Author: Treelife

IIT-M start-up Planys Technologies raises ₹43 crore in round led by investor Ashish Kacholia

VitusCare Raises $2.7M in Series A Funding

Doctrine of Work for Hire

The doctrine of “work for hire” is a legal concept that determines the ownership of a copyrighted work when it is created in the context of an employment relationship or under a specific contractual arrangement. The purpose of this doctrine is to establish clarity regarding the rights and ownership of creative works, particularly when multiple parties are involved in the creation process.

Criteria for Work to Qualify as a “Work for Hire”

To qualify as a “work for hire,” certain criteria must be met, although the specifics may vary depending on the jurisdiction. Generally, the following elements are considered:

- Employee-Employer Relationship: In an employment scenario, the work created by an employee within the scope of their employment duties is automatically considered a “work for hire.” The employer is deemed the legal author and owner of the copyright.

- Commissioned Works: In some cases, a work may be commissioned from an independent contractor, such as a freelancer or consultant. For such works to be categorized as “works for hire,” there must be a written agreement explicitly stating that the work is a “work for hire” and that the commissioning party will be considered the legal owner of the copyright.

It is important to note that different jurisdictions may have variations in the specific requirements and definitions of a “work for hire.” Therefore, it is essential to consult the copyright laws of the relevant jurisdiction for a comprehensive understanding.

“Work for Hire” In The United Kingdom

In collaborative scenarios, where multiple parties contribute to the creation of a work, it becomes necessary to ascertain the ownership of the copyright. The terms of the collaboration agreement and the intentions of the parties involved play a crucial role in such cases.

The case of Creation Records Ltd v. News Group Newspapers Ltd [1997] EMLR 444 shed light on this issue. The court considered a situation where a photograph was taken by a photographer for a newspaper article. The court emphasized the importance of the contractual arrangements and the intention of the parties involved in determining the ownership of the copyright. The photographer, in this case, retained the copyright as the collaboration agreement did not clearly transfer it to the newspaper.

“Work for Hire” In The United States

In the United States, the concept of “work for hire” is extensively addressed under the Copyright Act of 1976. According to Section 101 of the Act, a work qualifies as a “work for hire” if it is:

Prepared by an Employee: The work must be created by an employee within the scope of their employment duties. In such cases, the employer is considered the legal author and owner of the copyright.

The landmark case of Community for Creative Non-Violence v. Reid (490 U.S. 730, 1989) explored the scope of an employment relationship and ownership of a work. The Supreme Court considered factors such as the control exerted by the employer, the provision of employee benefits, and the nature of the work to determine whether the work was a “work for hire.” The court ultimately ruled that the work in question did not meet the criteria for a “work for hire,” and the copyright ownership remained with the creator.

“Work for Hire” In India

In India, the concept of “work for hire” is not explicitly defined in copyright legislation. However, the Copyright Act, 1957, does provide provisions related to the ownership of copyright in works created in the course of employment. The case of Eastern Book Company v. D.B. Modak (2008) addressed the ownership of copyright in works created by employees. The court held that if an employee creates a work during the course of their employment and it falls within the scope of their duties, the employer will be considered the first owner of the copyright unless there is an agreement to the contrary.

When it comes to works created by freelancers or under contractual arrangements, the ownership of copyright is typically determined by the terms of the agreement between the parties involved. In the case of Indian Performing Right Society v. Eastern Indian Motion Pictures Association (2012), the court emphasized the importance of contractual arrangements and the intent of the parties involved in determining copyright ownership. The court ruled that the ownership of copyright rests with the party who commissions the work unless otherwise specified in the agreement.

Similarities and Differences between U.K., U.S., and Indian Approaches

The U.K., U.S., and India have different approaches to the “work for hire” doctrine. While all jurisdictions consider the employment relationship and written agreements as important factors, the specific criteria and legal provisions differ. The U.S. has a more detailed statutory framework for “works for hire,” while the U.K. and India rely on case law and contractual agreements to determine copyright ownership.

Emerging Trends and Future Outlook

- Evolving Nature of Employment Relationships: The nature of employment relationships is undergoing significant changes, driven by factors such as the gig economy, remote work, and freelance culture. These developments pose new challenges in applying the doctrine of “work for hire.” The line between employee and independent contractor can become blurred, making it more complex to determine copyright ownership. As the workforce becomes more flexible and diverse, legal frameworks may need to adapt to address these evolving employment relationships.

- Influence of Technology and Remote Work: Advancements in technology have transformed the creative industries, enabling collaboration and work across geographical boundaries. Remote work has become more prevalent, and creative projects often involve contributors from different locations. This raises questions about jurisdictional issues and the application of copyright laws in cross-border collaborations. Clear contractual agreements and international harmonization of copyright laws may be necessary to provide guidance and ensure fair treatment of creators.

Practical Considerations for Creators and Employers

- Clear Contractual Agreements: Creators and employers should prioritize clear and comprehensive contractual agreements that address the issue of copyright ownership explicitly. These agreements should clearly define the scope of work, the intended ownership of copyright, and any limitations or conditions related to its use, licensing, or transfer.

- Negotiating Fair Terms: Creators, especially freelancers and independent contractors, should be proactive in negotiating fair terms that protect their rights and interests. This may involve discussing ownership, compensation, attribution, moral rights, and the ability to use their work for self-promotion or future projects.

- Consultation with Legal Professionals: Seeking legal advice from professionals well-versed in copyright law is crucial, particularly when dealing with complex projects or cross-jurisdictional collaborations. Legal experts can provide guidance, ensure compliance with relevant laws, and help draft contracts that protect the rights of creators while meeting the needs of employers.

- Awareness of Jurisdictional Differences: When engaging in international collaborations, it is important to have a thorough understanding of the copyright laws and regulations in the relevant jurisdictions. Being aware of jurisdictional differences can help parties anticipate potential conflicts and take proactive measures to address them through appropriate contractual provisions.

- Regular Review and Updates: Contracts and agreements should be periodically reviewed and updated to reflect changes in circumstances, business relationships, or legal frameworks. Regularly revisiting contractual arrangements can help ensure that they remain relevant and provide adequate protection to all parties involved.

- Collaboration and Communication: Open and transparent communication between creators and employers is essential for a successful working relationship. Engaging in discussions about copyright ownership, expectations, and any potential issues can help prevent misunderstandings and disputes down the line.

Conclusion

In conclusion, the doctrine of “work for hire” under copyright law is a complex and significant concept that determines copyright ownership in various employment and contractual relationships. Through our critical survey of cases in the United Kingdom, United States, and India, several key insights emerge. In India, while there is no explicit provision for “work for hire,” the Copyright Act recognizes the ownership of copyright in works created during the course of employment. Ownership in freelance and contractual arrangements is determined by the terms of the agreement. Throughout our survey, it becomes apparent that clear and explicit contractual agreements are vital in all jurisdictions to address copyright ownership and prevent disputes.

Demystifying Legal Metrology Rules in India: Ensuring Fairness in Everyday Transactions

In the bustling markets and stores of India, where buying and selling happens every day, there’s a set of rules quietly at work to make sure you get what you pay for. These acts and rules are colloquially known as ‘Legal Metrology’. The rules are intended to make sure that measurements and weights used in trade are accurate and fair, and are represented to the consumer clearly. The rules are enforced by the Legal Metrology Division, which is managed by the Department of Consumer Affairs under the Ministry of Consumer Affairs, Food & Public Distribution.

What is Legal Metrology?

Legal Metrology sets out to ensure that whatever you buy (whether it’s rice, oil, fruits, cosmetics, backpacks, electronics, or any other packaged goods or commodities) is in compliance with requirements and guidelines about the quantity, weight, measurements, expiry date, origin, manufacturer, etc., and is also packaged in a manner that these details are captured and made available to you. It’s like having referees in the game of trade, making sure everyone plays fair.

How Does It Work?

