign-held crypto in Schedule FA

✔ Consult a tax expert for complex transactions

Conclusion

The taxation framework for Virtual Digital Assets in India is comprehensive but stringent, imposing a flat 30% tax on gains with limited deductions and no loss set-off provisions. The tax implications vary significantly based on the investor’s residency status and the location of the exchange or platform used for transactions.

For resident Indians, all VDA gains are taxable at 30% regardless of where the transaction occurs, while NRIs may have limited exemptions for offshore transactions. The recent emergence of alternative investment vehicles like Bitcoin ETFs offers potential tax advantages compared to direct cryptocurrency holdings.

As the regulatory landscape continues to evolve, investors should stay informed about changes to tax provisions and compliance requirements. A thoughtful approach to VDA investments, considering both investment objectives and tax implications, can help navigate this complex but potentially rewarding asset class.