- Ensuring Accuracy: You might notice a stamp or mark on the weighing/measuring devices/equipments, this is to show that they’ve been verified and are accurate. In fact, the Legal Metrology department also issues Licenses to manufacturers, dealers and repairer of weighing/measuring devices for dealing with such instruments.

- Packaged Goods: Ever look at a pack of biscuits or a bottle of shampoo and see all those details like MRP, manufacturing date, expiry date, consumer care information as well as the quantity of the package? Legal Metrology rules make it mandatory for companies to give you this information in the manner prescribed under the Legal Metrology Act, 2009 as well as the Legal Metrology (Packaged Commodities) Rules, 2011 so you are aware of the contents of the package and of your mode of communication with the company in case of any complaints.

What a Consumer Should Know?

- Rights as a Consumer: You have the right to get what you pay for. If you feel something is not right, like the weight of a product or the information on the pack, you can file a complaint through the online platform – https://consumerhelpline.gov.in/ , which will be forwarded to the appropriate officer for grievance redressal. One can register complaints by call on 1800-11-4000 or 1915 or through SMS on 8800001915.

- Checking for Stamps: Next time you buy something by weight, look for the stamp or mark on the scale or the measuring device. It means it’s been checked and is okay to use

What a Business Owner (For Consumer Goods) Should Know?

- Product Packaging and Labelling: You must ensure that all products intended for retail sale are accurately weighed or measured and are packaged as per the prescribed standards. This includes providing essential information such as net quantity, MRP (Maximum Retail Price), date of manufacture, expiry date, and consumer care details on the packaging.

- Weighing and Measuring Instruments: Businesses using weighing and measuring instruments (like scales, meters, etc.) must ensure these instruments are verified and stamped by authorized Legal Metrology officers. Regular calibration and maintenance of these instruments are essential to maintain accuracy and compliance.

- Compliance and Audits: Regular audits and inspections are conducted by Legal Metrology authorities to verify compliance with Legal Metrology rules. Non-compliance can lead to penalties, fines, seizure of goods or even legal repercussions, which can impact a company’s reputation and operations.

Challenges and Moving Forward

Offences relating to weights and measures are punished with fine or imprisonment or with both depending on the offence committed. The government is working on making these rules easier to understand and ensuring everyone follows them correctly.

Conclusion

Legal Metrology rules are not just about weights and measures; they are about fairness and trust in every transaction you make. By making sure everything is measured and packaged correctly, these rules protect you as a consumer and ensure that businesses play by the rules. So, next time you shop, remember these rules are on your side to make sure you get what you deserve!

𝐁𝐨𝐨𝐤-𝐤𝐞𝐞𝐩𝐢𝐧𝐠, 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠, 𝐓𝐚𝐱𝐚𝐭𝐢𝐨𝐧, 𝐚𝐧𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐂𝐫𝐢𝐦𝐞 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 (𝐁𝐀𝐓𝐅) 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐢𝐨𝐧𝐬

The International Financial Services Centres Authority (IFSCA) has recently rolled out the 𝐁𝐨𝐨𝐤-𝐤𝐞𝐞𝐩𝐢𝐧𝐠, 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐢𝐧𝐠, 𝐓𝐚𝐱𝐚𝐭𝐢𝐨𝐧, 𝐚𝐧𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐂𝐫𝐢𝐦𝐞 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 (𝐁𝐀𝐓𝐅) 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 𝐉𝐮𝐧𝐞 2024. We are thrilled to share a snapshot of the permissible activities and essential considerations to keep in mind before setting up a BATF unit.

Permissible Activities

Book-keeping Services

- Inclusion: Classify and record transactions, including payroll ledgers in books of account

- Exclusion: Does not include payroll management and taxation services

Accounting Services (excluding audit)

- Inclusion: Review, compilation, preparation, and analysis of financial statements

- Exclusion: Audit; Review and compilation without any assurance and attestation

Taxation Services

- Offer tax consultation, preparation, and planning

- Advise on all forms of direct and indirect taxes

- Prepare and file various tax returns

Financial Crime Compliance Services

- Render compliance services of AML/CFT measures, FATF recommendations, and related activities

Additional Requirements

- Legal Form: Company or LLP

- Service Recipient: Non-resident and does not reside in a high-risk jurisdiction identified by FATF.*

- Minimum Office Space Criteria: 60 sq. ft. per employee

*Please refer to the list of High-Risk Jurisdictions – February 2024.

Significance of Governing Law and Jurisdiction in International Commercial Contracts

In today’s interconnected global economy, businesses engage in cross-border transactions and collaborations, necessitating robust legal frameworks to govern contractual relationships and resolve disputes. Governing law and jurisdiction clauses play pivotal roles in international commercial contracts, providing clarity, predictability, and mechanisms for effective dispute resolution. This comprehensive guide delves into the intricacies of governing law and jurisdiction clauses, offering insights from legal principles, industry best practices, and relevant regulatory frameworks.

Understanding Governing Law Clauses

Definition and Purpose: Governing law clauses, commonly included in commercial agreements, specify the legal system and laws that will govern the interpretation, validity, and enforcement of contractual rights and obligations. These clauses serve to provide certainty and predictability to parties involved in international transactions, ensuring uniformity in legal interpretation and dispute resolution. The selection of a governing law in international contracts assumes paramount significance, as it delineates the legal framework governing the formation, performance, and termination of contractual relationships. Failure to specify the governing law can culminate in costly jurisdictional disputes, highlighting the indispensability of clear and unequivocal clause articulation. Through diligent consideration of factors such as suitability, parties’ jurisdictions, and intellectual property protection, stakeholders can strategically align the governing law with their commercial imperatives, thereby bolstering contract enforceability and mitigating legal risks.

Importance of Governing Law

The selection of an appropriate governing law is crucial for several reasons:

- Consistency and Predictability: By designating a governing law, parties ensure consistency and predictability in the interpretation and application of contractual terms, thereby reducing uncertainty and potential conflicts.

- Enforcement of Rights: Understanding the governing law facilitates the effective enforcement of contractual rights and obligations, enabling parties to seek legal remedies in a familiar legal environment.

- Mitigation of Legal Risks: Parties can mitigate legal risks associated with unfamiliar legal systems by selecting a governing law that aligns with their business objectives and risk tolerance.

English law is widely preferred in international commercial contracts due to its:

- Predictability: English law offers a well-established and predictable legal framework, providing parties with clarity and certainty in contractual matters.

- Commercial Expertise: The city of London, renowned as a global financial center, boasts a sophisticated legal infrastructure and expertise in commercial law, making it an attractive jurisdiction for international business transactions.

- Arbitration Facilities: London is home to prestigious arbitration institutions like the London Court of International Arbitration (LCIA), offering efficient and impartial dispute resolution mechanisms for international disputes.

Exploring Jurisdiction Clauses

Definition and Scope: Jurisdiction clauses, often coupled with governing law provisions, determine the forum where disputes arising from the contract will be adjudicated and the procedural rules that will govern the resolution process. These clauses play a crucial role in establishing the legal framework for dispute resolution and clarifying the parties’ rights and obligations. Absence of a jurisdiction clause can precipitate jurisdictional ambiguities, exacerbating legal costs and impeding timely resolution of disputes. Through meticulous consideration of factors such as geographical locations, dispute resolution mechanisms, and governing law recognition, stakeholders can strategically align the jurisdiction clause with their commercial objectives, thereby facilitating efficient and cost-effective dispute resolution.

Key Considerations in Jurisdiction Clause Drafting

- Type of Jurisdiction: Parties must decide whether to opt for exclusive, non-exclusive, or one-sided jurisdiction clauses, each with distinct implications for dispute resolution.

- Geographical Factors: Considerations such as the location of parties, performance of contractual obligations, and the subject matter of the contract influence the selection of an appropriate jurisdiction.

- Enforcement Considerations: Parties should assess the enforceability of judgments and awards in potential jurisdictions, considering factors such as reciprocal enforcement treaties and local legal practices.

- Best Practices for Clause Selection

- Clarity and Precision: Drafting governing law and jurisdiction clauses requires clarity and precision to avoid ambiguity and potential disputes over interpretation.

Conclusion

Navigating governing law and jurisdiction issues in international commercial contracts requires careful consideration of legal principles, industry best practices, and regulatory frameworks. By selecting appropriate governing law and jurisdiction clauses that align with their commercial objectives and risk tolerance, parties can mitigate legal risks, enhance contractual certainty, and foster successful business relationships on a global scale. With a comprehensive understanding of the complexities surrounding these clauses and adherence to best practices, businesses can navigate the challenges of international commerce with confidence and resilience.

Unconscionable Contracts and Related Principles

The Doctrine of Unconscionable Contract stands as a vital safeguard in the realm of Indian contract law, aiming to prevent exploitation and injustice arising from unfair or oppressive contractual agreements. Unconscionability is a legal concept rooted in fairness, particularly within contractual relationships. It allows a party to challenge a contract if it contains excessively harsh or oppressive terms or if one party gains an unjust advantage over the other during negotiation or formation. This principle has been acknowledged by the Law Commission of India in its 199th report on Unfair (Procedural & Substantive) Terms in Contract. The Doctrine of Unconscionable Contract serves as a mechanism to rectify these imbalances by empowering courts to scrutinize contractual agreements and invalidate provisions that contravene principles of fairness and equity.

In addition to unconscionability, the principles of non est factum offer further protection to individuals against unfair contracts. Non est factum, meaning “it is not the deed,” applies when a party signs a document under circumstances where they are mistaken as to its nature or contents. This principle recognizes that individuals should not be bound by contracts they did not understand or intend to enter into. Indian courts have invoked non est factum to set aside contracts in cases of fraud, misrepresentation, or extreme misunderstanding, thereby safeguarding individuals from unjust contractual obligations.

Furthermore, the doctrines of coercion and undue influence provide additional safeguards against unfair contractual practices. Coercion refers to situations where one party compels another to enter into a contract through threats, undermining the voluntariness of the agreement. Undue influence, on the other hand, occurs when one party having apparent authority of a fiduciary relationship exploits a position of power or trust to exert undue pressure on the other party, thereby influencing their decision-making. Indian courts scrutinize contracts for signs of coercion or undue influence, and contracts tainted by these factors may be declared void or unenforceable.

UK and Indian Law

In the United Kingdom, scholars have associated “exploitation” with the concept of unconscionability. They distinguish between unconscionable enrichment and unjust enrichment, with the former focusing on preventing exploitation and providing restitution for damages caused by exploitative bargains. Courts assess whether one party has taken advantage of the other, often due to factors like immaturity, poverty, or lack of adequate advice.

Indian law, while not explicitly codifying the doctrine of unjust enrichment, embodies principles that align with its core tenets. Within Indian jurisprudence, concepts of undue influence and unequal bargaining power, as delineated in Sections 16 (Undue Influence) and 19 (Voidability of Agreements without Free Consent) of the Indian Contract Act 1872, establish a foundation for equitable treatment in agreements. Unjust enrichment, though not codified, encapsulates the essence of retaining benefits unjustly at another’s expense, contravening principles of justice and fairness. Despite the absence of specific legislative mandates, Indian courts possess inherent authority to order restitution, aiming to dismantle unjust gains and restore fairness. This empowerment enables courts to fashion remedies tailored to the unique circumstances of each case, ensuring that aggrieved parties are made whole again.

Landmark Judgments in India:

The evolution of unconscionability in Indian contract law is punctuated by landmark judgments that have shaped its contours and applications. In Central Inland Water Transport Corporation v. Brojo Nath Ganguly (1986 SCR (2) 278), the Supreme Court of India set a precedent by declaring a clause in an employment contract, which waived an employee’s right to sue for breach of contract, as unconscionable and therefore void. Similarly, in Mithilesh Kumari v. Prem Behari Khare (AIR 1989 SC 1247), the court deemed a lease agreement clause requiring exorbitant security deposits as unconscionable and unenforceable. These judgments underscore the judiciary’s commitment to upholding fairness and equity in contractual relationships, irrespective of the parties’ relative bargaining positions.

Recent judicial pronouncements further illuminate the significance of the Doctrine of Unconscionable Contract in protecting vulnerable parties from exploitation. In Surinder Singh Deswal v. Virender Gandhi (2020 (2) SCC 514), the Supreme Court struck down a clause in a promissory note that deprived the borrower of due process rights, reaffirming the judiciary’s commitment to rectifying injustices arising from unconscionable contracts.

Broader Implications and Legal Perspectives:

The Doctrine of Unconscionable Contract transcends its immediate legal implications, embodying broader principles of distributive justice and societal welfare. By addressing power imbalances and ensuring equitable outcomes in contractual relationships, unconscionability contributes to a legal framework that prioritizes fairness and integrity. Moreover, the doctrine underscores the judiciary’s role as a guardian of individual rights and a bulwark against exploitative practices in commercial transactions.

Conclusion:

In conclusion, the Doctrine of Unconscionable Contract serves as a cornerstone of Indian contract law, safeguarding individuals against exploitation and injustice in contractual agreements. Through landmark judgments and insightful analyses, Indian courts have reaffirmed the legality and relevance of unconscionability, underscoring its pivotal role in upholding fairness and equity in contractual relationships. By promoting principles of distributive justice and societal welfare, unconscionability contributes to a legal landscape that fosters integrity, equality, and justice for all parties involved.

Vitality of Disclaimer of Warranty Clause in SaaS Agreements

Software as a Service (SaaS) agreements have become increasingly prevalent in the digital era, especially in India, where the technology sector is rapidly expanding. These agreements typically involve the provision of software applications hosted on cloud-based platforms to users on a subscription basis. One critical aspect of SaaS agreements is the disclaimer of warranty clause, which plays a pivotal role in defining the rights and responsibilities of both the service provider and the user. In this article, we delve into the significance of the disclaimer of warranty clause in SaaS agreements under Indian contract law, exploring its implications, legal framework, and practical considerations.

Contextualizing the Disclaimer of Warranty Clause

At its essence, the disclaimer of warranty clause embodies the principle of caveat emptor – let the buyer beware. In the realm of SaaS agreements, this clause assumes paramount significance as it pertains to the assurances and guarantees, or lack thereof, regarding the performance, functionality, and suitability of the software platform provided by the service provider. By disclaiming certain warranties, the provider seeks to mitigate legal exposure and shield itself from potential claims arising from performance discrepancies, operational disruptions, or functional inadequacies inherent to software solutions.

Providing Platform on an “As Is” Basis

Central to the disclaimer of warranty clause is the provision of the SaaS platform on an “as is” basis. This legal construct signifies that the service provider makes no representations or warranties regarding the platform’s fitness for a particular purpose, merchantability, or non-infringement of third-party rights. Essentially, the platform is delivered in its current state, devoid of any implicit or explicit assurances regarding its performance, reliability, or compatibility with the user’s specific requirements.

Waiving Off All Warranties

By waiving off warranties of merchantability, fitness for purpose, and infringement, the service provider seeks to insulate itself from potential liabilities stemming from software deficiencies, operational disruptions, or intellectual property conflicts. This blanket waiver underscores the contractual understanding that the user assumes all risks associated with platform utilization, including but not limited to data loss, system incompatibility, or third-party claims arising from intellectual property violations.

Legal Framework in India

Under Indian contract law, SaaS agreements are governed primarily by the Indian Contract Act, 1872, which provides the legal framework for the formation, interpretation, and enforcement of contracts. Section 16 of the Act specifies that contracts which are entered into by parties under a mistake of fact or under certain misrepresentations may be voidable at the option of the aggrieved party. However, the Act also recognizes the principle of freedom of contract, allowing parties to negotiate and agree upon the terms of their agreement, including limitations of liability and disclaimer of warranties.

Implications and Importance

- Limitation of Liability: The disclaimer of warranty clause serves to limit the liability of the service provider in case of software defects, performance issues, or service interruptions. By explicitly stating that the platform is provided “as is” and disclaiming certain warranties, the service provider seeks to shield itself from potential claims or lawsuits arising from user dissatisfaction or system failures.

- Risk Allocation: In SaaS agreements, the disclaimer of warranty clause helps to allocate risks between the parties more equitably. It puts the onus on the user to assess the suitability of the platform for their intended purposes and acknowledges that the service provider cannot guarantee flawless performance or absolute compatibility with the user’s specific requirements.

- Clarity and Transparency: Clear and explicit disclaimer of warranty clauses promote transparency and facilitate informed decision-making by apprising users of the inherent risks associated with platform utilization. Users are empowered to assess the platform’s suitability for their specific requirements and risk tolerance, thereby fostering a relationship grounded in mutual understanding and transparency. Further, a well-drafted disclaimer of warranty clause ensures compliance with Indian contract law principles, particularly regarding the requirement of clear and unambiguous contractual terms. Indian courts generally uphold the principle of freedom of contract and give effect to the intentions of the parties as expressed in their agreement, provided that such terms are not contrary to public policy or statutory provisions.

- Flexibility and Innovation: By disclaiming warranties of merchantability and fitness for purpose, service providers are afforded greater flexibility and autonomy to innovate and iterate upon their software solutions without the burden of implicit contractual obligations. This fosters an environment conducive to continuous improvement and technological advancement, thereby enhancing the platform’s competitiveness and value proposition in the marketplace.

Conclusion

In the ever-evolving landscape of SaaS agreements, the disclaimer of warranty clause emerges as a cornerstone of legal protection, risk mitigation, and transparency. By delineating the scope of warranties provided and waiving off certain assurances, service providers and users alike navigate the SaaS ecosystem with prudence, clarity, and mutual understanding. As digital solutions continue to redefine business paradigms and empower enterprises with unprecedented capabilities, embracing the nuances of the disclaimer of warranty clause becomes indispensable for fostering resilient, mutually beneficial contractual relationships in the digital age.

Understanding the Doctrine of Severability and the Blue Pencil Rule in Indian Contract Law

Introduction

In the intricate realm of Indian Contract law, the doctrine of severability and the Blue Pencil Rule serve as vital tools in ensuring fairness and enforceability in agreements. When confronted with contracts containing both legal and illegal provisions, courts employ these doctrines to salvage the valid portions while nullifying the illegal ones. This article delves into the principles behind severability and the Blue Pencil Rule, their application in various jurisdictions, and their significance in modern contract law.

The Doctrine of Severability

At the heart of the contract law lies the Doctrine of Severability, which dictates that if any provision of a contract is deemed illegal or void, the remaining provisions should be severed and enforced independently, provided such severance does not thwart the original intentions of the parties. This principle, embodied in the Severability Clause, safeguards the validity of contracts by allowing courts to salvage the enforceable portions while disregarding the unlawful ones.

The Severability Clause is based on the ‘Doctrine of Severability’ or ‘Doctrine of Separability’, according to which, if any provision of a contract is rendered illegal or void, the remaining provisions shall be severed and enforced independent of the unenforceable provision, ensuring the effectuation of the parties’ intention.

The Blue Pencil Rule

The Blue Pencil Doctrine, rooted in the principle of severability, offers a solution to this dilemma by allowing courts to strike out the illegal, unenforceable, or unnecessary portions of a contract while preserving the remainder as enforceable and legal. The term “blue pencil” originates from the practice of using a blue pencil for editing or censoring manuscripts and films. In contract law, the doctrine gained prominence through the case of Mallan v. May (1844) 13 M and W 511, initially applied in disputes over non-compete agreements.

Subsequently, the doctrine received broader application through cases like Nordenfelt v. Maxim Nordenfelt Guns and Ammunitions Co. Ltd. [1894] A.C. 535, extending its reach beyond non-compete agreements. The concept was officially named in the case of Atwood v. Lamont [1920] 3 K.B. 571. Grounded in the principle of severability, the Blue Pencil Doctrine operates in common law jurisdictions, allowing courts to salvage valid contractual terms by excising the problematic ones.

In India, the Blue Pencil Doctrine finds expression in Section 24 and Section 27 of the Indian Contract Act, 1872. Section 24 states that if any part of the consideration in a contract is unlawful, the entire contract becomes void. Similarly, Section 27 provides that any restraint on lawful profession or trade is void to that extent. Initially applied in cases involving non-compete agreements, the doctrine has since been expanded to cover various aspects of contracts, including arbitration agreements, memorandum of understanding, sale of real estate, and contracts against public policy.

Judicial Pronouncements and Principles

Judicial pronouncements, particularly in landmark cases like Shin Satellite Public Co. Ltd. v. Jain Studios Limited, have elucidated the principles underlying severability. The Supreme Court of India has emphasized the doctrine of substantial severability, focusing on retaining the core aspects of contracts while disregarding trivial or technical elements. Furthermore, principles governing statutory provisions, as outlined in cases like R.M.D. Chamarbaugwalla & Anr. v. Union of India & Anr., provide a roadmap for the application of severability in contractual contexts.

The landmark case of Shin Satellite Public Co. Ltd. v. Jain Studios Limited, AIR 2006 SC 963, underscores the significance of the Blue Pencil Doctrine in Indian jurisprudence. The court emphasized the principle of “substantial severability” over “textual divisibility,” highlighting the importance of preserving the main or substantial portion of the contract while excising trivial or unnecessary elements. For the Blue Pencil Doctrine to be applied, substantial severability is essential, and it is incumbent upon the court to carefully assess the contract to determine its validity.

Importance of Express Severability Clauses

The insertion of express Severability Clauses in contracts serves to clarify the intentions of the parties regarding the enforceability of contractual provisions. While such clauses are invaluable in eliminating ambiguity, their absence does not preclude the application of severability principles. Courts rely on established tests and principles to determine the validity and enforceability of contracts, even in the absence of explicit Severability Clauses.

Conclusion

In conclusion, the doctrines of severability and the Blue Pencil Rule stand as bulwarks of fairness and equity in contract law. These principles enable courts to navigate complex contractual disputes, ensuring that valid agreements remain enforceable while invalid clauses are appropriately disregarded. As contract law continues to evolve, the application of these doctrines remains essential in preserving the integrity of contractual relationships and upholding the principles of justice and fairness.

Employment Agreements in India – Clauses, Enforceability, Negotiability

Employment Agreements Clauses

In employment agreements in India, certain clauses often give rise to more debate or controversy compared to others. These contentious clauses, their significance, and aspects of their enforceability and negotiability are as follows:

- Non-Compete and Non-Solicitation:

-

- Importance: Restricts employees from working with competitors or soliciting clients or other employees after leaving the company. This helps employers safeguard their trade secrets and customer relationships.

- Enforceability: Non-solicit clauses are generally valid. However non-compete clauses are generally not enforceable post-termination of employment, except in special circumstances with limited scope and duration.

- Negotiability: Scope and duration can sometimes be negotiated.

- Confidentiality:

-

- Importance: Ensures protection of sensitive business information.

- Enforceability: Strongly upheld, often extending beyond the employment tenure.

- Negotiability: Generally non-negotiable due to its critical nature for safeguarding business interests.

- Intellectual Property Rights (IPR):

-

- Importance: If done correctly, automatically transfers rights of employee inventions created during employment to the employer.

- Enforceability: Widely enforced, especially in roles involving research and development.

- Negotiability: Typically not negotiable.

- Termination Clauses:

-

- Importance: Defines conditions for ending employment, either ‘at-will’, for cause, or by resignation.

- Enforceability: Enforceable when compliant with labor laws (such as the reason for termination).

- Negotiability: Limited, as it usually aligns with statutory requirements.

- Probationary Period:

-

- Importance: Establishes a trial period to evaluate the employee’s suitability.

- Enforceability: Standard practice, conditions usually enforced as stated.

- Negotiability: Duration or terms may be negotiable.

- Salary and Compensation:

-

- Importance: Details salary, bonuses, and other benefits.

- Enforceability: Highly enforceable as per agreed terms.

- Negotiability: Often negotiable, dependent on the role and candidate’s experience.

- Working Hours and Leave:

-

- Importance: Specifies expected working hours, workdays, and leave entitlements.

- Enforceability: Generally enforceable within labor law guidelines.

- Negotiability: Limited, generally adheres to company policy.

- Appointment and Position:

-

- Importance: Specifies role, designation, and key responsibilities.

- Enforceability: Generally binding but subject to changes in organizational structure.

- Negotiability: Limited, often aligned with organizational needs.

- Dispute Resolution:

-

- Importance: Outlines how employment disputes will be resolved.

- Enforceability: Generally upheld, often includes arbitration clauses.

- Negotiability: May be negotiable but usually follows standard legal practices.

- Governing Law and Jurisdiction:

-

- Importance: Indicates the legal jurisdiction and laws governing the agreement.

- Enforceability: Standard and enforceable.

- Negotiability: Typically non-negotiable, aligns with the company’s operational jurisdiction.

In these agreements, the most contentious clauses tend to be those that limit future employment opportunities (non-compete and non-solicitation) and protect business secrets (confidentiality and IPR). While clauses like salary and probation can be more open to negotiation, those related to legal compliance and the company’s proprietary rights are usually firmly set.

Employment Agreements Importance

- Protecting Business Interests: These clauses are crucial for employers to safeguard their business interests, including trade secrets, customer relationships, and market position.

- Restricting Future Employment: Non-Compete clauses prevent employees from joining competitors or starting a competing business for a specified period post-employment.

- Preventing Talent Poaching: Non-Solicitation clauses help companies prevent ex-employees from poaching their clients and current employees.

Employment Agreements Enforceability

- Reasonableness of Terms: The Indian Contract Act, 1872, governs these clauses. A Non-Compete clause is generally not enforceable post-termination of employment if it is overly restrictive or unreasonable in terms of duration, geographic scope, and the nature of restrictions.

- During Employment: However, during the term of employment, such restrictions are usually considered reasonable and enforceable.

- Judicial Interpretation: Courts in India have often held that any clause which ‘restrains trade’ is void to the extent of the restraint, post-termination of employment, as per Section 27 of the Indian Contract Act. However, a balance is sought between the employee’s right to earn a livelihood and the employer’s right to protect its interests.

Employment Agreements Negotiability

- Depends on Bargaining Power: The scope for negotiation often depends on the employee’s bargaining power, which varies based on seniority, uniqueness of skills, and market demand.

- Customization for High-Value Employees: For senior-level employees or those with access to sensitive information, these clauses are often tailored more specifically and may involve negotiations.

- Clarity and Fairness: Prospective employees can negotiate for clarity, a reasonable duration, and a specific scope to ensure the clauses are fair and not overly burdensome.

- Compensation in Lieu of Restrictions: Sometimes, negotiations can include compensation for the period during which the employee is restricted from certain activities post-termination.

Contractual Requirements under DPDP ACT, 2023

BACKGROUND

Under India’s new Digital Personal Data Protection Act, 2023 (the “DPDP Act”), entities which process any personal data in digital form will be required to implement appropriate technical and organizational measures to ensure compliance. In addition, entities will remain responsible for protecting such data as long as it remains in their possession or under their control, including in respect of separate processing tasks undertaken by data processors on their behalf. These overarching responsibilities will extend to taking reasonable security safeguards and procedures to prevent data breaches, as well as complying with prescribed steps if and when a breach does occur.

Importantly, compared to its predecessor draft and unlike the General Data Protection Regulation (“GDPR”) of the European Union which places direct regulatory obligations on data processors, the DPDP Act appears to attribute sole responsibility upon the main custodians of data vis-à-vis the individuals related to such data – as opposed to a mechanism of ‘joint and several’ or shared liability with contracted data processors – even when the actual processing may be undertaken by the latter pursuant to a contract or other processing arrangement.

This position appears to be based on the principle that an entity which decides the purpose and means of processing should be held primarily accountable in the event of a personal data breach. Such liability may also be invoked when an event of non-compliance arises on account of the negligence of a data processor. While processing tasks can be delegated to a third party, such delegation and/or outsourcing needs to be made under a valid contract in specified cases.

Further, organizations need to ensure that their own compliance requirements and other statutory obligations remain mirrored in their supply chain in terms of (i) implementing appropriate technical and organizational measures, as well as (ii) taking reasonable security safeguards to prevent a personal data breach. This parallel compliance regime will extend to the actions and practices of data processors, including in terms of rectifying or erasing data. For example, when an individual withdraws a previously issued consent with respect to the processing of personal data for a specified purpose, all entities processing their data – including contracted data processors – must stop, and/or must be made to stop, the processing of such information – failing which the primary entity may be held liable.

CONTRACTUAL ARRANGEMENTS

Although the term ‘processing,’ as defined in the DPDP Act, involves automated operations, such operations can be either fully or partially automated. Besides, the definition includes any activity among a wide range of operations that businesses routinely perform on data, including the collection, storage, use and sharing of information. Thus, even those business operations which involve some amount of human intervention and/or stem from human prompts will be covered under the definition of ‘processing,’ and thus, the DPDP Act will remain applicable in all such cases.

A “data fiduciary” (i.e., those entities which determine the purpose and means of processing personal data, including in conjunction with other entities) can engage, appoint, use or otherwise involve a data processor to process personal information on its behalf for any activity related to the offering of goods or services to “data principals” (i.e., specifically identifiable individuals to whom the personal data relates) as long as it is done through a valid contract. However, irrespective of any agreement to the contrary, a data fiduciary will remain responsible for complying with the provisions of the law, including in respect of any processing undertaken on its behalf by a data processor.

DUE DILIGENCE AND RISK ASSESSMENT

Given that data fiduciaries may be ultimately responsible for the omissions of data processors, contracts between such entities need to be negotiated carefully. In this regard, the risks associated with such outsourced data processing activities need to be taken into account by data fiduciaries, including in respect of risks related to the following categories:

- Compliance: where obligations under the DPDP Act with respect to implementing appropriate technical and organizational measures, preventing personal data breach and protecting data are not adequately complied with by a data processor;

- Contractual: where a data fiduciary may not have the ability to enforce the contract;

- Cybersecurity: where a breach in a data processor’s information technology (“IT”) systems may lead to potential loss, leak or breach of personal data;

- Legal: where the data fiduciary is subjected to financial penalties due to the negligence or omission of the data processor; and

- Operational: arising due to technology failure, fraud, error, inadequate capacity to fulfill obligations and/or to provide remedies.

Thus, data fiduciaries need to (1) exercise due diligence, (2) put in place sound and responsive risk management practices for effective supervision, and (3) manage the risks arising from outsourced data processing activities. Accordingly, data fiduciaries need to select data processors based on a comprehensive risk assessment strategy.

A data fiduciary may need to retain ultimate control over the delegated data processing activity. Since such processing arrangements will not affect the rights of an individual data principal against the data fiduciary – including in respect of the former’s statutory right to avail of an effective grievance redressal mechanism under the DPDP Act – the responsibility of addressing such grievances will rest with the data fiduciary itself, including in respect of the services provided by the data processor.

If, on the other hand, a data fiduciary outsources its grievance redressal function to a third party, it needs to provide data principals with the option of accessing its own nodal officials directly (i.e., a data protection officer, where applicable, or any other person authorized by such data fiduciary to respond to communications from a data principal for the purpose of exercising their rights).

In light of the above, before entering into data processing arrangements, a data fiduciary may want to have a board-approved processing policy which incorporates specific selection criteria for: (i) all data processing activities and data processors; (ii) parameters for grading the criticality of outsourced data processing; (iii) delegation of authority depending on risks and criticality; and (iv) systems to monitor and review the operation of data processing activities.

DATA PROCESSING AGREEMENT

The terms and conditions governing the contract between the data fiduciary and the data processor should be carefully defined in written data processing agreements (“DPAs”) and vetted by the data fiduciary’s legal counsel for legal effect and enforceability. Each DPA should address the risks and the strategies for mitigation. The agreement should also be sufficiently flexible to allow the data fiduciary to retain adequate control over the delegated activity and the right to intervene with appropriate measures to meet legal and regulatory obligations. In situations where the primary or initial interface with data principals lies with data processors (e.g., where data processors are made responsible for collecting personal data on behalf of data fiduciaries), the nature of the legal relationship between the parties, including in respect of agency or otherwise, should also be made explicit in the contract. Some of the key provisions could incorporate the following:

- Defining the data processing activity, including appropriate service and performance standards;

- The data fiduciary’s access to all records and information relevant to the processing activity, as available with the data processor;

- Providing for continuous monitoring and assessment by the data fiduciary of the data processing activity, so that any corrective measures can be taken immediately;

- Ensuring that controls are in place for maintaining the confidentiality of customer data, and incorporating the data processor’s liability in case of a security breach and/or a data leak;

- Incorporating contingency plans to ensure business continuity;

- Requiring the data fiduciary’s prior approval for the use of sub-contractors for all or part of a delegated processing activity;

- Retaining the data fiduciary’s right to conduct an audit of the data processor’s operations, as well as the right to obtain copies of audit reports and findings made about the data processor in conjunction with the contracted processing services;

- Adding clauses which make clear that government, regulatory or other authorized person(s) may want to access the data fiduciary’s records, including those that relate to delegated processing tasks;

- In light of the above, adding further clauses related to a clear obligation on the data processor to comply with directions given by the government or other authorities with respect to processing activities related to the data fiduciary;

- Incorporating clauses to recognize the right of the data fiduciary to inspect the data processor’s IT and cybersecurity systems;

- Maintaining the confidentiality of personal information even after the agreement expires or gets terminated; and

- The data processor’s obligations related to preserving records and data in accordance with the legal and/or regulatory obligations of the data fiduciary, such that the data fiduciary’s interests in this regard are protected even after the termination of the contract.

LEARNINGS FROM THE GDPR

Many companies that primarily act as data processors have standard DPAs which they ask data fiduciaries to agree to, or negotiate from. The GDPR provides a set of requirements for such DPAs, including certain compulsory information. In India, such standards could evolve through practice, such as by including clauses in DPAs related to the following:

- Information about the processing, including its: (i) subject matter; (ii) duration; (iii) nature; and purpose

- The types of personal data involved

- The categories of data principals (e.g., customers of the data fiduciary)

- The obligations of the data fiduciary

A DPA in India could also set out the obligations of a data processor, including those that require it to:

- Act only on the written instructions of the data fiduciary

- Ensure confidentiality

- Maintain security

- Only hire sub-processors under a written contract, and with the data fiduciary’s permission

- Ensure all personal data is deleted or returned at the end of the contract

- Allow the data fiduciary to conduct audits and provide all necessary information on request

- Inform the data fiduciary immediately if something goes wrong

- Assist the data fiduciary, where required, with respect to: (i) facilitating requests from data principals in exercise of their statutory rights; (ii) maintaining security; (iii) data breach notifications; and (iv) data protection impact assessments and audits, if required.

CAN A DPA BE USED TO TRANSFER LIABILITY?

Even if a personal data breach or an incident of non-compliance arises on account of a data processor’s act or omission, a DPA alone may not be sufficient to relieve the corresponding data fiduciary of its obligations (including in terms of a financial penalty, as may be imposed by the Data Protection Board of India (the “DPBI”)). However, a DPA may be negotiated such as to allow the data fiduciary to recover money from the data processor in some circumstances.

To be sure, if a data processor fails to comply with its contractual obligations under a DPA and thereby causes a data breach or leads to some other ground of complaint under the DPDP Act, the data fiduciary may still be required to pay the penalty, if and when imposed by the DPBI. However, if such breach and/or non-compliance occurs because the data processor did (or did not do) something, thus amounting to a breach of its DPA with the data fiduciary, then the data fiduciary may be able to seek compensation from the data processor for a breach of the DPA and/or invoke the indemnity provisions under such contract.

For example, a DPA can include a “hold harmless” clause. Such clauses may serve to govern how liability falls between the parties. On the other hand, a limitation (or exclusion) of liability clause may aim to limit the amount that one party will pay to the other in the event that it breaches the contract.

WHAT IF A DATA PROCESSOR PROCESSES PERSONAL DATA OUTSIDE THE CONFINES OF A DPA?

If a data processor processes personal data beyond what is permitted under a DPA, or does so contrary to the data fiduciary’s directions, such processor may become a data fiduciary by itself (other than possibly being in breach of the DPA). As long as a data processor operates pursuant to the instructions of a data fiduciary, it is only the latter that will remain directly responsible to data principals under the DPDP Act (for the specified purpose with respect to the processing of such personal data). However, as soon as a data processor determines the means and purpose of processing in its own right, it may become directly responsible to corresponding data principals.

In this regard, a data fiduciary may wish to include a clause in the DPA that obliges the data processor to process personal data only in accordance with the DPA, and to the extent necessary, for the purpose of providing the services contemplated under such DPA. Alternatively, a data processor could be permitted to process personal data further to the written instructions of corresponding data principals. Further, processing outside the scope of the DPA could require a prior contract between the data principal(s) concerned and the data processor, respectively, with respect to a separate arrangement.

Nevertheless, the personal information that a data processor receives from a data fiduciary for the purpose of processing, or that it collects on the latter’s behalf, can only be processed pursuant to the restrictions of a DPA. If the data processor starts processing such personal data outside the confines pf a DPA, e.g., by gathering additional personal data that it has not been instructed to collect, or starts processing data in a way that is inconsistent with, or contrary to, the data fiduciary’s directions, such data processor is likely to be considered a data fiduciary for the purposes of the DPDP Act.

INDEMNIFICATION

As mentioned above, data fiduciaries may need to include indemnity clauses in their DPAs with data processors, where data processors agree to indemnify the data fiduciary against all third-party complaints, charges, claims, damages, losses, costs, liabilities, and expenses due to, arising out of, or relating in any way to a data processor’s breach of contractual obligations. A mutual “hold harmless” clause is one in which the protections offered and/or excluded are reciprocal between the parties.

CONFIDENTIALITY AND SECURITY

Data fiduciaries need to ensure the security and confidentiality of customer information which remains in the custody or possession of a data processor. Accordingly, the access to customer information by the staff of the data processor should be strictly on a ‘need-to-know’ basis, i.e., limited to such areas and issues where the personal information concerned is necessary to perform a specifically delegated processing function.

Further, the data processor should be able to isolate and clearly identify the data fiduciary’s customer information to protect the confidentiality of such individuals. Where the data processor acts as a processing agent for multiple data fiduciaries, there should be strong safeguards (including via encryptions of customer data) to avoid the co-mingling of such information related to different entities.

Nevertheless, a data fiduciary should regularly monitor the security practices of its data processors, and require the latter to disclose security breaches and/or cybersecurity-related incidents, including, in particular, a personal data breach. After all, a data fiduciary is required to notify the DPBI as well as each affected individual if a personal data breach occurs. In addition, cybersecurity incidents also need to be reported to the Indian Computer Emergency Response Team (“CERT-In”) within six hours from the identification or notification of such incident. At any rate, the data processor must be obliged through a DPA to notify the data fiduciary about any breach of security or leak of confidential information related to customers or other individuals as soon as possible.

BUSINESS CONTINUITY AND DISASTER RECOVERY

Data processors could be required to establish a framework for documenting, maintaining and testing business continuity and recovery procedures arising out of any data processing activity. The data fiduciary could then ensure that the data processor periodically tests such continuity and recovery plans. Further, a data fiduciary could consider conducting occasional joint exercises with its data processors for the purpose of testing such procedures periodically.

To mitigate the risk of an unexpected DPA termination or the liquidation of a data processor, the data fiduciary should retain adequate control over the data processing activities and retain its contractual right to intervene with appropriate measures to continue business operations and customer services. As part of its contingency plans, the data fiduciary may also want to consider the availability of alternative data processors, as well as the possibility of bringing back the outsourced processing activity in-house, especially in the event of an emergency. In this regard, the data fiduciary may need to assess upfront the cost, time and resources that would be involved in such an exercise.

In the event of a DPA termination, where the data processor deals with the data fiduciary’s customers directly, the fact of such termination should be adequately publicized among data fiduciary customers to ensure that they stop dealing with the concerned data processor.

CONCLUSION

As discussed in our previous note, organizations need to check whether and to what extent the DPDP Act applies to them and their operations. Although the provisions of the DPDP Act are not effective as yet, organizations may need to improve their IT and cybersecurity systems to meet new compliance requirements. Relatedly, organizations should monitor entities in their supply chains, such as suppliers and vendors, about data processing obligations. Further, existing contractual arrangements may need to be reviewed, and future contracts with data processors must be negotiated in light of the DPDP Act’s compliance requirements.

Importance of Service Level Agreements (SLA)

What is an SLA?

SLA stands for service level agreement. It refers to a document that outlines a commitment between a service provider and a client, including details of the service, the standards the provider must adhere to, and the metrics to measure the performance.

Typically, it is IT companies that use service-level agreements. These contracts ensure customers can expect a certain level or standard of service and specific remedies or deductions if that service is not met. SLAs are usually between companies and external suppliers, though they can also be between departments within a company.

Why are SLAs important?

Service Level Agreements (SLAs) are essential in the B2B (Business-to-Business) SaaS (Software as a Service) industry for several reasons:

- Customer Expectations: SLAs help set clear and specific expectations for customers regarding the level of service they can expect. This transparency is crucial in B2B SaaS, where businesses rely on the software for critical operations. Clear expectations reduce misunderstandings and improve customer satisfaction.

- Quality Assurance: SLAs provide a framework for measuring and maintaining the quality of service. By defining metrics, response times, and availability requirements, B2B SaaS companies can ensure that their software consistently meets or exceeds customer needs and industry standards.

- Risk Mitigation: SLAs also serve as risk mitigation tools. They outline what happens in the event of service disruptions, downtime, or other issues. This helps both parties understand their rights and responsibilities, reducing legal disputes and financial liabilities.

- Service Improvement: SLAs encourage continuous improvement. When B2B SaaS companies commit to specific performance metrics, they have a strong incentive to invest in infrastructure, monitoring, and support to meet these commitments. Regular performance evaluations can lead to service enhancements and increased customer satisfaction.

- Competitive Advantage: Having well-crafted SLAs can be a competitive advantage. B2B customers often compare SLAs when evaluating SaaS providers. Companies that offer more robust and reliable service levels are more likely to win and retain customers.

- Trust and Credibility: B2B SaaS companies build trust and credibility by adhering to their SLAs. Meeting or exceeding the agreed-upon service levels demonstrates a commitment to customer success and reliability.

- Compliance Requirements: In some industries, regulatory requirements demand that service providers maintain certain service levels and provide documentation of compliance. SLAs serve as the basis for demonstrating adherence to these regulations.

- Scalability: As a B2B SaaS company grows and serves a larger customer base, SLAs can help ensure that the quality of service remains consistent and can be scaled to meet increasing demand.

- Communication and Accountability: SLAs provide a structured means of communication between the service provider and the customer. They help define roles and responsibilities, making it clear who to contact in case of issues and who is accountable for specific aspects of service delivery.

- Customer Satisfaction and Retention: Meeting SLAs leads to higher customer satisfaction and loyalty. Satisfied customers are more likely to renew their subscriptions and recommend the service to others, contributing to long-term business success.

Consequences of an Unstamped or Insufficiently Stamped Contracts on Dispute Resolution Clause

In April 2023, the five-judge constitution bench of the Supreme Court of India (“Supreme Court”), in M/s NN Global Mercantile Private Limited (“NN Global”) v. M/s Indo Unique Flame Limited (“Indo Unique”) & Ors.,1 has held that an unstamped instrument (including an arbitration agreement contained in it) which is otherwise exigible to stamp duty is non-existent in law and must be impounded by the Court before appointing an arbitrator. In respect of such unstamped agreements, the rights of the parties will remain frozen, or they would not exist until the defect is cured.

In July 2023, the Delhi High Court in Arg Outlier Media Private Limited v. HT Media Limited,2 while considering a challenge to an arbitral award passed on an unstamped agreement held that although in terms of NN Global, the agreement not being properly stamped could not have been admitted in evidence; however, once having been admitted in evidence by the arbitrator, the award passed by relying on such agreement cannot be faulted on this ground. Similar view has been expressed by the Delhi High Court in SNG Developers Limited v. Vardhman Buildtech Private Limited (initially by the Single Judge,3 and later confirmed by the Division Bench4).

In another recent judgment in August 2023, the Delhi High Court in Splendor Landbase Ltd. (“Splendor”) v. Aparna Ashram Society & Anr. (“Aparna Ashram”),5 has laid down the guidelines for expeditiously carrying out the process of impounding the agreement, and determining the stamp duty (and penalties, if applicable) payable. The judgment is in the context of appointment of the arbitrator under Section 11 of the Arbitration Act, and as such, not a binding precedent, as clarified by the Supreme Court in State of West Bengal & Ors. v. Associated Contractors.6

BACKGROUND TO THE DISPUTE

Indo Unique was awarded a work order and entered into a sub-contract with NN Global. The work order (which included the sub-contract) contained an arbitration agreement. A dispute arose in relation to encashment of a bank guarantee between NN Global and Indo Unique. NN Global filed a suit against Indo Unique. Indo Flame applied under Section 8 of the Arbitration and Conciliation Act, 1996 (“Arbitration Act”) for referring the dispute to arbitration. The application was rejected on the ground that the work order was unstamped, and therefore, unenforceable under Section 357 of the Indian Stamp Act, 1899 (“Stamp Act”).

Indo Flame filed a writ petition challenging the order of rejection. The Bombay High Court allowed the writ. Subsequently, NN Global approached the Supreme Court, where the primary issue was whether an arbitration clause, contained in an unstamped work order, can be acted upon. A three-judge bench of the Supreme Court, vide its judgment dated 11 January 2021 in NN Global vs. Indo Unique,8 held that an arbitration agreement is a distinct and separate agreement, and can be acted upon even if contained in an unstamped instrument.

ISSUE BEFORE THE SUPREME COURT

As there existed contrary judgments of the Supreme Court on this issue, the three-judge bench referred the question of law (reproduced below) to be conclusively decided by the five-judge constitutional bench of the Supreme Court:

“Whether the statutory bar contained in Section 35 of the Stamp Act, 1899 applicable to instruments chargeable to stamp duty under Section 3 read with the Schedule to the Act, would also render the arbitration agreement contained in such an instrument, which is not chargeable to payment of stamp duty, as being non-existent, unenforceable, or invalid, pending payment of stamp duty on the substantive contract/instrument?”

DISCUSSION BY THE SUPREME COURT

Existence vs. validity of the arbitration agreement

The Supreme Court discussed the purpose of insertion of Section 11(6A) in the Arbitration Act.10 Noting that under Section 11(6A), Courts must confine their examination to the existence of an arbitration agreement in proceedings under Section 11 of the Arbitration Act, it held that the examination of the existence of an arbitration agreement under Section 11(6A) does not mean mere “existence in fact”. In enquiry under Section 11, the Courts must see if the arbitration agreement exists in law, i.e., the arbitration agreement must be enforceable in the eyes of the law.

Reliance was placed on Vidya Drolia & Ors. vs. Durga Trading Corporation (“Vidya Drolia”),11 where it was held that for an arbitration agreement to “exist”, it should meet and satisfy the requirements under both Arbitration Act and the Indian Contract Act, 1872 (“Contract Act”).12 Therefore, an arbitration agreement must be a valid and enforceable contract under the law. The phrase “arbitration agreement” under Section 11(6A) of the Arbitration Act must mean a contract, by meeting the requirements under Section 2(h) & (j) of the Contract Act.13 Any agreement that cannot be enforced under law cannot be said to be a valid contract and therefore cannot be said to “exist”.

Effect of non-stamping of a document under the Stamp Act

It was held that under Section 35 of the Stamp Act, an unstamped agreement cannot be “acted upon” by the Courts. Relying on the judgment in Hindustan Steel Limited vs. Dilip Construction Company,14 it was held that to “act upon” an instrument or document would mean to give effect to it or enforce it. Therefore, an unstamped agreement, which is otherwise exigible to stamp duty, cannot be enforced by the Courts and cannot be said to have any existence in the eyes of the law.

Further reliance was placed on Mahanth Singh vs. U Ba Yi15 to observe that Section 2(j) of the Contract Act would only be attracted when a contract is rendered unenforceable by application of a substantive law. While the Stamp Act is a fiscal statute, it was held to be substantive law. Therefore, any unstamped contract exigible to stamp duty shall be rendered void under Section 2(j) of the Contract Act. It was further observed that the rights of the parties under an unstamped agreement would remain frozen or rather would not exist until such an agreement is duly stamped.16

Lastly, it was held that Courts are bound under Section 3317 of the Stamp Act to impound an instrument that has not been stamped or is unduly stamped.

On the doctrine of severability

It was observed that doctrine of severability would not play any role in the Courts duty to impound and not give effect to an unstamped instrument under the Stamp Act. While upholding that the arbitration agreement is a separate and distinct agreement from the principal agreement containing the arbitration clause, it was held that the evolution of the doctrine of severability indicates that the same cannot be invoked when dealing with the provisions of the Stamp Act.

It was observed that the doctrine of severability was primarily developed to preserve the arbitration clause in situations where the principal contract is terminated or rescinded for any reason. This was to protect the rights of the parties to resolve their disputes through arbitration, and to ensure that the powers of the arbitrator are not extinguished with the termination of the main contract. The Supreme Court opined that since arbitration agreement by itself is also exigible to stamp duty,18 the doctrine of severability would not be of help where the main contract, containing the arbitration clause, is unstamped.

DECISION OF THE SUPREME COURT

In light of the above analysis, the majority held as under:

- An instrument containing the arbitration clause, if exigible to stamp duty, will have to be necessarily stamped before it can be acted upon. Such instrument, if remains unstamped, will not be a contract and not be enforceable in law, and therefore, cannot exist in law.

- Section 33 and 35 of the Stamp Act would render an arbitration agreement contained in an unstamped instrument as being non-existent in law, unless the instrument is validated under the Stamp Act.

However, the Supreme Court specifically observed that it is not pronouncing any judgment in relation to the proceedings under Section 9 of the Arbitration Act, i.e., interim protection in aid of arbitration.

EMERGING CHALLENGES IN THE AFTERMATH OF THE JUDGMENT

The judgment of the Supreme Court will have far reaching implications on the pro-arbitration trend that started in 2012 with the BALCO judgment by the Supreme Court. The process for impounding an unstamped or unduly stamped instrument is generally marred by extreme delays, which would in turn cause delays in initiating arbitral proceedings. From a policy perspective, the judgment will also impede the implementation of the institutional arbitration in India, as recommended by the high-level committee chaired by Justice Srikrishna (retd.), as the arbitral institution may not be able to appoint an arbitrator in proceedings arising from unstamped arbitration agreements governed by Indian law. However, the Delhi High Court has provided guidance on the expeditious disposal of the impounding proceedings in cases where the agreement has to be impounded in relation to appointment of arbitrator under Section 11 of the Arbitration Act.

The finding that an unstamped agreement does not exist in law, and the rights of the parties under such an agreement would rather not exist may adversely impact foreign-seated arbitrations. For example, an unstamped agreement, executed outside India, and subject to Indian laws, may not be given effect to by the foreign-seated tribunal, as such an agreement would not exist under the Indian laws. Moreover, while the Supreme Court has stated that it has not pronounced on the matter in relation to Section 9 of the Arbitration Act, it remains to be seen if the Courts would grant any interim reliefs in an agreement that does not “exist” in law.

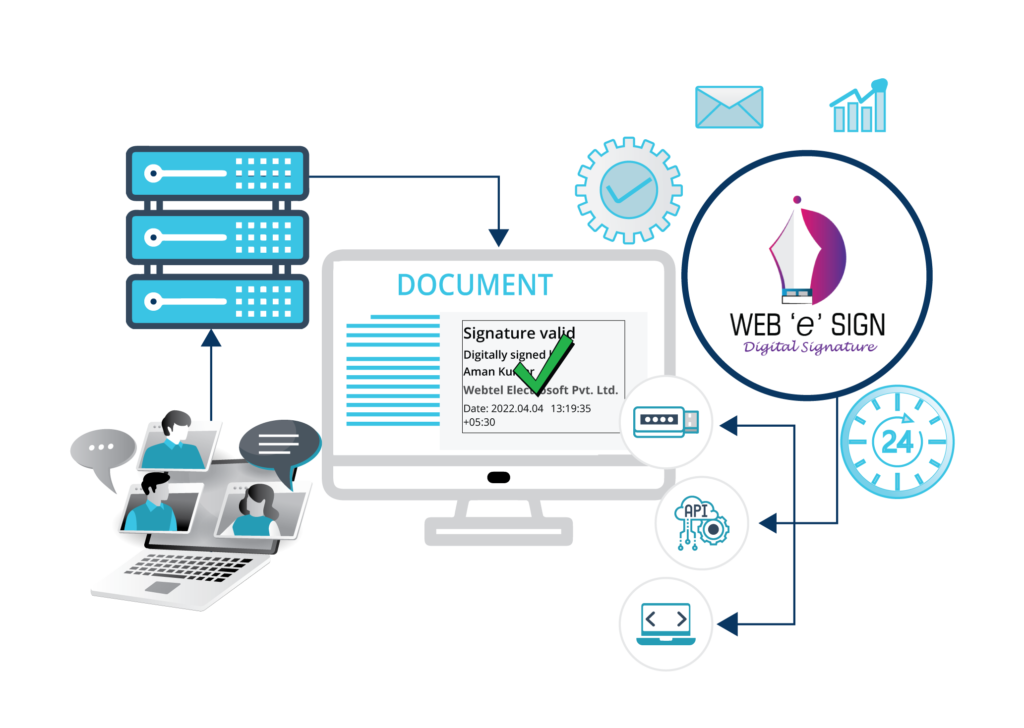

Lastly, as recognized in the dissenting opinion of Justice Hrishikesh Roy, there have been technological advances in the manner of execution of agreements (such as electronic signatures through DocuSign, etc.) and the advent of smart contract arbitration. The majority judgment has not considered such developments. This may threaten the developing ecosystem of dispute resolution through deployment of technological and artificial intelligence tools.

What do Consequential Damages Mean?

Consequential damages, as the name suggests, refer to the compensation granted to one party for the harm or loss they experience as a result of a breach of the terms in an agreement. These damages are primarily linked to financial losses suffered by the party, including but not limited to potential profits delayed due to the breach or expenses incurred to address the harm caused by the agreement breach.

One of the essential conditions for claiming consequential damages is that they should be clearly and undoubtedly linked to the breach of the contract, rather than being remotely related. It is necessary for the plaintiff to demonstrate that the pecuniary loss or expenses incurred are a direct consequence of the other party’s breach of the agreement.

Important considerations in determination of consequential damages

When determining the extent of consequential damages, several important aspects must be considered:

Proximity/Natural ConsequenceThe first step in assessing consequential damages is to establish that the loss being claimed by the plaintiff is a direct result of the contract breach. Section 73 of the Indian Contract Act, 1872 emphasizes that damages cannot be sought for losses that are remote or indirect.

To determine proximity, the concept of the remoteness of damages is applied. According to the Indian Contract Act, for damages to be awarded, it is essential that the loss or damage “arose in the usual course of things from such breach, or the parties knew that such loss or damage could reasonably occur at the time of entering into the contract.”